The Islamic finance industry has experienced a tremendous growth in recent years, it has more than 25% of all banking assets in GCC and is a strong finance vertical in all major Muslim countries. The western world has now started taking interest in its financial and socio-economic benefits.

The growth of any industry is directly dependent on the human capital of that industry. Learning & Development has played a critical role in providing training and certifications to the professionals in this field. However, this division has a lot of potential and room for improvement.

While certifications equip the Islamic finance professionals to understand the Shari’a regulations and financial products, to keep up with this vertical’s growth expectations, the global industry needs to work on the knowledge diffusion and curriculum of Islamic finance.

It is essential to understand that Shari’a regulations and frameworks are derived from Islamic values; thus, a professional must understand the entire framework to translate the regulation into a financial instrument. The lack of accurate knowledge of the Shari’a framework results in difficulties when it comes to explaining a financial product to a client and also poses limitations in the development of new products. Islamic finance is considered an applied science.

Therefore, any professional in the area should have complete knowledge of associate fields and businesses to apply the Shari’a regulations to real-world problems. Having said that, the industry needs to develop an interdisciplinary curriculum and a problem-centric approach, with a focus on deriving solutions from the Shari’a framework. The curriculum design should be interactive, allowing domain experts from various disciplines and a combined curriculum to be developed. A value chain analysis can further recommend formulating, circulating, and interpreting quality assurance frameworks and program standards to maintain and sustain improvement to the curriculum and training design. The training should be a combination of collaborative and self-paced learning to instigate reasoning, critical thinking, and context-based decision-making skills. The collaborative mediums will enhance leadership skills as well as analytical skills through discussion forums and role-playing projects. By collaborating with various disciplines, cultures, and other organizations, the learners will be exposed to several real-world scenarios and problems and will learn to derive solutions based on their Shari’a knowledge but according to the current context. Multidisciplinary environments also enhance the understanding of other business processes, assisting in better policy-making skills. The need for time is to develop and invest in the human capital to produce agile, innovative, competent, and entrepreneur individuals who could compete to grow, adapt and sustain in a volatile socio-economic techno-centric environment.

The world has converged with social media, and its significance and importance cannot be overemphasized. It is of the utmost importance to channel social media platforms to reach a wider audience and tap into the western market, where there’s still a lot of confusion and need for Islamic banking. The Islamic financial sector needs to strategize its social media channels to promote its vision and philosophy and to spread awareness of how Islamic finance provides an alternate socio-economic platform. Social media can be an effective tool in getting to know the customers better and understanding the requirements of a new market. Social media – as a complete marketing and PR tool – can also help in educating the mass customers through focused videos and tutorials. YouTube has proven to be an effective medium for short educational sessions. The easy availability of relevant content helps facilitate the customers as well as the professionals in the market. Technology has revolutionized all aspects of life. eLearning, online lectures, and self-paced learning – all can be improved a lot more through new technologies. Islamic FinTech has also shown a promising growth, and has played a critical role in providing online education and training in the sector. However, the future of eLearning in the Islamic finance sector lies in a more interactive and collaborative environment.

The use of Virtual Reality, Augmented Reality, and Metaverse will allow the learners as well as the trainers an opportunity to be more innovative. Group projects and role-based gamified experiences can enhance the learning outcomes by offering the real-world learner problems in augmented reality and letting them decide the flow of the events. The learners could be assessed in this environment better as compared to the old-fashioned way of exams. The objective of postgraduate and professional training is to develop analytical and professional skills. An augmented reality learning environment with real-life scenarios is the best way to train and assess.

The role of technology is critical to every industry’s growth, and the Islamic finance industry also needs to be innovative and pioneer in technology advancements when it comes to delivering training and educating professionals. Training and education in the future have to be focused on developing versatile professionals equipped to modernize the industry and help it reach a bigger market. Thus, the future of online training lies in engaging, interactive, and collaborative content in a real-world scenario-based gamified environment that challenges learners’ capabilities and enhances their performance metrics.

Introduction

The post-COVID-19 era has revolutionized the world of education and training. eLearning has been an innovative vertical since its inception, but ever since organizations, institutes, and certification authorities adapted the remote working architecture, distant learning has become the new norm of training. This trend can be proven by the statistics shared by Statista that the eLearning market globally is expected to rise by over $240 Billion by 20221.

