To know the light, we must also see the darkness. In part 1 (ISFIRE Nov 2014 Issue) we have already taken a look at how the darkness of the current financial system has enveloped the world and enslaved most of mankind to unending debt and interest repayments. The result is debt mountains piled upon debt mountains created out of nothing inflicting interest compounding without mercy stealing purchasing power and appropriating the wealth and resources of mankind to enrich the global elite of our financial system. In the 2nd part, we take a look at how a financial system rooted in the principles of Islam and adheres to the Shari’a offers a financial system which is beneficial and mercy to all of mankind.

Islam is a mercy from Allah. So it follows a financial system based on Islamic principles will be a mercy for all mankind. The philosophy, outlook and orientation of an Islamic financial system completely contrast to the financial system we know and govern our lives today.

It requires a complete shift in our thinking, attitude and relationship with money and wealth.

Let’s start at the beginning! For Muslims, the meaning of life is no great mystery. Allah (SWT), says in the holy Quran “I have only created Jinns and men, that they may worship (or serve) Me”. (Surah 51 Al-Dhariyat) For the believer, this life and all its possessions and wealth are but a test. This life is very short and fleeting. Allah (SWT) said in Surah 57 AL- Hadid Verse 20:

“Know that the life of this world is only play and amusement, pomp and mutual boasting among you, and rivalry in respect of wealth and children, as the likeness of vegetation after rain, thereof the growth is pleasing to the tiller; Afterwards it dries up and you see it turning yellow; then it Becomes straw. But in the Hereafter (there is both), a severe Torment (For the disbelievers, evil-doers), and Forgiveness from Allah and (His) Good Pleasure (for the believers, good doers), whereas the life of the world is only a deceiving enjoyment.”

For those who have been given great wealth, it is both a great blessing and benefit to be grateful to Allah, but also a test as they will have to account for their wealth in the next life – how you earned it and spent it. For those with little wealth, it is also a test – will one accept what Allah has bestowed with patience (sabir) and without complaining.

“Be sure We shall test you with something of fear and hunger, some loss in goods, lives and the fruits (of your toil), but give glad tidings to those who patiently persevere. (155) Who say: when afflicted with calamity: “To Allah we belong and to Him is our return.” (156) They are those on whom (descend) blessings from their Lord and Mercy and they are the ones that receive guidance”. (Surah 2 Al-Baqara)

Allah (SWT), is the owner of all wealth “To Him belongs what is in the heavens and on earth, and all between them, andall beneath the soil.” (Surah 20 Ta-Ha) There are 2 dimensions to this. Firstly, we recognise and believe that whatever wealth we have is by the will of Allah. Secondly, no matter how wealthy you are, you only possess your wealth for as long as the lifespan Allah has written for you. After you die, your wealth will be passed on to somebody else. Even on our death, believers cannot will their estate (except a portion) as they wish – it is stipulated in the Shari’a how one’s estate should be distributed.

Another very important concept in Islam is balance and moderation in all aspects of our lives. Our material pursuits should be balanced with our spiritual needs. Individuals’ needs should be weighed against society’s needs. We are free to pursue profit and seek to increase our wealth, but it should not come at the expense of our worship and duties to our Creator. Our pursuit of personal gain, should not come at the expense of society, nor the detriment of the environment, or impinge on the rights of anyone else. Allah (SWT) says “Those who, when they spend, are not extravagant and not niggardly, but hold a just balance between those (extremes)” (Surah 25 Al-Furqan).

Who was the best person who embodied the teachings of Islam and set the best example in both actions and words for us to follow? This of course was our beloved Prophet Muhammad (Peace be Upon Him). In a beautiful hadith (reported saying) “None of you (truly) believes until he loves for his brother what he loves for himself.” (Al-Bukhari and Muslim). In another saying ‘He who sleeps on a full stomach whilst his neighbour goes hungry is not one of us’ (Bukhari). Care, compassion and mercy for others are part of our religion and are a duty incumbent upon the Muslims. Imagine if our business dealings, trade and investments reflected these ideals – our world truly would be a more prosperous, kind and happy place for all.

Whilst an Islamic financial system is built on the foundations of values and beliefs, it must also have specific rulings and detailed guidance to enable us to achieve a system which meets the objectives of the Shari’a and fulfils our role and duties as trustees of our planet and all the resources and wealth Allah has provided for us.

The best known of these injunctions is the prohibition of Riba, which literally means excess, increase or addition. There are different types or categories of Riba, but the most prevalent and widespread type of Riba practiced in our world today is the charging of interest, which is what this article will focus on. Interest can be defined as the charge for borrowing money, typically expressed as an annual percentage rate i.e. if you borrow money, you have to pay the principal back plus an additional amount of money – the additional amount or increase is interest.

