INTRODUCTION

Availability of affordable housing is an important requirement for a country with a growing young population to sustain the economic development and the standard of living of its populace. About 50% of the population of the Sultanate of Oman is aged 24 and under. Thus; representing a high demand for affordable housing and other amenities required for modern urban living. In its recently published report Kuwait Financial Centre reports “Demand for affordable housing in Gulf Cooperation Council (GCC) states is estimated to be high and the ever-widening gap between the demand and supply of affordable housing is pressing the GCC governments to have an urgent look at the issue”.

Most of the housing demand in the GCC and the Sultanate is for housing in urban areas. Increased initiatives by GCC economies to diversify their earning sources and growth in per capita GDP is expected to attract more and more population to the urban areas resulting in expansion of cities and demand for affordable urban housing. According to a study in 2011 by consultancy Jones Lang LaSalle (JLL) the total housing shortfall in Oman was around 15000 housing units. With preference of the local population to live in detached villas, demographics and increase in employment the demand is expected to rise.

There are many challenges to the affordable housing industry in the GCC which include high prices of Land, scarcity of developable land in urban areas, affordable credit terms, volatility in prices of the building materials, shrinking margin for developers, matching growth provision of civic amenities in newly developed areas, etc.

Some studies point to the fact that a more holistic approach needs to be taken for resolving the issue of housing shortage encompassing financial, cultural, social, economic, planning and regulatory factors into consideration. A study by Strategy& pointed out that securing mortgage financing is a key constraint for potential home buyers; this is majorly due to weak access to home financing and strict requirements.

The housing finance market is a natural territory for Islamic finance in the sense that its requirements are perfectly aligned with the form and structure of Islamic financial contracts which require a physical asset to be financed through trade or equity based modes. This is evident from the large exposures of Islamic banks across the globe in housing finance sectors. Another main reason for this is the preference of the Muslim populace to finance their abodes in a manner which is free from Riba. The provision of Islamic banking services in the Sultanate of Oman started around two years ago. The situation of Islamic banks in the Sultanate is more glaring with regards to high exposures to the real estate and housing sectors. With certain Islamic banks having housing finance portfolio much larger than the corporate financing book; even the corporate financing book is largely tilted high concentration risk.

Another major issue that is evident is that the nature of Islamic Banking deposits in the Sultanate is largely short-term in nature. Hence the Housing and real estate financing which is l long-term in nature; with tenors ranging from ten years or more; are being financed through short-term funding. This represents the asset-liability mismatch with an asset book of illiquid assets which will force the Islamic banks to rely on wholesale interbank sources in case of large withdrawals. With the underdeveloped Islamic interbank market in the Sultanate, non-availability of liquid management instruments like sukuk and restriction on excess to Shari’a compliant funding from conventional banks the raising of liquidity and emergency funding will be an uphill task.

In addition to this a major source of liquidity and reliable deposits to the Omani banking sector are the government-owned entities. However with falling oil prices and the budget deficit this source of reliable liquidity is expected to dry up. Hence Islamic Banks will find it difficult to sustain the required Asset to Deposit Ratios(ADR).

CAN ISLAMIC FINANCIAL ENGINEERING HELP?

The situation described above is likely to exacerbate the supply of affordable mortgage finance and ultimately effect the access to affordable housing. The situation requires a win-win solution for the financial and the housing industry at the same time. Does the current Islamic Finance landscape provide such a solution? Or can the Omani Islamic banking industry learn from its more experienced peers in the region and across the globe? The answer cannot be found in the current Islamic finance practices in either the GCC or Islamic finance centers across the globe.

Hence the industry needs to innovate on its own or try out successful models from the conventional finance world which can be structured to comply with Shari’a principles. The innovation in Islamic finance space has toward the real estate sector with financing developers and the construction sector. This shows that the Islamic Banks are exposed to failed to keep pace with its conventional counterpart during the past decade with Islamic finance majorly relying on various forms of the basic commodity murabaha, sale and lease back and other plain vanilla financing techniques.

The dynamic nature of Islamic finance principles and Fiqh concepts allow unlimited possibilities of financial innovation and engineering to solve the economic and financial problems currently being faced by Muslim countries. One such approach could be to try out successful conventional models which can be adapted to Islamic finance through innovation in a manner that the model fits naturally to the Shari’a requirements without any controversial corner cuttings to obtain the Shari’a justification.

