Key Sukuk Data

The first sukuk ever was issued by Shell MDS in 1990 for MYR125 million (US$ 33 million). Since then, the progress of the market depended heavily on efforts of the Malaysian government that had made the world’s first sovereign US$ 600 million sukuk issue in 2002. Malaysia’s Cagamas MBS has issued US$ 540 million worth of residential mortgage-backed securities. Malaysia has also seen issuance by corporations, including a pioneering US$ 2.86 billion issue by the PLUS highway concessionaire in 2006. The government’s investment arm, Khazanah Nasional, issued the first exchangeable sukuk the same year.

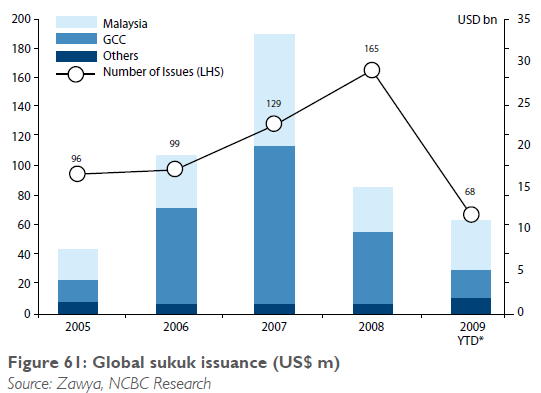

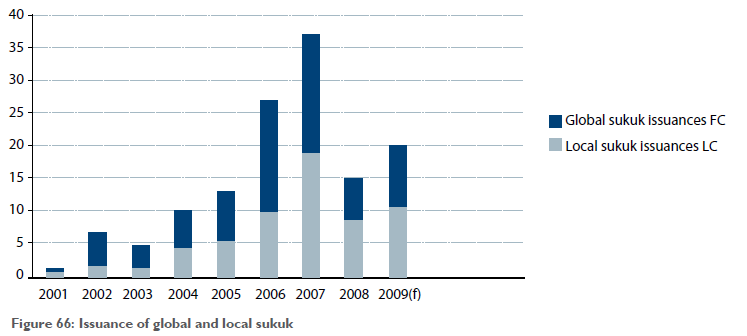

Emulating the Malaysian example, other Islamic countries started issuing sovereign sukuks. Bahrain issued a sovereign sukuk worth US$ 100 million in 2001. Qatar issued a global sukuk of US$ 700 million in 2003, and Pakistan came out with US$ 600 million sukuk issue in 2005. In the Gulf, Bahrain remains the most active sukuk market. The country regularly issues short-term sukuk for liquidity management. In 2002, Islamic Liquidity Management Centre was established in Bahrain in order to boost sukuk issuances. The world’s first global corporate sukuk issuance for US$ 150 million was made by Kumpulan Guthrie, a Malaysia-based company, in 2001. Since then, sukuks have not only grown in size but in product sophistication and structure. Bai bithaman ajil was initially the most popular form, accounting for 77% of total issues in 2001. However, efforts aimed at standardization, notably by AAOIFI, have now made ijara the dominant structure. Sukuks have attracted considerable attention in recent years. Although the onset of the financial crisis and efforts to standardize the market temporarily reversed the progress, restrictions on bank credit and depressed stock markets have renewed attention. Global sukuk issuance grew from US$ 5.8 billion in 2003 to US$ 33 billion in 2007. The strong growth in sukuk issuance can be attributed to sukuks being perceived as a ‘less risky’ investment proposition when compared to conventional bonds, in part because they are backed by physical collateral. Moreover, the huge public and private investments being undertaken in the Middle East, particularly in infrastructure, have boosted funding requirements. Leading Middle Eastern sukuk issuers include companies such as the petrochemicals giant SABIC and the Saudi Electricity Company, as well as a growing number of real estate developers.

