WHAT IS MARKET PERCEPTION AND THE WAY FORWARD

This ISFIRE Report looks into the Shari’a/Islamic credentials of Islamic banking in light of the perception held by important stakeholders in the Islamic financial services industry, namely employees of Islamic financial institutions and their customers. The findings are based on a global survey conducted by Cambridge IF Analytica, using technological tools of social media and online interactions with a sample of employees of Islamic financial institutions and their customers. The sample also includes non-users of Islamic financial services.

Debate on whether Islamic banking is truly Islamic or if it fulfils Shari’a requirements in letter and spirit is long-standing. On one side of the spectrum are those who consider Islamic banking a complete sham, and on the other side are those who find nothing wrong with the current practices being conducted in the name of Islamic banking.

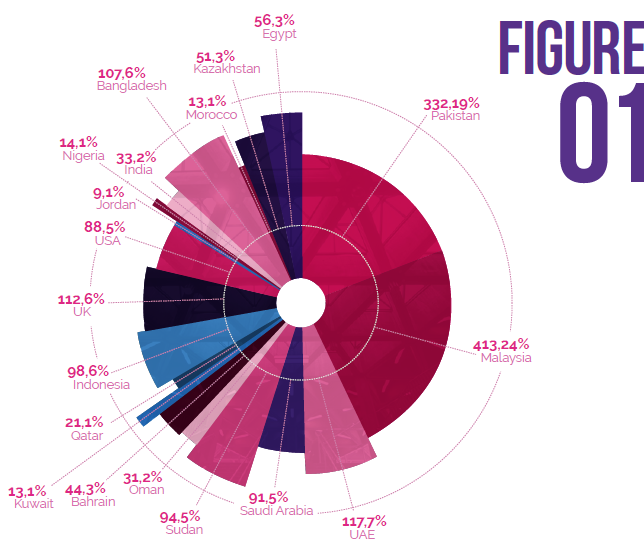

Cambridge IF Analytica conducted a global survey of perceptions to gauge how employees of Islamic financial institutions and their clients view Islamic banking in terms of Islamicity and Shari’a-compliancy. A total of 1,737 respondents from 19 countries took part in the survey (see Figure 1). Top three participating countries were Malaysia (24%), Pakistan (19%) and the UAE (7%). Figure 1 shows that it is indeed a well-diversified sample.

Out of 1,737 respondents; 351 were either employees of Islamic financial institutions or have previously worked for such institutions in the past. There were some Shari’a scholars who responded to questions and shared their views on authenticity of Islamic banking.

WE ASKED TWO SIMPLE

QUESTIONS:

A total of 9,000 people were randomly chosen from a dataset of 15,000 individuals, held by Cambridge IF Analytica. The chosen sample was sent the first question through emails, out of which 2,234 responded. These respondents were then asked to answer the second question, and only 1,737 responded with their answers. The 497 who did not respond were then excluded from the sample. The respondents were further asked to give at least one reason for their choice. It was an open-ended question that generated about 100 answers, which were grouped into 16 answers (see below for further details).

Is Islamic banking truly Islamic?

Is Islamic banking truly Shari’a-Compliant?

THE OBJECTIVES OF THE SURVEY WERE:

