Introduction

Amidst an environment of considerable change in the global economic sphere and the growing significance of Islamic finance worldwide, human resource development has become the defining factor in sustaining the performance and competitiveness of The Islamic financial industry is arguably in need of new market leaders to drive growth and scale as well as, most importantly, visionary leaders to deal with the new complex challenges that lie ahead. The pace of growth in the industry to date has IFIs. The unprecedented success and continued growth of Islamic finance could not have been achieved without human intellectual development. As John F. Kennedy once said, “Our progress as a nation can be no swifter than our progress in education. The human mind is our fundamental resource.” Since human capital plays a key role in driving the performance and market competitiveness, in- the shortage of skilled Islamic finance professionals is a global phenomenon and could impede the double-digit growth that the industry is experiencing, making it imperative for the industry to focus on nurturing talent and developing cross-border expertise if it is to continue to drive current impressive growth rates and flourish alongside conventional counterparts. Developing human resource capacity and ensuring a future supply of skilled workforce is integrally linked to the overall growth and sustainability of the industry.

posed real challenges for both regulators and operators to embrace better and sound prudential practice-related policies. A recent industry report (September 2010) from Deloitte’s Islamic Finance Knowledge Center (IFKC) revealed that most industry leaders agree on the need for new regulation, good governance, effective risk management frameworks, standardization of products and vestment in this core pillar will be the defining factor in the sustainability of the Islamic financial services industry.

The shortage of skilled Islamic finance professionals is a global phenomenon and could impede the double-digit growth that the industry is experiencing. This makes it imperative for the industry to focus on nurturing talent and developing cross-border expertise if it is to continue to drive current impressive growth rates and flourish alongside its conventional counterparts. services, and the need to invest in talent, leadership development and professional excellence. This chapter attempts to take the latter point further and probe the merit of adopting winning strategies in talent management and competency-based leadership. It begins with suggesting how IFIs can develop a skill formation strategy to be competitive in the global economy. The key requisite for this is that IFIs should host and develop an organization-wide ‘create awareness’ strategy for competency and professionalism in the workplace.

Obviously, this winning strategy acts as a catalyst to fuel a rally for change in the industry. Human resource development transcends finance practitioners and covers the full spectrum of the corporate landscape such as lawyers, accountants, auditors, fund managers and other financial intermediaries.

Importance of human capital development in Islamic finance

The shortage of skilled Islamic finance professionals is a global phenomenon and could impede the double-digit growth that the industry is experiencing, making it imperative for the industry to focus on nurturing talent and developing cross-border expertise if it is to continue to drive current impressive growth rates and flourish alongside conventional counterparts. Developing human re- source capacity and ensuring a future supply of skilled workforce is integrally linked to the overall growth and sustainability of the industry. The increasing demand for talented human resources in Islamic finance stems from 3 main factors: the internationalisation of Islamic finance, evolution of Islamic finance from a faith-based to a business-driven industry and the rising demand for Shari’a-compliant products and services, ranging from retail banking to insurance and the capital markets.

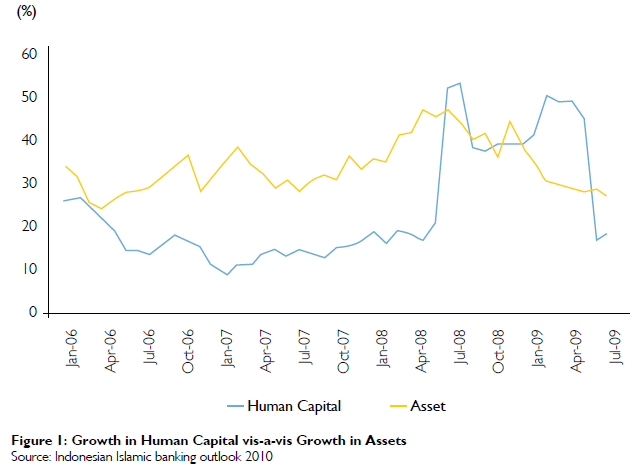

At present, the industry is growing at a much faster rate than human resource development. Figure 1 shows that asset growth, as a proxy for business volume, exceeded the availability of human capital of Islamic banks in Indonesia. The global Islamic finance industry has evolved from a faith-based to a commercially driven industry for all communities. As Islamic finance is a customer to business model, it has proved appealing to Muslims as well as non-Muslims who are interested in ethical financing and investments. The rising participation of conventional players globally including issuers and investors, is a manifestation of the huge potential that Islamic finance has to offer to the financial and business communities. Conventional banks, for example, through their cross-selling of Islamic products have assisted in making Islamic finance more mainstream. As the scope for Islamic financial products has now expanded to more sophisticated products and services in response to a shifting customer base, the demand for Islamic finance experts in product structuring has never been higher before.

Human resource requirements

According to statistics released by the International Islamic University of Malaysia, a total of 2 million finance professionals will be required to fill in various positions in the Islamic financial institutions worldwide by 2020. This is in stark contrast to the estimated 92,000 finance professionals working in the Islamic finance industry in 2007. In Malaysia, a total of 12,000 Islamic finance professionals will be needed, almost double the current 7,826 professionals employed by Islamic banks in the country. The takaful industry in Malaysia currently employs around 2,460 professionals. However, with the recent approval of 2 new takaful licences, industry observers have projected that the industry is looking for around 100 to 200 people to enter the industry within the first 2 years of operations.

