The Islamic finance industry has come a long way from its humble roots to assume a significant position in the wider financial framework. IFIs total around 500 and are geographically spread across 75 countries. The size of the industry is approximately USD 1.1 trillion and estimated to have an annual growth rate of 10% per annum despite the difficult overall economic environment. It is now time for the masses to establish with greater certainty where the industry really stands, and see if an objective view can be taken on the current state of affairs in the industry, in order to formulate policies/strategies towards a sustainable future course. Indeed central banks, regulatory bodies, state governments, investors, financial institutions, consumers and other stakeholders in the industry would like to take a more informed decision based on objective reasoning, as opposed to merely following subjective fantasy.

An area of particular interest is gauging the depth and incidence of Islamic finance across the globe. It is also important to understand the elements that make one country more conducive to progressing with Islamic finance as compared to another. Even when relying on quantitative information, it is important that conclusions are not based on univariate observations. Unfortunately, however, a common perception about country ranking is based on univariate analysis.

Univariate analysis is the usual way of assessing countries against one another based on one or more variables. In doing so, however, each variable is studied in isolation from others, and as such, it is unable to help form a definitive collective view. Mere dependence on individual observation to a particular question of interest could be misleading if due weight is not attached to each observation. An isolated analysis, though useful, therefore remains limited in terms of its reliable acceptance.

It is only fair to rank countries by looking at all the available information and form a collective view – a multivariate analytical approach. This study therefore aims at developing a unique and completely objective Islamic Finance Country Index (IFCI) – the first of its kind and a major breakthrough in appraising the industry. IFCI is based on multivariate analysis of available information on countries included in the analysis, whereby each category of information is assigned weights by the analytical system in a purely statistical fashion. below, we describe the process of constructing the IFCI, together with the description of data used and its respective limitations.

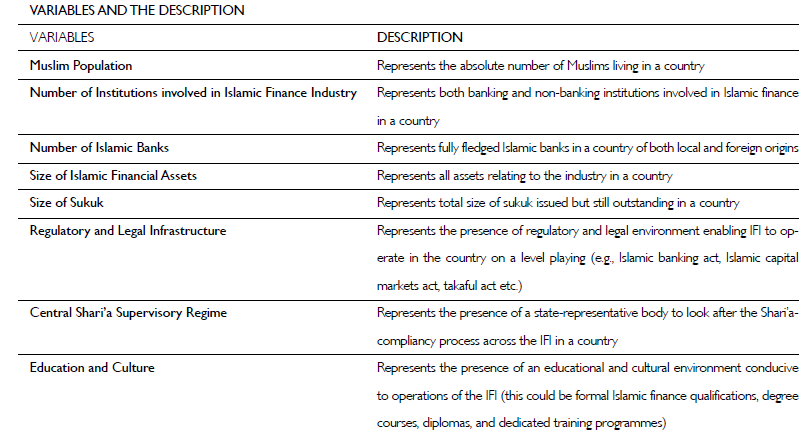

The IFCI aims to rank countries involved in the industry on the basis of available information/data on various variables of interest across each of these countries, by conducting a multivariate analysis in a purely objective manner to avoid any personal bias / a priori judgement affecting the outcome. Construction of the IFCI began with letting the data speak for itself. To that end, the IFCI focused on gathering data on 15 different variables of interest across 75 countries in the world. The heterogeneous nature of each of these countries and inadequacy of data resulted limited the IFCI to only 36 countries, with the focus reduced to just 8 variables. In all cases, data has been collected from various secondary sources; including central regulatory bodies, individual IFI’s published accounts, global agencies’ websites, various periodicals, authentic newspapers, and other country specific resources involving extensive data search procedures. below is the list of these variables and the way they are defined for the purposes of IFCI:

Data was gathered on the above 8 variables for all 36 countries included in the IFCI. The data was then coded and organized to enable multivariate analysis and eventual construction of the IFCI using SPSS. In a multivariate analysis, one is always interested in knowing first the structure of data/information collected – i.e. whether the various levels of moments are observed to see if data has any useful information content to draw inferences from. Factor analysis is one correlational technique to determine meaningful clusters of shared variance in the data set. It attempts to identify underlying variables that explain the pattern of correlations within a set of observed variables. This procedure is often used to reduce the number of variables in a data set but can also be used to explore the latent structure of the variables in the data file – a purpose for which we employed Factor Analysis.

In order for Factor Analysis to be applicable, it is important that the data fits a specification test for such an analysis. The Kaiser-Meyer-Olkin Measure of Sampling Adequacy is a statistic that indicates the proportion of variance in observed variables that might be caused by underlying factors. High values (close to 1.0) generally indicate that a Factor Analysis may be useful with data. If the value is less than 0.50, the results of the Factor Analysis probably won’t be very useful. We found this measure to be 0.8, which is reasonably close to 1.0 and hence provided us comfort that the data was fit for Factor Analysis. bartlett’s test of sphericity is another specification test which tests the hypothesis that the correlation matrix is an identity matrix, which would indicate that given variables are unrelated and therefore unsuitable for structure detection. Small values (less than 0.05) of the significance level indicate that a factor analysis may be useful with the data. In our case, this test value was found to be significant at 0.00 level which was another strong confirmation that the data set was of a high quality and very fit for Factor Analysis. Once satisfied with specification tests, we ran Factor Analysis to compute Initial Communalities using Principal Axis Factoring method of factor extraction. For correlation analyses, Initial Communalities measure the proportion of variance accounted for in each variable by the rest of the variables. This procedure provided us a statistically significant method of assigning objective weights to all 8 variables entering the data set in a collective fashion. As a result of data speaking for itself in a multivariate manner, any subjectivity or univariate objectivity was completely ruled out in assigning the weights. These weights, in order of their respective significance, are reported in the table below:

The above table indicates interesting findings as to which variables contribute greatly towards the ranking of countries. Interestingly, it appears that countries with a higher number of full fledged Islamic banking institutions stand greater chances of ranking high in the list. On this basis, one would expect bahrain to top the list with 26 banks, followed by Iran, Malaysia, Indonesia, Sudan, UAE, Saudi Arabia and Kuwait. However, as confirmed by the results of the multivariate analysis, this is not the case in reality – indeed what is clear from the findings here, is that future growth lies in establishing more Islamic banking and financial institutions (with a greater emphasis on these being fully fledged Islamic as opposed to Islamic windows) . The most striking observation to note is that countries with a formal state level Shari’a supervisory regime are better placed to rank higher (Iran, Malaysia, Pakistan, Indonesia, bahrain, Kuwait and Sudan may sound as the only candidates on this basis as such regimes do not exist at the moment in other countries in the world). A clear message to emerge from this finding is that prospects of growth are higher in those counties where Central Shari’a Supervisory regimes are already in place or in the making. In the past, the most popular measure of a country ranking used has been to look at the size of Islamic financial assets. On this basis, one can intuitively expect countries like Iran, Saudi Arabia, Malaysia, UAE, Kuwait, bahrain and Qatar to top the list. However, as noted by the multivariate country index discussed below and the lower weight assigned to it in the table above, this is indeed a misleading measure of a country ranking – the contribution of this variable is yet reasonably strong at a level of 14%. Surprisingly, being active in the sukuk market does not necessarily contribute extensively in country ranking. This is also true in case of the size of the Muslim population in a country and as such mere presence of Muslims in a country does not necessarily guarantee a higher place in the ranking. While one would expect presence of a supportive regulatory and legal framework to have a high positive correlation with ranking of the country, it appears, on the contrary, to contribute least by having a lower positive correlation. Educational and cultural awareness in a country is also an important contributor but far less than a Central Shari’a Supervisory regime for example.

