The parameters of Socially Responsible Investment in Islamic Finance have changed dramatically. This is due to the creation of a new financial instrument called Social Impact Bonds and more specifically the possibility of having Shari’a-compliant Social Impact Bonds. In this article, the author proposes to explore Social Impact Bonds and Shari’a-compliant Social Impact Bonds. We shall begin with definitions of Social Impact Bonds followed by insights from Sir Ronald Cohen; a founding father of the financial instrument. This will be followed by a discussion on the feasibility of Shari’a-compliant Social Impact Bonds. We shall also analyse a recent European event which is a cause for concern. We shall try to conclude on a cautiously optimistic note.

SOCIAL IMPACT BONDS DEFINITIONS

There are numerous definitions to Social Impact Bonds, amongst which

Social Finance UK describes Social Impact Bonds as:

‘Social Impact Bonds are based on a commitment from government to use a proportion of the savings that result from improved social outcomes to reward non-government investors that fund the early intervention activities.’

Whereas Social Finance US describes Social Impact Bonds as:

“God grant me the serenity to accept the things I cannot change; courage to change the things I can; and wisdom to know the difference.”

Serenity Prayer – Reinhold Niebuhr (1892-1971)

‘A Social Impact Bond (SIB) is a specific type of social impact financing in which funds are raised from Investors to provide Social Service Provider(s) with the working capital to deliver their services. For example, a government may enter into a Pay for Success contract with an Intermediary and its Social Service Provider partners in which the government only pays if youth employment increases. The Intermediary would raise the working capital that the Social Service Providers need to operate the program from Investors. If the services are successful in improving youth employment rate, then the Government would repay Investors for the successful outcomes. If youth employment does not improve, then the Government does not pay and Investors risk losing their capital.’

The Young Foundation describes Social Impact Bonds as:

‘a range of financial assets that entail raising money from third parties and making repayments according to the social impacts achieved.’

In a recent interview by the Harvard Business School official podcast1, Sir Ronald Cohen used this definition:

‘Social impact investing is seeking to achieve a social objective as well as a financial return at the same time, and to measure both. The concept, of course, has existed forever: that you can invest and achieve good. But that would be called investment with impact, in our terms. Impact investment is when you set out an objective that is just as important as the financial one, but is a social one (social, for us, includes environmental) and you seek to achieve both. And what it does is it gives the key to the capital markets to social entrepreneurs by linking the achievement of a social return to a financial return. So it’s actually very significant for the funding of not-for-profits, just as it’s significant for the funding of social entrepreneurs who want profit-with-purpose businesses, and to lock-in a social mission, and set social objectives for for-profit businesses. It’s a huge change of mindset, but it is an idea, in my view, whose time has come, and I see a lot of evidence of that through the work of the task force.’

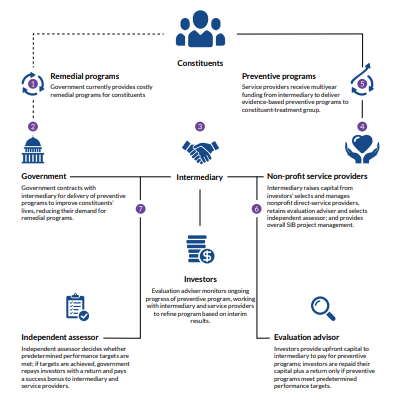

HOW A SOCIAL IMPACT BOND WORKS

The following exhibit summarises how a Social Impact Bond works. This diagram was compiled by McKinsey & Company.

A social impact bond is a partnership in which philanthropic funders and impact investors— not governments — take on the financial risk of expanding proven social programs.

GLOSSARY OF TERMS

Remedial Services: Government programs that address negative social outcomes after they ‘ve occurred (e.g., incarceration for criminals, emergency room access for the chronically homeless).

Preventive Interventions: Social-service programs that focus an avoiding negative social outcomes (e.g., alternatives to incarceration, permanent supportive housing for the chronically homeless).

Consitutent Treatment Group: Those individuals who benefit from the preventive intervention and whose results are compared to others who did not receive similar services.

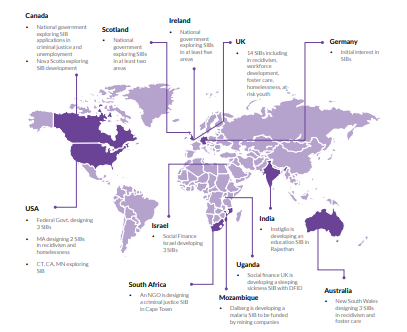

GEOGRAPHIC SPREAD Social Impact Bonds have become a global phenomenon. The following map compiled by Instiglio gives an overview of their geographic spread.

