The principles of Islamic economics and finance create social finance that possesses the potential to be a robust tool offering public and private sectors alike to strengthen sustainable development in economies. According to an estimate, by 2030, 50-80% of the poor population will be in Muslim countries or countries with a significant Muslim population. Amidst these estimations, the COVID-19 shackled the global economy. This pandemic is considered to be the worst of all the past financial crises. The COVID-19 impact on economies is multifold and almost encapsulated small to medium and even large firms. Governments around the globe have announced exclusive economic stimuli and packages to tackle the pandemic. Private institutions including financial institutions have also played their role in combatting this crisis. In view of this, the importance of social and ethical finance in general and IsSF in particular is realized by the government and commercial institutions alike. During this outbreak, steps such as lockdowns, social distancing and travel restrictions have been taken as cautionary and preventive measures by the authorities at the global level to stop the spread of the virus. No doubt, these precautionary measures helped the countries reduce the number of cases and the dissemination of the disease, but the growth curve of businesses and the overall GDP of majority of the countries, especially the developing countries, have fallen and the curve of unemployment and poverty has gone up.

IsSF includes charity-based tools such as zakat, waqf and other donations and commercial-based tools such as qard al-Hassan (benevolent loan) and Islamic microfinance, and other modes of Islamic finance. These tools and instruments of IsSF have a strong capability to address major challenges such as poverty, unemployment, lack of financing for businesses and can also better align with the United Nations Sustainable Development Goals (SDGs). The Islamic philosophy of economics and the SDGs are similar in developing shared prosperity and creating economic growth to “leave no one behind”. This is even more important in the wake of visible slowdown in the growth of the Islamic finance industry (see Chapter 1).

Zakat: a mandatory giving comprising of at least 2.5 percent of the income or wealth, which should be paid by every eligible Muslim earning above a certain threshold, transforming beneficiaries into givers

The worldwide value of zakat alone is potentially US$200 billion to US$1 trillion annually.

In terms of the resource requirements for poverty alleviation, it is estimated that a country like Pakistan would need 1 to 6.77 percent of its GDP to combat poverty. Given the scarcity of resources, zakat must play an active role in such countries. For this, the collection and disbursement system needs some real changes and improvement.

Salman Ahmed Shaikh tried to estimate the nationwide zakat collection in Pakistan by including heads like zakat on the value of livestock, agriculture produce, tradable inventory, foreign exchange reserves, currency in circulation, estimated gold and silver deposits and financial assets like investments in mutual funds, stock market capitalization, National Savings Scheme (NSS), pension schemes and bank deposits. His estimates show that the zakat collection in Pakistan could approximately reach 7 percent of total GDP and is enough for covering the poverty gap in Pakistan.

Despite the tremendous potential of zakat and realizing its significance, the goal of poverty alleviation and the creation of employment has not yet been met. Contrarily, both the unemployment and poverty ratios are increasing in most of the countries. One of the main challenges in harnessing the power of zakat is the inappropriate mechanism of distribution of zakat funds that lead to a lack of transparency, loss of trust and unavailability of data. Majority of the people give zakat to their connections and relations without involving any government offices and authorities. This may be due to lack of organization and trust on the government institutions.

The main essence and objective of this obligation is the circulation of wealth in a way that the poor people are taken out from the ambit of deprivation and their living standard made better. Zakat is a positive measure of redistribution of money from the rich to the poor. If the number of poor people continues to increase and the zakat funds are managed inappropriately, the collected zakat amount will never be enough to achieve its stated goals.

Waqf: one of the dynamic tools and instruments of IsSF, which has unique features IF THE NUMBER OF POOR PEOPLE CONTINUES TO INCREASE AND THE ZAKAT FUNDS ARE MANAGED INAPPROPRIATELY, THE COLLECTED ZAKAT AMOUNT WILL NEVER BE ENOUGH TO ACHIEVE ITS STATED GOALS

Throughout the Islamic history, waqf has been used to improve the standard of living of the needy and poor strata of the community. It is no doubt that waqf is considered one of the best tools for social welfare and empowerment. At the same level, it is also an important economic device, which can be used to fulfil important needs such as employment creation for the unemployed, alleviation of poverty, financing micro and small enterprises, and facilitating other commercial and business activities. Researchers have investigated the socio-economic potential and the impact of cash waqf among Muslims in Malaysia. They selected two waqf institutions and interviewed their targeted respondents from both the institutions. Their findings showed that a cash waqf is a tool best suited for societal development.