Mortgage refinancing securitization is one such concept which can be easily adapted to Islamic finance to resolve the problems and issues being faced by the Islamic banking and housing industry in the countries like Oman. The concept has been successfully implemented in the United States and other countries with a far-reaching positive impact on the financial sector, economic growth and availability of affordable housing. Some might argue that mortgage refinance securitization was partly to be blamed for the sub-prime financial crises; but closer analysis would reveal that the involvement of transactions such as Credit Default Swaps, imprudent credit practices, sub-prime lending and derivatives which have no direct link with mortgage securitization were the direct cause of the financial crises highlighting the deficiency in regulation and greed as being the cause of the financial chaos rather than the practice of securitization.

The question that arises at this stage is whether can the practice of mortgage refinance securitization be applied to Islamic finance. To answer this question we first need to look at the Shari’a non-compliance aspects involved in conventional mortgage securitization.

Following two core issues render such forms of securitization as non-compliant:

- Bay Al Dayn or Sale of Debt when the Originators sell the receivables to the Issuer and when the securities issued by the Issuer are sold in the secondary market.

- Riba-based cash flow streams at the originator level as well as from the income stream of the issued securities.

There is one example from Malaysia where this form of mortgage refinance securitization has been attempted in Islamic finance by a Sukuk issued in 2013. However the structure used multiple commodity murabaha transactions on behalf of sukuk holders to generate liquidity which was then used to purchase mortgage assets by the Issuer from the originators. As a result the structure suffers from the following Shari’a issues:

- Bay Al Dayn or Sale of Debt since the issued sukuk represents the ownership in commodity murabaha receivables; the trading of such instruments is not

approved by a number of scholars globally and is not in line with AAOIFI Shari’a standards.

- Secondly the cash flow stream and income for the sukuk holders is generated from commodity murabaha transactions which is again subject to criticism by various scholars and not viable for jurisdictions like Oman where there are regulatory restrictions regarding its use.

IDEAL SHARI’A COMPLIANT STRUCTURE FOR SHARI’A COMPLIANT MORTGAGE SECURITIZATION:

Creation of SPV:

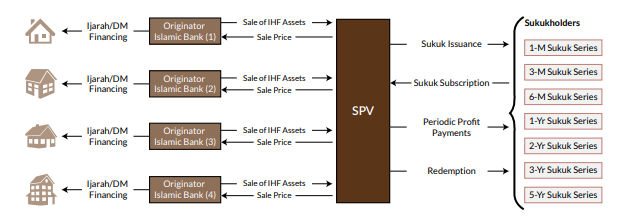

Along the lines of Freddie Mac and Fannie Mai as is the case in the United States a special purpose vehicle (SPV) should be created for the purpose of issuing sukuk from time to time. The company can be created either as fully owned entity of the government or through public and private partnership or with equity of several government entities like Oman Housing Bank, Ministry of Finance, etc.

The SPV shall outline the criteria for purchasing Islamic Housing Financing assets/properties from Islamic Banks financed either through the modes of Ijarah, Ijarah Mawsufah fi Dhimmah or Diminishing Musharakah. Financing based on Murabaha cannot be purchased by the SPV since that would tantamount to sale of debts. The criteria shall outline the quality of assets in terms of risk, return, security, etc. which shall qualify the asset to be purchased by the SPV.

The criteria shall more or less be equivalent to the prevailing credit criteria as per the regulation.

Origination

Based on this criteria the Islamic Banks as originators shall provide Shari’a-compliant Housing financing to customers across the country. Upon building sizable portfolios Islamic banks shall be free to sell these assets to the SPV through a sale agreement. The sale of these assets shall not tantamount to sale of debt since the underlying assets that would be sold will be the housing assets and properties owned by the Islamic banks and leased to their individual housing customers.

Pricing Issue: The price at which these assets will be purchased by the SPV can be the outstanding Book Value of the asset or the Value of the Discounted Cash Flows (DCF) that the asset is expected generate in future; discounted based on the prevailing market profit rates. Hence if the DCF model is used the asset might be purchased at a discount or a premium from the Book Value.

