Waqf has historically played a crucial role in poverty alleviation and socio-economic development throughout the Islamic civilization. The period of colonization in the mid-eighteenth century along with an intellectual deterioration led to a continuous diminishing in the role of the waqf institution. However, current economic, social and climatic challenges have made its revival relevant. The integration of waqf within the current financial framework can enhance its role in overcoming the past shortcomings and achieving its longstanding goals.

According to AAOIFI, waqf refers to making a property invulnerable to any disposition that leads to transfer of ownership, and to donating the usufruct of that property to beneficiaries. This definition makes durability and consistence as the main characteristic of waqf.

The concept of waqf is different from the western perspective on the topic. The purposes of setting up waqf can cover anything related to social welfare activities. These include sectors that the government has a direct responsibility to administer, such as national defence, education and health.

There are different types of waqf: general and a family/private waqf. The first type relates to philanthropy in the form of a public waqf or a religious waqf where the usufruct is devoted to the interest of general public like hospitals, public utilities, mosques, libraries, books, etc. The family/private waqf benefits the children or offspring of beneficiary families.

This chapter suggests revival of the role of awqaf in socio-economic development through sukuk. Linking waqf with sukuk may create a suitable solution to raise funds and help Muslim countries in improving socio-economic conditions. The basis of waqf-sukuk is similar to a project-based sukuk with the difference that in the former the issuance of sukuk is intended for socio-economic purposes.

The first step towards integrating waqf into the socio-economic policy framework would be to allow the private sector to effectively participate. Indeed, the institution of waqf can encourage larger private sector participation through voluntary actions and reduce government involvement in the economy. This suggestion is not entirely new, as the share of waqf revenues in total public revenues in the Ottoman era went up to 12 percent in the sixteenth century. Consequently, the need to re-integrate the waqf institution within the public finance framework may prove fruitful, even in modern times.

Some scholars have extended to role of social institutions in Islam like zakat and waqf to finance direct productive activities. Many scholars suggest the creation of intermediary institutions to help SMEs to grow based on zakat, waqf and sadaqa. It is the returns from productive waqf and sadaqa that could be channeled to finance SMEs. Waqf institution may engage in investment activities to use returns to maintain and expand the waqf assets. In modern times, a practical application of this was undertaken by the MUIS (Majlis Ugama Islam Singapore) through setting a cooperative model to finance local SMEs. Subsidiaries were set up by the MUIS to channel funds using Shari’a-compliant investment into local SMEs.

Nevertheless, the main challenge facing current day’s waqf institutions is the absence of creation of new waqf assets and the poor profitability of existing waqf assets. This could be due to poor cultural awareness about the importance of waqf both on individual and corporate levels. Hence, Islamic finance should innovate to come up with solutions that must attract the following to the waqf. The securitization of waqf could be one such possible innovation.

The cornerstone of sukuk-waqf is the concept of cash-waqf, which makes its implementation practical and manageable. It is considered a source of social funding. As a perpetual instrument, cash-waqf is different from a western endowment or charitable fund. Cash-waqf functions through preserving the principal of waqf, while making the benefits of waqf portfolios available for religious, philanthropic and righteous purposes.

The basic model of sukuk-waqf uses the usual sukuk structuring which makes the operational aspects easy to implement. The general process for issuance of sukuk requires three steps: creation of a special purpose vehicle (SPV) to represent the investors, issuance of the certificates and putting them into circulation, and securing the cash-flow through the period of the contract from the issuer to the investor. Other parties include rating agencies, underwriters, custodians and the securities authority.

Ultimately, there is no significant difference between the general structure of waqf- sukuk and normal sukuk except in terms of objectives. While investors into normal sukuk seek financial return, waqf-sukuk holders aim at serving public interest. Furthermore, waqf-sukuk have attracted a growing attention, with ever-increasing innovation in its practice. The proceeds of the sukuk can be used either for humanitarian needs with no immediate expected cash returns, or for investments which usually yield returns and can help in further developing the endowment.

The use of waqf-sukuk for socio-economic development can be implemented in different ways:

- By issuing (commercial) sukuk (corporate or government) for awqaf land development to develop existing waqf assets;

- By using awqaf assets as the underlying assets or object of financing in sukuk originations; and

- By issuing cash-waqf certificates and having investors subscribe to the issuance (to create new waqf assets.