Today in our modern world, interest by most is viewed as a very normal part of life. The prices of assets, evaluation of investments and projects, lending and even Islamic banking are all effected by interest rates. You could almost say the interest rate is considered to be a ‘universal law of money’. Even many western writers who are very eloquent in their criticism of different aspects of the financial system will rarely talk about interest as being the root of the problem. Of course this was not always the case. For most of human history, the charging of interest was universally despised by most societies and religions. For example, in England in the 13th century, usury was illegal and linked to blasphemy. In this period, those guilty of usury, had their assets seized. This included 300 English Jews who were hanged and had their property confiscated. Aristotle (384 – 322 BC) the Greek philosopher and one of the fathers of Western thought, wrote about lending of money at interest;

“The most hated sort, and with the greatest reason, is usury, which makes a gain out of money itself, and not from the natural object of it. For money was intended to be used in exchange, but not to increase at interest. And this term interest, which means the birth of money from money, is applied to the breeding of money becausethe offspring resembles the parent. Wherefore of a mode of getting wealth this is the most unnatural”.

So the prohibition and condemnation of Riba or the charging of interest in the Quran is not new. The verses in the holy Quran use strong and dramatic language to leave no doubt regarding the serious nature of Riba, its prohibition and utter condemnation. In Surah Al-Baqara, Allah (SWT) says;

“Those who devour usury will not stand except as stands one whom the Evil One by his touch hath driven to madness.

That is because they say: “Trade is like usury,” but Allah hath permitted trade and forbidden usury. Those who after receiving direction from their Lord, desist, shall be pardoned for the past; their case is for Allah (to judge); but those who repeat (the offence) are companions of the Fire: they will abide therein (forever). (Surah 2 Al-Baqara)

For those who persist in demanding interest, they are given a very bleak warning from Allah;

“O ye who believe! Fear Allah and give up what remains of your demand for usury, if ye are indeed believers. (278) If ye do it not, take notice of war from Allah and His Messenger: but if ye repent ye shall have your capital sums; deal not unjustly and ye shall not bedealt with unjustly” (Surah 2 Al-Baqara)

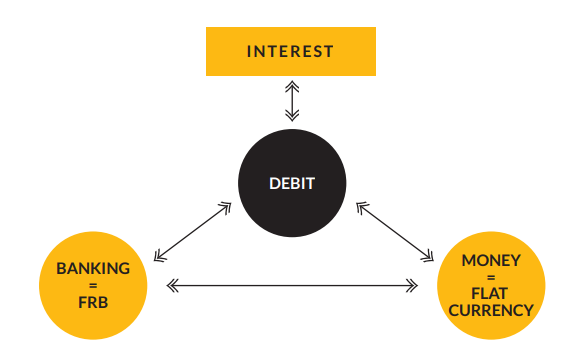

And it is not just the one who charges interest that has to worry – it is a serious sin for all parties involved in Riba dealings. In a hadith of our Prophet (PBUH) said, “Allah has cursed the one who consumes Riba (interest), the one who gives it, the one who records it and the witnesses.” He said: “they are all the same” (Sahih Muslim) Moving on from the charging of interest itself, I believe the next important step is to look at the support structures of our Riba or interest-based financial system. Interest derives from Debt. Debt is manufactured by our banking system via Fractional Reserve Banking (FRB) and most of our Fiat Money comes into existence as interest-bearing bank debt. This relationship is summarised in the diagram below.

Remember the vast majority of our interest-bearing debt has been manufactured by banks out of nothing via FRB which typically accounts for 97% of our fiat money supply.

Amongst the vast majority of the ulema (scholars) and people there is almost unanimous agreement that all forms of interest constitute Riba. What is less clear and certainly much less discussed is the position regarding FRB and Fiat Currency. Of course both of these monetary phenomena did not exist at the time of the Prophet (PBUH) or for most of the existence of the Islamic Empires/Era. FRB did not evolve organically in Muslim lands – it has been imposed via the former colonial powers.

I am not a Shari’a expert, so I will not get entangled in a debate about Shari’a compliance or not of FRB and Fiat Currency.

