Size Does Not Matter-by Dr. Aishath Muneeza

Share of Islamic banking in the national banking sector of the Maldives is reaching 5%. Despite this, the Maldives has not featured in ISFIRE previously. In fact, it hs not been even ranked in Islamic Finance Country Index (IFCI), published by our yearbook, Global Islamic Finance Report (GIFR).

This is an important exclusion, as the country has been involved in Islamic banking and finance for more than 14 years. This article should serve as a prelude to a country report that will be included in GIFR 2018, to be published in March 2018.

The Maldives is a sovereign island nation consisting 1,190 islands that lie southwest to India and Sri Lanka in the Indian Ocean, with a hundred percent Muslim population of about 400,000. The friendly people and the natural beauty of the nation has captured undivided attention of tourists from various parts of the globe, making it as one of the world-famous honeymoon destinations. The constitution of the country clearly states that Islam is the religion of the state and to become a citizen of the country it is a condition precedent to be a Muslim. This proves the position of Islam in the country.

Though the constitution of the country states that any law contrary to Islam shall be declared as void, the financial system of the countr is primarily based on conventional system. The influence of English law to the legal and financial system of the country is nil, as the country was never a British colony but rather it was a protectorate. As such, the legal system of the country is based on a mixture of Islamic and the civil law.

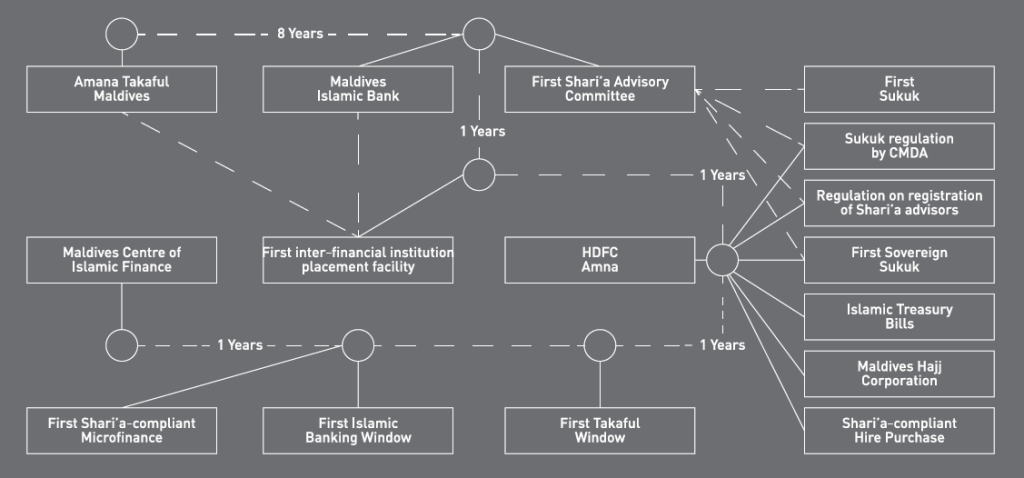

Though Islam is the ground norm of the nation, the country was alien to Islamic finance until 2003. The first form of Islamic finance that the country witnessed was takaful. However, at that time takaful was welcomed to the country in a “disguised” form. This is because Amana Takaful Maldives started its operations in 2003, without a takful license (as there was no laws to regulate operations of takaful companies in the country). It continues to operate as such even now. As a result, the people did not comprehend the significance of takaful in the name of the company and presumed that takaful was part of the company’s name.

Like many other Islamic countries or Muslim-dominated jurisdictions, Muslims in the Maldives were (and to a large extent are) concerned more about worship or ibadaat activities and not enough thought was given to the improvement of commercial or muamalat activities. Awareness of the prohibition of interest is basic, without any meaningful understanding of its rationale and implications amongs the Muslim community. In other words, the Maldives is a typical Muslim-majority country where deep understanding of the prohibition of interest is lacking even among Muslims.

After the Amana Takaful Maldives, it took the stakeholders long eight years to establish the first full-fledged Islamic bank in the country. In 2011, after long engagement and numerous attempts by the government of Maldives to engage Islamic Development Bank’s private arm, Islamic Corporation for the Development of the Private Sector (ICD), Maldives Islamic Bank opened with the mission to serve as a trusted provider of Islamic financial products and services in the country. Adequate regulation was formulated by the central bank of Maldives, Maldives Monetary Authority (MMA), to establish and regulate the bank. This regulation is in essence a replica of the Islamic Banking Act 1983 of Malaysia.

