This year’s Islamic Finance Country Index (IFCI) is based on our 2011 index, with two major adjustments in the methodology over the last 10 years. It uses data on the constituent factors for the year 2020 – the most recent data available at the time of analysis. To understand the methodology completely, we strongly recommend to the readers to consult previous editions of GIFR. This will also allow the keen researchers to consider how different countries have evolved in terms of their leadership role and potential in IsBF over the last decade. An update on the methodology is included in this chapter. In our view, IFCI remains the most robust measure of state of IsBF in the countries included therein.

Developed by Edbiz Consulting in 2011, Islamic Finance Country Index (IFCI) is the oldest index for ranking different countries with respect to the state of Islamic banking and finance (IsBF) and its relative importance in a national context and benchmarked to an international level. IFCI has evolved over the last 11 years, with two adjustments in 2018 and 2019. These adjustments aimed at normalising the data over the time series, and to reflect on our increased intelligence into some key IsBF markets (see Box 1 on Data and Methodology).

The IFCI was initiated with the aim to capture the growth of the industry, and to provide an annual assessment of the state of IsBF in each country. With 50 countries included, the index is based on a multivariate analysis providing a comprehensive assessment of the state of affairs of IsBF in the countries included in the sample. It doesn’t claim to capture the whole of global Islamic financial services industry. Nevertheless, it is a useful snapshot of the industry as a whole. The important variables, as identified by the multivariate analysis, provide an accurate assessment of IsBF in each country.

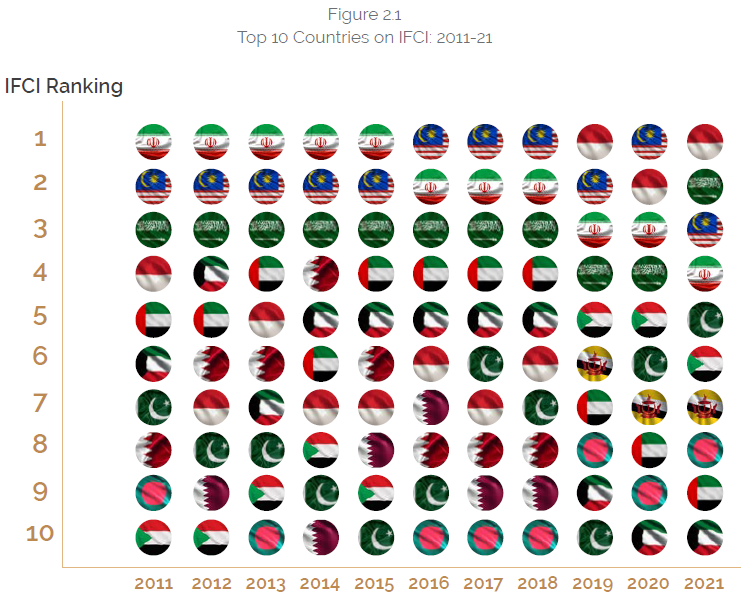

With the 10-year data since its inception, IFCI can now be used to compare the countries not only each year but also over time. As more countries open up to IsBF, the index will provide a benchmark for nations to track their performance against others. Over time, the individual countries on the index should also be able to track and assess their own performance. Figure 2.1 presents the top 10 countries on IFCI since its inception.

Following are some of the important observations evident in Figure 2.1:

- Given that there are only 12 countries featuring in the Top 10 IFCI countries over the period of 11 years, the IsBF as a global phenomenon remains highly concentrated in these countries.

- The Top 3 IFCI countries were not challenged by anyone of those below in the ranking except lately when Indonesia captured the first position in 2019. Indonesia is now considered as a player with potential to lead the global Islamic financial services industry2,3. In addition, we believe that Bangladesh and Pakistan must remain on the watch-list of keen observers of the industry, as an increase in advocacy and government action in these countries can push them up the rankings in the years to come.

- Iran is the largest contributor to the global Islamic financial assets. Nevertheless, its isolation from the international financial markets (due largely to the international sanctions) and its rather conservative approach to communicating major developments in its national sector have contributed to its sliding down the IFCI ranking.

- The upward movement of Indonesia started happening after the establishment of KNEKS and personal patronage of the president and vice president of the country (see below for further details).

- Interestingly, the representation of the countries comprising the Gulf Cooperation Council (GCC) is decreasing, as IFCI is becoming more inclusive in its results. The likes of Indonesia, Iran, Pakistan and Bangladesh (the countries with the larger Muslim populations4) have started dominating the ranking.

- Having said that, Saudi Arabia is a rising start, as explained later in this chapter.

