Introduction

Islamic banking and finance has been growing substantially in many parts of the world, especially in South East Asia and the Middle East. In Malaysia, the market share of Islamic banking assets as a proportion of the total banking industry has grown from only 6.9 percent in 2000 to 22 percent in 2011. The contribution of Islamic finance to the Malaysian economy has also been growing significantly, accounting for 2.1 percent share of the country’s GDP in 2009, as compared to only 0.3 percent in 2000. 1

Parallel to the success of the Islamic finance industry, the halal industry has also experienced positive growth. The halal industry is a new growth segment in the Malaysian manufacturing sector and is the fastest growing global business across the world.2 It is also an emerging market force that is attracting non-Muslims with its wholesome, hygienic and contamination-free principles in food production. Research by the World Halal Forum Secretariat estimates that the global value of trade of halal food and non-food products is estimated at USD2.3 trillion (excluding banking). 67 percent (USD1.4 trillion) of this market comprises of food and beverages. A further USD506 billion comes from pharmaceuticals while USD230 billion is generated from cosmetics.

- Islamic finance and halal industry meeting point

However, both industries – Islamic banking and finance and halal food and non-food manufacturing – are seen as independent to each other. There are different regulators for each. Islamic finance falls under financial services,

whereas the halal industry is a branch of product manufacturing and distribution. The closest meeting of both markets is the availability of Shari’a-compliant investment in Bursa Malaysia for its Shari’a-compliant securities, which includes the halal manufacturing sector in the consumer goods section.

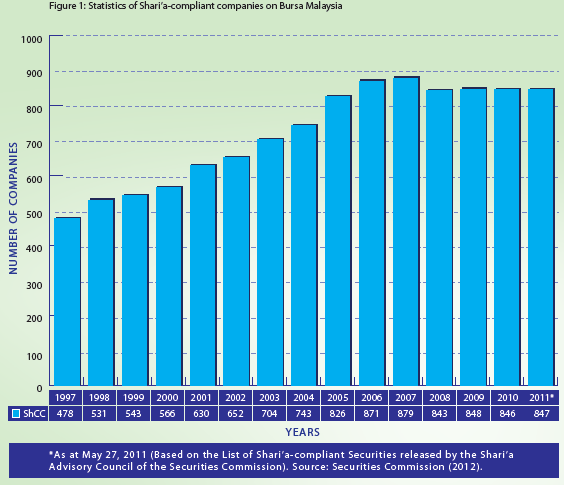

In Malaysia, 89% (839 securities) of the total 946 securities listed on Bursa Malaysia as at 31 December 2011 were Shari’a-compliant. This figure represents around two- thirds of Malaysia’s market capitalization. Figure 1 presents the number of Shari’a-compliant companies on Bursa Malaysia during a 15-year period from 1997 to May 27, 2011. The list is essential in boosting growth in the Islamic capital market, providing reference and guidance to the investing public, and for the development of the Islamic fund management industry.

This data suggests that Shari’a-compliant securities represent approximately two-third of Malaysia’s market capitalization. Notably, the number of Shari’a-compliant securities was only 272 as of 31 December 1998 representing 37% of the total listed securities. The rate of increase between the years 1998 and 2009 is 211%, thus indicating the importance of Shari’a compliant companies within the overall capital market in Malaysia.

With the support of the country’s large Muslim population who seek to invest in companies which conduct their activities in strict accordance to Islamic principles, the number of Shari’a-compliant companies is set to increase significantly in the future. Shari’a-compliant companies have become the favoured choice for investment in Malaysia as both Islamic and non-Islamic investors are gaining awareness of the potential rewards from investing in Islamic funds which can only be invested in these types of companies.