As with all other industries, the Islamic finance industry has experienced growth and worldwide acceptance. With this growth the need for HR development and upgrade has become even more important. The eLearning industry is becoming more and more sophisticated with the inception of innovative technologies like artificial intelligence and virtual reality that enhances and provides the next level of user experience.

The Islamic financial sector has been impacted with tremendous growth with innovative technology and FinTech. Organisations have developed and new startups have been encouraged to promote and provide learning and development in the sector by aligning the skilled people with the growth strategies for the sector. Along with the current practices, the learning and development leaders and organizations need to research and adopt trends to ensure a better future for Islamic finance and the FinTech industry. This chapter discusses the current shortcomings, solutions, and global trends that would transform the future of eLearning.

Significance of Training & Instruction in Islamic Finance

Last year, we reported that the Islamic finance industry was expected to reach its global size of US$3.789 trillion to US$5.115 trillion (depending on the underlying assumptions) by 2025. This was against the global Islamic financial assets of US$2.941 trillion by the end of 2020. Most of this business is, however, driven by the GCC and Southeast Asia. This growth has yet to be driven by developments in the FinTech industry and digital banking which many still believe will assist the future growth.

The Islamic financial industry is nascent as compared to the conventional financial and banking industry, however in recent years, the industry has received interest globally. There has been a growth in the demand for Shari’a-compliant financial products, outreach, and opportunities, which implies the need for trained human resources to sustain the growth expected in the future. Talent development, management, and continual upgrade is a huge task that needs to be executed globally in a structured and collaborative manner, comparable to the conventional banking education and training, to equip the Islamic financial industry everywhere with competent people.

The current market of Islamic financial services lacks the four basic components that are highly crucial to the development of this sector. These factors are Knowledge, Expertise, Awareness, and Competence.

Knowledge

Knowledge diffusion refers to building a comprehensive and uniform curriculum globally for Shari’a-based financial learning. As with any industry, this needs to be upgraded with the latest trends and practices so that the curriculum is according to the modern-day needs.

Communication & awareness

Islamic financial and banking industry, even after being accepted globally has failed to create awareness and presence through social media and PR platforms as compared to conventional banking. Awareness is the need of time to help the non-Islamic market and client to realize the opportunities this sector has to offer.

Collaboration

The lack of collaboration creates hurdles, a structured approach is needed where other businesses understand and collaborate with Islamic finance and vice versa. To grow the sector needs to be understandable and adaptable.

Competence

Instead of just training people for a particular certification, the education needs to focus on developing competence and challenging the people to be more innovative.

Technical advancement & FinTech development

No industry can survive today without the implementation and continual growth of technology. Technology is at the core of eLearning, and more needs to be done to achieve scalable and responsive learning opportunities. IsFIs and Regulatory bodies must support R&D and core technology training centers. The following sections will throw light on these components and suggest future solutions.

Knowledge Management & Diffusion- Realization of Sentimental Value

Learning in any field depends on the quality, quantity, and availability of content and curriculum. In the case of the Islamic finance industry, education or training for the industry also relies heavily on the curriculum but there is a stark difference, compared to other industries. While it is of utmost importance to develop a uniform curriculum for the various aspects of this industry, training people regulations, products, and operations in a Shari’a-based business environment, the curriculum and the trainers also need to instill the basic realization of the Shari’a regulations and morality according to the principles of Islam.

The regulations of Islamic finance are based on the core of the religion and a trainer, a professional or a student at any level should understand why or how certain financial instruments differ from their conventional banking counterparts. They should also be able to answer the customers how they relate to them. Every customer in the financial or investment industry needs to know the financial gain of that service and the Islamic financial industry professional should be well equipped and educated about that.

To elaborate, an investment fund or an account in an Islamic bank is not merely an account but it has a complete set of Shari’a regulations that define the operation for that product or instrument. Shari’a is an ethical system of values that relates to economic, intellectual, social, and religious aspects of life. Thus, anyone receiving training should understand the sentimental value attached to Shari’a-based finance.

The importance of this aspect can be shown by a study published in a European Scientific Journal carried out to study the Islamic banking environment in Jordan, that questioned about 80+ banking professionals with 5 or more years of experience in the banking industry regarding understanding and comprehension of Shari’a based financial products and operations. The results clearly showed that these experienced professionals faced difficulty in explaining the Shari’a regulations and the core principles attached to the products. This limitation of lack of knowledge has intimated them in working, exploring, or for that matter hinders the development of the industry.

