Introduction

Market efforts at promoting standardization in the Islamic hedging market have been making steady progress following the publication of the Tahawwut Master Agreement (TMA) by the International Swaps and Derivatives Association, Inc. (ISDA) and International Islamic Financial Market (IIFM) in early 2010. The next project ISDA and IIFM have been working on after the publication of the TMA has been standardized Islamic Profit Rate Swap (“PRS”) documentation to fit with the TMA. Both the TMA itself and the PRS documentation have been the subject of extensive consideration by IIFM’s panel of Shari’a scholars.

This chapter explains the ways in which the proposed standardized PRS documentation will enable a PRS to be structured, along with a worked example of using a PRS to hedge sukuk.

The TMA

Before looking at the PRS in detail, a quick refresher on the TMA and its terminology is useful. The TMA is a master agreement that contains the general terms and conditions agreed between the parties and under which parties may enter into “Transactions” and/or “DFT Terms Agreements” relating to “Designated Future transactions”.

The TMA draws a distinction between “Transactions” that have been entered into between the parties and “Designated Future transactions”, the latter referring to transactions that will or may be entered into between the parties at an agreed date in the future. This is an important distinction and one that is driven by the different close-out mechanisms which apply to these two types of arrangements. The terms of a Transaction are evidenced by a “Confirmation”. The terms of a Designated Future transaction are provided for in a DFT Terms Agreement, which is evidenced by a “DFT Terms confirmation”. Once a Designated Future transaction is actually entered into between the parties, it becomes a “Transaction” under the TMA and should be documented using a “Confirmation”. A failure to enter into a Designated Future transaction when required to do so in accordance with a DFT Terms Agreement is an Event of Default under the TMA. Remember that the TMA brings a number of benefits. First, as its usage as a market standard agreement in- creases, it will help reduce the documentation time, cost and effort of entering into hedging transactions, as in- deed will the standard PRS documentation. Importantly, also, the TMA establishes master terms that can apply to all the Islamic hedging transactions between the parties, potentially enabling them to risk manage their relationship on a net basis. While netting recognition in the event of counterparty insolvency will depend on the relevant insolvency regime’s acceptance of it, the contractual entitlement to close out on an event of default and to net, as contained in the TMA, has a value in its own right.

Two different structures for PRS

There are two ways in which it is contemplated that a PRS under the TMA may be structured. They are:

- based (or undertaking-based) and involving a Two Sales structure and

- based (or undertaking-based) and involving a Single Sale structure

The Two Sales Structure and Single Sale Structure are explained in paragraphs 9.7 (Two Sales Structure PRS) and 9.8 (Single Sale Structure PRS) below.

Two legs of a PRS

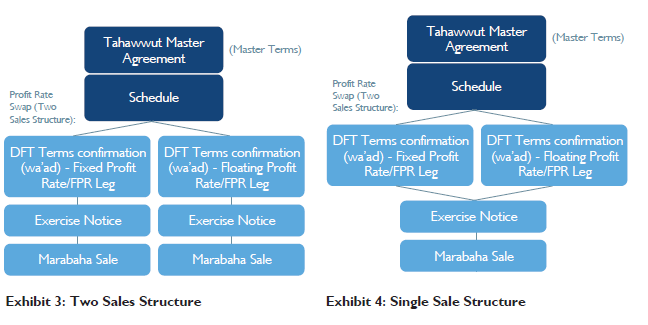

Each PRS may be documented using two DFT Terms confirmations, one relating to the Fixed Profit Rate leg of the PRS; the other relating to the Floating Profit Rate leg of the PRS. If and when a Transaction arises out of a Designated Future transaction, a Confirmation is used to document that Transaction.

In the conventional swap market, a swap, consisting of two legs (typically, one fixed and one floating¹), will be treated as a single transaction and documented by a single confirmation. In the case of a wa’ad based PRS, however, instead of using a single document for both legs, there is some Shari’a preference that the wa’ad (or undertaking) for each leg should be clear and distinct, and not combined with that of the other leg. Therefore, to document the PRS, two separate DFT Terms confirmations are proposed, one for each leg.9.4 Use of wa’ad leading to murabaha sale

Use of wa’ad leading to murabaha sale

The PRS templates being prepared by ISDA and IIFM will use a wa’ad (or undertaking) structure, as is now increasingly common in Islamic finance transactions.

