In the recent past, policymakers are shifting the economic policies to embrace a new set of guiding principles, a sustainable world that promotes social justice, environment-friendly and inclusive growth. This is a change from the common policies in the past, which solely focus on economic development and job creation. Even though these policies were effective, uplifting millions, if not billions of people from poverty, there are gaps particularly in addressing hardcore poverty, social justice and climate risk.

The need to see the world differently paved the path for a more inclusive policy and gave birth to the Millennium Development Goals (MDGs). The MDG declaration signed by 191 countries in the year 2000 had eight goals and 21 targets to eradicate extreme poverty and hunger (MDG 1); to achieve universal primary education (MDG 2); to promote gender equality and empower women (MDG 3); to reduce child mortality (MDG 4); to improve maternal health (MDG 5); to combat HIV/AIDS, malaria, and other diseases (MDG 6); to ensure environmental sustainability (MDG 7) and to develop a global partnership for development (MDG 8). Despite its short extent, MDGs achievements were remarkable and hailed as the most successful anti-poverty movement in history. According to former UN Secretary-General Ban Ki-Moon “The MDGs helped to lift more than one billion people out of extreme poverty, to make inroads against hunger, to enable more girls to attend school than ever before and to protect our planet. ”The expiry of MDGs in 2005 was succeeded by a greater and more ambitious plan. Sustainable Development Goals (SDGs) were crafted not only to continue meeting some of the objectives that fell short but also to cover a greater number of new goals and targets. Building on the principle of “leaving no one behind”, these 17 high-level goals are more holistic, encompassing economic, social and development goals. The new goals, among many, include perseveration of life underwater and on land, clean water and sanitation, affordable and clean energy, and sustainable cities and communities. In short, the main agenda of SDGs is to improve the quality of people’s lives by eradicating poverty and hunger, reducing inequalities and gender disparities, building sustainable infrastructure, combating climate change and protecting oceans, forests and biodiversity.

It is apparent that the success of SDGs hinges on large financial resources and greater support from the government and private sector. Thus, the presence of a comprehensive and well-structured financial system is said to play an effective role in financing SDGs’ initiatives. Thus, the absence or the lack of it is becoming an impediment to achieving the set targets. According to the latest SDG report or scorecard, funding remains a major bottleneck to accelerating progress towards the SDGs. In a recent survey by Sustainable Development Solution Network (SDSN), only 18 of 43 countries include SDGs agenda as part of the government budget, reinforcing the need for a larger investment from the private sector.a

“THE MDGS HELPED TO LIFT MORE THAN ONE BILLION PEOPLE OUT OF EXTREME POVERTY, TO MAKE INROADS AGAINST HUNGER, TO ENABLE MORE GIRLS TO ATTEND SCHOOL THAN EVER BEFORE AND TO PROTECT OUR PLANET.”

Ban Ki-Moon Former Secretary General, UN

The need to mobilize larger financing or investment on SDGs agenda permeates globally, particularly in the Muslim countries due to the apparent gap to attain the set targets. Islamic finance, being one of the fastest-growing sectors in the global financial industry, is an obvious option for assisting the Muslim countries to tap into substantial and non-traditional sources of financing for the SDGs. The fact that the Shari’a-compliant sector has been rapidly growing at the rate of 11.7% percent annually provide a great opportunity for financing or investment in SDGs related initiatives (see Chapter 1). Considering, most of SDGs initiatives resonate with the objective of Shari’a, juxtaposing both initiatives seems to be an ideal way for Islamic finance to grow and play a greater role in the development of Muslim nations.