The Case of Malaysia

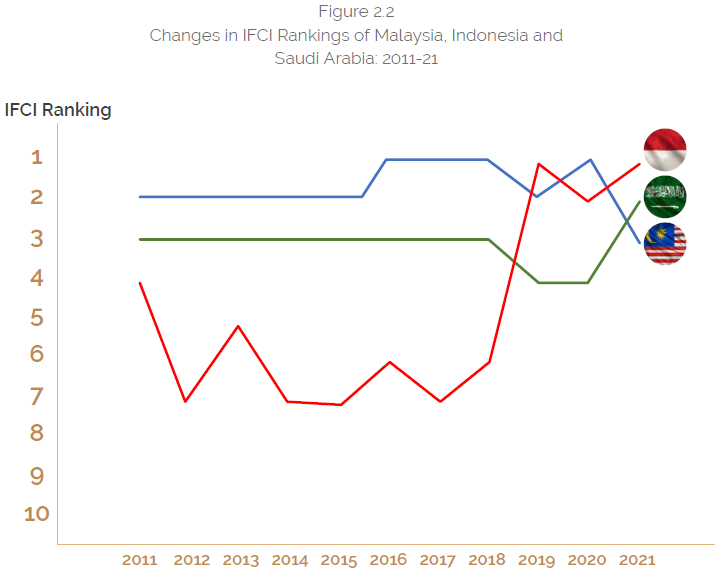

In this respect, Malaysia has emerged as an interesting case. It instructs us that the regulators (and other public bodies) are instrumental in developing and sustaining growth of IsBF. Malaysia has featured prominently in IFCI, sitting mostly on the first two positions, only to fall down to the third position this year. Malaysia attempted to become an unrivalled global leader in IsBF, but of late there are clear signs of fading of the leadership role of the country in the global Islamic financial services industry. What factors are responsible for this phenomenon? While COVID-19 is certainly a big disruptor, the explanation must go beyond it. Also, it must be kept in mind that Malaysia continues to earn very high score on IFCI. It is actually the other competitors that have done better than it to challenge its leadership role. Given the increase in competition, there is no room for complacency by anyone wishing to remain on top.

Malaysia Compared with the Main Challengers

Malaysia’s leadership has seriously been challenged by an unusual and unsuspected rival – Indonesia. Saudi Arabia has also surpassed it in terms of ranking this year. At least three factors may be cited to have contributed to this result.

The Role of Regulators

Bank Negara Malaysia (BNM) – under the leadership of long-reigning governor Dr Zeti Akhtar Aziz – not only provided a level-playing field to Islamic banking and finance, but also emerged as an advocate and champion of IsBF globally. The successive governors of BNM after Dr Aziz have, however, seemingly not maintained such a strong interest in IsBF. This is certainly a factor that has contributed to stagnation of IFCI score for Malaysia.

In the neighboring Indonesia, however, President Joko Widodo has since 2016 maintained a very strong interest in IsBF. The establishment of KNEKS and initially chairing it by himself, the President showed his resolve to develop IsBF as part of the overall halal ecosystem that country aims to develop as part of its national strategy for increasing its competitiveness in the halal economy, in general, and the halal tourism, in particular. There seems to be proper planning in this respect. Now, the Vice President Ma’ruf Amin is given the additional responsibility of being chairman of KNEKS, which has been provided with dedicated annual budget.

In case of Saudi Arabia, the main financial regulator, Saudi Central Bank (SAMA), has now become very active in developing a comprehensive framework for regulation and supervision of Islamic banks in the country. The incumbent governor of SAMA takes very keen interest in IsBF and has appointed a dedicated deputy governor who oversees the Islamic financial sector, in addition to his other responsibilities. Saudi Arabia, despite being the largest Islamic financial market in terms of assets (excluding Iran), lagged Malaysia primarily due to a less robust regulatory framework for Islamic banking and finance. This report does not attempt to criticize the historical regulatory approach adopted by Saudi Arabia towards IsBF, as there is ample evidence that it actually worked for growth and development of IsBF in the country. One may, however, argue that the new approach is visibly better than the previous one.

The legacy situation is being fast rectified in Saudi Arabia. SAMA has since 2019 issued several directives for Islamic banks. It has now issued its long-awaited Shari’a Governance Framework (SGF) which has since February 2020 been enforced. This is an excellent document that is consistent with other such frameworks introduced in other countries. Yet it has introduced some country-specific requirements.

The COVID-19 as a Disruption

Surprisingly, Malaysia created a mess for itself during the middle part of the COVID-19 pandemic. Consequently, all sectors in the country – including IsBF – suffered. Saudi Arabia, on the other hand provided one of the best – if not the best – responses to the COVID-19. The strict regime it created in this respect helped all the sectors in the country to continue to focus on their main activities. This has resulted in better performance of Saudi Arabia on the IFCI, as compared to Malaysia where the response went from excellent to bad to eventually manageable.

However, one may argue that COVID-19 is not going to be a sustainable disruptor and that Malaysia may rebound vis-à-vis IFCI, post-COVID.