However, I will certainly argue that they go against the maqasid (objectives) of Shari’a. Please refer to part 1 where I give a comprehensive critique of the financial system– I will not repeat all the criticisms here, but l will just focus on one key aspect which is inflation. When you increase the supply of something, all other things being equal you reduce its price or value. So it is with money. Via FRB the money supply is dramatically increased. Fiat money (especially the electronic version), because it has no real value can be produced endlessly at almost no cost. However, though fiat money has no real value you can buy real things with it. So essentially the banking system can produce something of no real value with little or no cost and via interest, repayments acquire money for nothing which entitles them of course to acquire real wealth. FRB and Fiat Currency are a deadly duo working in tandem to increase the money supply/debt levels which is therefore constantly eroding the value of money.

Simply, now one needs to ask who benefits the most and who suffers the most from inflation? The poor in society and those on low incomes are the most badly affected. Their cost of living is constantly on the increase and many are forced into high-interest debts, just to survive. Wealthy business owners and investors benefit the most. As prices go up, the prices of the goods and services they provide increase which increases their profits and business value. Over the long term, asset prices such as property, stock markets and commodities have increased dramatically. Such a system that favours the rich and penalises the poor certainly does not fulfil the maqasid al-Shari’a.

Some argue in favour of debt, because it allows individuals, businesses and government to spend more (whether for investment or consumption). One person’s expenditure is another person’s income. Thus allowing and increasing debt increases income, wealth and overall economic growth. This narrative paints a very attractive and compelling case for debt. However, it is a false promise – you get a short-term boost, but at the sacrifice of future expenditure as debt and interest have to be repaid. This exponential growth in our debt has been caused by our man-made financial system. The result is the world crushed by an inverted pyramid of debt. As the debt pile accelerates, increasing amounts of income are required to service it, thus continuously reducing the ability of those in debt to repay. Even with near zero or negative real interest rates much of the world is straining under its debt burdens. A major debt crisis or default will have a domino effect causing more defaults leading to systemic crisis in our financial system. Inevitably, the global financial system will eventually collapse under the weight of its debts. Just global government debt alone is now over $55 Trillion. To give this colossal figure more meaning, let’s look at the per capita debt of some of the key countries.

The public debt per head of population (for every man, woman and child) in USD (source: The Economist):

- USA $46,214

- UK $41,929

- Japan $97,450

This is only public debt. Counting private and public debt, ING estimate total world’s debt at an astounding $223.3 trillion! This amounts to 313% of global gross domestic product.

Many advocate returning to money which has an intrinsic value or at least backed by something of intrinsic value. Traditionally, throughout most of human monetary history this has been gold and silver. Al-Qaadhi Abu Bakar Ibn Al-Arabi, (Ahkaamul Quran, 3/1064) defined money “(The gold dinar & silver dirham) is the medium to measure the value of things … they are the judge in measuring and determining the value of wealth when there are differences in quantity or when the value of the thing is unknown.”

“Money power is the greatest power in the whole world. It is the power to give and the power to take away, the power to destroy and the power to create, the power to crush opposition or bestow favours” (The Money Trick, by the Institute of Democracy). By allowing FRB and Fiat Currency to exist we give this power to Central Banks, World Banks, and Commercial Banks. Governments legislate to facilitate and cooperate because in the short run they benefit from easy money via quantitative easing i.e. money printing or more correctly loading up more national debt. Money which has intrinsic value or at least backed by such, will take this power away. Interestingly, Personal Income Tax was introduced in US in 1913 the same year as the formation of the US Federal Reserve – coincidence or collusion between government and banking!

For further reading on this critical subject matter I would also like to refer the reader to a paper by Dr. Ahamed Kameel Mydin Meera and Dr Moussa Larbani (both Professors at International Islamic University Malaysia)

“Ownership Effects of Fractional Reserve Banking: An Islamic Perspective”. In great detail they tackle the issues of FRB and Fiat Currency from an Islamic perspective. They assert that FRB “….violates the ownership principle in Islam while inflicting profound injustice on the economy and society”. They further argue that “… money creation through FRB is creation of purchasing power out of nothing which brings about unjust ownership transfers of assets in the economy, to the bank effectively, paid for by the whole economy through inflation. This transfer of ownership is not based on human effort by taking on legitimate risks… They conclude “…. that FRB has elements of riba that goes against the maqasid al-Shari’ah; and therefore can be termed illegal or haram from Islamic perspective”.

