The Islamic banking and finance (IBF) industry has shown resilience despite challenges and the continued drop in oil prices throughout 2015. According to a recent report published by TheCityUK (2015), the Islamic financial services industry (which includes various subsectors like Islamic banking, Takaful, asset management, Islamic microfinance) managed to cross the mark of US$2 trillion by the end of 2014. It is expected that by the end of 2015, the global size of assets of Islamic financial services industry will reach up to US$2.2 trillion.

These figures seem to be heartening because oil prices during the end of 2015 reached at its lowest point since 2009 causing shortage of liquidity in oil-dependent Gulf Cooperation Council (GCC) countries. The industry also witnessed unprecedented decline in the issuance of Sukuk globally, mainly because of Bank Negara Malaysia’s (BNM), a Malaysian Central, decision to stop offering short-term Sukuk bonds.

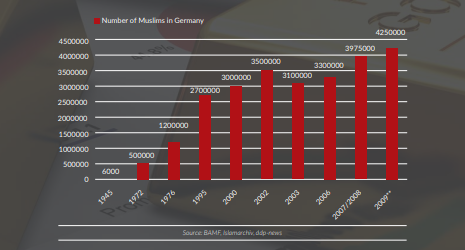

Despite a number of challenges, the IBF industry continued to penetrate into new markets around the globe. For instance, from a Western European perspective, a hallmark of IBF in 2015 has been the establishment and operations of KT Bank AG (Kuveyt Turk Bank), Germany’s first and only full-fledged Shari’a-compliant bank in the country. This is a significant development for Islamic banking because Germany is a leading global economic power and financial hub. Moreover, Germany has substantial influence within the European Union (EU) and the establishment of KT Bank AG could pave the way for similar initiatives in other European countries where Muslims are in the minority. As Figure 1 shows, Germany is home to the largest Muslim population in Europe; i.e., 4.8 million which is equivalent to 5.8% of the overall population. France ranks in second position where about 4.7 million Muslims live which is nearly 7.5% of total population. The UK has approximately 3 million Muslims and their share in total population is about 4.8%.

DEVELOPMENT OF IBF IN GERMANY

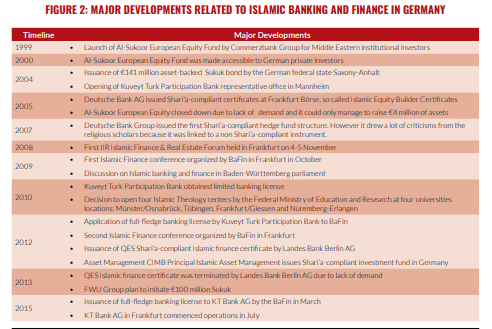

This article looks at major developments related to the Islamic financial services industry in Germany as shown in Figure 2. The history of IBF in the country dates back to 1999 when Commerzbank Group, the second largest banking group, launched the Al-Sukoor European Equity Fund mainly for Middle Eastern institutional investors, which was later opened to individual investors. However, it was closed down in 2005 due to low demand and it only managed to raise €4 million worth of assets.

It is worth to note that Saxony-Anhalt, the German federal state was the first government in the entire European continent to issue the first asset-backed Shari’a-compliant Sukuk worth €141 million in 2004. Interestingly, in the same year the UK authorized the Islamic Bank of Britain Plc – the first Shari’a-compliant retail bank which was later rebranded as Al Rayan Bank Plc. It is thought-provoking to note that Germany took over 10 years to approve Islamic financial products and services to be offered in the country despite having the largest Muslim population in Europe.

As far as European corporate’s involvement in Islamic finance is concerned, FWU Group, a German financial services group based in Munich became the first corporate to plan the largest corporate Sukuk programme worth US$100 million and eventually issued its first tranche of US$20 million 5-year bond backed by real assets in 2013.

The turning point in the development of IBF in Germany was the establishment of the first full-fledged Islamic bank in the country – KT Bank AG, which is owned by Kuveyt Turk, the largest Islamic banking institution in Turkey. Based in Frankfurt, KT Bank AG, has also opened its affiliates in Mannheim and Berlin and plans to expand its operations in Cologne, Hamburg and Munich in the near future. In time, it plans to expand beyond the German borders. Based on a poll carried out by the bank, it was estimated that 21% of the 4.3 million Muslims residing in Germany are ready to use the services of an Islamic bank.

