Dr. Nafis Alam, Associate Professor, Nottingham Unversity Business School (NUBS)

Exchange Traded Funds (ETFs) emerged as one of the most innovative financial market instruments of the 20th century and have provided investors the advantage of risk diversification, index tracking, all-day trading, strategic trading capability, tax efficiency, lowest fees, and transparent holdings (Carty, 2001). According to Ferri (2008), ETFs marked an imperative investment revolution that began in 1924 with the first open-end mutual fund offering. In the wake of the market crash of 1987, and by request of the law firm of Leland, O’Brien and Rubinstein, the U.S. Securities and Exchange Commission started reviewing and rewriting securities regulations to facilitate a novel kind of exchange-traded vehicle. In 1990, the SEC issued the Investment Company Act Release No. 17809, which ultimately paved the way for the formation of mutual funds that allowed for share creation and redemption during the day (Ferri, 2008). In 1993, ETFs were first introduced in the U.S. by State Street Global Advisors to track the S&P 500 index (Carrel, 2008).

ETFs are listed and therefore their units can be bought and sold anytime during stock exchange trading hours. Investors buy and sell ETF units through their stockbroker rather than through unit trust agents. Most ETFs have passively managed index funds although there is ongoing work being done to create enhanced and actively managed ETFs. In the managing of index funds passively, managers do not pick stocks based on fundamental analysis. Instead, managers aim to track the performance of a benchmark index.

ETFs are assumed to be more cost-efficient than actively managed mutual funds due to their passive investing character. They are also more cost-efficient compared to many open-ended index mutual funds. In a study conducted by Dellva (2001) , compared the expense components of Standard & Poor’s Depositary Receipts (SPDRs) and Barclay’s iShares S&P 500 from the bundle of ETFs and the Vanguard index mutual fund. The author exhibits a significant advantage of ETFs with respect to annual expenses, even though they experience transaction costs, commissions paid to brokerage firms and impacted by the bid-ask spread effect. Bernstein (2002) contradicts Dellva (2001) by claiming that the cost advantage of ETFs are diminished by the trend of investors who liquid their shares very frequent.

With the rapid growth of Islamic finance, there has been an emergence of Shari’a-compliant ETFs which seek to provide investment opportunities beyond the existing pool of investment for Muslim investors and ethical investors as part of its integration process into the international financial system. While there had been unprecedented growth of the conventional ETFs, Shari’a-compliant ETFs found their rightful place only in February 2006 when the Dow Jones Islamic Market (DJIM) Turkey ETF was listed on the Istanbul Stock Exchange to track the performance of the DJIM Turkey Index. IShares one of the dominant force in global ETFs, with over $620bn invested in 474 funds which account for 43.0% of the world’s total ETFs assets (Blackrock, 2011), launched three Islamic funds in December 2007 on the London Stock Exchange amid an increasing shift by ETFs providers to offer alternative investment products. The three funds were primarily aimed at European investors with share classes in sterling and US dollars.

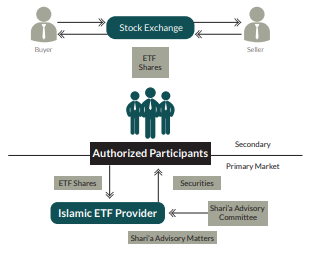

Islamic ETFs and conventional ETFs share common characteristics. The main difference between a conventional ETF and an Islamic ETF is the benchmark index that the Islamic ETF tracks. An Islamic ETF tracks a benchmark index comprised wholly of constituent securities which are Shari’a compliant whereas a conventional ETF may track any benchmark index regardless of the Shari’a status of its constituents. In addition, an Islamic ETF is managed under the Shari’a principle and guidelines, and overseen by an appointed Shari’a committee. The Shari’a committee conducts regular reviews and audits on the Islamic ETF to ensure strict compliance with the Shari’a principles and practices.