The next major prohibition is gambling. In Arabic, it is referred to by Maysir which is the acquisition of wealth by chance instead of by effort and Qimar which refers to a game of chance. Allah (SWT) says in the holy Quran;

“O who you believe! Intoxicants (e.g. alcohol) and gambling and idols and (lottery by) arrows are an abomination of Satan’s work, so avoid them so that you may get salvation. Satan’s only desire is to create among you enmity and hatred by means of intoxicants and gambling and stop you from praying and remembering Allah. Will you not then stop?” (Surah 5 Ma’idah) Gambling is a huge and lucrative industry. Forbes estimated the global market to be worth $417 billion in 2012 – and this just represents ‘legal’ gambling. Black market gambling is huge – just illegal sports betting in Hong Kong alone generates about $64.5 Billion each year. Sports match-betting industry (legal & illegal) is worth anywhere between $700bn and $1tn a year. The world’s biggest market is the U.S., which accounts for 25% of the world’s gambling profits. China is the 2nd biggest market, but counting illegal gambling it is estimated to be 1.5 to 2 times as large as the U.S. In many countries up to 70 to 80% of the adult population participate in some form of gambling.

Obviously from an Islamic perspective there is no distinction between legal and illegal gambling – whether sanctioned by a state or not all gambling is an abomination. The temptation for many states or governments to legalise gambling is often too much as they can earn huge revenues from taxing it. Of course many public servants have argued and struggled against legalising gambling. The late governor of New York Thomas E. Dewey declared “The entire history of legalized gambling in this country and abroad shows that it has brought nothing but poverty, crime and corruption, demoralization of moral standards, and ultimately lower living standards and misery for all the people.” However, the lure of easy money though it is built on the misery and despair of others has in most cases triumphed over these arguments.

No country Muslim or otherwise is immune from gambling. However, thanks to clear prohibition and condemnation of gambling in the Quran at least legalised gambling in Muslim countries is generally not allowed or if allowed is often restricted to targeting tourists. Casinos do exist in Egypt, Lebanon, Malaysia and even in Palestine (amidst all the trouble!) for a period before being closed down in 2000. Gambling in Israel is illegal, so they used to travel to a casino in Jericho in Palestine – Palestinians were not allowed to gamble, but they did comprise most of the workforce!

The growth in online gambling is another huge problem – it now takes gambling into the home making it easily accessible to anyone with internet access and money. According to a survey of the 5,000 secondary students conducted by the Gamblers Rehab Centre Malaysia indicated that 89% admitted to have been exposed to gambling before they even hit the age of 12.

The ill effects of gambling on individuals, families and society are well documented. Gambling is all-consuming, leading to great stress and anxiety. It takes man away from his prayers and remembrance of Allah leading to a descending spiral of moral decay and corruption. It is often accompanied by other vices such as drinking and drugs and like a domino leads to many more vices.

These include cheating, fraud, stealing and accumulation of gambling debts. The lure of easy money, the glitter and dazzle of casinos make gambling very addictive. Addiction leads to financial ruin and disaster for individuals and brings heartbreak and sorrow to their families. Most profit comes from problem gamblers

- however they pay a heavy price with their jobs, their houses, their health and their families. It discourages hard and honest work and promotes selfishness, hatred and greed. Obsessive gamblers waste an extraordinary amount of their time neglecting family and work.

Unfortunately the common attitude that prevails especially where gambling is legalised is that people should have the freedom to decide what they want to do with their money and their time even if it leads to disgrace and tragedy. Unlike our governments, Allah’s law shows his love for his creation by protecting and keeping us safe from that which is not good for us.

Closely related to gambling is speculation. Speculation needs to be distinguished from investing. It is generally characterised by buying liquid assets for a very short period with the sole intention of betting on short-term price movements. Speculation in its extreme form is the same or sometimes even worse than gambling itself i.e. it is possible for the speculator to lose all their capital and in the case of leveraged speculation the losses can easily exceed the initial capital placed.

Speculation is a huge element of the financial markets today and earns huge commission and fees for intermediaries. The biggest and most liquid market in the world today is foreign exchange – $5.3tn changes hands every day (FT Nov 2013). According to the economist Bernard Lietaer, author of The Future of Money, back in 1975 about 80% of foreign exchange transactions involved the real trading of a product or a service. However, by 1997 the percentage of foreign exchange which involved transactions in the real economy was only 2.5%! According to the Global Policy Forum, by 2011 only a tiny 0.6% of foreign exchange could be traced to genuine international trade in goods and services. Of the remainder, a minimum of 80% was directly attributable to speculation. This of course is just the tip of the speculation iceberg. In all financial markets such as the stock market, debts, oil, gold and other commodities speculation is pervasive. Speculation causes bubbles to blow up in asset prices. When the bubble inevitably bursts, it unleashes a tsunami of financial hardship and economic misery as individuals, companies and even nations go bust. This is in addition to all the usual problems associated with gambling already mentioned. Huge corporations and governments have been brought to their knees as result of the reckless actions of speculators. Speculation is a huge waste of time and resource – no new wealth is created, it is simply transferred from one to other and constantly eroded by the fees of brokers and taxes of governments.

