In this chapter we present some interesting cases of IBF on a country or regional level. Two countries – Indonesia and Kazakhstan – are emerging markets in two different regions. While Indonesia is a rising star in the Far East, Kazakhstan is emerging as an important player in the IBF market in the Central Asia. Bahrain is an established leader in IBF and an update on the current state of affairs should be of interest to the readers. Although these countries are covered in Country Sketches (Chapter 3), we thought it would be interesting to have an additional focus on them to highlight their true potential in IBF.

There are a number of analysts who believe that the new wave of growth in IBF will come from Africa – a region that is fast assuming importance in the global Islamic financial services industry. This chapter, therefore, includes a discussion on the prospects of IBF in Africa.

BAHRAIN

The erstwhile existential debates about the role, nature, and potential of Islamic finance have now clearly given way to a conviction that Shari’a-compliant finance is not only here to stay. Rather, it can be expected to be one of the most dynamic segments of the broader financial sector worldwide and an increasingly systemically significant element of the financial sectors of a growing number of countries with significant Muslim populations. Starting from a current base of approximately US$1.984 billion, the annual growth rates of Shari’a-compliant assets globally can be expected to remain close to double digits for the foreseeable future.

While the scale and sophistication of Shari’a-compliant finance still often pales in comparison to the more established conventional financial industry, rapid forward momentum can be expected from a number of areas of convergence-style growth. Three things, in particular, stand out about the dynamics of the sector.

Firstly, the global footprint of Islamic finance is continuing to expand, typically with active government support. A number of countries are creating the regulatory framework for Shari’a-compliant financial activities or eliminating hurdles that have historically disadvantaged Islamic products and structures. Significant growth, albeit from a modest base, is already well underway in significant emerging markets such as Turkey and Indonesia. New growth opportunities are taking shape in North Africa, in a growing number of sub-Saharan African countries, and in parts of Asia where Malaysia and Pakistan have historically been the two main bastions of Islamic finance. Beyond this, more and more initiatives are underway to serve markets with significant Muslim minorities, including large populations in countries such as China and India, not to mention immigrants in the West. In some of the more established markets, some institutions are converting from a conventional or mixed to a purely Islamic modus operandi.

At the same time, efforts in the area of product and market infrastructure development along with regulatory reform are progressing and even gathering momentum. This is particularly pronounced in the case of the Shari’a-compliant capital markets where sukuk issuance has gone from strength to strength in recent years. The range of issuers, structures, and tenors is continuing to expand. For instance, the erstwhile de facto tenor ceiling of five years has given way to a full range of options. Platforms have sprung up for secondary trading, although liquidity remains a challenge. Organic growth is continuing across the range of Islamic products, partly in response to the growing preference for Shari’a-compliant solutions among customers in many countries. Nonetheless, the menu of products remains relatively narrow and uneven, typically dominated by fairly basic plain vanilla instruments. The ability of Islamic finance to cater to the financial needs of customers in a comprehensive, flexible, and cost-competitive way still falls short of that available in the conventional universe. This is of particular importance at a time when the number and scale of fully Shari’a-compliant investors is continuing to grow.

Thirdly, Islamic finance is increasingly appealing to non-Muslim clientele. In some cases, Shari’a-compliant funds enable investors to access to new markets. More generally, the unique characteristics of Islamic financial products allow them to be used for portfolio diversification purposes. Finally, the principles-based nature of Islamic finance is finding favour with customers looking for alternatives to mainstream products. The global financial crisis has in many ways served to further enhance the appeal of principles such as aversion to leverage and to speculation.

As positive as the momentum has been, and few would dispute the obvious and compelling potential going forward, considerable efforts are required on a broad front to support the evolution of the industry. To establish itself as a truly global industry, Islamic finance needs more builders and building blocks! Bahrain, as one of the cradles of Islamic finance, has a particular role to play in this regard and is in a strong position to be a key enabler of the next stage of development of Shari’a-compliant finance. Bahrain today boasts a complete

Human resource training and education has been a perennial theme of almost every Islamic finance conference. No doubt that a number of institutions have come up and are doing good work in this area, yet the supply falls short of demand by a big margin. We have witnessed excellent progress in Bahrain, Malaysia and the UK; however, we see a need to foster closer cooperation among these centers in Islamic finance training and education (for discussion on the Centers of Excellence in IBF, see Chapter 16).

It would be appropriate to mention here that three years ago the University of Bahrain with the sponsorship of the Waqf Fund started a 4-year bachelor’s degree program combining Shari’a studies with finance, business, banking and statistics to create uniquely qualified graduates in Islamic finance. This is among the first such initiatives anywhere in the world. The first batch will graduate next year, and we expect that the industry will find them highly employable not just for the Shari’a department but any department due to their knowledge of the industry and exposure through seminars and internships.

INDONESIA

Indonesia is now under the leadership of newly elected President Jokowi and a politically experienced vice president Jusuf Kala. As the forth most populous country in the world, the third largest democracy, and the biggest Muslim nation in the world, with favourable demographics and transition to a middle-income country, Indonesia is expected to eventually become the biggest market for IBF. Its importance in IBF is reflected by the fact that it has for the last five years featured in the list of top 10 leading countries in the Islamic Finance Country Index (see Chapter 2 for further details).

