INTRODUCTION

If large number is a matter of pride for Muslims who comprise almost 24% of the global population, they should also be concerned as more than half of the world’s poor reside in the Muslim world. More alarming is the fact that poverty in the Muslim world is continuously increasing. This can have catastrophic effects if not contained timely. A large population of the Muslim majority countries is unbanked and financially excluded for a number of reasons including, but not limited to, poverty, lack of supply of adequate financial services, and religious beliefs. While the first two factors have been analysed extensively by development economists, the last one has just started receiving attention. The focus on religious beliefs stems from the recent success of Islamic banking and finance (IBF).

There are numerous organizations working around the globe with the objective to reduce poverty by providing financial assistance to the poor who do not have access to capital. This financial assistance is provided through microfinance.

Islamic microfinance provides similar services but in a Shari’a-compliant manner. Conventional microfinance products were introduced in last three decades to meet the needs of poor segments of societies but as yet it only reaches less than 20% of its potential market among the world’s three billion or poorer. Furthermore, some recent studies conclude that microfinance has a very low impact on poverty alleviation.

This article investigates Islamic microfinance in Pakistan in the context of IBF. According to Global Islamic Finance Report 2015, Islamic financial assets exceeded US$1.984 trillion at the end of 2014, with microfinance contributing less than 1%.

The growth in Islamic finance unlocks the door for many Muslims whose beliefs preclude them from accepting interest-based finance and fee structures outlawed by Sharia doctrine. It is interesting to note that Islamic finance is not only growing in Muslim-majority countries but also in non-Muslim countries, yet the experts in the industry believe that most of the growth in Islamic finance will come from Asia and Middle East (home to the majority Muslims). Out of the total US$1.984 trillion industry, 88% comes from Muslim-majority countries. Further, among the top 15 countries ranked by Islamic Finance Country Index (IFCI) – an index that ranks countries according to its prominence and development in Islamic banking and finance industry, only 1 country (UK) appears as a non-Muslim country. Countries such as Iran, Malaysia and Saudi Arabia have emerged as leaders in the industry, while other countries like UAE, Bahrain, Bangladesh, Qatar, Turkey, and Pakistan are slowly catching up as they develop their local industries.

Pakistan is among the countries where IBF is developing at an impressive pace, with strong support from the government and the State Bank of Pakistan (SBP). This owes to a number of factors. According to the SBP’s latest Islamic Banking Bulletin, published at the end of 2014, the Islamic banking industry witnessed a phenomenal annual growth of over 23.3%, the Islamic deposits first time crossing a trillion rupee mark reaching Rs1,070 billion by the end of December 2014. Islamic banking assets reached Rs1,259 billion, showing an increase of 24.2% compared to previous year.

ISLAMIC MICROFINANCE

Islamic microfinance accounts for only 1% of the overall Islamic banking and finance industry globally. However experts in the industry believe that its true potential is yet to be reached and only with education and awareness, its benefits can be achieved. In the six countries with the largest Muslim populations (Indonesia, India, Pakistan, Bangladesh, Egypt and Nigeria) half a billion people live on less than US $2 per day.

Conventional microfinance is well developed with huge outreach across the globe.

In Pakistan, conventional microfinance emerged almost three decades ago and has witnessed sustainable growth since then. However, many experts believe that it has failed to produce desired results in terms of poverty alleviation. A number of factors must have contributed to this failure but it may very well be the case that the high-interest rates charged by microfinance lenders have not been helpful in income generation and its fairer distribution. According to some high-profile microfinance practitioners in the country, microfinance is the most lucrative form of banking. It is a ruthless business disguised in charity.

The government of Pakistan has brought numerous policies into the system including facilitation of legal and regulatory frameworks, Khushhali Bank Foundation, and restructuring of Microfinance Programme (MFP) to strengthen the microfinance sector in the country. There has been strong support from SBP and multilateral organisations to accelerate microfinance services, but still a very small portion of potential microfinance demand is being met. To encourage Islamic microfinance, SBP has allowed establishment of full-fledged Islamic microfinance banks, Islamic microfinance services by full-fledged Islamic banks and Islamic microfinance divisions within conventional microfinance banks.

Pakistan is a country with huge potential for the growth of Islamic microfinance, as about 70% of the total population of the country is unbanked. The current government and SBP are also promoting and facilitating Islamic finance in the country, and a Deputy Governor in charge of Islamic banking at SBP is also looking after its financial inclusion programme. The government is serious about promoting microfinance in general and Islamic microfinance in particular. However, most of the players, both Islamic and conventional, are at best opportunistic with their own hidden agendas.

