INTRODUCTION

There is no doubt that growth in Islamic banking and finance (IBF) is closely linked with the oil prices. Given the historically low oil prices in the international markets, it is not unrealistic to assume that IBF will witness a slowdown in the key IBF markets, i.e., the Gulf Cooperation Council (GCC region). Outside these key markets, a substantial part of growth must come from greenfield expansion of IBF to maintain its momentum. However, a considerable part of the OIC block, especially the Middle East is in political turmoil. Libya, Tunisia, and to some extent Egypt, which were seen as emerging IBF markets in the backdrop of the so-called Arab Spring, have not fulfilled expectations of the industry observers who predicted huge greenfield and brownfield expansion of IBF therein.

The emergence of Islamic State of Iraq and Syria (ISIS) has given birth to a crisis that has engulfed not only the Middle East but its adverse effects on anything to do with Islam in Europe.

In wake of the heightened Islamophobia, Western banks and financial institutions in the West will certainly hesitate to get involved in IBF. For example, Barclays Bank has already cut down its Islamic operations after having been an active player in the Islamic capital markets. Barclays Capital used to have a team of experts in IBF to benefit from opportunities in sukuk arranging and other such big-ticket transactions. The team has now been dismantled and the bank has no systematic approach to IBF. It still maintains a small Islamic business under the banner of ABSA Islamic Banking in South Africa, but many industry analysts fear that even this business will be further marginalised if ABSA is rebranded as Barclays. If this happens, it will be consistent with Barclays’ position back home in the UK, where it has not shown any significant interest in maintaining its engagement with IBF.

Despite various claims by non-Muslim governments of being global or regional centers of excellence for IBF, the OIC countries remain leaders in terms of incidence of Islamic financial assets. In a list of top 20 countries in terms of Islamic financial assets, the UK is the only non-Muslim country that features significantly. The USA and European countries other than the UK have yet to receive the attention and confidence of Islamic investors.

“There is some anecdotal evidence that Shari’a sensitive investors prefer dealing with the fund managers who manage only Shari’a compliant funds and portfolios.”

Furthermore, despite attempts by European financial centres to attract business from Islamic asset managers, Saudi Arabia tops the list of domicile of Islamic funds in terms of assets under management (AUM). Malaysia has for some time invested a considerable amount of resources into Labuan to develop it as a jurisdiction of preferred choice for Islamic capital markets transactions and wealth management. Furthermore, Western (e.g., BNP Paribas) and other financial institutions (e.g., Nomura) based in Kuala Lumpur are performing far better in their Islamic businesses than their counterparts based in Europe.

IBF in 2015

A hallmark of Islamic banking and finance (IBF) in 2015 has been the resilience of Islamic retail banks in the Gulf Cooperation Council (GCC) countries in wake of historically low oil prices.

The year has proven to be a testing period for the global Islamic financial services industry, with the gradual exit of the likes of Islamic Bank of Asia in Singapore and the visible diminishing enthusiasm in IBF of global banks.

Furthermore, Islamic asset management industry has also been slow in attracting new players from the Western world. While the likes of Amana Growth Fund managed by Saturna Capital and Shari’a compliant socially responsible funds by Azzad Asset Management have continued to excel, new players like Arabesque Asset Management have yet to make a mark.

SEDCO Capital is another success story. It has shown great commitment to offer Shari’a-compliant funds with social responsibility in the heart of its investment philosophy.

