Malaysia has firmly established itself as a hub for Islamic finance, making strides in thought leadership, product development and institutional establishment. Its overall success in Islamic finance owes itself to the support of the government, which has taken gradual steps in creating the right infrastructure for Islamic finance to flourish. Malaysia has the most comprehensive and progressive Islamic financial system in the world through the adoption of a 4-pronged strategic approach: regulatory framework development, legal and Shari’a framework, products and markets development, and enhancement of knowledge and expertise. Today, Malaysia is one of the world’s most developed Islamic finance jurisdictions and the world’s first country to have a complete Islamic financial system operating in parallel to the conventional system.

Comprehensive Legal and Regulatory Framework

Malaysia has also been at the forefront in developing an enabling and facilitative legal framework for Islamic finance since the early 1980s. In 1983, before the establishment of the first Islamic bank (Bank Islam Malaysia Berhad) in the country, the Islamic Banking Act (IBA) was drafted to facilitate the governing framework for an Islamic bank to operate in. The enactment of the Islamic Banking Act 1983 provided for the apt administration of Islamic banking business and conferred power to Bank Negara Malaysia (BNM) as the central bank to regulate and supervise Islamic banks. Most importantly, the Act provided flexibility to Islamic banks to undertake a broad range of Shari’a-compliant banking business, which ultimately acknowledged the acceptance of Islamic banking into the banking sector in Malaysia.

The first takaful company was established in 1985 with the enactment of the Takaful Act 1984. Since then, Malaysia’s takaful industry has positioned itself for greater development and has been increasingly recognized as a significant contributor to the country’s overall Islamic financial system. The Takaful Act 1984 provided a framework for the regulation and registration of takaful business and covers, amongst others, provisions on the registration of takaful operators, conduct of takaful business by registered takaful operators, examination on the operations of takaful business as well as disclosure of the financial results of takaful business.

As the country’s financial system matures, in particular the Islamic finance sector, greater governance was required to contain the robust growth and ensure that by all means the authenticity of the Shari’a is maintained. As such, the Central Bank Act was introduced in 2009 and catered, in certain areas for Islamic banking. The Central Bank of Malaysia Act 2009, which came into force on 25 November 2009, replaced the Central Bank of Malaysia Act 1958. The Act made particular provision for the establishment of a Shari’a Advisory Council (SAC) at BNM and provided detail functions of the SAC and declared it as the apex Shari’a authority in ascertaining the applicable Shari’a principles in Islamic banking and takaful. With this, SAC rulings are made binding on arbitrators and judges.

The latest development is the Islamic Financial Services Act (IFSA) of 2013, which repealed Islamic Banking Act 1983 and Takaful Act 1984. The IFSA provides a legal platform for development of Islamic finance in Malaysia, which is reflected upon a comprehensive regulatory framework on specificities of the various Islamic financial contracts and supports on the effective application of Shari’a financial contracts in the offering of Islamic financial products and services. In promoting compliance with Shari’a, IFSA imposes a duty on Islamic financial institutions to ensure compliance with Shari’a at all times and also empowers BNM to issue standards on Shari’a requirements to facilitate institutions in complying with Shari’a. The IFSA also requires that takaful operators that run dual takaful businesses to split their operations into either family or general takaful businesses. This segregation of family and general takaful licensing and businesses by 2018 is expected to strengthen the takaful sector.

Malaysia remains at the forefront in sukuk issuance and is the world’s largest sukuk market historically contributing more than 50% to total global sukuk issuance. The guidelines for sukuk have been revised in 2011 to (i) enhance the regulatory framework relating to debt capital market and Islamic capital market in Malaysia; (ii) expedite time-to-market for issuance of corporate bonds and sukuk with the introduction of the deemed approved regime that adopts a truly disclosure-based approach and compliance with a set of transaction criteria; and (iii) enhance the level of protection for investors by introducing additional compliance provisions to facilitate a more informed investment decision-making process.

The revised Islamic Securities Guidelines of 2011 provided greater clarity on the application of SAC of Securities Commission’s (SC) Shari’a rulings and principles in relation to sukuk transactions. The new Private Debt Securities and Sukuk Guidelines of 2015 supersede the previous guidelines and outline (i) the requirements for issuance of private debt securities or sukuk; (ii) approval for the issuance of private debt securities or sukuk; (iii) additional Shari’a requirements for sukuk; and (iv) requirements for issuance of sustainable and responsible investment sukuk.

In August 2014, the SC launched the Framework for the Issuance of Sustainable and Responsible Investment Sukuk (SRI Sukuk), which is an extension of the existing Sukuk Guidelines. Among the objectives of the framework are to meet the demand of both retail and sophisticated investors to access a wider range of investment products and to facilitate greater participation in the sukuk market, facilitate the creation of an ecosystem that is conducive for SRI investors and issuers (in line with the trend of green bonds and social impact bonds) and add value proposition as a centre for Islamic finance and sustainable investments. The Framework listed four types of SRI projects including natural resources, renewable energy and energy efficiency, community and economic development, and waqf properties/assets.

