The recent global financial crisis (GFC) has led to redefining of financial sector and to the possibilities of building new economic models. Some economists and other experts have even called for revamping the whole global economic system based on a new worldview.

The recent global financial crisis (GFC) has led to redefining of financial sector and to the possibilities of building new economic models.

Some economists and other experts have even called for revamping the whole global economic system based on a new worldview.

Economies that incorporated some of the Islamic ethical standards showed more resilience and stability during the crisis. This has led to the emergence of newly independent countries examining Islamic economic models and hence appearing on the global Islamic finance map. It is indeed right when the Secretary General of IFSB called Islamic finance the “disruptive model”.

In Europe, the Islamic finance sector although small in size has promising potentials to gain traction. Islamic finance progressed gradually in Europe since its initiation in 1980s. However, the momentum has picked up post-GFC as witnessed by the debut sovereign issuances by two European countries last year and the expanding bilateral ties between European countries and Islamic finance hubs such as the GCC and South East Asia.

Islamic banking and Islamic funds sectors have made significant progress in Europe. Islamic funds have been gaining greater importance, and several European financial centres have taken a number of steps to facilitate the sector. Islamic funds domiciled in European jurisdictions cumulatively holding US$14.4 billion in assets as end of 2014, and accounts for 20% of the Shari’a-compliant assets under management of Islamic funds worldwide.

The development of Islamic finance has been beneficial for multiple stakeholders, both within and outside of the region. The offering of Islamic banking products and services in Europe has made it possible for the Muslim population to resort to Shari’a-compliant financial services.

However, non-Muslims have also come to appreciate the virtues of Islamic finance and its impact on financial stability, financial inclusion and income inequality. This has lead to increasing interest in converging Islamic finance with ethical finance.

OPPORTUNITIES FOR EUROPE & EXPANSION OF ISLAMIC FINANCE

The presence of Islamic finance is beginning to be felt globally. In Europe, it is still early stages, however, there are a number of factors that will support its development further.

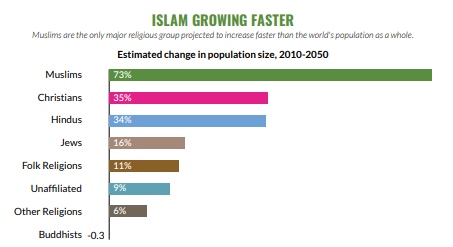

The world’s population is expected to grow by 35% in the next decades; the number of Muslims is expected to increase by 73%; from 1.6 billion in 2010 to 2.8 billion in 2050. In Europe, the Muslim population is projected to exceed 58 million by 2030. The Muslim share of the population was 6% of the region’s inhabitants in 2010. By 2030, Muslims are projected to make up 8% of Europe’s population.”

The increased political will in a number of countries across the European continent have lead to the introduction of incentives and measures to encourage the development of the Islamic finance industry. This also has led regulators and private sector organisations in the EU to cooperate with other countries such as the OIC to further explore Islamic financial business opportunities.

In the wake of the European financial crisis, Europe is increasing the emphasis on alternative finance solutions and looking for alternative pool of liquid funds.

Even though the size of the Muslim population within European jurisdictions is increasing significantly; Islamic financial products appeal to non-Muslims as well.

The development of an Islamic financial industry within Europe will be beneficial for all players in the industry. In this respect, the following considerations are relevant.

Economic Inclusivity

Large segments of the Muslim population are underserved by conventional finance; only 24 percent of adults have a bank account and 7 percent have access to formal financing, compared with 44 percent and 9 percent, respectively, for non-Muslim populations (IMF).

In Europe, conventional financial institutions are increasingly realizing the value of Islamic financing techniques and are starting to incorporate these into their existing financing practices or opening up separate Islamic windows.