A recent study conducted by Edbiz Consulting and supported by SBP revealed the huge demand for Islamic banking and finance in the country. It is the first known initiative of its kind, the study quantified the demand for Islamic banking in the country both for retail and corporate customers and identified demand-supply gaps. The demand for Islamic banking in the country is evenly distributed amongst rural and urban areas, varied income strata and education levels. It also highlighted a huge opportunity for Islamic microfinance in rural areas. The major potential sector of microfinance in rural areas, Small and Medium Enterprises (SMEs) and agriculture have got huge financing needs, the report suggested.

| INSTITUTIONS | GLP (PKR) | BORROWERS | BRANCHES | EMPLOYEES | DISBURSEMENTS 2013-2014 (PKR) |

| Aas Foundation | 8,814,150 | 515 | 3 | 73 | 6,750,000 |

| Akhuwat | 9,227,251,842 | 567,525 | 261 | 1,742 | 4,351,452,100 |

| Asasah | 38,419,110 | 1,334 | 8 | 26 | 38,419,110 |

| Care Starz | 6,276,980 | 205 | 2 | 7 | 3,084,230 |

| Haral Bunyad | 24,162,174 | 1,740 | 1 | 4 | 2,499,174 |

| HHRD Esaar Microfinance | 386,523,140 | 13,893 | 25 | 52 | 121,291,366 |

| Islamic Relief Pakistan | 287,500,000 | 11,500 | 3 | 18 | 54,544,801 |

| Kashf Foundation | 88,344,000 | 3,567 | 8 | 86 | 88,344,000 |

| Kawish Welfare Trust | 8,250,000 | 1,650 | 2 | 7 | 1,460,000 |

| Muslim Aid Pakistan | 87,484,195 | 5,472 | 2 | 11 | 24,075,000 |

| Naymet Trust | 75,000,000 | 7,500 | 6 | 17 | 25,000,000 |

| NGO World Foundation | 7,000,000 | 200 | 1 | 6 | 3,500,000 |

| NRDP | 8,500,000 | 850 | 1 | 3 | 6,160,000 |

| Sungi Development Foundation | 28,150,000 | 2,815 | 4 | 38 | 28,150,000 |

In February 2015, SBP launched the UKAID-funded 3rd Financial Innovation Challenge Fund that attempts to promote Islamic microfinance. The central bank sought proposals for grants to test solutions for delivering low-cost Islamic microfinance services in the country. There is a strong need to educate the people on Islamic finance in general and Islamic microfinance in particular to promote the sector in the country.

Because of the regulator’s active role in promoting microfinance, Islamic microfinance has started establishing itself as a tool for reducing poverty with support of several private ventures in the country. An important player is Islamic Microfinance Network (IMN), which is working for development and promotion of Islamic microfinance. It was established by some private sector organizations. However, it is still in its early days and hence its impact and benefits cannot be quantified at this stage. Government has started taking some initiatives to promote Islamic microfinance in the country and the most recent example is the Prime Minister’s Interest-Free Loan Scheme (Qarz-e-Hasan), introduced for the extremely poor segment of the society. Pakistan Poverty Allocation Fund (PPAF) was chosen to administer the funds and capacity building of Partners Organizations who will directly disburse the funds to the gross root level. Another major initiative is Youth Loan Programme conducted by the Government of Pakistan through the National Bank of Pakistan and the First Women Bank. The prime objective of this fund is to promote SME activities in the country with a very low mark-up rate being paid by the government of Pakistan.

MAJOR ISLAMIC MICROFINANCE PLAYERS IN PAKISTAN

There are around 15 major organizations in private sector endeavouring to bring the Shari’a-compliant modes of financing in the market, including Akhuwat, Kashf Foundation, Naymet Trust, Muslim Aid Pakistan, Islamic Relief Pakistan, Kawish Welfare Trust, Essar Foundation and Sungi Development Foundation. In addition to the government support, social sector has taken some positive steps to promote Islamic microfinance in the country. Akhuwat is the largest microfinance provider in the country. Although it has significant impact through its interest-free lending, it is also a fact that its promoters have exaggerated its success. Founded in 2001, its model is based on donations and philanthropy. Akhuwat claims to have more than 300,000 active borrowers, with total beneficiaries to date of around 830,000. About 40% of them are women. They have extended their network in all four provinces along with Gilgit-Baltistan and AJK and their total branches have crossed 300 in more than 200 cities and towns. The core product Akhuwat started with is Qarz- e-Hasan, i.e., interest-free loans with easy repayment options to their clients. There is no fee associated with the loans and they have 99% recovery rate. Their recovery rate needs scrutiny, as it might very well be the case that they are disguising it through rollover loans.

Akhuwat also offers loans for relieving people in debt, for education, medical treatment and marriage expenses.

Punjab is the main hub of Islamic microfinance institutions and practitioners where 76% of the total Islamic microfinance institutions operate. Other provinces feature marginally in this respect, with Khyber Pakhtunkhwah (KPK) and Sindh having a shares of 12% and 4%, respectively. In terms of recent growth of Islamic microfinance, KPK tops the list with 147% growth in in 2013 -2014. In Punjab and Sindh, the corresponding figures are 47% and 50%, respectively. Baluchistan, the troubled province in terms of law and order and security threats has experienced decrease in microfinance activities.