Shari’a Governance and Standards

On 1 January 2011, BNM issued the Shari’a Governance Framework (SGF) for Islamic

Financial Institutions aimed at establishing a proper internal Shari’a governance structure. The SGF of 2011 has become a referred model worldwide. This framework outlines a robust governing system to ensure optimal Shari’a supervision at every level of operations by adopting a two-tier Shari’a governance infrastructure comprising two (2) vital components – centralized Shari’a advisory body at BNM and an internal Shari’a Committee formed in each respective Islamic financial institutions.

The framework is also structured such that the institution’s Shari’a Committee is at the core of the governance process and reports directly to the Board of Directors, just as any other “Board” Committee would do, i.e. Board Risk Management Committee and Board Audit Committee. Their central function is to ensure oversight on Shari’a-related matters in the institution and report the relevant concerns to the Board. The Board holds the final decision to ensure that the concerns of the Shari’a Committee are adequately addressed.

Shari’a Governance Framework Model for Islamic Financial Institutions

The Shari’a Committee has the responsibility to ensure that, through management, ongoing business and operations are in accordance with Shari’a principles. The framework recognizes the necessary powers to be provided to management to address any Shari’a related issues. Hence, four operational units that assist the Shari’a Committee in ensuring Shari’a governance in the institutions are to be established as follows:

- Shari’a Risk Management Control Function

This unit systematically identifies, measures, monitors and controls Shari’a non-compliance risks to mitigate any possibility of non-compliance events. The systematic approach of managing Shari’a non-compliance risks will enable Islamic financial institutions to continue their operations and activities effectively without exposing them to unacceptable levels of risk. They also report to the Board’s Risk and Management Committee.

- Shari’a Research Function

This unit conducts required research on particular Shari’a related matters arising in the institution prior to submission to the Shari’a Committee. This comprises of qualified Shari’a officers to conduct pre-product approval process, research, vetting of issues for submission, and undertake administrative and secretarial matters to support the Shari’a Committee. This function refers to the conduct of performing in-depth research and studies on Shari’a issues, including providing day-to-day Shari’a advice and consultancy to relevant parties, including those involved in the product development process.

- Shari’a Review Function

The Shari’a review function refers to the regular assessment on Shari’a compliance in the activities and operations of the Islamic financial institutions by qualified Shari’a officer(s), with the objective of ensuring that the activities and operations carried out by the Islamic financial institutions (IFIs) do not contravene with the Shari’a.

- Shari’a Audit Function

This unit will from time to time conduct periodical assessment with the aim to provide an independent assessment and objective assurance designed to add value and improve the degree of compliance in relation to the Islamic financial institution’s business operation. This is to ensure a sound and effective internal control system for Shari’a compliance is in place. Besides the Shari’a Committee, they also report to the Board’s Audit Committee.

In order to facilitate sound understanding and cohesive adoption of similar practices among Islamic financial institutions in Malaysia, BNM introduced Shariah Standards and Operational Requirements. The features identified in the standards serve to assist the Islamic financial services industry to identify, understand, apply and distinguish one Shari’a contract from the other contracts prevalent in the industry. During 2014, five standards including murabaha, mudaraba, istisna and another six standards and operational requirements were issued in 2016 on kafalah, wakala, wadiah, hibah, qard and ijara. Three more standards (namely on wa’d, rahn and bai’ al-sarf) are expected to be issued in 2017.

Blueprint for Growth

As outlined in the Financial Sector Master plan (2001- 2010), formulated by BNM, Islamic banking was recognized as one of the major potential growth sectors and had set a target for Islamic finance to make up 20% of finance sector by 2010. The second master plan, the Financial Sector Blueprint (2011 – 2020) builds on the achievements of the first Master plan but with an emphasis on the internationalization of Islamic finance through the diversity of players in the domestic Islamic finance industry, wider range of Islamic financial products and services, innovative financial solutions to meet the more sophisticated investment demands of the increasingly affluent population particularly in Asia and the Middle East, and greater cross-border financial business.

