The success of a business venture lies exclusively in the hands of its people as they are key enablers for organisations to achieve their corporate objectives. The contemporary commercial world is changing rapidly due to the internationalisation of business and technological advancement. Within the context of talent management, a paradigm shift is evident. For example, there is a growing focus on results and empowerment, not hours worked. Global brands like Virgin and Netflix have introduced ‘unlimited holiday time’ to their employees. Because high performance is so ingrained in their corporate culture, employees are trusted to act responsibly. Another out-of-the-box example is Google. Famously known for its unique and unconventional perks that promote greater creativity and innovation, Google’s corporate culture entails flexitime and free lunches.

More and more organisations are taking bold steps outside the status quo to nurture a corporate culture that creates an inspiring and engaged work environment, including encouraging ‘work from home’, considering commute hours as working hours and creating various job opportunities for women. But at the heart of a strong corporate culture is an organisation’s values. Entrenched in Islamic principles are virtues of trust, morality and accountability. Hence, organisations operating in accordance to Islamic principles tend to embrace a distinctive corporate culture that is premised on these notions, unlike the conventional corporate culture based upon beliefs and values.

ISLAMIC FINANCE TALENTS

The Islamic finance industry is set to grow at a faster pace globally with total assets expected to reach between US$3.5 trillion to US$5 trillion by 2020. For the industry to stay on this growth trajectory and remain sustainable, Islamic financial institutions should strive to advance best practices in corporate culture, which uphold the values of Islamic principles. At best, there exists a corporate culture gap when it comes to engaging the Gen Y workforce between Islamic financial institutions and their western counterparts.

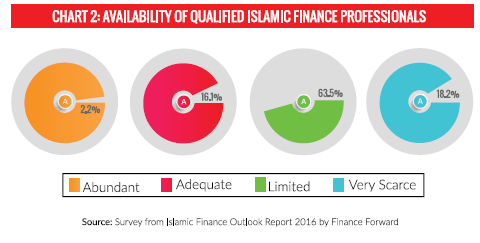

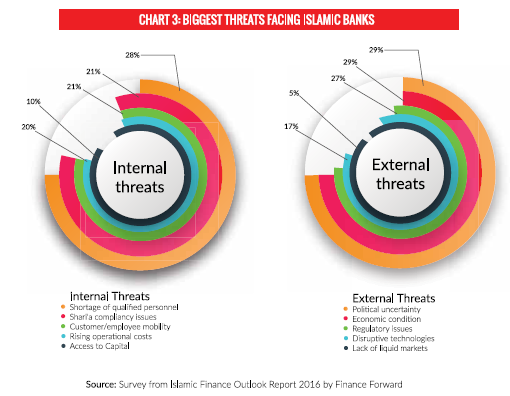

As the industry matures and moves into the mainstream, Islamic finance’s ability to build a qualified workforce that is in tune to the need of the hour is crucial. According to recent reports, there are more than 750 educational institutions that are offering degree programmes (certification courses to full-fledged degrees) in Islamic finance. The Islamic Outlook Report 2016 reported that 80% of Islamic finance practitioners from the Middle East North Africa and Southeast Asia (MENASEA) believed that there was limited or very scarce availability of qualified human resource capital. They also listed shortage of qualified personnel as the biggest internal threat facing Islamic banks.

Numerous reports have noted that a wide gap exists between what is learnt in the classroom and the actual field experience. Hence, it becomes critical for Islamic finance industry to fill the gap through practical exposure in order to give learners the balanced knowledge they need. When such practical exposure is combined with classroom studies, learners would be in a better position to understand and appreciate the profession.

PEOPLE FIRST CULTURE

According to a research conducted at the University of Warwick, people who were happier at work were 12% more productive than those who were not. The report went on to say that there is positive correlation between investment in employee support and employee satisfaction. Google is a prime example of this. This is what a “people-first” culture is all about. More and more companies are recognising the need for treating their employees like customers in order to attract and retain good quality employees.

As Islam desires and encourages unity, Islamic finance industry must therefore promote a “we” culture, which is characterised as a culture of shared core. This, coupled with people-first culture, embodies the spirit of Islamic corporate culture.

Such relationship should be a bond of trust, honesty, and integrity. It should be an association for fair dealing and social justice. No stakeholder should feel aggrieved that his or her group’s interests have been ignored. This forms the bedrock of a strong corporate culture to develop.

In Islam greeting one another with salaam is highly recommended whether one knows them or not. Islam encourages greeting both physically and verbally when we meet other people, respect others, and assist in all possible ways. Even saving customer’s time reflects the ‘people-first’ culture. Islamic corporate culture needs to depict Islamic values when it comes to dealing with customers for uplifting Islamic finance industry. In some parts of the globe, Islamic financial institutions lack ‘people-first’ customer services, which leaves a negative impact on the customers/clients.

ENGAGEMENT

To develop a strong and long-lasting financially beneficial understanding, employer, employee and customer must be optimistically associated as the positivity trickles down from a satisfied employee to exceptional customer services; achieving loyalty of the offerings/products or company/brand.

The affiliation strengthens the connections between the employer-employee and customer and appeals to form a universal corporate culture. All the global brands are living examples of this interconnection.

Understanding an employee’s aspirations is not difficult; whether the employee work solely for money or actually works for passion and utilises best of the time by serving customers and providing them with the best available (possible) solutions. Hence, Islamic principles encourage to serve generously. History of Islamic civilization show many such examples.

However, if an employee does not do justice to their work, Islamic principles clearly imply their compensation as prohibited income for them. Organisations having people-first culture are eager to offer better work environment, as they do realise that happy, satisfied and loyal staff members ultimately leave the customers satisfied and in goodwill. When working together people either realise their dreams or collaborate to achieve vision of like-minded people.

To create an everlasting Shari’a-compliant corporate culture, employer, employee and customer relationship is as important as the other key stakeholder’s interests in the company.

ENTREPRENEURIAL LEADERS

A people-focused culture emphasises upon providing solutions to the customers instead of merely dealing with them as matter of routine. Such an entrepreneurial mindset is required to empower banking and financial services in its true spirit. Presently ATMs and chequebooks exemplify entrepreneurial inventions. However, Islamic finance industry inspires to provide financial solutions in a unique style, embodying an entirely diverse experience to all stakeholders. Islamic finance eco-system promotes the creation of an entrepreneurial mind-set within the workforce for the long-term sustainability of the industry and personal development of the individuals, especially the millennial talents aspiring.

Leadership is all about creating new leaders and driving them towards the vision with zeal and zest. To keep the ball rolling transitional leadership culture is a must. Without accelerating transitional leadership culture, it would be impossible for an organisation to fill the vacuum created at different levels and to find new leaders within the organisation. The entrepreneurial leadership inspires to cultivate a uniquely Shari’a-driven culture. A people-driven corporate culture will always offer empowerment and independence to the respective stakeholders, assuring retention of the talent. An Islamic corporate culture is not confined to the employer-employee relationship rather it goes beyond the borders, including the communities. Hence, the Corporate Socially Responsible (CSR) projects are the live wire of Islamic banking and business transactions.

In conclusion, the Islamic finance industry is at the crossroads of creating an exemplary Islamic corporate culture for the growing industry and considering best practices in the global marketplace to drive the industry. It is pivotal to have people- first culture with total engagement in an entrepreneurial leadership in the Islamic finance eco-system to experience the shifting paradigm. The Islamic corporate culture can inspire Islamic organisations to become friendlier, keeping high standards of morals with Islamic values.