Since 2011, we have been constructing, maintaining and reporting Islamic Finance Country Index (IFCI) that is a composite index used for ranking different countries with respect to the state of IBF and their leadership role in the industry. The IFCI was initiated with the aim to capture the growth of the industry, and to provide an immediate assessment of the state of IBF industry in each country. With the five-year data since its inception, IFCI can now be used to compare the countries not only in a given year but also over time. As more countries open up to IBF, the index will provide a benchmark for nations to track their performance against others. Over time, the individual countries on the index should also be able to track and assess their own performance.

The IFCI shows the growth of IBF in an objective manner, making it a useful tool for industry analysis and comparative assessments.

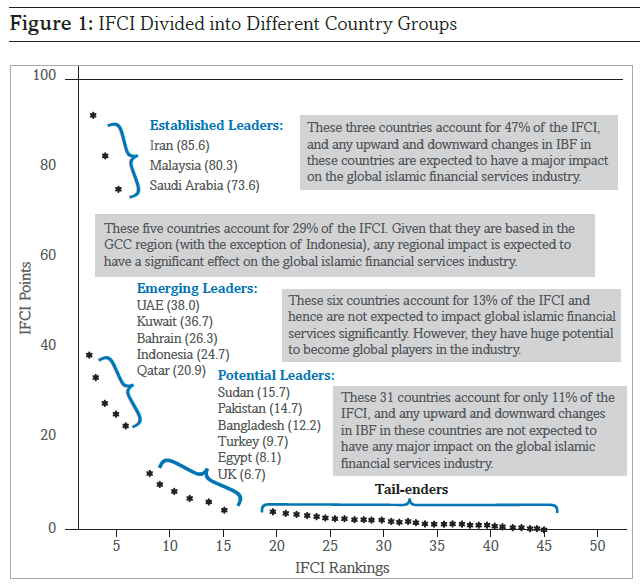

Although some other indices have lately been introduced in the market but IFCI has established itself as the oldest, most authentic and robust Islamic finance country index in the world. The indices that have more coverage than IFCI in fact do not have better information content. This is because after the UK the size and significance of other countries included is rather small in terms of their involvement in IBF (as is clearly evident in Table 1 and Figure 1).

ESTABLISHED LEADERS

In the last five years, there has been no change in the ranking of the top three countries included in IFCI, namely Iran, Malaysia and Saudi Arabia. However, looking at their individual scores, there is some anecdotal evidence that Malaysia is closing the gap with Iran. Figure 2 predicts that by 2020, Malaysia will take over Iran as the number 1 ranked country on IFCI. While Iran is expected to rank number 2, Saudi Arabia will also be closing its gap on it to challenge for the number 2 slot.

There are a number of factors that have helped Malaysia to emerge as the global leader in IBF, but the most significant of these is the commitment of the government to use IBF as a policy tool to use it as an integral part of its economic agenda.

