Introduction

fund family has been offered for distribution to the literally hundreds of broker/dealer operations in GCC, from Kuwait to Saudi Arabia to the UAE. These local broker/ dealers already have relationships with investors, from the smallest to the largest, from which a strong sales case can be made for Islamic mutual funds.

Swiss distribution must be on any list of priorities for an Islamic mutual funds program. Asset managers in Switzerland opt for allocations on a fund-of-funds basis for smaller accounts, typically under US$ 10 million. Over the past two decades mutual funds and many other kinds of fund managers have penetrated the veritable Swiss market and made enormous progress in selling their products. Considering that Switzerland could have as much as US$ 200 billion in Muslim AUM, and that there are today literally no offerings of Shari’a-compliant products across the investment spectrum, one could consider this market among the most important of them all.

These are only a few of the examples of the creative thinking that needs to go into the wider, cross-border distribution of Islamic mutual funds. There is little doubt that most Muslims would prefer a Shari’a-compliant investment to a conventional investment if Muslim investors knew they need not sacrifice performance, liquidity, or transparency. Anyone who develops products meeting world standards, and understands the key point of distribution, can achieve sizeable AUM in short order.

Indicative of the overall interest and growth in the Islamic fund management industry is the augmentation of products and services which support the management of Shari’a-compliant portfolios. This includes the launch of new indices, specialised Shari’a data service providers and Shari’a-compliant advisory services.

In the following chapter, we will initially present a Shari’a-compliant fund management framework that will ensure that funds move towards Shari’a compliancy. Further, we will compare current Shari’a screening practices and trends across the industry. Finally and through multiple case studies, we will reflect how Shari’a screening varies, and influences compliance credibility.

Shari’a-compliant fund management framework

Fund management both conventional and Islamic is generally about generating alpha. However, Islamic fund managers have a much smaller universe of stocks to in- vest in due to Shari’a screening, than their conventional counterparts.

The Shari’a compliancy of a fund goes beyond static compliancy lists and spreadsheets that use data retrieved from conventional data providers. Unfortunately, a large number of Islamic funds are still maintained in this manner. Effective Shari’a compliancy is about providing fund managers with credible Shari’a advisory, data and screening services, purification, and on-going compliance monitoring capabilities.

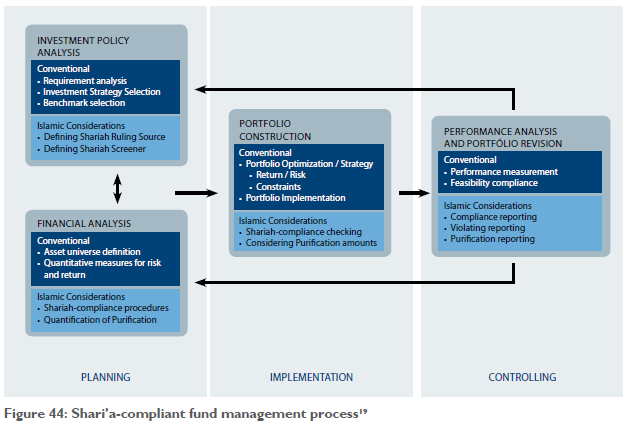

As shown in Figure 44, there are multiple requirements needed to ensure that conventional portfolios are managed in accordance to the Shari’a. This includes a Shari’a governing body and a screening service at the planning phase, which would guide the fund management in structuring the fund. Once the governing body (either a Shari’a board or advisory service) has been appointed, a data provider has to be selected to ensure that the guidelines defined by the governing body are met as intended. This can be achieved either through a subscription to an Islamic index such as the Dow Jones, MSCI, or the newly launched Islamic indices (Jadwa Sha- riah Index) of Russell Investments, a global investment advisory firm.

Another approach is to use a Shari’a data service provider like IdealRatings. The advantage of this approach is that the fund manager can define his investable asset universe according to the Shari’a screening and purifi- cation requirements specified by the fund’s governing body, instead of being limited to the scope of the index used. Purification is an important consideration when selecting investments, since the status of an investment can change frequently from compliant to non-compliant depending on market volatility and other factors. An investment opportunity that requires large sums to be purified might turn out to be less profitable than an investment that yields a lower initial return.