Accounting Treatment: Since this will involve a True Sale the assets will move from the Balance Sheet of the originator Islamic Banks to the Balance Sheet of the SPV. The Islamic Bank will get the selling price in return.

Issuance of Sukuk

The SPV shall continue to buy these housing finance assets from Islamic Banks and build a sizable asset pool. To finance this asset pool the SPV shall issue sukuk certificates representing undivided ownership share in the underlying housing finance assets of the asset pool. The sukuk of various short and long-term tenors can be issued for instance 1 month, 3 months, 6 months, 1 Year, 2 Year, 5 years, etc. based on the market requirements.

The return on the sukuk shall be based on the performance of the underlying housing finance assets that is the rentals earned through the underlying Ijarah and Diminishing Musharakah contracts. Any default in payment or destruction of the underlying asset will result in a negative impact on the cash flow earnings of the sukuk.

FOR ISSUING THE SUKUK THE SPV CAN USE THE FOLLOWING OF THE TWO METHODS

One Pool Model

The SPV can group all the assets into one large pool and issue sukukof different maturities from the same pool. In this case all the sukuk holders of different maturities will be musharakah partners to each other. For distributing profits to these sukuk holders different weightages or profit-sharing ratios will need to be assigned so that the profits earned from the pool are distributed to each type of sukuk as per the agreed ratio. Losses arising on the pool shall be shared by all sukuk holders as per their pro rata investment in the pool.

Multiple Pool Model

Alternatively the SPV can group the housing finance assets purchased from the SPV into various different pools of assets for instance pool A, B, and C based on the quality of the assets in terms of risk, rate of return and tenor. Subsequently sukuk of different ratings and tenor can be issued representing undivided ownership in the underlying assets of that particular pool. Hence different types of rating can be assigned based on the quality of the underlying assets and security features. With this mechanism different sukuk catering to different segments of the market based on tenor, rating, profit rate, etc. can be issued.

INTRODUCTION

Availability of affordable housing is an important requirement for a country with a growing young population to sustain the economic development and the standard of living of its populace. About 50% of the population of the Sultanate of Oman is aged 24 and under. Thus; representing a high demand for affordable housing and other amenities required for modern urban living. In its recently published report Kuwait Financial Centre reports “Demand for affordable housing in Gulf Cooperation Council (GCC) states is estimated to be high and the ever-widening gap between the demand and supply of affordable housing is pressing the GCC governments to have an urgent look at the issue”.

Most of the housing demand in the GCC and the Sultanate is for housing in urban areas. Increased initiatives by GCC economies to diversify their earning sources and growth in per capita GDP is expected to attract more and more population to the urban areas resulting in expansion of cities and demand for affordable urban housing. According to a study in 2011 by consultancy Jones Lang LaSalle (JLL) the total housing shortfall in Oman was around 15000 housing units. With preference of the local population to live in detached villas, demographics and increase in employment the demand is expected to rise.

There are many challenges to the affordable housing industry in the GCC which include high prices of Land, scarcity of developable land in urban areas, affordable credit terms, volatility in prices of the building materials, shrinking margin for developers, matching growth provision of civic amenities in newly developed areas, etc.

Some studies point to the fact that a more holistic approach needs to be taken for resolving the issue of housing shortage encompassing financial, cultural, social, economic, planning and regulatory factors into consideration. A study by Strategy& pointed out that securing mortgage financing is a key constraint for potential home buyers; this is majorly due to weak access to home financing and strict requirements.

The housing finance market is a natural territory for Islamic finance in the sense that its requirements are perfectly aligned with the form and structure of Islamic financial contracts which require a physical asset to be financed through trade or equity based modes. This is evident from the large exposures of Islamic banks across the globe in housing finance sectors. Another main reason for this is the preference of the Muslim populace to finance their abodes in a manner which is free from Riba. The provision of Islamic banking services in the Sultanate of Oman started around two years ago. The situation of Islamic banks in the Sultanate is more glaring with regards to high exposures to the real estate and housing sectors. With certain Islamic banks having housing finance portfolio much larger than the corporate financing book; even the corporate financing book is largely tilted high concentration risk.

