Introduction

The Islamic Economics Institute (IEI) of King Abdulaziz University (KAU), since 2010, has created a special research interest dedicated to Islamic finance higher education (IFHE) all over the globe. The main rationale behind the launch of this initiative has been to meet two basic objectives: the first is to construct an accurate and up-to-date database about IFHE programmes (IFHEP) globally, and second, to examine the quality and relevance of these programmes to talent development that can contribute positively to the furtherance and sustainability of Islamic banking and finance (IBF) over the years to come. The data and analysis in this chapter are built on the work carried out so far by this project. The chapter intends to provide a brief history about the introduction of IBF in higher education and its recent spread and development in the light of major events such as the financial crisis and the Arab Spring. In later sections, the chapter touches upon some challenges and opportunities that these programmes may face. For the purpose of this chapter, an ‘Islamic finance programme (IFP)’ is defined as a set of dedicated courses or a stream in an existing programme yielding a university or a higher educational establishment degree (e.g. BSc, BA, Diploma, Master) that bears the Islamic finance, banking and insurance or takaful title. Therefore, degrees focused on Islamic economics, in its broad spectrum or specific to waqf or zakat, are not accounted for.

The chapter then presents a case study of the implementation of an Islamic finance Master’s programme in France. The IBF industry remains quite small, and the implementation of an advanced degree appears strange. However, France has aimed to be an IBF hub for the last few years. Creating the education foundations shows a degree of foresight in that by educating students on IBF, it creates a talent pool, something the UK has been successful in achieving.

The Education of Islamic Finance: A Brief History

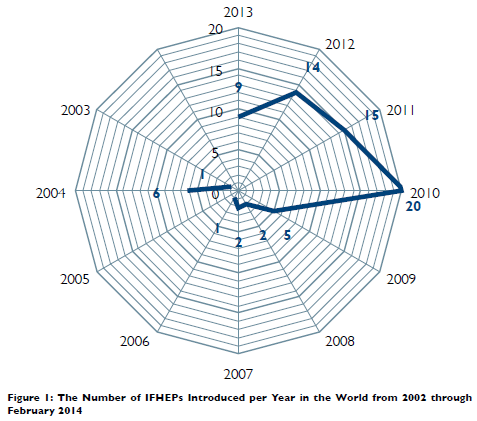

According to available sources, the teaching of Islamic financial contracts from an entrepreneurial perspective entered academia in 1904, through a course dedicated to the political economy1 at the al-Thalibiyah higher education school, an establishment that was created by the French colonial authorities who were controlling Algeria at that time. Nearly three-quarters of a century thereafter, several courses dedicated to IBF have been introduced in higher education programmes of many Arab and Muslim countries. This introduction was the result of a recommendation of the first international conference on Islamic economics, organized by KAU in 1976. It was not until the beginning of the new millennium, that IBF emerged as a distinct discipline that has surpassed the teaching of its parent field, Islamic economics. After the financial crisis of 2008, these programmes have become ever more important, as illustrated in Figure 1. In 2006, the industry witnessed a significant landmark with the establishment of a unique institution fully dedicated to Islamic finance education – the International Centre of Education in Islamic Finance (INCEIF). In September 2013, the Umm Al-Qura University of Makkah created a dedicated faculty for Islamic economics and finance, with three specialized departments in financial affairs: finance, banking and insurance. The same year saw the introduction of the first-ever executive degree in Islamic finance at a public University in Saudi Arabia. The emergence of new programmes and faculties reflects the growing importance of Islamic finance in the Islamic economics field. This reflects a natural response by financial centres to promote human capital development for IBF.

Current Trends and Developments

Here we provide a detailed account of the current global map of IBF programmes in different geographical places, and from different angles and perspectives. The analysis is based upon a sample of 139 programmes compiled from various authentic and up-to-date primary and secondary sources. It has to be noted that since the start of this project four years ago drastic changes have taken place. Some countries, like Italy, have vanished altogether from the IFHEPs map; others remain stagnant, while others have increased their presence. Lack of properly qualified faculty staff as well as financial resources have played a detrimental role in the non-realization of some initiatives. The political turmoil that has engulfed many Arab countries has produced mixed results as we will discover later.