Political Uncertainty

Malaysia has for the last three years faced huge political uncertainty, with rapid changes in the government. This may have contributed to a less focused approach to IsBF. In Indonesia and Saudi Arabia – the main two contenders for the top slot – the political situation was not only stable but remained progressively in favour of IsBF.

Figure 2.2 provides a comparison of IFCI rankings for the three countries over the 2011-21 period. It is already embedded in Figure 2.1, but it was intended to explicate the comparison by way of a separate graph.

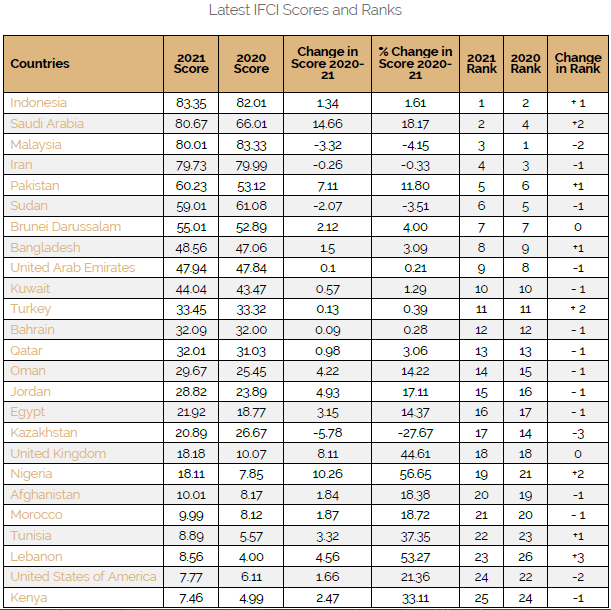

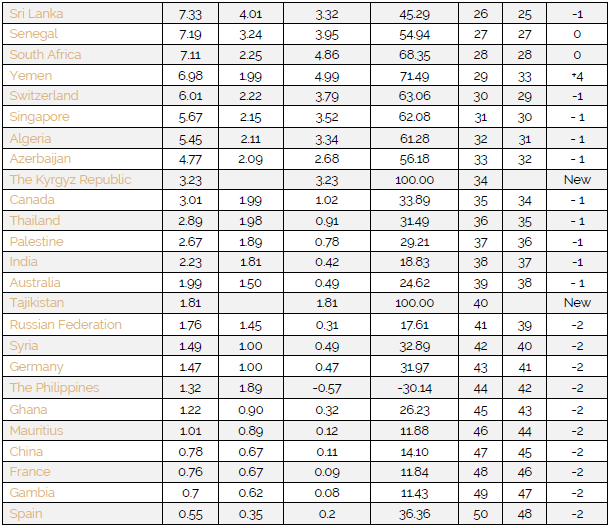

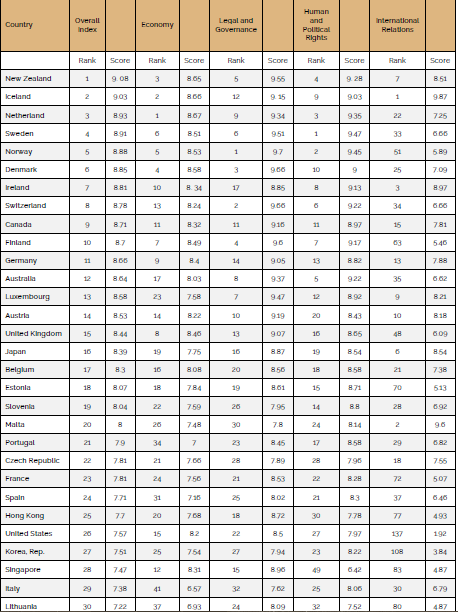

IFCI 2021

Table 2.1 presents the latest IFCI scores and ranks. It must be reported that the average IFCI score improved by 1.31 points or 6.5%, implying an improvement in the global Islamic financial services despite the challenges of the COVID-19. The most significant factor that contributed to the increase in quantitative and qualitative improvement in the industry is government action. As reported in Chapter 1, the global Islamic financial assets grew by 7.61% (Table 1.3), IFCI’s 6.5% increase suggests that other aspects of the development of IsBF (i.e., education, regulation and Shari’a assurance) did not witness as much advancement.

“The most significant factor that contributed to the increase in quantitative and qualitative improvement in the industry is government action.”

The COVID-19 slowed down a lot of socio-economic and political activities around the world. Therefore, there is nothing sinister about less contribution of qualitative factors to the growth of IsBF than what quantitative factors contributed. Although there was a shift in education of IsBF in favour of the technology5, it did not improve the situation in terms of the quantitative impact of initiatives like training and awareness. However, it must have indirectly led to improvement in quantitative measures of the size of the industry.