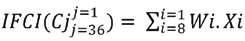

The weights listed in the table above were then used to create an additive country index accounting for all 288 observations across 36 countries and 8 variables. The index model followed the specification below:

Where C = Country

W = Weight for individual variable

X = Variable

Using the above specification and the objectively

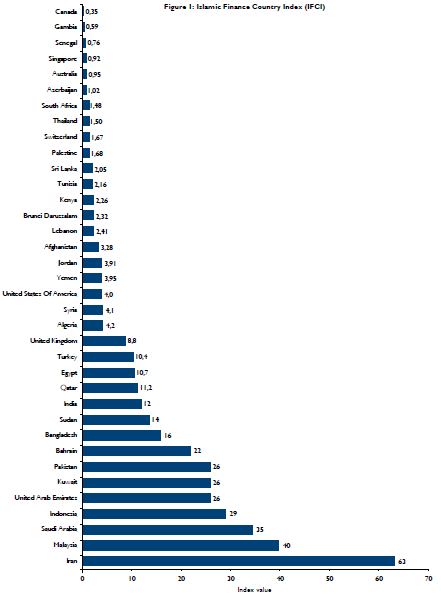

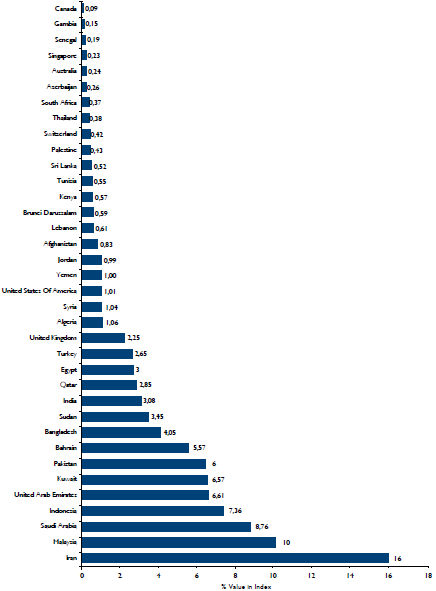

calculated weights, we construct the first-ever objective ranking of the countries involved in the islamic Finance industry as shown in Figure 1 and 2 below. This ranking does not rely on observing individual variables and even when we were able to estimate the relative importance of each of these variables, they were employed together in a multivariate manner to come up with a final ranking. As shown by the calculations, iran tops the list by ranking 1st in the list of 36 countries. It is followed by Malaysia while saudi arabia stood 3rd. It is important to note that on a univariate basis, if, for example, a view was to be taken on the basis of Size of Islamic Assets only, while Iran would have maintained 1st position Malaysia would have ranked 3rd (a potentially misleading observation). On the other hand, if a univariate view was taken based on number of total Islamic financial institutions, Malaysia would have topped the list, followed by Saudi Arabia and then Iran. However, multivariate findings have asked us to be careful in drawing conclusions based on isolated analysis of these variables.

A very interesting and surprising observation is the ranking of indonesia which has assumed 4th place in the country rankings despite, for example, the size of its Islamic assets being about 12 times less than its next ranked country of UAE. This finding is relatively insensitive to the population bias as well because of the objective weights assigned to all variables including population which contributes to only 7% to the index itself (on the basis of size of assets, Indonesia would have ranked 11th instead which indeed is misleading based on multivariate results).

Another interesting case is that of pakistan which has gone 7 steps the ranking from 14th position (based on size of Islamic assets only, for example) to 7th. This can be explained better knowing that Pakistan does exercise a Central Shari’a Supervisory regime – a factor which carries about 20% of the weight in the index construction. This is despite Pakistan deriving little advantage from having a higher Muslim population, a variable which has lower weight in the index.

A very attention-grabbing finding is the case of india for example, which has occupied 11th position in the overall ranking, leaving behind countries like Qatar (12th), Turkey (14th) and UK (15th). This is despite the current diminutive size of Islamic financial assets and the absence of a full-fledged Islamic banking institution, even though it is a country with the third largest Muslim population in the world. We would therefore like to take a cautious view on the standing of India and remind ourselves of the size of Islamic assets in Qatar, Turkey and UK which are far greater than India. In case of Qatar and UK, one explanation may be a smaller Muslim population. All said, in terms of % value of these countries in the index (Figure 2), India and Qatar stack very closely while Turkey and UK are not very far behind either.

While ranking data is presented for all 36 countries, we do not present dedicated discussion on countries ranked 16th to 36th because of their % value in the index which is either 1 or less. In fact, the first 15 countries represent about 88% of the total index position which is a good enough subset to limit plausible discussion on results.

AFGHANISTAN

October 7th 2011 will mark 10 years since the NATO led forces entered Afghanistan. The attack brought promises of liberty, hope, democracy, prosperity and women rights to a country long crippled by years of war from both within its borders and beyond. 10 years on, the Afghani people are still mulling over whether these promises have been met, while America and its’ allies worryingly ponder as to how to withdraw their 13000 strong force in the face of a strengthening Taliban insurgency. A decade on, It is unlikely there will be cessation of hostilities in this war torn nation.

opportunities in the rubble of war

be that as it may, the rebuilding efforts continue in the midst of bombs and gunfire. It was hardly going to be a smooth transition from failed state to a flourishing democracy, though the building blocks are clearly visible. Afghanistan’s government is limited to using short-term bills and international aid to finance development and have received more than USD 32 billion in international aid since 2001 to rebuild. The financial sector is slowly developing. Essentially, the banking system had to be created from a blank piece of paper with a complete overhaul of the banking sector in 2003. local and international consultants, advisors, visionaries and practitioners gathered to setup a framework for the system with attempts to bring its banking standards up to those of its neighbours, Pakistan and Iran. At present, total deposits stand at USD 3.58 billion as of August 2010, according to a central bank report. but bankers estimate that there is close to USD 30 billion in circulation that remains untapped by the banking sector.

In 2009, the Central bank of Afghanistan introduced a five year plan to enhance the banking framework. A pressing concern is how to attract a larger customer base. Currently, only a tiny proportion has a bank account with over 95% not having access to banking services. Poverty along with the threadbare number of banking branches across the country, contributes to this high figure. Additionally, potential customers have rejected conventional finance as it is antithetical to Islamic financial tenets. There is therefore a potentially significant captive market for Islamic finance.

Subsequently, the five year plan recognises the expediency of the Islamic finance market for Afghanistan’s rejuvenation. The central bank has set up an Islamic finance division to work on Islamic finance and a Shari’a board. Currently, there is no specific Islamic finance legislation nor is there a fully fledged Islamic bank. but out of the 17 conventional banks that operate in the country, six of them have Islamic banking windows.

Afghanistan’s central bank expects an Islamic banking law to be enacted by September and the inauguration of a fully fledged Islamic bank soon after. The central bank is planning to issue three banking licenses once the law has passed, and a number of banks have already shown interest. The government hopes that Islamic banks will tap into the giant reservoir of unbanked customers. In addition to establishing Islamic banks, the sector is looking at innovative means to draw customers. In this regard, mobile banking has significant attraction especially as the physical infrastructure of the banking system is at an embryonic stage.

corruption in the elite

Unfortunately, the banking sector has taken a battering recently and suspicions are high about the industry. In the birth pangs of Afghanistan’s banking sector, it should not come as a surprise that corruption has already inflicted damage to the integrity of the system. Early 2010 saw American investigators and their Afghani counterpart unearth opaque tributaries of money going from depositors’ accounts at Kabul bank – the country’s largest private bank – into personal accounts of senior banking and government officials. It is estimated that

USD 900 million is missing from the bank, which for a country whose GDP is currently at a meagre USD 11.76 billion (World bank 2008) staves a sizable hole in their rebuilding budget. Investigators believe that the USD 900 million includes failed loans and loans to fictitious organisations. It is hoped that Islamic banks and its already intuitive attraction to a country predominately Muslim and conservative, will galvanise the sector.

third sector development

Moving away from banking, the third sector has seen Islamic finance play a crucial role in reaching out to the impoverished segments of society. Organisations such as FINCA Afghanistan have developed Shari’a- compliant microfinance products. It currently has 10000 clients with an average loan size of USD 385. The World Council of Credit Unions (WOCCU) program established the country’s first national association for Islamic investment and finance cooperatives (IIFCs), or credit unions, which are intended to benefit small and medium-scale business owners, farmers and low- income households in underserved rural areas. In December 2009, The U.S. Agency for International Development (USAID) awarded WOCCU USD 60.5 million to expand financial services in southern and eastern Afghanistan. As the anniversary fast approaches, the Afghani people have plenty of milestone events to deliberate over. Has the War on Terror in their country been a resounding success? The answer on the lips of most Afghanis would be no. but in the rubble of war, there are shoots of opportunity: opportunities that need to be taken quickly before they flounder. Islamic banking is present in Afghanistan, but nascent; demanded but not extensively supplied. 2011 could be another milestone year but it is for the Afghanis to take the right steps. Seemingly they are on the path but have to be careful not to trip up.

