A major challenge facing any banking institution is estimating the impact of interest rate movements on its financial standing. In light of such uncertain movements of interest rates, banks can face significant challenges in managing their interest rate risk exposure. These interest rate movements can also affect Islamic banks in terms of rate of return risk. In a system where Islamic financial institutions (IFIs) are operating hand-in-hand with their conventional counterparts and the practice of benchmarking their products on the market interest rate, these factors could expose Islamic banks to the rate of return risk, which has significant consequences for IFIs’ stability and performance.

Rate of return risk is one of the major strategic risks which needs to be managed by IFIs as highlighted by Islamic Financial Services Board’s (IFSB) Guiding Principles of Risk Management for institutions offering only Islamic financial services. The risk is different from the interest rate risk faced by conventional institutions in the sense that as per the underlying contractual agreements between IFIs and their depositors, the returns to the depositors are directly dependent on the actual earnings that the IFIs generate on their assets during an investment period.

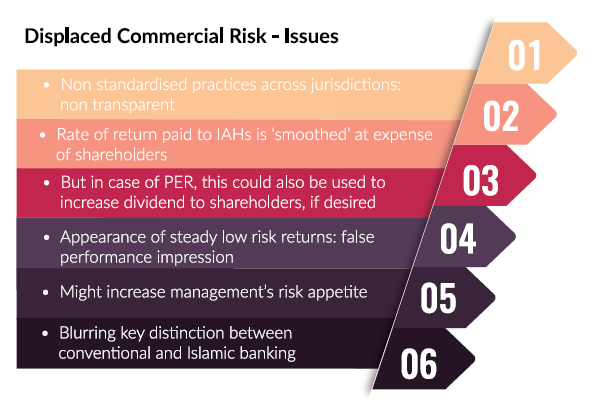

The rate of return risk leads to the displaced commercial risk. This can be defined as the market pressure on Islamic banks to maintain their profit rates to depositors at par with the competition – along with other IFIs and the conventional banks; despite the fact that actual return on its assets in an investment period are lower than rates distributed to the depositors or would not allow the equity holders to earn their required rate of return.

Most Islamic banks use the concept of hiba to waive their share in the profits to mitigate this risk. This again has commercial ramifications for the Islamic banking entity and erodes the commercial viability of the banking operations. On the other hand, due to market pressures Islamic banks are forced to tow this line to avoid withdrawal of deposits resulting in liquidity risks. This becomes more pronounced given the long-term nature of Islamic banking assets.

IFSB advises the following guiding principles for managing the rate of return risk:

- Principle 6.1: IIFS shall establish a comprehensive risk management and reporting process to assess the potential impacts of market factors affecting rates of return on assets in comparison with the expected rates of return for investment account holders (IAH).

- Principle 6.2: IIFS shall have in place an appropriate framework for managing displaced commercial risk, where applicable.

Along with other recommendations, the IFSB Guiding Principles encourage Islamic banks to adopt the following strategies for minimising the exposure to the rate of return risk:

- determining and varying future profit ratios according to expectations of market conditions;

- developing new Shari’a-compliant instruments; and

- issuing securitisation tranches of Shari’a permissible assets.

INNOVATIVE MECHANISM FOR ISLAMIC PROFIT RATE SWAP INSTRUMENT BASED ON WAKALA ISTITHMAR

Currently one of the favored instruments for conventional finance entities to hedge against interest rate risk is to use the Shari’a non-compliant interest rate swap; which of course Islamic banks cannot use. On the other hand, an Islamic alternate of profit rate swap based on commodity murabaha has been used whereby both the counterparties make a wa’ad to enter into a series of commodity transactions to achieve the result of profit rate swap and hedging. However, the major forms of international commodity murabaha prevailing today have been criticised by a number of scholars on Shari’a grounds; including the Islamic Fiqh Academy (IFA); and termed as organised tawarruq. Hence, commodity murabaha together with the use of bilateral wa’ad makes the structure even more critical on Shari’a grounds. What is more, increasing number of regulators are taking steps to restrict the use of commodity murabaha in their jurisdictions.