IFHEPs at Country Level

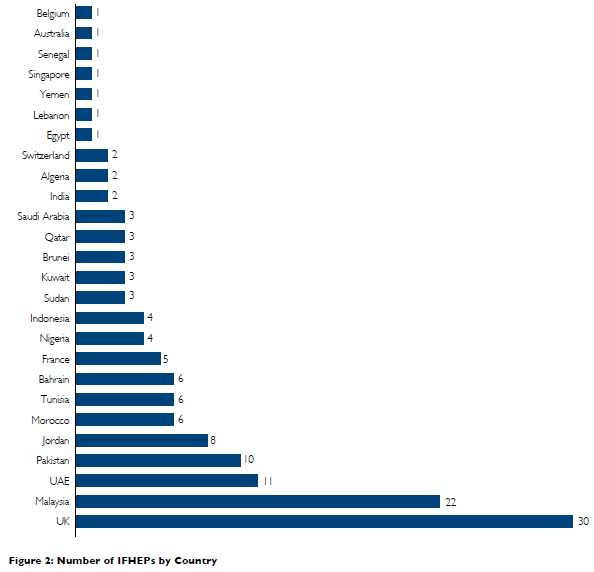

Figure 2 gives an idea of the supply of IFHEPs by country. Britain leads with 30 programmes (21.58%) followed by Malaysia with 22 programmes (15.82%), United Arab Emirates with 11 programmes (7.91%), Pakistan with

10 programmes (7.19%), Jordan with 8 programmes (5.75%), Bahrain, Morocco and Tunisia with 6 programmes (4.31%), France with 5 programmes (3.59), Indonesia and Nigeria with 4 programmes (2.87%), Sudan, Kuwait, Brunei, Qatar and Saudi Arabia with 3 programmes (2.15%), India, Algeria and Switzerland with 2 programmes, and a set of 7 countries with a single programme (0.52%). The effect of the Arab Spring on IFHE appears to be mixed. While Morocco and Tunisia have witnessed a remarkable rise in programmes, Egypt and Yemen remain the same, and Syria recorded a significant decline.

The geographical diversity of IFHEPs shows that IFHE is no longer confined to Arab or Muslim countries. In addition, these programmes attracted students of different nationalities and backgrounds (economics, management, finance, law, and theology). For instance, the launch of the first Executive MBA in Islamic Finance at Strasbourg University attracted students from France, Germany, Switzerland, Luxembourg, Belgium and North Africa. La Trobe University in Melbourne, Australia, attracts students from the United States, Hong Kong, Vietnam, Pakistan, India and Saudi Arabia in addition to Australians. Furthermore, in the two student visits, hosted by IEI of KAU, in 2012 and 2013, respectively accommodating Islamic economic business school students, the same pattern was noticed. These students, attending finance and MBA programmes, came from different places, Latin America in particular.

This evolution of IFHEPs in the aftermath of the global financial crisis and the Arab Spring is even more apparent in the West and in the MENA region, particularly in the United Kingdom, France, UAE, Bahrain, Jordan, Morocco and Tunisia.