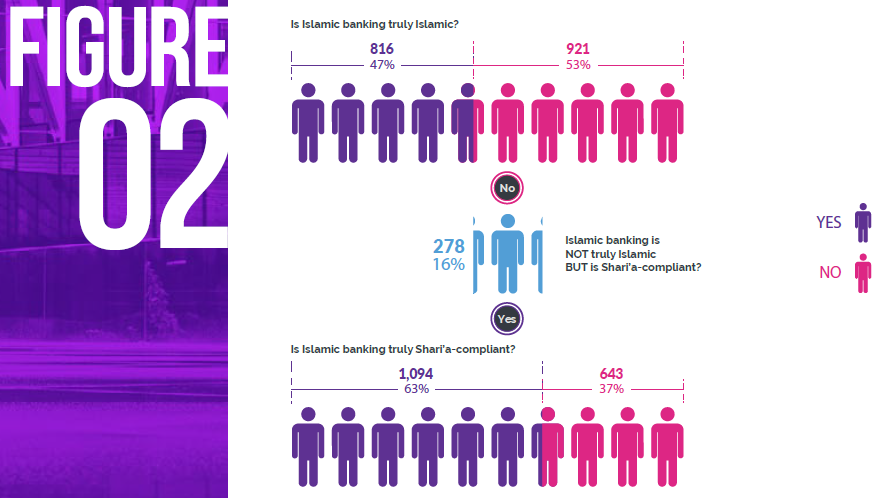

Answering the first question, 47% showed their belief that Islamic banking was truly Islamic, and slightly more (53%) thought otherwise (see Figure 2). Interestingly, 16% thought Islamic banking was not truly Islamic but it was still Shari’a-compliant.

To assess if the chosen stakeholders believed that Islamic banking was truly Islamic;

To assess if the chosen stakeholders believed that Islamic banking was truly Shari’a-compliant; and

To find out if the chosen stakeholders differentiated between Islamicity and Shari’a-compliancy.

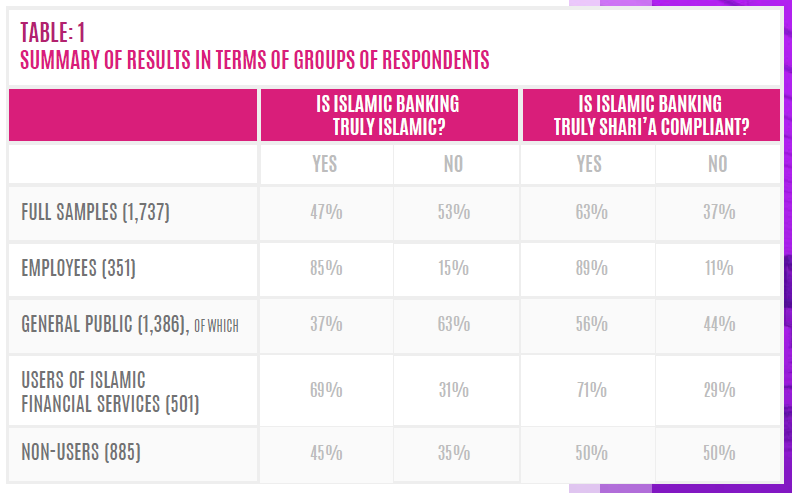

The above results are from the full sample, comprising respondents from general public as well as employees of Islamic financial institutions. It is interesting to see if there is a difference of response between the general public and those who are more exposed to Islamic banking, e.g., employees of Islamic financial institutions, who have more transactional and operational knowledge of Islamic banking.