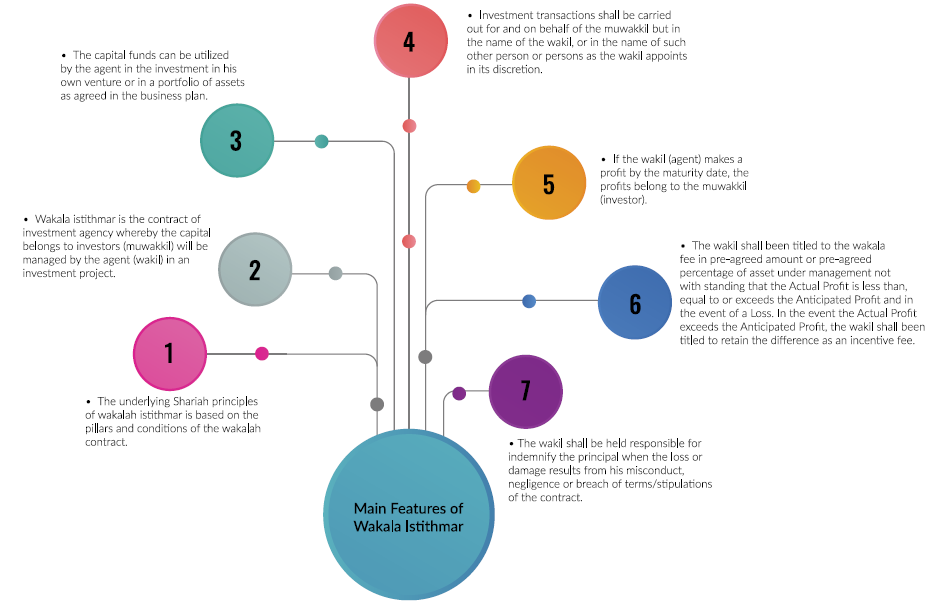

In line with IFSB’s guidelines on developing new instruments; the following sections propose a new method for Shari’a-compliant hedging of profit rate based on the concept of wakala istithmar (investment wakala) and without the use of the controversial commodity murabaha. A wakala istithmar refers to a method whereby IFIs manage funds on behalf of clients through the provision of agency (Wakala) services in return for specific fund management fees, which are pre-agreed and do not vary based on profit and loss from the relevant funds. The fees can be fixed or a percentage of invested assets. Wakala istithmar is now popular in Islamic financial transactions and has been applied in various structures of Islamic banking and Islamic capital market.

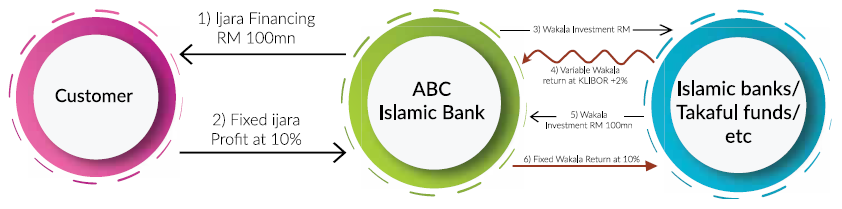

A base case is used to explain this in more detail. Suppose ABC Islamic Bank has provided a $100 million financing under a 5 year ijara period to a customer under a fixed rate of 10%. The Bank keeps the financing on its books for the first year and earns the agreed return. From the following year, the ABC Islamic Bank foresees increase in market benchmark rates and hence runs the risk that if the market benchmark profit rates (i.e., KLIBOR) increase to 12% the Islamic bank will be locked with the 10% return over the five year period. Given that the Bank has many fixed rate financings on its balance sheet, the bank runs a significant rate of return risk and displaced commercial risk if the market profit rates for depositors are inelastic or increase with the benchmark rate. Hence, the bank needs to hedge this risk by swapping its fixed profit rate into a variable profit rate with a party that is willing to do the opposite based on its reading of the market.

WAKALA-BASED ISLAMIC PROFIT RATE SWAP STRUCTURE

ABC Islamic Bank can achieve the above purpose through the wakala istithmar structure. Under this structure, ABC Islamic Bank acting as muwakkil will enter into a wakala transaction with another Islamic bank/Islamic window/financial institution/takaful fund (hereinafter referred to as ‘FI’) with Islamic assets of equal value to the outstanding ijara for the purpose of this example is $100 million). Under wakala, the wakil (i.e. the FI) will agree to invest the funds of ABC Islamic Bank in identified pool of assets to earn a return equal to the benchmark KLIBOR+2 for four years for the profit to be paid annually.

