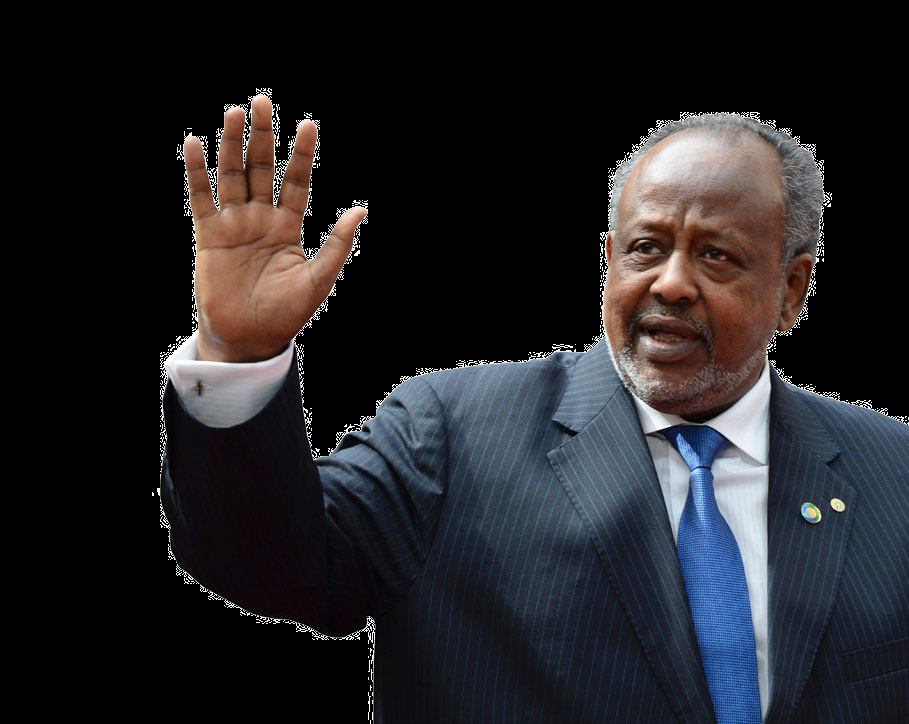

This article is an excerpt of the acceptance speech delivered by His Excellency Ismail Omar Guelleh, President of the Republic ofDjiboutiattheGlobal Islamic Finance Awards (GIFA) 2017 ceremony held in Astana, Kazakhstan. His Excellency Ismail Omar Guelleh was honoured with the Global Islamic Finance Leadership Award 2017 for his relentless role in promoting Islamic banking and finance in the Republic of Djibouti as well as the wider African region.

Praise be to Allah the most Glorified, and peace and blessings be upon the Prophet, his Family and Companions.

Allow me to begin my speech by expressing my appreciation as well as convey my greetings to you Mr President and to the brotherly people of Kazakhstan for the warm welcome and gracious hospitality extended to me and my delegation since our arrival in the beautiful city of Astana.

I am honored to receive the prestigious Global Islamic Finance Leadership Award 2017. It is a great recognition for my country. I cannot bear the merit of this award alone, as it is the result of many years of steady work done with passion

by many public institutions, private investors and businessmen, as well as multilateral institutions, all convinced that Islamic finance is useful and effective for the economic development of the Republic of Djibouti. Therefore, I would like to express our profound gratitude to the Awards Committee, whose decision to recognise our albeit modest contribution to the development of the Islamic finance is not only an honor but first and foremost a challenge for us to do more in this endeavor.

At a time when Islam and our Ummah are attacked and our faith is disparaged by the false claims of criminals, it is crucial to proudly point out one of the many areas in which Islam excels. This area is Islamic finance, which has over the last few decades evolved considerably and is now at the forefront of innovation. Islamic finance owes it success to its core values and principles of operations based on Shari’a laws, which protect it against shocks and crises.

Furthermore, the linkages with the real economy, and the competitiveness of Islamic banks and their innovative financial products, are the reasons behind their remarkable performance.

These core values have sheltered Islamic finance against the 2008 financial crisis, and they are building its strength and attractiveness well beyond the Islamic world.

This is to express how much these virtuous principles, drawn from the Holy Koran and our Sacred Scriptures, which are the cornerstone of the Islamic financial industry, are noble and right. However, beyond its profound ethical values,

Islamic finance also owes its success to tireless efforts and tremendous works of men and women, decision-makers, experts and practitioners in our great Islamic financial community, represented by the eminent personalities gathered here.

Decision-makers and practitioners of the Islamic finance have proven that finance can be reconciled with ethics, and that Islam is not incompatible with the business world. Thanks to their initiatives, Islamic finance has become a secure and a qualitative feature that everybody is now looking for.

The Republic of Djibouti is a small country, with less than one million people and limited natural resources. But the infinite Grace of Allah places my country on one of the most strategic sea route, at the confluent of three continents.

