Introduction

COVID-19 has appeared to bring back the poverty clock, unemployment, low per capita income, financial instability, and inflation even in developed economies. This pandemic produced hurdles in achieving the sustainable development goals (SDGs) recommended by the United Nations (UN) as a new global development agenda. A series of research papers and reports appeared to give importance to the problem and possible solutions. Islamic finance can alleviate these social and economic abuses through diversified Shari’a-compliant tools and Islamic financial institutions (IsFIs). This chapter explores Islamic finance opportunities to align with SDGs in a post-COVID world to provide relief to those who are affected in this regard. It discusses the possible ways to overcome the socio-economic problems of the day in the framework of Islamic finance. The potential role of Islamic finance in stimulating economic activities for individuals, SMEs, corporations, government, and welfare organizations in the post-COVID world is also highlighted. Therefore, this chapter recommends that countries with a Muslim majority adopt the Islamic financial market products for capital formation, financial inclusion, employment creation, resources mobilization, and investment invitation after surviving the pandemic. Likewise, the UN and other international market players are recommended to adopt Islamic finance to achieve SDGs. It is also suggested that the processes critical for implementing the SDGs are reviewed with the help of high-quality, accessible, timely, and reliable data. Overall, every economic indicator has performed unsatisfactorily during the COVID-19 pandemic.

Different variants of COVID-19 have adversely affected people’s economic conditions across the globe. For fear of the spread of the virus, which is highly contagious, almost every country imposed locked down because of which industries, markets and even restaurants have been partially operating, resulting in high prices of products in most of the cases. Other than that, many industries and organizations laid off their employees due to financial crisis. In short, countries everywhere have been bested with high inflation and unemployment due to COVID-19-induced economic disruption. There has been an extraordinary rise in workers submitting unemployment insurance claims in different countries. On the other hand, people with the job have to deal with psychological stresses emanating from the fear of losing jobs. According to a random estimate, almost 25 million people across the globe are at risk of losing their jobs due to the COVID-19 – study documented that this uncertainty and loss of employment have manifested in high incidents of suicides. Therefore, the 2030 completion deadline of SDGs is at risk from all dimensions in socially and economically weak countries.