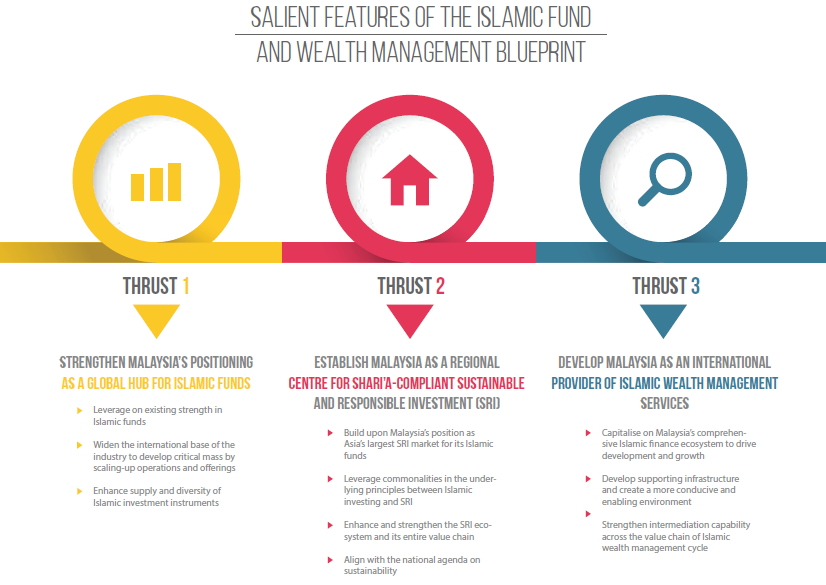

In supporting Malaysia’s aspirations to establish itself as a regional leader in Islamic finance, Capital Market Masterplan 2001-2010 followed by Capital Market Masterplan 20112020 was released by SC. The Plans mapped out strategic direction for establishing Malaysia as the international center for Islamic capital market activities. With greater internationalization of Islamic finance, it is expected that Malaysia’s Islamic capital market will register a growth rate of 10.6% per annum over the ten year period. Greater internationalization would also see more product issuers and service providers expanding beyond their home market. A positive development in the Malaysia’s Islamic wealth management industry was the launched of the 5-year Islamic Fund and Wealth Management Blueprint by the SC in January 2016. The Blueprint aims to further strengthen Malaysia as a leading international center for Islamic fund and wealth management. It also aims to establish Malaysia as a regional center for Shari’a-compliant sustainable and responsible investment (SRI), leveraging Malaysia’s position as the largest SRI market in Asia.

Islamic Banking

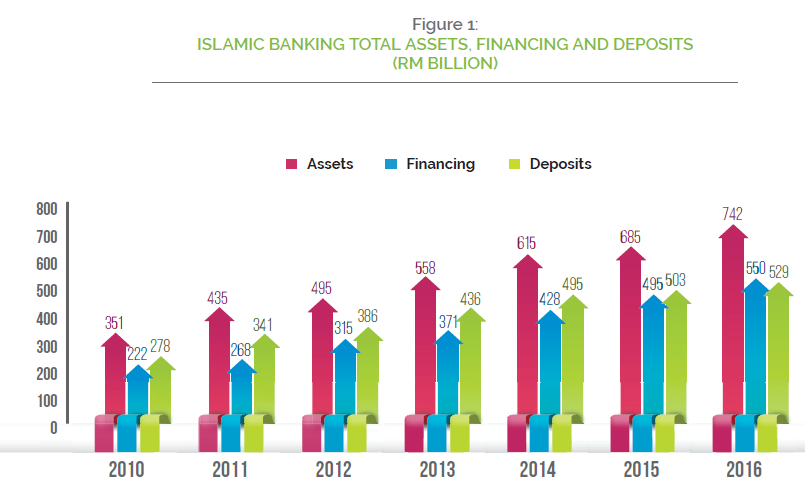

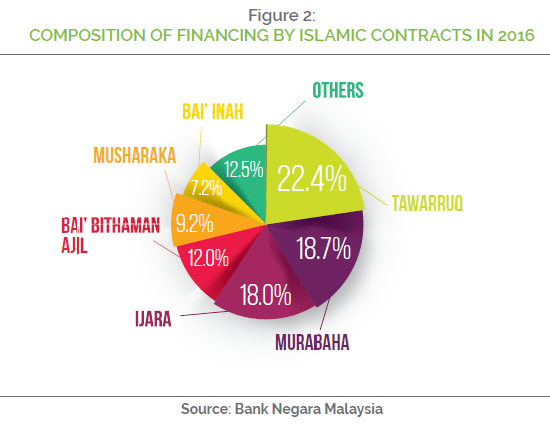

Throughout the years, Islamic banking in Malaysia has gained significance, and has been on a progressive upward trend. As at end of 2016, total assets of the Islamic banking industry increased to RM742 billion to account for 28% of the overall banking system, up from 26.8% in 2015 (Figure 1). Based on the upward year-on-year growth trend, market share of Islamic banking assets is set to reach 30% next year. Similar trends were observed for Islamic financing and deposits. By 2016, Islamic financing accounted for a third of all bank financing after reaching RM550 billion, an increase from RM505 billion from the previous year. About 60% of financing disbursed by Islamic banks during 2016 was channeled to households, followed by financing, insurance and business activities sector (7.7%); education and health (5.3%) and real estate (5.2%). In terms of the composition of financing contracts, tawarruq financing has gained prominence in recent years. In 2016, tawarruq financing grew over 34% to account for 22.4% of total outstanding Shari’a-compliant financing (Figure 2). This growth has largely been spurred by the commodity trading operations of Bursa Suq Al-Sila.

