Introduction

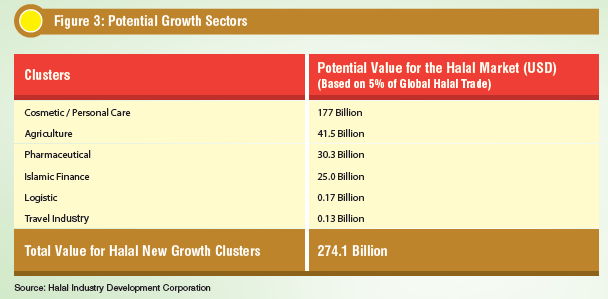

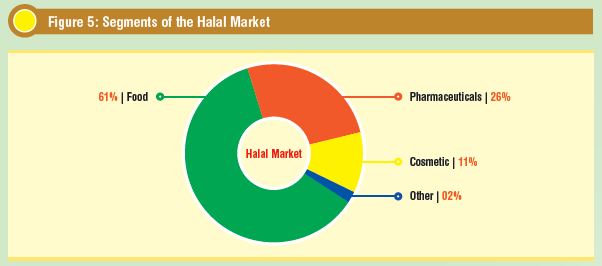

The global halal industry is estimated to be worth around USD2.3 trillion (excluding Islamic finance). Growing at an estimated annual rate of 20%, the industry is valued at about USD560 billion a year. Thus, making it one of the fastest growing consumer segments in the world. The global halal market of 1.8 billion Muslims is no longer confined to food and food related products. The halal industry has now expanded beyond the food sector to include pharmaceuticals, cosmetics, health products, toiletries and medical devices as well as service sector components such as logistics, marketing, print and electronic media, packaging, branding, and financing. In recent years, with the increase in the number of affluent Muslims, the halal industry has expanded further into lifestyle offerings including halal travel and hospitality services as well as fashion. This development has been triggered by the change in the mind set of Muslim consumers as well as ethical consumer trends worldwide.

The halal market is non-exclusive to Muslims, and has gained increasing acceptance among non- Muslim consumers who associate halal with ethical consumerism. As such, the values promoted by halal – social responsibility, stewardship of the earth, economic and social justice, animal welfare and ethical investment – have gathered interest beyond its religious compliance. The popularity of, and demand for, halal- certified products among non-Muslim consumers have been on the rise as more consumers are looking for high quality, safe and ethical products

No longer a mere religious obligation or observance for Muslims, halal (which means “lawful” or “allowable”) has become a powerful market force, becoming increasingly a worldwide market phenomenon for both Muslims and non-Muslims alike. The appendage of “Halal” to a product is not just a guarantee that the product is permitted for Muslims, but it has also become a global symbol for quality assurance and lifestyle choice.1 This is evident by the participation and involvement of non-Muslim countries and organisations where halal is fast emerging as the standard of choice. Many Western countries have recognised the emerging global trend in consumerism towards halal products and services, and are now racing to gain a footing in the halal industry.

In lieu of the paradigm shift on global issues such as sustainability, environmental protection, and animal welfare, the potential growth of the halal industry has made it a lucrative market to be tapped into and presenting a major global opportunity. Players from every sector of the industry, from the huge multinationals down to small enterprises, are looking to capture their share of this growing market. In the last decade, the halal industry has undergone further evolution as a market force when governments have started to look at halal in terms of policy formation for developing their own economies.

- A growing market force

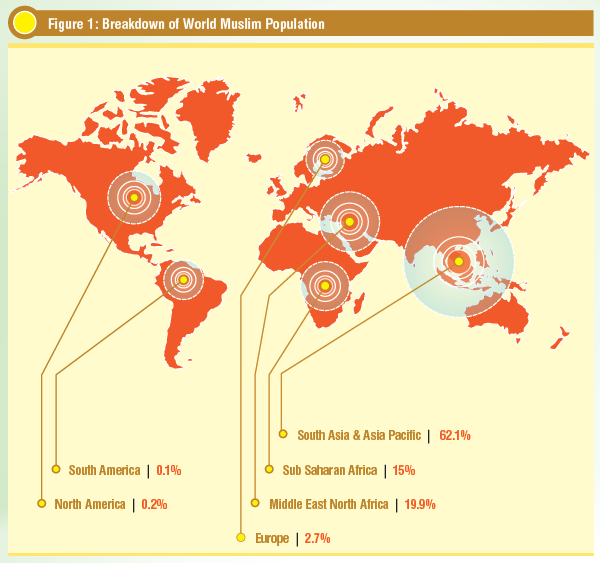

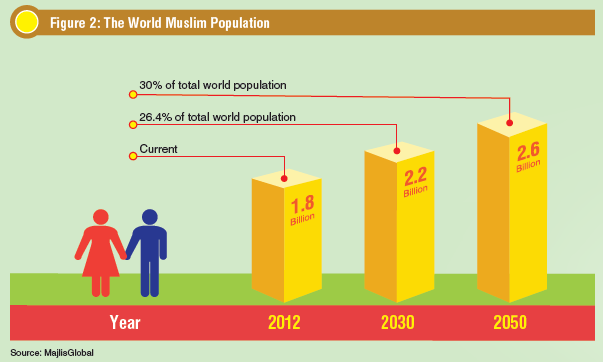

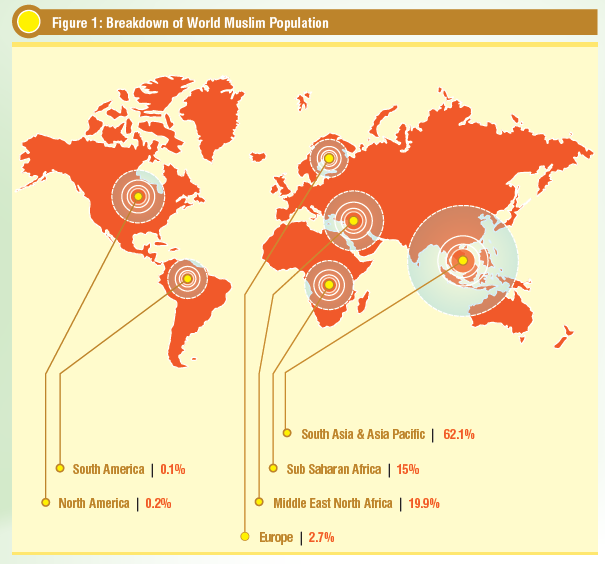

Muslims represent an estimated 23% of the global population or about 1.8 billion consumers with an average growth rate of 3% per annum.2 If this growth trend continues, Muslims are expected to make up about 26% of the world’s total projected population of

2.2 billion in 2030. The two strongest markets for halal products are the Asia Pacific and the Middle East. More than half of the global Muslim population lives in the South Asia and Asia Pacific and the number of Muslims from these region are expected to reach 1.3 billion by 2030.3 Four of the ten countries in the world boasting the largest Muslim population in the world are located in the South Asia and Pacific region: Indonesia, Pakistan, India, and Bangladesh.

