The Islamic Finance Country Index (IFCI) is a composite ranking that reflects the state of IBF in different countries. More importantly, it highlights the leaders in the industry. The IFCI was initiated in 2011 with the aim to capture the growth of the industry, and provides an immediate assessment of the state of the IBF industry in each country. It is also a means to compare countries in this sector. As more countries open up to IBF, the Index provides a benchmark for nations to track their progress against other nations. The IFCI shows the growth of IBF in an objective manner making it a useful tool for industry analysis and comparative assessments. It is the first, and only, index of its kind in the industry, and has proven to be very popular amongst regulators, analysts, researchers and industry players all over the world. For example, the Central Bank of Indonesia has quoted it on a number of occasions in various conferences.

IFCI ranks countries based on available information for different variables across each country in a manner that avoids any bias affecting the outcome.

Data

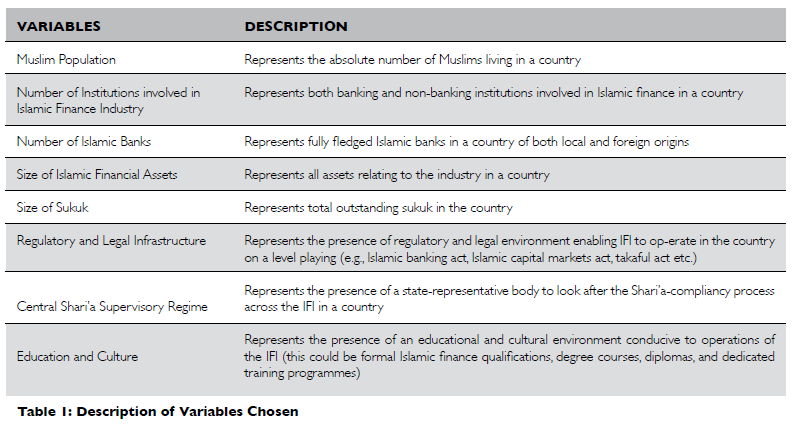

There are over 70 countries involved in Islamic finance in some capacity. However, due to limitations related to the authenticity, availability and heterogeneity of the data, we have only been able to rank 36 countries in the year 2011, 42 in the year 2012, 43 for the year 2013 and 42 for the year 2014. In all cases, the data has been collected from various secondary sources, including central bank websites, individual Islamic financial institution’s published accounts, various agencies and national newspapers, and information portals like IFIS, Bloomberg and Thomson Reuters. Tables 1 and 2 evidences the eight variables used for IFCI 2014 together with their weights.

Weights

Data was collected on eight variables for 42 countries. The data was organized and coded to enable multivariate analysis and construction of IFCI using SPSS. The data was then tested to see if it contained any meaningful in- formation to draw conclusions from. In order for factor analysis to be applicable, it is important that the data fits a specification test for such an analysis. The Kaiser- Meyer-Olkin (KMO) measure of sampling adequacy is used to compare the magnitudes of the observed correlation coefficients in relation to the magnitudes and partial correlation coefficients. Large values (between 0.5 and 1.0) indicate factor analysis may be useful with the data. If the value is less than that, then the results of the factor analysis might not be very useful. For the data we used, we found the measure to be 0.85, which made it reasonable for us to carry out the factor analysis. Bartlett’s test of sphericity is another specification test which tests the hypothesis that the correlation matrix is an identity matrix indicating that given variables are unrelated and therefore unsuitable for structure design. Smaller values (less than 0.05) of the significance level indicate that factor analysis may be useful with the data. For the purpose of IFCI 2014, this value was found to be significant (0.00 level) which means that data was fit for factor analysis. Factor analysis was run to compute initial communalities to measure the proportion of variance accounted for in each variable by the rest of the variables. In this manner we were able to assign weights to all 8 variables in an objective manner. By following the above method, we have been able to remove the subjectivity factor in the index as now the data speaks for itself, and the statistical method comes up with the weights. The weights used in IFCI 2014 are similar to IFCI 2013. These weights points to the relative importance of each constituent variable of the index in determining the rank of an individual country. Hence, it is natural to assume that countries which have a large number of Islamic banks, a central Shari’a supervisory authority, and a number of institutions involved in Islamic finance will rank high because they have a high weightage in the index compared to other variables.

| Table 1: Description of Variables Chosen | |

| VARIABLES | % Weights (2013) |

| Number of Islamic Banks | 21.8 |

| Central Shari’a Supervisory Regime | 19.7 |

| Number of Institutions involved in Islamic Finance Industry | 20.3 |

| Size of Islamic Financial Assets | 13.9 |

| Size of Sukuk | 6.6 |

| Muslim Population | 7.2 |

| Education and Culture | 5.7 |

| Regulatory and Legal Infrastructure | 4.9 |

| Table 2: Weights |

The Model

The model used for the IFCI index is as below:

IFCI (Cj)= i=8i=1 Wi.Xi

Where

C = Country j = 1, 2, …, 43

W = Weight for individual variable X = Variable

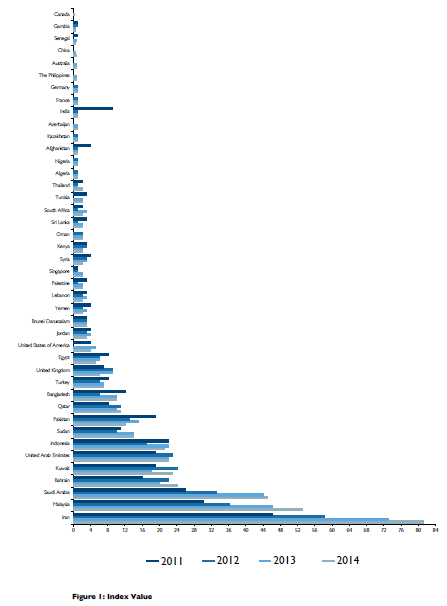

With these minor changes in the data set, and resulting changes in the weights assigned to the variables used, the above model generated some interesting results. Exhibit 3 and 4 provide a comparison of the ranking of the countries for the years 2013 and 2014.

