This year’s Global Islamic Finance Awards (GIFA) were held at Gulf Convention Centre, Manama, Bahrain, following the four previous successful awards ceremonies in Muscat (2011), Kuala Lumpur (2012) and Dubai (2013 & 2014). There should be no doubt in anyone’s mind that GIFA has indeed established itself as the market leader in Islamic finance awards programmes. No other market-based Islamic finance awards programme offers the kind of prestige and recognition that GIFA provides to its winners. In the words of our fifth GIFA Laureate, HRH Muhammadu Sanusi II, Emir of Kano, “In just 5 years, GIFA has emerged as the most sought after Islamic finance awards in the global Islamic financial services industry, with its awards ceremonies attended by the royals, prime ministers, presidents, ministers, central bank governors and CEOs of Islamic financial institutions from around the world.” No other Islamic finance awards programme can boast to have hosted more VIPs than GIFA.

Hailed as the most respectable market-led awards in IBF, GIFA aims to highlight the best practices in IBF, and honours the efforts and contributions of individuals and institutions in the Islamic finance industry. Speaking on the occasion, Professor Humayon Dar, founder and chairman of GIFA, emphasized that GIFA awards ceremonies are an occasion of acknowledgement, appreciation and celebration of the success of the global Islamic financial services industry. Dwelling on the history of GIFA, he said that the industry surpassed the historic mark of two trillion US dollars at the end of 2014, which necessitates that the actual leadership of IBF remains in the safe hands of those who are sincerely driven by a real commitment to IBF, social responsibility and Shari’a authenticity. “When we founded GIFA in 2011, our prime motive was to ensure that the thought leadership of IBF remains in the hands of Muslims, while accepting the fact that anyone – Muslims or non-Muslims alike – may use Islamic financial services and non-Muslims may hold key management positions in Islamic financial institutions,” he said emphatically while addressing the gathering.

Professor Dar emphasized that the success of IBF was not possible without contributions from a number of governments, institutions and individuals involved. These contributions deserve formal recognition that must be respected and held in high esteem. This is exactly what GIFA attempts to do.

Mr Alibek Nurbekov, while representing National Bank of Kazakhstan, the central bank of the country and a co-organiser of the awards ceremony, echoed Professor Dar’s views. He shared with the audience that IBF in Kazakhstan entered into a new and accelerated phase of development after HE Nursultan Nazarbayev, president of Kazakhstan, was announced as the fourth GIFA Laureate last year.

GIFA distinguishes itself by being the first and the only Islamic finance awards programme in the world that attempts to engage the political leadership in IBF. The top award – Global Islamic Finance Leadership Award – is presented to a political personality, preferably a head of government or state. Some of the political personalities that have over the past five years attended our annual awards ceremonies have included:

- Tun Abdullah Ahmad Badawi, prime minister of Malaysia (2003-09)

- Dato’ Asyraf Wajdi Dusuki, deputy minister in the Prime Minister’s Department, Malaysia

- Shahid Malik, the UK minister (2007-10)

- HRH Sultan Nazrin Shah of Perak, Malaysia

- Shaukat Aziz, prime minister of Pakistan

(2004-07)

- Nursultan Nazarbayev, president of Kazakhstan

- Dato’ Seri Najib Razak, prime minister of Malaysia

- Sheikh Mohamed Bin Rashid Al Maktoum, ruler of Dubai and the prime minister and vice president of the UAE

- Sheikh Hamdan Bin Mohamed Al

Maktoum, crown prince of Dubai

- Dr Zambri Abdul Kader, chief minister of

Perak, Malaysia

- HRH Muhammadu Sanusi II, emir of Kano, Nigeria

Speaking on the occasion, Alibek Nubekov echoed Professor Dar’s views. “Last year’s Global Islamic Finance Leadership Award presented to our president helped us in establishing Kazakhstan as a regional hub for the central Asian states.” Political engagement, therefore, is absolutely essential for further growth of IBF.

Like previous years, the pre-and post-event coverage of GIFA in the international media was impressive.