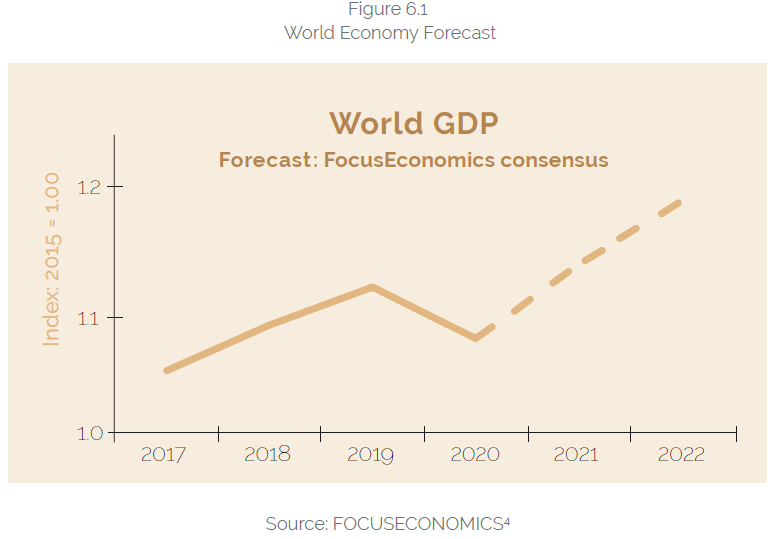

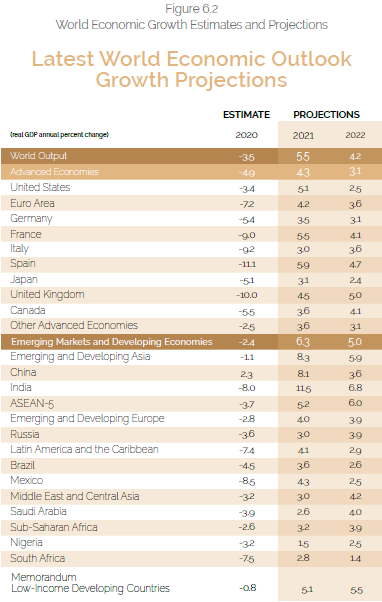

The global economy was expected to take off in 2021 at a different pace, as the world would undoubtedly benefit from vaccinations, lockdowns, and coronavirus SOPs. However, it will take time before the full benefit of vaccination is felt in the form of economic stability. In the case of developing countries, the time lag could be even longer. The Organization for Economic Co-operation and Development (OECD), the representative of 38 inter-governmental member countries, has reported: “Prospects have improved over recent months with signs of a rebound in goods trade and industrial production…. Global GDP growth is now projected to be 5.6% this year. World output [was] expected to reach pre-pandemic levels by mid-2021.” The International Monetary Fund has also predicted similar growth with additional descriptions for advanced, developing, and low-income developing countries (for details, see Figure 6.2).

Being a vital part of the economic and financial system in several Muslim and Non-Muslim countries, it becomes necessary for Islamic finance to provide cost-effective and user-friendly opportunities in these difficult times. Islamic finance offers a paradigm for an equitable distribution of resources to discourage the concentration of wealth in a few hands. Through its several tools such as waqf, zakat, charity, and donations, Islamic finance can solve all the socio-economic objectives outlined in the SDGs. In short, Islamic finance can become an excellent operative vehicle for SDGs in these testing times.

This chapter’s main objective is to draw attention of the policymakers in understating the role Islamic finance can play in achieving the SDGs within the framework of Islamic economics.

This chapter’s main objective is to draw attention of the policymakers in understating the role Islamic finance can play in achieving the SDGs within the framework of Islamic economics. The paper is divided into five sections. The first and second sections comprise the introduction and the history of COVID-19. Section three explains different aspects of SDGs as delineated by the UN. In section four, Islamic finance’s potential to meet crises in these challenging times is presented. Finally, in the fifth section, the paper gives recommendations to move forward in the post-COVID-19 world.

Advent of COVID-19 as Pandemic

On 30th January 2020, the World Health Organization (WHO) announced the coronavirus outbreak as the sixth public health emergency of international concern (PHEIC). On March 11, 2020, it was declared a pandemic. The striking similarities of crises in the past eight centuries leading up to COVID-19 have been recounted as well. According to the former chair of the US Federal Reserve, financial imbalances and risks grew over the years to culminate in the 2007–2009 global financial crisis (GFC).

Some believe that the COVID-19 crisis is genuinely different in scope, effects, and severity from past emergencies. Previously, because of lack of facilities, pandemics would result in millions of deaths. However, in this era of information technology, globalization, and economic and financial integration, COVID-19 has been less harmful than its predecessors. That does not mean coronavirus was not lethal. It did, however, take a toll on lives, economic activities, and social well-being. Quarantines and lockdowns brought social unrest, anxiety, insecurity, and unemployment in almost every economy.

Every pandemic had its impact. For example, during the pandemic outbreak in 439 A.H, in Baghdad, the commodity prices skyrocketed, such as the pomegranate price rose to two, a chick to two qirat, and cucumber to one qirat.

SDG 3 (Good Health and Well-being), SDG 4 (Quality Education), SDG 8 (Decent Work and Economic Growth), and SDG 17 (Partnership for the Goals) has been the subject of extensive discussion. However, the pandemic’s impacts on other SDGs have not received considerable attention.

Development that meets current needs without compromising the future is called sustainable development. The first SDG theory was presented and defined by Bruntland Commission in 1987. Later different definitions emerged, but all of them revolved around the concept presented by Bruntland Commission. In short, the SDGs’ evolution and integration into economic, social, and environmental dimensions have been incremental.

According to, in the early 60s, sustainable development was primarily seen in the context of material productivity. Therefore, economic development theory played a significant role in the overall development agenda of many countries. Later in the 1980s, environmental protection theory took center stage in the sustainable development paradigm.

