Is There A Role for

Islamic Finance to Play?

Jamil Akhtar, CEO of Britnaire Limited

London has seen dramatic changes over the past decade, notably the increasing concentration of super-rich individuals and international investors buying property on Prime Locations. The scale of investment is a confirmation of capital’s success in business and a vote of confidence in the UK’s political stability and in the financial and judicial system. It is a global endorsement of democracy, the rule of law, individual liberty, mutual respect and religious freedom offered by the multicultural society of London.

London has worlds’ best schools, colleges, and universities including a number of prestigious Russell Group universities, high living standard, and world-renowned cultural infrastructure.

London is a safe haven for assets of the super-rich.

London is a global epicenter of personal wealth.

In September 2017, there were 16.5 million High Net Worth Individuals (HNWIs) with $1m or more of investable assets (excluding primary residence) in the world. Of these, 568,000 are residing in the UK, the vast majority of them living in London.

According to Forbes, there are 50 billionaires residing in London with a combined net worth of $217.3 billion.

From 2009 to 2015, foreign buyers pumped in £100 Billion into London property.

ABOUT a third of the sales handled by certain international estate agents between April 2014 and April 2016 were to overseas buyers, rising to over 50% in central London. Most of the overseas buyers come from Hong Kong, Singapore, China, Russia, Malaysia, Saudi Arabia and from many other countries with diverse purposes to buy: as an investment for growth and rental income; to accommodate family; or as a second home to be used in vacation by family members and friends or to accommodate a child during education. However, more than 70% of the sales were for letting purposes.

While investing in the London property has always been a secular decision but increasingly Shari’a sensitivities have also been observed by some devout investors hailing from the countries with predominant Muslim populations.

Almost 100% of London’s very large residential development sites are backed by investment from overseas especially in the build-to-rent schemes. Many of such very large sites are owned by foreign entities. Billions of pounds of foreign investment in the UK property has pumped up the prices to unaffordable levels for the vast majority of the local buyers.

Since 1996, the average residential house price has drastically increased by 281% across the United Kingdom, whereas in London the extraordinary figure is 501%. Buy-to-let landlords have acquired the greatest yield, typically generating returns worth £14,987 for every £1,000 they had invested for the past two decades.

Investment in residential property is very popular throughout the world especially in the UK, and London being the most popular and rewarding. Investment in residential property remained popular despite the credit crunch which resulted in tighter regulation for mortgages. However, low-interest rates, low yields on other investments have helped demand for residential property and of course prices.

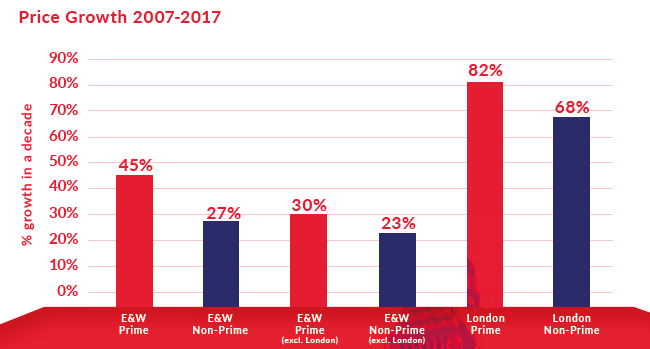

The most exclusive property has delivered the best returns over the long term. Investment in the super prime market returned the best returns not only in London but also across the whole of the UK. In the last ten years prices of prime property rose by 45% compared with 27% for non-prime. In London, prime property increased by 82% while non-prime increased by 68%. Property owners have seen very satisfying returns but the amount depends upon the location. New areas of the city classified as prime fringe have seen the strongest returns over the period.

WHILE INVESTING IN THE LONDON PROPERTY HAS ALLWAYS BEEN A SECULAR DECISION BUT INCREASINGLY SHARIA SENSITIVITIES HAVE ALSO BEEN OBSERVED BY SOME DEVOUT INVESTORS HAILING FROM THE CONTRIES WITH PREDOMINANT MUSLIM POPULATION.