However, Indonesia has yet to realize its true potential in IBF, as at present Islamic finance industry makes up just less than 5 percent of its financial sector. The new government sparks hopes for further development of Islamic finance industry. Although not known for his engagement and support for IBF, President Jokowi is a reform-friendly leader open to new ideas. Jusuf Kala, on the other hand, has a background in IBF. As vice president (2004-2009), Kala was the force behind the enactment of Sovereign Sukuk Law Number 19 in year 2008.

President Jokowi has outlined his four economic reform priorities to accelerate growth over the next 5 years. The top priority is the simplification of business licensing. The World Bank’s latest “Doing Business” report found that setting up business in Indonesia appears to have improved only slightly over the past year, as it climbed 3 spots to 114th place. With the reforms implemented, Indonesia will have an integrated system of investment licenses that can be accessed online.

The next on the list is tax reform. The tax-to-GDP ratio will be targeted to 16% from the current level, which is still below 13%. Achieving this would bring Indonesia almost at par with Malaysia, which had around 16% ratio.

The third is reducing the burden of fuel subsidies and transferring the allocation to financial infrastructure and social welfare, namely the construction of roads, seaports and airports, and a social support programme for disadvantaged people.

Finally, the President wants to develop a social infrastructure for advancing human resources to increase productivity and national competitiveness. This refers to the three welfare programmes – social welfare cards for health, education, and conditional cash transfer.

It is understandable to note the exclusion of IBF in the reform agenda, given that Indonesian constitution is after all secular. However, this is the time that the government of Indonesia starts owning and promoting IBF. If the likes of UK can take a lead role in IBF in an attempt to attract more Islamic capital, and Turkey, despite being secular constitutionally, can decide to promote IBF, this is the time that the government in Indonesia starts a policy of being visible in the global Islamic financial services industry.

In some way, the Indonesian approach is like that of Pakistan wherein the government has “outsourced” the promotion of IBF to the State Bank of Pakistan (SBP) – the central bank. In Indonesia, the newly formed Financial Service Authorities or Otoritas Jasa Keuangan (OJK) is now preparing a new blueprint to expand IBF in the country. The new blueprint may include additional benefits to current fee and tax incentives to revive the domestic sukuk market. The document will also suggest addressing issues in IBF, including lack of economies of scale, consolidation opportunities, and the role of foreign ownership. Optimism abounds around new political leadership and government, together with OJK’s new blueprint.

IBF in Indonesia can play a strategic role in economic growth and development if the government devises a comprehensive plan similar to what neighbouring Malaysia has done over the last few decades. In fact, IBF should be central to the government’s agenda to stimulate economic growth, to reduce poverty and income inequalities, and to enhance stability of financial system.

With this in view, GIFR assesses the development of Islamic financial services industry in Indonesia during 2014. The first impression one may get from the performance of the government is that it has made no significant progress to further develop IBF in the country after President Jokowi took over.

Next, we focus on Islamic banking, takaful and capital markets – three important segments of IBF in Indonesia.

Islamic Banking

Indonesian Islamic banking industry consists of 11 full-fledged Islamic commercial banks and 23 Islamic units (or windows) of conventional banks. In addition, there are 163 rural banks whose assets account for less than 2.5 percent of the total Islamic banking industry.

Although the number of players has been the same since 2010, the sector saw significant growth in terms of assets until 2014. Prior to that, Islamic banking industry in Indonesia has been steadily growing at a rate above 20 percent per year, double of the pace of the overall banking industry in the country. The growth reached its peak in 2011, when the industry recorded 49.2 percent growth. After that, it declined to 34.1 percent in 2012, and further down to 24 percent in 2013. The year 2014 indicated stagnation of the growth. It is the first single digit growth with very thin positive number in terms of assets. However, there will be serious plunge in the profitability.

There are certainly serious internal problems with Islamic banks in the country, but there is a need that the new government starts taking IBF seriously as part of its strategic economic thinking. The new government in Pakistan, for example, took a fresh approach to IBF, and as a result share of Islamic banking is fast increasing in the financial sector of the country. Its KAP report is first of its kind of study in the world to understand the nature of demand for Islamic banking and the supply-demand gaps. Indonesia must also undertake such a study to grasp the true nature of issues facing the Islamic banking industry in the country.

2014 has proven to be a difficult year for Islamic banking industry, owing to tougher macroeconomic conditions and increase in non-performing financing (NPF). This has resulted in erosion of profitability. The issues of growth, competitiveness and profitability, facing the industry, should be seen as a challenge to improve the performance of Islamic banks and their relative positioning with respect to conventional banking.

Lack of proper risk management practices and ethical and corporate governance regimes in the wake of pid asset growth could create financing risk in the medium and long term. Therefore, it is very important for Islamic banks in Indonesia to strengthen the fundamentals of growth and to have a steady and sustainable strategy to foster it. Reinforcing risk management and embedding ethics into corporate governance policies can do this. On a more practical level, Lembaga Penjaminan Simpanan (LPS), or Indonesia Deposit Insurance Corporation, has already started the implementation of deposit insurance for Islamic banks. LPS rules and policies are expected to be released in 2015, which is expected to strengthen stability in the industry.