IFHEPs at the Continent Level

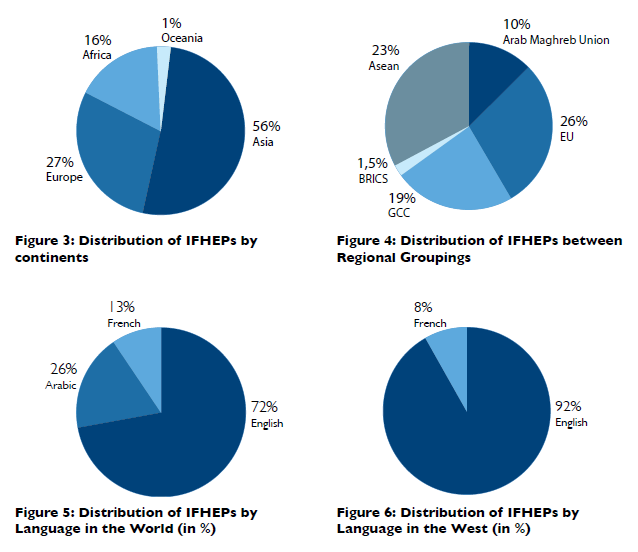

Figure 3 displays the distribution of IFHEPs across the five continents. Asia comes first with 78 programmes (56%), followed by Europe with 38 programmes (27%), Africa with 23 programmes (16%), and finally Oceania with a single programme. The cartography shows that IFHE in the Western world is concentrated in Europe. This does not mean that the United States has no courses or research programmes in Islamic finance in their territory or abroad. For instance, the Fletcher School of Tufts University offers a course entitled “Islamic Banking and Finance” which provides a comprehensive introduction. Moreover, the Harvard Law School at Harvard University developed a unique initiative that has been running since 1995, the Islamic Finance Project (IFP). Moreover, the American University of Leadership in Morocco, as part of its MBA, has a specialization stream in Islamic finance, and the International School of Business, recently launched in Tunisia, has an Executive Masters in Islamic finance.

The leading position of Asia can at first glance be deemed due to a large number of Muslims in this area, but this explanation does not stand on firm ground. Africa has a significant number of Muslims as well. Thus, the population factor cannot fully explain the diffusion of Islamic finance education in the Asian continent. Other factors may provide better insight. Perhaps key factors are the political and economic will of pro-active actors and their communication strategy in promoting IBF. Based on this, Malaysia can be singled out for the proactive role its government and regulatory authorities are playing in promoting Malaysia as an international hub for Islamic finance. At the European level the cases of the UK and France are the most revealing ones – UK in particular. The UK has been

IFHEPs at the Economic Bloc Level

In terms of economic blocs, as is illustrated in figure 4, the European Union leads with 36 programmes (26%) followed by ASEAN with 32 programmes (23%), GCC with 26 programmes (19%), the Arab Maghreb Union with 14 programmes (10%), and BRICS with 2 programmes (1.5%). Moreover, the previous results reveal a paradox: while the Gulf countries are undeniable leaders in many aspects of the Islamic financial products market, their competitive position in Islamic finance higher education is lagging vis-à-vis EU and ASEAN.

IFHEPs by the Language

Concerning the IFHEPs distribution by the language, as illustrated in Figure 5, English leads with 100 programmes (72%) followed by Arabic with 26 programmes (19%), and French with 13 programmes (9%). This result is not surprising given that English is the language of international business. But this does not imply that native English speakers have the advantage in the workforce market. On the contrary, in this dynamic and globalized world, language proficiency has become an additional asset. Consequently, the major Islamic financial institutions prefer to hire staff who speak at least two languages as compared to those limited to English only. Some French and Arab business schools attempt to take advantage in this respect by providing IFHEPs entirely in English, like ESA Beirut, Reims Management School, Effat University Jed- dah, TAG-Org Amman or HBMeU Dubai. In the Western world (Figure 6), the position of the English language is even more prevalent, 92%, while the share of the French language decreased to 8%. In order to shed more light on this feature it is important to look into the distribution of these two respective languages by country.

