It is reported that some US$60 billion has been invested into fintech and the amount is estimated to exceed US$150 billion over the next three to five years. Originated from more matured markets such as the United States and the United Kingdom, fintech is making its impact in almost all parts of the world. The biggest investment is in North America but rising rapidly in the Asia Pacific positioning it to second biggest region. While traditionally Africa experienced low financial services penetration, fintech has been successful in increasing financial inclusion, particularly in key African markets such as Kenya, Nigeria and South Africa.

Using a combination of technology, consumer-centric services and flexible business practices; fintech offers genuine alternatives to traditional banking and payment systems offered by financial services institutions. Unburdened by regulators, legacy IT systems, branch networks and the need to protect existing businesses; these new companies are able to reduce the cost of doing business, extend their customer base and take market share from their more established rivals. Much of the demands for the new and more flexible financial products are also driven by the digital natives or the millennial. These lead to fintech innovations which have redefined the way we store, save, finance, invest, move, spend and protect money. Operating in a digital age, Islamic finance cannot escape the fintech revolution. Islamic finance providers need to embrace fintech in order to survive. Customer experience is the name of the game. Customers in the digital age demand digital financial services and fintech has been filling up the gaps. Although fintech has already penetrated the Islamic finance space, it is still in its infancy and has relatively small number of participants

What is Fintech?

At its most basic form, fintech is simply the contraction of two words – finance and technology. It refers to the application of technology within the financial industry and covers a wide range of financial activities such as lending, investment, payment, risk management, data analytics and wealth management. Broadly, fintech refers to the innovative use of technology in the design and delivery of financial products and services. From mere tools for delivery. of financial products and services, fintech has transformed into an economic industry composed of companies that use software and state-of-the-art technologies to make financial systems more efficient. The start-up companies that run fintech businesses are also often simply referred to as “fintechs”.

The Fintech Evolution

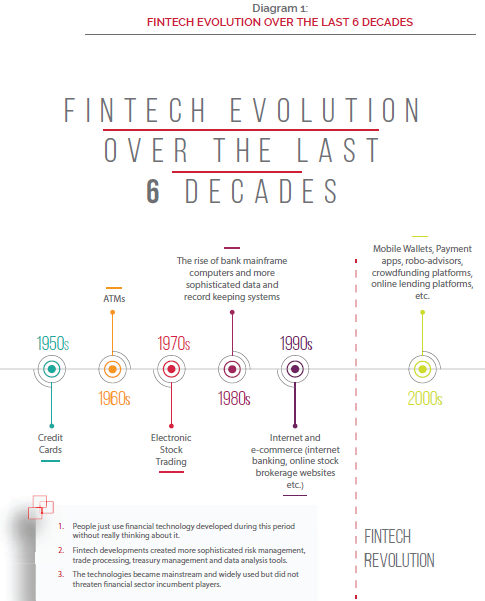

Fintech has a long history of being an integral part of the financial services industry. Fintech innovations have significantly contributed towards making financial services more automated and efficient. Fintech continued to evolve starting from the introduction of credit cards in the 1950s, auto teller machine (ATM) in the 1960s, electronic stock trading in the 1970s, mainframe computers and more sophisticated record-keeping systems in the 1980s; and internet banking and online stock brokerage in the 1990s. Over these five decades, consumers were embracing technologies without thinking much about them. Instead of feeling threatened, financial sectors incumbent players welcomed these innovations that had excellent track records in assisting financial institutions deliver their products and services to the ever-demanding customers. Time to market for new products and services had become shorter and more transactions could be processed in much lesser time.

With more widespread internet penetration and mobile devices especially smartphones, the innovations became more intense from 2000s onward. Mobile wallets, payment apps, robo advisors, crowdfunding and peer-to-peer (P2P) lending platforms were introduced during this era. This marked the beginning of the fintech revolution. Today, fintech innovations are no longer mere tools for financial institutions to deliver their product and services, but fintech companies are starting to offer alternative financial services. Diagram 1 summarizes fintech evolution over the last six decades. The fintech revolution became more prominent post the 20072008 financial crisis. While fintech business models have been seen as disruptions to traditional financial services providers, they have reshaped finance for the better.

