Introduction

The halal ecosystem cuts across many industries, ranging from halal food and non-food products to halal-related services including Islamic banking and finance, certification, logistics, tourism and health care. The recent world population of 2.1 billion Muslims (which is far greater than earlier estimates) have a faith that shapes their Islamic way of life including their food consumption choices.1 The value of this halal market is estimated at USD 2.1 trillion and is fast gaining attention worldwide as the next world market force. The Muslim consumer market is one of the hottest new niche market segments in the West. From food, to finance, from tourism to education, the Muslim consumer market is a unique opportunity segment.

This chapter explores the size, the opportunities and the challenges of building a halal market in the West. However, the market in the west faces significant challenges – least of which is anti-Muslim political environment in some markets. Bigger issues are around population fragmentation, product certification consistency, authenticity and distribution. These issues affect the markets of both Europe and North America. This chapter provides two case studies – USA and Europe in which the reader will be provided with a deeper analysis into the markets, helping them appreciate the successes and the challenges.

European Muslim demographics

As of 2009, there were approximately 735 million inhabitants in Europe (not including Turkey). It is conservatively estimated that while Muslims comprise 5% to 8% of Europe’s population, they exhibit a very high relative growth rate when compared to the general (non-Muslim) population. Pew Research Center estimate that in 2009 there were approximately 38 million (5%) Muslims in Europe. This estimate is derived using census data (usually older) as a baseline and then applying a conservative assumption that the Muslim population grew at the same rate as the rest of the population. Unfortunately, this assumption is flawed. Multiple surveys, national reports, and academic sources confirm that the Muslim population has been, in fact, growing at a much higher rate than the general population – especially in Europe.

For example, in the UK, the Muslim population grew ten times faster (6.68%) than the rest of population, according to a 2004-08 survey by The Office of National Statistics. This increase has been attributed to immigration, a higher birthrate amongst Muslims, and conversions to Islam. According to a 2008 estimate by Euro monitor, Europe’s Muslim population increased at a rate of 140% from 1995 to 2005.

Dinar Standard estimates Europe’s 2009 Muslim population to have been approximately 54 million which is 7.4% of Europe’s total population. The 10 countries with the largest number of Muslims in Europe represent 90% of all Muslims in Europe. Russia has the highest Muslim population of 26 million (19% of total population.) Following Russia, France (6 million) and then Germany (4.1 million) have the highest estimated number of Muslims. Within the five Western European countries, France has the highest concentration of Muslims at 10.1% of the population.

A key distinction between the Western and Eastern European Muslims is that the makeup of the Western European Muslim population is composed primarily of recent immigrant populations originating from South Asia, North Africa and Turkey, whereas the Eastern Muslim population is almost entirely composed of people of indigenous origin.

US Muslim demographics

Dinar Standard conservatively estimates the American Muslim population in 2010 to range between 5.8 million and 6.7 million in 1.7million to 2 million households, and that the aggregate American Muslim disposable income in 2010 ranged from USD107 billion to USD124 billion. The demographics of American Muslim consumers are further attractive in that American Muslims are younger than the national average, and their education and income levels are at par with the average American household profile.

A major dynamic of the American Muslim market is the challenge and opportunity it presents in its vast geographic fragmentation. Mainstream national chains, retailers and brands that are not yet engaged with this The major ethnic segments in the US are Arab, South Asian (Pakistani, Indian, and Bangladeshi backgrounds), African American, Caucasian American, with sizeable Turkic, Latino, European, Sub-Sahara African, Afghan, Iranian and East Asian populations.

Halal food brands in Europe

The European halal food market, in aggregate, is estimated to be worth between USD55-USD65 billion (including Russia). The Muslim population of Western Europe is comprised mostly of immigrants, and presents a more attractive demographic in terms of their halal market needs.

population are well positioned to address the geographic challenge, given their existing national channels and networks. By DinarStandard’s estimation, fifteen states across the US represent approximately 85% of the total American Muslim population. These fifteen states run from coast to coast and are listed in descending order of their Muslim population size: California, New York, Texas, Illinois, New Jersey, Michigan, Pennsylvania, Maryland, Virginia, Georgia, Ohio, Massachusetts, Florida, Connecticut, and North Carolina.

