Introduction

Global wealth is highly concentrated, with the top 1% owning more than the rest of 99% population in the world. The top 1% of the global population include those who have US$798,000 in total assets (cash plus other assets, including the house the person is living in)1. Obviously, this is only an indicator of wealth concentration and not the wealth held by High Net Worth Individuals (HNWIs) who should have at least US$1 million in investible cash2. A major focus of this report is on wealth held by HNWIs and governments, although the mass affluent will not be completely ignored. In particular, we shall focus on Islamic wealth and its management in the context of fast-growing global Islamic financial services industry.

Islamic wealth in this report refers to the stock of wealth held by Muslim high-net-worth families and individuals, the investible surplus cash held by the Muslim-owned businesses and Islamic financial institutions, and the investible cash held by sovereign wealth funds (SWFs) set up by the governments of the countries comprising Organisation of Islamic Cooperation (OIC). This estimate of Islamic wealth

includes both the private and public segments, unlike some other definitions that use the wealth of HNWIs only to calculate wealth, and in this sense are actually estimates of the private wealth. To be consistent with other wealth estimates and its classifications, this report makes a distinction between Islamic wealth and the Muslim HNWI wealth; the latter being the wealth by Muslim HNWIs, excluding the stock of money with Muslim-owned businesses and governments and wealth of the emerging mass affluent segment.

Many wealthy Muslims find most investment opportunities inconsistent with their beliefs and, hence, are not optimising their financial prosperity. This indirectly implies that lack of Shari’a-compliant wealth management solutions is a drag on Islamic wealth. As capital markets are considered to be an effective engine of growth in wealth in USA and Europe – the two regions with the largest concentration of wealth and its growth – under-developed wealth management practices in the Muslim world are not helpful for growth of Islamic wealth.

Although in general HNWIs are those with at least US$1 million in cash available for investing, different banks and financial institutions use their own definitions. Some private banks may put a higher threshold for considering an individual to be a HNWI.

UHNWIs are those with US$30 million in investible funds.

Muslim Demography – A Potential Source of Growth in Islamic Wealth

There are various estimates of global Muslim population, ranging from 1.6 billion (Pew Research Centre) to 2.08 billion (www.muslimpopulation.com). According to these estimates, Muslims account for 23% to 28% of the mankind. Whatever be the health of these estimates, it is realistic to assume that every fourth person on the planet is Muslim. However, vast majority of them happens to be amongst the poorest in the world. An estimated 40% of the population in the OIC block lives under the poverty line. This segment of the Muslim population is certainly of no interest to this report.

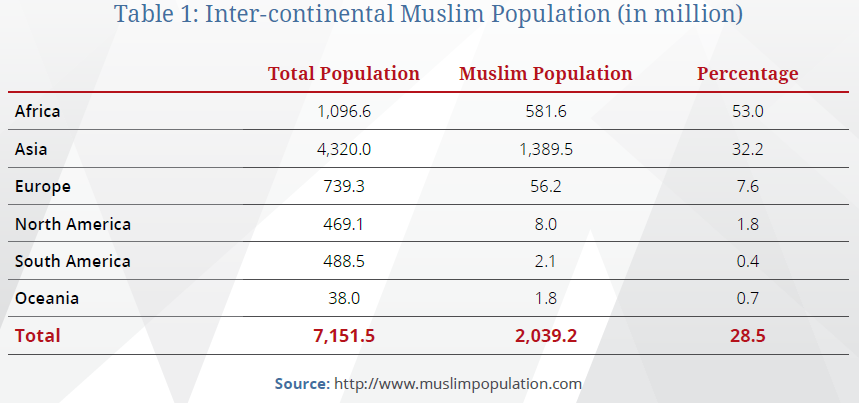

Asia hosts the largest number of Muslims in the world, which is about 30% of the total continental population. In terms of proportionate continental Muslim population, Africa has the largest percentage of Muslims in any continent, with Muslims accounting for over half of the continental population. In other parts of the world, Muslims are in small numbers and even smaller proportions. Table 1 provides estimates of inter-continental Muslim population.