| COUNTRIES | SCORE 2015 | RANK 2015 | RANK 2014 | CHANGES |

| IRAN | 85.6 | 1 | 1 | 0 |

| MALAYSIA | 80.3 | 2 | 2 | 0 |

| SAUDI ARABIA | 73.6 | 3 | 3 | 0 |

| UNITED ARAB EMIRATES | 38.0 | 4 | 6 | +2 |

| KUWAIT | 36.7 | 5 | 5 | 0 |

| BAHRAIN | 26.3 | 6 | 4 | -2 |

| INDONESIA | 24.7 | 7 | 7 | 0 |

| QATAR | 20.9 | 8 | 10 | +2 |

| SUDAN | 15.7 | 9 | 8 | -1 |

| PAKISTAN | 14.7 | 10 | 9 | -1 |

| BANGLADESH | 12.2 | 11 | 11 | 0 |

| TURKEY | 9.7 | 12 | 12 | 0 |

| EGYPT | 8.1 | 13 | 14 | +1 |

| UNITED KINGDOM | 6.7 | 14 | 13 | -1 |

| JORDAN | 4.4 | 15 | 16 | +1 |

| UNITED STATES OF AMERICA | 3.6 | 16 | 15 | -1 |

| BRUNEI DARUSSALAM | 3.2 | 17 | 17 | 0 |

| SRI LANKA | 3.0 | 18 | 25 | +7 |

| OMAN | 2.8 | 19 | 24 | +5 |

| YEMEN | 2.7 | 20 | 18 | -2 |

| LEBANON | 2.6 | 21 | 19 | -2 |

| KENYA | 2.5 | 22 | 23 | +1 |

| SINGAPORE | 2.3 | 23 | 21 | -2 |

| SWITZERLAND | 2.3 | 24 | – | – |

| SOUTH AFRICA | 2.3 | 25 | 26 | +1 |

| SYRIA | 2.2 | 26 | 22 | -4 |

| COUNTRIES | SCORE 2015 | RANK 2015 | RANK 2014 | CHANGES |

| CANADA | 2.1 | 27 | 42 | +15 |

| TUNISIA | 1.9 | 28 | 28 | 0 |

| THAILAND | 1.9 | 29 | 27 | -2 |

| INDIA | 1.9 | 30 | 34 | +4 |

| ALGERIA | 1.7 | 31 | 29 | -2 |

| AFGHANISTAN | 1.4 | 32 | 31 | -1 |

| AUSTRALIA | 1.4 | 33 | 38 | +5 |

| NIGERIA | 1.4 | 34 | 30 | -4 |

| AZERBAIJAN | 1.3 | 35 | 33 | -2 |

| KAZAKHSTAN | 1.2 | 36 | 32 | -4 |

| PALESTINE | 1.2 | 37 | 20 | -17 |

| FRANCE | 0.9 | 38 | 35 | -3 |

| THE PHILIPPINES | 0.7 | 39 | 37 | -2 |

| GERMANY | 0.6 | 40 | 36 | -4 |

| GAMBIA | 0.6 | 41 | 41 | 0 |

| CHINA | 0.6 | 42 | 39 | -3 |

| SENEGAL | 0.5 | 43 | 40 | -3 |

| GHANA | 0.4 | 44 | – | – |

| MAURITIUS | 0.3 | 45 | – | – |

Iran, on the other hand, has faced economic sanctions from the Western powers and other countries, and hence has failed to emerge as an influential player in the global Islamic financial services, despite the fact that it boasts to have the largest amount of Islamic financial assets in the world.

Saudi Arabia commitment to IBF has increased significantly over the last four years, as the government has apparently reduced its indifference to IBF. Unlike in the past, the authorities in Saudi Arabia now not only acknowledge the existence of IBF in the country but have also started highlighting its growth.

EMERGING LEADERS

Figure 1 lists five countries, namely UAE, Kuwait, Bahrain, Indonesia and Qatar, as the emerging leaders in the global Islamic financial services industry. Apart from Indonesia, all these countries are in the GCC region, making the region the global hotspot for the Islamic financial services industry. It must be noted that two of the established leaders in IBF, i.e., Iran and Saudi Arabia, also fall in the Middle East. Therefore, it is safe to assert that any changes in the GCC region will have positive or adverse effect on the development of IBF on a global level. Hence, any global strategy for competition and growth1 must consider the risks associated with the concentration of IBF in the GCC.

| 100 | |||||||||||

| Established Leaders: These three countries account for 47% of the IFCI, Iran (85.6) and any upward and downward changes in IBF inMalaysia (80.3) these countries are expected to have a major impact Saudi Arabia (73.6) on the global islamic financial services industry. These five countries account for 29% of the IFCI. Given that they are based in the GCC region (with the exception of Indonesia), any regional impact is expected to have a significant effect on the global islamic financial services industry.Emerging Leaders:UAE (38.0) These six countries account for 13% of the IFCI and Kuwait (36.7) hence are not expected to impact global islamic financial Bahrain (26.3) services significantly. However, they have huge potential Indonesia (24.7) to become global players in the industry.Qatar (20.9) Potential Leaders:Sudan (15.7) These 31 countries account for only 11% of the Pakistan (14.7) IFCI, and any upward and downward changes Bangladesh (12.2) in IBF in these countries are not expected to Turkey (9.7) have any major impact on the global islamic Egypt (8.1) financial services industry.UK (6.7)Tail-enders | |||||||||||

| 80 | |||||||||||

| 60 | |||||||||||

| 40 | |||||||||||

| 20 | |||||||||||

| 0 | |||||||||||

| 5 | 10 | 15 | 20 | 25 30 | 35 | 40 | 45 | 50 | |||

| IFCI Rankings |

Figure 1: IFCI Divided into Different Country Groups

Bahrain is an odd inclusion in the list, as the country has for long played an instrumental role in the development of IBF on a global level. While Bahrain has been active in industry-building initiatives (e.g., AAOIFI, IIFM and IIRA etc.), the size of its domestic Islamic financial market is rather limited in a global context, which makes it a less important player as compared with other players in the established leaders category. This should, however, not be deemed as belittling its leadership role. Bahrain remains a very important player in the global Islamic financial services industry, as is evidenced by the entry on Bahrain in Chapter 4.

POTENTIAL LEADERS

Figure 1 also lists six countries, namely Sudan, Pakistan, Bangladesh, Turkey, Egypt and the UK, which can be potential leaders in the global Islamic financial services industry. Interestingly, all these countries (except the UK) have high number of Muslims, a factor that is important for future growth of IBF.