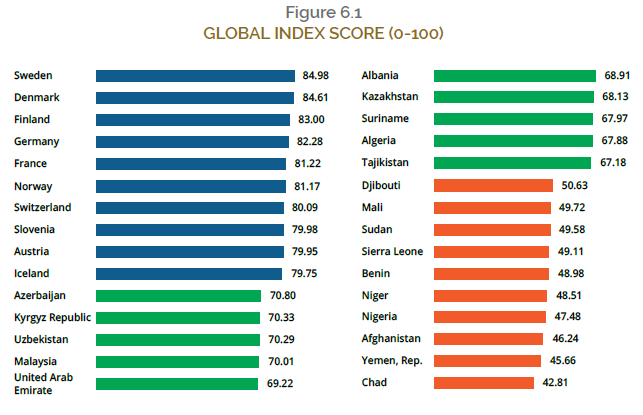

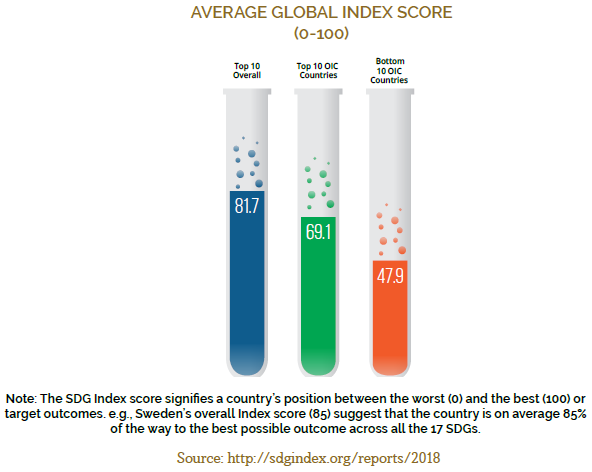

It is evident that many Muslim countries today are far behind in providing the basic needs and living standards (e.g., food, shelter, safety, etc.). A glance at the ranking shows that there is a huge gap in term of overall SDG performance between the Top 10 SDG countries (blue) wherein none of them are Muslim countries and the Top 10 OIC countries (Green) together with the Bottom 10 OIC Countries (see Figure 6.1).

Figure 6.1 also illustrates the standings on Muslims countries relative to other nations. The gaps reflect the socio-economic problems and challenges that prevail in Muslim nations including: (i) extremely high poverty rates and widening income gap; (ii) frequent series of economic crises and financial instability; and (iii) pollution, environmental and climate change threats. The rankings also highlight the predicament and malaise of the Muslim nations. Albeit blessed with natural resources and sizable human capital, the majority of Muslim nations are still a long way off in attaining the set targets. Alas, none of the Muslim countries was listed in the top 40.

Rather than looking at the challenges and issues in totality, this chapter reflects on the several SDGs that are related to the ‘preserving of life’ HOS and No Poverty (SDG 1), Zero Hunger (SDG 2), and Good Health and Wellbeing (SDG 3). The fact that these SDGs are highly critical to Muslim countries, which mostly are inept to provide necessities to the masses, trapped in vicious poverty circle and extremely vulnerable to multitude form of threats (e.g., health, political, economic, etc).

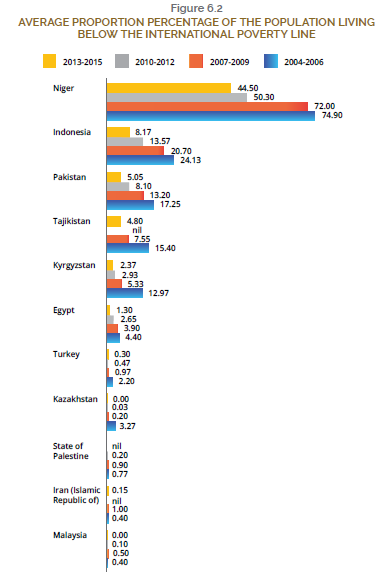

Despite the ironies and perplexities, there is a still a silver lining where a proportion of the population living below the international poverty line ($1.90 a day at 2011 international prices) in Muslim countries has declined over the years. Indonesia, for instance, had shown remarkable progress in poverty eradication where the percentage of hardcore poverty had dropped from 25 to 8 percent (refer to Figure 6.2). Surely, the success in one SDGs will be the beginning to achieve more in other SDGs as well.