While the share of Islamic banking was around 4.5 percent in 2014, the momentum generated in the previous years would lead it to over 5 percent in 2015. This will be despite a bad 2014. To have Islamic Banking more significant and to increase its share beyond 5 percent, strategic initiatives are required, with the participation of all the stakeholders.

One particular area of focus should be harmonizing practices of Islamic rural banks and Baitul Mall wa Tamwil (BMT) microfinance institutions. With a nationwide network of these institutions, an alliance between the two may result in increasing the base of Islamic banking. Islamic banks must also engage themselves in such an alliance. An increase in financial inclusion achieved with such cooperation will bring greenfield growth in Islamic banking in the country.

The industry also needs to support initiatives for talent development. While there is a lot of local talent already available, it is vital for the industry to bring the quality of human resources to a level on a par with international standards. Indonesian IBF market has by and large been introvert, and this is just about time that it starts opening itself up.

Lastly, the industry needs government support. While OJK has released regulations on branchless banking to foster financial inclusion in the country, wider support from the government will remain vital to achieve objectives of financial inclusion. Also, it is interesting to see OJK setting a target of at least 15 percent market share of Islamic banking in the country by 2023, it is imperative that a detailed roadmap is also drawn to achieve this target.

Takaful

Indonesian takaful industry is still dominated by Islamic units of conventional insurance companies. There are 17 such units of life insurance and 23 units of general insurance. In addition, three full-fledged Islamic life insurance and two full-fledged Islamic general insurance companies in Indonesia. Three Islamic units of conventional reinsurance companies also operate therein.

In 2014, takaful industry enjoyed double-digit growth of around 22 percent. However, this was less than expected growth, primarily due to slowdown in general insurance, in the wake of stagnation in Islamic banking. In terms of market share, life insurance is better than general insurance, with overall share of 5 percent.

Takaful industry is projected to continue to grow at 25 percent in 2015. With still low insurance penetration rates, there is huge growth potential for takaful products in future. This growth can be sustained by developing micro takaful, creating awareness about takaful, and devising a policy on a regulatory level to oblige conventional insurance companies to spin-off their Islamic units by an agreed date.

Capital Market

Like in other countries, Islamic capital market in Indonesia started its development in 2000, naturally a late start compared to Islamic banking and takaful. However, this segment of Islamic finance industry has proven to be more promising. While market share of Islamic banking is still below 5 percent, the government sukuk issuance comprises 10.6 percent of the overall capital market in the country. By the end of 2014, there were 22 outstanding issues of sovereign sukuk.

Beside sukuk (government and corporate), Islamic capital market also comprises Islamic mutual funds and halal stocks. As shown in Table B1, there has been an increase in activity in Islamic capital market (with an exception of the issuance of corporate sukuk that witnessed a dip in 2014). In 2014, there were 7 new issuances with total value amounting IDR923 billion while 8 previous issuance matured with total value amounting

Table 1: Assets of Indonesian Islamic Capital Market 2014 (in IDR Trilion)

| 2013 | 2014 | Market Share | |

| Government Sukuk | 169.29 | 208.40 | 10.6% |

| Corporate sukuk | 7.55 | 7.11 | 3.1% |

| Islamic mutual funds | 9.43 | 11.16 | 4.5% |

| Halal stocks (capitalization) | 2,557 | 2,946 | 56.5% |

IDR1,332 billion. Remaining 35 series of corporate sukuk are available in the market. In 2015, there will be only 3 sukuk matured with total amount IDR395 billion.

As of 2014, there were 31 investment managers that offer 73 funds which consist of 22 equity funds, 18 balance funds, 17 protected funds, 8 fixed income funds, 6 money market funds, 1 Index fund, and 1 ETF (exchange-traded fund). During 2014, 19 new funds were launched while 10 mutual funds were liquidated.

Indonesian Stock Exchange (IDX) has 316 halal stocks out of total 506 in the market. Indonesia Shari’a Stock Index (ISSI) is an index that was launched by IDX in 2012, which constitutes all the halal stocks listed on IDX. ISSI constituents are reviewed every 6 months (May and November and published at the beginning of next month) by regulators, National Shari’a Board, and the IDX. For the transaction of halal stocks in the market, IDX has registered 8 securities houses that provide brokerage services through a Shari’a Online Trading System (SOTS).

Going forward, Indonesian capital market will have more room to grow. Government sukuk are expected to be an engine of growth. Government has signaled to increase sukuk issuance for financing many government projects, in addition to possibly meeting public sector borrowing requirements. Issuance of project-based sukuk is projected to be more than IDR6 trillion in 2015, while in 2014 it started with an amount of IDR1.6 trillion.