Algeria

Algeria is a country situated in North Africa along the Mediterranean Sea. It boasts of a rich cultural heritage due to its unique history, as the country has been sub- ject to various forms of occupation throughout its past. A mixture of berber, Arab, Turkish as well as French influence has given the local populace much diversity. Algeria possesses natural resources in abundance such as oil and gas. However, there is high unemployment and poverty within Algeria leaving much of the youth disenfranchised. This is clearly evident from the recent demonstrations held against the government, with more expected, inspired no doubt by the success of similar protests in Egypt and Tunisia.

With the majority of the population being Muslim, one would expect Islamic finance to already be well established within the country. Unfortunately, the government of Algeria has been slow to facilitate the entrance of Islamic finance, stunting its growth. The scepticism and attitude of the Algerian government has no doubt been influenced by historical events in the country, i.e. the civil war in the 90’s.

However there are signs that the government is warming towards Islamic finance. This change in attitude is due to the fact that the leadership of the country is keen to attract investment from the rich Gulf States and furthermore Algerians themselves, now want more access to financial services which are at par with their religious beliefs. Furthermore, as was mentioned earlier, there is much unemployment and unhappiness at the current regime, thus Islamic finance expansion will create much needed jobs and may ease some of the pressure on the government.

The year 2010 saw some crucial developments in the Algerian legislative framework, to facilitate the growth of Islamic finance within the country. After the government received much criticism for stifling the growth of Islamic finance, it responded by amending the law on Money

and Credit in May 2010. The amendment which was due to come into play this January (2011) aims to make it easier for banks to offer both conventional and Shari’a-compliant finance and enable them to establish their own respective Shari’a boards.

The law amendment will hopefully fuel the growth of Islamic finance within Algeria, as even though there are a few IFIs currently operating within the country, the market share held by Islamic banks is still insignificant. besides retail and investment banking, there is also potential for Shari’a-compliant micro-finance, which has not escaped the attention of potential entrants to the market. The clamour for Islamic finance is growing louder. Conferences were held in 2010 and MPs have started to promote its cause. Thus it is expected that Islamic finance will play a much greater role in future in the Algerian economy.

Azerbaijan

Azerbaijan is a country which is strategically located near the Caspian Sea. It is rich in culture and resources possessing large reserves of both oil and natural gas. With the majority of its nearly 9 million strong Muslim population, it seems a ripe market for Islamic finance to enter.

The country gained independence from the Soviet Union in 1991, after years of occupation which had curbed religious activity. Islamic finance development was slow within Azerbaijan, as well as in other Muslim countries in the region. Gradually, a reawakening of religious values amongst individuals in the region has occurred and this, in turn, enabled Islamic finance to make some inroads into the financial system.

Due to an absence of appropriate legislation and regulation stemming from a lack of support from the government, much of the Islamic finance activities in the country had been informal and silently countenanced by regulatory bodies and government. However, it appears as though Islamic finance seems to be becoming more and more “official” in a sense.

Kovsar bank has been offering Islamic financial services for some time now; but the bank was recognised by the government not as an official “Islamic” bank, but rather a bank which offers alternative or interest-free finance. The IDb was critical in changing the views of the Azerbaijani government towards Islamic finance. It was involved in the setting up of an Islamic investment fund known as the Caspian Investment Company (CIC), a joint-venture between the IDb and Azerbaijani government. by creating an amicable partnership, the government was exposed to the potential benefits of Islamic finance. Compounding this good will, the Islamic Corporation for the Development of the Private Sector (ICD) has been providing certain Azerbaijani banks credit to use for “unofficial” Islamic finance offerings such as ijara.

Today, the largest bank in the country, the International bank of Azerbaijan (IbA) has expressed its wish to introduce Islamic financial services. The bank is in the final stages of opening up an Islamic window, after a team worked tirelessly since 2009 to formulate a strategy and engage relevant stakeholders. The Islamic banking window is expected to begin operations in 2011. Other banks within the country which have been looking at setting up an Islamic banking window include Turan bank. The ball has started to roll which could have lasting effects for Azerbaijan and impress the rest of the region. The government however still needs to amend certain laws and do more to facilitate Islamic finance in the country. However the future of Islamic finance seems bright and the importance of Azerbaijan cannot be underestimated. This view is supported by IDb choosing to have its 35th annual meeting in the country in 2010.

Australia

The Ashes have returned to England, much to the dis- may of the passionate Australian fans, who had been so used to their imperious cricket ticket team discarding rivals with their technical mastery, elegant deliveries and an unflinching ruthlessness that teams had already lost before walking on to the pavilion. Unfortunately, time waits for no man and the old guard, one by one, have left; it is up to the new guard to learn from their exam- ple and move forward.

Similarly, 2010 also saw the previous Prime Minister, Australian labour Party’s Kevin rudd leave and hand over the reins of power to his Deputy, Julia Gillard. In the ensuing parliamentary elections, the labour Party narrowly claimed victory, forming a minority government, and entered into its second term in power. Policies have therefore not altered significantly and the focus of developing Australia as leading financial centre still remains. This is good especially for the progress of Islamic finance in the country. The previous government had shown a great deal of enthusiasm for the establishment of an Islamic finance hub in Australia. This was ostensibly driven by former Assistant Treasurer, Senator Nick Sherry, who has set the groundwork in place for Islamic finance to flourish in Australia.

demistifying islamic finance

On May 27th, the Treasury launched a joint publication with Malaysian based law firm Zaid Ibrahim and Co, entitled ‘Demistifying Islamic finance’. The booklet was a general introduction to Islamic finance intended to raise awareness and encourage growth. Furthermore, the publication hoped to dispel misconceptions regarding the link between terrorism and Islamic finance. At the official launch, Sherry was keen to point out the government’s support on Islamic finance’s ethical precepts stating, “The Australian Government works to foster competitive and efficient markets that promote consumer wellbeing, a secure financial system and sound corporate practices.

This work supports a market system based on integrity, transparency and clarity — the same principles which are set out in the Quran and the Sunnah and which form the basis of Islamic finance”.

It was an edifying comment, one which unfortunately brought the ire of the more prejudicial and contemptuous segments of Australian society. Nevertheless, it was a statement of intent, a culmination of months of discussions, networking and consultations.

To augment and develop their capacity in Islamic finance, Australia has sought the assistance of Malaysia and Middle Eastern nations with Sherry making a number of official visits of Islamic finance hubs such as UAE, bahrain, Qatar and Malaysia. At the end of 2009, the Malaysian Islamic Finance Centre (MIFC) sponsored a roadshow which consisted of seminars and roundtable discussions with government officials on opportunities to be gained from Islamic finance. To strengthen the relationship, the Australian Treasury signed a Memorandum of Understanding with bank Negara Malaysia in order to foster long-term strategic business development in conventional and Islamic finance between Malaysia and Australia. Zaid Ibrahim & Co became the first Asian law firm to open offices in Australia in 2009 with a focus on advising upon Islamic finance services. Concurrently, UAE expressed interest in developing commercial relationships with Australia. The Dubai Export Development Corporation has undertaken two Islamic financial services mission to Australia aiming to strengthen the export of Islamic financial services. The Corporation which consists of leading IFIs such as Noor Islamic bank have also been assisting the Australian government in potential changes in legislation to accommodate Islamic finance.

the year of the reports

The aforementioned booklet was not the first piece of literature issued by the government. In fact 2010 can be regarded as the year of reports and consultations, with three other publications being issued over the course of the year. The year began with the Australian Financial Centre Forum (AFCM) releasing ‘Australia as a Financial Centre: building on our Strengths’, more commonly known as the Johnson report. The AFCM was established in September 2008 to promote Australia as a leading financial centre. The report was the result of in-depth analysis looking at ways Australia can boost ‘financial services and improve the competitiveness of their Australia’s (sic) financial sector’210 and issued a number of recommendations. recommendation 3.6 requested the board of Taxation to see if amendments had to be made to Commonwealth taxation provisions in order for treatment of Islamic products to be on parity with that of their conventional counterparts, in terms of economic substance. recommendation 4.8 called for the removal of regulatory barriers. The document highlights Islamic finance as a key growth area and one which would tap into the highly liquid Middle Eastern market as well as provide access to offshore saving pools. This was a pivotal document, signifying Australia’s sincere interest in developing the regulatory framework for Islamic finance products.