Another key dynamic of the American Muslim market is the strong role of ethnic and indigenous sub-clusters that exist today within the market, as well as the impact of immigration cycles on consumer behavior, channels and preferences. It is important for marketers to understand that within major ethnic categories of American Muslims, there exists a strong cluster of ethnic media, organisations, events, concentrated mosques, Islamic centers, and product considerations (e.g., ethnic food) that influences their buying decisions. Each sub-cluster also effectively engages with national and indigenous American Muslim channels. Major European brands have realised the economic rewards of targeting Muslim consumers and are increasing their halal offerings. Tesco, the British grocery retailer, has halal meat counters in 27 of its stores. It sells halal chicken, mutton, lamb and beef – including sausages, burgers, and ground beef provided by the National Halal Centre.

The German international confectionery company, Haribo, which produces gummy bears and other candy, produces certified halal gummy bears, and soft candy in its Turkish factory. Other German brands offering halal brand extensions are Dr Oetker, Muller, Pfanni, Storck and Maggi.

International food companies such as Nestle and Unilever have for years offered products that meet halal food standards. Their products are certified by the Halal Control Authority, which certifies products made by many of the major European food producers, including Nestle, Langnese, Elbmilch, Pfanni. Nestle earns more profits from its halal products than from its range of organic products.

Halal food brands in the US

The USA, though still lagging behind Europe in terms of the size of its halal food market, boasts many success stories in the halal food arena. One such successful halal brand is Saffron Road, a premium organic packaged food brand. Saffron Road successfully launched its line of halal frozen entrees at Whole Foods Market during Ramadan of 2011. To spread the word to Muslim consumers Whole Foods Market and Saffron Road jointly conducted a full scale social media campaign to create excitement around the launch. The online campaign included guest posts on Whole Foods Market blog by Muslim blogger, Yvonne Maffei of “My Halal Kitchen,” Saffron Road’s marketing partner, as well as running contests on My Halal Kitchen’s blog. Expectedly, Whole Foods faced a lot of criticism for carrying a halal brand and “celebrating” Ramadan from a small group of vocal anti-Muslim bloggers. Instead of shying away from its association with Saffron Road, Whole Foods stood firmly behind its decision to promote Saffron Road’s brand, and both Whole Foods and Saffron Road were rewarded for standing steadfast by increased awareness and sales of the Saffron Road brand at Whole Foods Market.

Islamic finance in the US

Closely following the food sector, the second largest Muslim market sector is finance. Although the US Muslim market is one of the most underserved affluent markets for Islamic finance, it is slowly gaining the Industry’s attention with the creation of financial products and services that cater to customer needs.

Just like its growth around the world, the Islamic finance industry in the US has grown significantly over the last 15-20 years. Today there are a few national players in the field such as Guidance Residential, Zayan Finance, and Amana Funds that are able to adequately serve a national market with proper supervision of Shari’a advisors and close partnerships with regulators and key financial institutions. These firms are bringing Shari’a-compliant products to the American Muslim market.

While the Islamic finance industry in the United States stands to gain in the midst of a market with underserved demand for financial products and services a number of challenges remain; most providers entered the market with compelling value propositions, but none has been able to deliver a full-suite of financial products to the market. Limited product sets, lack of service quality based on industry standards, and non-competitive pricing have been challenges faced by market players. However, these issues are changing as the market becomes more sophisticated and starts demanding competitive pricing and world-class service standards. The nascent market in the US still presents a tremendous opportunity for companies looking to offer a full-suite of products with effective marketing and distribution strategies.

The global Muslim lifestyle travel market

Travel is another growing Muslim market segment in the West. In a recent study, the 2012 Global Muslim Travel Market, that was conducted by Dinar Standard in partnership with Crescent rating, it is estimated that the global Muslim tourism market in 2011 was USD126.1 billion in outbound expenditure (not including core religious travel expenditure of Hajj & Umrah, but covering leisure, business, and other tourism segments). This constitutes 12.3% of the total global outbound tourism expenditure in 2011 at USD1034 billion as estimated by the United Nations World Tourism Organization.