Although Islam is often associated with the Arab world and the Middle East, this region is home to only 20% of the world’s Muslim population. This number is expected to grow by more than a third in the next two decades. Sub-Saharan Africa make up 15% of Muslims worldwide and is projected to grow by nearly 60% in the next two decades. About one-fifth of Muslims live in a country or region where they are the minority.

Although Muslims will remain a minority group in Europe and Americas, they will constitute a growing share of the total population.5 Europe’s Muslim community is expected to increase by nearly a third from 44.1 million in 2010 to 58.2 million in 2030. In the Americas the number of Muslims is expected to double during the same period. The sizeable and growing Muslim consumer market across the globe will continue to fuel the halal industry’s double digit growth, creating a plethora of opportunities in the market for halal products and services. Increasing awareness of Muslim consumers on their religious obligations has also contributed to the increasing demand for halal products and services. The demographics of Muslims have undergone significant change in recent years. There is now a wave of religious fervour amongst the rising social class of young, highly educated, savvy and affluent Muslims, who embraces an “Islamic contemporary with global lifestyle.” This new generation of Muslims favours Western-style products and aspires to a modern lifestyle as they become more integrated into the global economy as consumers, employees, travelers, investors, manufacturers, retailers and traders. This has created a worldwide demand for mainstream products and services that conform to Islamic values.

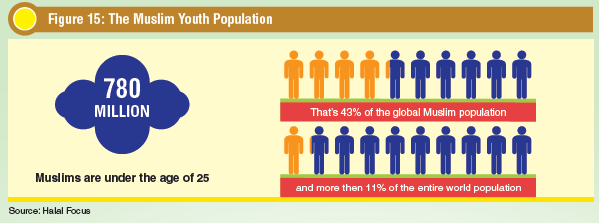

Many are consciously seeking out products with an Islamic brand.6 With Muslim youth now accounting for 11% of the world’s population and representing just under half of the total global Muslim population, demand for stylish halal brands is expected to increase significantly. These young consumers are the future of Muslim consumption, and fast becoming a new outlet for future growth. Although their core religious values remain the same as their parents, they are having new expectations and desires for halal brands.

The growing Islamic consumerism among urban middle-class Muslims in countries with a large population of Muslims – such as Indonesia, Pakistan and Turkey – has set a new trend in the halal market. This is reflected in the mushrooming of an increasing number of religious-themed products and services including banking, tourism and fashion. Hence, the modern Muslim consumes view halal products as not only acceptable from a religious viewpoint, but also they imbue a sense of pride and confidence.

- Halal products on the rise

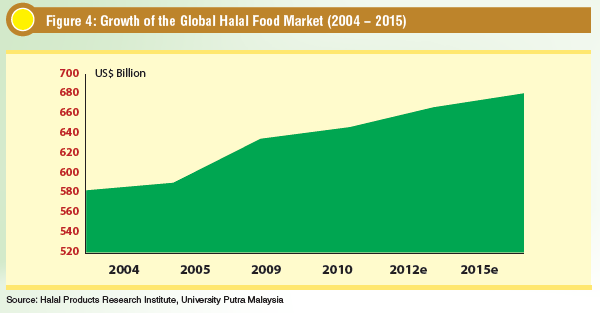

- Food

The halal marketplace is emerging as one of the most profitable and influential market arenas in the world food business today. The halal food market has grown strongly over the past decade and is now worth an estimated USD667 million.7 Halal food represents close to 20% of the entire global food industry. With expected increases in both population and income of halal consumers, and coupled with the expected increase in demand for food by more than 70% by 2050, the future demand for halal food is strong.

Many food economists posit that the halal food industry will become a major market force in the near future based on four prevalent trends. Firstly, Islam is now the fastest-growing religion in the world thus fuelling a global demand for halal products. The annual growth in consumption of halal food is estimated at 16%. Secondly, the increasing trend of consuming halal food products for ethical and safety reasons by non-Muslim consumers. In the UK, for example, there are over 2 million Muslims, yet there are 6 million consumers of halal meat.8 In the Netherlands, non-Muslim Dutch consumers have shown marked interest in halal food where total demand is estimated to reach about USD3 billion on an annual basis.9 These two factors combined have made halal products mainstream consumer goods. Third is the rising halal consumer power as a market force in tandem with the growth of the Muslim population and their rising disposable income. Finally, there is greater awareness among Muslims on the need and necessity to consume only halal food. A good example of such increasing consumer awareness is the rapid rise in annual sales of halal food throughout Russia and the growing demand for halal products between 30% and 40% annually.

Until a decade ago, halal food products were offered in traditional corner shops and neighbourhood butchers. The halal market has witnessed a universal shift in the demand and supply chains of halal food products. They are increasingly made available in Western-style grocery stores including supermarkets and hypermarket chains. In many western countries, supermarkets and food producers are starting to reach out to Muslim consumers by offering a wider selection of halal food products. Halal food is becoming an increasing part of the Western diet and has become a multi-billion dollar global industry involving multinationals like Tesco, Unilever and Nestlé who have aggressively expanded their halal-certified product lines. To date, Nestle is the biggest food manufacturer in the halal sector with annual sales of more than USD5 billion. Halal food accounts for about 35% of Nestle’s global sales.

From a market perspective, the traditional major target markets remain in Asia and the Middle East. However, halal markets in the UK, Europe and the USA will see their roles in the development of the halal market

significantly enhanced as they are markets that play defining roles in other markets around the world. It will bring halal into the global mainstream. As the dynamics within the Muslim world change and globalization trends continue to shape consumers’ tastes, habit and spending patterns across the world; it is highly likely that the developing halal markets will have increasingly influential roles in the established markets of the Middle East and Asia particularly by influencing global corporate halal strategies.

Source: Economist Intelligence Unit

It is not surprising that the biggest halal food manufacturers and exporters are located in non-Muslims countries like the US, Brazil, Argentina, Australia and China. Because of the traditional nature of the market, it is estimated that multinationals from these countries control 90% of the global halal market. In Malaysia, for example, Muslim consumers spent an average 14% of their food budget on meat. 60% of the halal meat is imported from India, Australia and New Zealand. Other Muslim countries including Saudi Arabia, Algeria and Egypt also import meat from non-Muslim countries to meet their local consumption demand. Countries like Brazil, Argentina, New Zealand and Australia have established themselves as market leaders in the export of halal meat and poultry.

Halal food products are not confined to meat and poultry, including other food items such as confectionary, canned and frozen food, dairy produce, bakery products, organic food, beverages and herbal products. The evolving lifestyle and increase in purchasing powers of Muslims means that there is widespread demand for prepared convenience foods as well as packaged foodstuff that still conform to Islamic dietary laws. Another growing sector of foods is comprised of substitutes for products that traditionally contain non-halal (haram) ingredients such as pork gelatine or alcohol. These products, which include yogurt, biscuits, and chocolates, are now being modified so that they can be marketed as halal.