Strengthened by this blessing, we are committed to transforming Djibouti into a strategic, commercial and financial hub. We translated this ambition into our development program entitled “Djibouti Vision 2035”. This programme is a

long-term vision with the objective to build the architecture of long-lasting and harmonious economic and social development by 2035.

In this regard, we are taking all the necessary steps to endow our country with the most modern and the most competitive infrastructure in the area of transportation and communication. Our objective is to translate the strategic position of Djibouti on the world map into an optimal source of sustainable growth, jobs, and wealth. With the support of our friends and development partners, who trust us, who know how promising the economic development of our continent is we are confident we will reach our goals and beyond.

Our objective is to translate the strategic position of Djibouti on the world map.

Promoting an effective, robust and sound financial system is the second pillar of our development strategy. Therefore, we undertook important reforms that have allowed a deep transformation of our financial sector attracting companies and promoting diversified financial activities and products.

Thus, the financial sector of our economy has evolved from two conventional banks and 5 financial auxiliaries in 2006 to 34 financial institutions. Today, the range of financial supply includes all types of financial products and services capable of meeting all kind of demand emanating from local and sub-regional markets. It is against this backdrop that Islamic finance appeared in Djibouti, as the youngest form of finance. The first Islamic bank having been established only in 2006 and since then the number of Islamic financial institutions has been growing steadily.

In this environment, the Islamic banks, currently three out of eleven banks, have adapted quickly, consolidated their market shares, and grown their activities, supported by their effectiveness and their ability to penetrate the market, as well as their propensity to innovate. These good results and the strong perspectives have incited the interest of many conventional banks in Islamic finance, as they consider opening their own branches in Islamic finance.

To fully support and continuously deepen the expansion and the influence of our financial market, it is our duty as policy makers to create a business environment that is attractive and convenient, by putting in place adequate policies and reforms. Our efforts in this regard, have allowed us to design and implement specific rules and regulations for Islamic banks operating in Djibouti, as we did for conventional banks. This regulatory framework has been supplemented in 2016, by the creation of the National Committee of the Shari’a laws, composed of experts in Islamic Laws and Islamic finance. This committee oversees the surveillance of the regularity and the conformity of Islamic finance products to Shari’a Laws in the Republic of Djibouti. The first Islamic bank having been established only in 2006 and since then the number of Islamic financial institutions has been growing steadily.

The first Islamic bank having been established only in 2006 and since then the number of Islamic financial institutions has been growing steadily.

The anchoring of Islamic finance in the financial landscape of Djibouti is now accomplished, both among professional and individual customers.

The success and the remarkable performance of the Islamic banks contribute to the expansion and the development of our financial sector; and they are confirming that we were correct in our strategic choices.

So, Djibouti, land of Islam, and commercial crossroads between Africa and Asia, has positioned itself as the natural place for the expansion of Islamic banking into the whole of Africa. In this capacity, the African Summit of Islamic Finance that we organise each year in our country since 2012 is the expression of this willingness to promote the development of Islamic finance in Africa.

We want for Djibouti, a viable and sustainable Islamic finance, a modern and sophisticated finance based on Shari’a laws and supportive of the productive investments in our economy and in conformity with the diverse needs of our businesses. We also want an Islamic finance that meets all the aspirations of the poorest people in our country.

This is because, like the rest of the continent, we are still facing many challenges especially in social development and the financing of our economies. Despite a rapid and sustained growth, and the progress made in human development throughout the continent, much remains to be done to alleviate poverty and social exclusion in many African countries.

One way to achieve that is through financial access for all and the deepening of our financial markets. I firmly believe that because of its solid ethical background, Islamic finance can be the right tool to achieve that.

In addition, we need to invest massively in strategic sectors of our economies such as infrastructure, energy, industry, water etc.…For that to happen, the current strong expansion of Islamic finance in the world and the important resources from the Islamic financial funds that come with it, appear to be one of the most appropriate solutions to our financing needs.

The solutions offered by Islamic finance are not just accessory or complementary. They are effective and adapted to our needs, and to our spiritual and moral principles. In fact, the virtue in trade, the prohibition of Riba or charging interest on loan, the prevention of speculative behaviors and the financing of the production, are the core values that any developing economy such as ours needs.

However, our impression is that, the delay that Africa is now experiencing regarding the development of Islamic finance is detrimental considering the growing interest shown by the western countries for this kind of finance. The penetration rate of Islamic finance in Africa is still low, whereas the continent’s exceptional potential continues to attract more and more conventional investors.

It is therefore urgent for the continent to catch up and adapt its financial industry to benefit from the much needed financial windfall to boost its economy and strengthen its development process.

Our countries are in dire need of alternative financing, and I call upon international Islamic finance institutions to partner with us and further grasp the excellent investment and business opportunities that our continent is offering.

This is a battle we must fight together for a better world, and it is at the core of our religion.

May the Almighty Allah grant us his Grace and Blessing.

Amin