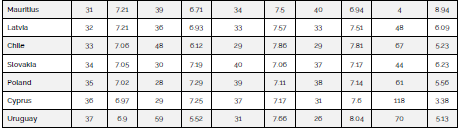

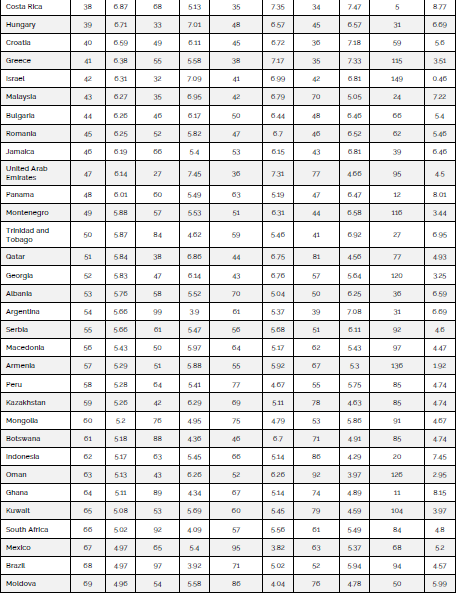

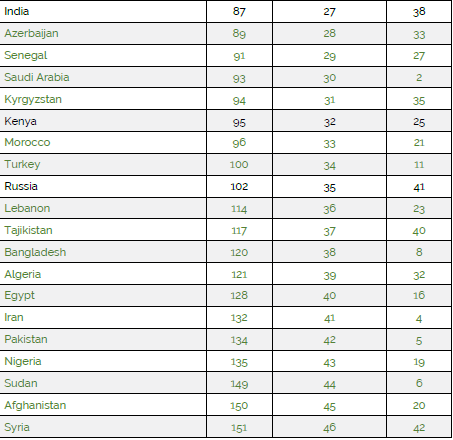

Table 2.1- Latest IFCI Scores and Ranks

Following are some of the important observations:

- Indonesia has regained its number one position, with 83.35 score, overtaking Malaysian important contender for the top spot along with Saudi Arabia which appears to be aspiring to be a global hub for Islamic banking and finance in the most comprehensive way. Malaysia had dominated the index since 2011, being number one in 2016, 2017 and 2018 and 2020. Before that, Iran held the coveted position. However, despite the large domestic financial sector, Iran is experiencing stagnation in its approach to developing a vibrant Islamic financial sector with a global relevance. In 2019, Indonesia jumped 5 positions up to capture the top position, and it has once again successfully challenged Malaysia to recapture the top slot.

- Saudi Arabia is emerging as a serious contender for the first position and all those countries in the race must be aware of the potential of the country to play a leadership role in the global Islamic financial services industry.

- There is no change in ranks of four countries (Brunei Darussalam, United Kingdom, Senegal and South Africa) but apart from Brunei Darussalam, these countries and all others in the sample have witnessed improvement in their score. This is a significant variation in the last year’s sample wherein seven countries did not move places. 44 countries moved up or down this year, as compared to last year when 42 countries that witnessed changes in their IFCI scores. This year, 9 countries moved up while 34 countries went down in their rankings, as compared to 41 going up last year while only one, India, going down.

- Two new countries were included in the sample, namely the Kyrgyz Republic and Tajikistan, which captured 34th and 40th positions, respectively, in IFCI.

- Although Yemen jumped up 4 positions, the real beneficiary in this year’s ranking is Saudi Arabia, which climbed up two places to capture the second position on IFCI. Saudi Arabia presents an interesting case, as the new leadership at the Saudi Central Bank (also known as SAMA in its abbreviated from drawn from its previous name) seems more committed to explicitly provide a level-playing field to Islamic banking and finance in the country. There is no doubt that the successive political regimes let Islamic banking and finance to continuously grow organically, without favoring it or disadvantaging it unnecessarily. The current leadership, however, has explicitly recognized the importance of the IsBF sector, and seems willing to promote it to target certain legitimate economic targets. In recognition of this role, SAMA was recognized as the Best Islamic Central Bank for the year 2021 by Global Islamic Finance Awards (GIFA).

“Saudi Arabia climbed up two places to capture the second position on IFCI”

- Another beneficiary is Pakistan which climbed one position to become the fifth most important Islamic financial market in the world. This is a continuation of an impressive performance, given that the country climbed up four slots last year to sit on the 6th position.

- It seems as if Sudan has started receding on the leadership front. Having been one of the two countries claiming to have a fully-fledged Islamic economic system (including Shari’a-compliancy of the financial sector), the new political regime in Sudan shocked the IsBF circles by announcing its intention to allow conventional financial institutions to operate along with the existing Islamic financial institutions. This is clearly a policy shift in favor of a dual banking system that is an adopted model in most of the countries where IsBF exists. Sudan’s sliding off the ranking by one position is reflective of this new development in the country.