Pharmaceutical and health products

Pharmaceutical and health products are also large growth areas in the global halal industry. Demand for halal pharmaceutical, generic medial, wellness and healthcare products are estimated to be about USD555 billion in Muslim-majority countries. The main concern among Muslims is the use of non-compliant substances such as animal derivatives and animal-based gelatines in these products. The global market growth for pharmaceuticals increased by 4% in 2009 to a value that exceeded USD820 billion, offering vast potential opportunities for the halal pharmaceutical industry to tap into. The rising healthcare costs also provide the halal market with a key differentiation factor in the supply of generic pharmaceuticals.

Although Muslims are generally allowed to consume haram (forbidden) products in life threatening situations, the demand for pharmaceuticals that adhere to Muslim rules is growing.11 The increasing global demand in halal pharmaceuticals is in tandem with the growing interest and concerns of Muslims concerning the halal status of pharmaceuticals. Many of them are challenging the industry on the origins of the ingredients of these products and whether they are compliant with an Islamic lifestyle. Halal pharmaceutical products should not only be free from haram constituents, but they should also be tayyib which is a term given to goods and products which meet quality standards. In general, tayyib refers to products that are clean, pure and produced based on standard processes and procedures. Thus, a pharmaceutical product should not only be halal, but should also be judged clean according to Shari’a law.

However, the halal pharmaceutical market is plagued with the lack of global halal standards on pharmaceutical ingredients and product integrity analytical methodology. In the move to strengthen the integrity within the manufacturing and servicing of medicines and health supplements, Malaysia introduced a new standard for halal pharmaceuticals. “The Malaysian Standard MS2424:2010 (P): Halal Pharmaceuticals General Guidelines” addresses the entire pharmaceutical industry’s supply chain from processing to handling, packaging, labelling, distribution, storage and display of medicines and health supplements.

Cosmetics

Growth in the halal cosmetics market is mirrored by a growth in consumer knowledge about the ingredients used and product awareness, fuelled by social networks.13 The global halal cosmetic industry is estimated at USD13 billion with an annual growth rate of 12%.14 At present the halal cosmetic market constitutes 11% of the total global halal industry. The emerging halal cosmetic and personal care market is seen by analysts as next in line for growth after the lucrative halal food sector. The main driver for this huge demand in halal cosmetics and beauty products stems from the demographic of young, religiously conscious, and dynamic professional Muslim population. In the scope of halal cosmetics, the concept covers critical aspects of production such as halal ingredients and usage of permissible substances which must be manufactured, stored, packaged and delivered in conformity with Shari requirements. Interestingly, halal cosmetics has also gained momentum amongst modern consumers who are eco-ethical conscious and are willing to pay a premium for organic, natural and earthy cosmetics products to suit their modern lifestyle.

The market for halal cosmetics is booming in the Middle East and Asia. Across the Middle East, halal cosmetics are registering a 12% annual growth reaching USD12 billion in total value of cosmetic related sales. Markets in Asia, particularly Malaysia and Indonesia as well as Europe, have seen a surge in interest in halal cosmetics. In Malaysia, halal cosmetics contribute 10% – 20% of the local cosmetics market. However, the global cosmetics industry is dominated, and to a certain degree monopolised, by non-Muslims companies. This poses serious challenges to the issue of halal ingredients in cosmetic products manufactured by the companies.

Many cosmetic products contain alcohol which is deemed as haram, and animal sourced components considered impure by Islam. Growing concerns about animal-derived ingredients such as gelatine and collagen in cosmetic products are fuelling demand form both Muslim and non-Muslims consumers. The halal label on cosmetics and beauty products appeal to consumers seeking integrity and authenticity in their cosmetic and personal care products. Although the concept of halal cosmetics is very new to the Muslim world, there is a growing demand especially from conscientious consumers who are becoming more selective in their choice of personal care items, and consciously choosing to spend money on cosmetics and beauty products that fit in with their religious and cultural requirements.

Halal cosmetics have developed far beyond a novelty. Capitalising on the burgeoning halal cosmetic market, a number of cosmetic companies are beginning to develop this niche market by producing halal-certified product lines that contain no animal ingredients, and not tested on animals to meet the growing demand of consumers who simply want more assurance that the cosmetics they are using are healthy and sustainably sourced. A challenge to further develop this niche halal sector is on how to best integrate halal cosmetics into the framework of the global beauty industry. Active collaboration with key parallel interest groups such as organic, vegan, ethical and environmental rights may be key to further strengthen the value of halal cosmetic products in the global market.

Tourism

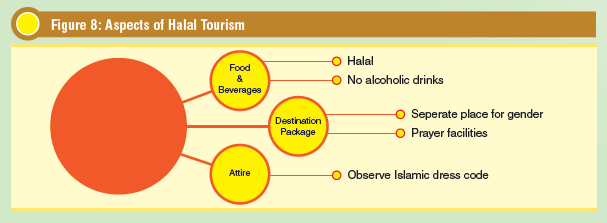

Halal tourism has recently gained popularity, and is now fast becoming a new phenomenon in the general tourism industry. It refers to tourism products that provide hospitality services in accordance with Islamic beliefs and practices. This involves serving halal food, having separate swimming pools, spa and leisure activities for men and women, alcohol free dining areas, prayer facilities, and even women-only beach areas with Islamic swimming etiquette.

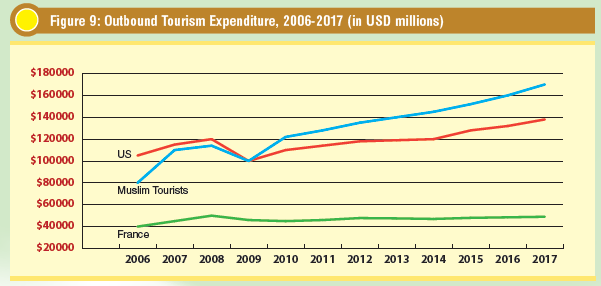

Traditionally, halal tourism has been commonly associated with pilgrimages hajj and umrah. The growing affluent middle class Muslim consumers, and increase in the degree of interconnectivity which has made traveling a part and parcel of everyday life, are gradually changing the tourism preferences of Muslims from traditional destinations such as Mecca to top holiday destinations and resorts. With Muslim tourist’s expenditure expected to rise to more than 13% of the entire global tourism expenditure by 2020, halal tourism has the potential to go mainstream and develop as an integral part of the burgeoning global halal market.

The halal tourism market represents 12.3% or USD126.1 billion of the total global outbound tourism market and is growing at 4.8% compared to the global average of 3.8%. In 2011 alone, Muslim travellers spent about USD126 billion.15 This figure is expected to reach USD419 billion by 2020. The MENA markets represent the largest share of the global Muslim tourist outbound expenditure at 60%.

Halal tourism has flourished in recent years to cater for the needs of Muslim travellers who want to enjoy full holiday services, which at the same time address their religious requirements as well as Islamic customs and culture. A number of countries have already adapted their tourism offers to include facilities and accommodations in accordance with the religious beliefs of Muslim tourists. Favourite destinations have predominantly been Islamic countries such as Malaysia, Turkey and Egypt. In recent years, non-Muslim countries including Australia, Singapore and France have shown strong interest in halal tourism. These destinations are favourite among Muslim travellers as they have halal certification bodies, which make it easier for tourists to find halal certified food outlets while vacationing there. Malaysia, for example, has been leading the way in the halal tourism industry, and has been successful in attracting Muslim tourists from all over the world, especially Middle Eastern travellers. Recently, Malaysia was ranked first among the top 10 halal friendly holiday destinations in the world. The ranking was based on several factors including availability of halal food, prayer facilities and halal friendly accommodation.