Islamic deposits grew by 5% to RM529 billion as at end of 2016 whilst Investment Account (IA) stood at RM73.7 billion to account for 12.2% of total Islamic deposits and IA within the Islamic banking system. As at end of 2015, IA reached RM47 billion upon completion of a two-year industry-wide exercise on the reclassification of accounts from deposits to investment accounts in accordance with the IFSA. Under the IFSA, Islamic banks are required to segregate Islamic deposits with a principle guaranteed feature from investment accounts with a non-principle guaranteed feature. The underlying reason for this exercise was to provide greater legal clarity on the application of the various types of Shari’a financial contracts and ensure end-to-end compliance in Islamic banking operations.

In order to support the implementation of IA offering to the public, the Investment Account Platform (IAP) was launched in February 2016 and was hailed as the first bank-intermediated technology platform for investment accounts. The IAP is an integrated multi-bank investment platform, which was set up to facilitate channeling of funds from investors to viable economic ventures and business activities. Hence, it enables investors to directly finance a broad range of economic activities of their choice. For businesses, the IAP provides a new source of funding with more competitive financing terms in a range of financing structures.

Takaful

Pursuant to the enactment of the Takaful Act 1984, Malaysia’s first takaful operator, Syarikat Takaful Malaysia Berhad was formed and it commenced operations in August 1985. As at 2016, there are 11 registered takaful operators and over 88,000 takaful agents providing family and general takaful services. The takaful industry continues to record higher growth than the conventional sector due to a low base, stable domestic consumption and increasing consumer awareness. Despite the robust growth, the penetration rate for takaful in Malaysia remained small i.e. about 14.8% when compared with conventional insurance which stands at more than 54%.

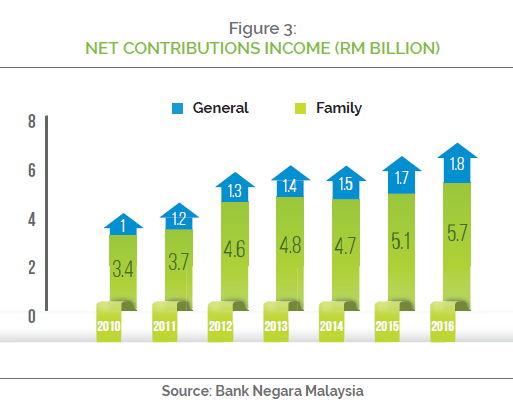

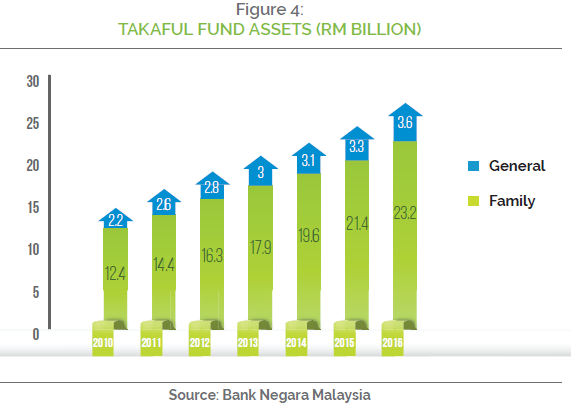

Net contributions income in 2016 stood at RM7.5 billion (2015: RM6.8 billion) to account for 14.6% of total industry premiums and contributions (Figure 3). Total takaful fund assets stood at RM26.9 billion, representing 10% of the total assets of the insurance and takaful industry in Malaysia (Figure 4). Industry growth is underpinned by the family takaful business, which accounts for 76% of total net contributions income of the takaful industry. In 2016, family takaful grew by 11.8% while general takaful grew by 5.8%. This compared to 5.3% growth in conventional life and 2.6% in general insurance.

Despite robust growth, takaful industry continues to face numerous challenges and issues, notably low penetration rate, shortage of human capital, inadequate technology capabilities, ineffective governance practices, and lack of innovation in business model for new market niches. In light of this, several reforms have been initiated to help support growth and profitability of the industry. In 2014, BNM issued the Risk-Based Capital Takaful (RBCT) Framework aimed at creating a strong risk management framework. The framework sets out the capital requirements for takaful operators based on their size and degree of risks undertaken. The Life Insurance and Family Takaful Framework was introduced in 2015 and covers wide range of areas including operating flexibility, product disclosures, delivery channels and market practices. The framework aims at promoting innovation, increasing competitiveness in the market, enhancing professionalism and transparency in providing insurance and takaful products and services to the consumers. The implementation of the framework is based on a phased approach to enable the industry to transition to the new operating environment.

In March 2016, BNM announced the full liberalization of the motor and fire tariffs, which will be completed in 2 phases. With tariff liberalization, insurance and takaful companies would be able to charge premiums commensurate with the risk behavior of the consumers. Hence, with risk-based pricing, customers with good risk profiles would be able to enjoy more competitive rates than those with higher risk ratings. In the first phase, which commenced on 1 July 2016, insurers and takaful operators will progressively offer new products to the consumers at market rates. Existing motor products under the tariff will continue to be available at prevailing tariff rates. In the second phase, which will start on 1 July 2017, tariffs will be removed for all existing motor products except compulsory motor third party products where tariff rates will be gradually adjusted. However, premium for fire class protection is still regulated under the tariff with gradual downward adjustments until a review is made in 2019.

