The Role Of Shari’a-Complaint, Sustainability, and Fintech

ABSTRACT

Whilst the Islamic finance growth has been rapid in recent years, the essence of maintaining this progress in a fast-changing world is highly encouraged within various emerging opportunities globally, and at the same time beholding the core values and quintessence of the industry.

A well-known principle of the Shari’a (i.e. Islamic Law) is that, all things are permissible until they are proven unlawful (1). This principle unlocks the barriers of integrating newly surfacing ideas and innovations for the futurism of the Islamic finance industry. Sustainability and FinTech are two of the most widely communicated concepts to support the industry growth today due to its environmental and social gains, transparency, efficiency and feasibility.

Meanwhile, compliance with the Shari’a maxims also curbs Islamic financial institutions from performing or funding businesses that could generate negative impact at every facet of the business processes. This manuscript aims to analyse mechanisms of integrating and promoting sustainability ideas and FinTech innovations into Islamic financial practices without compromising its key role of Shari’a screening, so as to have a footprint in the sustainable development goals and solve several challenges of people around the world.

KEYWORDS: CAPACITY BUILDING, ISLAMIC FINANCE, SHARI’A-COMPLIANT, SUSTAINABLE DEVELOPMENT, AND FINTECH.

INTRODUCTION

Actions for capacity building in the Islamic financial industry are viewed to be confined within the framework of the current Islamic financial system with technological, social, economic, and environmental considerations and screening. However, there are impediments to this financial system due to a lack of knowledge and a weak, stringent approach towards these potential opportunities to derive economic prosperity and security while preserving the Shari’a interest. Correspondingly, educational creativity like Islamic finance capacity-building awareness, seminars, forums, and more, are organized and initiated across various parts of the world where Shari’a scholars, industry professionals and experts study the background, opportunities and benefits offered by the Islamic financial sector. Islamic banks also need to play important roles by looking into the impact of their business actions (2), and proactively screen and coordinate every stage of their activities in line with Shari’a and capacity-building standards.

Luckily, the Islamic finance industry has transcended the evaluation stage of awareness and acceptance among various subscribers of different backgrounds, race and religious beliefs, and is now recognized as one of the world’s leading financial industry. Consequently, the countless number of advocates and subscribers of the Islamic finance will not appreciate the industry to be restricted to a limited-spaced market, they’d rather like it be broadened into mainstream transactions. To actualise this idea, an effective profit-oriented, social and environmental gain products in business financing must be provided by the Islamic financial institutions such as banks, for both Muslim and non-Muslim communities. Though, some standards could hinder the competitive margin of this type of products based on jurisdictions. Nevertheless, a well-organized system and services for investing customers could be a helping hand. This urgent need has birthed the idea of capacity building of the Islamic financial system.

Basically, Islamic finance surfaces from a set of distinctive maxims as spotted by the Islamic economics development during the 1950s. Instead of becoming an original emergence that is independent, the roots of Islamic finance was regarded as a methodological foundation conjugated with institutional conventional banking idea that is dominated by Shari’a compliance. This approach has led towards the firmness and resilience of the Islamic financial structure even during the global financial crisis in 2008 (3). The fundamental goal of Islamic finance is not about “money making” alone (4), It revolves around the practical reinforcement of social prosperity and economic stability. Therein, the good alignment of the society’s financial corporate bodies’ aims and standards will determine how robust and successful a society will become (5). The private enterprise has led the industry’s growth via developing various innovation products, which has championed several financial commodities within the Islamic finance sector fitted to meet the potential market needs.

Alongside, the Islamic finance industry’s purview is being spread to tap from the newly emerging areas such as green sukuk funding and risk management utilising Shari’a-compliant confined implementations. Additionally, financial engineering and designs are also attractive to advance Shari’a-compliant products to serve the present-day market demands. Ultimately, Islamic finance has been growing in recent years to be a possible driver for strengthening financial inclusion due to it being diverse risk-sharing arrangement which lessens the financial cost of doing business (6). This manuscript shall explore the duties, which Shari’a-compliant businesses play to exploit these emerging opportunities to further the capacity building of the Islamic financial industry and encourage its sustainability over the coming years.