As the theoretical framework of sukuk-waqf is getting refined and developed, practical application of this concept is starting to appear around the Muslim world. One of the first successful applications was undertaken by MUIS, as mentioned above. In addition to the private investors, three parties were involved:

- Waqf;

- Baitulmal; and

- Warees (wholly-owned subsidiary of MUIS).

The investors contributed US$35 million to develop the waqf property and then, a leasing contract agreement was signed between the SPV and Ascott International Pte. Ltd. to lease the property for a period of 10 years. Although this structure is simplistic in a way that it does not create new waqf assets, but it served the socio-economic purpose of developing existing waqf properties.

Saudi Arabia has conducted a similar operation through sukuk al-intifa’ to develop a waqf property belonging to King Abdul Aziz Waqf (KAAW). The operation was structured through leasing one of the waqf properties, in this case a piece of land in the center of Makkah, to the Binladin Group on a BOT (Build-Operate-Transfer) concession contract for 28 years. The latter subcontracted the construction to another company from Kuwait, which financed the project and is now operating the property.

Nevertheless, the ultimate aim of waqf-sukuk is to create new waqf assets to address specific socio-economic problems that may otherwise be a burden on national exchequers. As mentioned in several other places in this report, Indonesia tried a hybrid approach combining cash-waqf and sukuk. The experience included raising funds through cash-sukuk and using the proceeds through the Indonesian Waqf Board, employing various sukuk structures. The return (on such investments) is used for educational facilities, health, community empowerment, including disaster relief and other similar activities.

This model is expected to revitalize the role of waqf within Muslim countries. The structure of the model relies on creating independent waqf institutions with full financial and operational autonomy. The latter would then create an SPV to represent the investors and then proceed to issue waqf certificates and putting them into circulation. After that, the funds raised should be used to create new waqf assets aimed to alleviate socio-economic problems in local communities. The structure may include permanent or temporary waqf which then requires the waqf institution to secure the cash-flow throughout the period of the contract from the issuer to the investor.

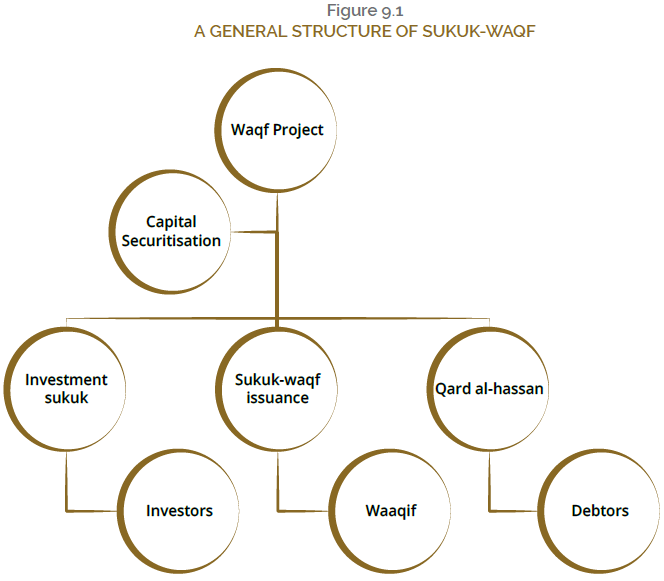

The structure by which the issuance can take place can also include a qard al-hassan or investment sukuk component depending on the socio-economic scale of the operation. Figure 9.1 shows the general structure of the issuance.

Similar waqf-sukuk structures must help many Muslim countries’ deteriorating finances. In fact, the current debt-to-GDP ratio in most Muslim countries exceeds 60%. Even oil-exporting countries have been pushed to call for international lenders to finance their social programmes in the wake of low oil prices. Hence, innovative solutions must be developed in order to respond to the growing need for Shari’a-compliant instruments. Takaful contract can be added to the structure to ensure more guarantees for the investors.

This kind of financial structuring matches a new framework of public finance management where the state disengages from basic socio-economic sectors in favor of the private sector. However, this process has the state as initiator and a monitor for the good execution of the projects. This framework proposes that the quality of public administration can be enhanced through productivity gains, like any other private organization.

Box 1 WAQF: MANAGEMENT BY GOVERNMENT BODIES OR PRIVATE SECTOR ORGANISATIONS?