It is clear from Table 1 that Islamic banking and finance (IBF) has real relevance to the top three continents, i.e., Africa, Asia and Europe. The bulk of Muslim population lives in these regions, and HNWIs, Islamic financial institutions and governments therein should have interest in Islamic wealth management.

There is a growing middle class in the Muslim world, of which the upper sub-segment called the mass affluent, may potentially be relevant to Islamic wealth management. Islamic wealth management and private banking is at best at an initial stage in most of the countries with significant Muslim populations.

Like most developing countries with under-developed capital markets, one asset that has been used in the Muslim world by the mass affluent for wealth management is the real estate. Most Muslim HNWIs have diversified businesses but almost all of them have significant exposure to the sector.

Wealth management is a rudimentary business in the Muslim world. A culture of professional wealth management has yet to develop fully, although some banks offer wealth management products and premier banking services to their wealthy customers.

However, with the increase in the mass affluent class, there is huge scope for asset and wealth management business in the Muslim world. Given that Islamic banking and finance is fast assuming mainstream importance in a number of countries in the OIC, Islamic wealth management and private banking business is expected to flourish in the decades to come.

An increasing number of Islamic banks have already started offering Islamic wealth management solutions to their high-net-worth clients, and with the patronage of government bodies and sovereign wealth funds (SWFs), this practice should further flourish. While the likes of Khazanah Nasional Berhad in Malaysia are already well-established patrons of Islamic wealth management practices and institutions, it is expected that other government bodies (like central banks) and government-linked institutions will come into the fold of Islamic finance in general and Islamic wealth management in particular.

Islamic Wealth in a Global Context

Islamic wealth is estimated to be US$11.3 trillion, which is only a fraction of the global wealth of US$107.3 trillion3. The private wealth held by HNWIs stood at US$57.83 trillion at the end of 2014, and can easily reach the mark of US$60 trillion by the end of 2015.

Muslims are the second largest faith group holding the global wealth, trailing Christians. Muslim HNWIs hold an estimated US$3.35 trillion, which is less than 30% of the total Islamic wealth. The remaining 70% is held by Muslim businesses, Islamic financial institutions, the mass affluent, and by the governments in the OIC block.

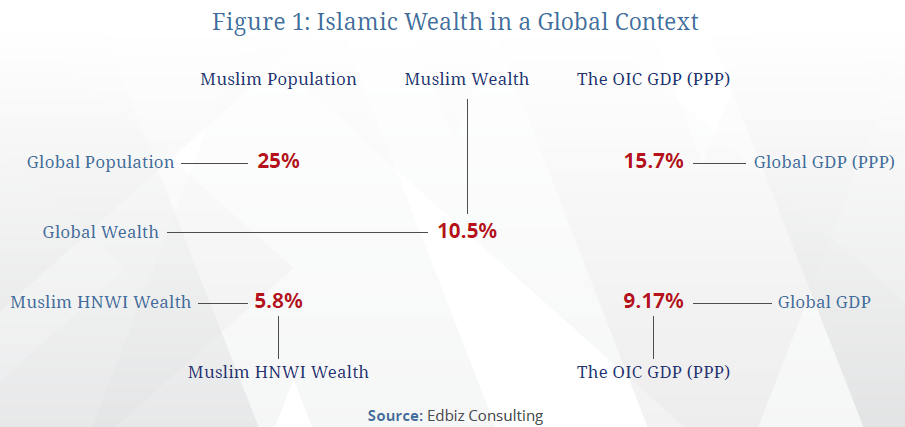

Figure 1 presents Islamic wealth in a global context in terms of total population and GDP and their comparison with the Muslim population and the OIC GDP.