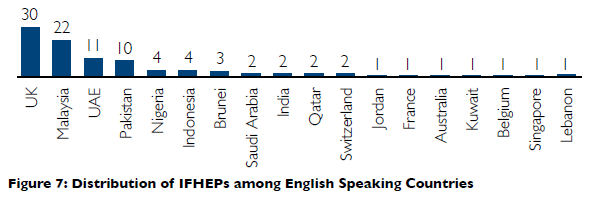

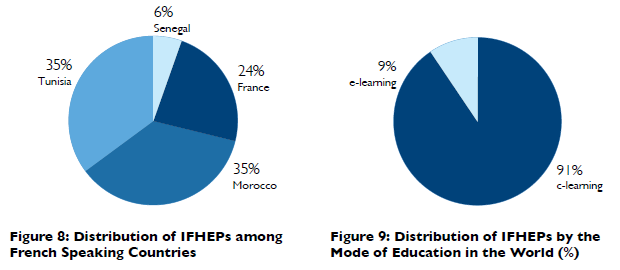

Figure 7 gives an idea about the distribution of the IFHEPs taught in English by country. The UK leads with 30 programmes, followed by Malaysia with 22 programmes, and the United Arab Emirates with 11 programmes. The contribution of non-Western countries appears significant. Interestingly, the presence of France and Saudi Arabia in this regard should be noted. France, traditionally known for its resistance to Anglicism, created a certificate in Islamic banking and finance at Reims Management School delivered entirely in English. Saudi Arabia, generally reputed as conservative, opened an Executive Master’s in Islamic Financial Management also in English at Effat University. Figure 8 shows the distribution of IFHEPs in French-speaking countries.

IFHEPs by Type of Learning

Concerning the type of instruction (Figure 9), the c- learning (i.e., conventional or traditional learning) leads with 126 programmes (91%) followed by the e-learning programmes with 13 (9%). In the Western world, the percentage share of e-learning has increased to 25%. In this part of the world the e-learning infrastructure is more developed. It is necessary to examine in depth the ‘ins’ and ‘outs’ of Massive Open Online Courses, both in education and in relation to their impact on IBF by addressing the following questions: What are their significance? Are they innovative (or not)? What prospects do they offer? In the absence of accurate and detailed data on this subject, one cannot respond immediately to these questions.

Challenges and Opportunities

Despite the tremendous spread and development of IF- HEPs over the past few years, there are many challenges that may restrain this trend if stakeholders do not ad- dress them properly and swiftly. In what follows is a brief discussion of some of the most pertinent issues related to this vital topic.

- Job opportunities have been singled out as one of the most frustrating factors that graduates of these programmes face after obtaining their respective degrees. In Malaysia, which is considered by many as a pioneering IBF market, graduate students, especially those from overseas, are finding it cumbersome to find a job in the Malaysian market. This has been the case in spite of the double-figure annual growth of IBF.6 The situation in Europe is even more In the UK, job opportunities are very slim as most authorized Shari’a-compliant banks are wholesale, and are more likely to hire staff with conventional financial knowledge and experience.

- There is a lack of global quality assurance standards to ensure conformity to an expected minimum standard that should be present in these programmes. This issue encourages educational organizations to delegate responsibility to other stakeholders, notably higher education agencies or organizations in respective countries, and infrastructure bodies that support the furtherance of There is an urgent need in this area to boost the confidence of industry players and students alike. The input of AAOIFI and IFSB, through their various standards, in education has to be taken seriously to overcome some of the disparities between ongoing and possibly forthcoming IBF programmes.

- There is a lack of strategic political support in some strongholds This is particularly the case in GCC countries. As far as IBF education is concerned no significant initiatives have taken place, over the recent past, in this important part of the IBF world. However, departing from the mimicry that has dominated product development in the IBF sector in the pre-crisis era. The crisis offered a golden opportunity that has not been seized upon by concerned parties in the design and delivery of IFHEPs.

The Way Ahead

The findings in this investigation reveal the fact that over the past few years IFHEPs have transformed into a global phenomenon. These initiatives are no longer confined to traditional Arab and Muslim territories. They have entered many renowned international educational systems. Thus their geographical and student bases have diversified as well. It is, therefore, of utmost urgency that the design and content of IFHEPs can meet the challenges that arise in the global financial markets. Besides, a breakthrough has to take place in the development and design of IBF products to come out with authentic and truly innovative instruments. This end cannot be achieved without careful and thoughtful design of educational and professional programmes. To meet these aspirations two prerequisite measures have to take place:

- Strong and closer collaboration between higher educational institutions and industry players and/or their supporting infrastructure The idea of “curriculum by design” might be a good starting platform in this regard. Under this process required and appropriate skills are well spelled out in consultation with the industry and are than implanted into professional and academia initiatives.