Similarly, the FI providing this hedging facility shall also agree to invest as muwakkil $100 million with the Islamic Bank at a fixed rate of 10% (same rate of ABC Islamic Bank’s ijara facility) under the wakala contract. Hence, both parties will execute the wakala investment contracts of equal value with each other. Since both parties will be investing in equal amounts with each other, the net outflow of each entity will be zero.

Now assuming that in the second year the market profit rates rise as forecasted by the Islamic Bank and KLIBOR touches the 10% mark; with this rate KLIBOR +2 = 12%. On the profit payment date the following shall be the situation:

- ABC Islamic Bank will receive a return of 10% under its initial ijara financing.

- The FI will have to pay a return at 12% to the Islamic Bank under the 1st wakala.

- ABC Islamic Bank will have to pay a return at 10% to the FI under the 2nd wakala.

- Payments under point (2) and (3) will be set off and the Islamic bank will receive 2% return from the FI.

Hence, ABC Islamic Bank will receive a variable return according to its targeted benchmark equal to 12% and not as per the fixed rate under ijara.

Assuming that in the third year the market profit rates fall and KLIBOR touches 8% mark; with this rate KLIBOR +2 = 10%. On the profit payment date the following shall be the situation:

- ABC Islamic Bank will receive a return of 10% under its initial ijara financing.

- The FI will have to pay a return at 10% to the Islamic Bank under the 1st wakala.

- The Islamic Bank will have to pay a return at 10% to the FI under the 2nd wakala.

- Payments under point (2) and (3) will be set off and there will be no payment by either party.

Now assuming that in the fourth year the market profit rates fall KLIBOR touching the 6% mark; with this rate KLIBOR +2

= 8%. On the profit payment date the following shall be the situation:

- ABC Islamic Bank will receive a return of 10% under its initial ijara financing.

- The FI will have to pay a return at 8% to the Islamic Bank under the 1st wakala.

- ABC Islamic Bank will have to pay a return at 10% to the FI under the 2nd wakala.

- Payments under point (2) and (3) will be set off and the Islamic Bank will have to pay 2% return to the FI.

Hence, the Islamic Bank will receive a variable net return of 8% equal to the benchmark of K+2.

Through the above mechanism, ABC Islamic Bank has successfully managed to swap its fixed profit rate for a variable one. Depending on their readings of the market and monitoring processes, Islamic banks can apply this mechanism to their profit rates from fixed to variable or vice versa. The corresponding party providing the hedging facility can charge a fee for this facility in the form of a fixed wakala fee. The solution requires that both counterparties have Shari’a-compliant assets to create a wakala pool. This will not be a problem since even most of the conventional banks and takaful companies also now hold Islamic assets in the form of sukuk, Islamic syndications, equity shares and units of Islamic mutual funds.

The structure based on wakala istithmar is widely accepted in terms of Shari’a; with majority of the Islamic banks already using the concept on their liability side of the balance sheet to generate call and long-term deposits. Even in terms of operational implementation, the structure is more effective as compared to the commodity murabaha-based structure due to the following reasons:

- Involves only the two parties concerned and not the numerous commodity;

- The transaction can be executed locally and does not require to be processed through the international commodity exchanges;

- Less documentation; and

- No requirement of multiple Wad or undertakings.

GLOBAL STANDARDISATION AND IMPLEMENTATION

Although wakalah istithmar either in short-term or long-term investment has been adopted widely in Islamic banking and financial transactions as well as Islamic capital, more innovation and standardisation is needed. The International Islamic Financial Market (IIFM) has finalised the standardized versions of Interbank Master Wakalah agreements. The same standardised contracts with minor modifications can be used to standardise the structure and operational procedure for this wakala istithmar-based Islamic profit rate swap mechanism. All Islamic banks and Islamic finance standardisation bodies such as IIFM are encouraged to use this structure as an Islamic alternate to profit rate swap post approval from their respective Shari’a Boards.

The views and opinions expressed by the author in this article are author’s personal and must not be construed as the opinion and views of Muzn Islamic Banking – National Bank of Oman.