In Indonesia, there are only 15,000 qualified Islamic finance professionals available to serve the 1,059 Islamic bank offices operated by 5 Islamic commercial banks and 24 Islamic bank units. AT Kearney reported that about 30,000 new Islamic banking positions will need to be filled in the Middle East, in the next 10 years. In a recent survey conducted by Deloitte, only 4% of Islamic finance leaders in the Middle East agreed that the Islamic financial institutions are properly staffed with people who have the necessary depth and experience relevant to the industry, while 61% of them felt that Islamic finance professionals require more training and skills development. These figures are alarming as it implies that Islamic finance professionals are currently perceived to be underqualified and do not have adequate knowledge and skill in this area.

Issues and barriers to human resource development in Islamic Finance

While the need for human resource development is evident, what is less apparent is the appropriate strategies and resource mobilizations that need to be adopted to advance human and talent development in the Islamic financial industry across the board. The development of intellectuals who are proficient in Islamic finance requires a comprehensive, systematic and goal-directed framework in order to develop a pool of high-calibre Islamic finance professionals. The Islamic financial industry is currently lacking a global industry body to oversee standardisation of continuous education and training to break the human resource bottleneck.

Stakeholders have a role to play in developing the required human capital at the macro, meso and micro level. At the macro level, the most pertinent policy option is to introduce Islamic finance courses at various levels of the educational system. Government and regulators have a crucial role to ensure that a proper human capital framework and infrastructure for the Islamic finance industry are in place. At the meso level, institutions engaging in capacity building such as specialized training institutions, consultancy organizations and professional bodies are the main promoters of knowledge in Islamic finance. Finally, at the micro level, it is the actual suppliers of the educational services such as schools, colleges and universities who are the stakeholders. In addition to these 3 main groups of stakeholders, another important player is the Islamic financial services industry as the ultimate users of human resources. The involvement of the industry in areas such as curriculum design and delivery as well as providing practical support to educational providers, will ensure that graduates are equipped with the relevant industry knowledge.

The collaborative efforts of all these stakeholders in capacity building and human capital development through strategic ownership at the national, regional and international level is critical for the continuing success of Islamic finance. In Malaysia, for example, the government and regulator have taken several strategic initiatives to ensure the continuous enhancement and ready availability of a talent pool of high-calibre Islamic finance professionals. The establishment of the Financial Sector Talent Enrichment Programme (FSTEP) by Bank Negara Malaysia, is a prime example of the kind of collaboration that the regulator, industry and training institutes have undertaken at the national level to meet the growing demand for well-trained and competent personnel for the Islamic financial services industry. At the international level, the IDB, through IRTI, is committed to the development and enhancement of human intellectual capital in Islamic finance via specialised training and educational programs. Other projects initiated by the IDB include helping member countries like Brunei to develop their human capital capacity building in Islamic finance.

Another issue is the diversity of human capital strategies currently adopted by IFIs across the industry. In multinational banks which operate an Islamic window, branch or subsidiary; their human capital strategies are more comprehensive in nature and very much in line with the conventional industry standards and norms. IFIs originating from the GCC or Asia, have yet to fully develop their human capital strategies, particularly in the area of compensation and benefits. Due to this diversity, IFIs in these countries more often than not base their salary and benefit package on country norms rather than industry norms. At the heart of the growth experienced by the industry is the critical issue of ‘brain drain’. The industry is facing difficulty in obtaining and retaining talented staff, who can be lured away from one institution to another with huge salary inducements. This has dire consequences, as it leads to a brain drain of qualified and highly experienced Islamic finance professionals, from more mature markets to mature or emerging markets. The main reason for this is the lack of company-wide strategies of attracting, recruiting, training, developing and retaining talent.

Setting the standard for Islamic finance talent

Since Islamic banking and finance is a trans-disciplinary subject, a multi-dimensional and interdisciplinary human resource approach is needed for the education and training of Islamic finance professionals. According to BIBF, there is an urgent need for Islamic finance experts who are not only conversant on principles and concepts of Islamic finance but also on specific matters facing the operational side of Islamic banks such as taxation, ac- counting issues, Basel II and regulatory issues.

One of the pertinent questions posed in the development of human capital in Islamic finance, is the adequacy in terms of development and certification programmes that are in place to support the creation of a new wave of elite scholars. The plethora of courses and training in Islamic finance offered by institutions wishing for a piece of the USD 1 trillion Islamic finance pie, has resulted in a new set of challenges for the industry – no uniform standard for qualifications in Islamic finance.