Key halal markets

The global halal market has emerged as a new growth sector in the global economy and is creating a strong presence in developed countries. The most promising halal markets are the fast-growing economies of the Asia, Middle East, Europe and the Americas. With a growing consumer base, and increasing growth in many parts of the world, the industry is set to become a competitive force in world international trade. The halal industry has now expanded well beyond the food sector further widening the economic potentials for halal.

Asia

The fastest growing region for halal products is Asia, driven by countries like Indonesia, Malaysia, Pakistan, China and India. Since this region has the largest Muslim population in the world, Asia has become an important and lucrative halal market. The halal market in Asia is estimated to be worth approximately USD418 billion, and is rapidly expanding as demand continues to grow. Major growth in the halal market has been driven by changing lifestyles of affluent consumers. The increase in purchasing power of consumers in this region also brings about demand for more diversified products, opening up a new and growing market for halal producers. A number of Asian countries have been actively promoting themselves as centres for halal production, standardization, research, and international trade.

Malaysia

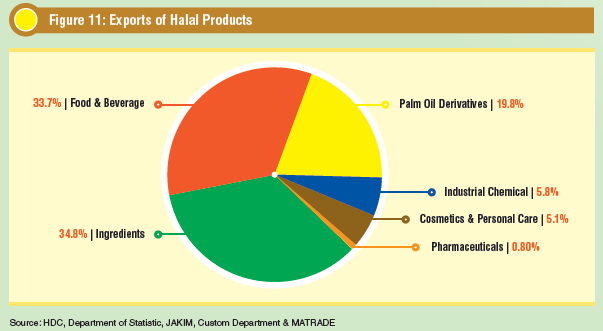

Malaysia has been aggressively promoting itself as a leader in the global halal industry. The market size of the halal industry in Malaysia is estimated to be USD1.9 billion with 90% contributed by the food industry. Export of halal products contributed about 5.1% or USD12 billion of the country’s total export and is expected to record an increase of 6% in 2013. The major bulk of halal products exported were ingredients (USD3.85 billion), food and beverage (USD3.83) and palm oil (USD2.25 billion).17 The top country destinations of halal products from Malaysia are China, the US, Singapore, Netherlands and Japan.

In Malaysia, a more holistic approach towards the development of a halal industry and creating a halal ecosystem is being undertaken by the government with the principal aim of positioning Malaysia as a global halal hub by 2020. A total of 11 strategic thrusts have been set for the development and promotion of Malaysia as the global halal hub. As one of the country’s engines of growth, the halal industry is expected to contribute 5.8% to the country’s gross domestic plan by 2020 from less than 2% currently.

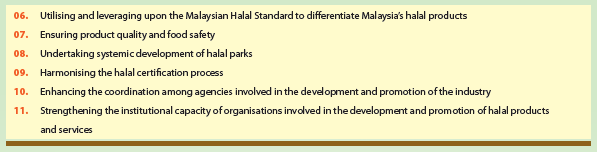

Evident of the strong institutional support by the government to develop the halal industry in Malaysia and make Malaysia the leading hub for halal products on the international front, several federal agencies has been tasked to undertake this developmental role. Chief amongst them is the Halal Industry Development Corporation (HDC). The HDC was set up to position Malaysia as a global halal hub and to accelerate the development of the halal industry worldwide with a focus on the development of halal standards and capacity building for halal products and services. The HDC, under the Halal Industry Master Plan, has identified 4 key halal industry sectors as the drivers of growth for the halal market – specialty processed food, cosmetic and personal care, halal ingredients and animal husbandry. The Halal Industry Master Plan provides for a holistic approach to the establishment of Malaysia as a global reference centre for halal integrity, and as a global hub for production and trade in these 4 key halal sectors.

The role of MATRADE, or the Malaysia External Trade Development Corporation, in the development of the halal industry is to provide an avenue for businesses to develop and expand their exports of halal products overseas. MATRADE organises trade events such the annual MIHAS, or the Malaysian International Halal Showcase, which is considered the world’s largest halal trade fair. Going into its 10th year, MIHAS has become an effective platform for international networking and trade expansion within the halal industry. Other federal agencies that have given the developmental role in promoting and developing the halal industry in Malaysia are:

- Ministry of Domestic Trade, Cooperatives & Consumerism (MTDCC) – provides enforcement and monitoring programme to protect halal integrity and consumer’s

- Ministry of Trade and Industry (MITI) – formulates strategies and provides incentives to encourage trade and investment in halal products and services.

- Malaysian Industrial Development Authority (MIDA) – promotes investments in the manufacturing and services sector as well as coordination of industrial development in

- Malaysia Productivity Corporation – identifies potentials in halal industry as well provides training and consultancy to SMEs and industries to meet halal standards and requirements.

- Standards Malaysia – develops Malaysia Halal Standards and plays an active role in helping industry leaders in development and promotion of Malaysia’s Halal

- SME Corporation Malaysia – provides matching grants to SMEs for halal product development and product formulation, sample testing, acquisition of machinery and equipment, renovation expenditure for compliance to certification requirements and other costs related to the compliance on halal certification and promotional activities.

A further evidence of Malaysia’s leading role in the promotion of the halal industry is the hosting of Halal Malaysia Week. This annual event is the merger of three events – International Halal Showcase (MIHAS), World Halal Research Summit (WHR) and World Halal Forum (WHF) – with the common aim of expanding the growth of the global halal industry through business matching, trade exhibition, forum and research.

The Malaysian government has undertaken significant measures to support the development of the halal market – beyond promoting halal products and services – to include regulating the industry as well. Under the Ninth Malaysia Plan (2006 -2010), Malaysia was developed as a centre for the certification of halal products. Halal certification comes under the purview of the Department of Islamic Development Malaysia (JAKIM) and is the sole body authorised to issue halal certification in the country. This certification grants companies the use of halal logo (also issued by JAKIM) for printing on their products’ packaging or for the display at the company’s premise. Apart from issuing halal certificates for local and export markets, JAKIM is also responsible in the monitoring and enforcing halal certification integrity. This involves ensuring the requirement of halal certification is met in the entire process of production including the handling, packaging, transportation and storage aspects.

JAKIM is also given the mandate to upgrade the status and integrity of Malaysian halal certification globally. With the many initiatives undertaken by JAKIM and HDC, Malaysia is not only recognized as a force in matters relating to halal certification globally, but is also the only country in the world that receives the full support of the government in promoting the halal certification process on products and services.