The UK is an odd entry in this list, as it is a country with no more than 3 million Muslims – only 5% of the total population, which is predominantly Christian. The UK has been central to IBF for many decades, with six

BOX fl: A NOTE ON DATA AND METHODOLOGY

IFCI is based on a multivariate analysis. For construction of the index, data was collected on a number of variables, including macroeconomic indicators of the countries included. The data was then tested to see if it contained any meaningful information to draw conclusions from. After consideration of different multivariate methods, it was decided to use the factor analysis to identify the variables that may influence IBF in the countries included in the sample.

In order for factor analysis to be applicable, it is important that the data fits a specification test for such an analysis. The Kaiser-Meyer-Oklin (KMO) measure of sampling adequacy is used to compare the magnitudes of the observed correlation coefficients in relation to the magnitudes and partial correlation coefficients. Large values (between 0.5 and 1) indicate that factor analysis may be useful with the data. If the value is less than that, then the results of the factor analysis may not be very useful. For the data we used, we found the measure to be 0.85, which made it reasonable for us to use factor analysis.

Batlett’s test of sphericity is another specification test that tests the hypothesis that the correlation matrix is an identity matrix indicating that the given variables are unrelated and therefore unsuitable for structure design. Smaller values (less than 0.05) of the significance level indicate that the factor analysis may meaningfully be used with the data. For the present purposes, this value was found to be significant (0.00 level), which means that data was fit for factor analysis.

Factor analysis was therefore run to compute initial communalities to measure the proportion of variance accounted for in each variable by the rest of the variables. In this manner, we were able to assign weights to all eight factors in an objective manner.

By following the above method, we have been able to remove the subjectivity in the index. The weights along with the identified factors make up the IFCI. The weights point to the relative importance of each constituent factor of the index in determining the rank of an individual country.

There are over 70 countries involved in IBF in one way or another. However, due to limitations imposed by authenticity, availability and heterogeneity of the data, IFCI was launched in 2011 with only 36 countries. Over the next three years, the availability of data allowed us to include another six countries to make a sample size of 42. This year, another three countries were included, in an attempt to expand the coverage of the index.

| Variables/Factors | Description | Weights | |

| 1. Number of Islamic Banks | Full-fledged Islamic banks both of local and foreign origin | 21.8% | |

| fl. | Number of IBFIs | All banking and non-banking institutions involved in IBF, including Islamic windows of conventional banks | 20.3% |

| 3. Shari’a Supervisory Regime | Presence of a state (or non-state) representative central body to look after the Shari’a-compliance process across the IBFIs in a country | 19.7% | |

| 4. Islamic Financial Assets | Islamic financial assets under management of Islamic and conventional institutions | 13.9% | |

| 5. Muslim Population | Absolute number of Muslims | 7.2% | |

| 6. Sukuk | Total sukuk outstanding in the country | 6.6% | |

| 7. Education & Culture | Presence of an educational and cultural environment conducive to operations of IBFIs, including formal Islamic finance professional qualifications, degree courses, diplomas and other dedicated training programmes | 5.7% | |

| 8. Islamic Regulation & Law | Presence of regulatory and legal environment enabling IBFIs to operate in the country on a level-playing field (e.g., and Islamic banking act, Islamic capital markets act, takaful act etc.) | 4.9% |

Table B.fl.1: IFCI Variables and Their Weights

Note: The weights shown are rounded figures, adding up to 100.1 but in actual calculations, they aggregate to 100.

The data used comes from different primary and secondary sources, but in its collective final form becomes the proprietary data set of Edbiz Consulting, which collects, collates and maintains it.

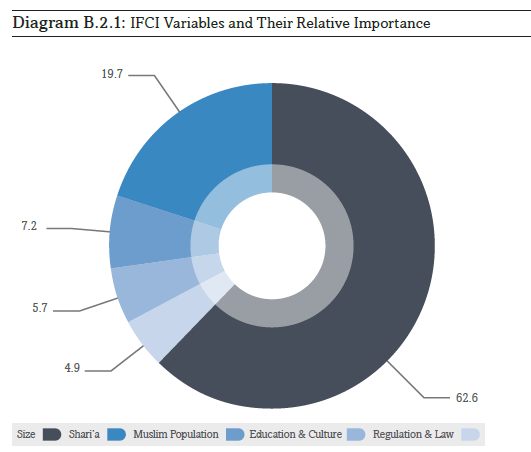

We collect data on eight factors/variables for the countries included in IFCI. The variables and their respective weights are described in Table B.2.1.