A BRIEF WITH REFERENCE TO THE MALAYSIAN EXPERIENCE

Waqf: singular; Awqaf: plural

Due to the non-governance of the awqaf many such properties have had the fate of being sold or misused by their trustees. Since some of these awqaf were important institutions like madrasas (seminaries) and public hospitals etc., government intervention was necessary to ensure that the awqaf continued to be used in accordance with their covenants. Also, many awqaf face the fate of termination due to land acquisitions by the government.

Therefore, it is not surprising that the likes of Timur Kuran1 argues that waqf is a dead-hand system-mortmain. Because of its perpetual nature some of the waqf purposes can no longer support the needs of the country and the community. He also asserts that since it is perpetual, economic inefficiency may arise in the way the resources are allocated.

The private group would like to have control over the waqf they created, therefore, having the government control this institution has in some cases led to the deteriorations and a state of atrophy for many of the awqaf. Obviously, a private group would be unwilling to create waqf and register it under the government/waqf authority fearing that they may not benefit from it and that the government may not manage it professionally and efficiently.

There are cases of waqf not being managed efficiently or abused by the authority.

There are both pros and cons of the state-managed waqf. However, there should be distinct governance between the management and the regulatory roles of ensuring that the waqf is being managed properly; as having to play both functions may be difficult and governance issues may arise. In order to regulate the entity the authority must not be involved in managing or administering it so that there is a clear demarcation of functions and roles as part of good governance practice. In other words, the state religious council, the government or the authority of the country can play a role in governing waqf but not directly manage it. For example, they must ensure that the waqf is registered and the appointment of trustees is approved by the waqf authority to ensure that the waqf is managed properly and professionally. In addition, certain criteria must be put in place for the appointment of trustees, and accounts should be audited and submitted to the authority. Shari’a compliance with regard to the management of assets can also be reported, ensuring that assets are invested in a Shari’a-compliant manner.

All these can be created by having a waqf governance framework and waqf regulations in place.

There are many acts and regulations in place at the moment, as many states have allowed for the appointment of trustees, mutawallis, nazir and agents. However, some countries are still controlling the entire regulatory, administrator and manager role in the aspect of waqf.

Many countries, where there is no Islamic authority, have established NGOs or charitable bodies to propagate its waqf. In this case, they need to regulate their own Shari’a parameters and have their own interpretations. However, they will be subjected to the country’s own regulations under the organizations or if they are charitable or philanthropic organization, they may be subjected to charities act etc.

Currently, in Malaysia, for example, the state religious council has allowed for certain bodies to be appointed as mutawallis so they will be allowed to collect funds and manage their own waqf entity. However, the assets will still belong to the state religious council. Most of the registered waqf contribution are also allowed tax exemption status.

Waqf Authority and Collaboration with Islamic Banks in Malaysia

Malaysia has also worked with several Islamic banks to propagate waqf. In this instance, a collaborative initiative is being made to let the banks participate in the collection and disbursement of the waqf. Bank Muamalat Malaysia was the first bank to initiate this collaboration with Wakaf Selangor; to date it has collaborated with three other states in Malaysia. The advantages of this collaboration are the rigorous governance, reporting and transparency required of a bank. In addition, the wide access to their network and channels for collections help in terms of outreach and in winning trust that the public has in the management of awqaf. The waqf is jointly managed, bringing good practices, governance and other investment and financing capabilities of the banks to the awqaf. On the other hand, the Islamic banks also benefit from reputational advantage in terms of being perceived as fulfilling their corporate social responsibility. The banks have also extended financing for various waqf projects and also end-financing for the public to own a part of the waqf properties. An example is the waqf of Seettee Aisyah in Penang.

Labuan Waqf Foundation

Malaysia has also established an offshore entity called Labuan Waqf Foundation, which allows establishment of waqf under this particular legislation and body. This also allows for the establishment of a global waqf platform where the founder or testators can be of any nationality and money can be repatriated to such waqf for charitable purposes. The state religious council do not have any jurisdictions to the asset as it is registered under the offshore Labuan. However, if the asset is in the form of non-movable properties residing in the state of Malaysia and is declared as a waqf asset the particular state can exercise its rights under the jurisdiction of the state.

This particular outfit is most suitable for cash waqf where the cash is then invested like fund management, which subsequently gives a return. It provides complete governance and regulatory framework to manage waqf funds globally.