To further elaborate, the training and education regarding Shari’a-based finance should not be limited to core banking professionals, rather it should be a mandatory training for all technical staff related to the Islamic finance industry to understand and relate to its regulations to their operations.

The curriculum of Islamic finance is distributed into 4 broad areas: Muamalat (Islamic Sciences), Islamic Economics (Social Science), Islamic Finance (Multidisciplinary), and Muamalat Administration (Multi-disciplinary). However, Islamic finance has been recognized as an applied science in the banking industry. Similarly, takaful in wealth management, Muamalat administration is also termed as managerial administration and halal management. Islamic finance curriculum as a discipline has three main components:

Ideological

The core of Islamic finance is based on theological arguments for socio-economic justice; thus, the curriculum needs to extend these arguments into all verticals of finance. Therefore, the curriculum should be adaptive and modern according to the current times. It should also embrace the complaisant spirit of Islamic banking to respect and be centered on community beliefs and values.

Professional/practical

The curriculum’s most crucial aspect is its innovation and applicability to modern standards, while Shari’a compliance precedes socio-economic objectives. Islamic laws work as a regulatory framework, and contract requirements became pertinent to enable a broader social acceptance and assurance of the Islamic financial transactions in banking, takaful, and capital markets. Significant juristic reasoning should be used to find alternative means with proper justification to replicate the financial products and services with permissible activities.

Scientific

The goal of Shari’a is to ensure the compliance of socio-economic objectives to a broader socio-religious construct. The implementation and application of these goals are in alignment with the increasing awareness of the climate of socially responsible investing, ethical investments, and socio-environmental impact investments. The importance of SDGs and financial inclusion through microfinance, waqf and alternative social welfare institutions, products, and instruments such as charities and endowments have given rise to the concept of social finance. Interestingly, the social experiment and experience of Islamic finance correlate with institutional and market developments of conventional finance such as universal banking, social impact sukuk bonds, and financial inclusion.

Currently, most of the curriculum and certifications of Islamic finance are knowledge- centered, teaching the Shari’a regulations and principles. Though it is important to learn and understand those, it is not enough, considering the fast-paced industry growth.

To devise a curriculum that will enable better knowledge diffusion and allow the learners to apply their knowledge effectively to the current scenarios is to design the curriculum in a problem-centred way. The advantage of a problem-centred curriculum is that it enables and trains a learner to look at a problem in the real world and then formulate the solution based on the guidelines and framework. As most of the learners are postgraduate and already working, they are already exposed to real-world problems.

Additionally, the problem-centric design of the curriculum will also improve the collaboration, innovation, and creativity of learners, will not only help them in the learning process, but also assist them in the real world. The use of case studies, interactive sessions, and action-based projects will also help the learners to translate the traditional banking problems into solutions with Shari’a-based products. It is of the utmost importance to understand that in professional scenarios, good interpretive skills, context-based decision making, policymaking, and implementation are all critical and the curriculum could focus on building these aspects.

Talent Development – Competence to Raise the Bar

Talent development is a prolonged and essential factor for the development of any industry. The Islamic finance industry also requires the development of a skillful, competent, and entrepreneur workforce. Education and training can only provide a basic set of instruction. However, a comprehensive program is also required to raise competitive and innovative instructors who are not only equipped with knowledge of Shari’a but are also aware of the banking operations, latest technology, trends, and best practices to train the students better.

Just like other industries, professionals from the Islamic finance industry need to be able to translate Shari’a regulations to any business and financial scenario, opening more opportunities for the application of Shari’a-based financial products.To ensure a steady growth of the workforce and professionals, institutes need to recognize the individuality of Islamic finance and offer courses globally that are based on the core of Shari’a and its implementation in modern businesses.

Need for an open platform for Islamic finance inclusion

To ensure that the future of the industry is more competent and dynamic comparable to the conventional banking industry, the training institutions need to set up Entrepreneurial Finance Labs to research, test, and implement such tools and practices to challenge the professionals and students with scenarios that force them to take risks and design solutions that can show how Shari’a products and regulations can solve economic crisis and limitations. Offering Islamic finance education at a younger age rather than at a professional level will also impact the workforce. Training and education at the undergraduate level can bring out better innovative and risk-taking attitudes among students.