- A general remark on the ranking must emphasize the fact that IFCI ranking has a clear discontinuity after the first four countries, namely, Indonesia, Saudi Arabia, Malaysia and Iran. It suggests that these countries collectively are the market leaders. This point is further explicated in the next section.

Classification of Countries with Respect to IFCI

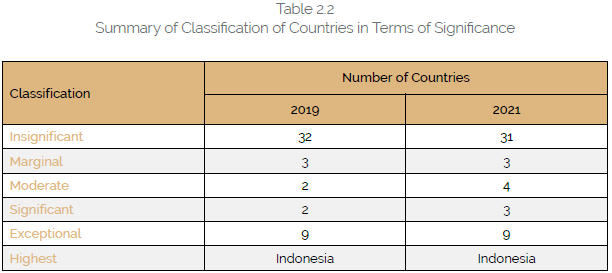

Table 2.2 presents a summary of the classification of the countries included in terms of their significance.

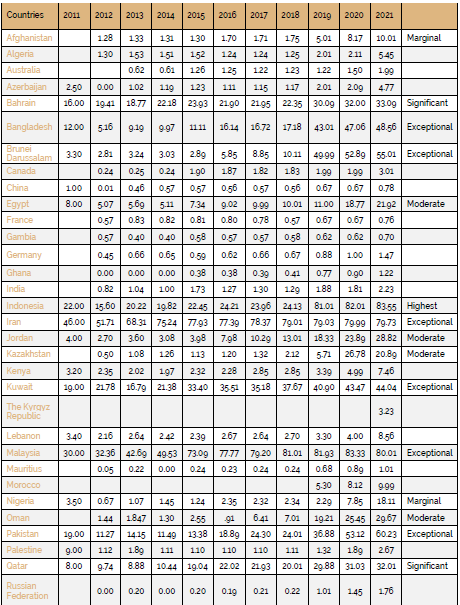

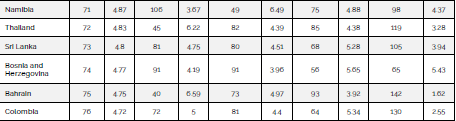

Table 2.3 provides the latest IFCI scores, along with that of the previous 10 years. Based on the scores, the table classifies the sampled countries into six groups:

- Insignificant: The countries with the latest IFCI score of less than or equal to 10 (IFCI ≤ 10);

- Marginal: The countries with the latest IFCI score of more than 10 but less than or equal to 20 (10 < IFCI ≤ 20);

- Moderate: The countries with the latest IFCI score of more than 20 but less than or equal to 30 (20 < IFCI ≤ 30);

- Significant: The countries with the latest IFCI score of more than 30 but less than or equal to 40 (30 < IFCI ≤ 40);

- Exceptional: The countries with the latest IFCI score of more than 40 (IFCI > 40); and

- Highest: The country that tops the list (in this case, Indonesia, which has an IFCI score of 83.35).

This means that there are only 19 countries where IsBF has assumed meaningful relevance to mainstream banking and finance. It is an important observation, and the likes of IMF must take note of this for its Financial Sector Assessment Programme (FSAP) for the countries with significant Islamic banking shares. As stated earlier, there are only 12 countries that fulfil the 15% Islamic banking threshold of the IMF. There is a need to extend this list to at least 19 for such purpose. In addition to the IMF, Islamic Development Bank (IsDB) must also devise an Islamic Financial Sector Assessment Programme (IFSAP) for its member countries for which IFCI rankings may be relevant. It is also high time that other industry infrastructure bodies (like AAOIFI and IFSB) must start taking note of IFCI, given its time series benefits emanating from it being the oldest index of its kind.

“There are only 19 countries where IsBF has assumed meaningful relevance to the mainstream banking and finance.”

Table 2.3: Classification of Countries in Terms of Significance

It is interesting to note that overall the global Islamic financial services industry has now moved from ‘Marginally’ relevant to the global financial system to ‘Moderately’ relevant (as evidenced by improvement of the sample average of IFCI score from 18.80 in 2020 to 20.14 this year. This is confirmed by the growing recognition of IsBF amongst the multilateral institutions like the UN, World Bank, IMF and the regional development banks like Asian Development Bank and African Development Bank.

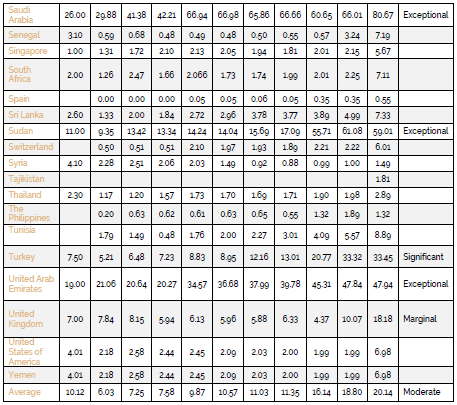

IFCI Compared with the Islamicity Index

The Islamicity Index ranks a large number of countries in the world in terms of their Islamicity, the extent to what these countries fulfil Islamic objectives in terms of economic affairs, legal and governance, human and political rights, and international relations.