KAZAKHSTAN

IBF has started to play a crucial role in fostering financial stability and sustainable economic development in a number of countries. Impressed by this new role of IBF, the government of Kazakhstan has adopted a policy to develop Kazakhstan as a regional IBF hub. It has already started pitching itself regionally and is expected to go global in this drive.

Kazakhstan’s current economic environment demonstrates strong economic recovery from the last global financial crisis. For the first half of 2014, Kazakhstan’s GDP increased in real terms by 3.9%.

The banking system of Kazakhstan is represented by 38 banks, of which 17 banks have foreign participation, including one Islamic bank. Bank assets in the country increased by 15.5% and amounted to almost US$100 billion by the end of 2014. Out of this, Islamic banking assets represent less than 1%. Nevertheless, the government is targeting to increase Islamic banking assets to reach 10 % share of the total banking assets by 2025.

Unlike the above two countries, Islamic banking has a very short history in Kazakhstan. This is not surprising as the country itself in its modern form came into being in 1991. It took the country 18 years after the independence to introduce Islamic banking in 2009. The progress since then has been lukewarm but now it is expected that IBF will take a new turn in the country.

In 2010, President of the Republic of Kazakhstan in his annual address to the people of Kazakhstan “New Decade – New Economic Growth – New Opportunities”, set an aim for Almaty to become as a one of the top ten financial centres in Asia and a hub for Islamic finance in the region.

During the last World Islamic Economic Forum (WIEF) in Dubai, President of Kazakhstan, Nursultan Nazarbayev, received the prestigious “Global Islamic Finance Leadership Award”, which was awarded for his outstanding contribution to the development and promotion of Islamic financial market at the regional and international level.

Today, the National Bank of Kazakhstan and other government bodies are actively working on establishing legal frameworks, developing Islamic finance infrastructure, and raising the level of financial literacy and financial inclusion of the population.

In 2009, Kazakhstan adopted a law on the issues of organization and activities of the Islamic banks and other forms of Islamic finance. The law is mainly aimed at establishing a legal basis for the functioning of Islamic banks, the removal of restrictions preventing the introduction of Islamic banking, the definition of the forms and methods of state regulation and supervision of Islamic banks, the list and order of the Islamic banking operations.

In 2011, the Law of the Republic of Kazakhstan “On amendments and additions to some legislative acts of the Republic of Kazakhstan on the issues of Islamic finance” was adopted. According to the law the state allowed to issue Islamic securities, as well as expanded the list of corporate issuers of Islamic securities.

For the development of Islamic finance, insurance and leasing in Kazakhstan, National Bank of Kazakhstan has developed a draft law “On amendments and additions to some legislative acts of the Republic of Kazakhstan on issues of insurance and Islamic finance.” The draft law provides for the introduction of the concept of “Islamic insurance”, regulation of Takaful market, the recognition of commodity murabaha as

a banking transaction, tax administration, banking operations of an Islamic bank, procedures of wakala (acceptance of deposits) in Islamic banks, definition of the rights and duties of participants of the lease relations, as well as resolution of taxation of leasing activity. At the moment the draft law is under discussion in the Parliament of the Republic of Kazakhstan.

In 2012, the Government of Kazakhstan approved a roadmap to develop Islamic finance until 2020, which is aimed at creating conditions for stable development of the Islamic financial services industry, establishing a critical mass of issuers, investors and market participants.

In 2011, the National Bank of Kazakhstan was admitted to the Islamic Financial Services Board (IFSB) as an associate member. This enabled us to receive effective assistance for developing prudential standards for Islamic financial organizations of Kazakhstan.

Moreover the National Bank of Kazakhstan has taken up membership in Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) in order to improve the legislation in the field of accounting and auditing of Islamic financial institutions. The signing ceremony to commemorate the membership was held on 2 December 2014 at the World Islamic Banking Conference 2014 in Manama, Kingdom of Bahrain.

At the same event with the aim of introduction of the Islamic money market instruments to manage liquidity in the domestic Islamic financial system the National Bank of Kazakhstan joined the International Islamic Financial Market (IIFM).

In addition, to further develop the Islamic financial sector and unlock the full potential of Islamic finance in facilitating economic development of Kazakhstan, the Islamic Development Bank is providing a technical.

Different Markets Different Stories

Assistance grant to the National Bank of Kazakhstan. Under this assistance, leading experts from Norton Rose Fulbright law firm have been invited to further amend Kazakhstan’s legislative framework.

Today, there are several Islamic financial institutions in Kazakhstan, including the first full-fledged Islamic bank, Al Hilal Bank, with branches in the cities of Astana, Almaty and Shymkent. The bank was established in March 2010, in accordance with an agreement between the governments of the Republic of Kazakhstan and United Arab Emirates. There is an Islamic insurance company, which provides insurance services for individuals who are not covered by traditional insurance.

In 2011, Zakat Foundation of the Spiritual Administration of Muslims of Kazakhstan has been established, which is the distribution centre for the collection of zakat and charitable funds.

In addition, in 2014 with the participation of the ICD (Islamic Corporation for the Development of the Private Sector) an ijara leasing company was established in Kazakhstan. As of today, the company has financed 16 projects of value US$4.5 million.