The future of training and education in Islamic finance lies in the debate-based, research-oriented, and practical challenges of modern economic problem areas that can be solved by the implementation of Shari’a products. This also implies further product development and enhancement. The financial products of the industry also need to evolve according to the current economic shortfalls.

To target these requirements, most organizations are now shaping their human capital investments towards training centered on skills, execution, and attitude. The result of such training is a more proficient workforce that has a problem-solving attitude and provides better career enhancement opportunities. Malaysia realized the need for skills-based training and set up the Islamic Banking and Finance Institute (IBFIM), International Centre for Education in Islamic Finance (INCEIF), Malaysian International Islamic Finance Centre (MIFC), and Shari’a Knowledge Centers as part of most banks to support human capital development to ensure smooth growth of the industry.

It is also important that the learners should be trained with a combination of the interdisciplinary and transdisciplinary approaches, where the former integrates the knowledge and concepts from different disciplines, the latter approach combines the intellectual frameworks beyond the disciplinary perspectives and designs a unified approach toward problem-solving. This will enable the learners to understand the various concepts of Shari’a-based finance, traditional finance, business, and economics, and will be able to devise a solution that is based on shared beliefs, but completely align with the Shari’a framework. This challenging approach will assist them in real work context-based decision-making skills. An open-source platform is needed to deliver skill-based training to the global consumers under industry veteran and active practitioners, where the entire community can contribute and benefit.

Communication & Awareness – Unlock the Market Gaps

The studies and statistics show that the Islamic finance industry is dynamic and has proven that trend with continued momentum with annual growth of 11.38% (2010-20). The growth is associated with the equity and capital market.

Even with this pace of growth, the Islamic finance industry has been able to position itself in the GCC and Southeast Asia. Our IFCI ranks Indonesia, Saudi Arabia, Malaysia, Iran and Pakistan very prominently amongst the countries where IsBF is significant in terms of numbers and proportions (see Chapter 2).

The growth can be associated with opportunities for halal investments and funding and sukuk. However, a huge gap still exists in the financial industry which is untapped by Islamic finance. In the GCC, Islamic financial products reached $1,253 billion by 2019, amounting to 44% of overall financial assets, followed by the MENA at $755 billion and 26.3% share, southeast Asia at 24% while Europe, Asia, America, and, Africa amounting for the rest.

The question arise how training and education improves the market size and positioning of Islamic finance. The answer lies in creating awareness and recognition through social media and other communication channels. The importance and effectiveness of social media in introducing new markets, fostering engagement, and understanding the market dynamics cannot be overemphasized. Thus, to leverage its benefits as an operating marketing and PR tool, an effective strategy is required.

Most Islamic financial institutions and the industry as a whole need more targeted social media and communication strategies to not only enter new markets, but also create awareness among the non-Muslim communities to attract the greater market. The industry needs to collectively work on promoting the true picture of Islamic finance and how it equates with the conventional financial industry.

The social media strategy should be more knowledge-centred rather than merely focused on conventional strategies. The key elements of the strategy should be centered on:

- Social Media Knowledge Management: Availability of knowledge-based content, devised according to the market. In terms of the financial industry, explanatory videos and brief video sessions are more beneficial.

The social media strategy for Islamic Finance should be more knowledge-centered rather than merely focused on conventional strategies

- Social Media Marketing Strategy Implementation: A unified approach across the industry that promotes and highlights the financial assets and products. The strategy needs to focus on educating the customers that Islamic finance is an alternate economic system with some benefits over conventional financial products.

- Social Media Communication: Social media offers the most effective medium to directly communicate with customers. The use of podcasts, live sessions, training videos, and distributed online discussion forums can all sum up to create awareness and allow the professionals in the financial industry to understand the difference and dynamics of the industry. This can also assist in talent development and encourage these professionals to perceive Islamic finance as a vertical in the finance industry.

- Future Enhancements: In addition to awareness, it is equally important to keep the customers abreast with new developments, products, and solutions. Social media as a tool for PR is the best way to demonstrate the innovative and futuristic approach of the industry.

The strategy needs to be aligned and adjusted in a way considering the market position and targets. It is also important to realize that social media marketing, along with training/education, is not comparable to traditional marketing strategies. The social media strategy should uncover and eliminate the communication gaps between the industry and the market. Thus, the social media communication channels should provide ways to provide knowledge about products and services, get direct and unfiltered customer reviews and suggestions, provide one-to-one education and financial advice, and career advice, and encourage more people to train and join the workforce.