The concept of sustainable development clarified that while we strive to improve our present, we also must ensure that these efforts benefit the new generations in the same zest. In this way, both short-term and long-term policies would be developed for the implementation of SDGs.

Researchers have been discussing challenges like energy crises, rising poverty, growing unemployment, health problems, environmental issues, and climate changes for years. Each of these issues causes economic and financial inefficiencies. To overcome these fundamental problems, the 2030 agenda of SDGs was introduced. The Europe 2020 strategy also presented the agenda of growth, employment, and innovation to achieve small, sustainable, and inclusive growth, keeping in mind the environmental issues.

COVID-19 has affected human life in three dimensions: economy, social life, and environment. First, it pollutes the environment because it survives in the air, surfaces, fabrics for a while and spreads through it.

Second, to prevent the spread of the virus, quarantines and lockdowns were introduced with significant impact on unemployment, food shortages, rising food prices, hunger, and poverty. Third, due to the sudden increase in the demand for medicines, the supply of medicines became very low, resulting in high prices. All these things together created an economic imbalance.

Interestingly, the scope of SDGs also addresses economic, environmental, and social problems. It has the prescription to cure existing crises and future shocks. Therefore, targeted actions can help the world achieve the SDGs.

The SDGs 1, 2,3, 8, 9, and goals can assist countries during COVID-19 in poverty reduction, zero hunger, good health and well-being, decent work, economic growth, industrial innovation, infrastructure development, and responsible consumption and production pattern. Therefore, to reduce the worst effects of COVID-19, countries should prioritize their strategies and actions in these directions.

Researchers have identified the gaps in understanding the relationship between Islamic finance and sustainable development in the backdrop of COVID-19 and its obstructive impact on economic growth. Notwithstanding the connection, little effort has been spent exploring their applicability. Therefore, in the next section, we intend to explore the opportunities of Islamic finance as a tool for sustainable development through Islamic financial products.

Opportunities for Islamic Finance

Globally, governments are taking immediate steps to counter the emerging issues resulting from the COVID-19 pandemic. Unlike other traditional economic and financial systems, the Islamic financial system has remained relatively stable and guarded in the face of economic and financial vulnerabilities. A glimpse of this quality was also seen during the financial crisis of 2007-08.

One of the distinguishing features of Islamic banking is that it delivers funds to its clients through its unique products without increasing the level of debt. This quality proves that Islamic banks are more resilient than their conventional counterparts. The literature provides enough evidence regarding the positive role the Islamic banking industry had played in economic growth even when the whole conventional system was facing crises in 2007-08.

This is because of its unique nature of operations, products, and services linked with the real sectors of the economy. All stakeholders of the financial system are very sensitive regarding its soundness, and this quality of the financial system determines the efficient channelization of funds throughout the economy. This quality of soundness is a crucial factor in regulating and monitoring the financial performance of the economy. Available empirical literature shows that banking growth is positively related to economic growth.

Therefore, the Islamic banking industry was found more resilient after the 2007-08 financial crises. It was also found that Islamic banks showed asset growth and higher credit achievement than their conventional counterpart. Therefore, rating agencies assessed IBs as more favourable for financial stability in the post-crisis era. The theoretical analysis of the Islamic banking performance suggests that Islamic banks had performed remarkably well in the last decade.

The quality of inclusiveness in Islamic finance has enabled it to show rapid growth over the globe during its shortage of 4 decades compared to its conventional counterpart. The global Islamic financial industry is submitting 12.71% accumulated annual growth (2009-20) in core markets worldwide. It has increased its total global assets from US$1.063 trillion in 2009 to & US$2.941 trillion in 2020, and it is forecasted to reach US$3.789 or US$5.115 by the end of 2025, depending on the underlying assumptions (see Chapter 1).