Though the bank was opened in 2011, in October 2009, ICD signed a Shareholders Agreement with the Government of Maldives to initiate the establishment of the bank. Within ten months of its commencement of operations, the bank was able to mobilize deposits amounting to MVR316 million and within its first year it was able to have total assets of MVR487 million.

This proved the viability of Islamic banking in the Maldives. The most critical challenge faced in the initial years by the bank was lack of availability of short-term liquidity management instruments in the market as the government did not have any Shari’a-compliant treasury instruments.

Although Amana Takaful Maldives had existed in the country well before the Maldives Islamic Bank, it was the establishment of the latter that proved to be a catalyst for the development of Islamic banking and finance (IBF) in the country.

“Although Amana Takaful Maldives had existed in the country well before the Maldives Islamic Bank, it was the establishment of the latter that proved to be a catalyst for the development of Islamic banking and finance (IBF) in the country.”

In the same year as of the establishment of the Maldives Islamic Bank, i.e., 2011, the capital market regulator, Capital Market Development Authority (CMDA), started work for establishing an Islamic capital market in the country. A Shari’a Advisory Committee for that purpose was set up and the Shari’a screening methodology for equities was formulated.

Amana Takaful Maldives made an application to apply Shari’a screening to its own operations to become the first Shari’a-compliant company listed on the Maldives Stock Exchange.

In the absence of a precedent, Amana Takaful Maldives was considered as a company with only partial Shari’a-compliance and Shari’a screening was applied. Obviously, the company was found to be in compliance with the generally accepted Shari’a principles, and was, therefore, deemed fit to be listed as a Shari’a-compliant company on the Maldives Stock Exchange. It, thus, became the first Shari’a-compliant company listed on the national bourse. Up until today, Amana Takaful Maldives is the only Shari’a-compliant equity listed on the Maldives Stock Exchange.

With this modest start of an Islamic equity market in the country, CMDA had the vision to create a sukuk market in the Maldives. This was a daunting task at that time, given that there was not even a single conventional bond listed on the Maldives Stock Exchange. It was, therefore, felt that the first step was to introduce this new tool to the potential issuers, with an aim to find a party not only interested in issuing sukuk but was willing to take the risk of listing the company on the Maldives Stock Exchange. This was indeed a regulatory condition precedent to issue a public sukuk. A few private companies expressed their interests but due to stringent regulatory requirements the public corporations were hesitant to take the giant leap. Therefore, it was decided that the best way to issue the debut corporate sukuk of the country would be to approach the listed companies and convince them to issue the sukuk.

At that point of time there were only 6 listed companies. They were hesitant to issue a debt instrument, making it almost impossible to issue a listed sukuk. In this whole process, it was discovered that there was one company in the country, namely Housing Development Finance Corporation (HDFC), which was previously listed on the Maldives Stock Exchange but was later delisted. If HDFC was convinced to issue a sukuk, Maldives would be able to witness and experience its debut corporate sukuk.

HDFC is a conventional home mortgage financing company, which is categorized as a non-banking financial institution by MMA.

When the assessment was made about the assets and operations of the company, it was evident that a sukuk was problematic as it lent on interest basis for home financing.

This led to discussions on how to introduce Islamic finance as part of the operations and offerings of HDFC. After a series of meetings and communications, the Board of Directors of HDFC agreed to introduce Islamic finance as part of the business of the company. Thus, in Maly 2012, HDFC Amna was introduced as an Islamic window of HDFC.

It is interesting to observe how one development may lead to another. In case of the Maldives, it started with the establishment of a takaful company, then an Islamic bank was set up, followed by a modest Islamic equity market.

The pursuit of issuing a sukuk gave rise to an Islamic window of a non-bank financial institution. What happened next is even more interesting.