The awards ceremony started with a dazzling flashback movie covering the previous four awards ceremonies. To date over 120 awards have been issued in about 40 categories.

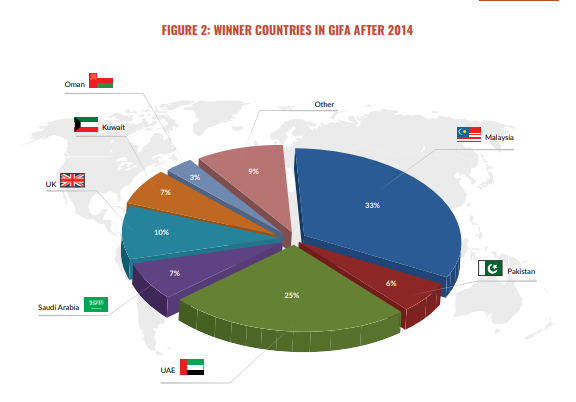

The winners have come from 16 countries so far, with Malaysia winning the maximum number of awards (42 in number and 35% of the total). The UAE is on second position, bagging 24% of the awards. The UK, Pakistan and Saudi Arabia have each received 7%. It is interesting to note that four Muslim-minority countries have featured in the winners’ list. For further details, see Figure 1 and Table 1.

Comparing Figures 1 and 2, it is very clear that Malaysia continues to strengthen its position in GIFA by increasing share in the awards from 33% in 2014 to 35% in 2015.

Pakistan is also emerging as an important player in GIFA domain by increasing its share from 6% in 2014 to 7% in 2015. There have been six awards presented to individuals and institutions from Pakistan. The first award winner from Pakistan was Bank Islami that received Shari’a Authenticity Award in 2012. This year, Meezan Bank bagged this award, implying that IBF remains the most authentic from a Shari’a viewpoint. A primary reason for this is the unwillingness of Shari’a scholarship in Pakistan to allow practices like tawarruq and bai’ al-‘ina, which are rampant in the Middle East and in Malaysia, respectively.

Previously, Meezan Bank won Best Research and Development in Islamic Finance Award (2013), but for the last two years, Islamic Research and Training Institute (a member of the Islamic Development Bank Group) have received this prestigious award. Dato’ Dr.

Mohd. Azmi Omar, director general of IRTI, was buoyant on receiving the award, “We are very proud to win GIFA’s Best Research and Development in Islamic Finance Award again in 2015, which is a recognition of IRTI’s work and successes in the field of research, advisory and training.”

The awards ceremony was attended by over 250 delegates from 30 institutions that fiercely fought for about 40 awards categories. Important attendees included:

- His Excellency Simon Martin, Ambassador of the United Kingdom to Bahrain

- His Excellency Dato’ Ahmad Shahizan Abd Samad, Ambassador of Malaysia to Bahrain

- His Excellency Muhammad Saeed Khan,

Ambassador of Pakistan to Bahrain

- Khaled Al-Aboodi, CEO of Islamic Corporation for the Development of the Private Sector (ICD), a member of the Islamic Development Bank (IDB) Group

- Dato’ Mustafha Abd Razak, CEO and Managing Director of Bank Rakyat, Malaysia

- Dato’ Wan Mohd Fadzmi Mohd Othman, CEO and Managing Director of Agrobank, Malaysia

- Mr Alibek Nurbekov, Representative of National Bank of Kazakhstan

The guest of honour was HRH Muhammadu Sanusi II, Emir of Kano, Nigeria, who received the top award – Global Islamic Finance Leadership Awards (GIFLA) – and hence became the fifth GIFA Laureate. HRH Emir Sanusi joined a prestigious club of GIFA Laureates that include HE Tun Abdullah Badawi (a former prime minister of Malaysia), HRH Sultan Nazrin Shah of Perak (Malaysia),