POSITION OF SHARI’A-COMPLIANT INVESTMENTS

The core value of Shari’a-compliant businesses is to provide an answer for poverty reduction, economic development and social fairness and equality which are also the cornerstones of the prohibition of Riba (interest/usury), according to Islamic legal system (i.e. Shari’a). Furthermore, the modes of contract in the Shari’a structure also go around productive venture and financial stability. This point has been proven during the 2008/2009 global financial crisis when the Islamic financial institutions had a lower influence in contrast to conventional financial institutions.

Islamic finance offers an unconventional access to the development established through an inclusive, fairness, and shared benefit in the allocation of resources. For instance, risk-sharing under Shari’a-compliant transactions increases contract impositions and fulfilment by both parties to generate more profit possibilities. Debt-based financing instrument of Islamic Finance fosters social involvement via risk-sharing agreement, demanding all agreeing parties to abide by all obligations along with those related to social or environmental security. In conclusion, Shari’a-compliant investment does not only aid the implementation of moral business activities, but in addition, promotes sustainable development of the economies.

Finance within the scope of Shari’a stand by the moral doctrine that supports the society to rise above covetousness and enhance the maxims of public commodities and social justice. According to the International Monetary Fund (IMF), “Islamic finance refers to the provision of financial services in accordance with the Shari’a Islamic law, principles and rules. Shari’a does not permit the receipt and payment of ‘Riba’ (interest), ‘gharar’ (excessive uncertainty), ‘maysir’ (gambling), short sales or financing activities that it considers harmful to the society. Instead, the parties must share the risks and rewards of a business transaction and the transaction should have a real economic purpose without undue speculation, and not involve any exploitation of either party.”

In distinction to the IMF and Islamic finance definition, it is crystal clear that exploitation and social injustice are motives behind the prohibition of ‘Riba’ (interest/usury), which is contrary to the conventional capitalist structure, in which few groups of the rich and powerful pull the masses off the opportunity of financial contribution to invest in the economy. The understanding of money in the Islamic economy is a means of exchange, which eases market transactions.

Hence, money cannot generate money, as it is done in conventional interest-based finance. Islamic modes of finance speak for real asset that will secure profit and value to any national economy (8). It is guided by the virtuous and ethical principles, which are supportive of the eco-friendly businesses to secure environmental preservation and growth. In respect to that, investment in the economy will act in accordance with the standards of Islamic finance, which drives capital and investment for encouraging sustainable development. Nevertheless, the power of the Islamic finance system in realizing the national aims of any economy needs strong government aid to reinforce the Shari’a compliance guidelines and unlock the potential of Islamic finance in attaining national and environmental goals. Lastly, the foundation of equity and justice under the Shari’a necessitates that resources are to be distributed between the members of a community. All members must be allocated with equal rights to financial resources to participate in the society’s investments.

SUSTAINABLE DEVELOPMENT OPPORTUNITIES

The concept of the unsustainable development goals aims to leave no-one behind. As a result, it advocates for a comprehensive involvement and contribution of everyone up to the level of decision-making. This approach of the United Nations in September 2015 corresponds to the inclusiveness ideology under Shari’a view, which mandates the significance of everybody’s participation in societal change and development. That indicated, the excellence of life is proportional to the development which aids all-round support for everyone, against social injustice, poverty, unfairness and environmental deterioration (9). Shari’a-compliant finance has a crucial quality of sustainable development via a broadened participant Governance. However, these sustainable implementations in governance are yet to be developed by way of wide major operation of negative screening, which includes interest (Riba) removal, enormous uncertainty (gharar) and keeping away of unlawful industries. Meanwhile, the sustainable implementation model necessitates positive screening like environmental and social results blended with Shari’a negative screening. (10).