Fintech Companies and Their Specializations

Fintech companies can be divided into competitive and collaborative. Competitive fintechs are direct challengers to the incumbent financial services institutions whereas collaborative fintechs offer solutions to enhance the position of incumbent players. There are also fintech companies that fall in both categories while others focus on niche areas. These newer fintech segments are Insurtech, Risktech and Regtech. Insurtech refers to tech companies in the insurance space, Risktech are tech companies focusing on risk management solutions and Regtech are companies focusing on the regulatory aspect of financial services. Generally, fintech targets all aspects of financial services across consumer, commercial and corporate segments as well as solutions that support business-to-business (B2B), business-to-consumer (B2C) or consumer-to-consumer (C2C) interactions. Some of the fintech specializations provide services directly to customers while others facilitate traditional financial service providers. In this respect, robo advisors are that fintech innovations that provides investment advisory.

Shari’a-Compliant Fintech

Technology is neutral from Shari’a perspective as it is only an enabler. However, certain fintech innovations for Islamic financial services are required to adhere to Shari’a guidelines. Generally, fintech solutions that require adjustments for Shari’a compliance purposes are those dealing with financing and investment including investment advisory services. Services-based fintech specializations such as mobile payments, money transfers and trading platforms are universally applicable for both conventional and Islamic finance. However, crowdfunding and P2P financing platforms have to have a clear demarcation between conventional and Islamic finance. These platform operators have to ensure financing and investment processes comply with the prevailing Shari’a standards for financing and investment activities. For investment advisory services, the recommendations must not lead customers to be involved in financial instruments which are not Shari’a-compliant. Therefore, fintech specialization in investment advisory such as Robo-advisor needs to ensure only Shari’a-compliant investment portfolios are recommended to the customers.

Fintech Disruptions and Opportunities for Islamic Finance

Fintech disrupts as well as creates opportunities for Islamic finance. On the consumer side, fintech innovation provides choices which are more aligned to individual needs. With more options, consumers enjoy more competitive financial services cost. Latest technology embraced by fintech leveraging on internet, mobile devices and social media integrations make financial transactions more automated, user friendly and more convenient, thus resulting in superior customer experience. Crowdfunding and P2P financing options provided by fintechs create hopes for individuals or SMEs that require financing but do not qualify to obtain financing from traditional Islamic financial institutions. Investors are entitled to higher potential returns by investing directly into the business ventures that they finance via online financing marketplace. Furthermore, fintech has the capability to provide access to financial solutions for the roughly two billion adults that according to the World Bank are currently unbanked.

On the supplier side, traditional Islamic finance institutions (IFIs) face more intensified competitions with fintech sharing their pies. In order to remain competitive, they have to reduce financing profit margins and service fees. With consumer now having options to invest through online P2P and crowdfunding marketplace, IFIs may end up with reduced deposit and investment portfolio. Spoilt by the fintech innovations of convenient online services anytime, anywhere, integrated and automated; IFIs are faced with demands for digital channels to perform transactions. Nevertheless, the impact is not all negative for the traditional IFIs. There are still sizeable customer segments who are only comfortable dealing with brick and mortar banks.

However, over time, traditional IFIs may face significant reduction in their customer base when digital natives form the majority of the population unless the traditional IFIs embark into the digital banking journey. Traditional IFIs need to consider collaborating with fintech players and leverage on technology partners. At the same time, IFIs can focus on specializations in the business segments that cannot be easily replicated by non-traditional players. On the overall Islamic finance scene, fintech in the Islamic finance space positively contributes to the evolution and innovation of Islamic financial products and services. Elimination of credit intermediaries have resultant in lower prices and/or higher potential returns. In addition, crowdfunding and P2P financing provides the platform for musharaka and mudaraba-based equity financing, which have not been very successful in the traditional IFIs environment.

Fintech for Islamic Finance Latest Development

Prior to 2016, fintech in Islamic finance was mainly in the form of a crowdfunding platform. A few remarkable achievements were recorded in 2016 such as the introduction of an Islamic robo-advisor and Islamic Account Platform (IAP). There are also other fintech initiatives in Islamic finance that were either launched or announced in 2016 such as the Islamic Fintech Alliance (IFT Alliance), Islamic Fintech Hub and Islamic Peer-to-Peer (P2P) financing. The rest of this section shall address each of these initiatives.