These estimates may be adversely affected by the COVID-19 pandemic because strict measures taken by governments to contain its harmful effects will likely slowdown Islamic financial growth. However, Islamic finance has now spread worldwide and is submitting increasing growth rate year by year. Therefore, hopes attached to the Islamic financial system will help the world find a concrete solution to the current economic challenge. Recently, UNDP called for Islamic finance to play its role in these circumstances of economic pandemic crises. While CodePandemic has significantly affected the performance of financial institutions, it has also brought some opportunities for them, which will not only improve their reputation and performance but also create employment opportunities for the people of the society. It is a better opportunity for Islamic financial institutions to take advantage of this opportunity because they have various modes of financing compared to their conventional counterparts, which have minimal modes at both sides of their balance sheets. Islamic banks were more stable, having higher capitalization and liquidity reserves before the 2007-08 crises. Similarly, financial products offered by Islamic banks are playing a positive role in economic growth. It was observed that the financial stability of the whole financial system was positively related to Islamic banks. Thus, within the paradigm of Islamic finance, different opportunities may stimulate economic activities, help in capital formation, mobilize economic resources, and produce jobs.

In the multiplicity of Islamic finance opportunities, Islamic microfinance is at the heart of economic revival to enhance the capabilities of poor people to enable them to be financially strong, but its outreach is minimal compared to its conventional counterparts. Therefore, it is necessary to strengthen the targeted segments concerning knowledge and skill through training in the Islamic microfinance business. In a survey of the 255 microfinancing institutions (MFIs), Islamic microfinancing was less than 1% of the total reach. On the other hand, the survey showed that Shari’a-compliant microfinancing played a significant role in stimulating economic activities and their scale effectiveness was also higher than other institutions. Likewise, IsMFIs were playing an influential role in empowering the lower class of society, enhancing their living standards, through four broad modes of finance: PLS, non-PLS, Islamic social enterprise, and charity.

Potential Role of Awqaf

In a pandemic, waqf is an essential instrument of Islamic social finance. Muslims have practised it at every age. The definition of waqf is that while retaining ownership, the benefit of the property should be reserved for all or a particular class. It cannot be sold or transferred. The first waqf in Islam was made by the Holy Prophet Muhammad (PBUH). He donated seven gardens which was the first waqf in Islam.

The second waqf in Islam was done by the second caliph Umar Farooq. After that, in his time, other companions made many waqfs. Whenever the Prophet (PBUH) faced a complex issue, he used to encourage his companions. In response to his encouragement, the companions used to donate the desired thing for the more significant benefit of society. Thus, waqf has a fundamental status in the Islamic financial system. Throughout Islamic history, Islamic Waqf has played a vital role in meeting the needs of the poor and needy, making them financially self-sufficient, equipping Muslims with science and art, providing relief to the sick, and financially supporting the students and scholars. Hence, cash waqf, qard hasan, and zakat can be effectively channeled through Islamic financial institutions so that the poor can have easier access to financial services.

The waqf may appear as a more effective form of social finance. Social finance plays an essential role in the contemporary financial environment and has become one of the most prominent financing pillars. The outstanding quality of waqf is its relevance with the economic system by creating investment. Opportunities from consumption and generating benefits and productive capital. Islamic Development Bank (IsDB) Jeddah introduced the innovative idea of diverting funds from consumption to investment by formulating the Awqaf Properties Investment Fund (APIF). API is a distinctive development model that promotes longstanding financial sustainability. This model establishes real estate and uses its income to empower civil society and other local institutions working for public welfare. Researchers conducted their studies on the role of waqf in social development and documented that waqf-based Islamic microfinance can be sustainable in the long term. Thus, we can see that waqf-based products may appear with a potential role for neglected segments of society in achieving SDGs, especially in a Post-COVID World.