The Johnson report was followed by the Australian Government’s trade and investment development agency, Austrade, launch of a booklet entitled Islamic finance. The booklet highlighted Australian market as strong market for investment and the development of an Islamic finance hub in the Asia Pacific. It would come as no surprise that the February 12th launch was in front of a high ranking delegation from the UAE. Moreover, the release of the booklet coincided with Westpac banking Corporation creating a Special Interbank placement for Islamic institutions which facilitates commodities trade for Middle Eastern and Malaysian investors.

regulatory bodies are responding to the increased interest in Islamic finance. The Australian Financial Markets Association (AFMA), the body representing wholesale banking and financial markets on regulatory issues, has formed the Islamic Finance Committee and is in regular dialogue with the Treasury regarding taxation matters. Senator Sherry has spearheaded a review of Australian tax laws in order that IFIs are not unfairly penalised. A working group at the board of Taxation has been established to review and suggest amendments and it is expected that the report will be published June 2011. Senator Sherry hopes there will be legislative changes to accommodate Islamic finance more effectively by the end of 2011.

Following the change of government, the board of Taxation released a discussion paper examining tax frameworks and identifying its limitations in accommodating Shari’a-compliant products. The paper focused on seven Shari’a-compliant products, looking at risk management strategies adopted by IFIs. An appraisal was made as to the tax ramifications of these products. The products analysed were murabaha, commodity murabaha, ijara wa iqtina, istisna, salam, diminishing musharaka and an ijara sukuk.

The report is to be followed by a series of consultations with stakeholders with an interest to developing Islamic finance. Submissions have been requested to assist in the process and consultation forums convened by the board of Taxation have been planned in major Australian cities: Canberra, Melbourne and Sydney.

islamic finance in australia

Zaid Ibrahim & Co in Australia was not the first commercial organisation with a stake in Islamic finance to enter the country. In 2008, Kuwait Finance House was the first foreign Islamic bank to set up operations in Australia. The current focus of KFH is on developing and promoting wholesale markets which enable cross border transactions between Australia and Islamic finance hubs. In 2009, Australia’s Macquarie Group ltd and Gulf Finance House partnered together to establish a joint Islamic financial services platform in the Middle East. Terms of the agreement included planned placement of a USD 100 million convertible murabaha. but it is the grassroots organisations that build up a profile. Any changes in the regulatory framework will result in an improved financial environment in which to offer a range of Islamic financial products, thereby potentially increasing customer base. Indigenous Islamic finance is still in its infancy in Australia with only a few small initiatives, providing a limited number of services for the small but growing Muslim community within Australia. recent figures show that Australia has a Muslim population of approximately 340,390. This population has expanded rapidly by more than 80,000 (or 28%) from 1996 to 2006. The Muslim Community Cooperative (Australia) ltd (MCCA) was the first provider of Shari’a-compliant services, founded as cooperative in 1989. It offers Shari’a-compliant home loans and was the largest originator of Shari’a-compliant residential home loans in Australia. Over the last year few years, it has branched out into asset management. In 2009, MCCA Income Fund became the first Australian Securities and Investment Commission (ASIC) regulated Shari’a-compliant retail fund.

MCCA lobbying was a crucial factor that prompted the amendment of the Stamp Duties Act in the State of Victoria, which has the largest population in Australia. The State Parliament amended the Governing Act in 2004 so that sales/re-sales taking the form of “Cost Plus” arrangements would be treated as unitary transactions. This removed the double taxation problem on ijara mortgage arrangements, the main structure used in property acquisition. While Victorian state law has been amended to provide relief against double taxation, other states continue to levy stamp duties at each stage of the ijara transaction. This problem was addressed in the board of Taxation paper.

The success of MCCA has lured other Shari’a-compliant organisations such as Iskan finance and Islamic Co- operative Finance. Iskan concentrates on home financing while the latter has a range of services including offering investment funds such as Zakat funds. The interest is not limited to Islamic finance organisations. In 2009, National Australia bank committed USD 15 million to introduce Shari’a-compliant loans. These are no interest loans provided to low income earners who have difficulty accessing credit. In the same year, lM Investment Management ltd, a specialist income

funds manager issued Australia’s first onshore Shari’a- compliant fund focusing on global property and business markets. The lM Australian Alif Fund is marketed via lM’s international network of licensed financial advisers, intermediaries, wholesale platforms, private banks, pension funds, corporate and institutional investment consultants spanning beyond 32 countries. In September 2010, the Central bank of bahrain authorised formation and marketing of the Hyperion Australian Equity Islamic Fund, the first Shari’a-compliant offshore fund comprising of stocks on the Australian Stock Exchange which are deemed to be Shari’a-compliant. The fund is hoping to provide investors in the Middle East exposure to the Australian equities market

oh no! no ball

The last two years there has been significant progress within the Islamic finance space in Australia. It has taken 20 years, but Australia is well on course to achieving an extensive and indigenous Islamic finance industry. la Trobe University is well aware of the zeitgeist and became the first university in Australia to offer master degree in Islamic banking and finance. The course also provides exemptions to part one of the Chartered Islamic Financial Professional qualification, thus showing a holistic approach adopted by la Trobe. They have further developed an E-learning masters course in partnership with Dubai’s Ethica institute.

Yet not everyone is happy with the approach undertaken by Australia’s government in supporting Islamic finance. liberal Party member Cory bernandi has voiced his opposition, arguing that Shari’a law is in opposition to Australia’s western values. Fortunately, party colleagues have been quick to dismiss his criticisms, supporting the governments’ efforts in removing barriers to integrate Islamic finance into the Australian system. It would seem then that there is a unity amongst the politicians on this most sensitive of matters. 2011 will prove how committed they are to the cause.

Bahrain

As a small Island in the Persian Gulf, bahrain has made significant waves in the Islamic finance sector. Its success has much to do with the free market policies of the government, who have encouraged international firms to enter the market. According to the Index for Economic Freedom 2011 published by the Heritage Foundation and the Wall Street Journal, it is the world’s 10th most free economy and the only Middle Eastern nation in the top 20. by having an open economy, it has allowed the proliferation of ideas and innovation, thus encouraging private sector developments in Islamic finance. More so than this, the support of the government and the central bank has been crucial to Islamic finance’s growth in bahrain.

state of the industry

According to the bahrain Economic Development board (bEDb), the financial sector had contracted slightly in 2009. However, the shrinking output was marginal, at only 1%, suggesting that bahrain had survived the financial crisis relatively well. bahrain owes its success to its open market, liberalized policies and ongoing country marketing which has attracted foreign financial institutions to set up branches there and retain majority ownership. The IMF has stated that high initial levels of bank capital and sound prudential norms established by the Central bank of bahrain (Cbb), ensured the resilience of the financial system. recourse to extensive direct interventions seen in many countries has not been required. In addition, the Cbb has endorsed Islamic finance and is keen to ensure transparency, efficiency and competitiveness, in order to boost the Islamic finance industry.

bahrain’s strength in the insurance and financial services sector has provided this island state a prominence in the Islamic finance market. According to Kuwait based Al Sabek, bahrain has 20 Islamic funds investing nearly USD 1 billion. It has more IFIs than any other purported