A wa’ad is essentially a unilateral undertaking or promise made by one party (the Buyer² of assets) to the other party (the Seller of assets) that, if required by the Seller (usually called exercise of the undertaking or wa’ad), the Buyer will fulfil its promise, in this case, to enter into a murabaha (or sale) contract under which it buys from the Seller an agreed quantity of agreed Shari’a compliant assets at an agreed price (or agreed formula for calculating a price) on the relevant exercise date.

If and when the Buyer’s wa’ad (or undertaking) is exercised by the Seller on a specified exercise date, the Buyer is required to enter into a murabaha (or sale) contract with the Seller and execute a Confirmation documenting the murabaha sale. A murabaha sale entered into between the parties constitutes a Transaction under the TMA.

The PRS templates being prepared by ISDA and IIFM will provide a form of exercise notice, which can be extracted, completed and used by the Seller when it wishes to exercise the Buyer’s wa’ad (or undertaking) on an exercise date.

Timeline examples – when is the murabaha sale entered into?

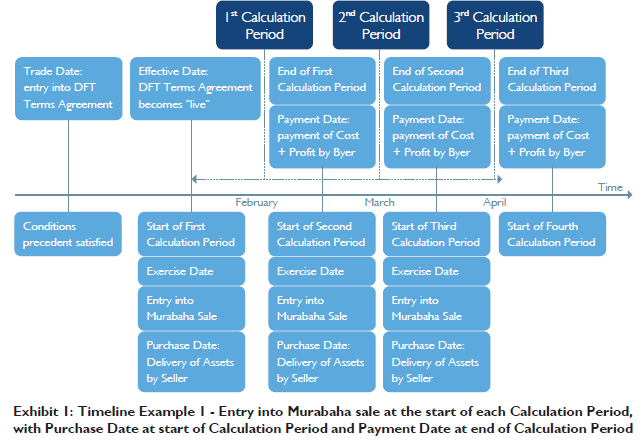

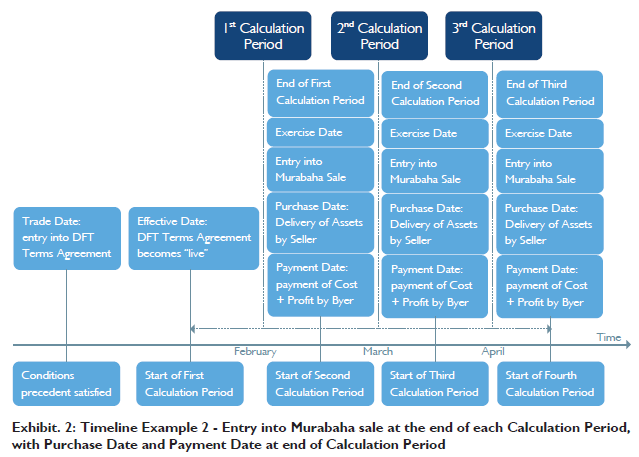

When structuring a PRS and finalizing the terms of the DFT Terms Agreements relating to that PRS, the parties must identify when a murabaha sale may be entered into following the exercise of a wa’ad. It is expected that, for each Calculation Period of the PRS, it will be required to enter into the murabaha sale either: (i) at the start of the Calculation Period (as shown in Exhibit 1 below) or (ii) at the end of the Calculation Period (as shown in Exhibit 2 below).

Two sales structure PRS

With a Two Sales Structure PRS, for each Calculation Period in relation to the PRS, the two wa’ads set out in the DFT Terms confirmations for the Fixed Profit Rate leg and for the Floating Profit Rate leg, respectively, will be exercisable and exercised by the Exercising Party (i.e. the Seller) against the Undertaking Party (i.e. the Buyer). Therefore, two murabaha sales will be entered into be- tween the parties; one in relation to the Fixed Profit Rate leg and one in relation to the Floating Profit Rate leg. Accordingly, there will be two asset flows and two cash flows between the parties in relation to each Calculation Period for the PRS. While two-way cash flows which are matured payment obligations becoming due on the same day, in the same currency and between the same parties may be set-off against each other, the asset flows may not. Purchased assets should always be delivered.