Besides, at present, one of Kazakhstan’s conventional banks (Zaman Bank) with the participation of ICD has started the process of conversion into an Islamic bank.

The national stakeholders in IBF have established an Association of Islamic Finance Development whose activities are designed to facilitate the comprehensive development of the market of Islamic finance in Kazakhstan through active cooperation with Kazakhstan and international organizations.

It is worth mentioning that in 2012, the National Bank of Kazakhstan issued all necessary permits to the Development Bank of Kazakhstan for the issuance and selling of quasi-sovereign sukuk and in August of 2012 the Development Bank of Kazakhstan became the first issuer in the CIS and Central Asian region, which successfully implemented the transaction on issuance of Islamic bonds sukuk al-murabaha amounting to US$76.7 million. 62% of the issue was distributed among foreign investors.

Malaysian company RAM Rating Service assigned the Development Bank of Kazakhstan AA2 rating, allowing Kazakhstani bank to position itself at the same level with the RBS Berhad, RHB Investment Berhad and other banks, known in the stock markets of southwest Asia and the Islamic stock market.

Being the first of the Kazakhstani issuers, the Development Bank of Kazakhstan established a benchmark of sukuk market for other issues and opened up a new market to attract Islamic capital for the corporate sector in Kazakhstan.

Besides that, this issue gave stimulus for the development of Islamic securities market of Kazakhstan by identifying any improvements required by the legislation of Kazakhstan in the field of Islamic finance.

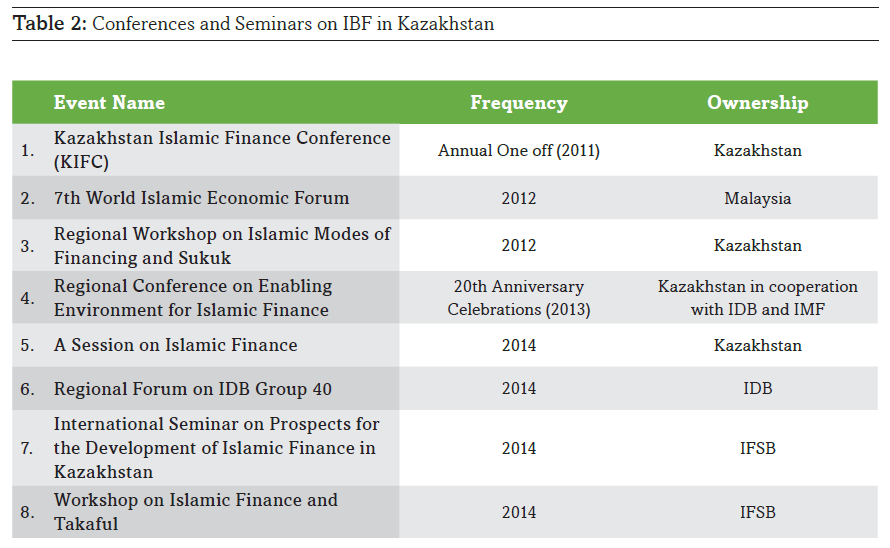

With the aim to improve the image of Kazakhstan as a country developing Islamic finance Kazakhstan hosts various international forums and conferences on Islamic finance. Some of these are listed in Table 2 below.

Though legal framework and institutional infrastructure has been introduced, there is still much room for further development of Islamic finance. As it is stated earlier the only Islamic bank in Kazakhstan, Al-Hilal Bank, makes less than 1% of banks’ assets. In this regard, it is necessary to mention a number of challenges that do not allow using of the full potential of Islamic finance. These include:

- Difficulty of adoption of Islamic finance under the legislative principles of Kazakhstan due to their specifications;

- Low public awareness of Islamic finance; and

- The lack of qualified personnel for inclusion to the Shari’a

However, the government has resolved to promote Almaty city as an Islamic finance hub in the Central Asian region. This is expected to further develop Islamic finance in Kazakhstan, which follows a gradual approach through the implementation of the roadmap of development of Islamic finance in Kazakhstan. Government and public authorities continue to work on the changes in legislation on Islamic finance in terms of improving the tax and accounting of Islamic banking, securities and insurance.

It is absolutely imperative for Kazakhstan to get engaged more internationally if it wants to develop IBF in the country. This will ensure that new investors enter the country aiming to establish new Islamic banks, takaful companies, Islamic investment funds, consulting firms, and other similar firms. With the aim of strengthening of international cooperation for the further development of Islamic finance and banking in Kazakhstan various forums, conferences, trainings and seminars on Islamic finance should continue.

AFRICA

Africa’s development has suffered through decades because of lack of market infrastructure, which, among other things, requires the development of alternative distribution and payment methods. With a population of 1.1 billion and 54 recognized nations, Africa has seen great macroeconomic and financial change in recent decades. This is noticeable and evident in the vastly improved economic growth and rising inflation in many African countries. Widespread poverty and socio-economic inequalities remain a big challenge. Despite this, there are ample opportunities for business development and for realizing the huge economic potential the continent has possessed for very long.