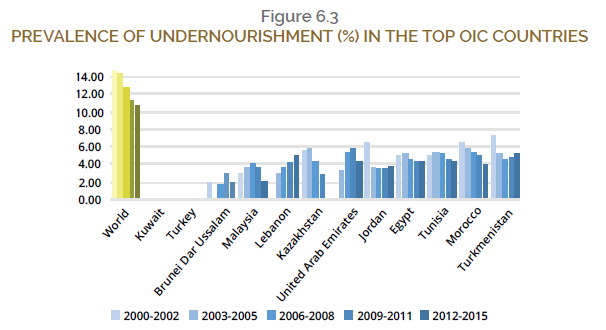

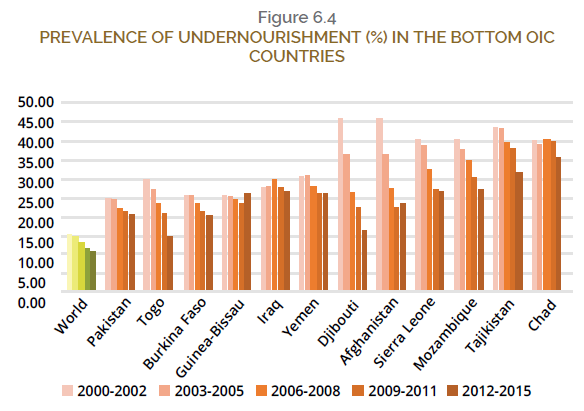

In addition to ending poverty, Muslim nations are also making positive inroads to end hunger (SDG 2), ensuring access to safe and nutritious food. Figures 6.3 and 6.4 depict that the rate of undernourishment has shown a downward trend of the years, particularly in top OIC countries. Unfortunately, the same cannot be said for the bottom OIC countries as the improvement had been marginal or stagnant at worst.

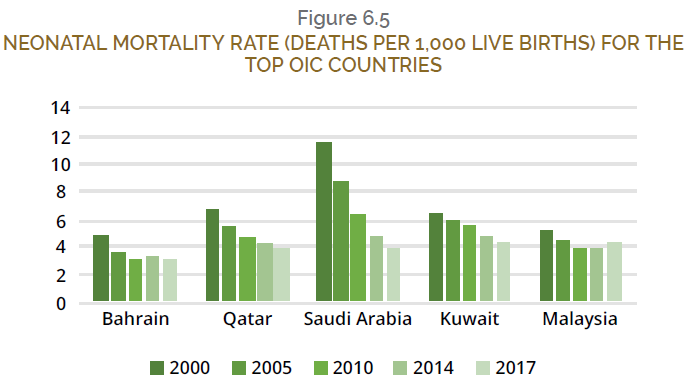

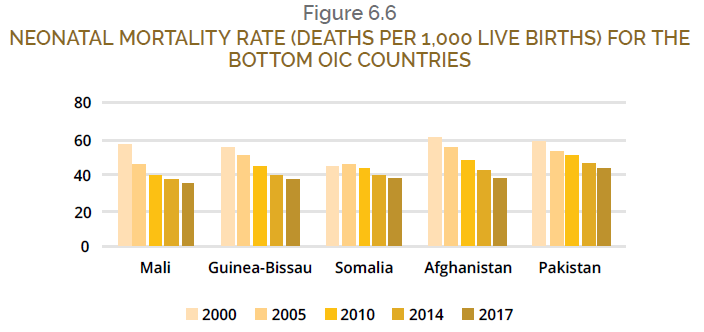

In terms of performance related to the Good Health and Wellbeing Goal (SDG 3), Figures and 6.6 demonstrate a large disparity in the health system among the Muslim countries, some are exceeding the global standards while many are still facing basic issues (i.e., low- income Muslim countries, especially in Sub-Saharan Africa and Central Asia). For instance, the neonatal mortality rate (deaths per 1,000 live births) for the top OIC countries have reduced significantly, particularly for Saudi Arabia. Encouragingly, despite a high neonatal mortality rate among the bottom OIC countries, there is a positive sign based on the marginal decline over the years.