Given the tremendous growth of waqf institutions in helping the grassroots and all up to the national level, the sector should not be limited to socioeconomic activities. Rather it should also be considered important in the state’s legal economic system, where every rule that applies on other organizations should apply to it as well. Waqf consists of versatile activities associated with every aspect of the economy such as social amenities, commercial activity, employment and the housing sector. Therefore, during policy-making related to waqf, it should be kept in mind that it affects all other associated sectors.

It is also important to consider that every policy that the government makes should impact waqf positively and does not hinder its growth. The policies that impose restrictions on free cash flow affect waqf operations in giving funds to potential beneficiaries. Since the operations and activities of waqf reduce pressure on the government budget, it is not unjustified to say that government is indirectly a beneficiary of waqf institutions. So, it is important for the government to create a favorable and flourishing environment for waqf institutions and create awareness among the general public to take part in waqf activities. Furthermore, the general public and waqf institutions should get subsidy in the form of tax relief or an incentive to promote their growth.

Islamic Microfinance: in the form of Qard al-Hassan, Mudaraba and

Musharaka

There are mainly three types of tools used by microfinancing institutions to help the poor. The first one is through qard al-hassan, an interest-free loan that is given to the poor. But for fulfilling administrative expenses microfinance institutions charge some amount of money on loan applications. The best example of this is Akhuwat in Pakistan, which has been serving the country since 2002. The second tool is financing based on mudaraba, such that the microfinance institution works as rabb al-mal and the loan-taker acts as an entrepreneur. The third tool used is the musharaka financing. The latter two tools are the least used today while the first one is very popular among microfinance institutions.

Green Sukuk: supported by the very same structures and modes as other commercial sukuk but the financing and investment parameters are defined to accommodate “green” rules and guidelines

The green sukuk have relevance with social finance as they are issued for energy, and infrastructure-related projects, etc. This segment of the market is progressing well.

The above discussion is summarized in Figure 7.1.

Economic Impact of COVID-19

On March 11, 2020, the World Health Organization declared the coronavirus outbreak as a global threat to world economies and the health system. This outbreak has a clear-cut effect on the world economy. Many countries of the world have adopted strict lockdown policies, which hampered economic activities. Consequently, they are suffering from short-term economic effects such as unemployment and inflation. The long-lasting impact of this pandemic can be seen through large unemployment due to the shutdown of several industries, such as aviation and tourism.

The COVID-19 outbreak, economic lockdowns, social distancing and travel restrictions have badly damaged global economic activity. The impact of the outbreak is alike on businesses and households. SMEs are notably vulnerable and most of them are almost on the verge of collapse and being wiped out from the economic ambit. Importantly, 90 percent of all the enterprises globally are SMEs that create more than 50 percent of employment. Considering this, COVID-19 pandemic will bring extensive loss of production output and very high rate of unemployment (World Bank, 2020).

With an alarming and exponential speed, the COVID-19 pandemic has delivered an economic shock at the global level with a heavy magnitude that is leading to a severe slowdown in most of the countries. As per the estimations of the World Bank, there is a possibility of 5.2 percent contraction in the global GDP in 2020. Moreover, in the majority of Emerging and