Almost half of the African population is 19 years or younger. Given the lower level of development, the young population could serve as an impetus for growth and development. The lack of financial sophistication and a lower level of economic development also helped Africa to remain insulated from the recent financial crisis. Thus when the whole world was trying to recover from the financial crisis, a number of African governments were introducing reforms for economic acceleration, and devising new growth strategies.

Consequently, Africa had an average growth rate of about 5% in the last 10 years, which is expected to rise in 2015 and beyond.

Nigeria, Africa’s largest economy, grew by 7.4% during the past decade. Angola grew by nearly 6%, Zambia by 6.6%, and Kenya by 4.1%. All these economies are amongst the top ten growing economies in the region.

African economy has benefited from the rising commodity prices, increased trade and higher FDIs. In addition, African governments are taking serious measures to address the issues of political instability, poor infrastructure and governance.

Financial services companies are playing a key role in this transformation. While Africa’s full growth potential has yet to be realized, latecomers will have to move rapidly to take advantage of the new opportunities in financial services. According to Accenture, “Financial services markets in several African countries are already well established or near the tipping point of rapid growth and financial services companies that seize the moment in Africa will establish a lasting competitive advantage in these promising markets.”

Rising income levels are raising demand for financial services and putting these services within reach of them for the first time, i.e., increasing financial inclusion. The incumbent banks and financial institutions have a comparative advantage vis-à-vis new players to win the new business. Once the existing institutions have taken up these customers, the new players will find it difficult to cost to switch is relatively high so companies who enter late will have a big disadvantage. However, even though there is a promising future for the banking industry of the region, to succeed new financial institutions will have to do much more then duplicate traditional business models from developed countries as the nature of work and social standards is a lot different. In addition, the governments of these countries have to also make great reforms to attract investors and institutions from specific regions. This is the case with Islamic banking.

Islam in Africa accounts for almost 35% of the continent. It is the fastest-growing religion and is expected to grow from 240 million Muslims in Africa to 400 million in the next two decades. Five of the top eight economies in Africa are over 70% Muslims. Some of the biggest economies of Africa like Nigeria, South Africa, Egypt, Algeria and recently Kenya are all on firm steps to make Islamic Banking a leading factor of their economies fro several reasons.

Most of these countries have huge populations, if not the majority, and there is a growing awareness of IBF amongst masses that are looking for financial institutions that follow Shari’a law. Carried out in 9 countries in Africa and Middle East, International Finance Corporation suggests that 35 percent of SMEs in North Africa region are not likely to use conventional banking products and services, because of Shari’a sensitivities. At the moment Islamic finance focuses mostly on large corporations and that only 17 percent of Islamic banks offer products to SMEs directly. IFC estimated the greenfield market size at US$13.2 billion, i.e., not including those who will want to switch to Islamic banking once they are available to them. This number could increase significantly with further improved awareness and the right infrastructure to attract these customers. Recent studies coming out of the Islamic Banking Summit suggest that 65 percent of the total population in Africa is unbanked, which offers room for financial expansion and development, if Shari’a-compliant instruments are put into action and regulations and legislation are made efficiently.

Almost 50 percent of total Muslims in the world live in Africa and this should be one of the main targets for IBFIs. However, according to IBS, only 40-50 of the 600+ IBFIs worldwide are operating in Africa. One of the reasons for this lack of interest in Africa by IBFIs is a rather premature drive in IBF to make it all-inclusive, i.e., offering Islamic financial services to Muslims and non-Muslims alike. This thinking has led IBFIs to target the countries where there is potentially large demand from non-Muslims. Consequently, IBF has grown in “One of the reasons for this lack of interest in Africa by IBFIs is a rather premature drive in IBF to make it all-inclusive, i.e., offering Islamic financial services to Muslims and non-Muslims alike. This thinking has led IBFIs to target the countries where there is potentially large demand from non-Muslims. Consequently, IBF has grown in a number of countries with small Muslim populations. This growth has necessarily come at the expense of the development of IBF in the Muslim majority countries, especially the ones in Africa.” a number of countries with small Muslim populations. This growth has necessarily come at the expense of development of IBF in the Muslim majority countries, especially the ones in Africa.

Despite this relative neglect of Africa by IFBIs, the emerging countries of Africa are relying on IBF to attract Islamic capital for their infrastructural needs and to meet their public sector borrowing requirements, especially through issuance of sovereign sukuk.

Consistent with the global focus on Africa, which is expected to become the next growth story after the recent phenomenal growth in Asia, the continent is becoming an increasingly attractive destination for Shari’a-compliant foreign direct investments. It has grown to be the third fastest-growing region in the world after Middle East and Asia. Further increase in trading between Africa the Middle East and Asia is expected to boost IBF in the region. In fact, if played strategically by the players in IBF, it can play a major role in the growth of trade and investments between the OIC block and the wider African region. There is growing awareness of this amongst the political leadership of the Middle East, who has started focusing on business relations and investments between the two regions, rather than just pure politics. Therefore, it is not just a coincidence that a Kuwaiti minister told the Financial Times, “Opportunities in Africa are starting to attract investments from Arab countries, by embracing large scale Islamic finance as it seeks the wealthy investors of the Middle East to help provide capital for their large infrastructure programs.” Consequently, trade between Africa and the GCC countries has grown 170%. This is despite the fact that Islamic finance did not develop a lot in Africa. This is expected to increase further once IBF achieves its prominence in Africa.