The IFSA also requires that takaful operators that run dual takaful businesses to split their operations into either family or general takaful businesses. This segregation of family and general takaful licensing and businesses by July 2018 is expected to strengthen the takaful sector. This means out of the 11 takaful players in Malaysia, three are sole family takaful operators and the remaining eight need to split their businesses. In January 2017, the Internal Capital.

Adequacy Assessment Process (ICAAP) guidelines for takaful operators took effect. Under this new regulation, takaful companies are required to actively manage their capital adequacy, taking into account their business strategies, risk profiles and overall financial resilience.

Several initiatives to improve affordability and access to takaful products are in the pipeline. Amongst them are requirements for life insurers and family takaful operators to make basic protection products available through direct distribution channels and the introduction of an insurance starter pack aimed primarily at low-income earners. Both initiatives are expected to be rolled out in 2017. According to BNM, only 4% of low-income households have some form of life insurance or family takaful coverage.

Sukuk

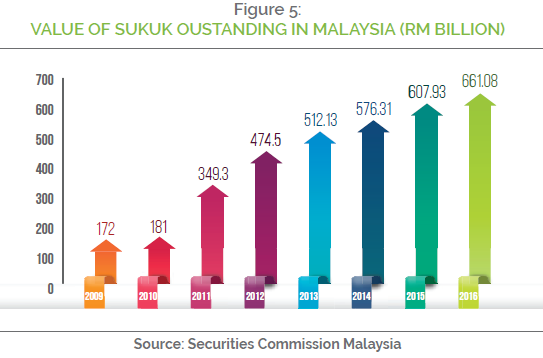

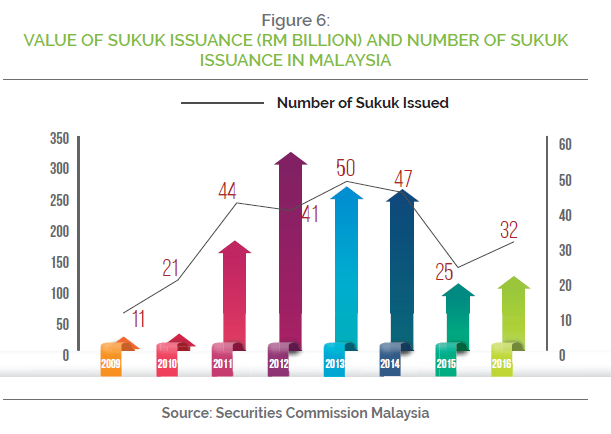

Malaysia continued its dominance in the sukuk market in 2016 with 46.4% new global issuances of all currencies originating from Malaysia. Sukuk outstanding reached RM661.08 billion by end of 2016, commanding 54% of global sukuk outstanding (Figure 5). Total issuance of sukuk in 2016 amounted to RM129.45 billion and a total of 32 sukuk were issued (Figure 6). Corporate sukuk outstanding increased by 8.9% to RM393.5 billion while total corporate sukuk issuances was RM64.82 billion, representing 75.7% of total corporate sukuk and bond issuances. Historically, Malaysia’s contribution to global sukuk issuance has been above 50%. However, in tandem with the slowdown in global growth, Malaysia’s contribution has been on a downtrend. The decision by BNM to cease issuance of its short-term sukuk had contributed to its further decline.

VALUE OF SUKUK OUSTANDING IN MALAYSIA (RM BILLION)

Malaysia remains at the forefront in innovation and development of the sukuk market. In 2015, the Malaysian sovereign wealth fund, Khazanah Nasional, launched the first ringgit-denominated sustainable and responsible investment sukuk to raise funds for its Trust Schools Programme. Khazanah raised RM100 million (US$27 million) from the seven year sukuk. The proceeds of the issuance are channelled to Yayasan AMIR, a non-profit organization initiated by Khazanah, to manage its cash flow for the deployment of the Trust Schools Programme for schools identified. Investors buying into this sukuk will need to be committed to the school project as the sukuk uses a “pay for success structure” that will reduce returns if certain key performance indicators (KPIs) are met. The sukuk’s prospectus states that the social impact of this “Pay for Success” structure is measured using a set of pre-determined KPIs, which will be measured over a 5-year observation timeframe. If at maturity, the KPIs are met, the sukuk holders will forego a pre-agreed percentage of the nominal amount due under the SRI sukuk as part of their social obligation in recognising the positive social impact generated by the Trust Schools Programme. On the other hand, if the KPIs are not met, the sukuk holders will be entitled to the nominal amount due under the SRI Sukuk in full.

Islamic Capital Market

The Malaysian Islamic capital market (ICM) has experienced phenomenal growth and is widely recognized as the world leader in product innovation and financial intermediation. As at end of 2016, the total size of the ICM stood at RM1,691.64 billion accounting for 60% of the total market capitalization in Malaysia, which has more than tripled over the last decade. The total size of ICM includes total market capitalization of Shari’a-compliant equities of RM1,030.56 billion and total sukuk outstanding amounting to RM661.08 billion.