Business Continuity Management

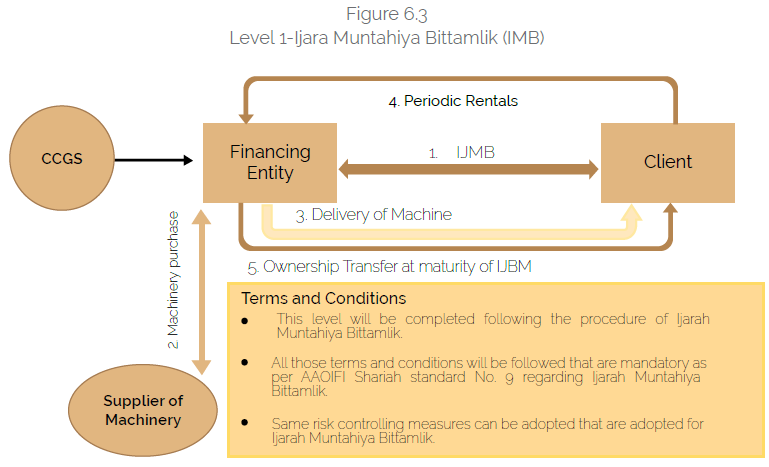

In a pandemic, the financing requirements of an existing business can be fulfilled through different Shari’a-compliant products. For instance, an ijara-cum-murabaha model may contribute to continuing a series of economic activities. This model consists of two separate contracts between financing entities and potential customers. This model will be completed in two levels. At the first level, the client will sign ijara muntahiya bittamlik (IMB) contract with the financing entity through which machinery will be provided to the client. At level two, the client will enter into a master murabaha financing agreement (MMFA) with a financing entity to meet the manufacturing process’s need for goods. MMFA consists of various sub-Murabaha executed in different time intervals as per prerequisite Shari’a terms and conditions. At level-1, after signing the IMB contract, the financing entity can buy machinery required by the client from a supplier on a musawama basis or any mode it wants. Then it will be delivered to the client against specific rentals per the IMB contract (see Figure 6.3).

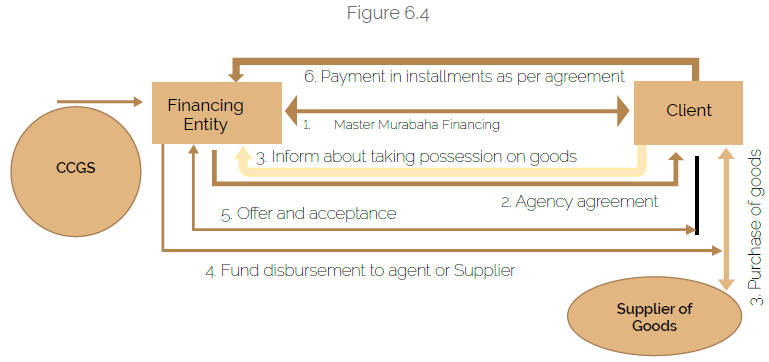

The further procedure of IMB mentioned in the Islamic finance manuals may be followed as per Shari’a principles. At this level, the client itself will decide about the waste collection procedure. For example, it can hire workers to collect waste or buy useable waste from private entities that collect waste and make it clean to sell recycling manufacturing factories. At level-1, CCGS will encourage the financing entity to finance the microenterprise. There are two options at the second level. At level-2a, the financing entity will sign the MMFA agreement under MPO as per the terms and conditions mentioned in AAOIFI Shari’a Standard No. 8. MMFA will be completed in the same four stages, and the same issues will be considered that are described in books of Islamic finance. After signing MMFA, the client will be allowed to purchase required goods as and when needed from the nominated supplier of goods incapacity of an agent of financing entity. Before consuming the bought goods, the client will inform the Financing entity about purchasing and getting possession of goods on its behalf. Islamic banks will disburse funds to an agent to pay the price to the supplier, or it also has an option to pay the supplier directly. Then the client will make an offer to buy the same from the financing entity at an agreed profit. The client will be allowed to consume it after getting acceptance from the financing entity (see Figure 6.4); otherwise, the murabaha contract will be invalid. This model will work only if suppliers of various goods are different.