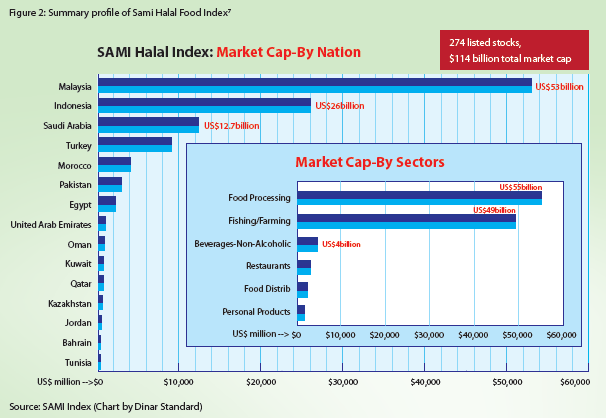

Islamic finance and the halal sector did not grow in tandem until recently. In April 2011, the world’s first halal food index, the Socially Acceptable Market Investments (SAMI) Halal Food, was launched. It is anticipated to grow faster than the Dow Jones Islamic Index (DJII) in terms of size, branding and spin-off products. This index contains over 200 stocks from six sectors with a market capitalisation of USD114 billion with 95 of these stocks emanating from Malaysia. The biggest Malaysian stocks on the SAMI index are Sime Darby Bhd, Nestle (M) Bhd and Genting Plantations Bhd. The leading advocate of the index was Rushdi Siddiqi, who championed the introduction of DJII in 1999.

Being halal is not just about certification. It involves the whole production chain from farm to fork. Even with a big sell-off in markets, the investor still needs to consume. Siddiqi foresees the SAMI index becoming a globally recognised index, surpassing DJII, since investors are more likely to connect with the principles and authority of halal. At the end of the day, investors are also consumers, and thus Investors have the “duty” to invest in these companies as it is important to sustain the halal food production for the betterment of the society.

The composition of the SAMI index by companies producing halal products included is provided in Table 1. The table shows the latest data as of March 2012 divided between countries. The summary profile of SAMI Halal Food Index can be seen in Figure 2.

Further developments in Islamic finance from the establishment of the Index

SAMI Index is a consumer non-cyclical sector. Investors may include in their portfolios the companies in the index as a hedge against inflation and also to boost the performance of their portfolios. In terms of performance, the SAMI index outperformed several leading global food indexes from March 2010 to March 2011 by 20%, according to IdealRatings, a Shari’a-screening company, which collaborated in the introduction of the Index.

Quality Shari’a-compliant asset classes are hard to come by. This is because new issuances of Shari’a-compliant papers are likely to be held by Islamic funds, creating a liquidity problem for Shari’a-compliant securities. Investors wanting to invest in Shari’a-compliant assets are then left with limited choice of high-quality Shari’a-compliant papers. The introduction of the SAMI Index provides investors with accessible information in order to perform fundamental analysis on these stocks. Having halal food companies as a Shari’a-compliant asset class moves the value proposition of halal food production. Consumers provide revenue to the firms producing halal food through consuming products, but now they are able to invest in these companies directly or through funds. By investing in the sector known to them, it will make it easier for them to comprehend and appreciate the risk and return profiles of these shares.

| No. | Number of Companies | % | |

| 1. | Malaysia | 40 | 27.59 |

| 2. | Indonesia | 16 | 11.03 |

| 3. | Saudi Arabia | 16 | 11.03 |

| 4 | Egypt | 15 | 10.34 |

| 5 | Turkey | 10 | 6.90 |

| 6 | Kuwait | 9 | 6.21 |

| 7 | Oman | 9 | 6.21 |

| 8 | Nigeria | 8 | 5.52 |

| 9 | Morocco | 7 | 4.83 |

| 10 | United Arab Emirates | 6 | 4.14 |

| 11 | Pakistan | 4 | 2.76 |

| 12 | Jordan | 2 | 1.38 |

| 13 | Qatar | 2 | 1.38 |

| 14 | Syria | 1 | 0.69 |

| Total | 145 | 100 |

Source: IdealRatings (March 2012) Table 1: Composition of the companies in the Index according to countries

With the introduction of the SAMI Index, investors are able to track and monitor their investment in the companies under the index. If the investment returns from their portfolios in halal food companies beats the Index, it indicates that their investment performance is doing well. Having an index in an industry helps investors, fund managers and financial planners to benchmark their portfolio returns. SAMI can also act as a benchmark helping fund managers to tangibly compare the performance of halal portfolios to the Index. Absence of such an index creates ambiguity as investors are constrained by a lack of aggregated information making it difficult to assess, compare and contrast investment risk and return characteristics, thus creating problems for portfolio monitoring and rebalancing.

The SAMI Index is expected be a bridge builder for Islamic funds, exchange-traded funds, and sukuk issues as well as for global non-Islamic investors interested in the emerging food sector markets, and a non-cyclical and lower-risk sector. Split-off effects for the Index introduction will be series of introductions of exchange-traded funds for halal food groups of shares, which will suit investors with various risk-taking profiles. IPOs opportunities are also possible. As the industry garners more interest from investors, halal food production companies may bring in financial injection from Islamic banks in the form of mudaraba participations.