However, over the past decade prices of prime central London property increased by 101% but super-prime areas recorded an increase of 116%. This is very lucrative and can be explained with a simple example. If you had bought a house for £4,000,000 with 75% mortgage, your investment in the property would be £1,000,000 excluding stamp duty and other costs. That house, would be £8,000,000 after 10 years. Three million is bank debt and £5,000,000 is your gross profit. The profit figure has not taken into account the rental income and finance cost. Last ten years have seen the lowest interest rates historically, so we can assume both rental income and interest charges off-set each other. Here we are not very far from turning £1,000,000 to £5000,000 in ten years. In other words, your £1,000,000 investment returned £5000,000 every year. If the property you bought had a potential to extend or convert into flats, the profit margin could have been much bigger. The actual figure would be lower after taxes but still very high returns. Opportunities to make very healthy profits still exist if a property is chosen carefully.

No wonder why Middle East investors have flocked to London in pursuit of higher returns in a market that has by and large been very stable. The Muslim’s interest in the UK property market in general and the London market in particular is evidenced by a number of Islamic investment banks operating in the capital. All of them have Middle Eastern shareholders who love to invest in the property.

THE MUSLIM’S INTERESTIS IN THE UK PROPERTY THE UK PROPERTY LONDON MARKET IN PARTCULAR IS EVIDENCED BY A NUMBER OF ISLAMIC INESTMENT BANKS OPERATING IN THE CAPITAL. All OF THEM HAVE MIDDLE ESTERN SHAREHOLDERS WHO LOVE TO INVEST IN THE PROERTY.

Factors Determining Price Appreciation in the London Market

The salient driving force behind prices is inadequate supply in relation to demand. In other words, demand for residential property has superseded its availability in the housing market.

London is historically one of the most popular cities in the world for many reasons including tourism, living, investments, and business or education etc. The performance displayed by the London housing market over the last couple of decades makes further investment in London property market more appealing. Last couple of years have been tough for prime London market but there are not many signs of any structural slowdown in growth. It doesn’t seem like investors are afraid of the ongoing uncertainty with respect to Brexit and tax changes. As seen in other most popular cities in the world, demand for luxury property is growing. The developers of luxury property have been achieving very high returns historically.

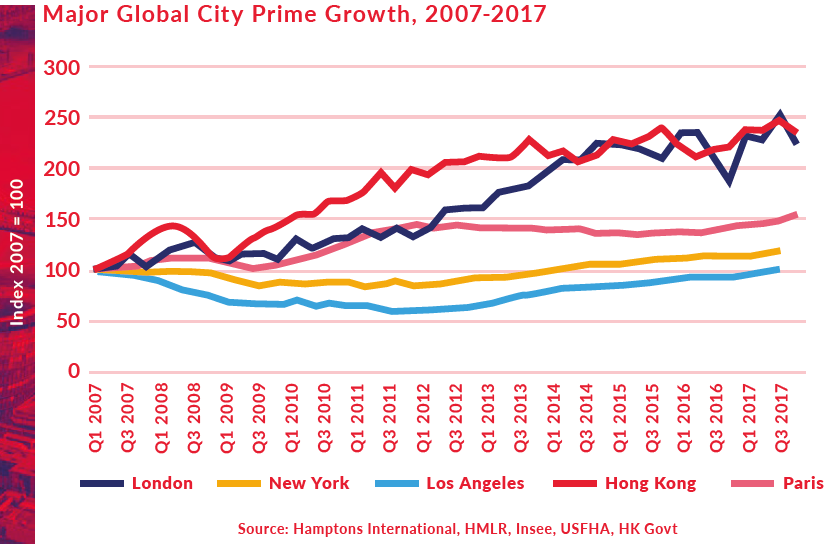

London property prices performed well compared to competitors since 2007 as shown below.

