It was another year of expansion for the global Islamic finance industry in 2014 with sukuk market making inroads into non-traditional issuance markets of Europe, Africa and East Asia. The emergence of new sources of sukuk in these regions highlights the growing acceptance of sukuk as a mainstream debt instrument. Until a few years go, sukuk issuances were generally small in nature, and the market was concentrated amongst a handful of issuers – Malaysia and the GCC.

With the addition of the UK, Hong Kong, South Africa and Luxembourg; the number of countries issuing sukuk almost tripled from 10 to 27 between 2006 and 2014. For these non-Muslim countries, sovereign sukuk are generally their first inroad into Shari’a-compliant funding.

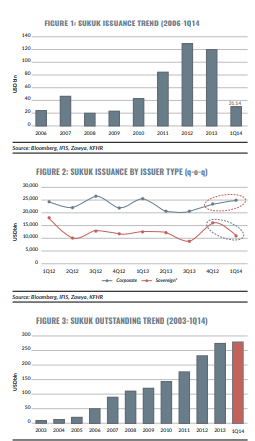

Sovereign issuance continues to dominate the global sukuk market, and accounts for more than half of total sukuk issuance in terms of value. Only this year, the issuance has reached US$38.6 billion in the first six months of 2015. Malaysia continues to drive growth in sovereign sukuk with Indonesia taking stage in the global sukuk race. As the pioneering country in the issuance of sukuk, Malaysia remains the largest issuer of sukuk accounting for 58% of total outstanding sukuk in 2014. Together, these two countries account for about two-thirds of total sovereign sukuk issuance as of July 2014.

THE RACE TO ISSUE SUKUK

Sukuk is an innovative instrument in Islamic capital market to fund long-term or short-term financing in a Shari’a compliant way. Sukuk provides an alternative for corporate and government for funding corporate or national development projects to the predominantly interest/debt-based instruments of bonds.

There are various types of sukuk structures depending on the underlying Shari’a principles. Common sukuk structures include musharaka, istisna’, mudaraba, murabaha, ijara and salam.

Germany was the first European country to tap the Islamic capital market when the German Federal State of Saxony-Anhalt issued a 100 million sukuk ijara in 2004. It wasn’t until a decade later that other Western countries began to show interest in sukuk as a tool for capital raising and infrastructural development.

In a bid to position UK as the global hub for Islamic finance, the UK government made its sovereign sukuk debut in June 2014, seven years after first posing the idea of issuing sukuk. Following close to the heels are Hong Kong, South Africa and Luxembourg.

In September, the governments of Hong Kong and South Africa issued sukuk for the first time. The former raised $1 billion with its five-year certificate, while the latter issued a $500 million Sharia-compliant sovereign bond. Luxembourg also issued a €200 million (US$249 million) sukuk with a maturity of 5 years. The growing acceptance of sukuk outside the traditional markets of Asia and the GCC signifies sukuk as attractive options for investors seeking to diversify their investment portfolios.

Let us briefly go through the sukuk issuances in these four countries:

UNITED KINGDOM

| ISSUER | HM TREASURY UK SOVEREIGN SUKUK PLC |

| Date of Issuance | June 25, 2014 |

| Currency | GBP |

| Offer size | GBP200 million (US$315 million) |

| Use of proceeds | Rental payments of three central government properties |

| Lead arrangers | HSBC, Barwa Bank, CIMB, NBAD |

| Structure | Ijara |

| Tenure | 5 years |

The UK became the first non-Muslim country to issue sovereign sukuk in 2014 (for further details, the readers may wish to read chapter 10 in the 2015 edition of Global Islamic Finance Report). The £200 million sukuk ijara attracted orders of over £2 billion from global investors and was 11.5 times oversubscribed. It was reported that UK investors subscribed more than a third of the issuance with the remaining sold to investors based in the Middle East and Asia. The sukuk will pay investors a profit rate of 2.036%, which is the same as the yield on the UK’s equivalent five-year government bonds. Based on ijara principles, the transaction is underpinned by rental income from three government buildings. The sukuk deal was structured by HSBC who also acted as a book-runner alongside Qatar’s Barwa Bank, Malaysia’s CIMB, and National Bank of Abu Dhabi NBAD.