Other socially responsible Shari’a-compliant funds have not been as successful as the above-mentioned. F&C Responsible Shari’a Global Equity Fund, for example, had shrunk its AUM from over US$50 million in 2014 to US$4.5 million at the end of October 2015. There is some anecdotal evidence that Shari’a-sensitive investors prefer dealing with fund managers who manage only Shari’a-compliant funds and portfolios. Conventional fund managers managing Shari’a-compliant funds are fast going out of favour of Islamic investors. The likes of Templeton, Nomura and BNP Paribas, which have taken a distinctive approach of making their presence in the important Islamic financial markets have benefitted significantly. A number of conventional asset managers have set up their Islamic businesses in countries like Malaysia, and have consequently benefitted immensely. For example, Franklin Templeton Islamic Asset Management (Malaysia) and BNP Paribas Investment Partners Najmah (Malaysia) have increased their Islamic assets under management (Islamic AUM) significantly merely by being present on the grounds in an important Islamic financial market. On the contrary, the likes of Allianz Global Investors and F&C failed to attract any meaningful investments primarily because of flaws in their distribution strategies and their half-hearted approach to developing Islamic business, respectively.

This is consistent with what has for long happened in Islamic retail banking, which is dominated by full-fledged Islamic banks. Conventional banks offering Islamic financial services through dedicated Islamic branches or Islamic windows only feature marginally in Islamic retail banking.

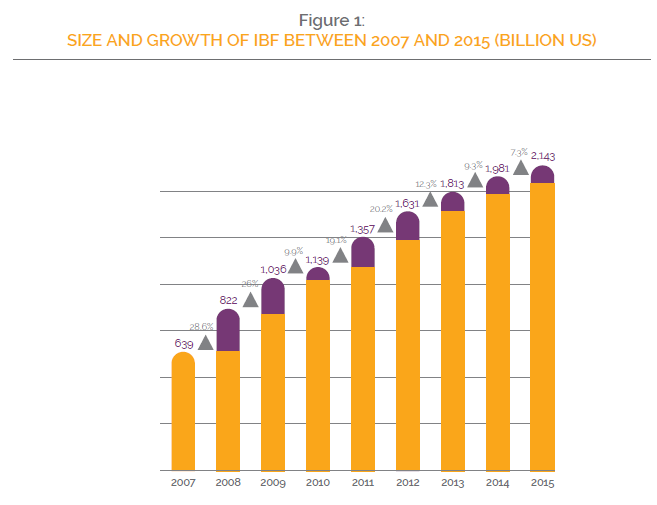

There are certain exceptions to this general observation. The likes of ADCB in the UAE and Bank Alfalah in Pakistan operate vibrant Islamic windows and close sources suggest that these banks are preparing for full-fledged subsidiary Islamic banks. Muslim Commercial Bank (MCB) in Pakistan has already received a license for a full-fledged subsidiary Islamic bank and is in fact preparing for its full launch in 2016. While the industry continued to grow, it is the second consecutive year of single-digit growth – 7.3% annual growth in 2015 as opposed to 9.3% in the previous year. In fact, IBF has

