Human Capital Requirements and Developments

Central to the current economic reality of tougher regulations, technology advances, demographic shifts, digital lifestyles and work style revolutions is putting emphasis on establishing a larger and competent talent pool of trained Islamic professionals to increase the market share of the Islamic banking sector. In Malaysia, the financial sector will require a workforce of about 200,000 by 2020 which is an increase of 56,000 from the current 144,000 employees. Currently, employment in Islamic finance contributes 11% of the total employment in the financial system. Deloitte’s Islamic finance survey shows that more than 60% of Islamic finance professionals and practitioners require further training and skills development. The same survey also reported that only 18.5% of the respondents believe that Islamic finance institutions are properly staffed with people that have the depth and experience to cope with the challenges. Standard Chartered Saadiq Bhd CEO, Mr Wasim Saifi, echoed similar sentiments when he told the Edge Financial Daily, a Malaysian newspaper, that, “In order to move forward in Islamic banking, Malaysia needs more trained professionals as many countries that are planning on expanding Islamic finance in their markets are looking to tap resources from Malaysia.”

In Dubai, a study conducted by Dubai International Academic City (DIAC) showed that the Gulf Cooperation Council (GCC) bank professionals lack the necessary skills to work in Islamic finance. It surveyed 60 banks and

reported the following findings:

- 50% of banks surveyed find it difficult to hire graduates for entry-level positions.

- 23% of banks surveyed face difficulties in filling mid-level positions.

- Only 5% of banks surveyed report experiencing hardship when recruiting senior-level employees.

At the recent Islamic finance roundtable conducted by DIAC in collaboration with the Global Islamic Economy Summit 2013, one of the major outcomes of the discussions was to address the issue of demand for skilled workers in this field. Islamic finance is a central pillar in Dubai’s strategy to become the world’s capital of the Islamic economy and efforts to increase awareness of the Islamic finance industry with respect to skill gaps are heavily underway to build skilled human capital to support Dubai’s Islamic finance sector.

Bank Negara Malaysia in its statement on talent development in Islamic finance over the next decade said that talent development for the financial services industry has become an even more important agenda. This is particularly important for Islamic finance given that it has become the most rapidly growing segment in the Malaysian financial system. Malaysia’s Economic Transformation Programme (ETP) has also singled out Islamic finance services as a key growth sector for the country

Islamic finance is a fast-growing phenomenon, growing extraordinarily over the years. Besides the GCC and Malaysia, other key financial sectors including Hong Kong, London and Luxembourg have established themselves in the Islamic finance sector. Sufficient talent, therefore, will be necessary to fuel and sustain growth in the industry globally.

Islamic Finance Training Providers

In the face of rapid development in Islamic finance, the industry has little option but to adopt a strategy to re- main at the forefront of change. Many are aware that talent development is the key to growth in this area.

Many countries and regions have seen the proliferation of Islamic finance training centres that offer courses and skills as well as qualifications to create a large talent

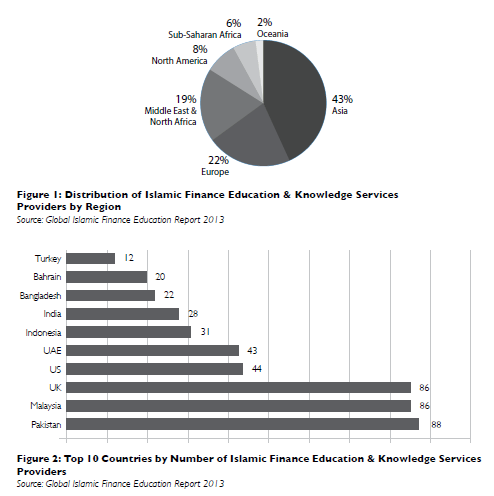

pool required to advance the Islamic finance sector. According to the Islamic Finance Development Indicator (IFDI) by Thomson Reuters, there are 420 institutions globally offering courses in Islamic finance and over 113 universities globally offering Islamic finance degrees.4 Another report on Global Islamic Finance Education 2013 (GIFE) by Yurizk, which is a more comprehensive study on Islamic economics and finance education across the world, shows that Asia hosts about 43% of the global Islamic finance education and knowledge service providers (IFEKSP), Europe (22%), MENA (19%), North America (8%), Sub-Saharan Africa (6%) and Oceania (2%).5 The multi-dimensional analysis conducted by Yurizk further demonstrated that Pakistan is the global leader in Islamic finance education with over 88 institutions offering Islamic finance education, 74 of which are academic and 14 are non-academic institutions. However, in terms of professional development programmes including certification, training, seminars and workshops, Malaysia ranks on top with 38 providers, followed by the UK with 37, UAE (15), Pakistan (14) and India (14).