- Quality assurance culture and best practices have to be elaborated to ensure a minimum conformity and convergence between different Thereafter, ranking and accreditation of these programmes should follow to create a competitive environment within ‘the market’ of IFE sector

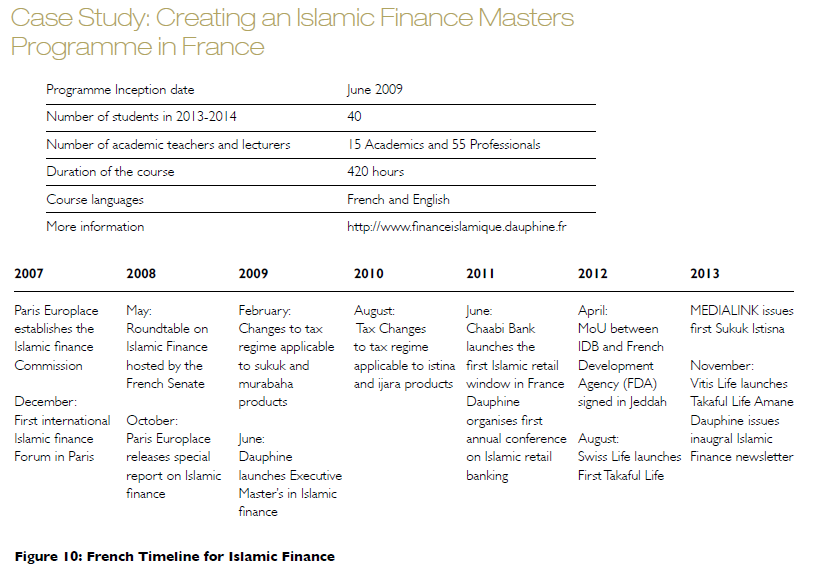

Case Study: Creating an Islamic Finance Masters Programme in France

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

| Paris Europlace | May: | February: | August: | June: | April: | MEDIALINK issues |

| establishes the | Roundtable on | Changes to tax | Tax Changes | Chaabi Bank | MoU between | first Sukuk Istisna |

| Islamic finance | Islamic Finance | regime applicable | to tax regime | launches the | IDB and French | |

| Commission | hosted by the | to sukuk and | applicable to istina | first Islamic retail | Development | November: |

| December: | French Senate | murabahaproducts | and ijara products | window in FranceDauphine | Agency (FDA)signed in Jeddah | Vitis Life launchesTakaful Life Amane |

| First internationalIslamic finance | October:Paris Europlace | June: | organises firstannual conference | August: | Dauphine issuesinaugral Islamic | |

| Forum in Paris | releases specialreport on Islamic | Dauphinelaunches Executive | on Islamic retailbanking | Swiss Life launchesFirst Takaful Life | Finance newsletter | |

| finance | Master’s in Islamic | |||||

| finance |

Figure 10: French Timeline for Islamic Finance

The Paris Dauphine University Executive Islamic Masters – the Story So Far

There is no doubt that human capital is a key success factor for any Industry, and Islamic finance is no exception. Many Islamic finance professionals complain about the lack of educated talent. Some even think that it would have been better to develop this industry only once the right talent was available. Certainly, the price to pay for a fast-growing industry without a suitably skilled workforce is bottlenecked. Indeed, the 2010 Islamic Banking and Finance Centre survey showed that the main blocking point on the development of Islamic finance is: “Quality of human resources and capacity development issues.”

In June 2009, Paris Dauphine University, one of the Top 5 universities for finance in Europe, decided to tackle this issue by launching the first IBF degree in France. At that time there was no IBF industry in France, but trends suggested that France could be a potential market. The university adopted an innovative and proactive approach towards IBF: training professionals first.

The objective of the degree is clear: train people to understand and master the concepts and techniques used in IBF to enable the to structure products that respond to the needs of investors by delivering a financial performance that is consistent with the investors’ values and ethics. In other words, the degree aims to supply the fuel for the future industry.

This adventure started five years ago and it is now time to assess the achievements.