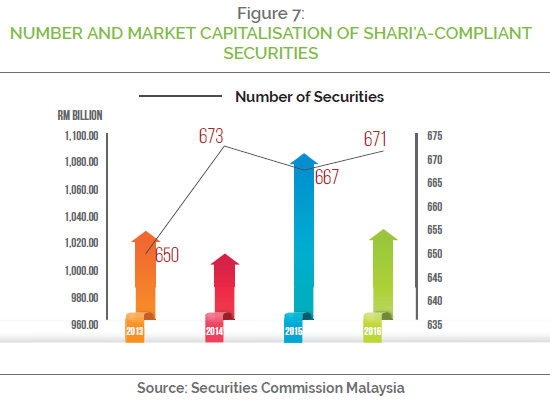

Malaysia has a large Islamic equity market. As at December 2016, of the 904 listed securities on Bursa Malaysia, 74% were Shari’a-compliant. The market capitalization of these Shari’a-compliant securities was RM1,030.56 million, representing 62% of total market capitalization. As shown in Figure 7, the number of securities complying with Shari’a principles has seen steadily growth. The number of Shari’a-compliant securities listed on Bursa Malaysia increased from 650 in 2013 to 671 in 2016.

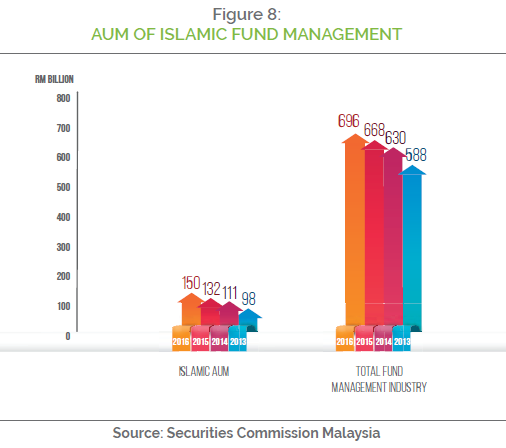

Malaysia’s Islamic fund management sector is the largest globally in number of funds (2016: 328) and second largest in size after Saudi Arabia. In 2016, Islamic assets under management stood at RM149.64 billion, an increase of 13% from the previous year (Figure 8). As at end 2016, there were 20 full-fledged Islamic fund management companies operating in Malaysia, with 31 fund management companies offering Islamic windows. But unlike the conventional funds industry, 80% of Islamic AuM is made up of retail investors whilst only 20% comprises of institutional investors. Hence, the key challenge remains penetrating the institutional investor segment, which includes pension funds and sovereign wealth funds. In this respect, the move by the Malaysian pension fund, the Employee Provident Fund (EPF), to offer a Shari’a-compliant investment option to its members has been seen as a positive development. According to statistics released by EPF, as at 31 October 2016, a total of 50.25%, amounting to RM50.25 billion from the initial allocation of RM100 billion for Simpanan Shariah 2017 have been taken up since registration for the Shari’a investment scheme was opened to its members on 8 August 2016.

At present, the fund management industry, including Islamic fund, is very much domestic-centric. In order to broaden the global capacity of the industry, several initiatives were undertaken by SC including the formalizing a framework on Shari’a sustainable and responsible investments (SRI), the introduction of a digital investment services framework, the broadening of linkages and connectivity, capitalizing on global opportunities and increasing the value add and talent base within the Islamic capital market to enhance its product and service offerings. In 2015, the SC released Equity Crowdfunding (ECF) framework, which seeks to bridge the capital gap for early start-ups and other small enterprises to access funding for their business expansions. Through the facilitation of online portals (ECF platform), issuers are able to obtain seed or other capital in return of small equity offering to investors. In just one year in operations, 14 issuers have collectively raised a total of RM10.4 million.

The introduction of the regulatory framework for peer-to-peer financing (P2P) by SC in 2016 paved the way for small and medium-sized companies to access a new avenue of funding and marked Asia’s first P2P financing guidelines. The framework sets out requirements for the registration of a P2P platform including the duty and responsibility of a P2P operator, type of issuer and investor who can participate in P2P. This subsequently led to registration of six operators – B2B FinPAL, Peoplender, Ethis Kapital, ManagePay Services, Modalku Ventures and FundedByMe Malaysia. Both market-based financing – P2P and equity crowdfunding, is expected to enhance access to financing for entrepreneurs and SME businesses in Malaysia. In January 2017, the SC launched a five-year Islamic Fund and Wealth Management Blueprint to further drive the growth of Malaysia’s Islamic capital market consistent with the Capital Market Master Plan 2. Several strategies and key initiatives were identified to develop the Malaysia as global hub for Islamic funds and wealth management.