This Index also has the potential of affecting sukuk issuance. Rafi-uddin Shikoh explicates the areas where sukuk can be utilised by halal food companies.6 True asset-backed financing could be issued to build factories producing halal food. Another interesting opportunity is for the halal food production companies which failed the debt screen test to issue sukuk to refinance conventional and BBA debt becomes a Shari’a-compliant security.

Moving forward: halal compliance procedures

Unfortunately, halal compliance mechanisms used to ensure the level of Shari’a-compliance adherence of companies in the Index remains weak. The Malaysian Securities Commission’s screening mechanisms are not comprehensive enough to cater for halal industry needs, which require companies to maintain strict adherence to halal certification, halal standards on production, transportation, storage and many more.

Organizations such as the World Halal Forum and the International Halal Integrity Alliance (IHI) are now taking initiatives to work hand in hand with companies on the SAMI Halal Food index to develop appropriate halal compliance procedures for the next phase of development. Halal compliance procedures account for current procedures, which include halal certification and financial screening, and extend to considering halal traceability and Islamic social reporting (Figure 3). The new regime will improve halal integrity of the companies operating in the halal industry. Further discussions on halal traceability and Islamic social reporting will be provided in the next sub-section.

Halal traceability processes in halal food production

The producers’ ability to trace processes from beginning to end – including distribution – in the production of halal food instills confidence in consumers that the whole process is authentically halal. Basic halal traceability provides further information about which halal standards have been applied, and allows the consumer to verify the halal claims and ensure that the product delivered to the customer is tayyib (wholesome, healthy, safe, nutritious and of good quality).

Currently, there are no established frameworks available for halal food producers to refer to as different companies have different methodologies and procedures to measure their products’ quality, system, and others. Although standards and guidelines currently in adoption – such as Good Manufacturing Practice (GMP), and Hazard Analysis and Critical Control Points (HACCP) – could be used to evaluate cleanliness, safety, efficiency and effectiveness of system, producers’ traceability practices are unclear.

The seven elements of traceability that a company needs to consider are: labour/ cost reduction, competitive advantage, legislation, food safety, documentation of sustainability, chain communication, and certification.8 When these forces are practiced, it reflects the management’s thorough adoption of traceability systems in their production processes. In what follows, we look into the adoption of the forces of traceability in a listed halal food production company in order to derive a higher level framework of halal traceability which may become a guide to other halal food production companies.

Adoption of seven elements of traceability in a halal food production company

Data was collected from a food production company listed on the main board of Shari’a-approved securities on Bursa Malaysia in order to inspect the adoption of the seven driving forces of traceability. Understanding this will allow investors and fund managers to learn about the requirements for halal traceability expected from a halal food production company. This information is also useful in performing non-financial fundamental analysis of companies that have gained investor interest.

Certification

All of the company’s products are certified halal, so consumers do not have to worry about the Shari’a compliancy of the materials or ingredients used.

According to a representative of the company’s halal committee, usually the company would apply for halal certification of their products 3 to 4 times per year. These applications are just for new products to be launched beside renewal of the existing products. Before they start the production for a new product, the Quality Assurance (QA) department will send a list of new products together with a list of ingredients used and the source of the ingredients itself to the halal committee for halal approval. The halal committee will verify the materials used with JAKIM – a government body that manages Islamic affairs at a federal level – to see if all the materials used are certified halal by JAKIM. The QA department will then proceed with the production processes, and at the same time, the committee will apply for halal certification from JAKIM. Halal certification application usually takes six months for approval.

Food safety

For safety and hygiene, the company introduced a food safety policy in order to ensure that all products achieve customer satisfaction and confidence. The food safety policies of this company are:

- Commitment to maintaining the effectiveness of Food Safety Management System (ISO 22000:2005) through monitoring and reviewing of the actual performance of established food safety objectives. The International Organization for Standardization (ISO) is an international standard-setting body composed of representatives from various national standards The organisation promotes worldwide proprietary, industrial, and commercial standards. It developed the ISO 22000 which defines the requirements of a Food Safety Management System covering all organisations in the food chain from “farm to fork”, including catering and packaging companies.