It is tough to foster the societal welfare without a hale and sound environment. Hence, Green Investment are an integral part of strengthening environmental potentials and encouraging sustainable development. According to Brundtland Commission on sustainable development, “ (It is said to be) meeting the needs of the present without compromising the ability of future generations to meet their own needs.” (11). The possibility to achieve people’s needs and maintain human sustainability can be expanded through Green Investments which can generate more job opportunities and boost the quality of life of all members of the community to restore social stability and bond.

Islamic Broad View of Sustainable Development

While the Shari’a (Islamic legal system) supports societal, economic, and environmental developments, it also addresses the current economic and business model by putting forward a broad stake-holding-formed balance (miizan) viewpoint within the Shari’a system of development. By means of this model, the idea of Iqtisaad (a wide Arabic term used for ‘Economic’) will be the lead and recommended point. Iqtisaad is an Arabic word which originated from the word ‘Qasd’ and ‘Qist’. Qasd, which means “aiming at an objective”, “right path and Qist which means “fair share”, “justice” (12). Thus, it can be clarified as “allocating the right of everything in its spot”, which consequently is the act of “displaying justice”. Similarly, it also means “aiming towards a goal” which signifies the liberation and empowerment of all associate within it centered development.

Iqtisaad seeks to support and preserve an essential balance between all stakeholders of a tenable world. Humans, environment, and the animal world are stakeholders of this world and must be assigned an equal chance and room to thrive and progress as balance demands. Consequently, in the financial and economic sector, there must be a comprehensive thought of all stakeholders’ interest including all things surrounding us because they are placed as a trust (Amaanah) for us, suggesting that humans are expected to preserve this balance and ward off disharmonious co-existence. In line with this established logic, the thought of Shari’a compliant risk needs to be integrated after screening of Riba (Interest), gharar (excessive uncertainty), and unlawful industries, and with positive screening of social and environmental risks to boost prosperity and avert all damage in business activities.

FINTECH INCLUSION:

Financial Technology or FinTech is a term overturned lately for technological revolution in financial services. It is considered as a game changer that aims to connect the dots between the financial industry and technology to advance sustainable economic development. Before now, the financial industry has moved through various phases of development from book balancing to the setting up of central national banks and payment remittance, and later, the addition of sophisticated asset markets and more financial products (13).

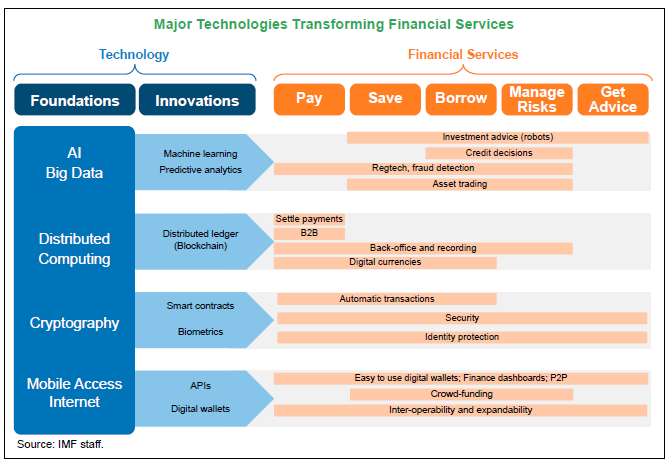

Similarly, a great idea of technological developments have occurred and have been integrated innovatively in many areas of finance such as payment, savings, lending, financial counseling, and risk management to name a few (14). Furthermore, the FinTech community is wide and incorporates technology builders, FinTech ventures, customers, government bodies, regulators, financial institutions, and Shari’a scholars in the event of Islamic FinTech.

The adoption of technological evolutions called ABCD of technologies (A – Artificial Intelligence (AI) , B – Blockchain, C – Cloud Computing, and D – Data) has led the way to smart agreement and bonds, digital wallet, online payment, machine learning, digital currencies, and predictive analytics to maintain a few.