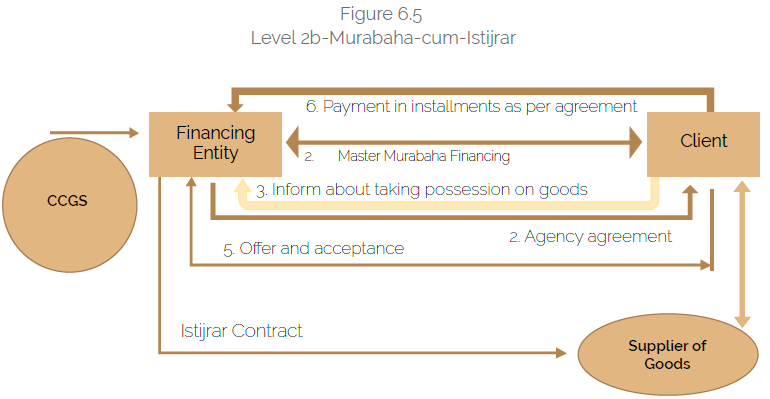

The second option of level-2 involves, very rarely used concept in Islamic finance, istijrar. Istijrar is an arrangement in which someone keeps getting the articles of need from a supplier from time to time, as and when needed, without any offer and acceptance or price bargain between the two. Istijrar is of two types: istijrar with deferred payment, istijrar with advance payment. In the former one, the price is paid when the contract is concluded, and accounts are settled. Later, the buyer pays the price in advance to the seller, and accounts are settled towards the end of the contract period. In level-2b, the financing entity will enter an istijrar agreement with the supplier of goods. They will mutually decide on payment settlements. This option will work if all goods are available from a single nominated supplier. The client of the financing entity will enter the contract of MPO, and with it, MMFA will be signed. After buying goods from a supplier, the client will renew the offer and acceptance with the financing entity before consuming it (see Figure 6.5). All other terms and conditions of MPO will be mentioned in AAOIFI Shari’a Standard No.

Agricultural and Non-agricultural Waste Recycling

Recent major global environmental initiatives toward a more sustainable society are the SDGs, the New Urban Agenda (NUA), and the Paris Agreement. The role of a sustainable built environment towards energy conservation and wastage management is central to the realization of the SDGs in general and SDG 15 in particular. The idea of waste recycling has emerged from the womb of the necessity of environmental protection, but it brings multi-dimensional economic, health, and other social benefits. As a result, corporate business units and industries started to pay attention to this neglected sector. The most neglected area in the waste recycling concept is agricultural waste recycling which is more diversified than its non-agricultural counterparts. It includes gasifying crops, taking crop stalks as feed, fertilizer, or new building materials, and making manure from livestock excrement. The cycling of life wastes is mainly carried out through separate collection of junk in order to achieve effective waste recycling and reuse. Agricultural waste recycling modes can also be divided into farmers and enterprises.

Waste recycling has brought multi-dimensional opportunities for small manufacturing businesses at the micro-level of home-based initiatives by employing the circular economy’s waste recycling concept, and these projects can be financed through Islamic microfinancing arrangements. Further, unemployed skilled labour can be financed through various Islamic modes of finance, e.g., musharaka, mudaraba, murabaha, istijrar, and ijara. These agricultural and non-agricultural waste-recycling activities in the framework of Islamic finance will fuel different economic activities of employment and recycling of resources for environmental protection, which will ultimately contribute to achieving SDGs.

Agricultural Waste Recycling: Biogas Plant

Vegetable market waste is usually thrown away without reusing it for any beneficial activity. This waste can be used if it is picked up on time and delivered to dairy farms. Cows and buffaloes will eat it and produce dung which can be used for biogas production. After gas production, instead of wasting manure, it can be benefitted through vermiculture, a valuable technique for recycling kitchen and livestock wastes into a rich organic fertilizer for producing high-protein feed for poultry. Worms are invaluable partners in building the soil in farms.

If worms are fed the manure after biogas production, they convert it into natural fertilizer, which is much better than artificial fertilizer in crop production. Islamic banks, as well as IsMFIs, can finance these projects by developing their financing models. For instance, a Dairy farm can be financed at the first stage on a Mudarabah basis. Cows and buffaloes will be bought from mudarabah investment. To collect waste from various places, vehicles may be financed through Ijarah muntahiyah bittamlik model. In the second stage, biogas and electricity plants can be financed through musharaka or murabaha basis. The Islamic financial sector can effectively achieve SDGs through environmental protection and poverty eradication from this type of financing.