Another milestone in the development of the halal industry is the introduction of Malaysia halal standards in several sectors including food, pharmaceuticals and logistics. Malaysia has been at the forefront in the development of international standards for the halal industry, and is widely recognized as the first country in the world to develop a comprehensive halal standard. Strategic plans to develop a comprehensive halal standard in accordance with both Shari’a law requirements and the requirements of food manufacturing and food servicing was first laid out in the Third National Agriculture Policy (1998-2010). This marked the beginning of the government’s concentrated efforts in positioning Malaysia as a halal food hub.

The first halal standard developed was on the “General Guidelines on the Production, Preparation, Handling and Storage of Halal Food”. The Guidelines prescribe the practical guidelines for the food industry on the preparation and handling of halal food, and forms the basic requirement for food products and food trade or business in Malaysia. The Malaysian Halal Standard’s compliance to Good Manufacturing Practices (GMP) and Good Hygiene Practices (GHP) cements Malaysian halal certification as one of the most recognised halal logos in the world. The standard on halal pharmaceuticals was developed as a strategic move to strengthen the integrity within the manufacturing and servicing of medicines and health supplements. The Halal Pharmaceutical Standard is a general guideline that describes the requirements and critical areas in the manufacturing and handling for halal pharmaceuticals.

The launch of halal standards for the cosmetics and logistics businesses will further expand the potential of the global halal market. The halal cosmetics standards are practical guidelines for the halal cosmetics and personal care industry whilst the standard on halal logistics is a comprehensive standard which addresses three main components: transportation, warehousing and retailing.

To further spur the halal industry, several incentives were introduced by the government. This includes tax exemptions on income earned and on export revenue by halal park operators, halal logistic operators and halal industry players. Double deduction incentive is also given to producers of halal products on expenses incurred in meeting the standards to obtain the halal certificate from JAKIM. encourage new investments and increase the use of modern and state-of-the-art machinery and equipment, an Investment Tax Allowance of 100% for five years is granted to companies producing halal food. The government also set up a special fund of RM10 million for the development and promotion of halal products. This fund will finance studies in business planning, technology and market development, as well as improving productivity and quality of halal products. In early 2013, the SME Bank announced a RM200 million fund under its Halal Industry Plan that will be made available to small and medium enterprises to add value and improve their halal products.

Another important initiative undertaken by the Malaysian government in making the country a global halal hub is providing the necessary infrastructure to facilitate investments in the halal industry through the development of Halal Parks. Halal Parks are essentially communities of halal-oriented businesses built on a common property where they are provided infrastructure and service support. At present there are 9 fully operational Halal Parks throughout Malaysia with another 8 being developed.

- Indonesia

Indonesia has the largest Muslim population in the world with 88% of its 235 million inhabitants following Islam. As the world’s most populous Muslim country, Indonesia is a halal market goldmine with the potential to become not only a major market but also a major producer of halal products. The halal food market is estimated at around USD10 billion annually with an annual growth of 7-10% whilst its annual halal food expenditure is over USD70 billion.18 However, Indonesia is not a major halal producing country as most of its halal food production is mainly for domestic consumption. In Indonesia, government regulations on food labelling and advertising require every manufacturer or importer of products to be sold in the country declare that their consumable goods are halal and for affixing halal labels to their products. The authority responsible for the issuance of halal certificates is the Indonesian Ulama Council (MUI) which is the country’s highest authority on Islamic affairs. The Food, Drug and Cosmetics Assessment Agency (LPPOM) was set up by MUI to conduct the audit, inspection and assessment of all application for halal certification.

Incentives for the Promotion of Halal Industry:

Halal Park Operators:

- Income Tax Exemption (100% tax exemption for 10 years) OR;

- Investment Tax Allowance (100% for 5 years)

- Exemption on import duty & sales tax for cold room equipment

Halal Industry Players:

- Income Tax Exemption on export revenue (100% for 5 years) OR;

- Investment Tax Allowance (100% for 10 years)

- Exemption from import duty on raw materials

- Double deduction on expenses incurred in obtaining international quality standards, Sanitation Std Operating Procedures & regulations for compliance for export

Halal Logistic Operators:

- Income Tax Exemption (100% tax exemption for 5 years) OR;

- Investment Tax Allowance (100% for 5 years)

- Exemption on import duty & sales tax for cold room equipment

Source: Halal Industry Development Corporation

At present obtaining halal certification is based on voluntary initiatives. However, lawmakers in the country are trying to push for the enactment of a Halal Product Protection Bill which if passed by the House of Representatives will make it mandatory for all products to be halal-certified before going to the market. Under the proposed law, halal certificates and labels will be required for all packaged foodstuffs, beverages, medicines and cosmetics produced and sold in Indonesia. Certifications are expected to cover ingredients and the equipment used to make the products. The bill also proposed stiff penalties on offenders ranging from a two-year jail term with one billion rupiah (USD100,000) fine to an eight-year jail term and six billion rupiah (USD600,000) fine. Hence, this new halal bill is envisaged to further strengthen the Consumer Protection Act in terms of the reinforcement and the security aspects of the halal products in the country.

The establishment of a new body, the National Halal Products Certification Agency, to oversee halal certification is also being pushed under the bill. The role of MUI shall be limited to setting halal standards.19 However, MUI is seeking to be the sole authority for halal certification. In a recent twist, Nahdlatul Ulama (NU), Indonesia’s largest Islamic organization, launched a new body that will issue halal certificates for goods and services. Citing public demand, the NU Halal Body will issue its own halal certificates for its members with the aim of protecting its members under stricter NU references for determining whether a product is halal.

There is huge potential for Indonesia to become a global halal centre if it can overcome several challenges. Firstly, the country lacks a comprehensive halal regulation. The issuance of such a comprehensive regulation will promote the growth of halal business and food production in Indonesia as well as provide protection to the halal industry. Secondly, the lack of monitoring of halal practices in Indonesia has long been a concern by Indonesian Muslims.20 Hence, more regular and stringent monitoring as well as inspection practices is recommended. The third issue is that most halal products in the country lack official approval. According to the Food and Drug Monitoring Agency, only 37% of all halal products for sale in Indonesia have official halal certificates. The Agency cited lack of awareness among manufacturers about the need for halal certification.

Pakistan

Despite being the 6th largest producer of milk and the 8th largest producer of meat and poultry products, Pakistan’s share in global halal food market is very negligible. The country’s share of the global halal meat market is only 0.26% of the total USD440 billion. The country has huge potential to become a halal hub due its large Muslim population that serves as a ready consumer base, and its geo-economic position which provides Pakistan a direct access to about 40 million halal consumers in Afghanistan, Central Asia and the Middle East. However, Pakistan is yet to implement a national halal standard and has thus far no official certification body. The halal market in the country is currently being served by a number of international halal certification companies.

The Pakistani government has so far not played any significant part in the development of the country’s halal market. The private sector has had a larger role in promoting the industry.

For example, the Halal Development Council (HDC), a NGO, was set up by a group of scholars, technocrats, jurists, diplomats and entrepreneurs with the aim of developing a halal economy in Pakistan. The Halal Research Council (HRC) was established as a collaboration between the Federation of Pakistan Chamber of Commerce and Industry and the Trade Association of Pakistan to provide research, counselling and halal certification to local food producers.