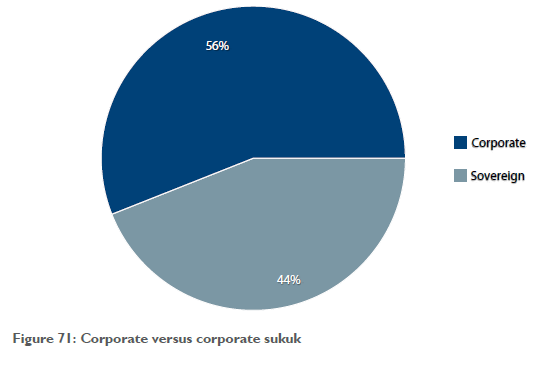

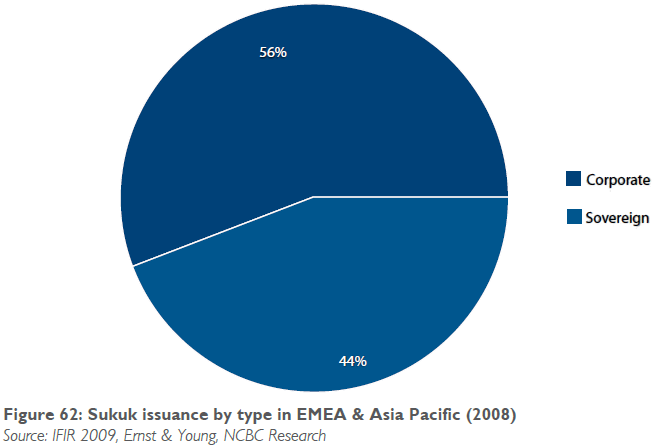

The progress made in recent years was abruptly reversed in 2008, when total global sukuk issuances declined to US$ 15 billion, as debt markets dried up globally. In terms of types of sukuk issuances, corporate sukuks continued to dominate, accounting for 56% of all sukuks issued in 2008. Sukuk issuances have been subdued in 2009 as well. The total size of issues stood at US$ 10.9 billion at the end of August 2009.

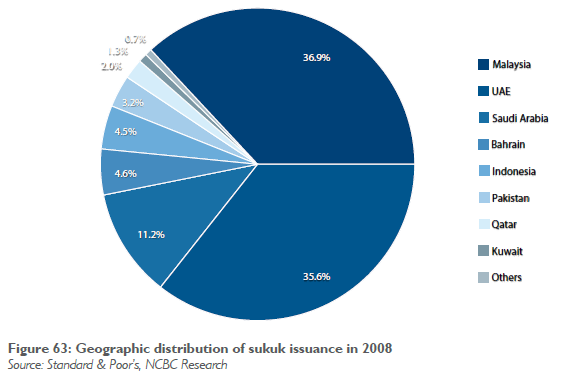

More and more issuers from different countries are employing sukuk for financing. In the current sukuk issuance market, Malaysia and the UAE are in the lead. Bahrain has been pursuing a deliberate policy of creating a Shari’a-compliant sovereign sukuk market and issuance program. Malaysia and the GCC countries together ac- counted for 91.6% of the total market in 2008. Going forward, 20 new governments have expressed interest in issuing sukuk, with Indonesia having already launched its first international sovereign sukuk issue worth US$ 650 million in April 2009. The issue was oversubscribed and received strong interest from both Islamic and conventional investors. Qatar and Jordan also plan to issue sovereign sukuk in 2009 to finance their development plans. Turkey, home to around 72 million Muslims, is another key emerging market for Islamic finance In the GCC, facilities for listing sukuks are limited. Currently three exchanges in the Gulf list debt instruments, Bahrain, NASDAQ Dubai (formerly Dubai International Financial Exchange – DIFX), and the Saudi Tadawul. NASQAQ Dubai is the world’s largest exchange in terms of value of the listed sukuk. Currently, 20 sukuk are listed on the exchange. A new sukuk and bond platform on the Saudi Stock Exchange (Tadawul) was introduced in June 2009. The new platform is being seen as a major milestone for the development of Islamic capital markets.