This arrangement also has some parallels in the western social finance framework like Social Impact Bonds. In the case of waqf, the operation concerns specific small scale waqf project, eyeing for maximum and inclusive participation from the targeted community through a minimum waqf contribution. The project is initiated with multiple objectives, mainly as an effort to disseminate the awareness on waqf among the community and push them to contribute, especially combining it with sukuk. This securitization would control the amount of issued certificates depending on the scale of project.

One of the few attempts to apply the concept of waqf-sukuk is the proposed ISRA-Awqaf New Zealand experience. The project, which looks very ambitious, will be implemented conjointly by Awqaf New Zealand, ISRA and Security Commission of Malaysia. The goal is to issue the worlds first waqf-sukuk worth of $1bn. The proceed of the sukuk will be utilized to establish farming industry in New Zealand and Canada. Via these farms, slaughtering animals will be provided for Muslims particularly in the west. The waste of the animals and skins will be used to produce shoes and bags, etc. The revenue will be used for charitable and social purposes all over the world. However, operational issues along with financial constrains related to the scale of the project have put it on hold.

Sukuk-waqf offers a genuine solution for Muslim countries to achieve socio-economic goals through engaging local communities in financing their projects. This situation creates a sense of responsibility towards the projects and enhances their sustainability perspective. However, the success of this model requires setting up a rigorous governance framework, focusing on good Shari’a auditing, government financial monitoring, consensual decision-making and an efficient investment committee. It is indeed a rigorous arsenal which will make the waqf institutions, if applied, getting back to their original duties towards Muslim communities.