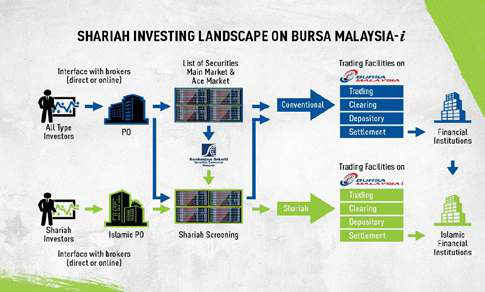

The world’s first end-to-end, fully integrated Islamic securities exchange platform called the Bursa Malaysia-i, was launched by Bursa Malaysia in September 2016. The new platform offers investors the option of investing and trading Shari’a-compliant products via a Shari’a-compliant platform and incorporates the full range of services including listing, trading, clearing, settlement and depository services. The new exchange platform underscores Malaysia’s leadership as the global marketplace for Shari’a listing and investments and raised the country’s profile of being ahead of the curve in Islamic capital market services and infrastructure.

Islamic REITs

Malaysia became the pioneer in the development of the Islamic REITs, with the introduction of the world’s first guideline for Islamic REITs in November 2005 by the SC. The guidelines among others included the utilization of real estate assets and the financial facet of operations. This was followed by the launch of the first Islamic REITs in July 2006, namely Al-Aqar KPJ REIT. Since then 3 other Islamic REITs have been listed on the stock exchange. Currently, there are sixteen Malaysian REITs listed on Bursa Malaysia, of which, four are Shari’a-compliant. As depicted in Table 1, the share of Islamic REITs to total industry was 41.9% with market capitalization of RM18.53 billion.

In 2016, the SC undertook a comprehensive review of the Guidelines on Real Estate Investment Trusts (REITs Guidelines) to further facilitate the sustainable growth of the REITs market. The proposed enhancements to the REITs Guidelines are part of SC’s effort to facilitate growth of the market and at the same time promote stronger governance and efficiency. According to the guidelines, Islamic REITs that have been established for over five years would be allowed to collect rental income that comes from Shari’a non-compliant activities but only up to 5% of a REIT’s total turnover. At present, Islamic REITs cannot accept new tenants or renew existing tenants whose activities are not fully Shari’a-compliant.

Islamic Finance Education and Training

In developing human capital to support the growth of the Islamic financial services industry, Malaysia has been in the forefront with the establishment of various academic institutions as well as talent development and research institutions dedicated to Islamic banking and finance. Malaysia is the second largest Islamic finance education centre in the world with an estimated 60 courses and 38 degrees in Islamic finance from various institutions and universities. Notable institutions offering Islamic finance programmes are the International Islamic University of Malaysia, Islamic Banking and Finance Institute (IBFIM), International Centre of Education for Islamic Finance (INCEIF), International Shariah Research Academy for Islamic Finance (ISRA) and Securities Industry Development Corporation (SIDC).

Table 1: ISLAMIC REITS IN MALAYSIA

| 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | |

| NUMBER OF ISLAMIC REITS | 4 | 4 | 3 | 4 | 3 | 3 |

| TOTAL INDUSTRY | 17 | 16 | 16 | 17 | 16 | 15 |

| MARKET CAPITALISATION (RM BILLION) | 18.53 | 16.11 | 15.04 | 14.14 | 3.47 | 2.9 |

| MARKET CAPITALISATION TOTAL INDUSTRY (RM BILLION) | 41.07 | 36.46 | 35.67 | 33.13 | 24.59 | 16.3 |

| % TO TOTAL INDUSTRY | 41.9% | 42.9% | 42.2% | 42.7% | 14.1% | 17.8% |

However, securing access to the increasingly finite pool of individuals with in-demand skill sets will be fundamental to keeping employee and organisational goals aligned within the Islamic finance industry. Against this backdrop, the Finance Accreditation Agency (FAA) was established as an international and independent quality assurance and accreditation body for the financial services industry. The FAA has developed a range of learning and development services specifically for the finance industry, including the world’s first Islamic Finance Learning Standards, which serves as reference suite for training providers, financial institutions, and individuals. The standards were developed as means to bridge the gap between the mismatch of knowledge competencies and industry needs.

A World Leader

Malaysia is home to the world’s biggest Islamic finance market and leader in expertise in Islamic finance covering regulatory, legal, retail and investment banking. A sound regulatory infrastructure, strong regulatory support and push for Islamic finance from the government has allowed the industry to outpace the development in more populous Islamic countries. While Malaysia faces competition from Islamic financial centers such as Dubai and increasingly Indonesia, to become the premier global Islamic financial center, it remains at the forefront of the development of this market. Although Malaysia is ahead of the race to become the Islamic financial capital of the world, continuous effort in industry liberalization is needed to attract more international financial institutions to set-up their Islamic operations hubs in the country, which would ensure Malaysia maintain its leading position in the long-run.