The overall documentary architecture for the Two Sales Structure is illustrated in Exhibit 3 below.

Single sale structure PRS

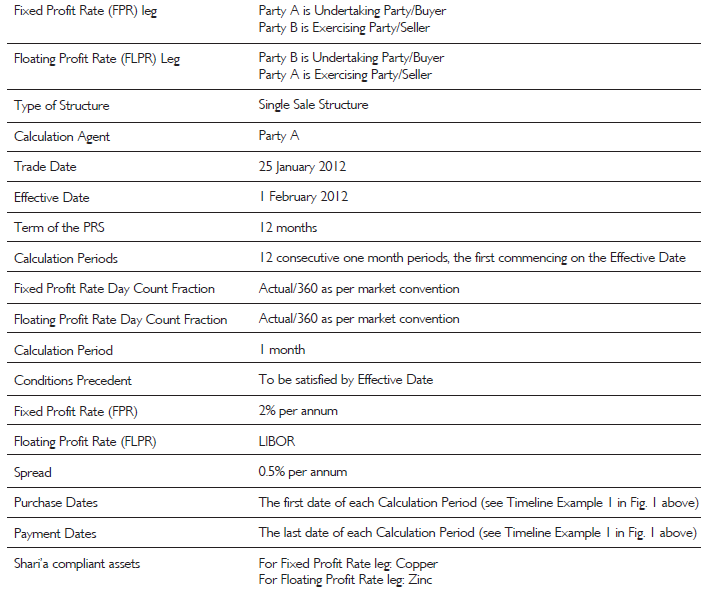

With a Single Sale Structure PRS, for each Calculation Period³ in relation to the PRS, only one of the two wa’ads set out in the DFT Terms confirmations for the Fixed Profit Rate leg and for the Floating Profit Rate leg, respectively, will be exercisable by the Exercising Party (i.e. the Seller) against the Undertaking Party (i.e. the Buyer), depending on whether or not a specified condition to exercise (i.e. the exercise condition) is met in

relation to a Calculation Period. The exercise condition is that the Profit in relation to a Calculation Period is greater than zero. The Profit is calculated by a Calcula- tion Agent by reference to a calculation formula. Ordinarily with a fixed floating PRS, if the Profit under one leg is positive (i.e. greater than zero) the Profit under the other leg will be negative, so leaving only one wa’ad (the one with the positive Profit) to be exercised. In respect of each Calculation Period, the exercise condition will be met in relation to only one leg of the PRS. Therefore, only one of the two wa’ads will be exercisable, and one murabaha sale will be entered into between the parties, either in relation to the Fixed Profit Rate leg or in rela- tion to the Floating Profit Rate leg. Accordingly, there will be only one asset-flow and one cash-flow between the parties in relation to each Calculation Period for the PRS.

The overall documentary architecture for the Single Sale Structure is illustrated in Exhibit 4 below.

Features of the DFT terms confirmations

- Transaction terms

Each DFT Terms confirmation should include specific transaction terms (e.g. Effective Date, Business Day, Purchase Dates, Payment Dates, Buyer, Seller, etc.), as agreed between the parties upon entry into the relevant DFT Terms Agreement on the Trade Date.

- Related confirmations/legs

For the purposes of enabling payment netting (i.e. the set off of sums due on the same day and in the same currency) between the two legs of the PRS, the DFT Terms confirmation for one leg of a PRS should identify the DFT Terms confirmation for the other leg as being related to it, as a “Related DFT Terms confirmation”.

- Shari’a compliant assets

Only Shari’a-compliant assets that are suitable as the subject matter of a murabaha sale may be sold by Buyer to Seller. It is therefore expected that, for example, gold and silver will not be used. To provide certainty of subject matter, the parties should agree and describe in detail the relevant assets relating to each leg of the PRS in the relevant the DFT Terms confirmation. Again, the expectation is that different types of assets will be specified in the two legs of the PRS.