The following key messages emerge from Figure 1:

- Muslims do not share global wealth proportionate to their share in the global population;

- Muslims own only about US$1 in every US$10 owned by wealthy individuals, institutions and governments;

- In terms of income generation, the OIC countries contribute less than 10% of the global GDP (in terms of real prices) and over 15% in terms of GDP purchasing power parity (PPP);

- Muslim HNWIs own less than 6% of the global HNWI wealth; and

- Given that the income generation (GDP) in the Muslim world is more or less the same as the Muslims’ share in the global wealth, there will not be any dramatic increase in the Islamic wealth in the short to medium run.

Following are the key points emerging from Figure 2:

- The largest amount of Islamic wealth originates from the Middle East and North Africa (MENA) region, and within it is clustered in the six countries comprising the Gulf Cooperation Council (GCC);

- In terms of the leading countries

- in terms of Islamic wealth, Turkey, Indonesia and Saudi Arabia stand out;

- ASEAN region holds special significance in terms of incidence

- of Islamic wealth; the second wealthiest Muslim country, namely Indonesia, is located there, and the most developed country in terms of Islamic capital markets and asset management, i.e., Malaysia, is a key member of ASEAN;

- The third most important region with respect to origination of Islamic wealth is Africa, which may come

- as a surprise to many who are not familiar with the African continent and the dynamism of income and wealth inequalities therein;

- It must be noted that a significant proportion of wealth in Indonesia belongs to non-Muslims (i.e., the ethnic Chinese business families);

- Despite a very long Iran-Iraq war followed by debilitating financial

- and economic sanctions, Iran holds substantial Islamic wealth; and

- A very significant proportion of the Islamic wealth actually originates from the non-Muslim world.

A Focus on MENA and the GCC

Simon Kuznets’ inverted U-shaped curve representing the hypothesis that with economic growth country’s inequality level initially increases and then decreases after reaching certain average income level has found support in countries with large populations (50 million upwards) but the countries with small populations tend to have more equal income and wealth distribution. The countries in the MENA region, particularly in the GCC tend to have better income and wealth distribution than what Kuznet’s hypothesis would otherwise suggest.

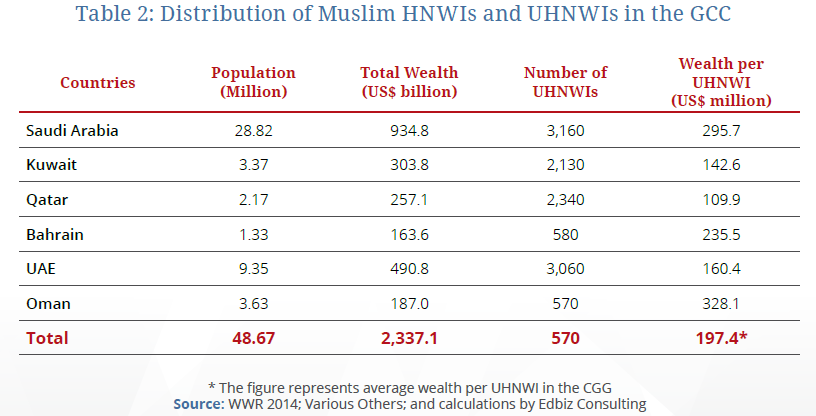

Combined, the six GCC states have a population of around 48.67 million, roughly half of Egypt’s total population.