(15). Following this development of FinTech, there is an essential demand to look into the regulation to enhance fairness, transparency and accountability (16). Consequently, RegTech is an area to harness also. Uniformly, there has been a rise in the duty of InsurTech (17).

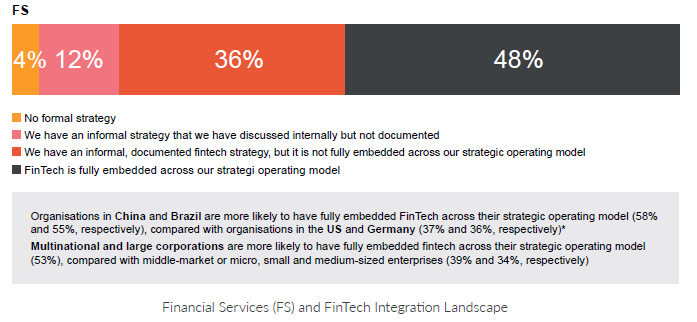

As reported by the PWC Global FinTech Report of 2019, about 48% of financial service organizations have fixed on a full scale into their strategic operating model (18). Similarly, about 37% of financial service organizations have integrated evolving technologies into the product and services they render (19).

Collaborations among financial service organizations and FinTech allows effortless, flexible and general low-risk settings for the two participants to meet each other’s robustness. Additionally, tech companies can grasp the influence from the company’s financing and possibly from their present customers’ connections and brand. Meanwhile, these collaborations provide beneficial opportunities for financial service and FinTech companies to determine and recognize problems, and also work on improving their companies expansion (20).

Position of FinTech in Islamic Finance

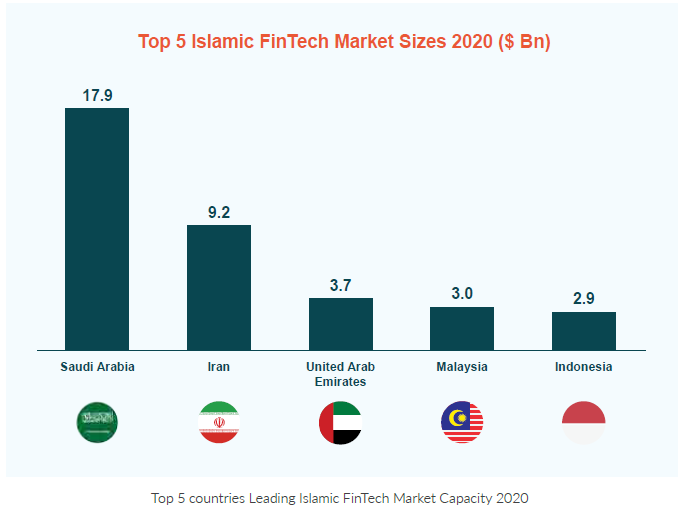

The general view of technology under Shari’a discourse is permissibility, except it is utilized in occurrences which oppose any ruling or conditions of the Islamic legal system known as Shari’a (21). In respect of that, FinTech applications and exercises should abide by the rulings of the Islamic legal system (Shari’a) as similar to Islamic finance practice by abstaining from prohibited component in the business activities like Interest/Usury (Riba), Gambling (Maysir), Excessive Uncertainty (Gharar), Harms (Dharar). Additionally, it is essential to be straightforward without hidden charges or irresponsible financing. About $49 billion was estimated in 2020 to be the global Islamic FinTech market size for OIC (Organization of Islamic Cooperation) countries which constitutes only 0.7 percent of the present global FinTech market size. All the same, it is now projected to expand at 21 percent CAGR to 128 billion by 2025 (22), where Saudi Arabia, Iran, UAE, Malaysia, and Indonesia stand among top 5 OIC FinTech markets by transaction volume.