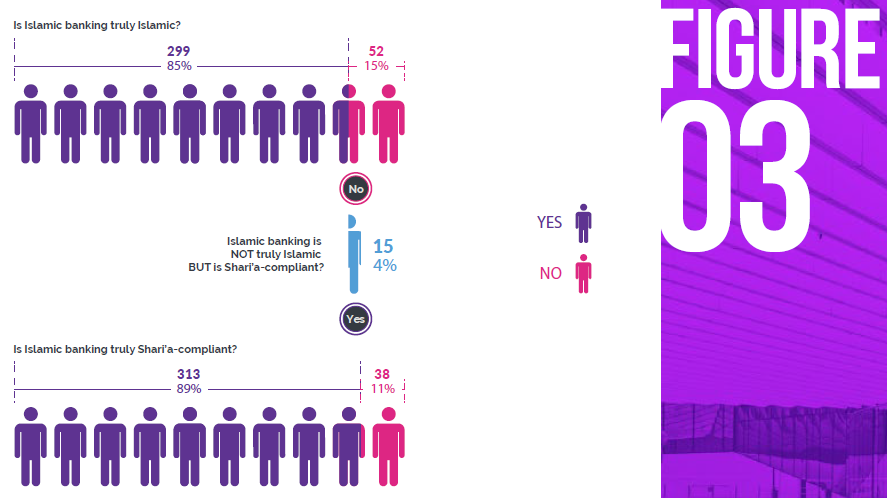

A sub-sample comprising employees of Islamic banks and financial institutions (351 in total) revealed strong views on the Islamicity and Shari’a-compliancy of Islamic banking (see Figure 3). An overwhelming 85% believed Islamic banking to be truly Islamic and even a bigger percentage (89%) deemed Islamic banking to be truly Shari’a-compliant. Only 4% thought Islamic banking not to be truly Islamic, although it fulfilled Shari’a requirements. This shows that those working for Islamic financial institutions do not in general differentiate between Islamicity and Shari’a-compliancy. This should not, however, not be equated with the perception on authenticity of Islamic banking (see below).

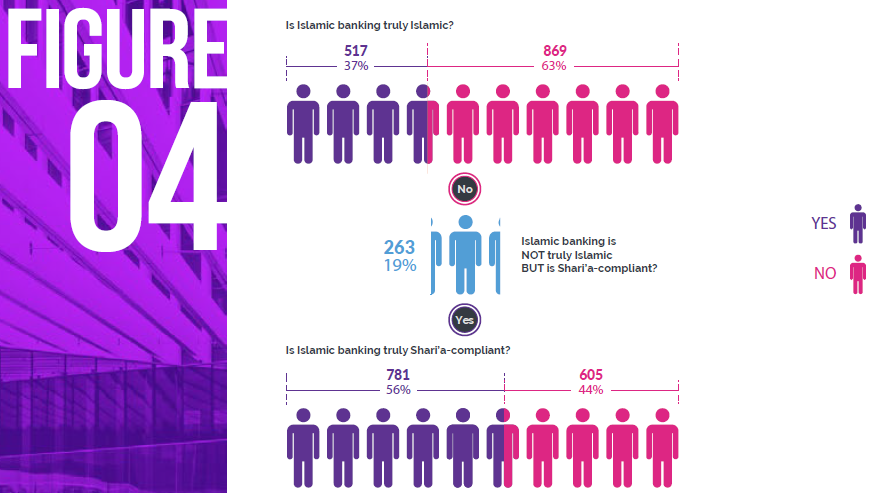

The general public have strikingly different views on Islamicity and Shari’acompliancy (see Figure 4). Only 37% of the general public believed in the Islamicity of Islamic banking, while 56% deemed Islamic banking truly Shari’acompliant. 19% of them differentiated between Islamicity and Shari’a compliance.

In a global survey of 1,737 respondents, 351 reported to be either employees of Islamic financial institutions or have previously worked for them. 85% of them viewed Islamic banking to be truly Islamic, while only 15% thought it was not. Out of those, an even greater percentage (89%) responded affirmatively to the question of Shari’a-compliancy of Islamic banking. Only 11% suggested that Islamic banking was not truly Shari’a-compliant. 4% of the respondents in this sub-sample of employees did not see Islamic banking truly Islamic but deemed it truly Shari’a-compliant.

In a global survey of 1,737 respondents, 1,386 were drawn from general public. 37% of them viewed banking to be truly Islamic, while 63% thought it was not. 56% responded affirmatively to the question of Shari’a-compliance of Islamic banking, and 44% suggested that Islamic banking was not truly Shari’a-compliant. 19% of the respondents in this sub-sample of general public did not see Islamic banking truly Islamic but deemed it truly Shari’a-compliant.