After the launching of HDFC Amna, it became difficult to get immediate funding to start its operations and time was required to proceed with the issuance of sukuk. The demand for HDFC Amna created the need for the company to find funding as soon as possible to commence its operations. Except for Maldives Islamic Bank, there was no other financial institution that could provide Shari’a-compliant financing. Due to this need, the first Islamic inter-financial institution placement facility was structured using wakala, and HDFC Amna was able to commence its operations through the funds it received via wakala placement from Maldives Islamic Bank and Amana Takaful Maldives.

These institutions were keen to invest in wakala placement because at that time both institutions were looking for Islamic short-term liquidity management instruments, which otherwise were not available in the market.

This provided a life-saving opportunity for the two Islamic financial institutions in the country. Since then, the wakala placements have been very successful. This is another example of how Islamic finance evolves in a jurisdiction. It is like letting the genie out of bottle – it is simply unstoppable!

“Starting Islamic banking and finance] is like letting the genie out of bottle – it is simply unstoppable!”

HDFC issued the first sukuk in the last quarter of 2013. It was indeed a challenge to come up with a suitable sukuk structure for the Maldives in a legal infrastructure where there were no provisions for the establishment of SPVs and trusts. The substantive law that could be relied was mainly the contracts law and as a result, the sukuk structure of HDFC deviated from the international complicated sukuk structures.

Given the legal limitations, it was decided to issue HDFC Mudaraba Sukuk, without an SPV. Also, it was structured in such a way that it offered the sukuk holders a fixed return. This was possible because the sukuk proceeds were used for istisna’ – the main contract used by HDFC for home financing. However, this did

not mean that HDFC sukuk structure was less Shari’a-compliant or risky. It simply meant that for the Maldives, it was the best suitable sukuk structure, compliant with Shari’a as well as consistent with the legal and regulatory framework in place.

The issuance of this inaugural sukuk faced other challenges, too. Disbursement of sukuk proceeds on time and consequent distribution of returns was not a smooth run in the first year. These issues were accommodated by CMDA that issued sukuk regulations in 2013. In the same year, CDMA also enacted Regulation on Registration of Shari’a Advisers, which was indirectly relevant to the sukuk regulation.

2013 proved to be a successful year for Islamic finance in the Maldives. Numerous key events happened in the year. The first sovereign sukuk was issued in the year, based on a structure that utilized wakala and mudaraba contracts, with trade in oil as the underlying asset. The government of Maldives also issued Islamic Treasury Bills where oil was used as underlying asset. This was the first time a government in South Asia issued an Islamic Treasury Bill.

Furthermore, the government set up Maldives Hajj Corporation, an organization similar to Tabung Haji of Malaysia. A private company engaged in hire-purchase, Alia Investment Maldives, started offering Shari’a-compliant hire-purchase facility with zero penalty clause. This was the first time in the history of the country a private party engaged in offering of Islamic financial products.

In the following year, the biggest insurance company of the country, Allied Insurance Maldives, opened an Islamic window under the name of Ayady Takaful and started offering general insurance products. The inauguration of Ayady Takaful provided for the growing demand for Islamic finance.

In 2015, the biggest bank of the country, Bank of Maldives, launched its Islamic window guaranteeing the viability, sustainability and ever-growing demand for Islamic finance in Maldives. In 2015, the “Faseyha Madhadu,” the first Shari’a-compliant Islamic microfinance scheme, was launched. In the same year, Maldives Transport and Contracting Company PLC launched “Odiverinnah Hallu Yageen” (a solution for fishermen and boat owners) via Islamic finance methods.

In 2016, Ayady Takaful introduced family takaful to the country, and a private hire-purchase company started offering Islamic hire-purchase. Furthermore, Housing Development Corporation (HDC) announced the option to cease compound interest portion for all the existing housing loan facilities given and started offering only Shari’a-compliant housing facilities. Bank of Maldives opened a special dedicated branch for Islamic banking, and Maldives Islamic Bank expanded its operation to new regions.

In the same year, the government of Maldives announced its vision to make the Maldives as the hub for Islamic finance in the South Asian region, and created Maldives Centre for Islamic Finance, a 100% government corporation established under a Presidential decree to implement the strategies in this regard. One of the first key projects that was announced to be undertaken by Maldives Centre for Islamic Finance was to develop Islamic tourism in Maldives linking the revenue to create a sustainable sovereign wealth fund with the assistance from Islamic Development Bank’s Islamic Solidarity Fund for Development (ISFD).