London Luxury Market in the Last Years

According to the data obtained from the London housing market, London luxury market is attaining some sort of stabilization after price decline in the past couple of years, which is attributable to the tax changes, Brexit, and oversupply. The data supports the market view that suggests that London’s luxury market has seen the bottom and will start gaining momentum soon after Brexit. This may be the perfect time to buy because certainty has not returned yet and sellers are more willing to drop prices. In certain times, sellers will be less willing to negotiate or offer no or less discount. In rising market, buyers compete for a property and many pay over the asking price and many are gazumped. If you want to invest for a long term, this may be the best time. Buyers of real estate property in London have been buying at a larger discount due to wider choices they have now. The discounts offered on the already developed prime properties increased to an average of approximately 10% (from peak) during the last quarter of 2017. As the sellers struggle to accept the reality of declining prices on time, they had to offer more discounts to sell the property. Nevertheless, the most recent quarter showed an increase in values of 1.1% with respect to the London luxury properties when a comparison is made with the preceding quarter as indicated by Coutts London Prime Property Index. Higher stamp duty costs and slow market make it hard to attain short-term gains unless a value is added to the property through extension, conversion or renovation. The prices of London luxury property are expected to remain flat on average till Brexit is over. If you want to invest for a long term, this may be the best time.

Effect of Taxes And Brexit on London Luxury Market

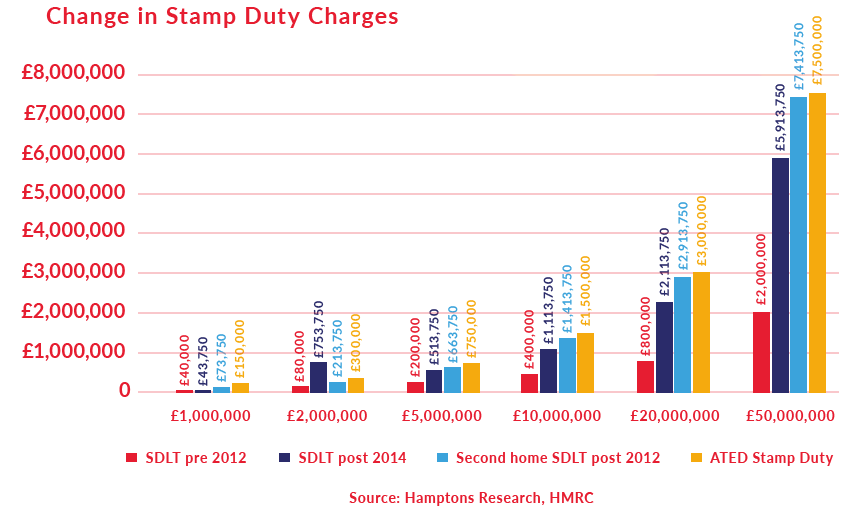

Escalating price growth of prime and super prime London property created anxiety for the government. The Bank of England and the Ten Downing Street were concerned that a property bubble is forming which will destabilize the financial system and hurt the economy if not controlled on time. The government wanted the market to cool down. So, they took a raft of measures including increasing the stamp duty, introduction of capital gains and income taxes for foreigners. New higher taxes on properties bought through offshore structures and a new 3% extra stamp duty on purchases of buy-to-let or second homes. This resulted in a gradual slowdown in the market.

In a referendum on 23 June 2016, 51.9% of the participating UK electorate voted to leave the EU, out of a turnout of 72.2%. This resulted in a further slowdown of the market. On 18th of April, The Prime Minister of the United Kingdom of Great Britain announced a snap election on 8th June 2017. The results were totally unexpected for the Prime Minister and her party. The ruling party succeeded to form a much weaker coalition government headed by the same Prime Minister, Theresa May.

The above changes produced undesirable results for the market and resulted in lower prices and a big reduction in transactions for properties above £1 Million. The areas with more concentration of Europeans experienced more decline in prices compared to other areas. Generally, the prices of London real estate property have dropped by 10 -20% following tax changes, the Brexit referendum and snap elections. The weaker pound and prices decline offers foreign buyers a very good opportunity to invest for the long term.

Many of the largest developers are delaying ongoing construction of units due to subdued demand. They want to sell their completed units first and are willing to offer special deals through their selected intermediaries like ourselves. The government wants the developers to shift their focus from luxury apartments to affordable homes. So, an opportunity exists for the investors to invest in smaller units for long-term growth.