The three highlighted SDGs are just to provide a glimpse of the attainment of Muslims nations. The room for improvement is huge and requires a myriad of initiatives. Nevertheless, we conjecture that these initiatives can be clustered into six pillars: governance, legal, infrastructure, human capital, partnership and the most important financial resources. As highlighted before, Islamic finance has a crucial role to play in terms of mobilizing funds to support these initiatives. Notwithstanding, some of these initiatives may not be viable in terms of profitability for Islamic banks and asset management companies but alternative financing mechanism such as IsSF deems to be a viable and perfect solution.

Success Stories

As the world will require technical assistance and financial support between US$5 trillion to US$7 trillion annually to achieve the SDGs 2030, the IsSF has a significant role in providing financial assistance to materialize the goals. The report of the UN High Commissioner for Refugees (UNHCR) has estimated that the current zakat given worldwide stands at US$76 billion, which is modest in the context of US$1.7 trillion in wealth held by high-net-worth individuals in the Middle East, and separately, US$2.733 trillion in assets held globally by the Islamic finance industry. The UNHCR also has estimated a potential of US$156.9 billion in zakat collection from five Muslim countries.

Zakat, waqf, and sadaqa as tools for wealth redistribution can be used to address the basic needs of the extremely poor and the destitute, create a social safety net and provide financing for Micro, Small and Medium Enterprises (MSMEs) as well as to support sustainable infrastructure projects. The principles underlying waqf, for instance, allow for the financing of socially beneficial endeavours. In such cases, capital or funding could be raised through the issuance of waqf shares, sukuk or fund to undertake not only welfare but also commercially-driven activities within the economy and thus offer a comprehensive approach towards enhancing financial inclusion and supporting poverty reduction. These instruments are being mobilized as part of the formal financial system. The integration with formal finance has helped to build greater transparency and governance, as well as trust amongst stakeholders. IsSF has the capacity to facilitate financing to the unbanked society. Financing to the low-income society is characterized by a higher default rate and higher cost of the fund when compared with retail and corporate financing. The fund provided by the IsSF is economically absorbing so that it would not create systemic risk.

The IsSF tools have been widely used, especially in poverty eradication, financial assistance for MSMEs, financing sustainable infrastructure and so forth. UNHCR’s zakat programme is one example of the efforts of how zakat fund can be mobilized in supporting refugees. Majority of refugees fall under at least four of the eight stipulations required by the recipients of zakat funds i.e., the poor and needy, in debt, or whose journeys have been interrupted by lack of funds. Over 50% of refugees under UNHCR’s care come from just five countries, most of which are predominantly Muslim: Syria, Afghanistan, South Sudan, Myanmar and Somalia. The mode of distribution of the UNHCR is quite innovative to ensure that funds reach directly to the targeted people who have been vetted and designated as most in need of assistance. Refugees access their allocated funds through iris-scan-enabled ATMs in Jordan, which in addition to being fast and convenient, adds an important feeling of control, dignity and normality to refugees during a very stressful time. In Lebanon, refugees are benefiting from cash assistance programmes to withdraw funds through bank cards. UNHCR’s zakat programme, established upon five authoritative fatwas, has already disbursed US$14.4 million to 6,888 families across Jordan, Yemen and Lebanon, from 2016 to 2018. US$11.4 million was donated from large institutions and US$3 million was generously raised from the wider public.