- Footnote guidance

The PRS templates that ISDA and IIFM are preparing are expected to contain extensive footnotes (as is the case with the TMA itself) in order to provide guidance to the parties (in particular in respect of the some important Shari’a considerations). Again these will not form part of the terms of the contract between the parties.

- Agency/brokerage

Parties entering into a PRS may wish to appoint an agent or broker to deliver, buy, sell or receive delivery of assets. In these cases, the parties’ Shari’a advisers should be satisfied with the use of the agent/broker and the relevant agency/brokerage procedures in the context of the particular PRS transaction or transactions to ensure the arrangements do not fall foul of restrictions such as the prohibition on bai al-ina.

Shari’a approval

While the new PRS templates will be approved by IIFM’s Shari’a Panel, it is always the responsibility of each of the parties entering into the PRS to ensure that its own Shari’a advisors are satisfied that the relevant hedging transaction is Shari’a compliant and that the documents are suitable for, and are being used appropriately in, the context of that particular hedging transaction.

Worked example of PRS hedge

How the PRS documentation described will work is best explained through an example of Islamic hedging.

- Hedging liability in respect of sukuk

Imagine that:

Party A will issue an AED 10,000,000 sukuk with a 12-month tenor on 1 February 2012:

- Sukuk pays out a capital (or principal) amount at one-year maturity and periodic (monthly) floating amounts to investors over the course of its tenor.

- A variable benchmark rate (in this case, one-month LIBOR) is used to calculate the periodic floating amount payable to investors.

- Party A is exposed to any changes in that benchmark rate. In this case, the sukuk is benchmarked to one-month LIBOR, so the 12-month sukuk has twelve one-month calculation periods commencing on 1 February.

- Party A wishes to hedge itself against the possibility that the benchmark rate used to calculate the periodic floating amounts will increase. By entering into the PRS, it is looking to fix its exposure in relation to the sukuk.

Party B is an Islamic bank with a large fixed-rate portfolio and, for risk management purposes, it wishes to hedge itself by converting some of its fixed-rate exposure into floating-rate exposure.

The PRS enables Party A to hedge its floating rate exposure under the sukuk by converting it into a fixed rate exposure (i.e. Party A knows that by paying the fixed amounts to Party B, Party A will receive from Party B the floating amounts necessary to pay under the sukuk). Party B is highly dependent on floating income and through the PRS is able to convert some of that into stable fixed income.

- The Hedging PRS

Party A and Party B enter into a PRS on 25 January 2012 (Trade Date), under which:

- Party A will pay fixed profit rate (“FPR”) amounts un- der one (FPR) leg of the PRS (and receive a floating profit rate amounts under the other leg).

- Party B will pay the floating profit rate (“FLPR”) amounts under one (FLPR) leg of the PRS (and receive the fixed profit rate amounts under the other leg).

To achieve these payments, the parties will buy or sell Shari’a-compliant assets to each other pursuant to a murabaha sale to be entered into pursuant to a wa’ad (or undertaking).

- The PRS documentation

Party A and Party B have already entered into a TMA. Party A and Party B enter into the PRS by way of two separate DFT Term Agreements (each of which is documented in a separate DFT Terms confirmation: one in respect of the fixed rate leg of the PRS, and the other in respect of the floating rate leg of the PRS).

Each DFT Terms Agreement contains a wa’ad (under-taking) to enter into one or more Designated Future transactions (if the wa’ad is exercised).

The DFT Terms Agreements are entered into on 25 January 2012 (Trade Date).

The PRS is to have a tenor of 12 months commencing 1 February 2012 (i.e. the date on which Party A is to issue the sukuk which it is looking to hedge) so that date will be the “Effective Date” under the DFT Terms Agreement and the first day of the period for which the PRS will provide Party A with the hedge. The PRS hedging period will have 12 Calculation Periods of one month each (to track the sukuk).