SIR RONALD COHEN ON IMPACT INVESTING & SOCIAL IMPACT BONDS

In the aforementioned interview, Sir Ronald Cohen, the venture capital & private equity legend gave a number of insights on social impact bonds. Sir Ronald Cohen was instrumental in the creation of this innovative financial instrument in the UK. In blue are selected excerpts from the interview transcript. My own comments are in black.

Sir Ronald Cohen: If in the 19th century, people spoke in terms of financial return alone, and the 20th century we brought the dimension of risk and return, in the 21st century, we’ve already brought the third dimension of impact. So risk, return, and impact is what it’s going to be about.

The term triple bottom line is traditionally associated with people, planet & profit. Nonetheless, the new triple bottom line would be risk, return and impact.

Sir Ronald is the chairman of the Social Investment Task Force, which was formed by the G-8 countries. Last fall, the Task Force released a report that found, among other things, that “the financial crash of 2008 highlighted the need for a renewed effort to ensure that finance helps build a healthy society.”

SRC: But actually, there are 26 social impact bonds across the world. They cover a dozen social issues, including homelessness, adoption, foster parentage, teenage unemployment, and dropout rates for school for girls in Rajasthan. Chicago just announced a $17 million social impact bond to deal with four-year-old children who come from less privileged backgrounds, to make sure they get the sort of training that’s going to help them stay in school. So you’re beginning to realize that, while not everything that counts can be counted, there are many things that can be counted, can be measured. And to the extent that you can measure, you can link it to a financial return and you can raise capital for it.

The crux of Social Impact Bonds is that all parties must agree to use a metric. In the absence of enough independently compiled data and useable metrics, it can be difficult to calculate the return of the social impact bond. Absence of reliable data also makes the design of the bond problematic.

BK: Can you make as good a return on a social impact bond as you can if you were investing in other types of organizations?

SRC: You can on a risk-adjusted basis. What do I mean by that? These are investments that are capturing a new set of opportunities. So if you get a 7% return from improving literacy in Africa, or preventing people from getting diabetes? These are not investment returns that go up and down with the stock market, or even with interest rates, because there’s a wide band of interest rates according to the success which is achieved. So, effectively, it gives you diversification in your portfolio. Social impact bonds and development impact bonds are what are being categorized today as absolute return instruments, which is what everybody is looking for.

The holy grail of asset managers are finding uncorrelated asset classes. In the era of high-frequency trading, finding asset classes that deliver predictable returns regardless of the whims of the market is greatly valued. The moot question is how predictable are Social Impact Bonds.

BK: It takes an ecosystem to make this work. Do you have to build that ecosystem with each one of these?

SRC: Governments have begun to do that. In the U.K., we already have tax incentives for investing in social impact bonds. As I’ve mentioned, we already have information on the web about the cost of social issues. The Law Commission has already looked at the fiduciary duties of the trustees of foundations and said, “You know, you’ve got an obligation to achieve an acceptable return.” But that doesn’t say just financial. It’s financial and social return. So, you’re beginning to change the ecosystem to enable impact investment to get to scale.

The UK deserves kudos for being a world leader in this field. The greatest strength of the UK is the rule of law. From this backbone, a lot of highly innovative financial initiatives can be devised. In the absence of properly enforced contracts, I question the feasibility or existence of Social Impact Bonds.

BK: So that can work in places where there’s a solid infrastructure, and there’s a functioning government. A lot of the change that needs to happen has to happen in parts of the world where that doesn’t exist. Do you see it moving in that direction? Do you see the opportunity for that to become maybe the next phase of this?

SRC: When you look at developing countries, they have been dependent on aid for a period of time. Now remittances are much more important than aid. They’re four or five times, perhaps, the size of official aid. Direct investment is probably two or three times official aid. And there’s a real opportunity for governments to begin to use their official aid through instruments like development impact bonds. So if you want to help literacy, are you better off just giving grants to non-governmental organizations, NGOs as they’re called, or are you better off creating a development impact bond where certain governments would pay when certain improvements have been achieved in the level of literacy? The answer is, of course, that if you’re backing social entrepreneurs to achieve an improvement in literacy, you stand a much better chance than if you’re just giving grants to people.

Sir Ronald Cohen champions transforming official aid through development impact bonds. While this makes sense from an optimization point of view, I question how politically feasible this is. It is unlikely that this would be well-received by corrupt politicians of third-world countries. Nonetheless, it could become a sine qua non for aid from donor countries. This would ensure that the aid is no longer squandered or embezzled; it would also encourage donors to give more especially against milestones achieved.