It is also interesting to observe increase in interest from gulf investors to Africa in acquisition of agriculture lands, mergers and acquisition of financial institutions, and a rise in Asian investments in manufacturing and project finance. Asians, for example, have financed construction of a new dam in Ethiopia (Grand Ethiopian Renaissance Dam). It is important that IBFIs start looking into such opportunities more seriously.

Specific to IBF, a number of conventional banks, both local and international, have started setting up their Islamic franchises in Africa. Barclays, for example, bought local banks in Africa – Absa Bank in South Africa and Nile Bank in Uganda. Both banks are involved in IBF. In Kenya, Gulf African Bank experienced triple-digit growth in 2012 with 154% in net profit after adding Islamic financial products. Kenya’s first full-fledged Islamic bank, namely the First Community Bank has proven to be profitable right from the beginning. Following these success stories in African Islamic banking sector, other countries like Botswana, Zambia and Senegal are also seriously looking into developing IBF in their respective markets. Banking and financial regulators are keeping a close eyes on developments in IBF, and it will be soon when these countries also start IBF. A number of GCC-based IBFIs have started their African expansion strategies, and it is expected in the coming years that IBF will see a new phase of development in these countries through acquisitions by IBFIs in the Gulf region.

“Sukuk is the panacea for many – if not all – public sector borrowing problems for African countries. There is growing interest in this instrument following successful capital raising by the governments of Senegal, South Africa and Nigeria. Analysts believe that tapping the global sukuk market by the African governments will have a trickle-down effect on the growth of Islamic retail banking in African countries.”

Nigeria with 70% Muslims has become the first big economy in Sub-Saharan Africa to use a vibrant sukuk programme. Other issuers like Senegal and South Africa have also entered the market successfully. While smaller countries in Africa are also getting involved in IBF, it is Nigeria that is expected to play a leadership role in this respect. As an important member of OIC from Africa, Nigeria’s involvement in IBF will boost the industry in the continent. Seeing the potential of Nigeria, Islamic Development bank is lending it US$150 million through Shari’a-compliant facilities for the new Lekki Port. Other international banks are also becoming increasingly interested in Nigeria’s Islamic banking industry.

Jaiz Bank is the first full-fledged Islamic bank in Nigeria. With a new CEO from Bangladesh, it has started a new plan for growth and is expecting to grow its branches to 100 by 2017. A number of other banks have also started moving into IBF.

It is not just banking sector that has shown interest in Islamic banking but other sub-sectors in finance are also making progress. In 2013, Nigeria’s Securities and Exchange Commission brought new guidelines for sukuk.

The country’s insurance regulator has developed guidelines for takaful.

As expected in any new market, growth in IBF in Nigeria is not as expected despite all these developments. The biggest challenge remains creating awareness about IBF, as about 60% of the bank users in the country are not familiar with Islamic finance. Nigeria needs to undertake a comprehensive study to quantify demand for IBF in the country.

In Kenya Islamic banking was introduced inn 2008, when two Islamic banks, namely Gulf African Bank and First Community Bank, started operations. They have since then evolved quickly and now provide Shari’a-compliant insurance, investment and pension products. The World Bank invested through IFC, its investment arm, in these banks in Kenya showing the confidence it has in this sector. After the success and an encouraging trend of customers joining these Islamic banks, other commercial banks stated opening Islamic windows to compete for these customers. For example, Kenya Commercial Bank entered the market with its Islamic window operations in 2014. In the same year, Standard Chartered Bank also started offering Islamic finance services, under its global brand Saadiq. Other banks see huge potential in this growing sector, as IBF penetration is low at this early stage of development of the industry.

Although Muslim population in Africa is the main target market for IBF, non-Muslims are also showing signs of interest. One product that has in particular caught attention of non-Muslims is takaful. For the sustainable success of IBF in Kenya, it is imperative that the products that have equal appeal for Muslims and non- Muslims should be developed and offered.

As IBF is still new in Kenya, there are not very many Islamic financial products available in the market.

Given that Kenya is not a Muslim-majority country, the regulatory developments are understandably slow and cautious.

“Interestingly enough, however, the central bank is very positive about setting up a national Shari’a advisory board – something that many other countries in the OIC block have not done so far.”

The central bank is also proactive in developing the required talent for IBF, and in this respect it has launched an international certification programme to support the fast-growing sector of IBF.

Kenya is pursuing an economic development plan that aims for the country to become a highly competitive industrial country by 2030. Development of a vibrant sukuk market fits well in this plan, as the country will certainly need foreign capital for the planned industrial growth and development of the requisite infrastructure.