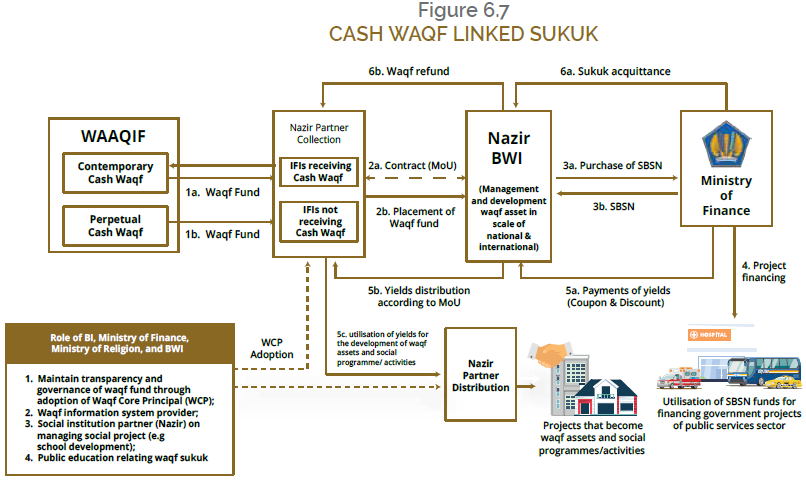

The issuance of Cash Waqf Linked sukuk by the Indonesian government (Figure 6.7) has offered an opportunity for the donators to contribute to the government social assistance programmes such as disaster relief efforts in areas hit by earthquakes. Under the new scheme, when the sukuk matures, the funds will be returned to the donators in full, but not including the yield. The yield will be reinvested to manage waqf assets.

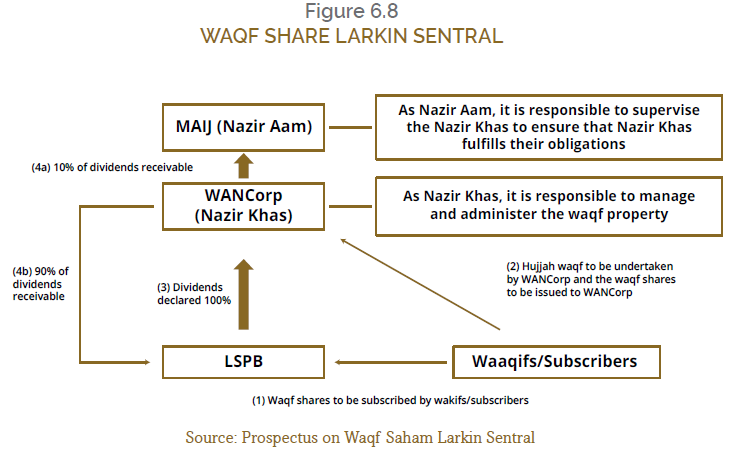

The issuance of Waqf Share Larkin Sentral (WSLS)1 by Waqaf An-Nur Corporation Berhad (WANCorp) has offered the opportunity for institutions and the public to contribute to financing sustainable infrastructure projects (see Figure 6.8 for the structure of the deal). Up to 850 million ordinary shares offered to institutions and individuals at RM0.10 per share, which will be subsequently endowed (via waqf) to WANCorp. The proceeds will be used primarily for the upgrading and refurbishment of Larkin Sentral as well as to fund the acquisition of land for the proposed development of a seven-storey car park.

Rumah Zakah Indonesia (RZI), which spends on an annual basis US$8 million in healthcare, infrastructure, rescue team, farming & livestock, economic development, and educational reform is another good example of how IsSF tools can be mobilized to support the development of sustainable infrastructure and inclusive growth. RZI runs its hospital in Medan, Pekanbaru, Jakarta timur, Semarang, Bandung, Yogjakarta, Surabaya and Makassar.

Additionally, a zakat fund of US$350,000 has been channelled by BAZNAZ to finance the construction of Micro Hydro Power Plant in Jambi. The plant has provided electricity for a total of 806 households, 8 schools and 5 clinics for children and pregnant women, benefiting at least 4,448 people directly and many more businesses and services indirectly. Shaukat Khanum Memorial Cancer Hospital & Research Centre, Pakistan since 1994 has provided financial support to 75 percent of its patients with the cumulative philanthropic spending reaching US$148 million. South Africa National Zakah Fund (SANZAF) allocated US$1.2 million for bursaries at tertiary level for the academic year 2014. SANZAF has been offering bursaries from early on in its history (minutes record that a bursary for US$200 was granted as early as 1974).