Current State And Emerging Trends

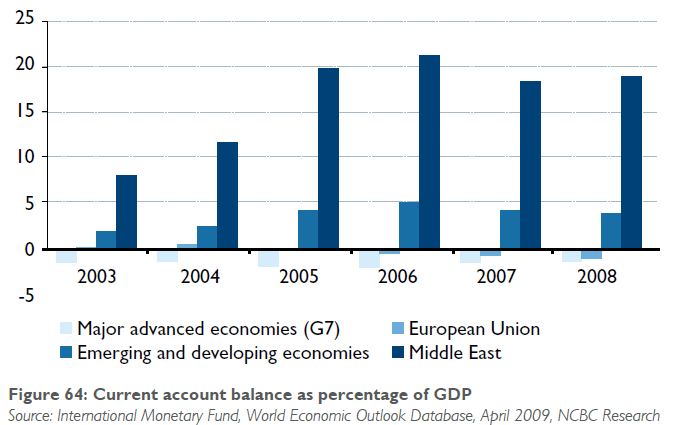

Although Islamic finance has had a relatively long his- tory the sector has seen phenomenal growth in the past five years. The total value of Islamic financial assets has grown at an average of 15-20% since 2004. The growth has been primarily driven by the rapidly growing acceptance of financial services in Islamic countries and recognition of the effectiveness of Shari’a-compliant products and services in bringing new segments of the population within the ambit of formal finance. Another factor that contributed toward the rapid expansion of Islamic finance is the growing wealth of Middle Eastern and other oil-producing countries. These countries have benefited immensely from the high oil price environment that prevailed from 2003 to the first half of 2008. This al- lowed them to boost their savings and sustain economic growth over these years. This, in turn, led to a notable rise in the income levels of individuals and corporations. As a result, per capita Gross Domestic Product (GDP) of Saudi Arabia, Lebanon, Jordan and Malaysia grew at a CAGR of 9-10% in 2000-2008, while those of Kuwait, Qatar and Indonesia expanded at more than 14% during the same period. The increased income and saving levels in these countries boosted the capitalization base of Islamic banks and takaful companies as they benefited from increased consumer interest. Given their mandate to invest in Islamic capital market products, these institutions were able to provide a ready market for Islamic products. Moreover, windfall surpluses generated by Middle Eastern and certain Asian countries encouraged fund managers worldwide to capitalize on the excess liquidity by offering Islamic finance products.

Since raising funds from conventional banks is becoming more challenging in the current economic scenario, companies and governments will increasingly turn to Shari’a-compliant options such as sukuks. Furthermore, several Middle Eastern, North African and Asian countries have currently embarked on massive infrastructure expansions as part of their efforts to diversify the economy away from oil. The MEED Projects (a premium subscription-only service that offers the most in-depth project tracking database in the market across the Middle East, North Africa and India) estimated that approximately US$ 2 trillion worth of projects are at various stages of planning or completion across the GCC. How- ever, following the global credit crunch, banks in many GCC and Middle Eastern markets have strengthened their lending norms, resulting in the drying up of project finance. Developers and buyers are struggling to cope with the increase in financing cost in a tighter lending environment. Volatility in the conventional equity market has ensured that primary issues are no longer a viable option for raising funds, thus increasing the possibility of greater reliance on sukuk as an alternative means of financing.

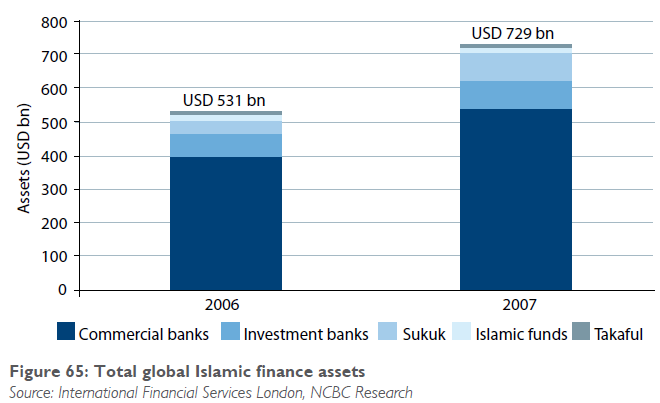

Driven by these factors and a strong demand from both individuals and corporations, the global market for Islamic financial services based on Shari’a-compliant assets was estimated at US$ 729 billion in 2007, as per the data provided by International Financial Services London in its report Islamic finance 2009. The Islamic finance industry is currently dominated by commercial Islamic banks that account for majority of its Islamic assets (74% in 2007), followed by Islamic investment banks (12%), sukuk (11%), takaful (11%), and Islamic funds (2%). In non-Muslim countries, UK dominates the Islamic financial industry with assets worth US$ 18 billion.

Despite growth rates at least twice as high as those recorded on global conventional financial markets, the Islamic financial industry remains fraught with diversity and heterogeneity. The current excess liquidity in Gulf economies since 11 September 2001, has fuelled both sustained demand for the products supplied by IFIs (Islamic financial Institutions) and the booming expansion of the market for sukuk (see Figure 66 below), while contributing to the creation of a very close link between Islamic banks and what remains to date a relatively illiquid compartment of the bond market. Nevertheless, liquidity in the sukuk market should improve gradually as the variety of sukuk issuances widens. Not only are volumes expected to exceed US$ 150 billion by the end of the current decade, but the nature, geographic location and credit quality of future issuers are also expected to considerably evolve and diversify.