The UK Property Taxes Compared to Other Destinations

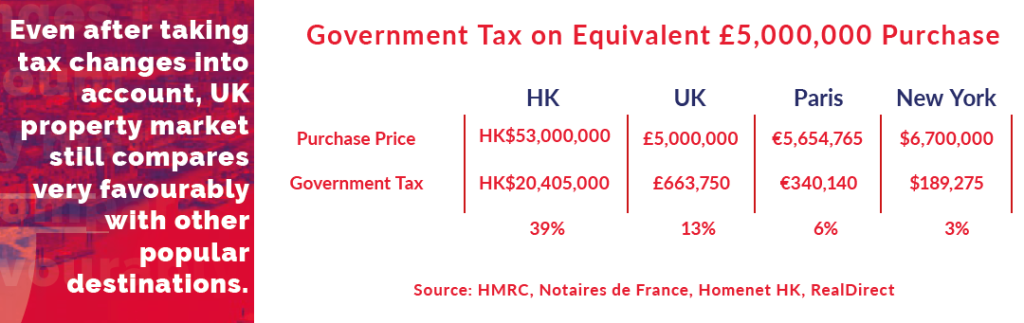

While it is true that overall property taxes in the UK rank highly in the Organisation for Economic Co-operation and Development (OECD) averages, the comparison is not straightforward since the structures of tax in different counties make like-for-like comparisons almost impossible.

Most UK Property taxes are levied on the purchase of the property and the annual property taxes are very low. While in other countries after sale taxes are much higher compared to the UK.

London Housing Crisis

Despite massive inflows of international investment; London is facing a domestic housing crisis.

- A waiting list of more than a quarter of a million people who want housing from local councils.

- In most London boroughs a household would require an income of £100,000 to buy an average three-bed home while the average salary is just over £35,000 per annum.

- The house price ratio to annual earnings with respect to the capital in London housing market has increased from 6.9 times in the year 2002 to 12.8 in the year 2016, based on the government data.

- The most recent official statistics, published on 22 March 2018, recorded 78,930 households in temporary accommodation at the end of December 2017. This marks the 26 times that the number of households in temporary accommodation has risen compared with the same quarter of the previous year. The 78,930 households include 120,510 children, representing a 75% increase since 2010. Of these households, 54,370 (69%) were placed in temporary accommodation in London. The number of families with dependent children placed in B&B-style accommodation increased from 740 at the end of June 2010 to 2,030 at the end of December 2017.”

- Private rents in the mainstream lettings market in London are more than double that of most other English regions.

- There are about 60,000 people living in non-domestic dwellings just in one borough of London.

- There are around 800,000 Londoners on the housing waiting lists for council and housing association affordable housing, an increase of nearly 84 percent in the last 10 years.

- House prices in London are 61 percent higher than the national average and more than double those in the North.

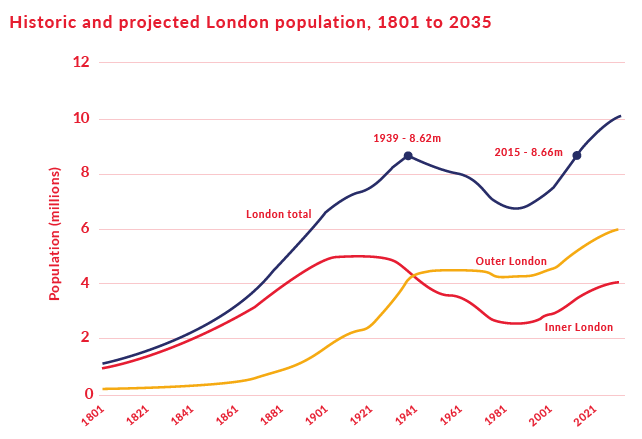

- London’s population is booming: it grew from 6.7 million in 1986 to 8.4 million in 2013. It will reach nine million by 2020 and ten million by 2030. This is the equivalent of adding the population of the UK’s second biggest city, Birmingham, every ten years.

“The increase in London’s population is unprecedented, growing more over in the last ten years than at any time in London’s 2000 years history. There could well be a staggering ten million Londoners by 2030. But while the population boomed, we failed to build enough homes, not just for ten years, but for thirty or more. Through decades of boom and bust, across economic cycles and under every shade of government it was the same story. We just did not build enough homes. Which leaves London facing the epic challenge of building more than 42,000 new homes a year, every year, for twenty years. A level of house building unseen in our great city since the 1930s”.