- Terms of the PRS (Single Sale Structure)

The terms of the PRS are as follows:

- Terms of the PRS: wa’ad in each leg of PRS

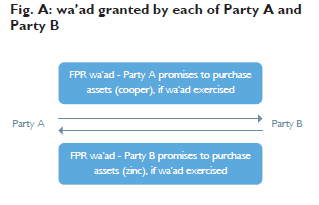

Each DFT Terms Agreement contains a wa’ad granted by one party to the other (by “Undertaking Party” to “Exercising Party”), as illustrated in Figure A below.

- In the DFT Terms Agreement for the FPR leg, Party A is the Undertaking Party.

- In the DFT Terms Agreement for the FLPR leg, Party B is the Undertaking Party.

By its wa’ad, the Undertaking Party undertakes to purchase Shari’a-compliant assets at an agreed price from the Exercising Party, if the Exercising Party exercises the wa’ad by notice on an Exercise Date (Fig. A)

Fig. A: wa’ad granted by each of Party A and Party B

F) Exercise of wa’ad

Party A and Party B’s PRS will use the Single Sale Structure and the murabaha sale will be entered into at the start of each Calculation Period with Purchase Date at the start of Calculation Period and Payment Date at end of Calculation Period (i.e. replicating Timeline Example 1) (as indicated in the table (Terms of the PRS).

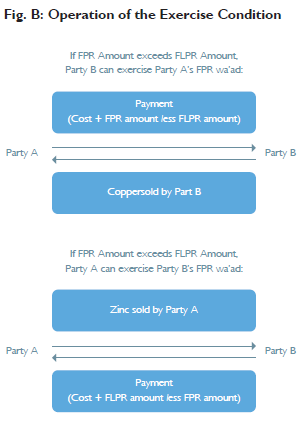

In the Single Sale Structure, a party may only exercise the wa’ad granted to it by the Undertaking Party on an Exercise Date if the Exercise Condition has been met. It is possible for the Exercise Condition to be met only in relation to one of the two wa’ads on any Exercise Date: the result is that only one wa’ad will be exercisable in respect of the PRS.

- If the Exercise Condition in the FPR leg of the PRS is met (which means that it will not be met in the floating rate leg), the wa’ad contained in the DFT Terms Agreement for the fixed rate leg is exercisable (and the wa’ad contained in the floating rate leg will not be exercisable).

- If the Exercise Condition in the FLPR leg of the PRS is met (which means that it will not be met in the fixed rate leg), the wa’ad contained in the DFT Terms Agreement for the floating rate leg is exercisable (and the wa’ad contained in the fixed rate leg will not be exercisable).

If a wa’ad is exercised, the Undertaking Party must buy assets from the Exercising Party and execute a Confirmation evidencing the murabaha sale between the parties: there is only one murabaha sale in respect of each Exercise Date in respect of a PRS with a Single Salestructure.

- Exercise of wa’ad: What is the Exercise Condition?

The “Exercise Condition” is satisfied in respect of a Calculation Period if the profit is greater than zero for that Calculation Period.

In other words, Profit in respect of that leg of the PRS for a Calculation Period must be greater than zero in order for the relevant wa’ad to be exercisable, as illustrated in Figure B.

- Exercise of wa’ad: Which leg of the PRS is exercisable?

Party A and Party B have now entered into a PRS. The Calculation Agent determines Profit in relation to each leg of the PRS in respect of the first Calculation Period to determine whether Exercise Condition is met and which leg of the PRS is exercisable.