Islamic finance centre. According to the Oxford business report (ObS) it has 27 Islamic banks out of 140 banks operating in the Kingdom, representing USD 25.5 billion in assets –approximately 10% share of total global Islamic banking assets. Moreover the banker accords it a favourable statistic: four of the top five Islamic banks in the world are from bahrain. The annual growth of the banking sector in the last five years has been remarkable since 2005, averaging approximately 48%. However, this has been impacted due to the global recession. While retail remains healthy, the wholesale sector requires a rethink in strategy. A major concern has been the concentration on real estate – bahraini Islamic banks are rumoured to have 70% of their capital invested in the Islamic finance investment of choice. The Cbb has attempted to put a cap on real estate exposure since 2006, but this has been met with a chorus of disapproval. However, due to the sluggish real estate market, a change of focus is needed for Islamic banks. Inertia will prevent an accelerated approach, but there are opportunities, for instance, in the local private sector. In November, bMI bank and Tamkeen launched an Islamic financing scheme for local private sector companies. The scheme hopes to invest USD 13 million dollars for the development of local entrepreneurship. Insurance has been vibrant in bahrain. In 2009, it was the only segment of the financial sector to experience growth, having reportedly expanded by 6%. bahrain also has 18 takaful operators – seven of which are fully fledged takaful providers – and one retakaful firm. Established conventional insurers such as Allianz and Chartis have bases in bahrain where they offer both conventional and Islamic insurance. bahrain remains a top choice for international insurers keen to set up takaful divisions to service GCC countries, and there are currently 177 insurance policy writers in bahrain. This is a testament to the highly regarded regulatory centre bahrain has created for insurance services. Gross premiums for takaful companies in bahrain reached USD 72.54 million in 2008, representing a 73% jump

from the previous year. by the end of 2008, takaful firms accounted for 42% of the paid up capital of bahraini insurers. In 2009, the seven takaful companies had gross contributions of USD 87 million, representing a 22% increase from the previous year. Family takaful represents the largest sector. Gross premiums from retakaful registered 217.6% growth between 2008 and 2009 highlighting the growing importance of retakaful structures. In September, T’azur a regional takaful company headquartered in the Kingdom of bahrain, signed of an Islamic reinsurance (retakaful) agreement with Hannover retakaful, the bahrain based Islamic subsidiary of Hannover-re, one of the world’s leading reinsurers. Consolidating resources between the Islamic and conventional sectors will be important in strengthening bahrain’s position as an insurance and takaful centre in the financial markets. These achievements have been recognised by the industry. At the annual International Takaful Summit it has been awarded best Financial Centre three years in a row.

standardisation in a world of diversity

being the base of standard making bodies such as AAOIFI has provided bahrain with a position to influence the direction of Islamic finance. AAOIFI, whilst a small body with few resources, has been active in setting out accounting, auditing and Shari’a standards for the Islamic finance industry. Its preeminent Shari’a board and committees are infused with prominent practitioners of Islamic finance as well as leading scholars. For an industry still finding its path, intellectual disagreement was likely to occur under the auspices of bodies such as AAOIFI, which is gradually becoming the most influential international fiqh body. Indeed, AAOIFI Shari’a board’s chairman, Sheikh Taqi Usmani’s 2008 criticism of the sukuk industry sent reverberations throughout the industry. Questions were being asked as to the nature of sukuks and whether they could be classed as Shari’a- compliant. Parallel to Usmani’s criticism, the credit crisis ensued which was followed by the default of the Nakheel Sukuk. Combined, the sukuk industry took a beating, one that it is only now recovering from. Sukuks have generally been an important part of Islamic finance’s product portfolio, not least because of its potential for innovation. but intermittent moments of reflection, where premises and postulates are questioned, are required for the health of any nascent industry, not least Islamic finance.

Thus AAOIFI’s announcement in August pertaining to the limitation of a scholar’s role on multiple Shari’a boards is seen as a positive means to ensure transparency and diversity on Shari’a boards, while at the same time increasing human resource capacity. They also called for the creation of a national Shari’a board to audit and clarify Shari’a products and reduce the incidence of disagreement amongst scholars. However, this has not been met with complete support, with many arguing that it would increase bureaucracy.

The announcement has also contributed to the ongoing polemic discourse regarding standardisation. In this regard, the International Islamic Financial Market (IIFM), a bahrain based standards setting body for the Islamic capital and money markets, has been paramount for the pedagogy of Islamic finance. Its primary focus lies in the standardisation of Islamic products, documentation and related processes. The recent collaboration between New York’s International Swaps and Derivatives Association (ISDA) and bahrain based International Islamic Financial Market (IIFM) in the creation of the standardised Tahawwut hedging agreement, is an achievement in terms of the flexibility of Islamic finance to create Shari’a-compliant derivatives. The agreement hopes to counter the ongoing problem of risk management within the industry. The IIFM have also looked at drafting standardised documents for asset backed bonds and creating repos to manage funds. These initiatives affirm bahrain’s strong advocacy of international standards for the Islamic financial sector along with better risk management practices.

liqudity challenges

Another pervasive problem has been the lack of liquidity in the market, due to the absence of secondary money markets. bahrain is the only GCC country to issue three and six month domestic Islamic bills. To address this challenge, bahrain Financial Exchange (bFX) launched its Islamic finance division, the bait Al bursa, in October. It offers a multi asset exchange, the first in the MENA region, which acts as a platform for electronic trading of Shari’a-compliant securities. Part of the platform is E-Tayseer, a fully electronic platform for automating murabaha transactions. The automated system mitigates the problem of efficiency, transaction costs and Shari’a compliancy. A further initiative has been the collaboration between Cbb and the liquidity Management Centre (lMC) to facilitate greater liquidity by the opening of a secondary market, granting the platform for the trading and repackaging of sukuks, converting them into shorter term debt. Government sukuks will be utilised in short term debt structures. The lMC was set up in 2002 in bahrain, to act as a conduit between banks looking to place surplus funds in traded investments.

improving the framework

The Cbb pioneered the development of a comprehensive regulatory framework for Islamic banks in 2001, followed in 2005 by a regulatory framework specific to Islamic takaful and retakaful companies. The Cbb has published detailed guidelines for Islamic banking in the country, similar to those of conventional banks. However, there are two additional requirements: each Islamic bank must have an independent Shari’a board, and Islamic banks need to adopt AAOIFI standards for financial reporting.

The Waqf Fund for research, education and training has recognised the need to develop financial professionals who have knowledge of both Islamic and conventional finance. The Waqf Fund is an endowment capital fund that has the support of Islamic banks and conventional banks with Islamic windows. The fund supports and finances training, education, research and other developments in Islamic finance. It was set up in 2006 by the Cbb, in partnership with 15 leading Islamic institutions and three conventional banks that also have units offering Islamic banking services. It unveiled plans to conduct training programmes in conjunction with the Scottish based Islamic Finance Council UK (IFC) for Shari’a scholars, auditors and compliance professionals, aimed at enhancing their understanding of global financial markets. The fund is also working with bIbF to increase the skills base for the sector through a graduate sponsorship programme. It provides support for graduate students from the banking, finance, accounting and economics streams of the University of bahrain and other institutions to obtain diplomas from the institute, while also receiving work experience at selected banks. In March, the Waqf Fund announced it had just completed the selection process for the second batch of graduates for the programme.

International multiservice firms such as Deloitte are capitalising on bahrain’s position as an Islamic finance centre by the creation of its new Islamic Finance Knowledge Centre (IKFC). The IKFC is designed to help Deloitte’s clients tap into the Islamic finance field by providing experts who will support the firm’s Middle Eastern audit, tax, consulting, risk and financial advisory.

expanding the industry

bahrain Association of banks (bAb), an umbrella body, which works closely with the Cbb. At the World bank/ IMF meeting it launched The Handbook of Islamic banking & Finance, an introductory text designed to explain Islamic finance products to non specialists. An initiative such as this, in the centre of capitalism, highlights bahrain’s intention to spread information and knowledge about Islamic finance to a wider audience. As the Islamic finance industry grows, a recurring need will be having expansive and high quality sources of information. In February, an Islamic finance directory was launched in bahrain by Thomson reuters. The directory consists of details of Islamic finance professionals and scholars, rating agencies, industry standard bodies, consulting firms and subsidiaries from 25 countries.