Knowing the Context

France is an interesting case for IBF. Whilst, it is officially a secular state with a strict separation of religion and state, the French Authorities have made strenuous efforts since 2007 to create a legal and regulatory framework that is supportive of IBF.

- In December 2007, Paris Europlace, the organisation charged with promoting the city’s role as a financial centre, established the Islamic Finance Commission.

- Since 2008, significant tax and regulatory changes have been made to encourage Islamic finance in France, most notably the changes to the tax regimes which have created parity in tax treatment between murabaha, sukuk, ijara and istisna and conventional financial

Paris Dauphine has a strong relationship with the regulator, and provides political and institutional organizations with regular updates on the challenges faced by the IBF industry. Paris Dauphine also advises institutional bodies and commercial partners. The head of the degree is a special adviser to Paris Euro place.

France has great potential for IBF to develop. It has significant trade flows with a number of countries with large Muslim populations, such as Morocco, Algeria, Tunisia and West African countries, from where a significant proportion of the French population originates. This population has been one of the driving forces behind the development of IBF in France. In particular, there has been significant growth in the Islamic retail banking sector, with Chaabi Bank – the first bank to open an Islamic window in France and a partner of the Dauphine Islamic Executive Master’s – now offering Islamic deposit accounts, mortgage products and corporate finance through its seventeen branches.

After only two years, Chaabi Bank has seen unprecedented success:

- Over 2000 current accounts have been opened since June 2011 representing over 11 million Euro in de-posits;

- The expansion of current accounts to professionals, companies and associations.

“We have received over 100 acceptable applications for our Murabaha Mortgage product” (Figure 11), said Chaabi’s Director of Marketing during a conference in Lille in October 2013. Whilst this number seems relatively small, it has to be analysed in relation to the current size of Chaabi Bank’s balance sheet. The bank expects to accept a growing number of applications as its capital increases. The bank also plans to open its Shari’a-compliant deposit account to small and medium-sized enterprises (SMEs). With two Shari’a-compliant retail products, Chaabi Bank has become an important player in France.

Other Shari’a-compliant products being launched to fulfil increasing demand in France include the first French Shari’a-compliant life insurance product, “Salam Pax”, offered by Swiss Life, one of the world’s major insurance companies, and developed by Hassoune Conseil. More than 300 professionals attended the launch of Salam Pax at Paris Dauphine in February 2013. Following this success, Swiss Life will be launching new Islamic products in 2014. Currently, more than 250 applications have been signed with clients representing around 10 million Euros. In November 2013, VitisLife, a subsidiary of the Luxemburg bank KBL European Private Bankers, launched a new takaful life product, Amane Exclusive, targeted at high-net-worth individuals based in France.

There are now six Shari’a-compliant funds in France with total assets under management of US$147.2 million, which are split relatively evenly between money market (47%) and equity (53%) assets. These products provide French Muslims with the possibility to invest their money in conformity with their ethical principles.

Mr Christophe Ollier, former head of Islamic finance development at Natixis (BPCE), said during a recent conference that, “Islamic finance cannot limit itself to addressing the Muslim population in France. The French market is attractive on many other levels as well and more players should recognise this fact and get involved, otherwise, the industry will keep developing slowly”. More and more French financial institutions are becoming involved in IBF, pushing France closer to becoming the vibrant market that it ought to be. French banks also remain very active in IBF outside France. The latest example being the launch by Société Générale of a 1 billion ringgit (US$300 million) Islamic bond programme in Malaysia, making Société Générale the second major European bank to issue a sukuk and the first to do so in Asia.

Other recent developments include the visit of Mr Madani, President of the Islamic Development Bank (IDB) to France, organized by the French Ministry of Foreign Affairs. During this visit, Mr Madani, giving a speech about the challenges and issues facing the GCC at the Academie Diplomatique Internationale (International Diplomacy Academy) stressed that France re- mains a very interesting market and one in which the IDB was keen to explore new opportunities.

In brief, the potential of the French market will become of increasing interest to international investors as the business and regulatory environment becomes more welcoming. It is well understood that human capital is needed to handle the increasing business and regulatory push.