HE Shaukat Aziz (a former prime minister of Pakistan) and HE Nursultan Nazarbayev (president of Kazakhstan). “We aim to engage the political leadership in the OIC countries to create awareness of IBF within the government sectors,” said Professor Humayon Dar, founder and chairman of GIFA. “Our GIFA Laureates have championed the cause of IBF in their respective countries and globally, and we hope that our this year’s GIFA Laureate HRH Emir Sanusi will continue to lead the global Islamic financial services industry with enthusiasm and the commitment he has shown in the last decade.”

| Award Categories 2011 2012 | |||

| Top Award | |||

| Global Islamic Finance Leadership Award (Individual Category) | Tun Abdullah bin Haji Ahmad Badawi, Former Prime Minister of Malaysia | Sultan Nazrin Shah ibni Sultan Azlan Muhibbuddin Shah, Sultan of Perak | |

| Global Islamic Finance Leadership Award (Institutional Category) | — | — | |

| Global Islamic Finance Leadership Award (Country Category) | — | — | |

| Prestigious Awards | |||

| Islamic Finance Personality of the Year Award | — | Sohail Jaffer Deputy CEO of FWU Group | |

| Islamic Banker of the Year Award | Badlisyah Abdul Ghani, CEO of CIMB Islamic | Yuslam Fauzi, CEO of Bank Syariah Mandiri | |

| Islamic Finance Advocacy Award | — | — | |

| GIFA Special Award (Leadership Role) | Mr Yasin Anwar, Governor of State Bank of Pakistan | — | |

| GIFA Special Award (Advocacy Role) | — | — | |

| General Categories | |||

| Best Islamic Bank | National Commercial Bank | CIMB Islamic | |

| Best Islamic Takaful Company | FWU Global Takaful Solutions | Etiqa Takaful | |

| Best Islamic Fund | — | CIMB Principal Islamic Asset Management (Ireland) plc | |

| Best Islamic Fund Manager | CIMB Principal Islamic Asset Management Sdn. Bhd. | SEDCO Capital | |

| Best Islamic Banking Window | — | ADCB Islamic | |

| Best Islamic Structured Products Platform | Societe Generale | CIMB Islamic | |

| Best Islamic Finance Technology Provider | Path Solutions | International Turnkey Systems (ITS) | |

| Best Islamic Finance Technology Product | ETHIX by ITS | ETHIX by ITS | |

| Best Islamic Law Firm | Agha & Shamsi/Agha & Co | Zaid Ibrahim & Co (ZICO) | |

| Best Islamic Finance Consultancy | KPMG | KPMG | |

| Best Islamic Supporting Institution of the Year | DDCAP | DDCAP | |

| Shari’a Lawyer of the Year Award | — | — | |

| Upcoming Personality in Islamic Finance | Dr Asyraf Wajdi Dusuki | Dr Wan Nursofiza Wan Azmi | |

| Upcoming Personality in Islamic Finance (Leadership Role) | — | — | |

| Upcoming Personality in Islamic Finance (Pioneering Role) | — | — | |

| Upcoming Personality in Islamic Finance (Product Development & Structuring Role) | — | — | |

| Best Sukuk Deal of the Year | — | AJIL Cayman Sukuk – Gulf Internation- al Bank | |

| Islamic Social Responsibility Award | — | Islamic Relief Worldwide | |

| Most Innovative Product | — | Qibla Card – Al Hilal Bank | |

| Best Islamic Rating Agency | — | RAM Rating Services | |

| Best Islamic Microfinance Institution | — | — | |

| Best Shari’a Compliant Commodity Facilitation Platform | — | — | |

| Best Islamic Savings Product | — | — | |

| Academic Awards | |||

| Best Islamic Finance Qualification | Certified Islamic Finance Executive (CQIF) by IBFIM | Certified Islamic Finance Executive (CQIF) by IBFIM |

| 2013 | 2014 | 2015 | |

| Mr Shaukat Aziz, Former Prime Minister of Pakistan | Mr Nursultan Nazarbayev, President of Kazakhstan | HRH Muhammadu Sanusi II, Emir of Kano, Nigeria | |