The Islamic finance industry, particularly the sukuk market, faced unprecedented challenges in 2008 – namely the global credit crisis, the rising cost of borrowing and lack of investor commitment to capital market securities, as well as debates over the Shari’a compliance of some sukuk structures.

By the end of 2008, global sukuk issuance had declined by more than 50% compared to 2007, a marked reversal of the strong growth trend witnessed in recent years since this market came into being. Globally, credit markets underwent a significant decline in debt issuance, mainly driven by the lack of global economic visibility, pricing issues and a shortage of committed investors. The GCC and Malaysia have been the hardest hit, experiencing declines in sukuk issuance of 55% and 59%, respectively.

Over the past year, ijara sukuk has become the dominant sukuk structure in terms of issuance volume, replacing mudaraba, which had been the dominant structure in 2007. This development followed a recommendation by AAOIFI in early 2008 that Islamic finance market participants should refrain from issuing sukuk structures that have a purchase undertaking or guarantee from the sukuk issuer to repurchase at a future date at a specific price (i.e. almost all structures except ijara). In AAOIFI’s view, this structural mechanism is not compliant with a fundamental principle of Shari’a, namely profit and risk sharing. However, although AAOIFI standards are widely followed (without obligation) across many countries, they are only adopted by Bahrain, the Dubai International Financial Centre (DIFC), Jordan, Lebanon, Qatar, Sudan and Syria.

Market developments in challenging times

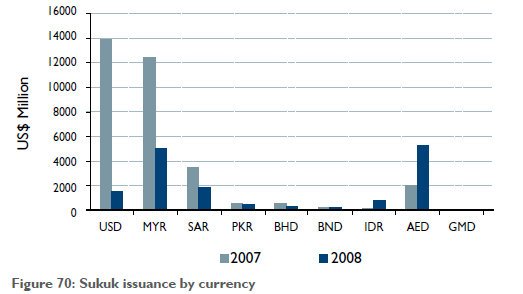

Sovereign and local currency sukuk issuances have recently increased in popularity across the GCC and Asia- Pacific. Speculation has been rising as to whether GCC currencies will de-peg from the US dollar, which was weakened for most of 2008 and which has historically been the most favoured currency for debt issuance in the GCC. As a result, issuers in the region have resorted to issuing sukuk denominated in Saudi riyals or UAE dirhams. This trend has also been seen in Asia, where the Malaysian ringgit, Pakistani rupee and Indonesian rupiah have been the most common currencies used.

A growing number of institutional and retail investors have been seeking local-currency-denominated sukuk in a bid to reserve profit yields under the difficult credit market conditions and declining US dollar. The HSBC/ DIFX sukuk index (SKBI), representing the weighted- average credit spread over LIBOR of the individual constituents underlying the relevant index, has increased by over three times since the global credit crisis started in August 2007, trading at just over 400 bps. As the crisis deepened further in October 2008, the weighted spread increased to 900 bps.

In 2007/2008, issuers in the GCC and Asia-Pacific announced over US$ 30 billion in sukuk that were due to close in 2008, accounting for over 88% of globally announced deals. Given the unfavorable credit conditions, the rising cost of borrowing and widening spreads, most of these deals failed to materialize in 2008. Had it not been for the closure of the debt markets and a decreasing investor appetite for debt securities, we estimate that 2008 issuance would have reached US$ 45 billion, compared to actual issuance of US$ 15.1 billion (see Figure 67). However, market conditions were not the only difficulty issuers faced in 2008. In February, AAOIFI issued a statement of six guidelines containing advice relating to Sukuk tradability, the corporate responsibility of the sukuk manager, the purchase of certain sukuk structures at their net rather than nominal value, and the duty of the SSB to oversee the implementation of funds and investments in a Shari’a-compliant manner and not to limit their involvement to issuing fatwa at the time of the sukuk issuance.

In 2008, the number of sovereign sukuk deals issued increased to 72, representing over 44% of total deals issued and an increase from 23 in 2007. In addition, previously planned and announced sukuk issues by Kuwait, Turkey, Japan and Thailand are likely to tap the market once there is some stability on the credit and capital markets.