Shari’a screening

A Shari’a-compliant portfolio needs to be checked periodically to ensure that changes in compliancy are identified in a timely manner. In addition to this, a fund might have to purify on a quarterly, semi-annual or annual basis, if: investments accrue income from a non-Shari’a-compliant source (i.e. generate up to 5% of their income from a non-compliant activity), or if a company has fluctuated from being compliant to non-compliant, and has paid out dividends during the non-compliant period.

Furthermore, from a Shari’a auditing and monitoring perspective, the fund should be able to generate compliance, violation and purification reports.

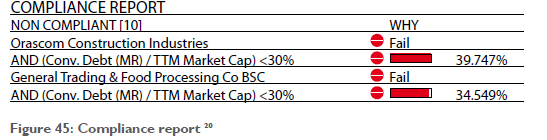

The compliance reports (see Figure 45) would indicate the compliance status of existing portfolio holdings. Generally, Shari’a scholars give funds a time frame of between 30 to 90 days to liquidate a non-compliant position.

Violation reports can help fund managers to prove that the positions they held were compliant at purchase date, and would indicate the time period during which the investment turned non-compliant.

Purification reports indicate the total sum that has to be purified for a specified time period and how many assets/ stocks need to be purified for each investment position in the portfolio. Enforcing this framework on Islamic funds would contribute both to the credibility and standardisation of the Islamic fund management industry, and ensure that Shari’a requirements are implemented as intended.

Screening process

In the context of equity investments, screening for Shari’a compliance is ensured using two screens: business activities and financial ratios. Companies which engage in a non-Shari’a-compliant activity as a primary business activity – such as the sale of pork, alcohol, conventional financial services and casinos are identified and excluded from an Islamic stock universe. Financial screens on the other hand, measure a businesses’ involvement in non-Shari’a-compliant activities, such as interest earnings and debt financing. The present practice in screening non- non-compliant activities unfortunately is still carried out using industry classification codes that only indicate the major business activity of the company. Accurate screening is concerned with translating into practice the verbal requirements defined by the respective Shari’a governing body. This can only be achieved by following a research-based screening approach rather than a process that just uses automated screening or spreadsheets based on conventional data.

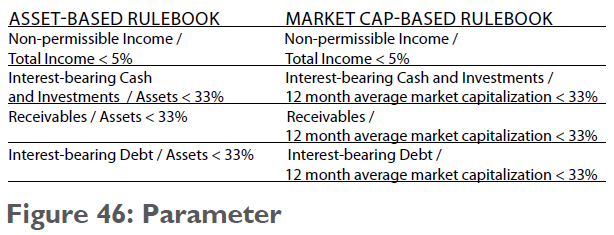

Highly leveraged companies are usually shown by conventional data providers to be non-compliant. How- ever, due to the fact that conventional data providers do not distinguish between interest-bearing and Shari’a-compliant debt, presently a company with a high Shari’a-compliant debt would also be deemed non-compliant. In the GCC asset universe, this would translate into halving the number of Shari’a-compliant companies a fund manager could potentially invest in. In the same vein, clothing and accessory companies are generally considered compliant from a business perspective by automated screening services. Nevertheless, if fashion companies like Louis Vuitton Moet Hennessy (LVMH) are analysed in detail, they would have to be considered non-compliant due to the large revenue they generate from the sale of luxury alcohol and spirits Generally, different parameters can be found across the industry which may result in different asset universe sizes and constituents. The main point of distinction between the parameters is the use of either total assets or market capitalization, as a base to value a company and to use as a denominator for the different financial ratios (see Figure 46).

Other varieties of the above parameter can be found across the industry, such as using a combined cash and receivables ratio, or including non-operating interest as part of non-permissible income. The following innovative screening alternatives have emerged in 2008 / 2009: Using a 36-month moving average market capitalization as a divisor.

Due to the current financial turmoil and volatile price fluctuations, some scholars and index providers have approved to smoothing out the crisis effect by using a 36-month moving average market capitalization, instead of the commonly used 12-month moving average market capitalization.