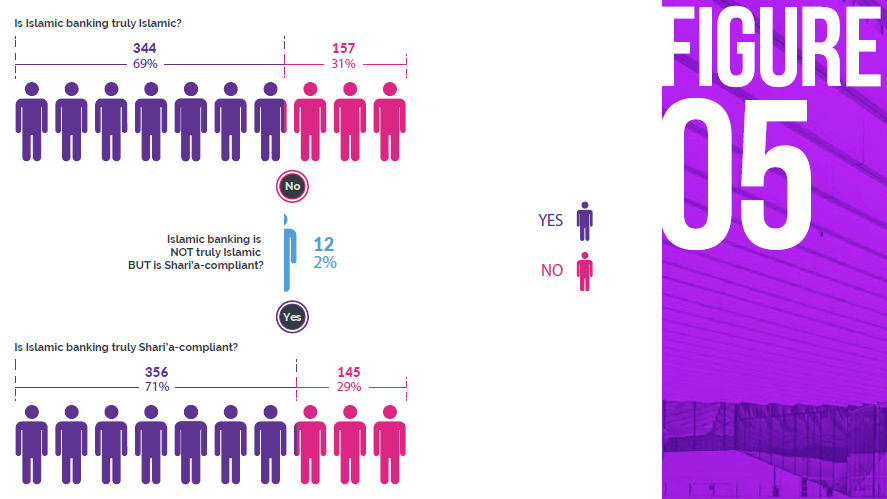

From amongst the general public who have used Islamic banking in the past or are at present dealing with them, 69% and 71% believed that Islamic banking was truly Islamic and Shari’a-compliant, respectively. However, 22% of them insist on making a distinction between Isalmicity and Shari’a-compliancy (see Figure 5).

In a global survey of 1,737 respondents, 501 happened to be those who were currently using Islamic financial services or in the past had used these services. 69% of them viewed Islamic banking to be truly Islamic, while 31% thought it was not. An overwhelming 71% responded affirmatively to the question of Shari’a-compliance of Islamic banking, and only 29% suggested that Islamic banking was not truly Shari’a-compliant. 22% of the respondents in this sub-sample did not see Islamic banking truly Islamic but deemed it truly Shari’a-compliant.

In a global survey of 1,737 respondents, 885 were those who had never used Islamic financial services. 45% of them viewed Islamic banking to be truly Islamic, while 55% thought it was not. 50% responded affirmatively to the question of Shari’a-compliancy of Islamic banking, with an equal proportion suggesting that Islamic banking was not truly Shari’a-compliant. 19% of the respondents in this sub-sample did not see Islamic banking truly Islamic but deemed it truly Shari’a-compliant.

Those who have never used Islamic financial products exhibit different opinions than those who have. 45% of those who never used Islamic financial services opined that Islamic banking was truly Islamic, while almost half of them thought it was truly Shari’a-compliant. 19% of them differentiated between Islamicity and Shari’a- compliance (see Figure 6).

WHAT IS THE DIFFERENCE BETWEEN ISLAMICITY AND SHARI’A-COMPLIANCE?

What is the difference between Islamicity and Shari’a-compliancy in the context of IBF? It will require another survey to find out what exactly the respondents mean by this differentiation. However, it suffices to say that Islamicity has more to do with the spirit of Islamic teachings, while Shari’a-compliancy is related with the letter of the Islamic law. There is some anecdotal evidence that people refer to maqasid al-Shari’a (higher objectives of Shari’a) rather than technicalities of fiqh al-mu’amalat al-maliya (jurisprudence of financial transactions) when referring to Islamicity. If so, then there should not be any meaningful difference between the two terms, as anything Shari’a-compliant should by default be Islamic as well, and vice versa.

Furthermore, Islamicity may also be considered as a general term while Shari’a-compliance may be deemed more specific and technical in nature.

However, it seems as if the respondents have something else in mind when answering these questions. Thankfully, the number of respondents making this distinction is small. However, this distinction is instructional in terms of understanding of Islamic banking.

KAP ANALYSIS OF UNDERSTANDING OF ISLAMIC BANKING

It is interesting to observe that 16% of the respondents in our global survey differentiated between Islamicity and Shari’a-compliancy of Islamic banking. For different sub-samples, the degree of differentiation differed significantly. Table 2 presents the extent of differentiation exhibited by various sub-samples.

| TABLE: 2 EXTENT OF DIFFERENTIATION BETWEEN ISLAMICITY AND SHARI’A COMPLIANCE | |

| EXTENT OF DIFFERENTIATION | |

| FULL SAMPLES | 16% |

| EMPLOYEES OF ISLAMIC FINANCIAL INSTITUTIONS | 4% |

| GENERAL PUBLIC, OF WHICH | 19% |

| USERS OF ISLAMIC FINANCIAL SERVICES | 22% |

| NON-USERS OF ISLAMIC FINANCIAL SERVICES | 19% |

The respondents who differentiate between Islamicity and Shari’a- compliancy may very well be those who lack an unambiguous understanding of Islamic banking. Based on the data on differentiation between Islamicity and Shari’a-compliancy for the three groups – (a) employees of Islamic financial institutions, (b) users of Islamic financial services, and (c) non-users.