HONG KONG

| ISSUER | HONG KONG SUKUK 2014 LIMITED |

| Date of Issuance | September 11, 2014 |

| Currency | US$ |

| Offer size | (US$1 billion) |

| Use of proceeds | To purchase certain properties owned by the government |

| Lead arrangers | HSBC, Standard Chartered Bank, CIMB Group Holdings, National Bank of Abu Dhabi |

| Structure | Ijara |

| Tenure | 5 years |

Hong Kong is the fourth Asian issuer of sovereign sukuk, after Malaysia, Indonesia and Pakistan. Hong Kong’s inaugural sovereign sukuk offering comes in the wake of a law passed that allowed the government to issue sukuk under the existing Government Bond Programme. The tax framework was also amended to help pave the way for sales of Shari’a-compliant debt. Amendments of the tax law include removing additional profit tax and stamp duty charges incurred in issuing sukuk, and thus making sukuk issuances comparable to that of conventional bonds.

The US$1 billion five-year sukuk ijara received a total order book of US$4.7 billion, recording an oversubscription of 4.7 times. It also marked the world’s first US$-denominated sukuk originated by an AAA-rated government.

In terms of investor breakdown, 47% of the sukuk was subscribed by Asian investors followed by Middle Eastern investors (36%), the US (11%) and Europe 6%. By investor type, financial institutions bought 55% of the notes, with the remaining subscribed by the public sector (30%), fund managers (11%), insurers (3%) and private banks (1%).

Building on the momentum from its successful issuance maiden sukuk, Hong Kong issued its second sovereign Sukuk in June 2015 with an issuance size of US$1 billion and a tenor of 5 years. Structured on wakala principles, the sukuk had a profit rate of 1.894% and gathered an order book of US$2 billion from 49 accounts.

SOUTH AFRICA

| ISSUER | ZAR SOVEREIGN CAPITAL FUND PROPRIETY LIMITED |

| Date of Issuance | September 17, 2014 |

| Offer size | US$500 million |

| Use of proceeds | Sale and leaseback of certain infrastructure assets owned by the Republic |

| Lead arrangers | BNP Paribas, KFH Investment, Standard Bank Group |

| Structure | Ijara |

| Tenure | 5 Years 9 Months |

The Republic of South Africa rolled out its US$500 million maiden sovereign sukuk in September 2014, making it the first international sukuk issuance from Africa.

Although the South African government first showed interest in issuing sukuk as early as 2011, it took another four years to identify the assets to back the Islamic bond and parse out regulatory requirements. It now joins the UK and Hong Kong as the third non-Muslim majority country to issue a sovereign sukuk.

Having a 5.75-year tenor and a fixed profit rate of 3.90% per annum, the sukuk was four times oversubscribed with an order book of US$2.2 billion. The investor distribution consisted of 59% from the Middle East and Asia, 25% from Europe, 8% from the USA and the balance from the rest of the world.

In a statement release by the National Treasury, the country’s decision to issue sukuk was “informed by a drive to broaden the investor base and to set a benchmark for state-owned companies seeking diversified sources of funding for infrastructure development.”

LUXEMBOURG

| ISSUER | LUXEMBOURG TREASURY SECURITIES SA |

| Date of Issuance | July 9, 2014 |

| Currency | EUR |

| Offer size | EUR 200 million (USD 254 million) |

| Use of proceeds | To finance three buildings belonging to the Luxembourg state |

| Lead arrangers | QInvest, Banque Internationale à Luxembourg, BNP Paribas, HSBC |

| Structure | Ijara |

| Tenure | 5 years |

Luxembourg became the first AAA-rated government to issue euro-denominated sukuk when it issued its first €200 million (US$254 million) five-year Islamic bond. Although not the first sovereign sukuk to be issued out of Europe, the issuance marked an important milestone not only for the Islamic finance industry as it welcomes growing interest from traditionally non-Muslim-majority jurisdictions but also for Luxembourg as it anchors its ambition to become a hub for Shari’a-compliant finance. By geographic distribution, 61% of the issue was allocated to investors from the Middle East, while European investors took 20% and Asia 19%.

A TRULY GLOBAL PHENOMENON

A decade ago, the sukuk market was concentrated amongst a handful of issuers in the Muslim countries and issues were generally small in nature. Today the sukuk market has truly gone global as the appeal of sukuk now extends far beyond the Muslim world. The issuances of sukuk from top rated sovereigns the likes of UK, Luxembourg and Hong Kong signals their interest in competing to become the hub for Islamic finance in their respective region. The issuances of sukuk by Western governments provide a guideline for a whole new source of funding available to issuers within the western world.