- London currently welcomes almost 25 million visitors, attracts 110,000 international students every year and is consistently rated as the best place in Europe to do business.

- One of the world’s biggest financial centres, London is home to thousands of employers. From world-famous companies to niche brands, the capital attracts people from all over the world, drawn by the major opportunities found here.

- London’s world-famous schools, colleges, and universities are recognized around the globe as centers of excellence and places are much sought after, creating another ready market for investors. In fact, foreign students rent almost a third of homes in prime central London locations.

All these points to a looming housing crisis and if the current situation is allowed to continue, London’s’ position as a world’s financial hub is at stake. The government wouldn’t allow this and has introduced many measures to tackle the problem.

Problems bring opportunities for those who can solve them. The housing crisis has created tremendous opportunities for property developers, investors, builders, construction companies and other related sectors both in the short term and in the long term and not only in the New Build but in the secondary market as well. The foreigners can invest in new ventures with local companies like Britnaire and make healthy profits. Currently, the low-end market is very active especially sub £600,000 with help to buy.

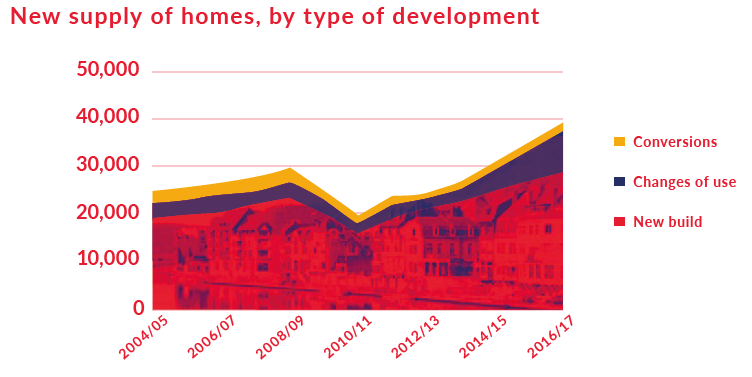

Supply of New Homes in London

According to new figures from the government, London needs to build 66,000 new homes every year to meet demand. The chart below shows a huge gap despite improvement in recent years.

Brexit is already creating a shortage of labour in the construction industry and it will be very hard for any government to fulfil demand for housing in the foreseeable future.

It must be noted that there is oversupply of newly built luxury apartments (above one million price) and a huge shortage of affordable homes.

Infrastructure and Regeneration

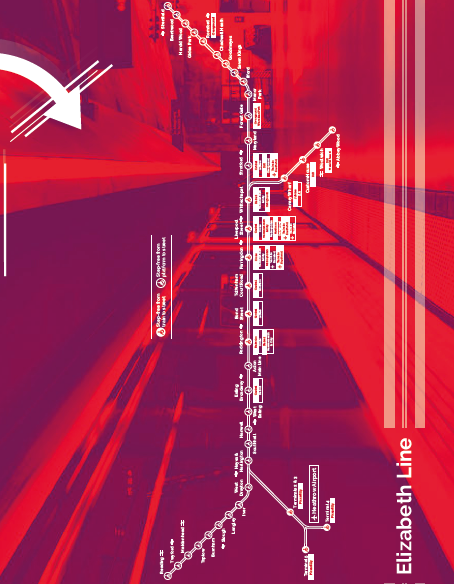

Government is determined to build hundreds and thousands of new homes to house the rising population. It has initiated a number of regeneration and infrastructure developments projects. One of the most important is 118 Km long CrossRail.

The Crossrail London

The Crossrail has created a very big opportunity for investors and prices in the areas covered by the Crossrail has are booming. Slough and East London are among the areas that recorded high price growth due to Crossrail. The areas will keep improving and lack of housing will keep pushing up prices.