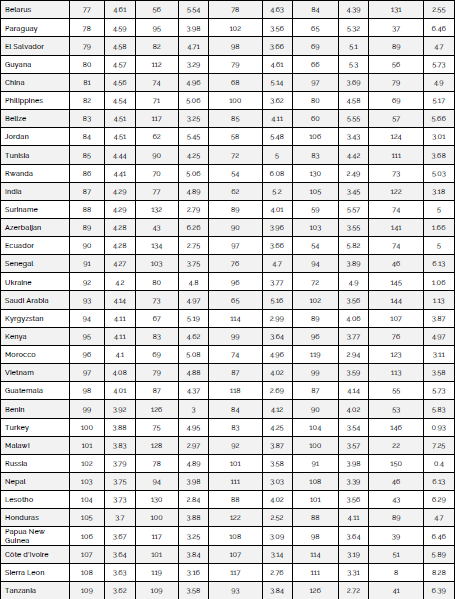

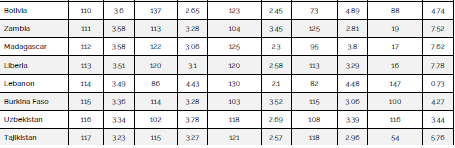

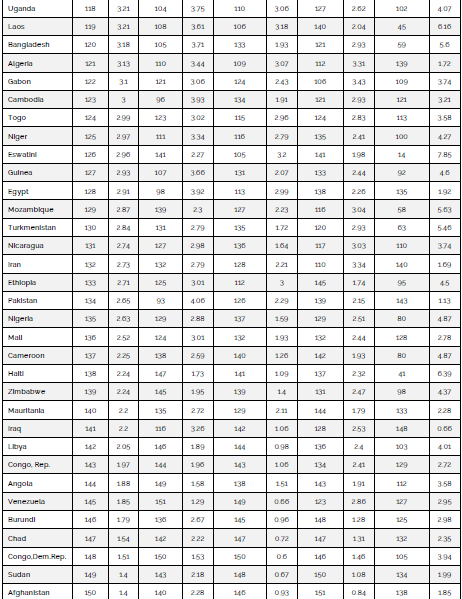

Although limited in scope and given that the two indices are based on different factors and variables, the comparison should indicate similarities and differences between the two. Table 2.4 reproduces the Islamicity Index for 2020 from its website.

Table 2.4- Islamicity Index and its Constituents for 2020

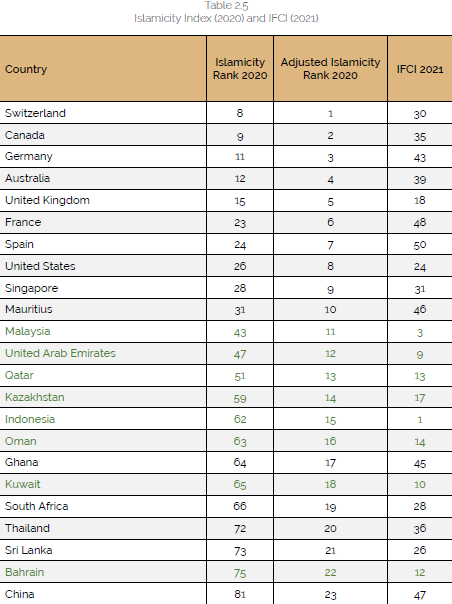

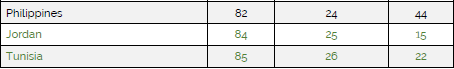

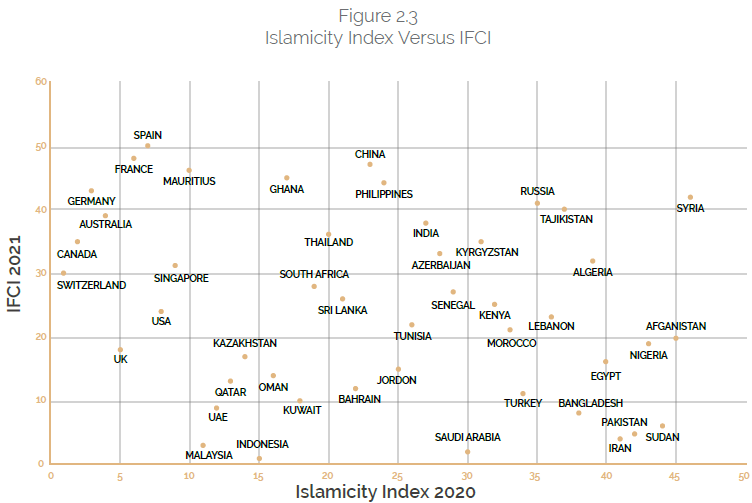

Table 2.5 presents the relevant values of Islamicity Index and IFCI for the countries that are common in the two indices. As shown in Figure 2.3, there is no correlation between the Islamicity Index and IFCI, suggesting that IsBF is an independent phenomenon of any political and legislative efforts in the countries that may remotely be deemed as Islamist.