COUNTRIES WITH THE LARGEST PROJECTED PERCENTAGES

Increase in Number of Muslims, 2010-2030

| COUNTRIES | Estimated Muslim Population 2010 | Estimated Muslim Population 2030 | Projected Percentage Increase 2010-2030 |

| Ireland | 43,000 | 125,000 | 187.7% |

| Finland | 42,000 | 105,000 | 148.9% |

| Norway | 144,000 | 359,000 | 148.7% |

| Sweden | 451,000 | 993,000 | 120.0% |

| Italy | 1,583,000 | 3,199,000 | 102.1% |

| United Kingdom | 2,869,000 | 5,567,000 | 94.0% |

| Spain | 1,021,000 | 1,859,000 | 82.1% |

| Belgium | 638,000 | 1,149,000 | 80.1% |

| Austria | 475,000 | 799,000 | 68.3% |

| Switzerland | 433,000 | 663,000 | 53.1% |

Many Islamic banks are in operation such as Germany, Denmark, France, Luxembourg, Switzerland and the United Kingdom.

Furthermore, a number of large European banks are operating Islamic banking windows to take advantage of the fast-growing Islamic banking sector.

Further developing Islamic banking in developed countries particularly in some parts of Europe will positively impact the global Islamic financial services industry. This is due to the well-established regulatory framework; more advanced human capital and better risk management practices.

Additionally, Islamic banks are better at financing SMEs and start-ups, therefore contributing to more inclusive growth.

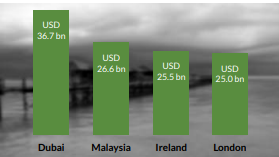

“Even though Dubai succeeded being ahead of the worlds three traditional Sukuk centres; Irish Stock Exchange said, “It continues to attract high levels of listings from the Gulf Cooperation Council region.”

Liquidity

It has been estimated that the EU’s infrastructure investment needs to meet the Europe 2020 objectives could reach as much as EUR2 trillion in transport, energy and information technology sectors (European Investment Bank). In order to maintain the region’s competitive position globally and to meet the future demand for infrastructure, European states are actively looking for alternative funding sources. Increasingly, the focus is shifting toward public-private partnerships (PPPs) and institutional investor-driven fundraising. Sukuk have shown their value in the area of infrastructure finance in supporting investment and economic growth.

“Even though Ireland has a relatively small Muslim population, it is expected to have the largest percentage increase in Europe in the number of Muslims. Muslim population will increase by almost 188%.”

Europe’s first sovereign sukuk issued was the German Saxony-Anhalt back in 2004. In the following years there were successive corporate sukuk issuances.

In 2014, the UK and Luxembourg entered the Islamic capital market with highly anticipated debut sovereign sukuk issuances. Despite the slow progress of evolution of sovereign sukuk market in Europe, there are two things that show healthy growth. One, the rise of some European stock exchanges as key listing exchanges for sukuk such as the Irish Stock Exchange (ISE) and the London Stock Exchange (LSE). Global sukuk issuers choose to list their sukuk on these stock exchanges due to their efficient and transparent listing processes and attractive trading liquidity profiles.

“The concept of mutuality and cooperative insurance makes it very similar to the takaful industry since both shares the principle of risk sharing with risks being spread over members/participants. Furthermore, with the European passporting services the Islamic insurance can remarkably spread in the European market.”

Two, the rise of issuances of some corporate sukuk from Europe. Regardless of size of issuances, these corporate sukuk prove that many financial institutions are interested in raising funds through the Shari’a-compliant channels to meet investors’ needs that are keen to invest in Shari’a-compliant investments.

A gradual growth is anticipated in the number of sukuk issuances from European countries in the next few years. Many regulators in Europe are embarking on drafting new regulations that will help boost Sukuk issuances in the near future.

Financial Stability

The sustained growth of the Islamic banking industry in the period 2009-2013 has shown sign of resilience during financial distress and economic slowdown. Islamic banks were less exposed to the toxic assets that contaminated the conventional banking world. This has led the Islamic banking industry to penetrate to many countries in the recent years.

The takaful (Islamic insurance) industry is an important sector of the Islamic financial system. Its robust and risk-sharing feature makes the financial system more resilient to financial shocks and accelerates economic growth.

The takaful industry is expected to develop remarkably over the next years as the world economy overcomes the spillover effects of the GFC.