- Conform to the legislation, regulation and relevant standard codes related to food

- Continually improve the operation through adoption of an effective Food Safety Management System (ISO 22000:2005) requirement whilst incorporating research and

- Be at the forefront of product innovation and creativity to ensure further commitment to food safety while being result oriented at all times.

- Keeping the policy at strategic locations and communicated to all level of organization.

On top of this, employees are guided by officers during preparation and processing to ensure the products’ safety and hygiene. There is only one entrance to the factory so all workers will go in and out through that entrance only. Employees are required to wash their hands before they enter the factory and wear special clothing with hand gloves for safety and cleanliness.

Legislation

The company has conformed to ISO22000:2005 for Food Safety Management System assessed by Lloyd’s Register Quality Assurance, United Kingdom which enhances their processing quality and hygiene standards. This company also uses Hazard HACCP, and the Malaysian

Standard, MS 1500: 2004 Halal Food – Production, Preparation, Handling and Storage – General Guidelines, as a guideline for production and processing of products.

Documentation sustainability

Sustainability in documentation is very important in order to maintain the system. The company uses a documentation system during processing and production which is very systematic allowing quick identification of problems and its causes. This system is also centralised making it easier for officers to control the system and keep important documents and information in the system.

Competitive advantage

The company also markets other imported products from the United Arab Emirates (UAE) and other countries. Every year, two or three new products are introduced. This company uses high technology in order to produce their products which save cost and time. In Singapore, this brand offers popular bakery and confectionary products. The company wishes to expand into the halal sector to leverage of its customer base in Malaysia which is predominately Muslim.

Chain communication

This was difficult to assess. Companies need to understand that customers are constantly surrounding themselves with their own ideals; they are building a world of their own. As producers and manufacturers, they must strive to understand that world consumer demand is changing and ask themselves how they can be a part of it. For the ongoing success of the company, they should always receive feedback from consumers to enhance and improve the quality of their products. Companies should also have a strong relationship with relevant authorities such as JAKIM, the Ministry of Health (MOH), Universiti Putra Malaysia (UPM) and other institutions in order to guide them regarding halal issues. When problems on halal matters arise, they should refer to JAKIM to ensure that decisions taken are appropriate and do not violate ethics or procedures of halal certifications.

Labor/cost reduction

The use of technology during production is a strength for the company; it also helps them in reducing the cost of production. Physical labour becomes import at the end of the production line. A combination of sophisticated European and Japanese technology is employed at this factory. This is to ensure that the highest level of production standards needed to deliver quality products to meet market demand is achieved. The usage of a traceability system in this company also ensures a reduction of cost through decreasing the time it takes to locate a problem and find its cause. The cost of implementing traceability is high, but its absence would be far more costly. The cost of not having a traceable system is effectively an export barrier and a limit to market access.

However, there is still skepticism that the industry is ready to adopt comprehensive halal traceability in the near future due to associated costs it brings to

producers. Unless halal traceability measures are made mandatory by the regulators, such as in the case of Bird nest export to China in early 2012 (subsequently uplifted in November 2012), producers are less likely to adopt halal traceability measures.

Islamic social reporting in Shari’a-compliant companies in Malaysia

One way to provide full disclosure in the Islamic context is by practicing Islamic Social Reporting (ISR) According to a study by Bassam Maali, Peter Casson and Christopher Napier, 9 the three key objectives of the ISR are: (1) To show whether the organisation is compliant with Islamic principles; (2) To show how the operations of the organisation affects the well-being of the Islamic community; and, (3) To help Muslims perform their religious duties. Therefore, ISR is needed for the Muslim community with the objectives of demonstrating accountability to Allah and the community and to increase transparency of business activities by providing relevant information in conformance to the spiritual needs of Muslim decision-makers.

Subsequently, with Shari’a-compliant companies conducting their business in accordance with Islamic principles, one would thus expect their disclosure practices to be similarly aligned. As Islamic organisations, Shari’a-compliant companies are expected to demonstrate their accountability and commitments to serving the needs of the Muslim community and society through disclosure of relevant and reliable information in their annual reports.

Social reporting is by and large voluntary; it is not required by any financial disclosure regime, accounting standard agency, stock exchange rules and regulations, and the Companies Act in Malaysia. However, In accordance with government policy, Bursa Malaysia requires companies to include additional information on social responsibility in their annual report. The Financial Reporting Standard (FRS) 101 explicitly states that additional information should be incorporated into company annual reports if the management believes that such information would assist their stakeholders to make better economic decisions.