Industry analysts comment that Islamic commercial banks are sitting on a bed of liquidity and are unsure as to how to deploy the cash. The foreign markets are proving to be lucrative and many banks have sought to tap into international markets. Al Salam bank, bahrain’s fastest growing lender by revenue, has been especially active in providing Shari’a-compliant financing for the investment in prime real estate in commercial hubs of the UK. They are also looking for USD 500 million in Asia Pacific markets such as Singapore, Malaysia and Indonesia, to profit from the flourishing markets within the region. Al baraka banking Group also plans to expand into the Asian market having finalised its merger with Emirates Global Islamic bank in Pakistan, in October. These are just some of the latest developments and are a testament to the growing power of bahrain’s Islamic banks. More investment, especially in non-Muslim countries, will increase awareness of Islamic finance and diversify the product portfolio of Islamic banks.

political upheaval The recent protests in bahrain revealed much discontent with the ruling elite. It starkly showed on the global stage the long-term fissures between the Sunni government and the Shi’a majority who make 70% of the population. For the Islamic finance industry in bahrain, there is unlikely to be ramifications given that the industry is thriving and the foundations are truly set. Moreover, Islamic finance is fortunate as it encompasses Sunni and Shia schools of law. Ideologues such as baqr al Sadr were Shi’a. but with mighty discontent, markets become mightily anxious. These will be testing times but Islamic finance in bahrain is likely to remain resilient.

Bangladesh

bangladesh’s foray into Islamic finance has not been with- out ambivalence; a flux between avidity and vacillation. The Saudi Prince Faisal’s vision for a pan-Islamic bloc naturally embraced the newly independent bangladesh in the 1970s. bangladesh ratified the IDb charter in 1974 and was, at one point, advocating separate banking sys- tems though this never transpired. The bangladesh Islam- ic bankers Association, a voluntary organisation whose objective were to abolish riba from the bengali economy, was an effective lobby group in the early 80s, encourag- ing Islamic banking to develop. Their efforts spearheaded the incorporation of the Islami bank bangladesh ltd (Ibbl) in 1983, which was not only the first Islamic bank in bangladesh, but is also considered the first interest free bank in South East Asia. Islami bank bangladesh limited (Ibbl) started as a joint venture multinational bank with 63.92% of equity contributed by IDb and financial insti- tutions like Al-rajhi Company for Currency Exchange and Commerce of Saudi Arabia, Kuwait Finance House, Jordan Islamic bank, Islamic Investment and Exchange Corporation of Qatar, bahrain Islamic bank, Islamic bank- ing System International Holding S.A, Dubai Islamic bank, Kuwait Ministry of Awqaf and Islamic Affairs.

legislative inertia

To the chagrin of Islamic finance supporters, legislation however was not changed. There were slight amendments made to accounts to fulfil the special requirements of Islamic banks. Necessary amendments were made in the Income Tax Ordinance (1984) which viewed both the profits paid on mudaraba as expenditure. This was hardly the absolution of interest from the economy, ardently desired by exponents of Islamic finance, but it provided a level playing field and enabled more Islamic banks to enter the market. Democracy became the de jure political system in bangladesh in 1991 after 20 years of dictatorship; and so began a debilitating rivalry between the two

leading parties in bangladesh – the Awami league and bangladesh National Party – which is ongoing today. Power shifted hands between the two parties approximately every 5 years, affecting stability and the achievement of long term goals. Each party oversaw certain developments for IFIs in bangladesh which has gradually improved the legal framework for Islamic banks, though in a piecemeal manner. However, one constant has been the power and authority of the bangladesh central bank, bangladesh bank, who regulates’ institutions engaged in financial activities and has the power to issue licenses to new banks.

bangladesh does not have a bespoke Islamic banking Act. A draft Islamic banking Act, which would have been included in the authoritative banking Act (1991), was discussed in Parliament but was not passed as law. Nevertheless, several clauses were incorporated in the bank Company Act (1991) regarding the mechanism of Islamic banking. In 1997, the bangladesh bank sought suggestions from banks working in Islamic finance in order to facilitate a consonant environment to Islamic banking. It was hoped this would lead to an Islamic banking act. 14 years on, an act has not been forthcoming. In 2004, the government formed an eight- member expert committee to draft the proposed insurance laws, including a Takaful Act for Islamic insurance companies. The interim cabinet, however, turned down the proposal.

show me the money

Arguably, Islamic finance could have been quite prominent with the right level of government support and focus. Practitioners in the field add that bangladesh bank is not doing enough to fully establish Islamic finance in the country. A lack of liquidity has been blamed on insufficient legal support from the central bank. Criticisms have also been made about a lack of expertise and a minimal portfolio of products. Islamic banks rely

extensively on murabaha to generate profit. However, the wider socio-economic picture has to be considered. bangladesh is one of the poorest countries in the world, with systematic corruption in all segments of society, low incomes, a widening gap between the rich and the poor, a sizable unbanked population, political instability, cronyism and weak legal enforcement.

banks face excess liquidity issues due to a lack of response from good credit borrowers and the lack of adequate interest free financial instruments. Industry practitioners state that the central bank has not provided legal support which has accentuated the liquidity problem. Furthermore, there is a dearth of expertise to appraise, monitor, evaluate, and audit Shari’a-compliant financing projects. There has not been much success in devising an interest free mechanism that places funds on a short term basis. Profit sharing risk is seen as too high and therefore banks have resorted to debt financing structures such as murabaha. The central bank is attempting to resolve these issues and have encouraged foreign banks to roll out more Shari’a based products.

To date, there have only been two issuances of sukuk to generate cash flow: the Ibbl 3000 million Taka Mudaraba Perpetual bond (which has no maturity) and the government’s bangladesh Government Islamic Investment bond, which also used mudaraba as an underlying structure. The objective of the latter was to maintain the Slr of Islamic banks, as well as providing an outlet for investment or procurement of funds. Aside from these instruments, Islamic banks are still heavily dependent on deposited funds. There is a need to develop primary and secondary markets as well as innovation and diversification of the product portfolio of banks. Another challenge for bangladesh bank has been determining a suitable profit sharing mechanism for depositors and the banks with respect to mudaraba accounts. The profit sharing ratio under a mudaraba can be determined by the commonly used weightage system or the Investment Income Sharing ratio (ISr). The differences are subtle but have caused much debate amongst adherents of Islamic finance in bangladesh. The Central Shari’a board for Islamic banks of bangladesh (CSbIb), a non-corporate body, registered in 2009, committed to the promulgation of Islamic finance in bangladesh, have argued for the latter. The bangladesh bank has prescribed the weightage system as a standard for Islamic banks to follow to generate a rate of return. The central bank has granted some preferential provisions to develop Islamic banking in bangladesh including a lower Statutory liquidity reserve (Slr) as compared to conventional banks. Since 1983, the Slr for bangladesh banks has been fixed at 10% whereas for conventional banks it has hovered around 20% and is currently at 18.5%. Infrequent changes have been made over the years to conventional banks’ Slr, in order to increase supply of funds thereby reducing interest rate differentials. The lower percentage takes into account the prohibition for Islamic banks to invest in interest bearing instruments, thereby reducing their liquidity. However due to the global economic downtown with the parallel increase in commodity prices, bangladesh has suffered from increased inflation rates. In May 2010.

the Slr was increased to 10.5% for Islamic banks.

central bank guidelines

The bangladesh bank Governor, Dr. Atiur rahman, in December 2010, reemphasised the commitment of bangladesh bank to develop Islamic finance in the country and publically called for Islamic banks to follow the Shari’a completely. bangladesh bank set up a research and Islamic economics division in 1990 under the Department of research within the bank, to conduct timely analysis of the Islamic finance industry in bangladesh.

In 2009, bangladesh bank issued guidelines through a circular on the operation and management of Islamic banks which supplement existing banking laws. The guidelines were a result of discussions between bangladesh bank, several Islamic banks in the country and the Central Shari’a board.