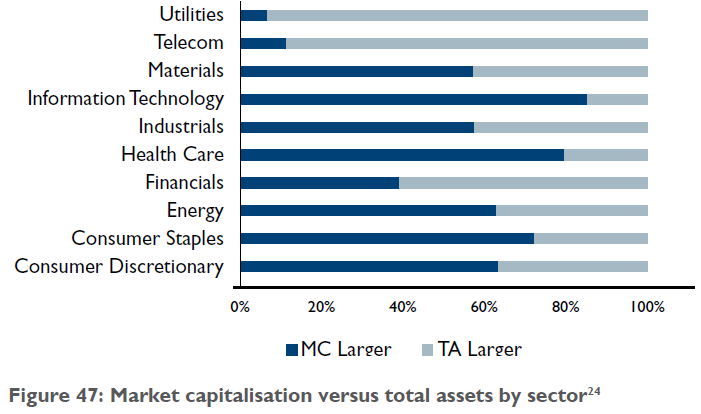

The use of sector-specific divisors

Another approach introduced in 2008 emphasizes that to reflect intrinsic value of the respective company, it is more logical to select a screening divisor based on the company’s operating sector. The authors have based their analysis and concluding results on the S&P 500 asset universe in September 2008 (see Figure 47). Taking the health or information technology sector as an example, the research proposes to use market capitalization rather than total assets as divisor given that total assets do not capture the value of intellectual properties, brand value, employees, management or projects in the pipeline.

However, since these are the factors considered by investors in valuing such companies, their real value is reflected in their market price, and thus market capitalization is used as a screening method. On the other hand, utility companies have a large asset base consider- ing infrastructure investments and should therefore be valued using total assets.

- Case 1: Research-based versus automated screening

Automated screening might be a practical screening method; however it would not necessarily give accurate results

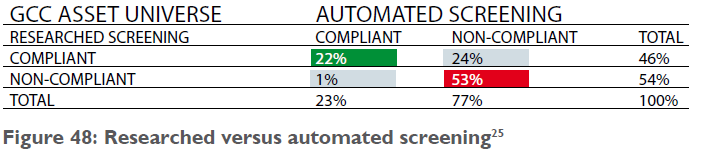

In the GCC market (see Figure 48), for instance, auto-mated screening results classifies about 24% of the asset universe as non-compliant, whereas the same assets are considered compliant using exactly the same rulebook in a research-based approach. The reasons for these discrepancies are:

Automated screening considers financial service companies in general as non-compliant whereas a majority of such companies in the GCC operate according to the Shari’a.

Automated screening considers all types of debt and investments non-compliant without distinguishing, for instance, between interest-bearing debt and Shari’a-compliant debt (in the form of sukuks).

The following examples illustrate some of the problems faced with an automated screening method in the context of a global asset universe:

Companies operating in the food sector

Companies operating in the food sector Automated screening providers screen companies ac- cording to sector level which is defined by the company’s core business. Therefore to minimize the possibility of exposing investors to companies selling pork or alcohol for instance, the whole sector would be considered non-Shari’a-compliant under an automated screening process. This is not acceptable from both a Shari’a and an investment perspective since compliant companies are branded as being non-compliant, and fund managers have no access to invest in the entire food sector.

Internet companies

This business activity is generally considered compliant; however research reveals that non-compliant revenue sources can also be identified in these companies. For example, Yahoo! generates revenue from online dating services as well as music and video downloads. These details cannot be identified using automated screening, and may impact the compliance status of a company as well as the amounts that need to be purified from such investments.

Researched screening on the other hand, does not rely on sector categorization or conventional data. To screen companies appropriately, a detailed analysis of company income sources needs to be carried out. Should income from non-compliant operations amount to less than 5% of total company income, the Shari’a board would classify this company as Shari’a-compliant. This can only be done through the utilisation of Shari’a-specific data sources which provide a level of detail that ensures that companies are screened thoroughly

Case 2: Market capitalization versus total assets

At present, no consensus or standard exists on whether a company should be valued based on market valuation (market capitalization), or from an accounting perspective (total assets).

The superiority of using one over the other based on asset universe size and performance cannot easily be determined and is affected by multiple factors such as prevailing market conditions and the companies sector of operation.