The concept of social responsibility in Islam encompasses a broader meaning embracing the taqwa (God consciousness) dimension by which a corporation, as a group of individuals, assumes roles and responsibility as servants and vicegerents of God.13 Accordingly, social responsibility in Islam stems from the concept of ukhuwwah (brotherhood) and social justice by sharing wealth for society’s progress. As business transactions are a part of religious acts, it should not be performed to simply satisfy material needs, but also to secure the social needs.

The obligation that an organization has to protect and contribute to the society in which it functions is defined as social responsibility.14 Social responsibility is considered crucial for Islamic business organizations. The practice of social justice will prevent Muslims from doing harm. The Quran states:

“Allah commands justice, the doing of good and liberality to kith and kin, and He forbids all shameful deeds, and injustice and rebellion…” (Qur’an, Surah An-Nahl, chapter 16: verse 90).

In addition, the concept of brotherhood makes Muslims responsible to each other. Both concepts (that is, commitment of Islam to justice and brotherhood) require Muslim society to take care of the basic needs of the poor.

Based on the axiom of tawhid, the primary objectives of Islamic social responsibility is to demonstrate responsibility to Allah, human beings, and to the environment as well. Tawhid, which signifies the acceptance of unity of Allah, provides one single direction in guaranteeing a unified spirit in adhering to Shari’a. The concept of tawhid also signifies man’s role as that of Allah’s khalifah (vicegerent) on earth. As the Quran states

“Behold, thy Lord said to the angels: “I will create a vicegerent on earth.” (Qur’an, Surah Al-Baqarah, chapter 2: verse 30).

To illustrate the concept of ISR, the extent of disclosure in Sime Darby Berhad, one of the companies featured in the Index for the year 2011, is analysed.15 The annual report has been used to assess the ISR information disclosure. An ISR index was formulated covering six themes: finance and investment, product/services, employees, society, environment and corporate governance. This analysis used the dichotomous scoring scheme (the nominal score approach) to record the absence (represented by “0”) or the presence (represented by “1”) data for the 43 ISR items either in the form of word(s), sentence(s), picture(s) or graphic(s). As long as a minimum of one occurrence of disclosed ISR in any form of disclosure, the item is considered as available.16 Table 2 shows the results of the analysis.

| Theme | Disclosure Items | ISR Score | |||||||

| 2009 | 2010 | 2011 | |||||||

| A | Corporate Governance | 1 | Shari’a compliance status | 0 | 0 | 0 | |||

| 2 | Ownership structure: Number of Muslim shareholders and its shareholdings | 0 | 0 | 0 | |||||

| 3 | BOD structure-Muslim vs non-Muslim members | 1 | 1 | 1 | |||||

| 4 | Declaration of forbidden activities: monopolistic practice/hoarding necessary goods/price manipulation/fraudulent business practice/ gambling | 0 | 0 | 0 | |||||

| 5 | Anti-corruption policies | 0 | 1 | 0 | 1 | 1 | 2 | ||

| B | Products And Services | 6 | Green product* | 0 | 0 | 0 | |||

| 7 | Halal (lawful) status of the product | 0 | 0 | 0 | |||||

| 8 | Product safety and quality | 1 | 1 | 1 | |||||

| 9 | Customer complaints/incidents of non- compliance with regulation and voluntary codes (if any) | 0 | 1 | 0 | 1 | 0 | 1 | ||

| C | Finance And Investment | 10 | Riba activities | 0 | 0 | 0 | |||

| 11 | Gharar (uncertainty) | 0 | 0 | 0 | |||||

| 12 | Zakah (Islamic tax): method used/amount/ beneficiaries | 0 | 0 | 0 | |||||

| 13 | Policy on Late Repayments and Insolvent Clients/ Bad Debts written-off | 0 | 0 | 0 | |||||

| 14 | Current Value Balance Sheet (CVBS) | 0 | 0 | 0 | |||||

| 15 | Value Added Statement (VAS) | 0 | 0 | 0 | 0 | 0 | 0 | ||

| D | Employees | 16 | Nature of work: working hours/holidays/other benefits | 0 | 0 | 0 | |||