Education: Spread the Knowledge

While there remain challenges for IBF in France, Dauphine has taken a very proactive approach in setting up the first Islamic Finance Executive Master’s in Paris – Excellence, Proficiency and Connections being the pillars of the degree.

The degree targets Excellence. Dauphine University is already renowned for its economics and mathematics expertise, and the Islamic Finance Executive Master’s is no different in striving for Excellence. The degree web- page is the most visited on Dauphine’s entire website and has increased Dauphine’s reputation. The degree is also officially recognized by French authorities. There is a rigorous application process. This diploma is designed for both IBF professionals and those wishing to enter the industry and covers the rules and practices of Islamic banking, finance, insurance and asset management. It is targeted for:

- Current employees holding a degree of BAC + 4;

- Managers from public or private sectors;

- Students holding a first-year Masters (in Management, Economy, Law, Computer Science, Mathematics, etc.)

The quality of professional experience can be taken into account in order to accept students who do not hold a degree of BAC +4 but have the requisite professional expertise.

Studying for the Master’s degree is challenging but re- warding. This course comprises 420 hours of lessons, 20 of which are devoted to conferences. The course is organized around five modules and a complementary module:

- Module 1 – Core Finance;

- Module 2 – International Islamic Finance Environment;

- Module 3 – Conceptual Approaches;

- Module 4 – Banking, Insurance and Markets of Islamic Finance;

- Module 5 – Islamic finance Techniques;

- Complementary module – Working paper and Grand Oral.

Students are required to undertake tests on each module which may take the following forms: final exam, case report and work on several common synthesis teachings. The delivery of Executive Master’s certificate is delivered only if the student:

- Obtains the average score in working paper presentation (production and presentation).

Admission is decided by a jury appointed by the President of the University and chaired by officials of the Executive Master’s.

Excellence has been also reflected in the choice of the learning languages during the courses. Indeed, most degrees in IBF are given either in English or Arabic whereas the Dauphine’s degree is given in English and French. The strategic decision to teach in these two languages has been taken based on a pragmatic approach:

- France is one of the doors to access Africa with the potential IBF markets in North and West Africa requiring qualified professionals to develop their The business language in these countries is French, and the legal systems are based on civil law and share many synergies with the French system (French-speaking countries contains more than 250 million people). The Dauphine degree offers graduates the possibility to study in French to adapt to their local markets

- Most research on IBF is published in English and English is required to understand the current challenges in IBF and to develop Moreover, many graduates will seek opportunities in English-speaking countries. This is why courses are also given in English.

Proficiency is key to training experts for the IBF industry. In order to attract excellent students as well as professionals, some innovative solutions have been implemented:

- The timing has been adapted. In France, normal courses are given from Monday to Friday, i.e. on working It has been decided to change the timing. Lessons are given on Fridays and Saturdays. This enables future graduates to work and to be trained.

- Moreover, courses are given in Paris, which is well situated for graduates working abroad as well as for professionals working in Paris. It enables these professionals to combine employment and training. When they choose this Executive Master’s, their goal is to continue their education in order to improve their career performance and enhance their knowledge of IBF. The Executive Master’s is both an academic and business-oriented programme that seeks to empower graduates to achieve these

- The Executive Master’s is taught by a mixture of 15 Academics and 55 Professionals, giving graduates the opportunity to gain new perspectives and develop theoretical and analytical reflections on IBF. Studying business case examples and the extremely constructive dialogue with different course leaders are particularly interesting. The quality of the courses, the variety of topics covered and the diversity of the students give students the opportunity to challenge their own vision and approach towards

- Cost has been adapted in order to attract the right Dauphine’s philosophy is that cost should not be a barrier for knowledge with the cost being considerably lower than comparable Executive Master’s courses.