Further analysis of the distribution of Islamic finance education and knowledge training providers in Asia shows that the driving forces for talent development are Pakistan and Malaysia while Indonesia, India, Bangladesh and Singapore are gaining popularity. According to Yurizk’s study, most of the programmes offered are professional-based studies with more than 80% of the courses focusing on professional development, while less than 20% are academic programmes. In Europe, the distribution of the training programmes is very much driven by the United Kingdom with 53% of the total IFEKSP in the region offered by institutions in the UK. Further analysis also shows more than 70% of the courses offered are for professional development, and these include workshops, training and seminars.

The projections for the growth of training centres for Islamic finance training providers by 2016 may surpass 1250. Even though Islamic finance in the United States has yet to be explored, there is evidence that Islamic finance programmes are already being offered by the Top 10 Business Schools in the States. These include Harvard University, Stanford University and Massachusetts Institute of Technology (Sloan) to name a few. Cambridge Judge Business School of Cambridge University, UK, has recently launched its new Islamic Finance Programme to position the United Kingdom as a major centre for Islamic Finance.

Broadly, these programmes lay the essential groundwork for competing effectively in the Islamic finance environment and exploring the business opportunities and challenges of the field.

Issues and Challenges in Developing Human Resources in Islamic Finance

As the financial market evolves Islamic banking and finance will face more challenges. Some of the challenges are, to a certain degree, intertwined but all of them are essential to ensure the health and sustainable growth of the industry.

Firstly, there is extreme variation in how Shari’a principles are interpreted and implemented among the countries involved. This has led to the existence of many regulations on various issues. For example, there are several forms of tax to be accounted for. Parties involved should form a Global Shari’a Advisory Council. Collaboration amongst jurisdictions and among member authorities will strengthen and integrate the regulatory system. This will not only result in the re-silience and stability of the IBF but will pave the way for the Islamic financial system to move forward and facilitate greater cross-border financing.

On the issue of Shari’a governance, it is imperative that the Shari’a framework is legally binding to resolve legal conflicts, as in the case of Malaysia. In view of numerous legal issues, the need to have a comprehensive legal framework and an effective Shari’a governance system is crucial. Failure to provide efficient Shari’a governance, either through law or legislation, would lead to radical disruption to the industry.

On the education front, research suggests that the lack of cooperation between academia and industry to develop a wholesome curriculum in Islamic finance has resulted in a mismatch between the graduates produced and the skills required by the industry. Graduates go through a system which is more theoretical than practical and are therefore are not suitably equipped for the industry. Bank Negara Malaysia (BNM) in its comments on ‘Talent development in Islamic finance over the next decade’7 highlighted that a more comprehensive approach and close collaboration between the industry and academia are essential to meet the highest standards of employees required in the work-force. This would ensure a steady stream of competent and versatile talent to support greater innovation and dynamism in the Islamic finance industry.

Additionally, new systems and technologies will provide the bedrock for the IBF to become more competitive and efficient and to deliver value, and ultimately to restore confidence and trust. The Islamic finance services industry is a very specialised field and acquiring the right competencies and skill sets is critical. A lack of qualified Islamic finance graduates with the required skills could impact industry growth.

This further reinforces research findings released by various parties on the shortage of skills for the industry. Studies conducted by The Capital Market Regulators Forum revealed that 82% of the countries which responded experience a shortage of talent in the IBF areas such as Shari’a and takaful. The studies also revealed that another 60% of Islamic finance professionals require further training and skills development.8

The importance of globally benchmarked standards for Islamic finance and training cannot be overemphasised. It identifies the required activities and tasks that are necessary to successfully identify, define, select, apply and improve benchmarking for the training programmes offered to Islamic finance practitioners. In simpler terms, it is a published document that establishes specifications and procedures designed to ensure the reliability of the training programmes, products, methods and services used within the IBF industry in order to improve their practices. The absence of these protocols that can be universally understood and adopted decreases the compatibility and interoperability of IBF services that fuel the development of the industry.

