One of the very important questions a bank’s manager should answer is how should the payable profit rate for the received deposits match with the profit rate payable for the paid facilities. In terms of banking terminology, such a question relates to asset and liability management (ALM). Such a concept requires the bank manager to try and match the different aspects of loans and deposits.

Let’s talk about asset and liability management in banking terminology and focus on how the concept may relate to the Islamic aspects of banking activities. Simply, the concept throws light on how a bank manager should comply with different aspects of loans that the bank’s clients have received from one side and the deposits that the bank has received from their deposit holders. Another important aspect of this concept focuses on the maturity term between the two sides. For example, let us suppose that the bank has received a five-year maturity deposit with a 5% interest rate and has penned a 10-year maturity loan which has a 4.8% interest rate. In such a situation, the bank at the very initial stage should try to match between the different characteristics of the deposits it has received, and the loan it has paid.

In a developed conventional banking framework, there are different types of derivatives which allow the bank’s manager to match the two sides of the balance sheet. A forward rate agreement is one of the well-known derivatives, which provides a hedging framework for matching between the interest rates on the deposits and loans sides. An exchange rate swap is another important instrument, in which a conventional bank may use it to hedge their interest rate fluctuations for deposits and loans. Such forms of derivative instruments bring much negotiation between the Shari’a scholars talking about their compliance with Shari’a principles. As it might be clear, there are different elements in such a financial instrument which contradict the fundamental Shari’a principles.

Various Contracts in Islamic Banking Framework

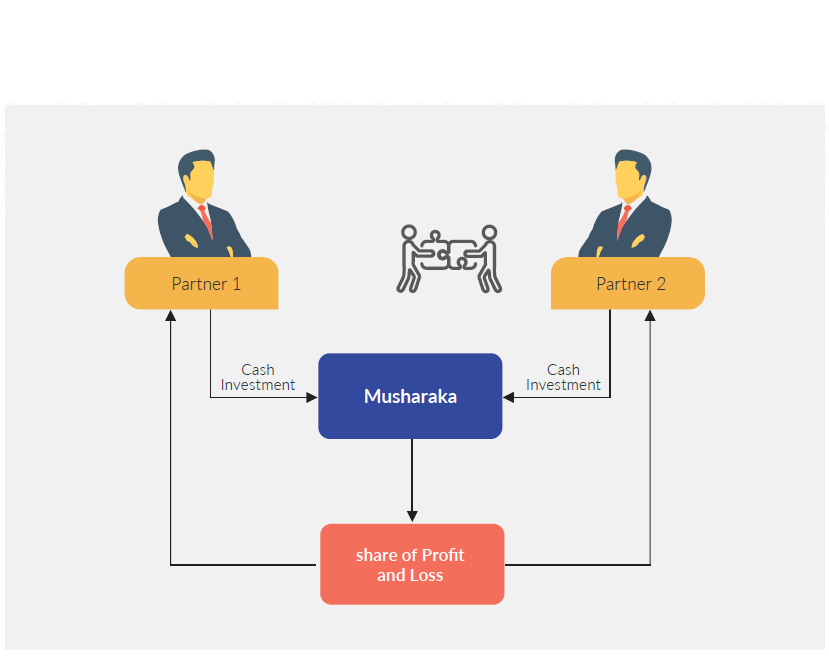

While discussing why such financial instruments contradict the Shari’a principles, in this writing I will not focus on describing such issues. Instead, I prefer to discuss how an Islamic bank might hedge profit fluctuations risk in musharaka-based contracts; as many of the Islamic financial professionals may know musharaka-based contracts to write a similar partnership platform in which an Islamic bank enters into the partnership agreement with its clients to benefit from a joint project. Different profit-making projects in several sectors such as agricultural products, industrial-based projects and investment opportunities might be financed by musharaka- partnership-based contracts. Similar to the conventional partnership agreement, the concerned parties agree to invest in a specific underline Project, and the profit or loss from the underlying asset will be dedicated to the partners.

For example, suppose that a bank’s client has 1 median USD and needs an extra US$500,000 to complete a specific project in order to make some revenues from it. In such a case, the bank and its client, according to the partnership agreements, have brought different amounts, and one-third of the

project’s revenues belong to the bank. Musharaka- based partnership is categorised as a variable income contract, and in such contracts, all revenues from the investment amount will be determined at the maturity date. Definitely the bank considers it a provisional profit rate but the exact amount might be different from what the bank had predicted. In Islamic banking, as a general rule, we categorise the underlying contract into two segments which include not-for-profit contracts and profit-making contracts. Some contracts such as qard al hasan are among those contracts which are considered as a not-for-profit contracts.

Some other contracts such as murabaha or musharaka might be set in the category of profit-making contracts. It is noteworthy that some profit-making contracts, such as ijarah or murabaha provide a determined rate of return for the bank and some others, such as musharaka, provide variable income for the bank. In such contracts, the final rate of return will be calculated at the time of maturity of the contract. Considering the fact that in the variable income contracts, the final rate of return will be finalised at the maturity time, the probability of the profit fluctuations in comparison with whatever had been planned at the beginning of the contract is an important source for profit rate risk for this bank.

