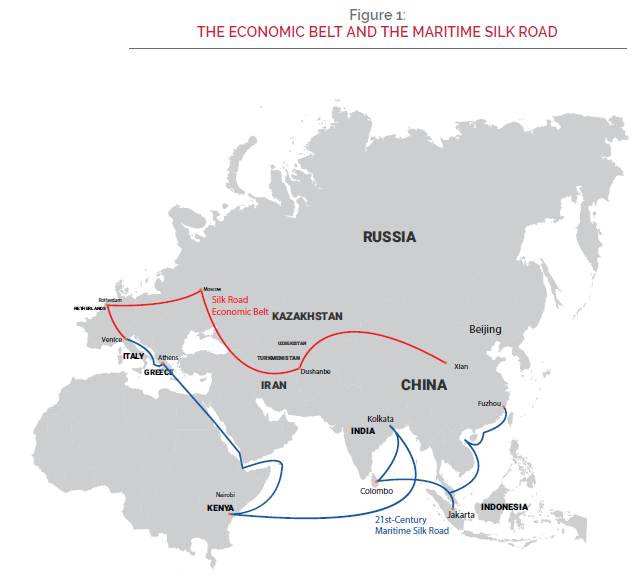

The China-Pakistan Economic Corridor (CPEC) is a part of China’s larger ‘One Belt One Road’ (abbreviated OBOR, and B&R for ‘Belt and Road’) project, which stands for the Silk Road Economic Belt and the 21st century Maritime Silk Road. This is an economic diplomatic initiative that can transform international trade, particularly in the Asian region. This has called for massive investment and development in trade routes in the region. It is a very ambitious long-term development framework proposed by the Chinese paramount leader Xi Jinping that plans to connect the People’s Republic of China through the Middle East, south and central Asian countries to Eurasia.

China, the third-largest economy in the world, and the second-largest country by landmass, has witnessed a decline in its recent annual GDP growth rate – from 14.2% in 2007 to 6.9% in 2015. A developed trade corridor connecting China to the Middle East, Eurasia and Africa in the next 15 years can help put China on the forefront of international trade. The ‘Belt’ describes the physical road part of the initiative, stretching from eastern China all the way through South and Central Asia, to the Middle East, to China. This includes the Maritime Silk Road, which includes shipping routes that once made China one of the world’s biggest economic and political superpowers many years ago.

The simple difference is that the Silk Road Economic Belt part of the initiative is largely land-based, whereas the Maritime Silk Road focuses on shipping routes. As China is rebuilding its Silk Road trade links with Asia and Europe, strong ties are expected to cover the world’s main centers of Islamic finance – the Middle East and Southeast Asia, where Shari’a-compliant assets account for as much as a quarter of total banking assets. Since the CPEC is expected to pass through 27 Muslim countries, its potential impacts on the Islamic finance industry cannot be ignored. On top of that, there is huge growth potential of Islamic finance in China given the country’s 1.3 billion population. Even if we take a more cautious and pessimistic view of the demand for Islamic financial services; 2% Chinese Muslim population makes a 26 million untapped market.

Opportunities for Islamic Finance

Though CPEC cooperation between Pakistan and China started decades earlier, with the completion of the Karakoram Highway (connecting China to northern Pakistan) in 1974, the CPEC concept was first discussed formally during a visit to Pakistan by the Chinese Premier in May 2013. With a Memorandum of Understanding signed in July 2013, during Pakistani Prime Minister Nawaz Sharif’s visit to China, a CPEC long-term plan and action plan was proposed and various routes were discussed (for CPEC within Pakistan), and finalized in November 2015. The proposed economic corridor includes a variety of roads, highways and developmental and infrastructure projects that will connect the north-western Chinese provide of Xinjiang with the Pakistani southern Port of Gwadar.

As the map in Figure 1 demonstrates, in doing so, the road and railways network alone will pass through the entire length of Pakistan: from Kashgar (in Xinxiang province of China) to Azad Kashmir, northern Pakistan, through the provinces of Khyber Pakhtunkhwa (KPK) and Punjab, and into Sindh and Baluchistan. It will connect China with most of the major cities of Pakistan, including the capital Islamabad, industrial hub and port city Karachi, Lahore, Peshawar (in KPK), Faisalabad, Quetta and Gwadar (in Baluchistan province).

Hence, the CPEC road network is sometimes called the ‘Kashgar-Gwadar corridor’. From

Gwadar, it will also pass into Pakistan’s western neighbour Iran. These network of roads measure about 3,000 km (1,800 miles) and can provide Pakistan with much-needed economic development, infrastructure, power generation and employment. This would also mean that China will have access to the Arabian Sea, where almost a third of the world’s oil shipments pass through. Historically, Chinese trading goods bound for Europe and Africa pass through the Straits of Malacca – but trade via the CPEC route (including Gwadar) will reduce the distance (and hence transportation costs) by almost 2,000 miles.