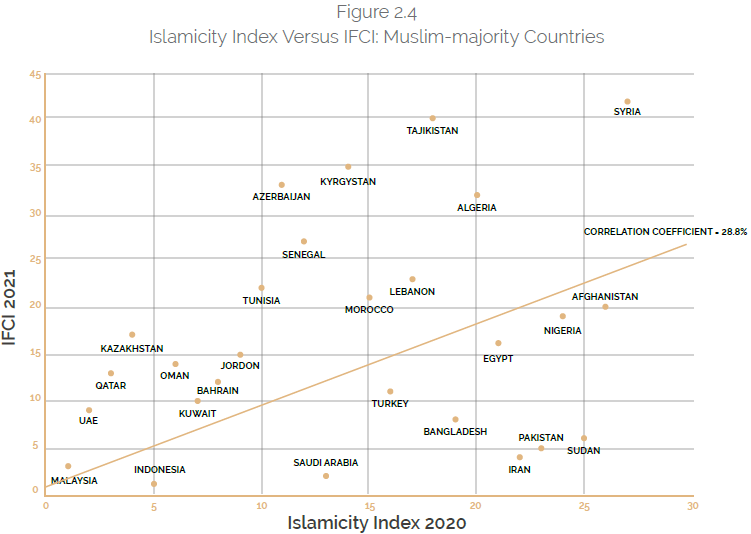

However, looking at Figure 2.4 reveals another potentially interesting story. The sample includes only Muslim-majority countries. The correlation coefficient, albeit mildly significant, stands at 0.2880, showing a positive correlation between the Islamicity Index and IFCI. As the lower values on the Islamicity Index imply lower Islamicity and the lower values on IFCI indicate higher incidence of IsBF in these countries, a positive correlation between the two indices implies negative relationship between religiosity (Islamicity) and the incidence of Islamic banking and finance. This is a rather curious result, which must be carefully interpreted.

“Islamic banking and finance, being explicitly identified as an Islamic phenomenon, may provide a basis for refuting many of the commonly drawn conclusions from the Islamicity Index, which should at best be considered as a measure of practicing of universally acceptable secular moral values than of the religiosity of the nations, as has so far been wrongly portrayed.”

Since the inception of the Islamicity Index, it has been taken as an indicator of Islamicity, i.e., upholding of Islamic moral values, in the countries, both Islamic and others, included in the sample. As the first 40+ countries on the index are predominantly non-Muslim countries, many observers have been implying that Islamic values are being practised more in such countries than in the predominantly Muslim countries.

The index has been widely quoted to suggest the superiority of non-Muslim countries over the Muslim ones. However, it is at best a secular index based on some universal moral values (which are admittedly acceptable in an Islamic tradition as well). Given the negative correlation, albeit weak, between the Islamicity and incidence of Islamic banking and finance in the Muslim countries, one may question the validity of implications of the Islamicity Index.

Given the negative correlation, albeit weak, between the Islamicity and incidence of Islamic banking and finance in the Muslim countries, one may question the validity of implications of the Islamicity Index.

Box 1: A NOTE ON DATA AND METHODOLOGY

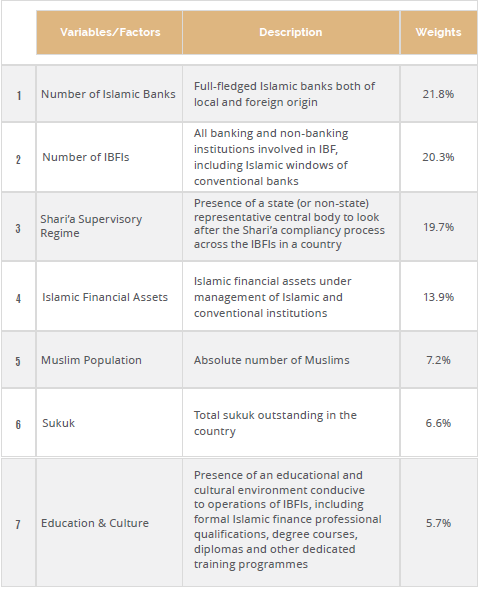

IFCI is based on a multivariate analysis. For the construction of the index, original dataset included information on several variables, including macroeconomic indicators of the countries included, for the year 2010. The data was tested to see if it contained any meaningful information to draw conclusions from. After consideration of different multivariate methods, it was decided to use factor analysis to identify the factors that may influence IsBF in the countries included in the sample.