Figure 7 presents the summary of results. It suggests that practical exposure to Islamic banking on transactional and operational levels contributes to understanding of Islamic banking the most (50%). This is followed by attitude (27%) [e.g., religious beliefs and a priori attitude towards Islamic banking]. Knowledge and literacy contribute the least, albeit significantly (23%).

It appears as if no less than working on structuring of Islamic banking transactions and practical familiarity with the operations of Islamic banking are effectively helpful for the comprehensive understanding of Islamic banking. Similarly, holding strong religious beliefs lead to favourable understanding of Islamic banking.

The respondents who differentiate between Islamicity and Shari’a-compliancy may very well be seen as those who lack unambiguous understanding of Islamic banking. Employees of Islamic financial instutions are the most consistent in their revelation of Islamicity and Shari’a- compliance. Non-employees, however, exhibit almost equal levels of inconsistency. Through a formula, we have quantified the contribution of knowledge, general attitude and practical exposure (KAP) to understanding of Islamic banking. Our sample suggests that practical exposure contributes 50% to the understanding of Islamic banking. Contributions of knowledge and general attitude is 23% and 27%, respectively.

The least contribution of general knowledge and literacy to the understanding of Islamic banking can be explained with the help of the diverse body of information on social media and in other sources of information. The existing body of literature on Islamic banking is at best confusing. The terms like Shari’a-compliant and Shari’a-based and the debates on whether Islamic banking should be ethical and subscribe to Ethical, Social and Governance (ESG) framework create a lot of uncertainty in minds of people as regards authenticity of Islamic banking.

DETAILED ANALYSIS

In addition to a Yes or No to the two questions posed to respondents, they were also asked to give at least one reason behind their answers. These answers

are helpful to understand the concepts of Islamicity and Shari’a-compliance as envisioned by the respondents. However, to get a conclusive answer on the nature of Islamicity and Shari’a-compliance as perceived by people, there is a need for further exploratory and experimental studies. We produce the following groups of responses to the two questions:

IS ISLAMIC BANKING TRULY ISLAMIC?

Sample of Answers

- Islamic banking can never be perfectly Islamic, as there is no Muslim in the contemporary world who is a perfect Muslim.

- Islamic banking is Islamic because its stakeholders have decided to name it as such.

- Islamic banking is (almost) exactly the same as conventional banking in terms of economic profiles of its products, but it remains significantly different from conventional banking in processes.

- Because Islamic banking is not uniquely Islamic, many practitioners and industry observers have started asking for making it Islam-neutral in nomenclature.

- Islamic banking doesn’t in general fulfil maqasid al-Shari’a (objectives of Shari’a) but then other businesses owned by Muslims also are not meant to achieve more than narrow self-interest in terms of pursuit of profit and private gains.

- Although Islamic banks attempt to maximise their owners’ interests, there shouldn’t be any credible objections to calling them Islamic.

IS ISLAMIC BANKING TRULY SHARI’A-COMPLIANT?

Sample of Answers

- Islamic banking is truly Shari’a-compliant.

- Islamic banks follow generally acceptable Shari’a principles governing business and finance, and are therefore perhaps the only expressly claimed Shari’a-compliant businesses in the contemporary world.

- Islamic banking (and related Islamic financial businesses) is the only example of business that is directly guided by Shari’a scholars.

- The distinction between Shari’a-compliant and Shari’a-based is superficial. Banking can either be Shari’a-compliant or Shar’a-repugnant; other classifications don’t make any real sense.

- Given that Islamic banking is Shari’a-compliant, both suppliers and demanders of Islamic banking services are involved in permissible business activities.

- Being Shari’a-compliant, Islamic banking is for sure better than conventional banking.