Muslim HNWI Wealth

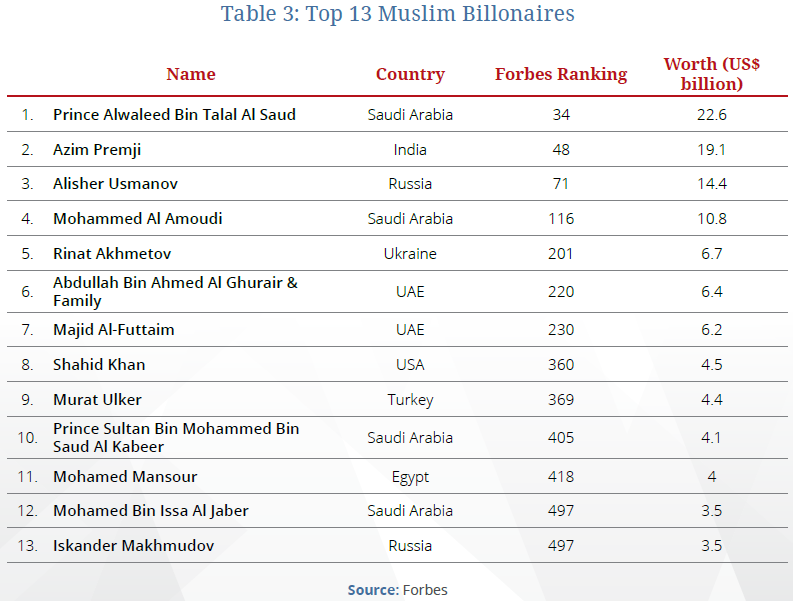

It is interesting to note that there are not very many Muslim HNWI reported in the global rich lists like Forbes’. There are only two Muslims listed in the Top 50 Billionaires List of Forbes, namely Prince Alwaleed Bin Talal Al Saud (ranked 34) and Azim Premji (ranked 48). This is a clear indication of the fact that global wealth is acutely concentrated outside the Muslim world. Table 2 presents the thirteen Muslim billionaires included in the 500 richest people in the world. Out of these thirteen, four come from Saudi Arabia and another four from the non-Muslim countries, namely,

Russia, India, USA and Ukraine. Two are UAE nationals and one from Turkey and Egypt each.

While it may not surprise many to observe Muslim HNWIs located in USA and India, it is certainly interesting to see that many wealthy Muslim families come from the countries like Russia and Ukraine.

Malaysia is an important exclusion from the list, given that it stands at second position in Islamic Finance Country Index (IFCI)5. The number one country on IFCI is Iran, which itself is not represented in the list in Table 2. However, Saudi Arabia – number 3 on IFCI ranking – is adequately represented in Table 2. But the most striking feature of the table is the fact that a very significant proportion of Islamic wealth is actually located outside the Muslim world. More than 41% of the Muslim HNWIs are based in the non-Muslim countries, which accounts for almost 40% of the wealth reported in Table 3.

A very significant proportion – more than 40% – of Islamic wealth is actually located outside the Muslim

world.

Islamic Sovereign Wealth

Given that not all the wealth owned by governments of the Muslim countries is invested in a Shari’a-compliant way, one may divide it into Islamic sovereign wealth and the wealth held by Muslim sovereigns. Islamic sovereign wealth is the share of total wealth held by governments of the Muslim-majority countries in the OIC block, which they have already invested in Shari’a-compliant way or which is available for Shari’a-compliant investments. This segment of Islamic wealth is invested directly by governments or through central banks that are responsible for foreign exchange reserve management. Wealth held by Muslim sovereigns and governments, which is invested conventionally is significantly larger than the Islamic wealth held by such sovereigns. We estimate this portion of the Muslim wealth to be about US$5.6 trillion.

Muslim HNWIs in South Africa

Muslim population in South Africa is very devout. It is one of the few Muslim-minority countries where Muslims on average are more affluent than the local communities (other than the white minority). According to the South Africa Wealth Report 2015, Muslims are the fastest-growing millionaire group in the country. This brings an opportunity for Islamic wealth managers to tap the Muslim HNWIs. The asset managers like Crescent originate from South Asia, and the success of their business relies on the HNWI Muslim wealth in South Africa, other African countries and even in the UK.

Out of 23,400 HNWIs and 285 UHNWIs living in Johannesburg only, a significant proportion is Muslim. In fact, Muslims are clustered in three big cities – Cape Town and Durban being the other two.

Islamic Wealth Held by SWFs and Other Government Bodies

SWFs

Kuwait Investment Authority (KIA)

KIA is the world’s first and the oldest sovereign wealth fund. Since its inception in 1953 with a bank account in London, it has been dubbed as an intriguing black box. No one knows the exact AUM of KIA and our preferred estimate is US$120 billion6.

In the recent past, KIA has started investing directly in the real estate projects and one should expect to witness its involvement in more Shari’a-compliant investments, as the real estate is deemed more in line with Shari’a requirements.