The following diagram depicts the general structure of an Islamic ETF:

Islamic ETF can be the next big thing for Islamic capital market after the sukuk which has made inroads in the global Islamic capital market landscape. One of the most developed Islamic capital market, Malaysia has two Islamic ETFs with a market value of $98.8 million, taking the nation’s total ETF to six which is worth $320 million. In Malaysia, Islamic ETF covers 31.5% of the total EYF market. (http://www.sc.com. my/data-statistics/islamic-capital-market- statistics/) MyETF-DJIM25, Malaysia’s first Shari’a compliant ETF launched in January 2008, tracks the Dow Jones Islamic Market Malaysia Titans 25 Index as a benchmark index which is a market capitalisation weighted and free-float adjusted index provided by S&P Dow Jones through the License Agreement.

The Benchmark Index consists of 25 Shari’ah-compliant securities of companies listed on Bursa Malaysia Securities Berhad, weighted by market capitalisation. The universe for selection of the components of the Dow Jones Islamic Market Malaysia Titans 25 Index includes all equities in the Dow Jones Islamic Market Malaysia Index, and index comprised of Malaysia-based companies that comply with the methodology established by S&P Dow Jones for screening stocks to comply with the Shari’a principles. (www.myetf.com.my)

Globally, Islamic ETF even after almost a decade in service, assets account for less than one percent of the total $2.3 trillion ETF market. Recently, Islamic ETF got a big boost when the U.S. fund management firm Falah Capital LLC set up its inaugural Shari’a-compliant ETF to tap growth in Islamic banking assets. While, the iShares MSCI Emerging Markets Islamic UCITS ETF was the best-performing fund in the last quarter of 2014, delivered a 10 percent return, according to data compiled by Bloomberg. The iShares MSCI USA Islamic UCITS ETF was second best at 9 percent. (http://www.bloomberg.com/ news/2014-10-21/etfs-lag-2-3-trillion-market- as-options-scarce-islamic-finance.html)

In a recent study conducted by Alam (2013) to look into the comparative performance of Islamic and conventional ETF By making use of 85 ETFs from UK iShares between 2008 and 2011, it was found that Islamic ETFs can beat both the conventional ETFs and market benchmark index based on risk-adjusted performance measures. Overall both ETFs were able to outperform the market benchmark index. It was also evident that a portfolio of Islamic ETFs shows less variability and hence is less risky compared to their conventional counterpart. (http://www. palgrave-journals.com/jam/journal/v14/n1/ abs/jam201223a.html)

For Islamic ETFs to catch up with conventional ETFs, it needs to be fully cost-effective and needs to reach an optimal size but none of the current Islamic ETFs have assets of more than $100 million whereas bigger conventional ETFs control funds of few hundred billion. Islamic ETF is an innovative financial product which has an appetite in a GCC , Europe and Malaysian market but it needs a long way before it catches up with conventional ETF.

Dr. Nafis Alam is an Associate Professor at the Nottingham University Business School (NUBS) in the University of Nottingham – Malaysia Campus (UNMC) and Director for the Centre for Islamic Business and Finance Research (CIBFR). He has published quite extensively in the area of finance and his scholarly research has featured in leading journals like Emerging Markets Review, Journal of Asset Management, Journal of Banking Regulation, Journal of International Banking law & Regulation, Review of Islamic Economics; Journal of Internet Banking and Commerce and Journal of Financial Services Marketing among others. He also coauthored three books in Islamic Finance among them is Encyclopedia of Islamic Finance which is first of its kind and has sold over 1000 copies worldwide. Dr. Alam is also Visiting Lecturer for Durham Islamic Finance Summer School, Durham University, UK. He is reviewer for leading finance & Islamic finance journals. He has also participated in leading Islamic finance conferences worldwide among them significant was participation in Harvard Islamic Finance forum at Harvard Law School and Gulf Research Meeting at Cambridge University, UK.

Recently Nafis was featured as Professor of the Month by Financial times.