Calc. 1 – Floating Profit Rate (or FLPR) leg

- Under the FLPR leg, Party A (Exercising Party) may exercise Party B’s (Undertaking Party’s) wa’ad in respect of the first Calculation Period if the Profit in respect of the first Calculation Period is greater than zero

- The Calculation Agent determines Profit as follows:

Profit = {Capital Amount x [(FLPR + Spread) x FLPR Day Count Fraction]} – [Reference Rate Amount for FLPR5]

Profit = {10,000,000 x [LIBOR at 1% + 0.5%] x 30 days/360} – {10,000,000 x [2% x 30/360]}

Profit = {10,000,000 x [0.015 x 0. 0833333]} –

{10,000,000 x [0.02 x 0.0833333]}

Profit = {10,000,000 x 0.0012499} – {10,000,000 x

0.0016666}

Profit = 12,499.99 – 16,666.66 Profit = AED -4,166.67

Therefore, Profit is negative (AED -4,166.67) in respect of the FLPR leg for the first Calculation Period. (The Profit element can only be positive in relation to one leg of the PRS). As Profit is less than zero, the Exercise Condition is NOT met in relation to the FLPR leg for the first Calculation Period Party B may NOT exercise Party A’s wa’ad on the Exercise Date.

Calc. 2 – Fixed Profit Rate (or FPR) leg

- Under FPR leg, Party B (Exercising Party) may exercise Party A’s (Undertaking Party’s) wa’ad in respect of the first Calculation Period if the Profit in respect of the first Calculation Period is greater than zero

- The Calculation Agent determines the Profit as fol- lows6:

Profit = Capital Amount x [FPR x FPR Day Count Fraction]}

– [Reference Rate Amount for FPR **]

Profit = {10,000,000 x [2% x 30/360]} – {10,000,000 x [LIBOR at 1% + 0.5%] x 30/360}

Profit = {10,000,000 x [0.02 x 0.0833333]} – {10,000,000

x 0.015 x 0.0833333}

Profit = {10,000,000 x 0.0016666} – {10,000,000 x

0.0012499}

Profit = 16,666.66 – 12,499.99 Profit = AED 4,166.67

Therefore, Profit is positive (AED 4,166.67) in respect of the FPR leg for that Calculation Period. As Profit is greater than zero, the Exercise Condition is met in relation to the FPR leg for the first Calculation Period. Party B may exercise Party A’s wa’ad on the Exercise Date.

- Exercise of wa’ad in Single Sale Structure: Consequences

FPR leg of PRS: In this example, Party A’s wa’ad to Party B has become exercisable in respect of the first Calculation Period. Accordingly, the expected order of events would be as follows:

- Party B exercises Party A’s wa’ad on the Exercise Date by notice to Party A.

- Party A and Party B enter into a murabaha sale (i.e. Party B sells assets to Party A).

- Party A and Party B execute a murabaha Confirmation.

The murabaha sale entered into pursuant to the FPR leg of the PRS becomes a Transaction under the TMA. FLPR leg of PRS: In this example, Party B’s wa’ad to Party A has not become exercisable in respect of the first Calculation Period (as per Calc.1 above). Accordingly, no murabaha sale is transacted in respect of the first Calculation Period pursuant to the FLPR leg of the PRS.

- Exercise of wa’ad in Single Sale Structure: murabaha sale

Exercise of the wa’ad under the FPR leg requires Party A and Party B to enter into a murabaha sale, (i.e. Party B sells FLP Assets to Party A at a purchase price consisting of Cost Price + Profit).

Delivery of assets: Party B (the Seller) delivers the FLP Assets (copper) to Party A on the Purchase Date, which, in this example, falls at the start of the each Calculation Period (see Timeline Example 1 in Exhibit 1 above).

Payment of purchase price: Party A (the Buyer) pays the deferred purchase price of Cost + Profit on the Payment Date, which, in this example, falls at the end of the each Calculation Period (see Timeline Example 1 in Exhibit 1 above).

- Cost Price is the cost of the FPR Assets (copper) to the Seller.

- Profit is determined by reference to the differential payment of the FPR Amount and the FLPR Amount.

In this example, Profit is the difference between (1) the FPR Amount calculated for the FPR leg of the PRS and (2) the Reference Rate Amount (which corresponds to the FLPR Amount calculated for the FLPR leg), i.e.: Profit

= Capital Amount x [FPR x FPR Day Count Fraction]} – [Reference Rate Amount for FPR]

In this example, Profit payable by Party A in respect of the first Calculation Period is the positive amount (AED 4,166.67) calculated above in Calc. 2 (in determining whether Exercise Condition is met).