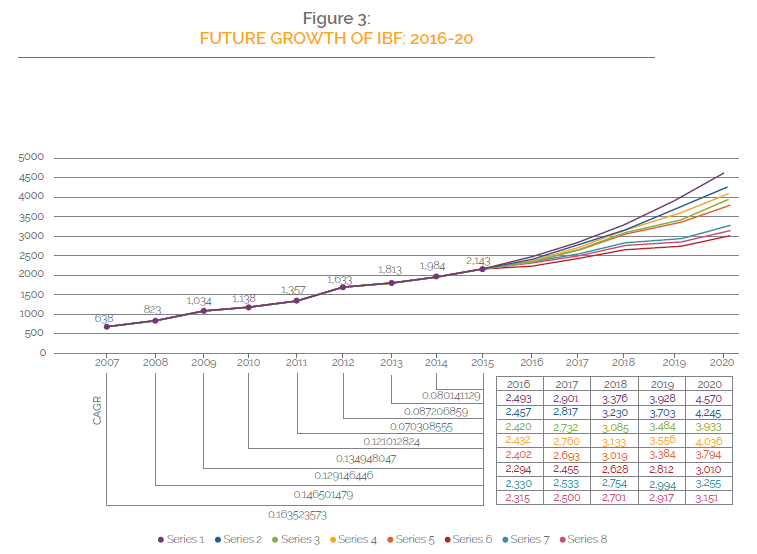

grown with a declining rate since 2013 when it grew by only 12.3%, compared with 2012’s growth of 20.2%. In this context, predictions by some industry observers and consultancy firms of the estimated size of the industry to reach US$3.5 trillion by 2016 seem to be exaggerated. GIFR 2015 predicted that Islamic financial assets would reach US$5.3 trillion by the end of 2020. However, in expectation of further slowdown in the growth of Islamic financial assets in wake of low oil prices and continued social disorder and political conflict in some of the key IBF markets, it was decided to revise the future size estimates.

Figure 3 presents different scenarios for the future growth of the Islamic financial services industry. It is evident that the earlier growth pattern is giving way to a slower and steadier pace. It is imperative to study this phenomenon to get implications for further growth in the global industry.

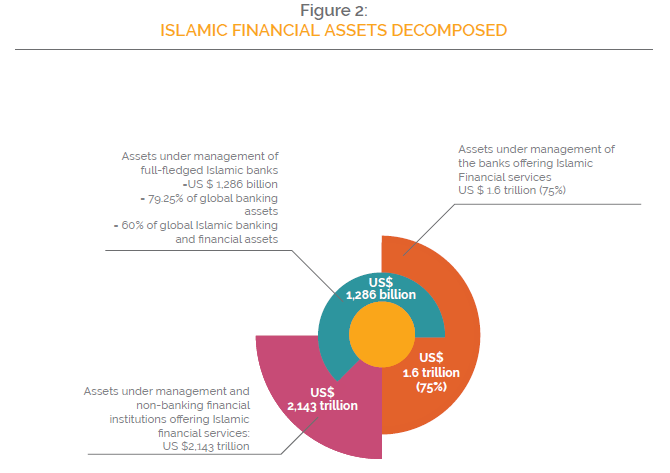

Size of the Global Islamic Financial Services Industry Edbiz Consulting estimates that the global Islamic financial services stood at US$2.14 trillion at the end of 2015, as shown in Table 1.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

| Potential size of the global Islamic financial services industry (US$ trillion) | 4.0 | 4.4 | 4.84 | 5.324 | 5.865 | 6.451 | 7.096 |

| Actual size of the global Islamic financial services industry (US$ trillion) | 1.036 | 1.139 | 1.357 | 1.631 | 1.813 | 1.981 | 2.143 |

| Size gap (US$ trillion) | 2.964 | 3.261 | 3.483 | 3.693 | 4.043 | 4.47 | 4.953 |

| Growth in actual size of the global Islamic financial services industry (%) | 26 | 9.9 | 19.1 | 20.2 | 12.3 | 9.3 | 8.2 |

| Average growth rate between 2009-2015 (%) | 15.0 | ||||||

| Catch-up period – based on 10% growth in potential size and 15% growth in actual size (years) | 27 |

POTENTIAL2 AND ACTUAL SIZE OF THE GLOBAL ISLAMIC FINANCIAL

SERVICES INDUSTRY

Iran, Malaysia and Saudi Arabia remain central to the growth story of IBF on a global level. With Islamic financial assets of US$544 billion, US$399 billion and US$368 billion, respectively, they are three leading players in the global Islamic financial services industry. With the lifting of economic sanctions on Iran, it is expected to play a more significant role in the global Islamic financial services industry. In the meantime, however, Malaysia and Saudi Arabia will continue to strengthen their positions in the global leadership of the Islamic financial services industry.

Banks continue to dominate in terms of assets under management (AUM) of IBFIs, with 75% of the global Islamic financial assets held by Islamic banks and conventional banks in their Islamic window operations. The second largest sector in terms of AUM is sukuk, which comprises 15% of the global Islamic financial services industry. Islamic investment funds have yet to see any significant growth and so is the case for takaful and the emerging business of Islamic microfinance.