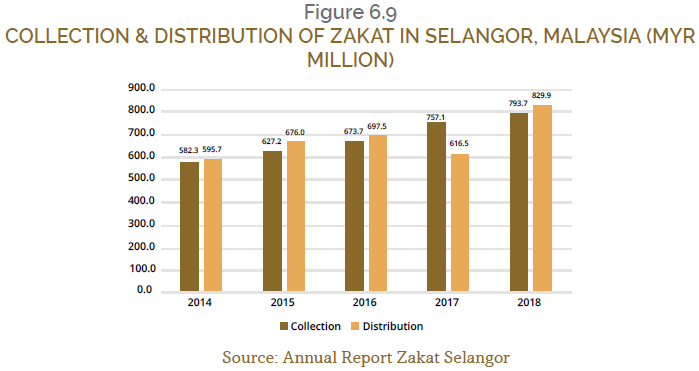

Zakat Selangor in Malaysia utilizes financial technology to improve its collection and distribution of zakat. The zakat payment can also be made via debit and credit card, ATM, online and mobile banking. E-Taisir introduced in 2013 enables the distribution of zakat to asnaf through MyKad, i.e., identification card. The zakat recipients can buy groceries at the selected supermarket, which has a POS terminal for E-Taisir. Thanks to the digitalization, the collection and distribution of zakat in Selangor have increased significantly since 2014, as shown in Figure 6.9.

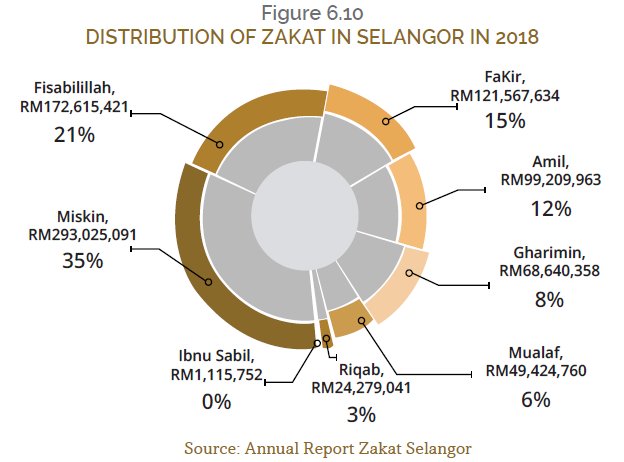

The distribution of the zakat fund in 2018 is shown in Figure 6.10. More than 50,900 poor and needy families benefitted from the programme. Beneficiaries such as the poor, the needy, riqab (prisoners), gharimin (refugees), fi sabillilah (general charitable causes) and ibnussabil (strangled travelers) are clearly mapped with the SDG 1 (No Poverty), SDG 2 (Zero Hunger), SDG 3 (Good Health and Well Being), SDG 4 (Quality Education), and SDG 10 (Reduced Inequality).

Building affordable houses on waqf land has been mooted by the Malaysian federal government2. Other countries like Saudi Arabia, Singapore and Selangor3 have also allowed developing waqf lands by way of leasehold basis. This is deemed to be consistent the principle of the perpetuity of the waqf, as there is no transfer of ownership. The market value of registered waqf land in Indonesia is estimated to be equal to US$60 billion, while there are about 490,000 registered waqf land in India with a total area of about 600,000 acres and with a book value of about US$24 billion. The waqf lands in Malaysia are estimated about 11,091 hectares and are valued at US$384 million.