Future Forecast

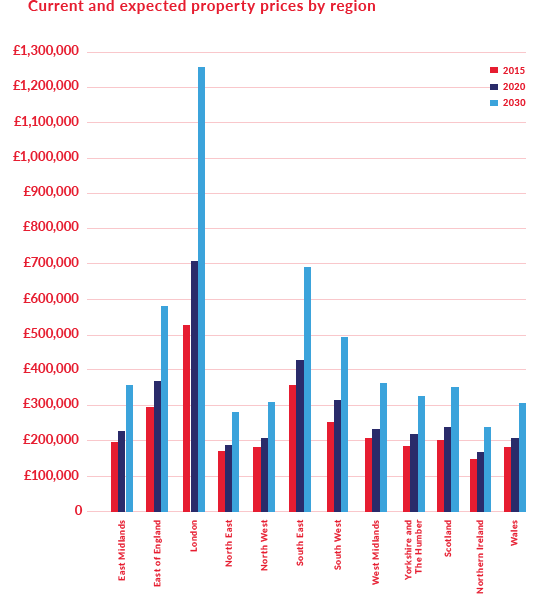

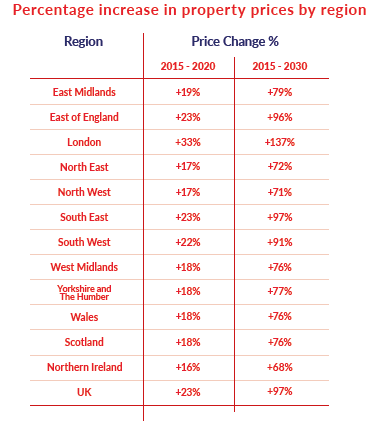

Housing demand tends to increase following an economic boom or rather when leveraging becomes cheaper and drops when the vice versa is the case. Given the fact that newly built homes are in short supply, demand for housing is increasing with time because of increase in population and other factors. So, the trend is towards increase in the prices but the it will not be uniform in all areas. The greatest rise in price is anticipated to be in London and the least rise in Northern Ireland.

Good news for owners at the top end of the market who are dwelling in relatively expensive properties as the projection indicates that the number of properties in the UK valued at least £1000, 000 is anticipated to more than triple as from the present moment and 2030.

London is expected to perform the best over the long term and prices are expected to increase by 137% by 2030 according to research done by Santander bank as shown below.

The project, which is well underway, will increase the capacity of the city’s transport system by 10%, The completion of Crossrail will have a twofold effect on the housing market: the rise of wider regeneration, coupled with significantly reducing commuters travel times to and from the capital every day. Today’s 750,000 existing commuters’ journey times into central London will be reduced by 25% of the current average commute. On completion, over 200 million passengers are expected to travel using Crossrail each year, leading to the creation of central hubs such as Paddington and Farringdon, where extensive public realm programmes are already being prepared and implemented. So far, 57000 new homes have been built and 3.25 Million Square foot of shops and offices space created along the route of Crossrail.

Islamic banking and finance in the UK will benefit immensely from the London property market boom.

Conclusion

In the UK, the residential property exhibits a commendable performance, but prime property surpasses it throughout the entire country. Prime London property considerably beats other portfolios over a longer time span and the most exclusive property reaps the greatest yields. Even though taxation has changed certain returns, the UK continues to enjoy its good placement as compared to other international cities. The transition from the European Union comes along with uncertainty, but the risk is well covered by the reduction in prices and a weaker currency. There is a positive outlook with respect to capital growth in London over the longer term.

Population of London is increasing very fast and in almost every ten years one million more people are added to the population. London faces a severe shortage of homes and construction levels are far below the target. This will keep the demand for housing very strong for the foreseeable future and Prime London market will gain momentum after Brexit.

While investing in UK property, the investors should get full information on recent tax changes and should also take tax advice on how the change will impact them.

UK, especially London offers lot of opportunities for investment in Prime as well as in none prime markets. Due to market uncertainties, vendors are more willing to negotiate, and currency is weaker. Many people don’t want to invest outside prime locations, this is perhaps one of the best times to buy newly built properties because demand is weak and sales volume which makes it buyer’s market and London don’t see that too often. The market is forecast to improve next year.

Government wants the builders to build thousands of new homes every year. It is promoting homeownership for first-time buyers and has initiated schemes like help to buy. Under this scheme, the government provides up to 40% deposit to first time buyers to buy newly built homes.

With all this excitement about the London property market, Islamic investment banks in the capital are also buoyant and one should expect that Islamic banking and finance in the UK will benefit immensely from the London property market boom.