BURSA MALAYSIA-i: THE

WORLD’S FIRST END-TO-END SHARIAH INVESTING PLATFORM Bursa Malaysia Berhad (Bursa Malaysia or the Exchange) achieved another significant milestone in the development of the Islamic Capital Market with the introduction of Bursa Malaysia-i, the world’s first end-to-end Shari’a investing platform on 5 September 2016. The introduction of Bursa Malaysia-i further cements the Exchange’s role as a key Islamic Capital Market hub in the ASEAN region and beyond. The platform is the culmination of Bursa Malaysia’s long standing commitment to making Malaysia a comprehensive Islamic investing hub that offers a broad suite of Islamic financial market instruments. Bursa Malaysia-i was launched by Datuk Seri Johari Abdul Ghani, Minister of Finance II.

Minister of Finance II, Datuk Seri Johari Abdul Ghani hitting the gong to symbolise the launch of Bursa Malaysia-i. Accompanied by, (from left) Senator Dato’ Lee Chee Leong, Deputy Minister of Finance II, Tan Sri Dato’ Seri Ranjit Ajit Singh, Chairman of Securities Commission Malaysia, Tan Sri Amirsham A Aziz, Chairman of Bursa Malaysia Berhad and Datuk Seri Tajuddin Atan, Chief Executive Officer of Bursa Malaysia Berhad.

The objective of Bursa Malaysia-i is to provide a conducive marketplace for Shari’a investing and to further strengthen the products and services offered by the Islamic Capital Market, thus attracting a wider pool of domestic and foreign investors and issuers. As a result of this new development, the Exchange hopes to increase:

- the number of Shari’a-compliant public listed companies;

- the number of Shari’a-compliant products;

- Shari’a market capitalisation;

- Shari’a Average Daily Trading Value (ADV); and

- the number of Islamic Participating Organisations (Islamic POs).

New and exciting chapter for the Malaysian Islamic Capital Market

Bursa Malaysia-i offers a comprehensive suite of Shari’a-compliant exchange-related services including listing, trading, clearing, settlement and depository services. The platform supports Shari’a-compliant products listed on the Main and ACE Markets, which include Shari’a-compliant Stocks (i-Stocks), Shari’a-compliant Indices (i-Indices), Shari’a-compliant

Exchange Traded Funds (i-ETFs), Shari’a-compliant Real Estate Investment Trusts (i-REITs) and Sukuk trading on Exchange Traded Bonds and Sukuk (ETBS).

Bursa Malaysia has worked with relevant stakeholders and conducted internal reviews and engagements with the Shari’a Advisory Council of Securities Commission Malaysia (the SAC of SC) as well as external independent advisors, amongst others, to develop the platform’s facilities and infrastructure. This has resulted in the improvement of governance and operational structures and processes, which aims to provide investors the confidence to undertake investment activities in a Shari’a-compliant manner.

Investors can choose Shari’a investing via Bursa Malaysia-i with any of the Islamic POs registered with Bursa Malaysia. There are currently 11 Islamic POs carrying out Islamic stockbroking services, of which one is on a full-fledged basis and 10 are on a ‘window’ basis.

Trading on Bursa Malaysia-i is guided by ‘Best Practices for Shari’a Investing’, whilst the conduct of the Islamic POs is in compliance with the ‘Best Practices in Islamic Stockbroking Services’ undertaken by Participating Islamic POs. Both practices are endorsed by the Shari’a Committees of Bursa Malaysia and SC.

As a leading emerging market exchange for Shari’a-compliant securities, Bursa Malaysia offers a broad selection of quality stocks. As at end 2016, 74 per cent of companies listed on Bursa Malaysia are Shari’a-compliant. The Malaysian market capitalization has been growing at a tremendous pace of 363 per cent since 1997, and the Shariah market capitalization as at 31 December 2016 makes up 60 per cent of the total market capitalization of RM1,667 billion.

Bursa Malaysia as the leading specialist and pacesetter in Islamic Capital Markets

This initiative is a step in the right direction to ensure Malaysia remains the global leader in the Islamic capital market, similar to the evolution of Islamic finance, which has matured into a sophisticated Islamic finance marketplace. Moving forward, Bursa Malaysia will continue to focus on forging collaborations with capital market participants, in particular the domestic market players, to be the catalysts of growth for Bursa Malaysia-i and increase the depth and breadth of the Islamic capital market. Bursa Malaysia will also intensify its efforts to promote Shari’a investing through roadshows, in collaboration with the Islamic POs and the industry.

The Exchange also recognizes the importance of sustainability and has placed it at the core of Malaysia’s capital market. Bursa Malaysia’s progress as a sustainable marketplace is further strengthened with the launch of Bursa Malaysia-i, as it offers a socially responsible investment platform. This will further elevate Bursa Malaysia’s marketplace and the role of Islamic POs, across ASEAN and globally, as an emerging market leader for Sustainable and Responsible Investing.

In summary, Bursa Malaysia will continue to champion exchange-based Shariah-compliant investing and provide new options to the Islamic Capital Market to invest based on the principles of Islamic finance. This effort will support Bursa Malaysia’s initiative in building a sustainable marketplace and elevate Malaysia’s role in advancing Islamic capital market services and infrastructure for the global marketplace.