| — | — | Islamic Development Bank | |

| — | Malaysia | Not Awarded | |

| Hasan Al Jabri, CEO of SEDCO Capital | Dr Jamil Jaroudi, CEO of Bank Nizwa | Mr Khaled Al-Aboodi, CEO of ICD | |

| Datuk Sri Zukri Samat, CEO of Bank Islam | Dr Adnan Chilwan, CEO of Dubai Islamic Bank | Datuk Mustafa Hj Abd Razak, CEO of Bank Rakyat | |

| Linar Yakupov, CEO of Tatarstan Investment Development Agency, the Russian | — | Khazana Nasional | |

| Mr Sanusi Lamido Sanusi, Governor of Central Bank of Nigeria | — | Yerlan A. Bedaulat | |

| — | Dr Zambry Abdul Kadir, Chief Minister of Perak, Malaysia | HE M. Ishaq Dar, Finance Minister of Pakistan | |

| Dubai Islamic Bank | Bank Rakyat | Dubai Islamic Bank | |

| FWU Global Takaful Solutions | FWU Global Takaful Solutions | Takaful Ikhlas | |

| F & C Shari’a Sustainable Opportunities Fund | NBAD Islamic MENA Growth Fund | Amanah Growth Fund | |

| AmInvest | AmInvest | SEDCO Capital | |

| ADCB Islamic | Bank Alfalah Islamic | Bank Alfalah Islamic | |

| Societe Generale | — | — | |

| International Turnkey Systems (ITS) | Path Solutions | Path Solutions | |

| — | — | — | |

| ARSA Lawyers | — | — | |

| — | AlMaali | Dar Al Shari’a | |

| Finance Accreditattion Agency (FAA) | DMCC Tradeflow | IIFM | |

| — | — | Kamran Sherwani, ADCB Islamic | |

| Moinuddin Malim | — | — | |

| — | Amr Al Minhali | Amman Muhammad | |

| — | Sulaiman Al Harthy | — | |

| — | — | Mohammed Shaheed Khan, GIB | |

| Axiata Group Berhad – CIMB Islamic | Al Bayan Sukuk, Hong Leong Islamic Bank | Al Baraka Bank Pakistan’s Tier II Capital Mudaraba Sukuk | |

| SEDCO Capital Global Funds | SEDCO Capital | — | |

| Emirati Savings Millionaire Account – ADCB Islamic | — | Arabesque Prime Fund | |

| — | MARC | Moody’s | |

| Amanah Ikhtiar Malaysia | Amanah Ikhtiar Malaysia | Amanah Ikhtiar Malaysia | |

| — | DDCAP Group | DDCAP Group | |

| National Bonds | National Bonds | National Bonds | |

| Bachelor of Islamic Finance and Banking by UUM | — | Diploma in Halal Management by UiTM |

| Award Categories 2011 2012 | |||

| Best Islamic Finance Education Provider | INCEIF | Durham University | |

| Best Islamic Finance Training Provider | — | — | |

| Best Research and Development in Islamic Finance | — | Asian Institute of Finance | |

| Occasional Categories | |||

| Pioneer of Islamic Banking | Bank Muscat (Oman) | — | |

| The Most Improved Islamic Bank | ADCB Islamic Banking | — | |

| Upcoming Shari’a Scholar | Mufti Talha Azami | — | |

| Shari’a Authenticity Award | — | Bank Islami Pakistan | |

| Best Islamic Finance Solutions Provider | — | — | |

| Upcoming Islamic Bank | — | — | |

| Best Islamic Finance Case | — | — | |

| Best Islamic Publishing House | — | — | |

| Best Islamic Exchange | — | — | |

| Best Zakat Distribution Programme | — | — | |

| Best Research in Islamic Financial Criminology | — | — | |

| Best Research & Publications Award | — | — | |

| Best Sukuk House of the Year | — | — | |

| Human Capital Development Initiative Award | — | — |

Five years back when GIFA was founded and the first batch of awards were presented to the industry leaders, the founders knew that they were actually starting not only a tradition but a global movement. A three-pronged objective of promoting commitment to Islamic banking and finance, social responsibility and Shari’a authenticity has resulted in identifying a group of institutions and individuals who are indeed more committed to IBF, are more socially responsible and are more sensitive to the requirements of Shari’a authenticity in their products and institutions than those who have yet to win a GIFA. This in itself is a huge achievement.