Islamic Crowdfunding

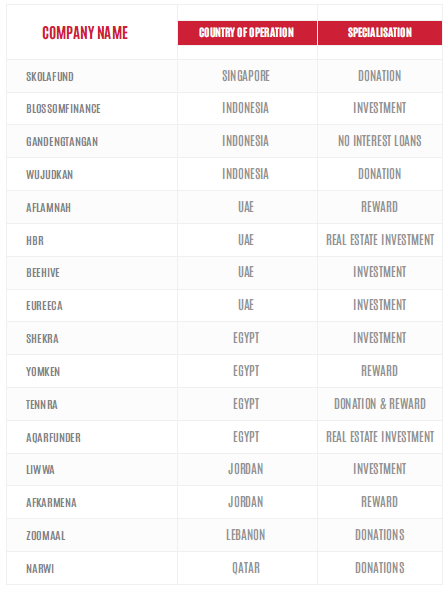

The following table lists fintech companies that operate Islamic crowdfunding platforms, their countries of operations and their specializations. Some of these Islamic crowdfunding operators have become more prominent than the others and have gone to win prestigious awards. EthisCrowd was awarded the Best Islamic Crowdfunding Platform at the 6th Global Islamic Finance Awards (GIFA) 2016 ceremony in September 2016. Narwi won the Ethical Finance Innovation Award in 2015 from Thomson Reuters and Abu Dhabi Islamic Bank and in 2016, was named the Best Islamic Fintech for Microfinance Award from Al Huda Center of Islamic Banking and Economics.

Investment Account Platform (IAP)

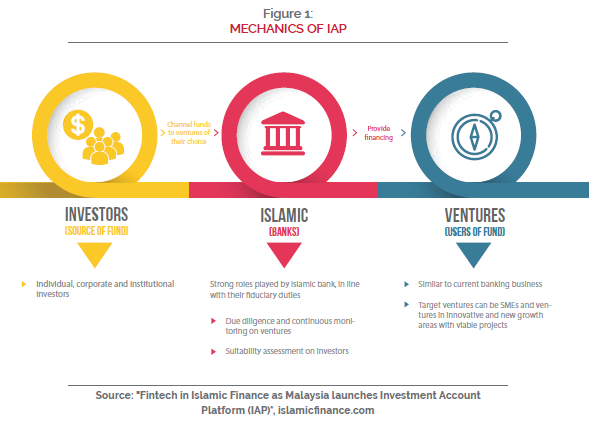

The IAP, Malaysia’s first multi-bank platform for financial intermediation in the Islamic financial system, was launched on 17th February, 2016. Owned by a consortium of six Malaysian Islamic banks – Bank Islam, Bank Muamalat, Affin Islamic, Maybank Islamic, Bank Kerjasama Rakyat and Bank Simpanan Nasional, the IAP serves as a central marketplace to finance small and medium enterprises (SMEs) with an initial fund of RM150 million. Figure 1 shows the mechanics of IAP.

Islamic Fintech Alliance

Eight Islamic crowdfunding platform operators from across the globe launched the Islamic

Fintech Alliance (IFT Alliance) on the 1st April 2016 in Kuala Lumpur, Malaysia. The founding members are Blossom Finance, EasiUp, EthisCrowd, Narwi, FundingLab, KapitalBoost, Launchgood and SkolaFund. The alliance has the following three primary objectives:

- Foster safety and trust by establishing, promoting, and enforcing shared standards for Islamic finance.

- Broaden the reach of Shari’a and social impact financial technology by supporting a network of innovators.

- Support the development of a sustainable global ecosystem by interfacing with and providing industry insights to regulators and other key stakeholders.

Islamic Robo-Advisor

New York-based Wahed Invest Inc. launched Wahed, the world’s first automated Islamic investment platform with “the aim of providing access to halal portfolio management for 2 billion Muslims around the world”. In addition to being the world’s first automated ethical investment platform, Wahed offers lower minimum investment of US$7,500. Wahed is claimed to be the first global robo-advisor to be accessible by the lower socio-economic demographic. Wahed is initially available in the United States and would be rolled out to over 100 countries worldwide by 2017. Two months after the launching of world’s first Islamic Robo Advisor, the Kuala Lumpur-based Faringdon Group announced that it would be launching Asia’s first Shari’a-compliant robo-advisor. The online tool called Algebra will provide automated portfolio management advice. Open to investors across all geographies with a minimum investment amount of US$200 per month, clients can choose funds from its Islamic Master Select Portfolio.

Global Islamic Fintech Hub

Finocracy announced Future Finance 2030, the first Global Islamic Fintech Hub which is expected to be the focal point of the fast-growing Islamic fintech space. The fintech hub will be at CH9, a business accelerator that envisions enhancing the entrepreneurship ecosystem in Bahrain and the GCC region. Future Finance 2030, which expected to be launch in the first quarter of 2017, will include key elements that will continue to power rapid expansion of Islamic fintech while building connectivity with the wider Islamic finance industry. The plan includes an accelerator programme, a virtual network to connect various businesses, educational programmes for executives and students, and a global hackathon series that will encourage Islamic fintech development across emerging markets.