- If Islamic banking is entirely the same as conventional banking, then conventional banks must start practicing Islamic banking. The fact that they don’t do Sonia a proof that Islamic banks are Shari’a-compliant.

- Shari’a-compliance is technical in nature and it shouldn’t be automatically related with social responsibility. Hence, a Shari’a-compliant bank may not necessarily be socially responsible.

- Shari’a-compliancy doesn’t come for free. Hence, Shari’a-compliant financial services may in fact be more expensive than conventional banking and finance.

- Only Shari’a scholars may proclaim a bank to be Shari’a-compliant.

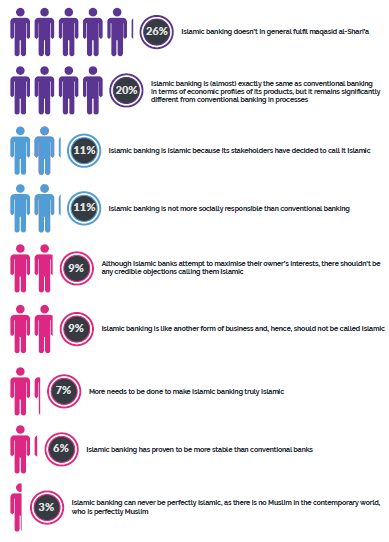

The top response to Question 1 suggests that over on-fourth of respondents did not deem Islamic banking to fulfil maqasid al-Shari’a (see Figure 8). Paradoxically, over one-fifth of the respondents said Islamic banking to be truly Shari’a-compliant. This may be confusing as the respondents merely repeated the wording of Question 2 with an affirmative statement. If we ignore this tautological statement, then about one-fifth of respondents found Islamic banks to follow generally acceptable Shari’a principles governing business and finance. They also thought that Islamic banking was the only form of business that was expressly proclaimed to be Islamic by shareholders/owners (see Figure 9).

IS ISLAMIC BANKING TRULY ISLAMIC?

In response to the above, 1737 respondents gave the following statements, in addition to their YES or NO to the question

WHO QUESTIONS AUTHENTICITY OF ISLAMIC BANKING THE MOST?

It must be stressed that the survey found an overall positive response on Islamic banking in terms of Islamictiy and Shari’a compliance. However, there were certain groups whose responses could be deemed as a criticism of Islamic banking.

The reasons given by the respondents in support of their Yes or No answers were further analysed to find out which group of the respondents questioned the authenticity of Islamic banking the most. It was not surprising to see that the bulk of criticism on Islamic banking was lodged by those associated with the universities and other institutions of higher learning. More than half of students and academicians gave reasons that could be grouped into criticism on Islamic banking.

It is important to clarify Figure 10, as the results should be treated in a context. It must be clarified that there were only 357 respondents whose response could be deemed as to construe questioning authenticity of Islamic banking. This is a relatively small number (over 20% out of 1,737). However, this is not negligible.

| TABLE: 3 GROUP-WISE RESPONSE ON AUTH | ENTICITY OF ISLAMIC BANKING | ||

| NUMBER OF RESPONDENTS IN THE TOTAL SAMPLE | NUMBER OF RESPONDENTS QUESTIONING AUTHENTICITY OF ISLAMIC BANKING | PERCENTAGE CONTRIBUTION TO RESPONSE | |

| STUDENTS | 113 | 107 | 30% |

| ACADEMICIANS | 90 | 82 | 23% |

| CONVENTIONAL BANKERS | 196 | 68 | 19% |

| EMPLOYEES OF ISLAMIC BANKS | 351 | 47 | 13% |

| OTHERS | 1,030 | 39 | 11% |

| SHARI’A SCHOLARS | 23 | 14 | 4% |

| TOTAL | 1,737 | 357 | 100% |

CONCLUSIONS

The above analysis suggests that Islamic banking is perceived to be Islamic and Shari’a-compliant by different stakeholders. The staunch supporters of Islamic banking are actually employees of Islamic financial institutions and Shari’a scholars. Also, it is interesting to note that a priori religious beliefs happen to favour understanding of Islamic banking. The general knowledge about Islamic banking is important but it is also creating a lot of confusion around the phenomenon.