GIFA’s real achievement is in terms of placing the leadership of the Islamic financial services industry where it rightfully belongs, i.e., the Muslims. Prior to that, Western institutions, purely motivated by business interests, led the Islamic finance awards programmes. Today, GIFA, being a project of Islamic Bankers Association, is in the hands of Islamic bankers and finance practitioners.

GIFA Methodology is the most scientific, data-oriented and objective methodology to quantify contribution of a government, business and individual to Islamic banking and finance (see Box). “Poll-based awards do not bring out adequately representative ranking of players in any industry, including IBF,” said Faheem Ahmad, President of the Bahrain- based Islamic International Rating Agency.

The objective methodology adopted by GIFA is perhaps the best approach to identify the institutions and individuals committed to IBF, social responsibility and Shari’a authenticity.

Every year, GIFA Awards Committee presents Global Islamic Finance Leadership Award (GIFLA) to a head of government or state, former or serving, for their leading role in promoting Islamic banking and finance in their respective jurisdiction. The recipients are called GIFA Laureates. “We plan to make GIFLA as prestigious as Nobel Prize by 2030,” said Professor Dar. There are two other prestigious awards in IBF, namely, IDB Prize in Islamic Finance (issued by Islamic Development Bank) and the Royal Prize in Islamic Finance (founded by Bank Negara Malaysia). As a first step towards achieving our 2030 Vision, we aim to make GIFLA as the most preferred award in IBF by 2020,” said Professor Dar. It is interesting to compare the IDB Prize, the Royal Prize and GIFLA in the last five years. It is clear from Table 2 that the GIFA Laureates are far more significant political personalities than their counterparts in the other two categories. Moreover, while GIFLA is awarded on an annual basis, the other two awards are issued every second year. This will help GIFA to assume more importance than other competing awards in a matter of four to five more years, making them the most prestigious awards in the field of IBF.

| 2013 | 2014 | 2015 | |

| CIMA | Accounting Research Institute, UiTM | Malaysian Financial Planning Council | |

| — | IBFIM | The University of Nottingham Malaysia IDB | |

| Meezan Bank | Islamic Research and Training Institute, IDB | Islamic Research and Training Institute, IDB | |

| — | Bank Muamalat (Indonesia) | KFH-Bahrain | |

| — | — | — | |

| — | — | — | |

| — | — | Meezan Bank | |

| — | — | SAB | |

| Bank Nizwa | — | Agrobank | |

| — | Bank Islam and Asian Institute of Finance | Amanah Ikhtiar Malaysia | |

| — | — | IBFIM | |

| — | — | Bursa Souk Al-Sila, Bursa Malaysia | |

| — | — | UiTM | |

| — | — | UiTM | |

| — | — | Sheikh Hamdan Bin Mohamed Smart University | |

| — | — | NBAD | |

| — | — | ADCB Islamic Banking |

| Year | The IDB Prize | The Royal Award | GIFLA |

| 2011 | Dr Riffat Abdelkarim (2010) | Sheikh Saleh Kamil (2010) | Tun Abdullah Badawi, Former Prime Minister of Malaysia |

| 2012 | Dr Zeti Akhtar Aziz | Iqbal Khan | HRH Sultan Nazrin Shah of Perak |

| 2013 | — | — | Shaukat Aziz, Former Prime Minister of Pakistan |

| 2014 | Sheikh Muhammad Taqi Usmani and Professor Rodney Wilson | Dato’ Dr Abdul Halim Ismail | Nursultan Nazarbayev, President of Kazakhstan |

| 2015 | — | — | HRH Muhammadu Sanusi II, Emir of Kano, Niegeria |

said Professor Dar. It is interesting to compare the IDB Prize, the Royal Prize and GIFLA in the last five years. It is clear from Table 2 that the GIFA Laureates are far more significant political personalities than their counterparts in the other two categories. Moreover, while GIFLA is awarded on an annual basis, the other two awards are issued every second year. This will help GIFA to assume more importance than other competing awards in a matter of four to five more years, making them the most prestigious awards in the field of IBF.