Another major issue that is evident is that the nature of Islamic Banking deposits in the Sultanate is largely short-term in nature. Hence the Housing and real estate financing which is l long-term in nature; with tenors ranging from ten years or more; are being financed through short-term funding. This represents the asset-liability mismatch with an asset book of illiquid assets which will force the Islamic banks to rely on wholesale interbank sources in case of large withdrawals. With the underdeveloped Islamic interbank market in the Sultanate, non-availability of liquid management instruments like sukuk and restriction on excess to Shari’a compliant funding from conventional banks the raising of liquidity and emergency funding will be an uphill task.

In addition to this a major source of liquidity and reliable deposits to the Omani banking sector are the government owned entities. However with falling oil prices and the budget deficit this source of reliable liquidity is expected to dry up. Hence Islamic Banks will find it difficult to sustain the required Asset to Deposit Ratios(ADR).

CAN ISLAMIC FINANCIAL ENGINEERING HELP?

The situation described above is likely to exacerbate the supply of affordable mortgage finance and ultimately effect the access to affordable housing. The situation requires a win-win solution for the financial and the housing industry at the same time. Does the current Islamic Finance landscape provide such a solution? Or can the Omani Islamic banking industry learn from its more experienced peers in the region and across the globe? The answer cannot be found in the current Islamic finance practices in either the GCC or Islamic finance centers across the globe.

Hence the industry needs to innovate on its own or try out successful models from the conventional finance world which can be structured to comply with Shari’a principles. The innovation in Islamic finance space has toward the real estate sector with financing developers and the construction sector. This shows that the Islamic Banks are exposed to failed to keep pace with its conventional counterpart during the past decade with Islamic finance majorly relying on various forms of the basic commodity murabaha, sale and lease back and other plain vanilla financing techniques.

The dynamic nature of Islamic finance principles and Fiqh concepts allow unlimited possibilities of financial innovation and engineering to solve the economic and financial problems currently being faced by Muslim countries. One such approach could be to try out successful conventional models which can be adapted to Islamic finance through innovation in a manner that the model fits naturally to the Shari’a requirements without any controversial corner cuttings to obtain the Shari’a justification.

Mortgage refinancing securitization is one such concept which can be easily adapted to Islamic finance to resolve the problems and issues being faced by the Islamic banking and housing industry in the countries like Oman. The concept has been successfully implemented in the United States and other countries with far reaching positive impact on the financial sector, economic growth and availability of affordable housing. Some might argue that mortgage refinance securitization was partly to be blamed for the sub- prime financial crises; but closer analysis would reveal that the involvement of transactions such as Credit Default Swaps, imprudent credit practices, sub-prime lending and derivatives which have no direct link with mortgage securitization were the direct cause of the financial crises highlighting the deficiency in regulation and greed as being the cause of the financial chaos rather than the practice of securitization.

The question that arises at this stage is that can the practice of mortgage refinance securitization be applied to Islamic finance. To answer this question we first need to look at the Shari’a non-compliance aspects involved in conventional mortgage securitization.

Following two core issues render such forms of securitization as non-compliant:

- Bay Al Dayn or Sale of Debt when the Originators sell the receivables to the Issuer and when the securities issued by the Issuer are sold in the secondary market.

- Riba-based cash flow streams at the originator level as well as from the income stream of the issued securities.

There is one example from Malaysia where this form of mortgage refinance securitization has been attempted in Islamic finance by a Sukuk issued in 2013. However the structure used multiple commodity murabaha transactions on behalf of sukuk holders to generate liquidity which was then used to purchase mortgage assets by the Issuer from the originators. As a result the structure suffers from the following Shari’a issues:

- Bay Al Dayn or Sale of Debt since the issued sukuk represents the ownership in commodity murabaha receivables; the trading of such instruments is not approved by a number of scholars globally and is not in line with AAOIFI Shari’a standards.

- Secondly the cash flow stream and income for the sukuk holders is generated from commodity murabaha transactions which is again subject to criticism by various scholars and not viable for jurisdictions like Oman where there are regulatory restrictions regarding its use.