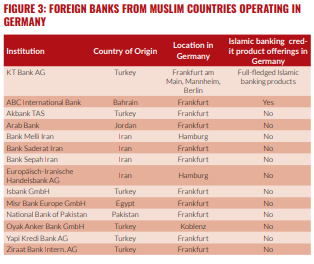

As shown in Figure 3, several banks operating in Germany have their origins from Muslim countries such as Bahrain, Turkey, Jordan, Iran, Pakistan and Egypt etc. However, none of these banks (KT Bank AG being the exception) are engaged in any kind of Islamic banking activities. These banks mainly function as liaison branches of their respective countries. The banking system in Germany is a universal banking system and it has three pillars namely private banks, cooperative banks and public banks. Deutsche Bank AG and Commerzbank AG are playing vital roles in the global Islamic financial services industry through offering Islamic financial products and services, consulting services in the issuance of Sukuk and other advisory services. However, these banks have not shown hitherto significant commitment and motivation for the domestic Islamic banking market due to the small market potential and lack of awareness about Islamic banking and finance. The main focus areas of these banks are in the GCC, South East Asia and up to some extent in the UK market.

The website of Deutsche Bank AG (2015) states that:

“On the Islamic capital markets side, Deutsche Bank has been honored to work with our sovereign, quasi-sovereign and private clients such as the State of Qatar, Saudi Aramco, Saudi Electricity Company, Khazanah, Dubai Islamic Bank, Banque Saudi Fransi, Dar Al Arkan Real Estate Development Company and many others to arrange and book-run landmark Sukuk transactions enabling them efficient and swift access the Islamic capital markets to achieve their funding objectives.”

Commerzbank AG (2015) reiterates its commitment to the IBF industry in these words:

“Commerzbank Financial Institutions is currently developing further Islamic Banking techniques, allowing our clients to structure their business in a Sharia-compliant way.”

FUTURE OF IBF IN GERMANY

A question now arises about the future of IBF in Germany without the participation of big banks. Can KT Bank AG, which is primarily a retail bank, be successful? The foremost important factor that could play a significant role in this regard is the operating model of a bank. As the market is already very competitive with cheap products and the presence of a large number of banks with long and reliable customer relationships; pricing and quality of Islamic products and services as compared to conventional banks may help to win customers.

However, the presence of a large Turkish community, which is well-connected with Turkish religious and social organizations, is a plus point for KT Bank AG. KT Bank AG is part of Kuveyt Türk Participation Bank A.S., based in Istanbul-Turkey and this group aspires to target the Turkish-speaking population in Western Europe mainly in the Netherlands, Belgium, Germany and Austria.

Some Islamic financial experts believe that Germany may be successful in attracting local and foreign Shari’a-sensitive clients by following the UK’s Islamic banking model and experience. Although IBF in Germany is currently less developed compared to the UK, the potential for significant Islamic financial services in Germany is undeniable. It is estimated that the total accumulated wealth of Muslims in Germany is about €25 billion.

German market, unlike the UK has different financial and regulatory environment. Both UK and Germany have different characteristics in terms of the size of Muslim population, history, economy, regulatory approach towards Islamic finance and financial markets.

The IBF industry in the UK is primarily driven by the proactive role of different government institutions such as the Bank of England and relentless government support. However, in Germany, IBF has not seen such unwavering support from government entities and political leadership. Apart from some initiatives of BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), support from the financial regulatory authority came only in the form of organising a few Islamic finance conferences in 2009 and 2012 to create awareness among financial institutions and Muslim population. Regulatory and legal issues remain the major constraint facing the implementation of Islamic finance in Germany.

The key difference of the IBF industry in Germany and the UK is the strategic location of London. Without any doubt, Frankfurt is also in the list of leading global financial centres but London has a long history of global intermediation as a financial centre and is a preferred destination for investors from rich Muslim countries.

Despite competitive advantage which London has, Germany could still have stronger engagement in IBF activities. For instance, Germany is a strong trading partner of Turkey where we have witnessed Islamic banking gaining grounds in recent years to command a market share of 6%.

Another factor which goes in favour of Germany is the exponential growth of Socially Responsible Investments (SRI) and ethical banking in the country with the launching of several SRIs and ethical banks in recent years. The Germany SRI market recorded a compound annual growth rates (CAGR) of more than 20% during the 2012-2013 period. Interestingly, religious institutions and charities represent an institutional investors’ market share of almost 60%.

If KT Bank AG is successful in promoting Shari’a-compliant and ethical banking to local Muslim and non-Muslim population in the coming years, this will entice other banks to consider Germany as a viable Islamic finance market that is largely untapped. It should also be noted that Frankfurt is home to the European Central Bank (ECB) and penetration of Islamic financial products and services locally may send positive signals to other European countries.