In order to gain a foothold in the lucrative halal market, the government in 2009 announced the establishment of the Pakistan Halal Products Development Board to regulate the halal food market and promote the country’s halal food exports. However, due to certain technical issues, the Board was put in the backseat.21 In 2012, the Pakistan National Accreditation Council introduced the Halal Food Accreditation Scheme which is expected to boost the country’s export between Rs15 to 20 billion. To date, the Pakistan Standard and Quality Control Authority have issued two standards on halal food – PS: 3733-2010 relates to management and procedure of halal food and PS: 4992-2010 relates to general criteria for the operation of halal certification bodies.

Thailand

The halal food market is one of the key elements in the Thai’s government efforts to promote Thailand as the “Kitchen of the World”.22 Thailand is emerging as an important halal food exporter. The country is the world’s fifth largest halal food producer with a 5.6% share of the global halal food market valued at USD5 billion a year.23 Thailand also ranks first for halal export among the Association of Southeast Asian Nations (ASEAN) countries. Halal food currently accounts for 20% of Thailand’s global food exports with more than 60% of halal exports going to Indonesia, Malaysia, and Brunei Darussalam. Considering the country’s strength in the agricultural sector, Thailand possesses huge potential to have a greater share of the global halal food market. The Thai halal food exports registered a total value of USD6.8 billion in 2011 and recorded a 12% growth in 2012.

Thailand has developed several key strategies to further strengthen the country’s halal industry particularly in meeting world standards, promoting competitiveness of entrepreneurs, increasing capability in halal certification and formulating standards, and upgrading research and development. The establishment of the Halal Standard Institute of Thailand, and the Halal Science Centre illustrates the government’s commitment in establishing Thailand as a recognised halal centre of excellence in science and testing. The Halal Standard Institute of Thailand was set up in 2003 with the aim of ensuring that the development and certification of national halal food standards comply with the provisions of Islamic law and correspond to international standards. The Halal Science Centre is located at the Chulalongkorn University to support halal inspection and certification processes based on valid laboratory analysis. Receiving full funding and support from the government, the Centre works in the application of science and technology in food analysis dedicated to maintaining standards of halal. The Thai government is also establishing a halal food industrial estate located in Thailand’s southern province of Pattani with the aim of empowering Thailand’s competitiveness as a halal food hub in the region.

Middle East

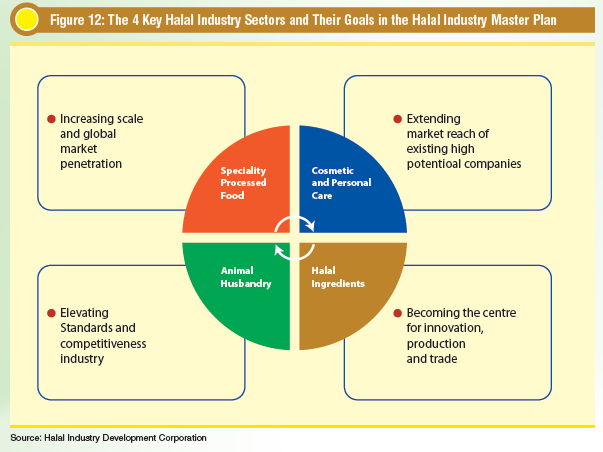

The halal industry in the Middle East is estimated to be worth more than USD20 billion. The region is a strong market for halal products and services as it imports 80% of its food requirements. The Gulf Cooperation Council (GCC) member countries include the wealthy nations of Saudi Arabia, Kuwait, Bahrain, Qatar, the United Arab Emirates and Oman. The region’s annual food imports are expected to double from USD25.8 billion in 2010 to USD53 billion in 2020 with total imports of halal meat (chicken and beef ) exceeding 1 million metric tonnes on an annual basis.24 In tandem with the expected rise in the region’s population by 40% by 2030, the consumption of food in the Middle East may well reach 51 million tonnes by 2020 to record an annual average growth of 4.6%. Not only is the region import-dependent for food, but consumers here are predominantly Muslims with rising per capita income. These factors taken together make the Middle East a lucrative market for halal food.

The region imports about 90% of beef and beef products from countries such as Brazil, India, New Zealand and Australia. The total imports of these products were estimated at USD5.1 billion with Saudi Arabia, Egypt and UAE emerging as the top importers in the region. In recent years, meat consumption has shown an upward trend. In Saudi Arabia, for example, meat per capita rose from 47.5kg to 51.4kg in just under 5 years.25 The volume of meat stood at 1.38 million tonnes in 2011, up from

1.15 million tonnes in 2006. The growing popularity of beef reflects social and economic changes in the Middle East, in particular the growing financial clout of the oil- rich nations in the region.

Another booming halal sector is the halal cosmetics and beauty product market. This sector is said to be worth about USD2 billion in the Middle East.26 In many of the countries in the region, the market for natural and organic cosmetics is growing by over 20% a year whilst halal cosmetics market is booming at a 12% growth rate per annum. Rising consumer affluence, and growing knowledge of cosmetic ingredients is making consumers pay a premium for cosmetics that meet their ethical and religious beliefs.

The halal industry in the Middle East has no specific halal standards and lacks a unified regulation particularly in labelling and listing standard for halal food products. However, all products imported or manufactured locally are required to have a valid halal certification issued by a recognised Islamic body. Given that countries in the Middle East import 80% of their food requirements, food security remain a major concern. Recently, the Emirates Authority for Standardisation and Metrology (ESMA) was tasked with developing on unified standards for halal food and cosmetics according to global industry requierments.27 The adoption of a unified rule for accrediting Islamic societies and meat exporters abroad to ensure sanitary conditions and adherence to halal methods will be a given a priority by the authority.

Europe

The increase in the global halal trade has sparked the interest of many countries in the western world to capitalise on its growth potential. In Europe, the market for halal foods has been estimated at USD66 billion with France having the largest share with approximately USD17 billion. The halal food market in the UK is valued at USD4.2 billion. In Europe, Port Rotterdam is keen to become a key halal entry point for the European market. The port intends to have a dedicated warehouse solely for halal products, thus ensuring that halal products do not come into contact with non-halal products.

The growth of the halal market in Europe is expected to increase significantly given the steady rise of the Muslim population in Europe, which has doubled in the past 30 years. The number of Muslims is projected to grow from

44.1 million to 58.2 million in 2030 across Europe. By 2050, Muslims will account for 20% of Europe’s populace.28 The halal industry in Europe is also capitalising on two major factors – the rise in the Muslim population and on the fact that Muslims in this continent are becoming more aware of their identity, which translates into a growing demand for halal products. An increasingly number of hypermarkets, supermarkets and food retailers in Europe are adding halal shelves to attract ethnic population in their domicile. As more supermarket chains and food retailers target the halal market, halal food is set to grow rapidly in the near future. Studies on consumer behaviour and preferences provide evidence that consumers are generally inclined to purchase halal products on the basis of the belief that such products are safe.