Humanitarian Sukuk as an Innovation

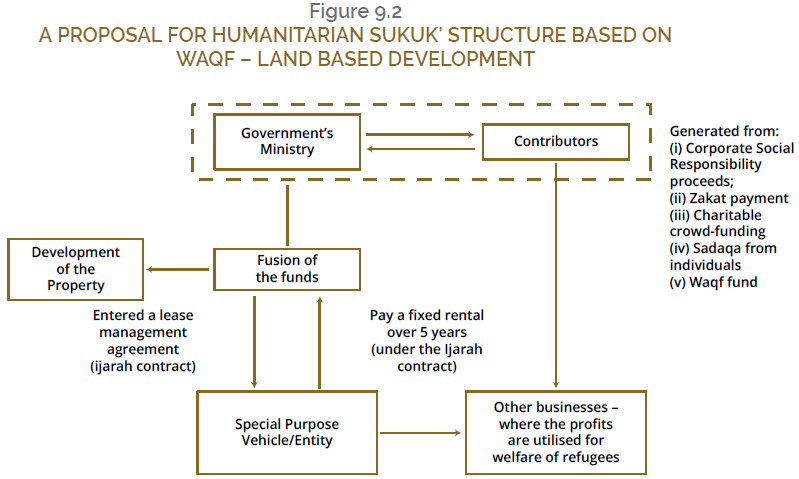

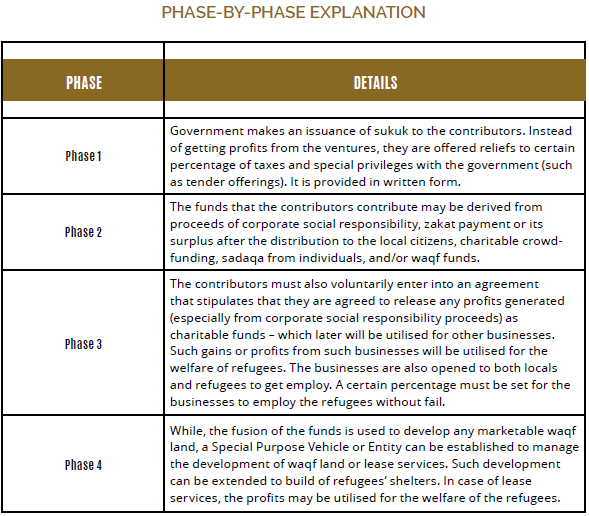

The efforts to introduce humanitarian sukuk are indeed noble and require more attention from all stakeholders of the global financial market (for an example, see Figure 9.2). The first issuance of sukuk that was based on humanitarian assistance can be traced back to 2015, issued by the International Finance Facility for Immunization for the Global Alliance (IFFIm). The said sukuk was worth up to US$500 million. Subsequently, it was again issued in 2016 with an additional issuance value of US$200 million. A collaboration with Gavi the Vaccine Alliance and the World Bank can also be traced back to this sukuk. Based on a coordination made by Standard Chartered Bank, with joint lead managers Barwa Bank, CIMB, National Bank of Abu Dhabi and NCB Capital Company, this sukuk has already matured on 4th of December 2017. According to IFFIm (2020), the sukuk was a success with oversubscription, attracting mainly Muslim global investors. The distribution of investors was also diversified with 21% from Asia, 11% from Europe, 68% from the Middle East and Africa. There were 74% involvement from banks and 26% from central banks and official institutions. However, this sukuk cannot be said to be a complete humanitarian intervention in nature since it did not involve humanitarian assistance to refugees. Its focus was on generating funds for the immunization of children from the world’s poorest countries.

In another noble attempt, the Islamic Relief Worldwide from United Kingdom tried to propose humanitarian intervention and assistance through sukuk in 2016. The issuance of such sukuk has the objective to generate funds in overcoming humanitarian crisis that was faced by refugees, especially with the flood of Syrian refugees to Europe. However, there is no apparent continuation of such efforts which was believed due to lack of fund and research. From the conventional practice, an initiative to have a humanitarian-oriented nature bond can be seen from the issuance of US$27.65 million bond by the International Committee of the Red Cross (ICRC) in 2017. They aimed to raise the funds for the purpose of building and operating three physical rehabilitation centers for those conflict-affected people that suffered from injuries and diseases. The facilities are built around African continent with established centers in Mopti, Mali, Maiduguri, Nigeria, Kinshasa, and Democratic Republic of Congo (ICRC, 2019).

From the success of such earlier issuances, it is possible to have more sukuk that stand up for humanitarian intervention and assistance. The humanitarian sukuk is also important to provide a channel for a comprehensive application of IsSF. It can be developed to generate financial funds that fulfil Shari’a requirements, while appreciating the underlying Islamic contracts, structures and operations with a sole objective to eliminate the refugee crisis and promoting human welfare. By this kind of sukuk issuance, it is not only an innovative step towards humanitarian intervention and assistance, but also it has huge potential to develop the economy of the country that receives the refugees. Majority of the refugees not only come from poor backgrounds, but there are also refugees with professional expertise, and thus have abilities to contribute to the country that receives and protects them.

Waqf as the Underlying Structure for Humanitarian Sukuk

In developing the structure for humanitarian sukuk, there is a flexibility in the selection of the structure which may be derived from the usual practice of sukuk in the global financial market. Structures such as social impact sukuk and murabaha sukuk are already adopted based on the previous successful issuances of humanitarian-oriented sukuk. Consideration should be given on the sustainability of such humanitarian sukuk, which not only has potential in developing the receiving country but also to assist the refugees in the long run. Waqf as an Islamic traditional philanthropy should be considered in structuring such sukuk. This is due to the nature of waqf itself where it must be perpetual and good. It is important to highlight that waqf and its generated proceeds can be utilized in flexible manners in supporting and protecting refugees.

There are a lot of waqf assets especially from Muslim countries (who are also active member states of OIC) that are not yet fully utilised and require funds to be developed. It is estimated that 1/3 or more waqf assets are available in Muslim countries and the majority of such assets are in the form of cultivated lands. It is believed that the value of such under-developed waqf assets may reach up to US$100 billion to US$1 trillion. It is also important to note that countries such as Turkey, Pakistan, Lebanon, Iran, Uganda and Ethiopia are among the receiving countries that accept the highest number of refugees in the world. Therefore, a consideration should be given by the receiving countries to issue a humanitarian sukuk that based on waqf.

“TURKEY, PAKISTAN, LEBANON, IRAN, UGANDA AND ETHIOPIA ARE AMONG THE RECEIVING COUNTRIES THAT ACCEPT THE HIGHEST NUMBER OF REFUGEES IN THE WORL.”

Moreover, with such huge number in total assets of waqf and their under development, it will be wasteful to leave such assets without proper management and revival process, especially due to the lack of financing. Looking into current situation, a combination between sukuk and waqf can be used to deal with the refugee crises by providing them with the required humanitarian assistance. Not only refugees can be properly assisted by the receiving countries through waqf, but the economy of the said countries may also be increased through issuances of humanitarian sukuk.