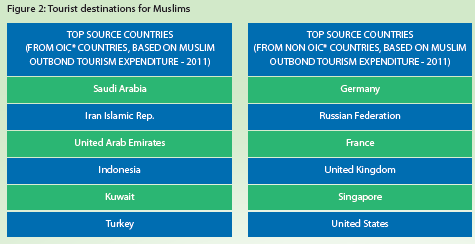

Among the top 10 tourism destinations for Muslims are Western markets of Russia, France and Italy. Other western tourism destinations are UK, Germany and the US. In addition, while the top Muslim tourist source countries by expenditure are Saudi Arabia, followed by Iran, UAE, Kuwait and Indonesia based on 2011 data, Muslim communities living in non-Muslim countries also have a sizable outbound tourism expenditure share including in the West. Out of the Top 50 Muslim tourist source markets, 29 are mostly Muslim-majority OIC (Organization of Islamic Cooperation) member countries and 21 are non-OIC member countries. The largest of Muslim tourist markets from non-OIC countries are Germany, Russia, France and UK (Figure 2).

Giving the significance of Muslim travelers, the Western markets hold tremendous opportunity to further service this segment. Some are already making targeted efforts. Munich International Airport prepares a travel guide in Arabic and identifies family-friendly sights and outings. Australia’s Gold Coast is attracting Muslim tourists by offering a Gold Coast Ramadan Lounge. In Thailand, spa- outlets have introduced the concept of Muslim-friendly spas in a bid to lure tourists from the Middle East. Global Health City, in Chennai, India, has gotten halal certified to better serve its growing medical tourists from Muslim countries. Even in Muslim-majority destinations, hotels/ resorts such as De Palma Group of Hotels in Malaysia, Al Jawhara Hotel in Dubai, Amer Group of Resorts in Egypt, Ciragan Palace Kempinski Hotel in Turkey are offering Muslim lifestyle-related services by not serving alcohol, separate recreation services/timings for women, prayer facilities and more. Airlines and destinations are just beginning to pay attention.

The unique Muslim lifestyle consumer drivers are centered around food, family-friendly environments, religious practices accommodation, gender relation nuances, and other areas. While this is a large travel segment, very few hotels, airlines and tourism destinations have moved to meet demand, giving industry players a unique opportunity to lead in adding this segment to their multi-cultural marketing mix.

A first of its kind online survey of Muslim tourists from select top source markets was conducted by Dinar Standard and Crescent rating. The survey covered questions related to Muslim tourists travel profile, destination, lodging, and airline/transportation experience, needs and satisfaction level. On the question of, “Overall, which of the following are important to you when travelling for leisure?” top answers were, “Halal Food” (67%), followed by “Overall price” (53%), and “Muslim-friendly experience” (49%).

Developing the Muslim consumer market

As demonstrated, the Muslim consumer market opportunity in the West is robust, but in its infancy. To improve the value of the Muslim consumer market, Islamic capital needs to look at Western halal sectors. Currently much of the western ‘halal’ niche market is served by SME’s. This is especially true in the halal food sector in the West. There is tremendous opportunity to create larger more productive players and to create regional halal brands from the West (rather local only). However, there is still some reticence in investing in halal brands. Saffron Road, started by a food industry veteran, is a premium and organic halal food line by a food that is distributed across “Whole Foods Markets” in US, the largest organic products supermarket chain. Its introduction was hailed as a “historical launch” by Whole Food execs.

The founder first went for Islamic Capital but was very disappointed. The Islamic capital investors were seeking quick return, not ready to invest in brand. The founder ended up with success with traditional food industry investors from Switzerland and US and their targeted USD5 million raise was oversubscribed and closed at above target.

Given SME financing nature, investors need to take long- term (5-10yr) investment horizon to build sustainable brands. The industry can be expected to give 25-50% IRR in the halal food space. However, investors need to do their homework and due diligence (visit plants/ operations) and have industry specialist on team.

As demonstrated by success of Saffron Road in the US, the Western Muslim consumer market needs to be nurtured to become a mainstream offering. Certainly the values and virtues extend beyond appeal to the Muslim audience only. While this is a higher level mission, the very basics of having good reliable standardization of halal processes or Islamic financing rules continue to be a challenge. Finally, the industry should certainly seek to raise its product quality and innovate. After all, Muslim consumers ultimately expect high quality innovative products that happen to be halal. No wonder the largest halal products producer in the world is a Western company – Nestle!