European insurers account for more than one-third of the global insurance market. The European insurance industry is a recognized fully equipped vehicle for the introduction of Islamic insurance operations. Fortunately, two-thirds of all insurers in Europe belong to the mutual and cooperative insurance sector. The concept of mutuality and cooperative insurance makes it very similar to the takaful industry since both shares the principle of risk sharing with risks being spread over members/ participants. Furthermore, with the European passporting services the Islamic insurance can remarkably spread in the European market.

Ethical Finance

An increasing number of investors in Europe, whether Muslim or non-Muslim, are attracted toward socially responsible investments (SRI). The European high-net-worth individuals (HNWIs) have been estimated to reach a CAGR of 6.2% between 2012 and 2015 taking it to US$13.1 trillion.

The rising demand leads to better outlook for Islamic funds in Europe. For Islamic fund managers, a broader audience of investors would be attainable through incorporating SRI criteria into their screening processes. Europe’s asset management expertise could also benefit European wealth managers through conducting Shari’a-compliant operation within Islamic finance jurisdictions.

Fund Passportability

Islamic funds have several options for geographical expansion or diversification in terms of domicile registration. The European domiciling of funds has an appeal for Islamic fund managers, as 20% of the global aggregate Shari’a-compliant assets under management (AUM) are domiciled in Europe. This is due to its combination of tax benefits, high regulations and operational efficiency.

A number of European states have responded to this opportunity through issuing guidelines to facilitate the registration of Shari’a-compliant investment schemes in their territories. The Undertakings for Collective Investment in Transferable Securities (UCITS) directive represents a significant window of opportunity for Islamic fund managers to sell to European investors. However, there are still a significant number of European investors who are largely unaware of Shari’a-compliant propositions.

Trade

Trade is a critical driver of the future growth of Islamic finance in Europe.

Shari’a-compliant trade instruments are fast becoming preferable modes of financing for a growing number of trading companies across Southeast Asia and the Middle East. This development is of particular importance to Europe whose trade linkages with the two regions are set to strengthen.

Challenges for Europe

The UK remains Europe’s main Islamic finance hub, with six Islamic banks and a number of Islamic banking window operations. However, since Islamic finance is gaining ground in Europe, we see Germany, a home to 4 million Muslims, has also acquired its first lender that complies with Shari’a law. Furthermore, Luxembourg is also planning to launch an Islamic lender of its own. Ireland is also looking at the opportunity of establishing its first Islamic bank.

ISLAMIC BANKS IN EUROPE

The UK Case

The UK is the EU country with the most developed Islamic financial sector. Except for Al Rayan Bank, which is a retail bank, all Islamic banks are wholesalers involved in trade finance, real estate, capital markets and fund management.

As for monetary policy, none of these banks have joined the reserve scheme because they do not meet the minimum threshold to be subject to the cash ratio deposit regime which is set at total liabilities of £500 million in the Bank of England and because of the Shari’a conflict with Bank of England floor system whereby all reserves are remunerated at the Bank rate. Furthermore, Islamic banks are banned from open market operations because joining the reserve scheme is a requirement that conflicts with Shari’a. As for operational standing facilities, joining OSFs scheme also conflicts with Shari’a law.

The six Islamic banks in the UK face greater limitations in terms of access to central bank facilities. The inability to rely on OSFs makes them prone to liquidity and solvency risk than their conventional counterparts, as they are forced to rely on typical Shari’a-compliant instruments, such as commodity murabahah, to manage their liquidity.

The British government issued sukuk structured as Ijara partly to help Islamic banks in Britain better manage their liquidity needs. Furthermore, the Bank of England has initiated work on developing Shari’a-compliant liquidity facilities.

The Euro Area

The first obstacle to the establishment of an Islamic financial institution is the minimum reserve system, this is due to conflict with the Shari’a law. A possible solution is for Islamic banks to hold their reserve accounts indirectly with another intermediary.

The framework of open market operations conflicts with the prohibition of interest rates, hence, leaves no room for the participation of Islamic banks. However, Islamic banks could operate in the euro area even if they are banned from open market operations.