GIFA Laureate 2011

His Excellency Tun Abdullah Bin Haji

Ahmad Badawi

Prime Minister of Malaysia (2003 – 2009)

Yang Amat Berbahagia Tun Abdullah Bin Haji Ahmad Badawi was honoured with the inaugural Global Leadership in Islamic Finance Award at a prestigious ceremony held on the occasion of Oman Islamic Economic Forum at Muscat on December 17, 2011.

HE Tun Abdullah Badawi’s nomination for the prestigious award followed his relentless efforts to set up supporting institutions for the development of Islamic banking and finance not only in Malaysia but also in the rest of the world. During his six-year tenure as Prime Minister of Malaysia, the country witnessed setting up of Islamic Financial Services Board (founded in 2002, and started operations in 2003) as a global player in Islamic banking and finance. He also founded International Centre for Education in Islamic Finance (INCEIF) in 2005, which has since then emerged as a premier seat of learning in Islamic banking and finance. In 2006, His Excellency’s government embarked upon another global initiative – Malaysia International Islamic Financial Centre – set up by Bank Negara Malaysia to develop Malaysia as an international hub for Islamic banking and finance. In 2008, his government set up International Shari’a Research Academy for Islamic Finance (ISRA), which is now spearheading a number of path-breaking research projects on different aspects of Islamic banking and finance.

GIFA Laureate 2012

His Royal Highness Sultan Dr Nazrin Shah-Sultan of Perak (2014 – Current)

Sultan Nazrin Shah was honoured with the second Global Islamic Finance Leadership Award at a prestigious ceremony held on November 19, 2012, at Royal Chulan Hotel Kuala Lumpur, Malaysia, on the occasion of Asian Finance Forum, for his dedicated services to internationalise Islamic banking and finance.

HRH Dr Nazrin Shah, Sultan of State of Perak, Malaysia, was honoured with the Global Leadership in Islamic Finance Award for his ambassadorial role and engagement on the highest level to promote Islamic banking and finance in Malaysia and other countries of the Organisation of Islamic Cooperation (OIC). As Financial Ambassador of MIFC, he travelled extensively to promote initiatives related with Islamic banking and finance. He has played an instrumental role in promoting projects related with Islamic banking and finance in a number of fields. He continues to inspire millions of young practitioners of Islamic banking and finance, and has engaged himself in different educational, cultural, research and financial projects to support and promote Islamic banking and finance.

His dedication, integrity and ambassadorial role in Islamic banking and finance put him ahead of any royal in the Muslim world, and he was honoured with Global Leadership in Islamic Finance Award in 2012.

GIFA Laureate 2013

His Excellency Shaukat Aziz

Prime Minister of Pakistan (2004 – 2007)

Mr Shaukat Aziz became the third GIFA Laureate on November 26, 2013, at a colourful GIFA ceremony held in Dubai, and attended by a large number of Islamic bankers and practitioners of Islamic finance from around the world. This was a special occasion for Mr Shaukat Aziz who received Global Leadership in Islamic Finance Award 2013 from the 2012 GIFA Laureate, HRH Sultan Nazrin Shah.

Mr Aziz was honoured for his services as Finance Minister and later Prime Minister of Pakistan when his government changed its policy towards Islamic banking and finance and adopted a dual banking system allowing conventional and Islamic banks to operate side by side. Due to this successful policy, the share of Islamic banking in the total banking sector increased from almost zero to over 6% when he left the office. This provided a solid foundation to the development of Islamic banking and finance in Pakistan. In 2014, Islamic banking’s share in the banking sector is well above 10%.

Mr Aziz was honoured with the Global Leadership in Islamic Finance for putting Pakistan back on the track as a leader in the global Islamic financial services industry.