The guidelines represent the first attempt to provide an operational framework for Islamic banks. The guidelines cover a number of points including corporate and Shari’a governance, product definitions and operational frameworks, alternative investment modes, and conversion of conventional banks into Islamic banks. However, guidelines are limited by a number of shortcomings and ambiguities. This has been admitted by bangladesh bank, though no amendments have been made. The guideline makes formation of a Shari’a board for Islamic banks optional, though this is contrary to global industry practice. There is also stringent criteria for a Shari’a board candidate to meet. Practitioners argue that a paucity of candidates who meet these criteria would deprive the Islamic banking industry of the necessary talent to go forward. They are therefore asking bangladesh bank for a relaxation in the stipulations.

state of the industry It is a common lament that the level of Islamic finance expertise in bangladesh is not sufficient for a robust Shari’a board, but this has not hindered bangladesh’s progress. Currently, bangladesh has seven fully fledged Islamic banks and eleven Islamic finance windows with their own Shari’a boards. The banks are Islami bank bangladesh ltd, Al-Arafah Islami bank ltd, ICb Islamic bank ltd, Export Import bank of bangladesh ltd (EXIM), Social Islami bank ltd, Shahjalal Islami bank ltd and First Security Islami bank ltd. Exim bank limited and First Security Islamic bank limited were conventional banks who fully converted into Islamic banks in 2004 and 2009, respectively. There are just shy of 300 branches offering Islamic finance products. According to bangladesh bank, Islamic banking systems in the country account for 25% of all private bank deposits with 30% of investments made by banks concordant to Shari’a principles. In December 2010, HSbC launched HSbC Amanah in bangladesh which offers a full range of products in the country for both retail and commercial customers. The Amanah service is only available in 8 countries and therefore reflects the opportunities available in bangladesh.

Since the inception of the first takaful company in bangladesh in 2000, the takaful industry has grown. As with banking, the absence of legislation pertaining to takaful has not presented obstacles for the formation of several more takaful companies. Today, there are as many as 62 insurance companies operating in bangladesh, of which six are fully fledged takaful operators, and 13 have windows. As of 2008, total assets for takaful institutions were 9.7 million taka, constituting 7% of total assets of the insurance sector. Total premium was 5.7 million taka in 2008, constituting 12% of total premiums of the insurance sector. In March 2010, the government enacted the Insurance Act 2010, with a provision for the creation of an Insurance Development and regulatory Authority. It was proposed that Shari’a consultants would sit on this board, but to date, the authority has not been constituted.

islami bank bangladesh: an international success

The burgeoning Islamic finance sector in bangladesh owes a considerable amount to the activities of the first Islamic bank in bangladesh, Ibbl. Since opening in 1983, Ibbl has become a conglomerate which has branched out from its traditional focus of Islamic finance. Ibbl created a Foundation which has established hospitals, schools and arts institutions. In August 2010, Ibbl announced an initiative to award two years term education scholarship for 200 poor students, who were achieving high grades in their class. They have also been entreated by Nigerian based Jaiz International to set up the first Nigerian Islamic bank. An agreement was signed between the two organisations in December 2009. Under the agreement, the Ibbl will help develop capacity building programmes for the training and development of the workforce and design and implement appropriate procedures for all processes, transactions and products to ensure smooth operations of the proposed Nigerian bank. Ibbl have already deposited USD 35 million to the Central bank of Nigeria. For their endeavours, Global Finance, the USA based financial magazine awarded Ibbl best IFI in bangladesh for the year 2010. It has previously won the award 6 times over the last decade.

What of microfinance?

bangladesh is internationally known for being the birthplace of microfinance. It is also reputed as the NGO capital of the world, most of whom have a significant component dedicated to microfinance. Consequently, Islamic banks have entered into the microfinance space within bangladesh, providing Shari’a-compliant products mainly based on bai’ Muajjal. The Ibbl has offered products through its rural Development Scheme (rDS) project and utilised its extensive network and presence in rural villages to develop a framework which encourages entrepreneurship and spiritual growth under an Islamic aegis. As a comparison with other larger and more widely known microfinance outfits such brAC and Grameen, rDS has done remarkably well especially with a lower uptake. According to 2008 statistics, rDS has been offered by 129 IIbl branches and covers 10,000 villages across bangladesh. The number of participants is just below a million.

Socio Islami bank limited (SIbl), is one of the seven

fully fledged Islamic banks in bangladesh which is active in rural financing though does not concentrate on microfinance. It focuses on SMEs, agrofinance, remittance and alternative delivery channels. There is a shift of focus from high income transactions in a bid to bringing economic mobility to a high percentage of the low income earners and create adequate employment opportunities, income generation and poverty alleviation which will lead onto financing industrialisation.

to the future and beyond

There is an alterity in the approach of the bangladesh government and the central bank to Islamic finance in the country. Their influence in driving the industry forward cannot be underestimated, but at the same time industry practitioners feel more can be done. They are certainly exasperated by the lack of legislative amendments needed to strengthen the industry. but even accounting for this backdrop, the private sector has done remarkably well in allowing a flourishing of the Islamic finance sector. They need to do more in developing human capital; a common bugbear for most IFIs and more efforts are required to educate the public about Islamic finance. The talent is there but needs to be channelled appropriately. Unearthing charismatic and influential individuals has not been a problem for bangladesh. Mohammed Yunus is the founder of Grameen bank and winner of the Noble Peace Prize; Jaseem Ahmed a former director at Asian Development bank, now succeeds industry heavyweight Professor rifaat Abdel Karim as Secretary General of the IFSb. It was a surprise appointment due to his relative inexperience in the industry, but it is an achievement bangladesh should be proud of. In the Islamic finance sector, they could be proud of more.

Bosnia

Bosnia is a country situated in the balkans, born out of the ashes of the former Yugoslavia. The country was the subject of a horrendous conflict among different ethnicities with some favouring independence and others favouring to remain with the Yugoslav federation. Tragi- cally there was genocide committed against ethnic bosnian (Muslims). After 10 years of relative peace, there is still tension between the different ethnicities and thus a rapid Islamisation of the financial landscape is likely to be met with strong opposition.

Islamic finance entered bosnia in 2000 with the setting up of the bosna bank International (bbI), which was supported by the IDb, Abu Dhabi Islamic bank as well as Dubai Islamic bank. The bank faced opposition from non-Muslims before its opening, but has been well received by the Muslim population. It has managed to offer some innovative Islamic financial offerings such as a Hajj and Umrah Investment account. besides this, the bank also offers other Shari’a-compliant financing products for home and vehicle financing amongst its service offerings.

Interest in Islamic finance in bosnia is increasing according to insiders familiar with local sentiments. Around 40% of the population is Muslim, hence it is a location which can be lucrative for Islamic finance. Many bosnian Muslims are studying Islamic finance abroad in places such as the International Islamic University Malaysia (IIUM) as well as bank Negara Malaysia’s University for Islamic Finance, INCEIF. Furthermore there are also undergraduate as well as postgraduate courses offered locally in Islamic finance by the International University of Sarajevo. The Malaysian government has a strong affiliation with bosnian Muslims, as it is one of the few countries which assisted them during the civil war. Furthermore many bosnians who have studied or are currently studying in Malaysia have been given scholarships. bbI’s CEO.

Amer bukvic, is an alumni of the IIUM. This strong relationship may prove vital in future as Malaysian interest could help propel the Islamic finance industry in bosnia forward.

In 2010, a conference held in bosnia under the auspices of the IDb, was attended by around 600 participants. The aim of the conference was to showcase bosnia as an attractive place for investment as projects of up to USD 11 billion were showcased. The country is also trying to leverage on its strategic location to highlight the role it can play as a link between Europe and the rest of the Muslim world. Furthermore trade between bosnia and the UAE is set to increase. However much more needs to be done in bosnia for Islamic finance to flourish. There are certain issues which need to be hammered out so that the country appeals to GCC investors; and motivates international institutions to set up Islamic windows in the country. Some have suggested that the government should issue sovereign sukuk. Additionally more effort needs to be undertaken to educate the government and the various regulatory bodies so that necessary amendments to legislation can be made in order to facilitate further Islamic finance development.