Shari’a-Compliant Peer-To-Peer (P2P) Crowd funding

The world’s first Shari’a-compliant P2P license was awarded to Ethis Kapital by the Securities Commission Malaysia in November 2016. Ethis Kapital focuses on funding small businesses and real estate development projects. Together with seven other crowdfunding platforms, Ethis Kapital is part of Ethis Ventures that builds, runs, and initiates ethical and Islamic crowdfunding platforms. Ethis Kapital plans to focus on supporting and developing the Islamic finance industry in Malaysia and with a view to later grow into a serious global player.

Fintech in Islamic Finance Future Outlook

Fintech in Islamic finance has been forging ahead quite steadily. Based on recent trends and various supporting factors, the future of fintech in Islamic finance looks promising. Almost all recent global-level Islamic finance conferences and seminars had at least a section on fintech. These have helped to create awareness among Islamic finance fraternities as Islamic finance stakeholders are beginning to appreciate the potentials of embracing fintech and to realize the disruptive impacts for not taking any actions. Tops officials of monetary authorities in key Islamic financial markets have also been advocating the integral role of fintech in financial services. Datuk Muhamad Ibrahim, the Governor of Central Bank of Malaysia, in his keynote speech at the Global Islamic Finance Forum (GIFF) 2016 in Kuala Lumpur stated that fintech initiative “opens up new possibilities for improving efficiencies, reducing wastage and enhancing the customer experience”. Speaking at the World Islamic Banking Conference (WIBC) 2016 in Bahrain, Rasheed Mohammed Al-Maraj, governor of the Central Bank of Bahrain (CBB), said “the smart use of technology is a game-changer in banking”. This was echoed by the Governor of Saudi Arabian Monetary Authority (SAMA), Dr. Ahmed Abdulkarim Alkholifey who said “as a matter of policy, we in SAMA encourage all regulated institutions to be responsive to the needs of their customers, and have always supported the development of products that meet those needs”.

In terms of regulatory support, Malaysia issued a Fintech Regulatory Sandbox Framework in October 2016. The framework aims to provide an environment that is conducive for the deployment of financial technology to foster innovations in financial services. The framework has a clear mention of fintech for Islamic financial services. In a similar vein, the Central Bank of Bahrain had announced it would be issuing regulations to facilitate fintech solutions by 2017. In early November 2016, Abu Dhabi Global Market launched the Fintech Regulatory Laboratory. The United Arab Emirates (UAE) being a country with the second largest Islamic finance asset, the fintech regulatory laboratory will benefit Islamic fintech development as well.

Other supportive elements in the broader fintech ecosystems are also available for fintech players in Islamic finance to take advantage of. Funding-wise, venture capital companies, private equity firms and other players have been pouring money into global start-ups. For mentoring purposes, there are various fintech incubation and acceleration programmes established all over the world. Technology has eroded barriers to innovations. All sort of technologies are available at affordable prices if not free of charge, thanks to the sharing of open-source technologies available in the cloud. In addition, there is an encouraging trends of symbiotic relationship between traditional financial services players with fintech companies. The incumbent players have scale, infrastructure and financial expertise while fintech companies can contribute innovative business models and technology.

Most importantly, the potential market for fintech in Islamic finance is huge as the industry is very new and largely untapped. The digital revolution drives customers’ demands for innovative, convenient, efficient and cost-effective financial services. It is estimated that by 2020 there will be between 2 and 3 billion new consumers that will be entering the digital finance space and 80% of these new consumers will be Muslims. This presents a significant opportunity for fintech in Islamic finance. Strong awareness among Islamic finance stakeholders, encouragement from monetary authority top officials and facilitative regulatory environments in key Islamic financial markets will play a major role in stimulating fintech innovations in Islamic finance.

Conclusion

Fintech penetration in Islamic finance is still in its infancy stage. Most of the players are in the crowdfunding business although Islamic robo-advisor has recently been introduced. Malaysia introduced the first Islamic banks-backed financial intermediary fintech platform and issued the first Islamic P2P Crowdfunding license. Other Islamic finance fintech-related initiatives are Islamic Fintech Alliance and Global Islamic Fintech Hub in Bahrain. The future looks promising. Major indicators for the positive outlook include growing awareness among the stakeholders, encouragement from monetary authorities and facilitative regulatory environments in key Islamic financial markets, other supportive elements from the broader fintech ecosystem, customer demands and a largely untapped potential market.