Figure 7.1 FIVE MAJOR TOOLS OF ISLAMIC SOCIAL FINANCE

| Qard al-hassan | This instrument could provide cost-free breathing space until the environment stabilises. One example is when some GCC central banks opened free liquidity lines for financial institutions to provide subsidised lending to their corporate, and SMEs clients. |

| Social sukuk | These instruments could help support the education and healthcare systems and attract environmental, social, and governance (ESG) investors (those investing for social reasons) and/or Islamic investors (those looking for Shari’a-compliant investments). |

| Waqf | This could help provide affordable housing solutions or access to health care and education for people that might have lost a portion of their income. Waqf endowments can, in many contexts, be important contributors to long-term resilience. Financial or non-financial assets such as land or buildings are permanently dedicated to social purposes. This can be an important way for stakeholders to contribute to the social infrastructure that serves the SDGs and help countries “recover better” over the long term. |

| Zakat | Zakat could help compensate for lost household income because of COVID-19. |

| Islamic microfinancing | This is an important tool in which both social and commercial tools of Islamic finance can be used as per the need of time. In particular, social finance, e.g., zakat and waqf based Islamic microfinancing can play a crucial role in the alleviation of poverty and the creation of employment. |

“THE SHORT-TERM COLLAPSE IN GLOBAL OUTPUT NOW UNDERWAY ALREADY SEEMS LIKELY TO RIVAL OR EXCEED THAT OF ANY RECESSION IN THE LAST 150 YEARS Kenneth Rogoff Professor of Economics Harvard University.”

Developing Economies (EMDEs), per capita incomes are also anticipated to shrink in 2020, putting millions back into poverty. Figure 7.2 looks at the situation of extreme poverty in EMDEs (World Bank 2020).

Taking this 5 percent contraction, the world could observe a potential rise in the existing number of poor people as per poverty headcount at US$1.90, US$3.20 and US$5.50 is respectively 80 million, 130 million and 124 million. If the contraction in per capita incomes hits 10 percent, the world could witness an increase in the numbers, 180 million for the US$1.9/ day poverty line, 280 million for US$3.20 poverty line and about 250 million for the US$5.50 poverty line. Under the contraction of 20 percent, the numbers will go up at a horrible rate. Figure 7.3 exhibits the potential poverty projections across regions (World Bank 2020).

In this background, the role of IsSF and the utilization of its tools is very important. The situation demands and calls for some innovative models that have a real-time impact in tackling the existing challenges and not limited to a specific region.

A Blended Model to Alleviate Poverty Using IsSF

IsSF has Maqasid al-Shari’a (the Higher Objectives of Shari’a or HOSs) built in. Historically, the tools of IsSF, zakat, waqf, and donations have been used for the development and empowerment of societies. In the era of the early Caliphates, the contribution of IsSF was very clear and prominent in the development process. Over time, however, it has diminished. The question arises then why it is not so effective in the contemporary world. There could be various explanations but poor management of funds and their disbursement is a major impediment.

“FOUR MAIN ELEMENTS ARE PARAMOUNT FOR THE REVITALISATION OF ISSF AND FOR HARNESSING ITS POWER FOR ALLEVIATION OF POVERTY AND EMPLOYMENT CREATION, NAMELY SHARI’A, TECHNOLOGY, SOCIAL IMPACT, AND FINANCE.”

Zakat Agency: It can be a government body (Religious ministry or Zakat and Ushr Department) or any private entity registered within the government body.

Zakat funds: Zakat funds include annual zakat as per nisab, ushr (zakat on crops), and zakat al-fitr. The model has multiple payment gateways to make it easy for the donors to pay zakat. In these payment gateways, both local and international payment service providers could be enlisted.

Zakat manager(s): Zakat funds will go to a zakat manager, an entity or group of entities (government institution such as SMEDA in Pakistan, OTF in Oman, and MDEC in Malaysia or private registered institutions), capable of performing the following functions and responsibilities:

- Registration and on-boarding of beneficiaries (e.g., the unemeployed);

- Scrutinizing of beneficiaries in light of their skills and experience, etc;

- Training and developing the skills of the registered beneficiaries; and

- Disbursement of funds.

Disbursement of Funds

The funds will be divided into two types i.e., non-refundable and refundable. The non-refundable fund will be the small portion of the total funds provided to recipients without repayment in terms of instalments. The refundable fund will be used for microfinancing and will be provided to people who are able to use it for starting a business or for the expansion of their existing business.