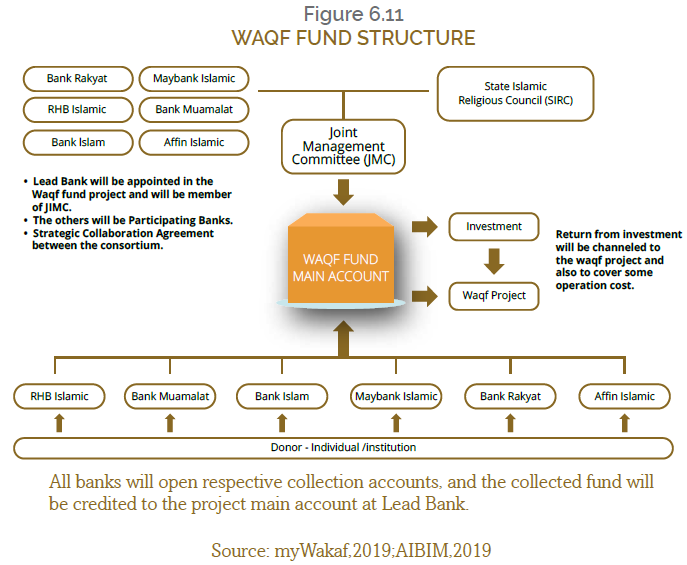

myWakaf under the Islamic Banking and Financial Institutions Malaysia (AIBIM) will provide an avenue to bridge the MSMEs with the donators and investors especially the growing number of angel investors who are willing to support genuine entrepreneurs. myWakaf comprises of participation from six Islamic banks, namely Affin Islamic Bank, Bank Islam, Bank Rakyat, Bank Muamalat, Maybank Islamic and RHB Islamic Bank. Under this arrangement, Islamic banks would collaborate with the State Islamic Religious Councils (SIRCs) in developing the potential of waqf and empower the economy of people in Malaysia. The waqf fund from an endowment of individuals and corporations aims to be utilized for education, health, investment, and economic empowerment (see Figure 6.11).

In terms of collection, funds available through participating bank branches have exceeded RM1.5 million. Since April 2019, myWakaf has entered in its second phase with the launching of the myWakaf portal, offering various channels of collection across the country. Donors may choose to subscribe to JomPAY or internet transfer to channel funds to their project of choice located in several states, including a hemodialysis service at the Tunku Fauziah Hospital in Perlis, a boat waqf project in Perak, the Islamic school in Negeri Sembilan, and the Al-Bait waqf fund in Sarawak. It is easier, more effective and tax-exempt contributions (myWakaf, 2019; AIBIM, 2019).

Another effort taken by IFIs in maximizing the IsSF tools in connecting the benefactors with the needy people is through sadaqa (charity) account such as BIMB’s Sadaqah House, Alliance Islamic Bank’s SocioBIZ, and Affin Barakah Charity Account-i. Donations can be made via mobile banking, internet banking and Quick Response (QR) code.

The innovative integration of IsSF tools with markets and technology is increasingly becoming a significant enabler to further advance the cause to broaden financial inclusion. IsSF presents itself as a unique and powerful tool to supply social capital to the underserved segments of society and create a significant impact to socio-economic development, bring about stability and spur sustainable practices and outcomes. The application of market-driven mechanics and cutting-edge technology such as blockchain into IsSF should contribute towards building of greater trust and transparency and help change communities’ mindset towards focusing on the broader objectives of Shari’a.

Financial Technology (FinTech) is useful in accelerating the distribution of funds. FinTech through its innovative technology makes it possible to control who receives the money and how the money is spent. The electronic payment systems could address potential abuse in IsSF. The funds can be distributed to the beneficiaries electronically to ensure that they reach the intended beneficiaries.

The IsSF institutions should utilize digitalization in addressing issues regarding transparency, efficiency and productivity in delivering the trust that is given to them. Strengthening the governance and performance measurement framework with embedded technology such as blockchain, big data, artificial intelligence, and machine learning will help IsSF in broadening its services across countries. The modus operandi of some FinTech models are highly congruent with the Islamic finance principles, with the latter’s focus on asset-backed transactions and risk-sharing. FinTech can make screening transactions quicker and easier, improve traceability and security, expand Islamic finance penetration and strengthen governance.