There are many Islamic financial training programmes credited by Western accreditation or validation programmes, like CIMA’s Certificate in Islamic Finance and the Islamic Finance Qualification (IFQ) offered by the Chartered Institute of Securities and Investments in London. There are also some training programmes developed and offered by Islamic educational and training institutions, like Institute of Islamic Banking & Insurance (IIBI) in London, Bahrain Institute of Banking & Finance (BIBF) and INCEIF in Kuala Lumpur. Some online training programmes have also been developed lately such as that offered by Ethica Institute of Islamic Finance. In order to address this issue fully, there needs to be a greater level of standardisation across countries to ensure common levels of compliance in terms of human resource requirements by the Islamic finance industry, particularly experts in Shari’a law. A question can arise as to whether Islamic finance qualifications and training programmes be accredited by academic and professional bodies, or their Shari’a authenticity be maintained by getting them validated accredited or approved by an Islamic institution (an Islamic university, school or institute) or an individual (like a Shari’a scholar).

It is important to appreciate that there is a huge gap between what is perceived as Islamic banking and finance in academic circles and its actual practice in the marketplace. One reason for this divergence of views is that academic developments in Islamic banking and finance are dominated by Islamic economists while its practice is guided by Shari’a bodies and scholars. Those Islamic economists who lack in-depth understanding of Fiqh (Islamic jurisprudence) are not the right people to contribute to human resource development for the Islamic financial services industry. Therefore, there is a preference in the industry for the Shari’a scholars to play an active role in disseminating Islamic financial literacy and training of the staff of Islamic banks and financial institutions. While it may not necessarily mean issuance of a formal fatwa on Shari’a compliancy of a training programme, it must however be a requirement that at least one qualified Shari’a scholar is involved in the development and/or delivery of the training. Those involved in development and delivery of Islamic training must demonstrate discernment, scrupulousness, and peer-reviewed competence within the financial industry.

It must be clarified that the argument here is about training programmes and not about academic qualifications. For academic qualifications, it is the academics who are better qualified and hence design and deliver such programmes. In fact, there are some Shari’a scholars whose academic qualifications are not impressive at all and that they must look into improving their academic credentials.

While it is imperative that Islamic religious institutions and Shari’a scholars are consulted for designing and development of Islamic financial training programmes, it is not absolutely important that such programmes are delivered by them as well. There are some trainers in the Islamic financial services industry, who have no background at all in Islam or in Islamic banking and finance. These trainers, (especially those who are not Muslim), delivering training on Islamic legal contracts are probably the worst, because they lack real understanding of juristic issues.

The standards for an approved Islamic finance trainer vary, but generally, someone who has acquired sufficient knowledge of the Islamic law of financial transactions, either formally (preferred) or through a self-motivated disciplined approach can be considered as a good Islamic finance trainer. Such a person must ideally be approved by an Islamic professional body but he/she may be acknowledged so by peers and other qualified trainers and Shari’a scholars. The issue of ensuring proper governance with respect to Shari’a scholars has taken a positive turn when the International Shari’a Research Academy for Islamic Finance (ISRA) proposed a global certification for Shari’a experts. To this end ISRA is already in the process of establishing a professional association which will have similar functions to that of other professional bodies. The association, to be known as the Association of Sharia Advisors (ASA), will not only regulate the Shari’a advisory services but will also lay code for Shari’a advisory practices and is envisaged to be the sole body that accredits these professional experts.

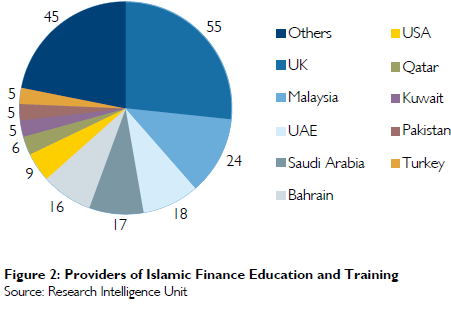

According to Islamic Finance 2009, a report published by the International Financial Services London, there are about 205 institutions providing education and training in Islamic finance globally with the UK at the forefront in providing global qualifications for the industry (see Figure 2). Although Malaysia comes second after the UK, the Research Intelligence Unit argued that the numbers of institutions offering education and training in Islamic finance is set to double, and the country’s influence over the curriculums as well as training programs in this are expected to grow in the Asian region.

There is a case for a single, internationally recognized and globally accredited Islamic finance qualification and certification as opposed to regional qualifications available in isolated geographies. Given that different countries introduce different professional qualifications in Islamic finance, the next step is the standardization of professional qualifications for the industry which is the essential requirement for improving the overall quality of education in Islamic finance worldwide and thus ironing out differences in access to qualified Islamic finance professionals.

Conclusion

As the Islamic finance industry continues its international expansion and double-digit growth, the requirement for finance professionals who have the combined knowledge of Shari’a principles with knowledge of the marketplace will also increase. The need to develop and support demand-driven skill development and training programmes should be at the top of the agenda of industry stakeholders. The dearth of qualified Islamic practitioners can only be redressed by investing in the creation of world-class education and training providers in Islamic finance; realigning the education and training programmes to suit the business requirements of the industry through forging greater collaboration between industry and academia; re-skilling conventional bankers who have crossed over to Islamic finance and by the offering of globally accepted qualifications that equip individuals with adequate Shari’a knowledge and technical skills.