Another challenge that is more visible now is the absence of an international accreditation body for Islamic finance. Accreditation is a significant achievement in producing high-quality learning as well as an enhancement process for the IBF industry in terms of quality and performance of employees. There is no setup that deals comprehensively with accreditation standards for industry-based learning programmes in Islamic finance to show evidence that the training programmes lead to the development of competencies needed in the marketplace. Acquiring document proof of employee training such as accredited programmes is essential for any regulated industry such as Islamic finance which should not differ across economies and jurisdictions as they are derived from Shari’a.

Diversity of regulations and operations across borders requires careful study and review before a common understanding can be achieved for best practices. This is particularly so in the Islamic financial industry where understanding of Shari’a and practices could differ from one practitioner or country to another. The absence of an Islamic finance qualification structure or framework can lead to fragmentation, whilst a framework forms a uniform approach to quality assessments of learning standards and accreditation processes that enhance the competencies of IBF employees.

As it stands, the Islamic finance sector remains a demand-driven market with scarce supply. This is more pronounced in Asia than in other countries due to the extent of its growth in the region, and this should compel the industry to act. If these issues remain unresolved, the growth in Islamic finance could be short-lived.

Finance Accreditation Agency at a Glance

Securing access to the increasingly finite pool of individuals with in-demand skill sets will be fundamental to keeping employee and organizational goals aligned in the IBF Industry. It is against this backdrop that the Finance Accreditation Agency (FAA) was established.

Formed in August 2012, FAA is an international and independent quality assurance and accreditation body for the financial services industry. FAA is mandated to contribute to the financial services industry through the following functions:

- Establish quality assurance and accreditation framework and criteria;

- Accredit programmes, institutions and individuals that fulfil the set criteria and principles;

- Promote and implement recognition of prior learning standards and practices;

- Maintain and administer the Qualification Structure for the financial services industry;

- Register and maintain the FAA-approved training providers and/or accredited learning programmes and qualifications, institutions and individuals in the financial services industry;

- Seek global recognition of learning and qualifications;

- Facilitate the recognition and articulation of learning programmes and qualifications through mutual recognition initiatives; and

- Seek accreditation and strategic alliances with world-renowned accreditation agencies and relevant.

In line with its vision of becoming a global leader in ensuring quality learning in the financial services industry and its mission to inspire and promote the highest quality in continuing education and professional development for the financial services industry through its globally benchmarked accreditation framework, standards and practices, FAA provides national and international financial institutions and practitioners with an effective way to regularly and consistently examine and improve quality of learning offered to financial institutions. This is to ensure that the learning programmes provided by IBF and training institutions meet globally acceptable levels of quality.

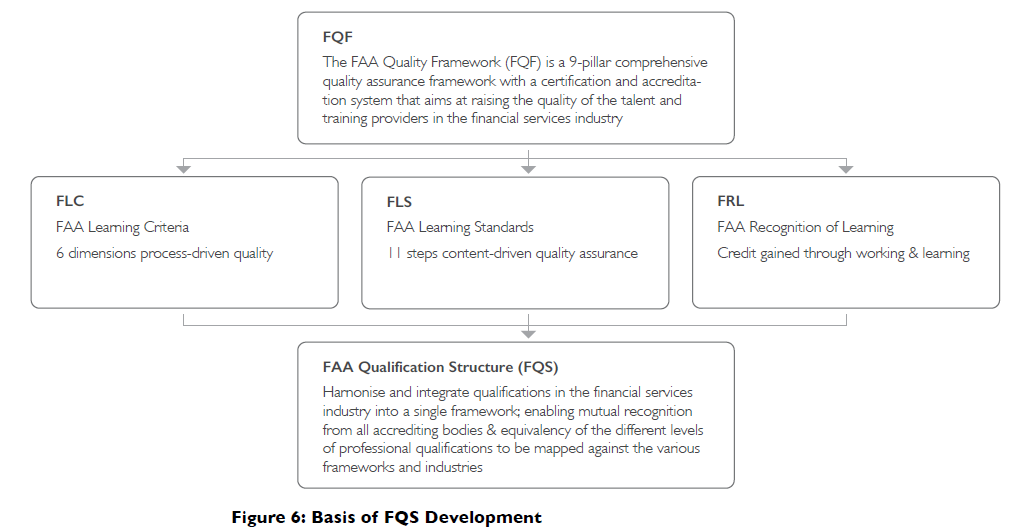

In managing quality and standards against a backdrop of possible talent development pitfalls, FAA adopts a vigorous accreditation process to enhance the competencies of Islamic finance practitioners. Through its homegrown products and services such as the FAA Quality Framework (FQF), FAA Learning Criteria (FLC), FAA Learning Standards (FLS) and FAA Recognition of Learning (FRL), FAA ensures that quality is met in the design, the development and delivery of learning programmes.