An interesting aspect about the Belt and Road initiative is that it encompasses around 60 countries in Asia and Europe, with at least 27 Islamic states. These include countries with large Muslim populations like Iran, Sudan, Saudi Arabia, UAE, Pakistan, Bangladesh, Oman, Turkey etc., where a significant size of Islamic finance industry is not only present, but also growing. Hence, these countries have the infrastructure and legal framework existing for the usage of Islamic financing products/structures for long-term project financing, including sukuk structures, ijara, istisna, musharaka etc. With large Muslim populations, and in some cases where 100% Islamic banking sector is present in countries like Iran and Sudan, there is significant opportunities and challenges for providing Shari’a-compliant financing structures for these long-term development projects. The Islamic financial institutions (IFIs) in these countries, including Pakistan, are legally not allowed to invest in interest-based (or otherwise non-Shari’a compliant) CPEC projects, even though they may have excess liquidity available on their hands.

As part of the larger US$900 billion ‘Belt and Road’ initiative by the Chinese government, CPEC is considered mutually beneficial for both Pakistan and China. It helps develop the predominating Muslim region in the northwest flank of China (which includes Pakistan, Afghanistan etc.) and in connecting it with a developed Port Gwadar, which is a closer outlet to Beijing than any Chinese coastal port. Because of its key geographical location, the Gwadar port equipped with a modern airport, road and rail network, power and other international standard infrastructure facilities also helps Chinese in its trading with the GCC countries, including UAE, Saudi Arabia, Iran and Iraq and other countries in the Middle East.

Initially, the Chinese made a long-term commitment of a staggering US$46 billion in development deals with Pakistan, which was roughly equivalent to 17% of Pakistan’s 2015 GDP of US$271 billion. Furthermore, an additional US$8 million to US$9 billion was requested in 2016. The economic corridor is not limited to developing a road network and Gwadar Port, but includes adding the generation of about 17,000 MW of electricity, at an estimated cost of US$34 billion. The remaining funds will be spent on transport infrastructure (including railway lines), communications and development. For Pakistan, the transport development also includes upgrading of the railway network between its mega port city of Karachi and northwest city of Peshawar. These projects can significantly raise Pakistan’s GDP growth rate above its current 4.7%.

As for China, Islamic finance has the potential to contribute to China’s economic plans in several dimensions. Firstly, Islamic finance emphasizes on asset-backed financing and risk-sharing feature, which means that it could provide support for small and medium–sized enterprises, as well as infrastructure projects. Islamic finance also poses less systemic risk than conventional finance due to its principles of risk-sharing. Since Islamic finance industry is not only meant to serve Muslims, measures to attract non-Muslims is required in order to gain a larger foothold in the country. Given the country’s 1.3 billion population and with recent approval of 300 infrastructure projects; the growth potential of Islamic finance in China is huge as the projects are valued at US$1.1 trillion. As China turns to Islamic finance to expand its economic clout, the “One Belt, One Road” could be the much-needed boost for Islamic finance.

Undoubtedly, the CPEC initiatives represent lucrative Islamic finance public-private partnership opportunities in energy and construction and offers an opportunity for the Islamic finance industry to channel liquidity into long-term projects, which also have spillover benefits for other industries, including real estate, manufacturing and building materials. Hence, CPEC is expected to give a big boost to Islamic finance especially in Pakistan where Islamic finance faces a major issue of liquidity development and for which CPEC presents a golden opportunity, especially for sukuk.

Challenges

A question posed is regarding the geopolitical dimension of CPEC. Is CPEC mainly beneficial only for China, with strings attached for Pakistan? One of the most significant apprehensions surrounding CPEC projects is about the efficiency, rate of success and delivery rates that these governmental projects can bring about. It is very attractive to receive billions of dollars to set up a ten-year developmental project, for example a hydropower plant creation, and one could even structure it with an istisna or an ijara sukuk. However, the riskiness of the project needs to be researched. Will the project achieve its completion as predicted, and be able to generate enough revenues to pay back its stipulated returns? Or would it become a financial burden on the government in years to come?

Additionally, since government-funded development investments can be driven by political decisions, they can fall victim to inefficient management, waste or corruption. For instance, the ineffectiveness of Chinese government investment projects reportedly cost it US$10.8 trillion since 1997. This included projects either not completed on time or not completed at all. In Pakistan, several government-managed large-scale

hydropower or road construction projects, for example, face some mismanagement of funds and/or significant delays (up to several years) in completion. For long-term development projects, the issues are even more severe if there is a political shift in power in the country during that time. CPEC, after all, is expected to be at least a 15-yearinitiative. It is worthwhile to note here that, from 2018 onwards, a significant foreign currency outflow (around US$3.5 billion) should be expected from Pakistan, to repay the CPEC investors. Hence, Pakistan’s exports would need to increase significantly (by almost up to 15%) to avoid pressures on Pakistan’s balance of payments. It is also imperative that the advisory part of investment banking in Pakistan (conventional and Islamic) and SME financing should step up to meet this challenge.