ISLAMIC FINANCE: MUHAMMAD IMRAN ASHRAF USMANI

PUBLISHER: Maktaba Ma’ariful Quran (Quranic Studies Publishers), Karachi, Pakistan

EDITION: April 2015

At a recent conference in Karachi, we were provided with a revised and updated edition of Meezan Bank’s Guide to Islamic Banking, first published by Darul Isha’at in 2002. The book is now entitled as Islamic Finance: Revised & Updated Edition of Meezan Bank’s Guide to Islamic Banking, to be referred as Islamic Finance in this review article.

At the outset, ISFIRE Reviews maintains its verdict that the best book on Islamic finance written by a Shari’a scholar remains An Introduction to Islamic Finance written by Mufti Taqi Usmani, who happens to be father of the author of the book under review here. Muhammad Imran Ashraf Usmani (to be referred as MIA Usmani afterwards) has, however, attempted to bring details to the concepts in the context of product development for Islamic banks. As a resident Shari’a advisor at Meezan Bank, MIA Usmani’s in-depth knowledge of structuring issues in Islamic financial products is reflected in the book.

The new edition has a couple of new chapters included to cover risk management, Shari’a audit and accounting treatment of major contracts used in Islamic banking. There are some other improvements in the form of inclusion of Arabic text of the quoted verses of Quran and sayings of the prophet (peace be upon him).

Islamic Finance is divided into 11 parts, and arranged in 33 chapters. It covers all the important contracts used in Islamic banking (10 in total), 6 Islamic retail banking products (including treasury operations of Islamic banks), a few investment banking and fund management products, and takaful, etc. Other important topics include Shari’a audit, risk management and a brief on the standards issued by Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI). At the start of the book, there is brief description of Islamic economic system, factors of production in Islam, and the importance of the prohibition of riba (interest) in the primary sources of Shari’a.

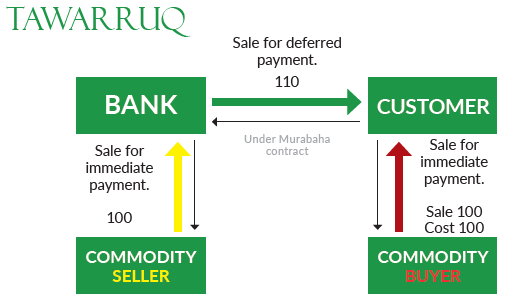

Although comprehensive in scope, the book lacks consistency and accuracy in details. For example, meanings of tawarruq in chapter 19 are given as “to buy on credit and sell at spot value.” This is obviously only one aspect of tawarruq but it cannot be considered as correct and complete meanings of tawarruq. At the same time, it must also be admitted that the meanings are not entirely incorrect as well. References to juristic opinions are adequate and to the point. Nevertheless, it appears as if the book is written for the benefit of those who already have sufficient knowledge of Islamic banking and finance (IBF), the main contracts used therein and the Islamic financial products.

If some lingual and stylistic issues are kept aside, the book provides almost all the information required from someone working in an Islamic bank. In fact, there are some contracts/arrangements that are not widely used in Islamic banking but these are included in the book for the sake of completeness. One such contractual arrangement is istijrar (described in chapter 16). Apart from point 2 on page 175 (which is at best confusing if not wrong), the information on this innovative contract should be of interest to those involved in product development and structuring for Islamic financial institutions.

example, meanings of tawarruq in chapter 19 are given as “to buy on credit and sell at spot value.” This is obviously only one aspect of tawarruq but it cannot be considered as correct and complete meanings of tawarruq. At the same time, it must also be admitted that the meanings are not entirely incorrect as well. References to juristic opinions are adequate and to the point. Nevertheless, it appears as if the book is written for the benefit of those who already have sufficient knowledge of Islamic banking and finance (IBF), the main contracts used therein and the Islamic financial products.

If some lingual and stylistic issues are kept aside, the book provides almost all the information required from someone working in an Islamic bank. In fact, there are some contracts/arrangements that are not widely used in Islamic banking but these are included in the book for the sake of completeness. One such contractual arrangement is istijrar (described in chapter 16). Apart from point 2 on page 175 (which is at best confusing if not wrong), the information on this innovative contract should be of interest to those involved in product development and structuring for Islamic financial institutions.

One should have expected a far more improved version of this revised edition of the book. Notwithstanding some additional chapters and topics, the book carries weakness in expression and style from the previous edition. In its present form, it can be used as a quick reference point for trainers in IBF, as the book seems to have evolved out of teaching notes of the author, or perhaps it is written keeping in mind the needs of trainers rather than trainees in IBF.