For factor analysis to be applicable, it is important that the data fits a specification test for such an analysis. The Kaiser-Meyer-Oklin (KMO) measure of sampling adequacy was used to compare the magnitudes of the observed correlation coefficients in relation to the magnitudes and partial correlation coefficients. Large values (between 0.5 and 1) indicate that factor analysis is an appropriate technique for the data at hand. If the value is less than that, then the results of the factor analysis may not be very useful. For the data we used, we found the measure to be 0.85, which made it reasonable for us to use factor analysis.

Batlett’s test of sphericity is another specification test that tests the hypothesis that the correlation matrix is an identity matrix indicating that the given variables are unrelated and therefore unsuitable for structure design. Smaller values (less than 0.05) of the significance level indicate that factor analysis may be useful with the data. For the present purposes, this value was found to be significant (0.00 level), which means that data was fit for factor analysis.

Factor analysis was therefore run to compute initial communalities to measure the proportion of variance accounted for in each variable by the rest of the variables. In this manner, we were able to assign weights to all eight factors in an objective manner.

By following the above method, we were able to remove the subjectivity in the index. The weights along with the identified factors make up the IFCI. The weights point to the relative importance of each constituent factor of the index in determining the rank of an individual country.

There are over 70 countries involved in IsBF in some way or another. However, due to limitations imposed by authenticity, availability, and heterogeneity of the data, IFCI was launched in 2011 with only 36 countries. Over the next three years, the availability of data allowed us to include another six countries to make the sample size of 42. The current sample stands at 50, and we believe that this is a robust enough number to analyze the state of affairs of the global Islamic financial services industry. Information contents of the data for other countries is not instructive at all.

The data used comes from different primary and secondary sources, but in its collective final form becomes the proprietary data set of Edbiz Consulting, which collects, collates and maintains it.

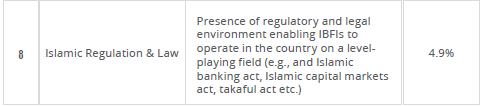

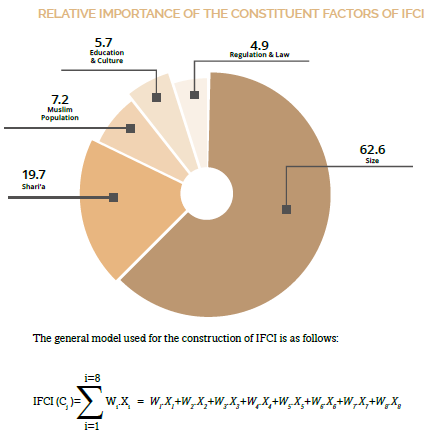

We collect annual data on eight factors/variables for the countries included in IFCI. The variable and their respective weights are described in the following table.

where

Cj = Country j including in the index

Wi = Weight attached to a given variable/factor i

Xi = A given variable/factor I included in the index

The countries are ranked according to the above formula every year, using the updated annual data.

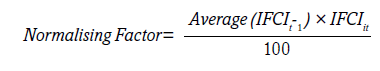

In 2016, a major adjustment exercise was undertaken to take into account some of the time-series characteristics of the data. The primary objective of this exercise was to normalize the data over the time. We adopted a methodology based on a weightage system that we

adopted to construct a normalising factor.

The normalizing factor used in the adjusted IFCI was calculated by the following formula:

where

Average(IFCIt-1 )= Average of IFCI scores for all the countries included in the sample of the previous year (t-1); and

IFCIit = IFCI score for an individual country i in the current year.

This normalizing factor allows us to neutralize the purely statistical effect of data movements on IFCI score in such a way that the overall ranking each year remains unaffected.

As the above table and figure suggest, size of Islamic financial services industry as captured by four factors (namely, number of Islamic banks, number of IBFIs, volume of Islamic financial assets, and the sukuk outstanding) is the most important factor in the index, explaining 62.6% variation. Therefore, it is superior to the unilabiate analyses that focus on just size of the industry in each country. Furthermore, size on its own is not enough to capture the relative importance of IBF in a country. It is equally important to consider depth and breadth of the industry. Hence, both the size of Islamic financial assets and the number of IBFIs are included. Furthermore, the inclusion of sukuk, which accounts for 15% of the global Islamic financial services industry, as a separate factor is also useful.

Although the other factors collectively explain 37.4% variation in the index, their inclusion is important as they give a comprehensive view about IBF in a country.

It must be clarified that IFCI is a positive measure of the situation of IBF and its potential in a country, without taking a normative view on what should be the important factors determining size and growth of the industry, and their relative importance (i.e., weights).