Fish Market Waste Recycling: Poultry farm Feed

In less developing countries (LDCs), fish waste management is not less than a headache for environment protection management. Fish waste is a viral feed for ducks. It enhances their capability of egg production. According to a report of the department of primary industry, Government of New South Wales, ducks usually begin laying at about 6–7 months of age and should be laying at a rate of about 90% (i.e., 100 ducks laying 90 eggs daily) within five weeks of the onset of laying. English breeds typically maintain more than 50% production for about five months. Peking starts laying eggs when they are about 26–28 weeks of age and can be kept economically for about 40 weeks of production when they have laid about 160 eggs. In LDCs, fish market waste is usually thrown out without using it for any productive purpose. Islamic financing institutions did not draw their attention towards this specific segment of fishery waste management. IsMFIs and SMEs can finance these projects by developing their Islamic financial models to finance emerging activities in the post-COVID world. This will add economic value and protect the environment through egg and meat production and wastage.

Freelancing in Islamic Finance

During COVID-19, freelancing has become a special blessing to earn, where people have traveled from roots to fruits. Freelancing is emerging as a border-free in the market modern era of information and technology. In other words, it is a contract-based profession where instead of being recruited in an organization, the person uses his skills and experience to provide services to several clients. In simple terms, freelancing is when you use your skills, education, and experience to work with multiple clients and take on various assignments without committing to a single employer – the number of assignments or tasks depends on the ability of the freelancer to deliver. Freelancing does not always mean work from home. One might have to work at a client’s office, depending upon the type of work and the client’s requirements. In this way, we can start from home and move into any organization on the freelancing wings.

Islamic banking and finance has also been the recipient of freelancer’s work. It depends on the impact Islamic finance leaves on consumers’ attitudes, social norms, and perceived behaviour by freelancers in the post-COVID world. Similarly, religiosity, subject knowledge, and subjective norms positively impact the intention to adopt Islamic finance as a freelancer. The earning through availing the opportunities of Islamic finance will be helpful for a nation to have a massive cash inflow in their economy, which is an accurate source to achieve the SDGs in rainy days of the current pandemic of COVID-19.

Conclusion

The capacity to deal with the fallout from the COVID-19 has been inconsistent with various solutions. Governments are welcoming proposals to provide relief to the masses and strengthen public infrastructure for the growth of economies. Similarly, the UN wants to achieve the global targets of 17 SDGs intended to meet in 1930. Being part of the economic system, Islamic finance is being awaited to play its role in the pandemic. Inherently, Islamic finance intends to provide socio-economic welfare for humanity based on Maqasid al-Shari’a.

Interestingly, Maqasid al-Shari’a covers all 17 SDGs introduced by the UN. Therefore, it would be accurate to say that achieving the SDGs fulfills the higher objectives of Shari’a, e.g., preservation of life, religion, property, family, and intellect. We have discussed the potential role of Islamic finance in stimulating economic activities for individuals, SMEs, corporations, government, and welfare organizations in the post-COVID world.

After a comprehensive review of the literature, we observed that both concepts, SDGs and Islamic finance, are highly linked in terms of their objective and practical strategies. Therefore, we concluded that Islamic finance could be considered, and indeed, it is a practical device to achieve the fundamental objectives of SDGs. Likewise, environment-friendly Islamic finance models will create employment at three levels: waste collection, production, and marketing. They will also enhance innovative capabilities by creating employment, collecting waste from society, and cleaning the environment.

The vehicle contracts of Islamic financial products, such as mudaraba, musharaka, ijara, murabaha, istijrar, salam, istisna’, and diminishing musharaka are highly integrated with the fundamental objectives of the SDGs. These are asset-backed with fair play a role in the financial market. They also downscale resources resulting from efficient allocation of resources by neglected segments of society, which is the need of the day in a post-COVID World. This study recommends that countries with Muslim concentration adopt the products of the Islamic financial market for capital formation, financial inclusion, employment creation, resources mobilization, and investment invitation after spending bitter days of the pandemic. Similarly, this study suggests that international agencies accelerate their speed to accomplish the agenda of SDGs by 2030 by welcoming Islamic financial opportunities in a post-COVID world.