IDEAL SHARI’A COMPLIANT STRUCTURE FOR SHARI’A COMPLIANT MORTGAGE SECURITIZATION:

Creation of SPV:

Along the lines of Freddie Mac and Fannie Mai as is the case in the United States a special purpose vehicle (SPV) should be created for the purpose of issuing sukuk from time to time. The company can be created either as fully owned entity of the government or through public and private partnership or with equity of several government entities like Oman Housing Bank, Ministry of Finance, etc.

The SPV shall outline the criteria for purchasing Islamic Housing Financing assets/properties from Islamic Banks financed either through the modes of Ijarah, Ijarah Mawsufah fi Dhimmah or Diminishing Musharakah. Financing based on Murabaha cannot be purchased by the SPV since that would tantamount to sale of debts. The criteria shall outline the quality of assets in terms of risk, return, security, etc. which shall qualify the asset to be purchased by the SPV.

The criteria shall more or less be equivalent to the prevailing credit criteria as per the regulation.

Origination

Based on this criteria the Islamic Banks as originators shall provide Shari’a-compliant Housing financing to customers across the country. Upon building sizable portfolios Islamic banks shall be free to sell these assets to the SPV through a sale agreement. The sale of these assets shall not tantamount to sale of debt since the underlying assets that would be sold will be the housing assets and properties owned by the Islamic banks and leased to their individual housing customers.

Pricing Issue: The price at which these assets will be purchased by the SPV can be the outstanding Book Value of the asset or the Value of the Discounted Cash Flows (DCF) that the asset is expected generate in future; discounted based on the prevailing market profit rates. Hence if the DCF model is used the asset might be purchased at a discount or a premium from the Book Value.

Accounting Treatment: Since this will involve a True Sale the assets will move from the Balance Sheet of the originator Islamic Banks to the Balance Sheet of the SPV. The Islamic Bank will get the selling price in return.

Issuance of Sukuk

The SPV shall continue to buy these housing finance assets from Islamic Banks and build a sizable asset pool. To finance this asset pool the SPV shall issue sukuk certificates representing undivided ownership share in the underlying housing finance assets of the asset pool. The sukuk of various short and long-term tenors can be issued for instance 1 month, 3 months, 6 months, 1 Year, 2 Year, 5 years, etc. based on the market requirements.

The return on the sukuk shall be based on the performance of the underlying housing finance assets that is the rentals earned through the underlying Ijarah and Diminishing Musharakah contracts. Any default in payment or destruction of the underlying asset will result in a negative impact on the cash flow earnings of the sukuk.

FOR ISSUING THE SUKUK THE SPV CAN USE THE FOLLOWING OF THE TWO METHODS

One Pool Model

The SPV can group all the assets into one large pool and issue sukukof different maturities from the same pool. In this case all the sukuk holders of different maturities will be musharakah partners to each other. For distributing profits to these sukuk holders different weightages or profit-sharing ratios will need to be assigned so that the profits earned from the pool are distributed to each type of sukuk as per the agreed ratio. Losses arising on the pool shall be shared by all sukuk holders as per their pro rata investment in the pool.

Multiple Pool Model

Alternatively, the SPV can group the housing finance assets purchased from the SPV into various different pools of assets for instance pool A, B, and C based on the quality of the assets in terms of risk, rate of return and tenor. Subsequently, sukuk of different ratings and tenor can be issued representing undivided ownership in the underlying assets of that particular pool. Hence different types of rating can be assigned based on the quality of the underlying assets and security features. With this mechanism, different sukuk catering to different segments of the market based on tenor, rating, profit rate, etc. can be issued.

Under this mechanism, there will be no musharakah partnership among the various grades of sukuk since each grade has an ownership in separate pool of assets. Hence the loss in one pool of assets will only have to be borne by the sukuk holders of that grade or pool; sukuk holders of other pools will be secure from the impact of such losses. This technique of creating separate pools has its own benefits and pitfalls the decision regarding which model to use depends on the operational effectiveness and market segment requirements.

Maturity of each sukuk tranche

Upon maturity of each sukuk tranche the maturing sukuk holders will sell their share in the underlying pool of assets to the SPV at the fair value of their share in the underlying asset pool. This shall be calculated as follows:

Fair Value of Share = Initial Investment + Accrued and unpaid profit share – Losses/costs if any.