At present there are a number of halal certification bodies operating in Europe including European Halal Certification Institute, European Halal Development Agency, Islamic Food Council of Europe, Association Ritualle de la Grande Mosquee de Lyon, Islamic Centre of Hamburg, Halal Control e.K.(EU), Halal Feed and Food Inspection Authority, Control Office of Halal Slaughtering & Halal Quality Control and Total Quality Halal Certification.

- Emerging markets for halal products

Emerging halal markets span over a range of different countries including those that have smaller Muslim populations. The halal market in the US is estimated at USD12 billion per year and comprises one of the fastest developing consumer markets in the US. Sales of halal food in the US have been increasing more than 70% since 1995. Estimated figures show that consumers spend about USD20 billion on halal food every year. The US is becoming an important halal exporter. Over 90% of US dry dairy ingredients manufacturers produce halal products for export. In 2011, the US exports of beef to the Middle East were valued at USD355 million.

Another important emerging halal market is the Russian Federation. There are about 25 million Muslims living in Russia, thus creating potential customers for halal products. Domestic demand for halal products has been growing at an average of 30% to 40% annually. Halal production has recorded positive growth in recent years. There are about 200 halal food producers with almost half halal certified by the International Centre for Halal Standardization and Certification which comes under the purview of the Russia Muftis Council. Production of halal meat has also been growing at a rapid rate. In 2011, Russia produced about 65,000 tonnes of halal meat. Several major events and trade fairs have been organised to increase awareness and stimulate the growth of the halal industry in Russia such as the Moscow Halal Expo and the Kazanhalal.

China is a growing market for halal products and services with over 23 million Muslims residing in the country. The halal industry in China is growing at an average rate of 10% per annum while the value of the country’s halal food trade is estimated at USD2.1 billion. In China, halal food producers are required to have their products certified as halal by local ethnic affairs commissions under regulations passed by provincial and regional lawmakers. Like many halal markets, China does not have a unified national halal standard. However, market demand and business opportunities have emphasized the need for China to have a halal national standard.29 In 2009, Ningxia, a province in China, established its own Halal Food Standard. The standard is now recognized by countries including Saudi Arabia, Egypt, Qatar, Malaysia, and Australia. The region exported about USD10 million worth of halal-certified food and beverage products in 2012 and produced about USD2.5 billion halal food during the same year. The Ningxia region was recently designated as a halal food hub by the Chinese government.

The African continent is playing a major role in developing a halal industry in the region. Countries such as South Africa and Kenya are realising the growing consumer base of African Muslims of 1 million and 10 million respectively. In Kenya, for example, about 150 companies have been halal certified by the Kenya Bureau of Halal Certification, and this is expected to grow in tandem with the growing demand for halal food. Although South Africa has a small Muslim population (only 2% of the population), the country has emerged as a leader in the halal food industry in the region largely due to its highly advanced halal certification programme, making South Africa one of the five largest producers of halal products worldwide.30 There are four halal certification bodies in South Africa – South African National Halal Authority (SANHA), National Independent Halal Trust (NIHT), Muslim Judicial Council Halal Trust (MJCHT) and the Islamic Council of South Africa (ICSA).

- Key factors driving growth – Coming of age

Halal transcends the traditional industry-sector boundaries, geographic, cultural, and even religious boundaries. It is fast becoming the new market paradigm with its own unique set of issues, challenges and opportunities.

- Global Halal Standard

Although halal certification is considered a key enabler for the successful development of the global halal industry, the industry is still plagued by the issue of differing certification standards. The lack of a single, unified global halal standard is a pressing issue within the halal industry. Currently, different halal standards between countries and within countries due to the presence of various halal authorities, and in some cases abuse in halal auditing and certification, are inhibiting the further development of the industry. Additionally, differences in interpretations on major issues such as slaughtering methods, packaging, logistics, gelatin, food flavorings and animal enzymes has impeded further development of the global halal industry. Having an all-encompassing halal standard and a harmonized halal certification system that is adopted worldwide has it merits. A global halal standard and certification system would expedite product development, provide greater assurance to consumers, reduce the number of multiple certifications and ultimately would compress the supply chain cycle time.31

Geographical locations and ethnicity differences has also resulted in variations in halal concepts adopted by Muslims worldwide. Complicating this issue is the lack of mutual recognition among the 300 halal certification bodies across the world. In the UK, some certification bodies allow the use of electrical stunning as part of the slaughtering method while the Halal Monitoring Committee and Muslim Council of Britain firmly reject this practice.32 Establishment of halal certification bodies also differs between countries. In Malaysia, Indonesia, Brunei and Singapore, halal certificates are issued by government or quasi-government agencies. In non- Muslim countries such as Europe, halal certifications are issued by either private certifying bodies, Islamic associations, and, even in some cases, the mosques. In the Middle East, consumers presume all foods are halal and place the obligation on the government.

Several initiatives, at the global level, have been directed towards establishing a global halal standard. The establishment of the World Halal Council in 1999 was the first step in this direction. The works of the Council in coming up with an International Certification Standard is not without its difficulties, especially with oppositions from various quarters including halal certification bodies. Recently, there has been the establishment of the International Halal Integrity Alliance or IHI Alliance to spearhead the harmonization of halal standards. The IHI Alliance is a non-profit, non- governmental body which “aims to provide a platform for its members to share information and work towards upholding the integrity of the halal industry; to provide a communication channel for its members with relevant parties; and to strengthen the halal industry to fulfil its highest potential.”33 The IHI Alliance in collaboration with the Islamic Chamber of Commerce and Industry (ICCI) published four halal standards modules, which will form fundamental guidelines in assisting OIC member countries in setting up a structured domestic halal assurance body and streamlining certification practices with a view to uphold halal integrity.

- New Muslim consumers

The Muslim world is experiencing a significant “youth bulge” whereby 60% of the population of Muslim- majority countries is under 30 years old. This young generation of Muslims are agents of change for the halal industry. They demand a diverse range of halal consumer goods and financial products that meet their nutritional, lifestyle and financial parameters specific to the Islamic faith. Because their strong sense of identity as Muslims, this new Muslim consumer set want to associate themselves with halal brands. Given their growing size, young Muslims will have a significant cultural influence on the consumption habits of the wider global Muslim community. They are a generation that embraces an Islamic lifestyle, and are becoming more knowledgeable about preserving halal as a part of their daily life.

A study by Ogilvy & Mather has revealed that young Muslims are proud of their religion, have high purchasing power, and high consumption patterns. The report also found a significant change in Muslim consumer attitudes towards halal brands. While halal certification is important to establish credentials, this alone is no longer sufficient to persuade young Muslims of the integrity of the brand. They prefer a brand that offers solutions beyond the halal aspects without losing sight of the halal integrity. They are also more interested in the provenance of the brand as well as companies behind this brand.

These young Muslims are educated, tech savvy, connected and ready to engage. They use the knowledge of the world and experiences to improve their lives and those around them.34 Since they are tech savvy, and remain connected through social media, they are not shy from using technology to share and move ideas forward beyond their own geographic and cultural boundaries. This was very much evident during the Arab Spring uprising. This has significant implications on halal products as this new generation of Muslim consumers have the power to influence the marketability of any products or services through the use of social media.