In South Africa, Islamic banking has a long history since the establishment of Albaraka Bank in 1989. A number of banks are already involved in IBF, including Rand Merchant Bank and Absa. Although the government issued its long-awaited US$500 million sukuk in 2014, which was greatly over-subscribed. This should encourage the government to increase the pace of regulation for IBF. Some changes in taxation regime were introduced in 2013 to provide a level-playing field to IBFIs.

In Zambia, Uganda and Botswana, interest in IBF is at an initial stage but the African success stories in IBF are catching attention of these and many more countries in the continent.

Egypt could prove to be a rising star in IBF. Having been the birthplace of modern IBF, it has been slow in adopting IBF wholeheartedly. The deposed government of President Morsi brought a lot of optimism to the development of IBF in Egypt. The new regime, although not as enthusiastic about IBF as the previous one, remains engaged and committed to IBF.

IBF in Egypt is still a long way ahead but the market and potential exists. It depends on the speed and efficiency of offering of Islamic financial services and products and regulatory treatment of these to further promote IBF.

Egypt is around 90% Muslim, and faces incidence of financial exclusion. A significant proportion of the financially excluded are out of the market voluntarily, due to religious sensitivities. Furthermore, the penetration of IBF in Egypt is still very low with an underserviced retail market. It is recommended like in case of Nigeria that the central bank must undertake a comprehensive research project to understand and quantify demand for IBF in the country, before adopting a strategy for its adoption and implementation.

In a nutshell, Africa has great potential in IBF. It has countries like Sudan where IBF has a long tradition and is deeply rooted in tradition. The North African belt is now getting up to IBF after a long period of indifference. West African countries have also started shown interest in developing Islamic banking systems. Even some of non- Muslim African countries are engaged in IBF.

Given the historical linkages between Africa and the Middle East, and close proximity between the two regions, it is logistically feasible to promote inter-regional cooperation on IBF. Malaysia has already engaged itself with a number of banking regulators in Africa, and is in the process of offering advisory services to develop the requisite regulatory framework for IBF. Such arrangements are almost non-existent between banking regulators in the GCC and their counterparts in Africa. There is, therefore, a strong need to create linkages between Africa and the Middle East to transfer Islamic financial intelligence to promote IBF therein.

Development of IBF in Africa is expected to benefit the Middle East in many ways but the most important advantage will be in the form of investment opportunities for Middle Eastern IBFIs in the continent.

BOX 3: ISLAMIC BANKING IN SOUTH AFRICA – FLYING UNDER THE RADAR…

On a continent that nearly half a billion Muslim people call home, Africa is certainly more than just another set of emerging economies. A number of the world’s fastest-growing economies are now to be found in sub-Saharan Africa. Commentators and critics alike agree that Africa has fast become one of the world’s most economically active and progressive regions.

Boasting one of the continent’s largest economies, South Africa, based at its southernmost tip, by contrast to most of its sub-Saharan neighbors, only two percent of its total population is Muslim. However, while a number of African countries have signaled their intentions to become the gateway to Islamic finance into Africa, South Africa has diligently gone about its business in developing a robust and vibrant Islamic finance market.

We have since witnessed the amendment of key enabling legislation, which allows for a balanced and flexible approach when working with Shari’a- compliant financial structures. Notably, the initial National Taxation Act amendments relating

to Islamic finance structures became effective on January 1, 2013. These amendments have contributed immensely towards the levelling of the playing field when comparing Islamic underlying structures to their conventional counterparts. The tax provisions that were introduced, concentrated on the more commonly utilized Islamic finance structures, like mudaraba, murabaha, diminishing musharaka and sukuk. Just last year, the National Treasury expanded on the definition of Sukuk within the National Taxation Act, which now entitles certain prominent State Owned Entities the privilege of issuing Sukuk alongside the National Government.

This all proved to be an exciting precursor to a landmark event in the time-line of South African Islamic finance, when the National Treasury announced during September 2014, the issuance of a US$500 million sovereign Sukuk with a 5.75-year tenor at a yield of 3.90%. The debut South African Sukuk issuance was four times over-subscribed at the international capital markets, with its pricing at a coupon rate of 3.90% the South African National Treasury proclaimed that it “represents a spread of 180 basis points above the corresponding benchmark rate”. In addition, the debut Sukuk ensured that South Africa earned its lowest dollar-borrowing costs, and according to available information, appears to be the lowest coupon out of 14 dollar bond issues since 1994. The issuance certainly attracted a diverse investor distribution base, consisting of 59% of the take-up from the Middle East and Asia, 25% from Europe, and 8% from the US and the remainder from the rest of the world. This distribution “represents a resounding success in building a more diversified investor base for South Africa”, this from the National Treasury. More importantly, the minority Muslim community of South Africa experienced a proud moment in being recognised as actively contributing towards the infrastructure development of this amazing country.

2015 with all its hope and promise bodes well for the transformation of the Islamic finance landscape of not just South Africa, but that of Africa as well.

South Africa enjoys a highly developed banking, risk and compliance infrastructure, this coupled with a sophisticated banking system positions it as the ideal launch pad that serious players could easily use to catapult themselves into the exciting and lucrative Islamic finance markets of Africa.

Amman Muhammad, Chief Executive Officer,

FNB Islamic Banking