Brunei Darussalam

‘To date, brunei has not done much. We still have a lot more to do in terms of market capability, human capital development, international Islamic banking, inter- national takaful. In terms of capital market, we are not yet ready’, said Ethica Consultants’ executive manager Sri Anne Masri, at an Islamic Finance News road-show in December. Her comments suggest that brunei have an enervated Islamic finance market. This would seem to be a harsh assessment but reading between the lines, Masri was not mourning the ineffectualness of brunei. rather she was exposing the desire and ambition of bru- nei to be an international market leader

in the beginning

brunei’s first official engagement with Islamic finance was in 1991 with the opening of Perbadanan Tabung Amanah Islam brunei (TAIb), a trust fund created to assist local Muslims undertake Hajj in 1991. Two years later, the International bank of brunei berhad, a commercial bank was converted into brunei’s first full-fledged Islamic bank, renamed as Islamic bank of brunei berhad (Ibb). A second conventional bank was transformed into an Islamic bank in 2000, the year in which the Sultanate established the brunei International Financial Centre.

It was in 2006, that brunei kick-started the industry with series of legislative changes beneficial to Islamic financial banking and insurance firms. Indeed, the year saw the constitution of a national Shari’a board and the merger of the two standing Islamic banks in brunei to create bank Islam brunei Darussalem (bIbD). The government launched a rolling short term sukuk al ijara programme to boost liquidity for banks. The Sukuk Holding Properties Inc and Sukuk (brunei) Inc were set up by the Ministry of Finance to issue sukuk. To date, the government has issued USD 2.1 billion worth of short-term sukuk al-ijara. Through issuing the sukuk, the sultanate became the first sovereign nation to issue securities without previously setting up a conventional capital market. A beneficial outcome has been the curtailment of national debt. However, for further development, it is expedient for brunei to develop an independent monetary policy. Currently, there is a reliance on Singapore to set interest rates, and though over the years this has worked well for both countries, any further developments in the capital market will require brunei to step out on its own. The establishment of the Monetary Authority of brunei in 2011 is a positive step in achieving independence as it will act as the central bank of brunei, concentrating on the formulation and implementation of monetary policies, supervision of financial institutions and currency management towards an islamic finance hub With a small population, the need for numerous and manifold financial institutions in a country is limited. but as an offshore centre, a variety of financial services and institutions is necessary for an efficient, dynamic market; and brunei has opened the markets to a number of international financial services companies to set up in the Sultanate. For Islamic banking, this has not been the case. Previous legislation for Islamic banking was narrower in focus, restricting foreign ownership which has meant that there is currently no foreign bank offering Islamic bank services. However, legislation was changed with the passing of the Islamic banking Order 2008, which permits financial institutions licensed as offshore companies to undertake Islamic banking. by extension, international banks can partake in Islamic financial activities in brunei. However, while paid up capital for a local Islamic bank has to be USD 100 million, for foreign banks, the figure rises to USD 500 million, which may prevent foreign banks in applying for the license. Nevertheless, in March, the brunei government invited Malaysian bank rakyat, Malaysia’s biggest Islamic cooperative bank to open a branch in brunei. While there have been no further developments with bank rakyat still considering its options, it shows the change of stance of the government.

The entry of another Islamic finance bank may have a positive impact in developing new products and services within the local markets. Islamic banks in the country do not have the incentive to foster innovative product development, because of the small population and also the need for loans from state run companies is limited. Financial institutions are known for their excess liquidity due in part to the abundant oil resources in the country but there isn’t a pressing need to convert it into debt finance. Privatisation may alter this state of affairs and the brunei government has shown interest in enabling the private sector to play a larger role in the development of the economy.

However, currently there are only two Islamic financial intermediaries: bIbD and TAIb. bIbD is the only bank to have a universal banking license. bIbD has more than 14 branches located in all brunei’s four districts and according to its website; bIbD has the single largest distribution of ATM networks in the country. bIbD also has two subsidiaries, namely Takaful bIbD Shd bhd which primarily provides insurance coverage and bIbD At-Tamwil berhad, a finance company, which provides hire purchase financing for vehicles and consumer products.

In 2009, bIbD arranged a USD 850 million international sukuk issues with IDb. bIbD was also the lead manager for GE’s USD 500 million sukuk and lead underwriter of the only private sukuk issuance in brunei, brunei’s lNG USD 68.7 million sukuk. bIbD’s investment banking division is growing in stature after opening their investment banking division in 2008. Since then the number of services has expanded to cover fund management, treasury, risk management and security services.

The main concern for bIbD is retail, which has outpaced conventional banking over the last few years and has a higher participation of local consumers than traditional Islamic finance hubs such as bahrain. It is estimated that brunei’s Islamic finance sector accounts for around one third of banking assets and more than 25 per cent of deposits while providing nearly 60 per cent of total financing. This is a reflection of the growing level of consciousness amongst Muslims in the country adhering to religious principles. According to brunei’s ministry of finance, Islamic banking assets in 2009 were about bND 6.3 billion (USD 4.81 billion) or 40% of the total banking sector in brunei. Unofficial figures suggest that this has grown to 45% in the last year.

The second institution, TAIb, is also the oldest IFI in brunei. It offers a range of products and services from retail based products – such as saving accounts and home financing – to corporate financing. TAIb offers all banking products except cheque facilities. A reflection of the growth of Islamic finance in the country can be inferred from the increasing uptake of their products. TAIb reports a steady growth of more than 50 per cent per annum for its Home Financing Portfolio. There has also been a 20% increase of their short term fixed deposit product. With a low minimum deposit of USD 100, as compared to conventional banks which charge

USD 1000, this is spurring on people to save thereby realising a secondary aim. Part of TAIb’s strategy is to inculcate a savings culture in a country with a high GDP per capita and they have been active in offering financial management education programs. This follows the general trend adopted by the brunei government in encouraging prudential money management. The brunei government issued tighter rules on credit cards in order to curb the increasing debt incurred by bruneians.

On the institutional side, TAIb is a cornerstone investor in the Securus Fund, the world’s first Shari’a-compliant data centre fund, which offers a long-stabilised cashflow and is managed out of Singapore. Data centres are purpose-built real estate facilities housing rack-mounted computer servers. Data centre demand has been driven by the rapid rise of e-commerce, social networking and file sharing. Supply of data centre space has been unable to match the growth in demand.

takaful

In 2008, the Takaful Order was enacted ensuring a level playing field with conventional insurance companies. The Order required Takaful providers to be better capitalised. Official figures show that while assets at conventional insurance companies shrunk between 2008 and 2009, the takaful industry grew by 5.2% from USD 144.2 million to USD 151.8 million. General takaful has been the most successful segment of takaful; while family takaful has experienced slow growth. In November 2010, Takaful Islamic bank of brunei and Takaful bank Islam brunei Darussalam announced they would be merging. The new entity will be known as Takaful brunei Darussalam. Merging facilitates a consolidation of resources and experience. Part of the problem for the takaful industry is that the expertise in this field is limited; though takaful companies have managed to increase their profile both within and beyond. In December 2009, Insurans Islam Taib became brunei’s first IFI to receive a rating from an international ratings agency, Fitch.

if it says its halal, it is halal.

The government’s long term development plan, lKN 2007-2010, explicated brunei’s keenness in establishing itself as an Islamic finance hub. However, this is not the only avenue through which they hope to achieve long term growth. Part of brunei’s strategy is to diversify from oil and gas, which has been been key to the success of brunei’s economy. but an acquiescing to the gradual depletion of resources, brunei has sort other means to vitalise its economy, namely the halal industry. by, creating products and financial services which are permitted under Shari’a, the government hopes that it will encourage trade in goods and services which is emblematically halal. brunei has already hosted five International Halal Market Conferences (IHMC); the most recent convened in June. The IHMC organisers stressed that this event is not just food related, and companies and organisations that are involved in Islamic finance, economic policy, travel and tourism, hospitality, media and networking were encouraged to participate. To add to this, in 2009, the government owned Wafirah Holdings, unveiled the global halal brand, a trademark.