Index Positions of Global Islamic FinTech Scores 2021

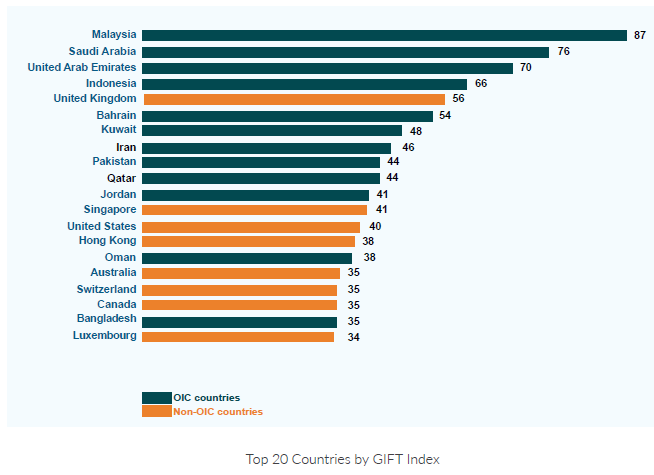

The index on next page showcases countries that are highly favourable to the development of FinTech within the Islamic finance market & ecosystem using 32 measures across five district divisions for each country as follows: Talent; Regulation; Infrastructure; FinTech in Islamic Finance & Ecosystem; and Capital (23). 9 out of 10 countries which are OIC members lead the table except the United Kingdom which already possesses a strong Islamic FinTech atmosphere due to a supporting regulatory form.

Challenges and Opportunities of Islamic FinTech

As reported by the Islamic Finance News (IFN), the service of FinTech within the Islamic finance comprises of nine classifications which are blockchain and cryptocurrency, trading and investment, personal finance, digital banking, peer-to-peer finance, Crowdfunding, data and analytics, remittances and forex, insurtech, and banking software (24). If we look at the FinTech services within the Islamic finance ecosystem, regulatory risks and information protection are the main threats arising from its adoption, which if overlooked can result to gone and misplaced opportunities in Islamic FinTech investing.

The broad diversity of the FinTech service and business model makes it demanding for regulators to develop a universal regulatory structure. Hence, Islamic financial institutions, tech startups, and regulators need to have earnest discussions and deep commitment with each other to build strong trust and compliancy room within the Islamic FinTech ecosystem. Considering the increase of cyber security incidents, since few years ago, it is incumbent to develop adequate security standards and arrangement to mitigate the risk of customers losing their personal data and investments. Flipping the coin, there are opportunities for Islamic FinTech via collaboration between Islamic financial institutions and FinTech startup. Instead of seeing each as competitors, collaboration creates an avenue to build up their brands, gain more customer trust and loyalty, and reduce service solution cost.

CONCLUSION

The discourse in this write-up has concentrated on Shari’a complaint investment, sustainable development opportunities, and FinTech inclusion in the growth of Islamic finance industry capacity. Whilst Islamic finance is experiencing growth and acceptance from people of different walks of life, creating a structure that not only meets the demand of Shari’a, but is also sustainable and will put the industry in front of the map, is highly needed. Thus, investments that comply with Shari’a and are environmentally friendly have the potential to play a prime position in enhancing the essentials for environmental governance, and encouraging development, justice, equity through moderate and reasonable utilisation of resources. The Shari’a gives a leading light to foster sustainable development by commanding Muslims to keep away from engaging in misconduct and resources wastage, as such actions create environmental degradation and shows immorality. Therefore, any structure of misconduct, including environmental misconducts is impermissible from the Shari’a view.

FinTech, as a game changer, also has a key duty in enhancing the method of which financial services are rendered with regard to time, charges, and accessibility. Hence, incorporating such a technology in Islamic finance will create inexpensive financial services accessible for unbanked people and corporations. Furthermore, the majority of FinTech solutions in Islamic finance are limited to payment and deposits, crowdfunding and asset management, while opportunities are widely open in other areas like insurance, regulations, and blockchain in terms of market potential and investment attraction.