Qatar Investment Authority (QIA)

Founded in 2005, QIA has emerged as an aggressive SWF with huge appetite for trophy projects. It has become as one of the most visible investors in the London property market, with investments in Harrods, Shard and the Olympic Village.

With estimated AUM of US$170 billion, QIA is expected to grow its assets to US$200 billion in the near future. As one can guess from the portfolio of its investments that include Barclays Bank, Credit Suisse, Banque International

Luxembourg and Marimax, QIB invests in a conventional way but its large exposure to property makes him a potential player in IBF.

Abu Dhabi Investment Authority (ADIA)

Founded in 1976, ADIA is one of the largest SWFs in the world, with AUM in excess of US$800 billion.

Other SWFs include:

- Mumtalakat

- BIA

Islamic Wealth Held by Central Banks in the OIC

Foreign exchange reserves held by central banks in the OIC countries should be considered as part of the Islamic sovereign wealth.

Investible Funds Held by IBFIs

The global size of the Islamic financial services industry is US$1.984 trillion7. Many Islamic banks and financial institutions (IBFIs) offer wealth management solutions to their wealthy clients (HNWIs and the mass affluent). However, Islamic private banking is a relatively new phenomenon that has to go a long way before it is deemed a significant activity within the global Islamic financial services industry.

Mass Affluent Wealth

The mass affluent segment of the market is becoming of an increased focus in banking and financial services industry, with high-street banks now offering premier banking services to their wealthy clients.

As mentioned in the Introduction, those who have about US$800,000 in the form of movable and immovable wealth own about 51% of the global wealth. This means that a growing proportion of wealth is now distributed among the mass affluent social strata. Given this, any analysis of wealth management cannot afford to ignore the premier customers of banks.

Estimates of the total wealth held by the mass affluent Muslims is US$2.25 trillion out of which only a fraction comes under management of IBFIs.

Why Does Only a Fraction of Muslim Wealth is Invested in a Shari’a-compliant Way

Out of over US$11 trillion, only a fraction is invested in a Shari’a-compliant way. This begs the multi-million dollar question. Why?

Governments, the central banks and SWFs in the Muslim world invest only in the highest quality instruments that are not available in abundance in the Islamic financial markets. There is shortage of supply of high-quality Islamic assets, creating a supply-demand mismatch.

Islamic Wealth Management – A Preview

Many wealth managers would dispute the use of a term like “Islamic wealth management” – or IWM in short because. According to them, the fundamental principles of wealth management are universal, applying to persons of all faiths. Wealth management involves integrated financial services incorporating financial planning as well as portfolio management as part of comprehensive advisory and management of a client’s wealth.

Whether it is just nomenclature or a matter of identity, it cannot be denied that there is growing focus on wealth management in the global Islamic financial services industry. It must be clarified that although Islamic wealth management reflects an Islamic identity, it can be practised by anyone – Muslims and non-Muslims alike.

IWM is the process of creating and building wealth, and preserving or protecting the same, in accordance with Shari’a principles. The distribution of the accumulated wealth is also part of IWM.

The process involves the creation of wealth through (inter alia) a business, profession or trade and/or savings with financial institutions, the investment of the wealth created to generate returns, the protection of wealth through risk management, takaful and trusts, and the distribution of wealth through gifts (hiba), wills and trusts. The range of activities comprises financial analysis, Shari’a-compliant asset and securities selection, investment planning and on-going monitoring of investments, as well as estate planning, tax planning and retirement planning.

The following are important considerations in Islamic estate planning:

- It is important to ensure Islamic injunctions regarding one’s properties and financial obligations are fully carried out, including outstanding debts, dependents’ expenses and zakat payments;

- It is necessary to achieve one’s objectives with regard to one’s assets and belongings in ways which are in accordance with Shari’a principles;

- It is vital to ensure expeditious distribution of the estate to one’s heirs; and

- It should also be ensured to minimise unnecessary legal costs, protracted legal proceedings and payment of taxes.