Though the Maldives is a 100% Muslim country and theoretically there was room to presume that it would be easier to introduce Islamic finance in the country, the challenges faced in this regard were unique. Creating awareness and education and development of the required human capital were the major challenges faced. Continuous attempts have been made by the stakeholders of Islamic finance in Maldives to create awareness and education about Islamic finance amongst general public and the finance industry. However, more initiatives need to be carried out.

Comprehensive publications have been made in the native language and research papers about the Islamic finance industry of Maldives have been written and published at national and international levels. The pension fund of Maldives offers opportunity for subscribers to opt for a Shari’a-compliant investment portfolio, but though Maldives is a hundred percent Muslim country by default, whenever a person participates in the pension fund, the investment portfolio selected will be conventional. As a result only about 1% of the total pension fund, which is in billions of Maldivian currency, now consists of Shari’a-compliant investment portfolio.

The main reason for this can be due to lack of awareness of public about the substantive and procedural matters of the pension fund.

Collective efforts of stakeholders of Islamic finance are required to grow the size of Shari’a- compliant portfolio of pension fund, as having a large fund is expected to lead to more Shari’a-compliant instruments in the market. According to the law, pension fund can only invest in listed securities, and if a large portion of fund is for Shari’a-compliant investment, this will motivate to issue more listed Islamic securities creating a resilient Islamic finance market in Maldives.

To resolve the human capital challenge, CMDA made collaborative efforts with INCEIF, Malaysia, to offer a postgraduate course in the Maldives. This has been a successful effort to create room for the existing industry players to educate themselves in Islamic finance while on the job. The strategy put forth by CMDA on this matter was to create opportunities for the conventional finance industry key personnel to be exposed to Islamic finance to use their industry knowledge and experience to advocate Islamic finance rather than targeting the fresh graduates with no experience.

This also aimed at creating interest for Islamic finance at the top level and lead the Islamic finance industry in Maldives from the top.

Furthermore, Islamic University of Maldives has started offering diploma and bachelor-level courses in Islamic finance since January 2017, catering for the growing demand for Islamic finance industry in Maldives.

All the above developments are impressive, especially when one considers them in the context of a short span of time. However, the legal, regulatory and tax framework of the country needs to be enhanced to create a favorable environment for Islamic finance in the country. A special law to regulate takaful is required and a comprehensive legal framework for Shari’a governance and to regulate banking and non-banking financial institutions offering Islamic finance is required.

Laws to create trusts and SPVs need to be enacted and a sophisticated version of company’s law following the international best practice needs to be enacted too. The existing legal, regulatory and tax framework applicable to Islamic finance needs to be studied thoroughly and a comprehensive national strategic plan to develop Islamic finance In the country needs to be drafted and adopted. This will assist to fill the existing gaps in the industry and will further deepen the growth of the industry at the domestic and regional level.

“The progress of Islamic finance in the Maldives is an inspiration to those jurisdictions who wish to commence Islamic finance and develop it in a sustainable manner.”

The progress of Islamic finance in the Maldives is an inspiration to those jurisdictions who wish to commence Islamic finance and develop it in a sustainable manner. It is evident from the growth of it in the Maldives that being a hundred percent Muslim country automatically does not make it easy to introduce, implement and sustainably develop Islamic finance.

Positive action and strategic development of it is required at all levels of the society. It is important to highlight the proactive role played by the government of Maldives to develop Islamic finance.

The Maldives has been recognized among the top 15 developed nations in the global Islamic finance industry according to the ICD-Thomson Reuters Islamic Finance Development Indicator (IFDI) 2016 and its report, the Islamic Finance Development Report 2016. The most developed performers include countries from the GCC, South and Southeast Asia.

The Maldives also comes second to Pakistan in terms of overall Islamic finance development in the South Asia region. This new development proves that the aspiration of the Maldives to spearhead Islamic finance in South Asia is indeed real and serious as size does not matter; what matters is the political will & support and the strategic planning and action to achieve the target.

The country aspires to be a regional hub for Islamic finance. To achieve this dream, it will have to do a lot more to pull the market share of Islamic banking from below 5% to around 15%. With the government’s support and political will, this is very much in reach of the country.