| 17 | Education and Training/Human Capital Development | 1 | 1 | 1 | |||||

| 18 | Equal Opportunities | 0 | 0 | 0 | |||||

| 19 | Employee involvement | 1 | 0 | 1 |

| 20 | Health and Safety | 0 | 1 | 1 | |||||

| 21 | Working environment | 0 | 1 | 1 | |||||

| 22 | Employment of other special-interest-group (i.e. handicapped, ex-convicts, former drug-addicts) | 0 | 0 | 0 | |||||

| 23 | Higher echelons in the company perform the congregational prayers with lower and middle level managers. | 0 | 0 | 0 | |||||

| 24 | Muslim employees are allowed to perform their obligatory prayers during specific times and fasting during Ramadan on their working day. | 0 | 0 | 0 | |||||

| 25 | Proper place of worship for the employees. | 0 | 2 | 0 | 3 | 0 | 4 | ||

| E | Society | 26 | Sadaqa/Donation | 1 | 1 | 1 | |||

| 27 | Waqf (religious endowment) | 1 | 1 | 1 | |||||

| 28 | Qard Hasan (“benevolnet or good” loan or No Interest Loan Scheme) | 0 | 0 | 0 | |||||

| 29 | Employee Volunteerism | 0 | 0 | 1 | |||||

| 30 | Education: School Adoption Scheme/Scholarships | 1 | 1 | 1 | |||||

| 31 | Graduate employment | 0 | 1 | 1 | |||||

| 32 | Youth development | 1 | 1 | 1 | |||||

| 33 | Underprivileged community | 1 | 1 | 1 | |||||

| 34 | Children care | 1 | 1 | 1 | |||||

| 35 | Charities/Gifts/Social activities | 1 | 1 | 1 | |||||

| 36 | Sponsoring public health/recreational project/ sports/cultural events | 1 | 8 | 1 | 9 | 1 | 10 | ||

| F | Environment | 37 | Conservation of environment | 1 | 1 | 1 | |||

| 38 | Endangered wildlife | 1 | 1 | 1 | |||||

| 39 | Environmental Pollution | 1 | 1 | 1 | |||||

| 40 | Environmental Education | 1 | 1 | 1 | |||||

| 41 | Environmental Products/Process related | 1 | 1 | 1 | |||||

| 42 | Environmental Audit/Independent Verification Statement | 0 | 0 | 0 | |||||

| 43 | Environmental Management System/Policy | 1 | 6 | 1 | 6 | 1 | 6 | ||

| TOTAL SCORES | 18 | 20 | 23 |

*The term is used to describe a product that meets one of these criteria: (1) It has qualities that will protect the environment; (2) It has replaced artificial ingredients with natural ingredients. For example, a cleaning product may be considered green for two distinct reasons. It may be manufactured without phosphates in order to reduce a source of pollution in the water supply, which makes it better for the environment than a cleaner that contains phosphates. Or it may contain ingredients derived from natural sources to lower the risk of health problems that can be caused by exposing the skin to artificial dyes or fragrances

Source: Faidzulaini M., Hanefah H.M., Shafii Z. (2012) adapted from Othman et al. (2009)

The results from Table 2 shows that despite the company’s poor ISR disclosure practices, the extent of ISR practices increased from previous years. Out of 43 disclosure items, 18 items (42 percent) were disclosed in 2009. This level then increased to 20 items (47 percent) in 2010 and 23 items (53 percent) in 2011. Ironically, it was found that although Sime Darby has been approved as a Shari’a-compliant company in 2011, the company did not disclose the information in their annual report. No information was disclosed on finance and investment for those years. On the other hand, the figures illustrate that the company still concentrated more on practicing its conventional disclosure by focusing on disclosing more on its society and environment items.

In order that communication on corporate governance, products/services, finance and investment, the state of welfare of employees, societies and environments are taken care of by companies producing halal products, ISR variables should be used to increase transparency of the companies’ operations.

Conclusion

The growth of Shari’a-compliant sectors that consists of the halal industry and Islamic banking and finance could be further developed to boost the depth of the market. It is crucial to have measures of halal compliance procedures to ensure transparency, which is vital in a faith-based industry. Shari’a compliance must be ensured and communicated to stakeholders. New regimes to ensure Shari’a compliance are not to be viewed as another set of regulations to increase complexity and red tape, but to facilitate the Shari’a governance of the industry. Halal compliance procedures to include halal certification, sectorial and financial screening, halal traceability and Islamic social reporting to communicate the Shari’a compliance measures could be a new regime in the halal industry.