Yields: Prepare the Future Through Connections

Connections with people, other higher education institutions and industry players are key to future development. IBF is not widely known in France. The degree is an opportunity to build a base in IBF, and to enable de- bates and initiate discussion on IBF in France. Dauphine has a responsibility to inform the population about the industry and to participate in the debate on its future. The best way to spread this knowledge is to organize conferences. The increasing number of conferences held this year shows that there is growing interest in IBF. Many conferences are becoming regular fixtures within the finance sector as major players become more interested in presenting their work and the advances in IBF. For instance:

- The Annual Conference on Islamic Retail Banking organized by Dauphine University since 2011.

- The Annual Conference on Islamic Real Estate Finance in France co-organized by Baker McKenzie and Dauphine University since

The creation of the graduate newsletter on IBF and its first publication in 2013 has pushed graduates to be more autonomous in finding interlocutors and be aware of the current issues in IBF.

Dauphine is conscious of the need to establish and maintain strong links with foreign higher education institutions to maximise academic research, teaching and cooperation. Dauphine’s Islamic Finance Executive Master’s will be taught in branches in North Africa and West Africa in 2014. Moreover, partnerships are under discussion with prestigious universities in various countries to increase the footprint of the degree. The challenge will then be to integrate the degree with other existing degrees.

Dauphine needs to train graduates in order to fulfil the needs of the industry. It has therefore combined the right mix of theory and practice with a blend of prestigious teachers from Dauphine University and professionals from the finance industry. Companies should not only look for great talent but also talent that is fitted to the organization’s culture and needs. The theory and practice blend is to give the students a full understanding of the principles of IBF, with presentations from hands-on practitioners and lectures from seasoned academicians. The reason for this blend is to train graduates to cope with the challenges ahead in the industry. More interaction between the industry and Dauphine can be formalized through graduate internships and business-oriented research.

Education is not fruitful if it is not adapted, and does not offer the right opportunities, to the graduates. This Executive Master’s is designed to train professionals and students who will work with IBF industry actors, or in non-Islamic institutions. In fact as previously mentioned, IBF does not yet offer enough opportunities in France for graduates. This is why the degree is based on the interaction between conventional finance and IBF, and gives graduates the opportunity to work in both Islamic and conventional finance sectors including credit establishments, asset management, corporate and investment banks, private banks, insurance companies, consulting agencies, brokerage firms, management firms, investment enterprises, audit companies, venture capital firms, etc.

Dauphine also organizes an annual academic trip to one of the Islamic finance hubs (in South East Asia or the Gulf) to enable graduates to experience the reality of the industry in a non-French environment and to meet experts from the industry. It is also an opportunity to assist the development of IBF in France as these hubs are home to many prominent Islamic finance institutions. The last trip in the Gulf was a real success with interesting debates and recognition in the media.

Dauphine’s professors, its professionals, and its alumni are involved in many projects in Islamic finance all around the world. They constitute a solid and growing network in IBF. Some of the alumni are now part of major financial institutions (IDB, ADIB, IILM, EY, BNP, Société Générale, Natixis, Moody’s, Simmons & Simmons, etc).

Key to Open Cooperation Doors

After five years, Dauphine can be proud to have had the vision to launch the first Islamic Finance Executive Master’s degree in Paris. The Master’s has been intrinsic in shaping the human capital needed for the industry in France and abroad. The recent announcement by the British Prime Minister, David Cameron, that the UK government intends to create a Shari’a-compliant listing for equities and issue a sukuk, may have implications for French players who have been monitoring the strong French retail market as well as several high-quality as- set classes (SMEs, Real Estate), and the stable French economic environment. This all illustrates how IBF could be a powerful means to capture opportunities in this very attractive French market, and internationally in “the French Commonwealth”, as ISFIN Managing Director Pr. Marliere often frames it. However to capture these opportunities, the right talent is needed. Dauphine has shaped the keys that fit the French market and enables IBF to develop both in France and globally by offering competitive resources to the industry. Dauphine graduates have an impressive network in IBF in France, Middle East, South East Asia and Africa with graduates working in all these territories. This network is a chance to have a global overview of IBF worldwide. Now it is time to strengthen cooperation both with other institutions as well as the whole IBF industry, in order to build an industry based on human capital as it will determine the shape of the business.