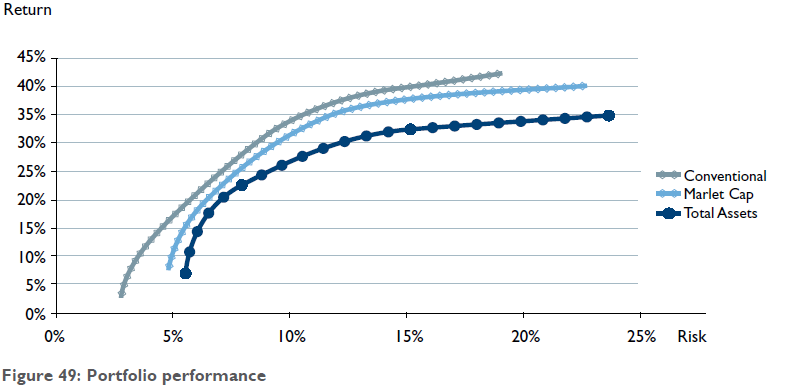

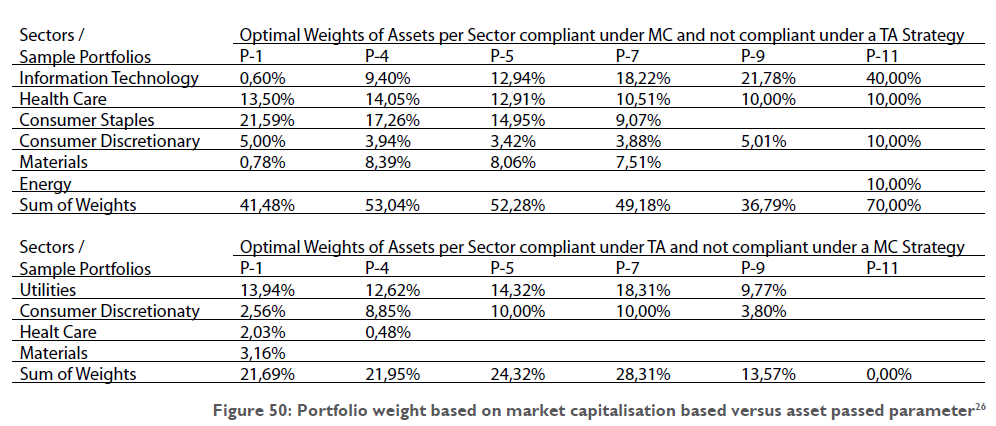

A research published in 2008, shows that for the booming market conditions in 2007-2008, using market capitalization as divisor for financial ratios is superior to using total assets, both in terms of asset size and portfolio performance. Based on the results of the S&P500 constituents, the market capitalization parameter had a 20% larger asset universe compared to a total assets-based universe. Additionally, the market capitalization-based parameter resulted in better portfolio performance (see Figure 49) compared to the asset-based parameter. The reason for better performance is based both on a larger asset universe and the constituents considered. Based on the same research, approximately 40% to 70% of the optimal portfolios (see Figure 50) on the efficient frontier of a market capitalization-based universe cannot be invested in an asset-based parameter as they are considered non-compliant. Therefore, in the fifth portfolio (P-5) about 30% of the portfolio weight is invested in Information Technology and Health Care companies, which are non-compliant if an asset-based parameter is used. These companies are compliant under the market capitalization-based parameter due to the fact that their sectors generally are valued higher than their accounting value. For instance, health companies, which work on developing new medicine for years, are not allowed to account medicine in research as assets before passing all the different testing phases and being finally approved by the respective health authorities.

These figures are based on conditions prior to the subprime mortgage crisis of 2008. Due to a drop in the markets, market capitalization values dropped and therefore more companies were screened out from compliance to non-compliance. Furthermore, during the current crisis, the total asset-based parameter is superior in terms of the asset universe since the companies’ intrinsic asset value did not experience similar significant drops. This can be witnessed in Saudi Arabia, where companies like Saudi Basic Industries Corporation (SABIC) during August 2009 alternated from pass (compliant) to fail (non-compliant) status due to a current debt-to-market cap ratio exceeding 40%. However, using an asset-based approach, SABIC is still compliant with a debt-to-asset ratio of 29%, (which is less than the maximum permitted threshold of 33%). Thus, the asset-based Shari’a funds would have benefited from SABIC in their portfolio since the Yield to Date (January to August 2009) exceeded 28%.

Looking ahead

The Islamic fund industry is growing significantly to meet the growing demands of Muslim and non-Muslim population. This demand needs to be met with credible product offerings which comply with true Shari’a principles. This can only be achieved if the following is introduced: Involvement and reliance on Shari’a advisory services and systems which support structuring and monitoring the compliance of Islamic funds. Building new human resources with a multidisciplinary background in Shari’a and finance, which would carry the future development of the industry The promotion and development of centres of excellence and academic institutions that nurture innovative ideas and research, making a positive contribution to the industry. Existing global specialised Shari’a advisory firms, Shari’a-specific data providers, new academic programs and research centres play a major role in setting global standards in the Islamic industry.