To fund this redemption SPV can either use funds from its equity or use the excess liquid funds of the pool which are generated from the maturity of the individual housing assets. In case of latter since the funds in the pool are owned by the existing sukuk holders the SPV would be purchasing the share of the maturing sukuk holders on behalf of the remaining sukuk holders and hence the share of the remaining sukuk holders would increase which may be sold to new group of sukuk holders upon new issuances. Alternatively, the SPV can issue a new sukuk series of the same amount; in this case the new sukuk holders would purchase the share of the maturing sukuk holders. In case the new sukuk cannot be issued or there is a shortfall in sukuk subscription the deficit amount can be funded by the SPV through Shari’a-compliant funding from the market until this shortfall is plugged through further new issuances.

Liquidity for Islamic banks

Upon selling their originated assets the Islamic banks will get their liquidity in form of sale price; from this newly released liquidity, Islamic banks can provide new Shari’a-compliant housing finance to eligible customers. Upon successful origination, the Islamic banks can further sell these assets to the SPV for further securitization. The question arises over here that why would Islamic banks sell their hard-earned assets to the SPV and lose their long-term earning assets. Ceteris Paribus the answer is they would not. However given the market conditions in the GCC and Oman with high exposure of Islamic Banks to real estate and housing sector, low deposit generation, asset liability term mismatches and restrictions to the asset-to-deposit ratio it would be prudent for Islamic Banks to sell these assets and unfreeze their liquidity. The proposition would seem all the more attractive since this mechanism would also provide Islamic banks to earn risk fee income by servicing their originated assets even after the sale to the SPV. This opportunity will result from the fact that the contact point of the end housing finance customer would still be the Islamic banks which had originated the financing. Hence to collect the cash flows on purchased assets the SPV will have to employ the originator Islamic banks as the Wakeel or agent to manage the assets for the purpose of collecting rental periodic payments, correspondence with the customers and other such issues. For these services the Islamic banks can charge a Wakalah Service Fee at a certain percentage of the collected amount. Hence this will open a new source of income for the Islamic banks.

ECONOMIC AND SOCIAL BENEFITS Availability of excess liquidity for affordable housing finance

The Islamic housing finance securitization model as discussed above would result in the release of excess liquidity in the market which can be channeled to originate yet more housing finance assets. This would result in sufficient supply of affordable funding available to home buyers in the market thereby increasing the access to mortgage finance which is defined as one of the main reasons in shortage of affordable housing. Hence it will ultimately lead to increase in home ownership within the country

Investment opportunities and participative development

The sukuk issued from this activity will provide investment opportunities to the various segments of the economy ranging from households, corporates, mutual funds, investment companies etc. This will be possible since the sukuk can be issued of various small and large denominations enabling various segments to invest in real estate sector which would not have been possible without such issuances since amounts involved would be much higher.

Development of Islamic Secondary market and interbank market

Along with the investment opportunities and the economically efficient denominations the sukuk certificates will be freely tradable in the secondary market and will not result in sale of debt or Bai al Dayn since the sukuk would represent the proportionate ownership for the holder in the underlying assets. This would bring an additional liquidity feature to these investments by allowing investors to sell these securities in the market making it more attractive. Hence this would lead to the development of an efficient secondary market for these securities.

Better management of term risk by Islamic Banks

These sukuk certificates would also be an attractive investment for Islamic banks since due to their liquid nature the investments will allow the Islamic banks to better manage their asset-liability term risk. Additionally the trading of these sukuk between Islamic banks will lead to the development of active secondary and Islamic interbank market in the Sultanate and hence the development of the Islamic financial industry. The Islamic banks would be able to use these certificates to get funding from other Islamic banks by pledging these certificates in case of liquidty requirements. The instruments could also be used by the regulator to develop a Shari’a-compliant financier of last resort facility.

Off Shore sale of sukuk foreign investment

The mortgage sukuk certificates with high ratings would also be an effective vehicle to attract foreign investments from global hedge funds, Shari’a-compliant mutual funds, Islamic banks from across GCC as well as globally, etc. Thereby paving the way for the Sultanate to be at the forefront of development in Islamic finance and boosting its credentials to be the global destination for Islamic investments in the region and beyond; at a time when different cities from East to West are vying for the coveted crown to be the global hub of Islamic finance.