SRC: Because you begin to focus on an objective and when you focus on an objective, you wake up in the morning wondering how you’re going to achieve it, and you go to bed at night worried about the fact that you might not. That releases tremendous innovation and energy. So I believe that in the area of international development, we’re going to find enlightened governments in Africa, and Asia, and elsewhere, that begin to prioritize areas where impact investment can really help them. And I think those areas are going to be areas like literacy, like sickness. There’s already a sleeping sickness development impact bond that is being worked on in Uganda. There’s a malaria social impact bond being worked on in Mozambique. There’s an attainment level on a school social impact bond or development impact bond that’s being worked on in Rwanda. The difference between one and the other, by the way, is that a social impact bond is typically paid for by a government. A development impact bond has an outcomes payer, a development organization of a government or a foundation, you know, or even a corporation.

In third world countries, Development Impact Bonds are more likely to be used than Social Impact Bonds. This is legitimate. Very few governments of third-world countries have the wherewithal to foster and subscribe to Social Impact Bonds. Pragmatically, this might be best left global donors, international foundations and NGOs who possess the necessary sophistication to harness the powers of the capital markets.

SRC: The next big thing is social entrepreneurship and investment in my view, and it reflects itself here at the B-school in the number of students who are taking social entrepreneur courses of one kind or another.

It reflects itself in the number of people who come to see me. Every day, I see young people who say to me, “You know, I want to do something that has more meaning than just making money.” After all, the characteristic of a bright, young person is to want to change the world. And just as we developed venture capital as a response to the needs of startups and young companies that wanted to take risk to achieve technological innovation then, so, today, impact investment is a response to the needs of social entrepreneurs to have risk capital to change the world for the better (Amen to that).

SHARI’A-COMPLIANT SOCIAL IMPACT BONDS

In an article titled “Social Impact Bonds: A new tool for Islamic Finance?” (dated 14th May 2014), the Islamic Finance news evaluated the potential of Social Impact Bonds. The news article refers to the excellent journal article by Michael S. Bennett & Zamir Iqbal of the World Bank: “How Socially responsible investing can help bridge the gap between Islamic and conventional financial markets”. What is obvious is that Shari’a-compliant Social Impact Bonds and/or Social Impact Sukuk are both desirable from a Capital markets perspective and feasible from a Shari’a point of view. There is some discussion as to whether an Ijarah or Jualah3 structure should be used. Thus, if it is both desirable and feasible why are we not seeing issuances? The logical answer is that there is currently no premium for any Islamic asset allocator to take the plunge on a financial instrument which is currently unproven. There is of course a solution to this dilemma. The author was working on an implementable solution when disaster struck:

CHARLIE HEBDO

As a rule, one must always acknowledge the elephant in the room. The events of Charlie Hebdo are unfortunately causing a huge backlash against Islam and Muslims (especially those living like the author in Western countries). Factually, these events have very detrimental effects on Islamic Finance and its development in Western countries. For instance, the author was recently working with an outstanding impact investment firm on the creation of a Shari’a-Compliant Social Impact Bond. This bond would have provided relief to hundreds if not thousands of persons annually in the Muslim world.

Also amongst the partners was a global top-tier NGO with impeccable credentials. Suffice to say that the unfortunate events of Charlie Hebdo and its aftermath have poisoned the well.

Out of transparency and integrity, the author is compelled to disclose his position on the Charlie Hebdo affair. The author concurs wholeheartedly with the stance of the journalist Mehdi Hasan The author recommends reading Mehdi Hasan’s well-argued article5 in The Huffington Post.

NEWB

This brings me to the reason why I am cautiously optimistic. Belgium is currently seeing the creation of NewB: the first crowd-funded ethical bank. As a background, all the major Belgian banks had to be bailed out by the Belgian state during the crisis. Countless minority shareholders of Fortis bank and Dexia bank were wiped out. Prior to the crisis, these banks had been considered very safe, conservative investments. A number of Belgian civil society organisations pooled forces and decided to prove that banking could be done differently; more ethically. NewB is this pioneering initiative to establish a new, fair bank. NewB is organized as a cooperative with 12 values defining its identity. These values are the DNA of NewB and they are registered in the statutes of the cooperative:

- Participation: the bank is looking for creative solutions to shape a real participation of the cooperative members

- Simplicity: clients and cooperative members must easily understand the structure and the products of the bank

- Safety: the bank will only invest in funds from the real economy; profit is not a goal in itself

- Austerity: the operating funds of the bank are managed economically; no excessive spending

- Transparency: in all of the bank’s activities

- Inclusion: the bank will offer universal financial services and access to credit adapted for everyone

- Diversity: the bank will offer products and services that meet the needs of all its customers

- Innovation: innovative solutions for a societal and ecological economy

- Proximity: The bank will be close to its customers and both literally and figuratively

- Sustainability: the bank will only invest in socially responsible projects

- Honesty: profit is not a goal in itself, but

the result of good management

- Societal Context: the bank will rely on the active participation of dozens of organizations and thousands of civilians

Prima facie, this unique initiative is very close to the Islamic Ethos. It will be interesting to witness the development of this courageous initiative. In the words of the great French author Antoine de Saint-Exupéry.