Let’s elaborate on such a risk while understanding the relevant activities of the Islamic bank.

Risk Management Vehicles in Islamic Banks for Musharaka-based Contracts

Suppose that an Islamic bank has received a 5-year deposit with a nominal value of US$1 million which the deposit holders expect to receive at the minimum level of 6% annually. The bank manager has decided to give a loan of US$1 million to finance a project in the agricultural industry based on the partnership between the bank and its client. The bank predicts that after 5 years the final value of the agricultural products will bring more than 7% annually and the difference between the receivable 7% and payable 5% will make a profit for the bank. However, there is an important question on the table: what would happen if the final profit from the invested project by the bank is less than 7% annually? It is clear that the amount which the bank has obliged to pay to its deposit holders comes from the revenues which are made by the facilities side. The probability that the profit-making arm of the bank works less properly than the profit-paying arm, is the main source of profit risk, which should be tolerated by the bank. In this short article, I will briefly discuss how an Islamic0 bank may hedge its net position in relation to the profit situation of the bank.

- PROVIDING PRINCIPAL PROTECTION ASSURANCE

In this suggestion, the bank provides facilities to its clients based on a specific partnership-based contract and will ask the client for providing specific assurances that the principal amount of the facility will be protected against negative fluctuations. This protection might be provided through specific mechanisms such as Islamic insurance contracts. Based on such a protection, the client who receives the facility should care that he/she will use the money in a type of project that do not carry such high levels of risk. Such protection might be provided through specific vehicles such as the followings:

11. The entity that receives the facility will assure the bank that the principal amount of money will be protected against negative fluctuations. Here the bank’s client will tolerate any losses by himself. It is clear that the bank’s client cares about where the money will be invested. Otherwise, he or she should pay the negative value of the received money to the bank.

12. Using Islamic Insurance Services: In this structure, the bank’s client will ask an Islamic insurance company to provide a specific service for the bank that in case of specific occurrences to the principal amount of the bank’s share, the company will compensate it. Such a service is not free of charge and the bank’s client should pay for it. Such payments will increase the total cost of the facility that he/she has received from the bank.

2. ACCEPTING FLOAT RATE DEPOSITS BASED ON AGENCY CONTRACTS

The first perfect risk management mechanism which might be useful for an Islamic bank is in relation to how it takes deposits from the deposit holders. The deposit holders expect to receive profits which will let them enjoy added wealth. According to this proposal, the bank announces that it really acts as the deposit holders’ agent and allows them to enjoy revenues which come from the specific investment opportunities. In this framework, the profit which will be paid to the deposit holders directly depends on the amount that comes from the profit of the invested project in the partnership framework. For example, suppose the bank has taken a US$500,000 deposit based on the agency contract and has allocated the money as a partner to a specific industrial project in order to make it complete and enable it to make (more) money. The bank as the deposit holder’s agent is not obliged to pay a predetermined rate of return and subsequently, the deposit holders will be engaged in the profit fluctuations directly. However, the bank as a technical intermediary will locate the money to those projects which are eligible for investments.

3. ASKING FOR TECHNICAL AUDITING SERVICES IN ORDER TO MINIMISE THE RISK OF FRAUD AS MUCH AS POSSIBLE

According to this proposal, the bank will ask experienced auditors to engage with the projects’ facilities and try to minimise the risk of fraud by its client as much as possible. One of the very important sources of risk for an Islamic bank is concerning the rates, which the client has declared as revenues coming from the invested project.

Let’s discuss this suggestion in a little more detail. Suppose that an Islamic bank has provided the facility of US$1,000,000 for a specific auto-making project. The automaker has predicted that after completing the project, it will result in an increasing number of produced vehicles and subsequently the revenues will increase. The automaker has announced that this project will end with increasing the quality of the

produced cars or enabling the production line to have extra cars produced during the same period of time. Any of the above circumstances will lead to more revenues produced by both the automaker and the bank as its partner. However, one of the very notable sources of risk comes from the total expenses for producing the cars. The automaker might declare that the production of each car will take much more than the real amount and subsequently any extra money will be in its pocket. The critical role of the auditor will be brought up here: how much does the production of each car cost?

If the bank wants to do the auditing services itself, this will increase the amount of expenses and subsequently review the total profits that it may have. It is therefore, inevitable to ask auditors to provide their services, reducing the risk of fraud in partnership-based contracts in an Islamic bank that will conclude with reducing the risk of profit fluctuations as initially predicted.

Conclusion:

The Islamic banks face different sources of risk while doing business. Profit fluctuation risk is one the very important sources of risk faced by Islamic banks that should be managed. In this article, I tried to introduce some techniques that might assist in managing such risks.

Some ideas for managing the profit rate fluctuations risk in Islamic banks include:

- Providing principal protection assurance.

- Accepting float rate deposits based on agency contracts.

- Asking for technical auditing services in order to minimise the risk of fraud as much as possible.

However, while the aforementioned risks might not be totally eliminated from the daily business of an Islamic bank, using some of them will enable the bank managers to protect themselves against negative effects which might be on the table. Islamic banking by its nature has specific risks and it is very vital to share new risk management vehicles. I hope my paper helps pave ways for further studies by Islamic banking experts.