EVOLVING ISLAMIC MICROFINANCE INDUSTRY IN PAKISTAN

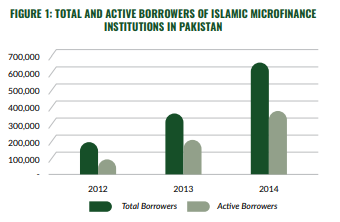

As per the latest statistics available of June 2014 from all Islamic microfinance institutions, the total number of active borrowers have increased enormously from 2013 with more than 60% increase in total and active borrows (see Figure 1 below). The industry experts relate this high growth with few developments. The primary reason for this growth is launch of the Prime Minister’s Interest-Free Loan Scheme, which has resulted in many conventional microfinance providers adding an Islamic microfinance portfolio to their operations. The other factor could be that some of the conventional microfinance providers have, in recent years, either partially or entirely converted their product portfolio from that of conventional microfinance to Islamic microfinance.

Most Islamic microfinance institutions gets funding from local agencies, including the government, fellow Islamic microfinance institutions, and other individual and organizational donors. In addition, some microfinance institutions receive funding from their sister concerns internationally, such as Islamic Relief Pakistan, HHRD and Muslim Aid Pakistan. It is also reported that a large chunk of donations come from individuals based outside the country.

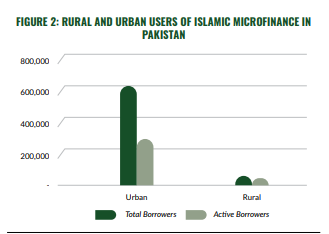

One of the key factors that should be considered by the major stakeholders and the government is to enhance Islamic microfinance penetration in rural sector. At present, the urban region in the country constitute 96% of the industry Gross Loan Portfolio (GLP) whereas the rural areas account for only 4% of the GLP, whereas the active loan portfolio of the sector currently stands at about 7% in the rural areas (see Figure 2). For a country like Pakistan where over 67% of the population lives in rural areas, the observed figures mean that there is a huge vacuum for Islamic microfinance services that still needs to be filled. There could be hindrances in the operations and growth of Islamic microfinance institutions at rural level but this has to be tackled seriously by the people involved in policy matters and decision-making so that rural areas should have an outreach to the Islamic microfinance.

Islamic microfinance services still needs to be filled. There could be hindrances in the operations and growth of Islamic microfinance institutions at rural level but this has to be tackled seriously by the people involved in policy matters and decision making so that rural areas should have an outreach to the Islamic microfinance.

INDUSTRY ANALYSIS

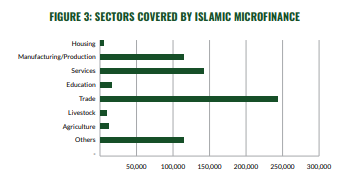

In the following we will have an overview of the sectors being supported by Islamic microfinance institutions in the country. It is not surprising to note that trade, services and manufacturing & production are three top industries being supported by Islamic microfinance institutions in Pakistan, accounting for 79% of the industry loans.

This coverage must be looked into in the context of Pakistan economy, which is primarily based on agriculture. Around 70% of population is directly or indirectly dependent on agriculture. It is, however, a huge omission on part of Islamic microfinance that at present provide only 1% of financing to agriculture. Another related sector, i.e., livestock, receives even less than 1% of financing. This is actually a general trend in microfinance in Pakistan, which has by and large ignored rural areas. Figure 3 shows the sectoral breakdown of Islamic microfinance.

There are a number of challenges that face Islamic microfinance in the country.

The most important aspect is the regulation of Islamic microfinance sector in Pakistan. Islamic microfinance has established itself as a major sector and yet it is unregulated. SBP regulates microfinance banks only. As non-bank institutions conduct most of Islamic finance activities, they do not fall under the privy of SBP. This vacuum of regulation is not in favour of further development of Islamic microfinance in Pakistan. There is a definite need for a comprehensive regulatory framework for Islamic microfinance, and in this respect, the most suited regulator is none other than SBP. Secondly, the average cost of disbursement of Islamic microfinance is comparatively high when compared to the other financial institutions in the country. Average loan size of Islamic microfinance is around Rs20,000 whereas the administrative cost per loan is around Rs1,600 and the average cost per rupee lent for the industry is Rs0.19. This may be because of the small average loan size and the institutions have just started offering Islamic microfinance services. Whatever is the case but the fact remains that Islamic microfinance happens to be costly, and there is a need to bring the costs down.

One of the reasons that Akhuwat has been successful in microfinance is their flagship product based on interest-free loans. There is a need to further develop this concept and more players are introduced in the market. The cost of disbursement in case of an interest-free loan is significantly lower than other alternatives. Hence, there is no better model than practicing interest-free loans.