A report by Ogilvy Noor also revealed that this new Muslim consumer group forms a deep relationship with brands, and seeks brands that embrace important values such as humility, transparency, purity and togetherness. Another market study by JW Thompson showed that young Muslims are more brand conscious. The report found that over 80% wants to buy brands that support their Muslim or cultural identity whilst 75% would purchase a brand that make them feel part of the wider community. Overall, the new Muslim consumer group are more dynamic in their taste, preferences and values, but maintain a strong identity to Islam and their culture. Another prominent change in the lifestyle of the Muslim is the inclination for convenience, ready-to-eat food rather than cooking from scratch. They also have a more

sophisticated taste in food thus creating a demand for high-end halal products. The consumer taste evolution, and these changing trends, not only promise a growing demand for halal foods but also require diversification of the halal market with a focus on ingredient origin, health benefits, and quality. Hence, innovation in halal products is not only driven by more affluent Muslim consumers, but also by their growing interest in high quality, safe products.

The halal economy

The value of the halal industry is almost double the Islamic financial services industry. But until very recently, the two industries have surprisingly developed independently of each other. This implies that ordinary Muslims are more concerned with what they eat or wear than the “halalness” of the financial products they use. There is, however, an increasing realisation that both need each other for their respective growth and development. For example, Islamic financial institutions are looking for genuine Islamic assets (which at present are scarce); and the halal producers and manufacturers are in serious need for capital. As most halal producers happen to be small and medium size enterprises, they are unable to benefit from capital markets that by and large favour large corporations. Islamic capital markets have also favoured large corporations, either through equity investments (both private and public) or through the issuance of sukuk.

There is, however, a real opportunity for both industries to benefit from each other. The halal industry can effectively absorb all the available funding from Islamic financial institutions. There are some early signs of realization of the need for convergence in these two industries. Malaysia, which is a global center of excellence for the Islamic financial services industry, is also emerging as a leader in the promotion of halal goods and services. For the convergence to accelerate, incentives should be given to halal manufacturers for maintaining a Shari’a compliant balance sheet. At present, most halal manufacturers are not Islamic finance clients or users. This is primarily because the users of halal goods and services are not necessarily those who subscribe to Islamic financial services, due to the dichotomy of “consumer Islam” and “financial Islam.” Hence, those companies already involved in the halal sector are not compelled to adopt Islamic finance. Since around 80% of companies producing halal products are controlled by non-Muslims, there is no religious impetus for them to participate in Islamic finance. In most countries, conventional financing is well established, and halal producing firms tend to be averse to switching unless there are substantial economic or monetary benefits.

The convergence between the two industries is inevitable but it will largely be regulation-driven, although both industries are by and large demand-driven. Once the competition in the halal industry increases, it is expected that convergence will become a supply- driven phenomenon, as many halal manufacturers will start marketing themselves as not only halal but also Shari’a compliant. There are some initial developments towards this supply-side phenomenon. One example is the emergence of Shari’a compliant multilateral trading platforms, which attempt to focus on the provision of Shari’a complaint capital market products to the small and medium size halal companies. Shari’a UMEX (which has admittedly yet to start operations) in London represents such a trend. The synergistic convergence of these two powerful and rapidly growing industries will form the basis of a new halal economy.

Halal integrity from farm to table

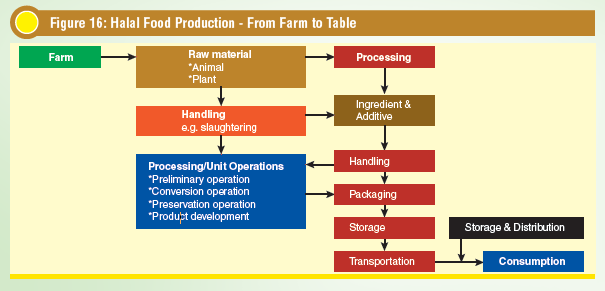

Ensuring halal integrity is another important challenge for the halal industry. Since the halal industry involves ‘farm to table’ operations, the issue of integrity throughout the halal supply chain becomes a major concern. Given the increasing number of reported cases of fraudulent halal certification, and physical contamination of halal food products, the authenticity and integrity of halal food consumed has raised a major outcry from Muslim consumers.

The halal concept encompasses the products value chain beginning with the acquirement of the ingredients or preparations for services to final delivery. The halal supply chain includes stages beginning from the procurement and preparation of halal ingredients to the manufacturing and delivery of the final product to the consumers. This process includes the separation of halal from non-halal ingredients or food products throughout the entire supply chain including during warehousing, transportation, storage and terminal interchange. Hence, halal integrity must be preserved along the value chain either upstream towards animal food or downstream towards food services as well as transportation, storage and handling of halal products.

Halal logistics involves a management process of procurement, movement, storage and operations of food and non-food items that adhere to Shari’a principles and law. In the halal logistics operations, a company that supplies halal products needs to provide transportation and special containers to carry the halal products to consumers to ensure the products’ safety as well as guarantee its halal integrity. Since the halal industry relies heavily on logistics service management capabilities to ensure the integrity of halal products, halal logistics plays a key role in protecting the halal integrity along the supply chain.

Human capital

Lack of skilled workers is identified as one of the challenges facing the halal industry. As more and more industry players become involved in halal business, the need for qualified people to administer halal matters is priority. Moving forward, the industry needs to focus on the development of human resources to ensure the sustainable growth of the industry. The issue on developing human capital to serve the needs of the halal industry is two-fold. First is the shortage of skilled and experienced professionals who can work in the halal industry, which if not addressed immediately can hamper the growth of the industry. Secondly, is the issue of knowledge development to ensure the industry keeps up with global trends especially shifting consumer preferences and production trends. This subsequently demands halal standards and certification procedures to keep up with these changing trends. A good example is the issue of genetically modified food which requires

extensive research to ascertain whether the production of this type of food fulfils halal requirements. Hence, having a skilled workforce with the necessary skills and knowledge is critical. More academic and training programmes in halal-related areas should be developed to train qualified people especially in research, development, innovation and commercialization of halal food, pharmaceuticals and consumer products as well as Shari’a-compliant services such as tourism and hospitality.

Conclusion

Halal no longer applies to solely food production and consumption. The halal industry has now evolved from merely halal food products to a holistic halal concept that encompasses the entire value of commercial activities. It has extended beyond food into the realm of business and trade and is fast becoming a global symbol of quality assurance as well as a lifestyle choice for both Muslims and non-Muslims. Halal products are gaining wider recognition not only due to meeting Shari’a requirements, but also hygiene, sanitation and safety aspects. Increasing demand for halal products is being seen in a number of Muslim countries, with strong economic growth fuelling demand. Rising income levels in these key markets have led to higher consumption rates and more opportunities for halal food producers. The largest of these markets are located in Southeast Asia and West Asia. However, the lack of a recognized global halal compliance standard and certification process has caused a lack of confidence for consumers, and uncertainty for the business. Because halal logos vary between company and country, there is no assurance that all products used and the value chain are indeed halal.