The significance of one-to-one interaction and financial literacy can be shown by the case of US based subsidiary of Canada (TD Bank) that created an online open forum for financial advice and literacy helping customers manage credit, plans, and investment options by making an easy channel between the financial experts and the customers. In the case of Islamic finance, the Shari’a experts and Islamic financial industry experts can be on forums answering the questions directly clearing any confusion at all.

Studies show that the financial industry and especially the Islamic financial industry need to fine-tune its social media strategy to make it more customer-oriented while ensuring that all aspects of the strategy are Shari’a based. The industry needs social media leaders, Shari’a scholars, and technologists to work in collaboration.

- Formulate governance and policy

- Work on the brand image

- Market penetration and gap analysis

- Offer industry-related training, discussion, and open forums to monitor audience response and improve the training and education strategies

- Gather training and content-related requests to design and implement the sessions accordingly

- To clarify the Islamic aspect, with presence of Islamic e-scholars for establishing credibility with potential or confused customers

Collaboration- Inclusion and Association

The modern era of business can be termed as a collaborative interdisciplinary platform. The role and the unprecedented impact of collaborations cannot be overlooked at all. Collaborative learning environments have proven to instigate critical analytical reasoning, and intellectual skills. The use of group-based forums and team exercises not only will help the learners in building new skills but will also improve their interdisciplinary knowledge. As discussed in the earlier section, professionals of the Islamic finance industry have usually found it hard to explain the products and the regulations related to them to the customer. However, the collaborative learning environment will help them develop the right soft skills to better communicate with a diverse set of customers.

As the statistics discussed in the previous sections showed that Islamic finance has yet to position itself in the non-Muslim majority markets, the experience of learning with different learners and instructors from various cultures and disciplines will help better interpersonal skills.

There’s one more exciting and expedient aspect of a collaborative environment. The institutes of Islamic financial organizations offering training can collaborate with other businesses and organizations to invite different domain experts to share knowledge and ideas and to provide the learners an opportunity to realize how their Shari’a knowledge can be translated into solutions in the real world. Such engagements will not only provide an interdisciplinary learning paradigm but will also let other businesses understand the principles of Shari’a-based finance that could turn into rewarding business partnerships, too. There are different models of collaborative eLearning environments, for Islamic finance training, a problem-centric think-tank approach is more workable where all the learners are given a problem, they research and come up with their suggestions and then brainstorm with the group to find out the most effective solution.

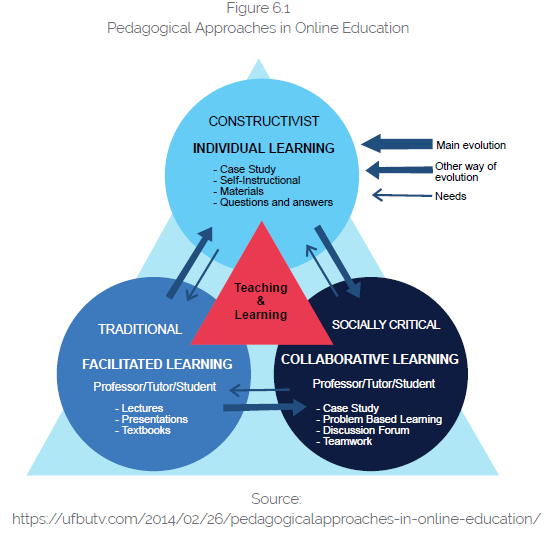

This approach will ensure every student works on the problem and brings something to the table. Presenting the solution and discussing the pros and cons of all the answers will help with the reasoning and intellectual skills. Figure 6.1 based on the principles of pedagogy explains the correct combination of the eLearning approach; this shows that the overlap between individual proactive learning, groups & forums for discussion, and instructor-led training is the best approach to ensure the learner leverages the most benefit of eLearning.

Technical Advancements – Driving Force

While COVID affected the entire world, it also opened new avenues for eLearning and distance learning, and accelerated the growth of the global Islamic FinTech ecosystem. The Global Islamic FinTech Report published in 2021 reported that the estimated Islamic FinTech transaction volume in 2020 reached US$49 billion, whereas the number of active Islamic FinTech was 241. This is only 0.7% of the global FinTech transaction volume. The Islamic FinTech is on a steady growth and is expected to reach US$128 billion by 2025 at a 21% compound annual growth rate (CAGR).