Analysis

It is the fourth consecutive year that the top three countries have remained unchanged, with Iran (1), Malaysia (2) and Saudi Arabia (3). Iran has an index value of 82, remaining the leading country across all the variables as its entire banking and finance sector is operating under Shari’a law. Total Islamic financial as- sets in Iran reached USD476 billion, the highest for any country. It is interesting to see that it is a country with the largest AUM yet it is a country which is ignored by the industry. The media fails to capture developments, and showcase its experience and expertise in the field. Representatives from Iran remain limited at global conferences highlighting closed nature of the economy, much due to the sanctions imposed. Nevertheless, Iran has developed a very interesting domestic model which is helping its IBF industry to flourish without depending on the international market.

| 2014 | 2013 | Changes | |

| Iran | 1 | 1 | 0 |

| Malaysia | 2 | 2 | 0 |

| Saudi Arabia | 3 | 3 | 0 |

| Bahrain | 4 | 6 | 2 |

| Kuwait | 5 | 7 | 2 |

| United Arab Emirates | 6 | 4 | -2 |

| Indonesia | 7 | 5 | -2 |

| Sudan | 8 | 9 | 1 |

| Pakistan | 9 | 8 | -1 |

| Qatar | 10 | 11 | 1 |

| Bangladesh | 11 | 10 | -1 |

| Turkey | 12 | 13 | 1 |

| United Kingdom | 13 | 12 | -1 |

| Egypt | 14 | 14 | 0 |

| United States Of America | 15 | 15 | 0 |

| Jordan | 16 | 16 | 0 |

| Brunei Darussalam | 17 | 17 | 0 |

| Yemen | 18 | 19 | 1 |

| Lebanon | 19 | 18 | -1 |

| Palestine | 20 | 24 | 4 |

| Singapore | 21 | 26 | 5 |

| Syria | 22 | 20 | -2 |

| Kenya | 23 | 22 | -1 |

| Oman | 24 | 25 | 1 |

| Sri Lanka | 25 | 23 | -2 |

| South Africa | 26 | 21 | -5 |

| Thailand | 27 | 30 | 3 |

| Tunisia | 28 | 28 | 0 |

| Algeria | 29 | 27 | -2 |

| Nigeria | 30 | 32 | 2 |

| Afghanistan | 31 | 29 | -2 |

| Kazakhstan | 32 | 31 | -1 |

| Azerbaijan | 33 | 34 | 1 |

| India | 34 | 33 | -1 |

| France | 35 | 35 | 0 |

| Germany | 36 | 37 | 1 |

| The Philippines | 37 | 38 | 1 |

| Australia | 38 | 39 | 1 |

| China | 39 | 40 | 1 |

| Senegal | 40 | 36 | -4 |

| Gambia | 41 | 41 | 0 |

| Canada | 42 | 42 | 0 |

Malaysia is seen by and large as a leader in the IBF industry. Malaysia passed a new comprehensive law, the Islamic Financial Services Act Malaysia 2013, which came into force in May 2013. Malaysia with the strong support of Bank Negara Malaysia continues to develop strong independent brands including INCEIF, ISRA, and the most recent Finance Accreditation Agency (FAA) which aims to offer accreditation services to banks and financial institutions globally. Malaysia is also home to the highest number of sukuk issuances.

Saudi Arabia, with Islamic financial assets of US$227 billion, is has an index value of 45. GIFR 2014 predicts that Saudi Arabia will be among the six countries where the share of Islamic banking and finance will reach 50% by the year 2020. Bahrain, irrespective of its domestic troubles, has shown improvement in the last one year and has moved two positions up from 6th to 4th. Bah- rain has the most mature regulatory system for Islamic finance in the Middle East, and is home to a number of multilateral organizations that support the industry. The International rating agency, Standards & Poor’s, declared the Bahraini economy stable following political unrest in 2011. Market share of IBF is currently at 13.3% as of August 2012. Bahrain Central Bank remains strong in its sukuk programme.

UAE, besides winning the bid to host the Expo 2020 and is aspiring to be a hub of the Islamic economy, has moved down two ranks. The Expo 2020 is likely to bring a lot of business and development opportunities to the UAE, which will also generate employment for the national and international market.

Indonesia is working hard to attract the attention of the global IBF industry, and is trying to become a regional hub (taking it away from Malaysia). It is a country with high potential, especially as only 14 million out of a population of 215 million are using Islamic finance. However it has moved two ranks down in 2014. Another important country to look out for the year 2014 will be Pakistan. The current government has shown a lot of interest in IBF. In early 2014, the State Bank of Pakistan brought in a deputy governor focusing on only Islamic banking and finance. The new incumbent is very upbeat about the growth in the country and driving strong initiatives. The central bank has recently issued a five years plan for the growth of Islamic banking in the country and is working on new regulations and liquidity management tools for the industry. The overall growth in the industry has been very impressive led by Meezan bank. With the improvement in global financial markets, it is expected that IBF will growth in a number of countries, this includes new entrants to the Islamic banking and finance industry. Five important countries to look out for in 2014 are Malaysia, Saudi Arabia, UAE, Pakistan, UK.

Figure 1: Index Value