Assuring Quality of Human Capital in IBF Through Accreditation

The Skills and Learning Criteria Gap

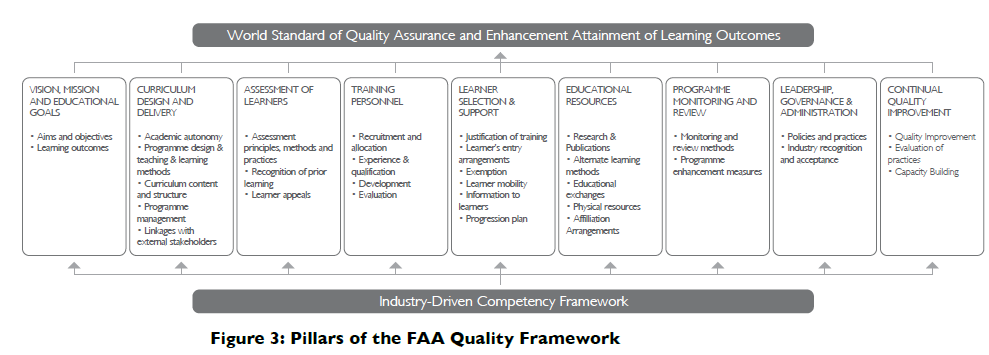

The demand for top-tier Islamic finance talent sharply outweighs the supply in the industry as technological development outpaces individual knowledge and skills improvement. To address this, FAA developed the FQF which is a comprehensive quality assurance framework with certification and an accreditation system that aims to raise the quality of talent in the IBF industry. The FQF was developed after extensive research and study of adult learning, higher education quality models as well as professional and certification bodies adopted by established quality assurance institutions globally. It is based on international good practices. The FQF consists of nine important pillars as shown in Figure 3.

The FQF is the basis on which the FLC and FLS are developed. The FLC is based on the principles of quality assurance, inclusiveness, creditability and transparency. It allows for validity, reliability, fairness and flexibility in the design, development and delivery of learning programmes in the financial services industry. The FLC consists of 6 dimensions as shown on the next page.

- Learning Programme

Establishment of a need for a particular learning pro- gramme

- Competency Fulfilment

Development of a learning programme that has to be closely related to competencies

- Learning Programme

Systematic design and development of learning pro- gramme

- Learning Programme

Appropriateness of methodologies used particularly in an adult learning environment

- Learning Assessment

Assurance of learning and knowledge transfer taking place

- Learning Programme

Acceptance of industry through points, exemptions, exchanges and affiliation, and awards

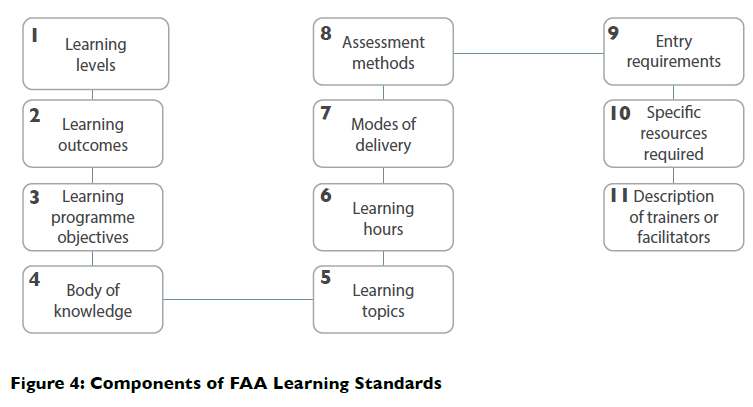

There are manifest weaknesses in the institutional structures of the IBF industry. Several key themes emerged from the list of challenges affecting the IBF industry. The first is the need to introduce an Islamic finance programme in the academic curriculum effectively. Aligning academic programmes with industry needs is paramount. Greater engagement and involvement by the industry, particularly by subject matter experts, are needed in designing the academic and training curriculum. Exposure and skilled training through internship and sharing of experiences is an alternative to address the mismatch between the graduates’ lack of skills and industry requirements. Such a move would not only provide value-added practical knowledge but provide the industry with more suitable talent. The FLS will help to bridge these gaps. As illustrated in Figure 4, the FLS consists of 11 components which were developed by FAA for various sectors in Islamic finance to ensure that all the accredited learning programmes are relevant to industry requirements.