Role of the Zakat Manager

- Monitoring and assessment of the performance of businesses (by the beneficiaries)

- Collection of repayments

- Real-time updates regarding the businesses on the portal and app so that zakat givers would be able to see the utilisation of their money.

Uniqueness of this Model

- Zakat beneficiaries would become zakat givers

- Will have a great impact on poverty alleviation and employment creation

- Economic activity would be boosted

- Economic growth would also sprung up

- Latest technologies ML and DS based platform

- Country-based causes

- Small businesses (self-employed)

- Interest-free loan to own

- Product-based financing

- Learn to earn (vocational training)

- Skills development

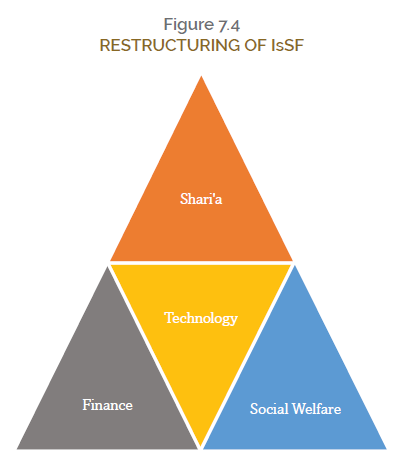

- Job placement

Four main elements are paramount for the revitalization of IsSF and for harnessing its power for alleviation of poverty and employment creation. These four elements are Shari’a, technology, social impact, and finance (see Figure 7.4). The dilemma with existing IsSF is that these four elements are not combined in practice. Resultantly, it faces challenges such as lack of transparency, lack of trust, informal collection and disbursement of funds, and inappropriate management.

The present Islamic finance industry involves only three of the four elements, i.e., technology, Shari’a and finance. The current COVID-19 scenario makes it imperative to incorporate the element of social welfare.

Zakat-based Microfinance: A way to Alleviate Poverty

The power of the zakat emanates from its management, i.e., its proper collection and distribution. The real benefits of using this tool could not be attained if the zakat system is outdated and not as per the requirements of present times. Moreover, if this tool is combined with other Islamic financing tools such as microfinance, it can be more useful and better managed. Zakat-based microfinance is not a completely new concept, as this has been in practice in various countries such as Malaysia, Indonesia and Bangladesh.

One of the reasons for the failure of the zakat system is that the zakat distribution is being done traditionally in various countries (such as Pakistan) and the majority of the zakat payers pay it informally. In an informal system, individuals pay zakat to their known needy persons in small pieces. This amount offers help for a very short time and temporarily. In the next year, the same recipient remains in the list for receiving zakat and the cycle goes on. Likewise, in the centralized system, where zakat is being collected by the government and registered NGOs, zakat is distributed in various sectors in small amounts. In a gist, it can be said that zakat funds are distributed as a charity and not managed in a way as the financial funds are managed. Resultantly, the people who receive this small amount every year do not come out of poverty.

This necessitates to come up with a kind of model that would break this cycle of the poor remaining a zakat recipient for years (see Box 1). In the proposed model, the zakat funds are utilized as microfinance funds. The utilization could be based on qard al-Hassan or any other viable mode. The zakat will be distributed in a way that each year the recipients’ number would go down and eventually, those who were the recipients will become zakat givers.

The tremendous growth and development in the field of Machine Learning and Data Science is an opportunity that can be utilized from the initial step to the distribution of zakat. Through Machine Learning, the platform will classify the zakat beneficiaries in terms of need and deservedness for zakat. After the classification of beneficiaries, there will be a second layer of verification that could be done by humans or can be automated as well through integration with the local identification systems such as NADRA in Pakistan. In the distribution step, Data Science will be used to analyze the donation collections, need of countries and how much funds should be distributed to a country. In the final step of the zakat distribution, the system will recommend the amount and the category that will be given to the individual according to the application submitted. On each step the donors will be notified about their donation status and what impact their donation has created. In this way, the whole process will move to automation and 100% transparency can be achieved.

This is only a snapshot of what could be done vis-a-vis use of zakat in the wake of COVID-19. The next chapter offers a detailed analysis of what BAZNAS has achieved in Indonesia.