The general model used for the construction of IFCI is as follows:

i=8

IFCI (C ) = ∑ W .X

i=1

= W1.X1 + W2.X2 + W3.X3 + W4.X4 + W5.X5

+ W6.X6 + W7.X7 + W8.X8

Where

Cj = Country j including in the index

Wi = Weight attached to a given variable/factor i

Xi = A given variable/factor i included in the index

The countries are ranked according to the above formula every year, using the updated annual data.

As Table B.2.1 and Diagram B.2.1 suggest, size of Islamic financial services industry as captured by four factors (namely, number of Islamic banks, number of IBFIs, the volume of Islamic financial assets, and the sukuk outstanding) is the most important factor in the index, explaining 62.6% variation.

Therefore, it is superior to the univariate analyses that focus on just size of the industry in a given country. Furthermore, size in itself is not enough to capture the relative importance of IBF in a country. It is equally important to consider the depth and breadth of the industry. Hence, both the size of Islamic financial assets and the number of IBFIs are included. Furthermore, the inclusion of sukuk, which accounts for 15% of the global Islamic financial services industry, as a separate factor is also useful. Although the other factors collectively explain 37.4% variation in the index, their inclusion is important as they give a comprehensive view on the state of affairs of IBF in a country.

It must be clarified that IFCI is a positive measure of the state of affairs of IBF and its potential in a country, without taking a normative view on what should be the important factors determining size and growth of the industry, and their relative importance (i.e., weights).

full-fledged Islamic banks and a number of other institutions involved in the industry in one way or another. The UK government issued a £200 million sovereign sukuk in 2014, which served as a milestone in the global Islamic financial services industry. Being the only country in Europe, which has developed a vibrant IBF sector, the UK certainly possesses a huge potential to become a global hub for the Islamic financial services industry.

THE ISSUE OF SIZE VERSUS POTENTIAL

IFCI is a measure of the size as well as potential of IBF in a country. The inclusion of Muslim population in the construction of the index captures the potential of IBF in a country. One of the reasons that Iran holds top position on IFCI is the size of the Muslim population in the country (in addition to having the largest volume of Islamic financial assets). Similarly, countries like Pakistan and Indonesia (included in the list of emerging and potential leaders in IBF, respectively) have huge potential in terms of IBF due to the sizes of Muslim population in these countries, among other factors.

GIFR takes the view that the future of IBF is brightest in the countries with large Muslim populations and that the Western hemisphere offers the least opportunities for growth in IBF. Therefore, those institutions that are looking for businesses in the Western countries are at best taking an elitist view on IBF. Grassroot level expansion and growth is possible only in the Muslim-majority countries in the OIC block.

TWENTY-TWENTY-SIX-FIFTY

GIFR 2014 reported that by 2020 there would be at least six countries in the world, in addition to Iran and Sudan (the two countries with full-fledged Islamic financial system), where IBF would attain a market share of no less than 50% of the total financial sector. These countries include:

- Brunei Darussalam;

- Saudi Arabia;

- Kuwait;

- Qatar;

- Malaysia;

- UAE

It is almost certain that Brunei Darussalam will be the first country to attain the target before any other country in the list. With the introduction of Shari’a law in the country, it is natural progression that the government decides in favour of introducing a full-fledged Islamic financial system instead of pursuing the current model of dual banking system that allows Islamic as well as conventional banks and financial institutions in the country. Once that happens, Brunei will become the third such country after Iran and Sudan.

Brunei Darussalam’s Minister for Development and Deputy Chairman of the Brunei Monetary Authority, Suyoi Osman, acknowledged that the market share for Islamic finance in Brunei would grow to at least 50 percent of the local financial sector by 2020.

Saudi Arabia is well on the target to achieve the 50% market share of IBF, with its retail banking sector already over 55% Shari’a-compliant. With the fast growth in Islamic investment banking and asset management, and with the likely full conversion of National Commercial Bank (the largest bank in the country), Saudi Arabia presents optimism in the context of 2020:6:50.

Kuwait is another country with huge potential in IBF and there are all the signs that by 2020, its financial sector will be predominantly Islamic.

With the pace of development in Qatar in the wake of 2022 FIFA World Cup, there will be sufficient number of projects in the country to allow IBF to play a role in the economic development of the country, and one should hope that well before the 2022, IBF will become at least as significant as conventional finance in the country.

Malaysia is perhaps the weakest link in the list of 2020:6:50. While it is undoubtedly a global player in the Islamic financial services industry, the government and financial regulators will have to come up with some radical policies to achieve an equal market share of IBF.

UAE is another uncertain case in this respect, and the authorities must keep a close eye on the developments in banking and finance to achieve the target of 50% market share of IBF.