The FLS was established to ensure consistency of learning content across the financial services industry according to internationally benchmarked industry requirements and to provide minimum standards for learning programmes across different sectors within the financial services industry. This integration of FLS contributes to the improvement of quality learning that enhances the competencies of IBF employees through the accreditation of learning programmes.

Both the FLC and FLS are used for learning programmes submitted for FAA Approval, FAA Provisional Accreditation and FAA Full Accreditation. FAA defines FAA Programme Accreditation (FPA) as a process to recognize that the design, development, delivery and all other related activities of a learning programme provided by the FAA-approved training providers meet the FLC and are in compliance with the requirements of the financial services industry.

The Qualifications Gap

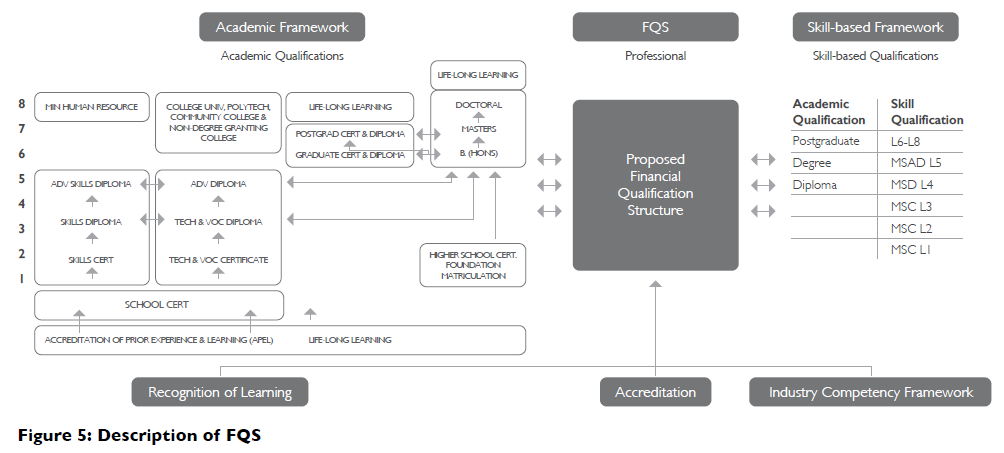

Studies have shown that there is an increasing amount of learning programmes from academic and non-academic institutions for the IBF industry. Significant variations are possible since the design of qualifications, progression routes and learners’ achievements differ greatly from one training provider to another. FAA has established a Finance Qualification Structure (FQS) to harmonies and integrate formal and professional qualifications with recognition of prior learning in the IBF industry into a single framework.

As illustrated in Figure 5, the FQS proposes to map professional qualifications in the financial services industry and the different levels of academic qualification framework into a unified structure.

This integration of learning standards and qualifications into the FQS maps all obtainable qualifications and presents them in relation to each other. The framework makes it possible for us to understand and compare the qualifications offered by training providers all over the world. This also enables mutual recognition from other accreditation bodies both local and foreign and facilitates the career and academic mobility of financial services industry employees, further enhancing the professional development of talent in the IBF industry.

FAA Recognition of Learning

FAA Recognition of Learning (FRL) enables financial services industry employees to gain recognition for their knowledge, skills and competencies that they al- ready possess or have gained through formal, informal and non-formal interventions. FAA acknowledges FRL as it is critical to the development of an open, accessible, inclusive, integrated and relevant education and training system, and is the key foundation for lifelong learning policies. FRL also maximizes the skills and knowledge of the workforce as it allows current skill sets to be codified and to serve as a step into further training or development.

As summarized in Figure 6, FAA’s development of the Qualification Structure will be amongst the first of such initiatives in the world to recognize the professional qualifications, continuous professional education and prior learning experiences possessed by practitioners in the IBF for the purpose of career development as well as to provide opportunities for pursing academic qualifications with possible exemptions. Additionally, it facilitates the engagement of industry experts to teach a university curriculum.