Furthermore, Islamic banks would not be allowed to rely on standing facility operations, which makes them more prone to financial stability risk.

In conclusion, Islamic financial institutions will rely on the same instruments as those used by their UK counterparts to manage their liquidity, and they will probably hold excess liquidity reserves in order to tolerate any liquidity shortage.

Liquidity Management

Islamic financial institutions face more challenges than their conventional counterparts, as they do not have access to the same wide range of financial instruments. This raises liquidity concerns, as they have to hold more cash than is necessary to meet liquidity thresholds, hence, reducing their profitability and impacting the financial sector they are operating in.

Developing a robust liquidity infrastructure will reduce the cost of intermediation for Islamic banks. Instruments to manage liquidity will help banks to better manage liquidity risk and to meet strict requirements of the Basel III for assets.

The significant growth of the sukuk marker in Europe could help alleviate this problem by increasing the supply of highly rated and tradable Islamic securities.

Furthermore, the International Islamic Liquidity Management Corporation’s (IILM) efforts in creating short-term Shari’a-compliant securities as a cross-border tool for Islamic banks to manage liquidity is signalling widening popularity.

REPUBLIC OF IRELAND: GDP GROWTH FASTEST IN EU

After exiting an international bailout at the end of 2013, Ireland’s economic growth rate surged to a post-crisis high of 4.8% last year, the fastest rate in the EU. It is the country’s highest growth rate since 2007, the final year of the Celtic Tiger boom, when the economy grew by 4.9%.

The European Commission has said that Ireland will grow by around 3.5% this year and the next year as the Irish economy re-emerges as one of Europe’s “top performers”.

According to the European Commission Spring Economic Forecast, Irish exports and private sector investment were continuing to drive growth. Also the domestic consumption was a contributory factor in higher growth rates for the country.

The forecast predicted that unemployment would fall to 9.2% in 2016, down from 11.3% in 2014.

The government’s new medium-term economic plan for the period to 2020 is based on enterprise, “not on speculation”, The Irish Head of Government (An Taoiseach) Enda Kenny said, to ensure that “never again will Ireland’s stability be threatened by speculation and greed”.

The Irish government saw the potential of Islamic finance and hence highlighted it as a key opportunity for growth in the strategy for the International Financial Services Industry in Ireland 2015-2020. Ireland looks to further enhance its sustainable economic growth through conducting Shari’a-compliant businesses.

Ireland has relevant expertise and capabilities; the building blocks of a credible set of marketing messages for Islamic finance investors. These included, among others, legislative changes introduced by the Department of Finance and Revenue Commissioners in 2010 to ensure equivalent tax treatment of conventional and Islamic finance transactions, the decision by the Central Bank of Ireland (CBI) to authorise a number of Shari’a-compliant investment funds and existing experience of Islamic finance within the financial services community and service providers.

“A Supportive tax and legal environment, easy access to the European market, a skilled workforce, an investor-friendly transfer pricing regime, supportive infrastructure, business friendly policies and a stable regulatory environment make Ireland well positioned for further development of Shari’a-compliant business. — Islamic Finance in Europe – ECB Occasional Paper Series-June 2013”

The Irish Stock Exchange has some US$11 billion of outstanding sukuk issuance programmes registered from some of the leading issuers in the Gulf and Asian markets.

The state and other state-owned companies are continuing to examine the possibility of issuing a sukuk to provide long-term funding at competitive rates in the international capital markets.

Ireland has developed unique educational opportunities to encourage specialist knowledge in Islamic finance. The Chartered Institute of Management Accountants (CIMA) in Ireland developed a Diploma and an Advanced Diploma in Islamic Finance. Ireland also started organizing a series of Islamic finance fora; the last was in April of this year.

The ethical approach and the physical nature of the traded asset in Islamic finance is an opportunity that the Irish financial services industry would be in strong position to promote to international investors. Ireland, which has spent the last 25 years creating a substantial international financial services sector, would look to position itself to capture some of the potential investment opportunities emerging from the Islamic finance space.