Islamic FinTech is still nascent and small as compared to the global market but promises high growth potential close to the most competitive markets. The Islamic FinTech market is still in its development stage and is mostly concentrated in a few regions. The top 5 markets for FinTech, that is, Saudi Arabia, UAE, Malaysia, Turkey, and Kuwait, account for 75% of the total Islamic FinTech market size. Within these markets, Malaysia has proven to be on top; it also leads FinTech Hubs Maturity Matrix which proves that Malaysia is the leading market with high growth and has the most potential for FinTech. Saudi Arabia, Pakistan, Indonesia, Qatar, and Kuwait, are also exciting hubs that should be on investors’ horizons.

FinTech is the use of innovative and disruptive technology like Blockchain, artificial intelligence, Regtech, smart contracts, Crowdfunding, P2P lending, and digital currency to offer financial services and can be integrated with any device or environment. FinTech has simplified several financial services and distant learning is no different. In the sudden shift of education from brick and mortar to online, FinTech has played a very critical role. Now, when the times are better, developments in FinTech will also affect eLearning solutions. eLearning is an innovative vertical in the technology domain, and it has been steadily improving and enhancing to cater to modern needs. At this point, the distant learning solutions in the Islamic finance industry need to become more interactive and secure. The future of eLearning is fun and completely interactive with virtual reality, augmented reality, and metaverse-based environments. These interactive environments can encourage collaborative learning environments, but also enable fun and interesting communication. These environments can help the trainer create real-world problem scenarios in the virtual world and assess how the learner tackles the situation with the Shari’a-based regulations/products. The interactive environment will revolutionize the way online exams are carried out as the assessment would be gamified in the virtual environment.

The current limitations of distance learning specifically, for online examinations, can be resolved by offering an interactive role-playing game where the learner will be tested and assessed on their decision and strategies. An important component of the metaverse is life logging which lets people capture, store and share knowledge, and daily experiences. With some augmented reality, this could be used for interactive and collaborative sessions where instead of direct questions the assessment could be scenario-based to better judge their analytical and reasoning skills.

Conclusion

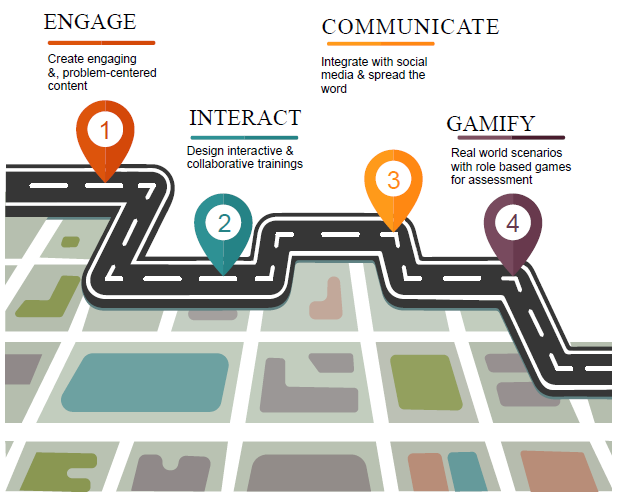

The future of learning decides the growth of the industry. Figure 6.2 provides a snapshot of goals the global industry needs to achieve and sustain this growth and stand in the same league as the traditional finance sector.

Engaging curriculum /content

Development of engaging and problem-centric content that is based on real-world scenarios where learners need to comprehend the interdisciplinary multi-domain problems and derive a solution based on the Shari’a framework.

Collaborative training

Design interactive and collaborative training sessions with a combination of self-paced and group discussion forums, debates, and case studies to ensure improving capabilities at personal as well as team levels. Collaborative environment with multiple domain experts to challenge leadership and analytical skills.

Communication

The integration of social media to create a better and more accurate picture of Islamic finance and facilitate the availability of educational content. Social media is critical to the success of gamified and interactive environments.

Enhanced user experience

User experience is the real game changer. An augmented reality environment that provides the learner with real-world scenarios and the trainer can assign roles to the learners to assess them on how to solve the problems and take decisions in a gamified environment. A role-based collaborative environment can replace the old school exams with interactive assessments.