The structure will benefit graduates of institutions of higher learning in terms of providing a holistic curriculum combining both the academic and industry requirements, making them job ready upon graduation. It also helps training providers in the development of the curriculum and creating qualifications with appropriate learning outcomes. Regardless of the beneficiaries, the quality assurance initiatives that encompass this framework will contribute to the talent development initiatives in the IBF across different economies.

Training and development vehicles also take on the following forms which FAA adopts:

- Quality Reviews

All learning programmes and institutions accredited by FAA are subject to quality reviews when the validity period of accreditation is about to expire. Whilst the documentation of ongoing quality activities is still an integral part of the accreditation process, FAA reviews how the institution addresses the FLC, not only after the accreditation has been obtained but also when the learning programme is delivered. This allows for retrospective, concurrent and prospective reviews that emphasize the desired outcomes by the financial institutions. Such an outcome-oriented approach which focuses on the competencies of practitioners, rather than on paper compliance, is essential to advance the mandate of FAA in facilitating the development of high-quality talent for the financial services industry.

- Industry Technical Experts

FAA appoints global industry technical experts in their respective financial sectors, i.e. Islamic Finance, Insurance, Capital Market, Conventional Banking and Corporate Programmes, to be part of the accreditation process. The roles of these experts are to ensure that the learning programmes submitted for accreditation are relevant to the requirements of the financial services industry. The experts also provide comprehensive information of the competencies required for the needs of the industry.

- Independent Quality Assurance

To advance the overall delivery of high-quality learning for the financial services industry, there is a need to pro- mote increased industry and public trust in financial institutions. To address talent, it is essential for the internationally benchmarked system to have a strong, credible and transparent system for structured assessment and accreditation. Transparency, accountability and the generic principles underpinning the process of quality assurance practised by FAA are critical. In order to maintain its transparency and integrity, FAA does not involve itself in the design, development and delivery of learning programmes. The accreditation decisions are therefore impartial and free from any conflict of interest.

Moving Forward

Islamic finance continues to draw attention from industry practitioners and regulators as an increasingly mainstream sector offering a strong growth in business volumes. Though the growth figures and demand dynamics vary from country to country and from institution to institution, research has shown that the current shortage of qualified staff working in Islamic finance sector will be exacerbated if enhancements of the infrastructure and review of the industry initiatives are undermined. As an emerging industry, Islamic finance must enhance the richness of its products and services. This is a task that is fraught with challenges, and which requires commitment from regulators, industry and training providers. The new generation of Islamic bankers with proper training is, at best, very limited. Institutions of higher learning in some countries have neglected core banking programmes of Islamic principles and this has led to graduates lacking the necessary knowledge and skills.

In Shari’a studies, economics, finance, as well as financial and commercial law are studied in passing rather than as specializations in some training institutes. There are however notable exceptions such as International Islamic University in Malaysia, International Centre for Education in Islamic Finance (INCEIF) and one or two others, but they are too few and far between. Additionally, very often, the Islamic finance industry has too conveniently relied on the conventional finance sector for employees rather than investing in the long-term development of the Islamic finance. There is a dearth of qualified Islamic finance personnel and as key Islamic hubs require thousands of individuals to fuel growth, the challenge for Islamic finance is to deepen the pool.

FAA, in alignment with the universal agenda in developing high-performing professionals in the financial services industry and in the Islamic sector in particular, has started many new initiatives since its establishment to achieve this goal. As an agency responsible for delivering quality excellence in the process of the development of talent, FAA, through its rigorous accreditation processes, ensures the quality of a programme, institution and competencies of an individual. It serves as an advocate for the provision of high-quality assurance of learning standards through the development of nationally and internationally recognized standards. Through the accreditation process, FAA provides national and international financial institutions and practitioners with an effective way to regularly and consistently examine and improve the quality of learning offered to financial institutions. The shift in accreditation emphasis has become the major focus in re- cent development. This will continue to be emphasized until quality learning which addresses the knowledge and skills required is firmly incorporated into the accreditation process to strengthen the human capital of the IBF industry. This paradigm shift in the enhancement of the infrastructure towards recognizing accreditation for the IBF industry is essential to expand the cross-border growth of Islamic finance by all players such as lawmakers, regulators and market participants.