Given that the total size of the global Islamic financial services industry is no more than US$2 trillion, a major chunk of the Islamic wealth is still outside the domain of Shari’a-compliant banking and finance. This is a main reason that Islamic private banking has been slow in emergence and development. Setting up of full-fledged Islamic private banks, e.g., Faisal Private Bank in Geneva, has not been successful. Similarly, private wealth management departments of a number of Islamic banks around the world have not been entirely successful.

Having said that, the premier banking services offered by Islamic banks to the mass affluent segment of the industry are popular and growing in size and AUM.

Internationalisation of IWM

Although relatively under-developed as compared with other sub-sectors in IBF, IWM has tremendous potential for growth. The current situation of limited supply of IWM products driven can be changed by product innovation and development, expansion of markets and investor base, strengthening of the supporting infrastructure, and generating greater level of confidence. The effectiveness of these growth drivers, nevertheless, is premised on the industry achieving further internationalisation that is well-entrenched and sustainable, which in turn, requires concerted and conscientious efforts and collaboration among the interested parties across the various jurisdictions to create an enabling environment within which cross-border selling of IWM products can truly flourish. It is therefore incumbent upon all stakeholders in the Islamic finance industry in general, and Islamic asset management industry in particular, to contribute towards realisation of this common objective.

Should IWM be Defensive or Offensive?

Given the disparity between the size of the global Islamic financial services industry (around US$2 trillion) and the magnitude of global Islamic wealth (over US$10 trillion), should IWM attempt to tap the Islamic wealth only (a defensive approach) or it should rather aim at attracting wealth from anywhere (an offensive style), as long as the holders of the wealth agree to the principles of Islamic finance and are in fact willing to manage their wealth in a Shari’a-compliant way?

This is a general question that has triggered a lot of debate on the strategic aspects of IBF.

The approach of “Islamic wealth management for all” has implication for its branding.

If it is to be developed as a product range appealing to all – irrespective of their faiths – then it should have a secular branding.

IWM as an Islamic brand can have a universal appeal only if Shari’a compliance by itself adds value and that it leads to better performance.

IWM and Value Addition

Wealth distribution can be developed as a cornerstone of IWM. While wealth acquisition and accumulation during economically active part of lifecycle of an individual, and management of it to maintain a given lifestyle is an important aspect of IWM, it is equally important to plan for distribution of wealth and its transfer to others, after one’s death. This latter aspect should be the distinguishing feature of IWM. Establishment of awqaf and the financial products offered by Islamic banks to raise money for their operations could be an important aspect of IWM. Management of zakat money for social welfare should also be an important aspect of IWM. In this respect, it is vital to understand psychological foundations of human behaviour, and appropriate products should be developed to combat human fears, which include:

- Uncertainty over the assets/capital;

- Uncertainty of income;

- Health-related uncertainties; and

- Inter-generational considerations like concern for the welfare of children and family after the client’s death.

IWM products should aim at addressing a comprehensive range of needs of their clients, with an aim of risk reduction for the lifecycle of the wealthy. In this respect, the role of waqf and Islamic foundations should be explored, with a view to develop these historical institutions into modern vehicles of IWM.

Malaysia’s Role and Position in IWM

Malaysia is the most developed jurisdiction for IWM, with a comprehensive regulatory framework for IBF, including a special focus on Islamic asset management. While Kuala Lumpur boasts to have one of the largest concentration of Islamic asset management business in the Muslim world, Labuan – its offshore jurisdiction – has emerged as the most active destination for wealth management in the OIC block.

Editor’s Note

There are a number of resources available on global wealth, including:

- World Wealth Report, published by Capgemini

- Global Wealth Report, published by Credit Suisse

- GCC Wealth Insight Report, published by Emirates Investment Bank

- The Wealth Report, published by Frank Knight

- South Africa Wealth Report

In addition, J. Safra Sarasin Group has for a few years been publishing a report on Islamic wealth management but these are no more than briefs on the topic, lacking in-depth analysis and comprehensive coverage.