Another very important principle is the avoidance of Uncertainty or using the Arabic term ‘Gharar’. Gharar is a broad concept that encompasses deceit, fraud, uncertainty, danger, peril, delusion, or hazard that might lead to destruction or loss. This means that any trade or transaction should be free from contractual uncertainty. There should be no ambiguity in the key terms and subject matter of the underlying contract or deal. This principle has very important implications for how business should be conducted. All financial and business transactions must be based on full transparency and disclosure, so that no one party has an unfair advantage over the other. The aim is to protect all parties from deceit, ignorance and uncertainty. This has been emphasised in the hadith of the prophet (PBUH); “Do not meet the merchant in the way and enter into business transaction with him, and whoever meets him and buys from him (and in case it is done, see) that when the owner of (merchandise) comes into the market (and finds that he has been paid less price) he has the option (to declare the transaction null and void)” (Muslim). Thus one is not allowed to take advantage of the seller’s ignorance of the market price. In a modern context, this closely aligns with insider trading laws. The financial services industry loves to innovate and speculate – contracts such as forwards, futures, options, and other derivatives are rendered invalid because of gharar.

Of course no matter how fair, balanced and just a financial system is, there will still be those who are rich and those who are poor. Zakat which redistributes wealth from the rich to the poor is such an important element that it is obligatory and is one of the 5 pillars of Islam. It is mentioned many times in the Quran and is associated with prayers, doing good deeds, mercy and forgiveness. The Believers men and women, are protectors one of another: they enjoin what is just, and forbid what is evil: they observe regular prayers, practice regular charity, and obey Allah and His Messenger. On them will Allah pour His mercy: for Allah is Exalted in power, Wise. (Surah 9 Al-Tawba)

It is a serious matter. The prophet (PBUH) said “I have been ordered to fight against the people until they testify that there is none worthy of worship except Allah and that Muhammad is the Messenger of Allah, and until they establish the Salah and pay the Zakat. And if they do so then they will have gained protection from me for their lives and property, unless (they commit acts that are punishable) in accordance to Islam, and their reckoning will be with Allah the Almighty.” (Al-Bukhari & Muslim)

In Arabic, the word Zakat means blessing, purity, growth and uprightness. In the Shari’a (Islamic Law) it denotes the obligatory 2.5% of net wealth Muslims have to pay on an annual basis (lunar year) to recipients as prescribed in the holy Quran. It applies to those Muslims whose wealth is over a certain minimum level called the nisab. The nisab is measured in reference to gold (85 grams of pure gold) and silver (595 grams of pure solver). One should have absolute possession of the wealth on which Zakat is due. For example, Zakat is not obligatory on money which is out of the owners reach for years or on debts owed but the debtor is insolvent. Certain wealth and assets are excluded from Zakat. These are possessions of a personal nature e.g. one’s private residence, furniture, car, clothes, tools of trade.

Zakat is a mercy and a blessing from Allah – it gives the poor a right over a portion of the wealth of the rich. This is turn promotes social harmony and brotherly love. It purifies the wealth of the rich and increases their wealth in blessings.

One of the beautiful aspects of Islam is that it sets basic minimum requirements that all Muslims should adhere to. But it also gives plenty of scope to do much more and achieve greater blessings. So it is with charity giving. This brings us to the concept of Sadaqa i.e. general charity, giving over and above than that is required of Zakat. It is highly encouraged and Allah promises huge rewards for charity giving.

“The likeness of those who spend their wealth in Allah’s way is as the likeness of a grain which groweth seven ears, in every ear a hundred grains. Allah giveth increase manifold to whom He will. Allah is All-Embracing, All-Knowing”.

(Surah 2 Al-Baqara)

Charity is not just confined to giving of wealth or money. The prophet has defined charity in broad terms as:

“Every joint of a person must perform a charity each day that the sun rises: to judge justly between two people is a charity. To help a man with his mount, lifting him onto it or hoisting up his belongings onto it, is a charity. And the good word is a charity. And every step that you take towards the prayer is a charity, and removing a harmful object from the road is a charity.” (Bukhari & Muslim)

Another charitable concept in Islam is known as Qard Hasan which means “Benevolent Loan”. This is generally a loan to help those who are needy, to relieve financial stress, for a good cause. Hasan means kindness to others and no interest or any financial gain is expected from the loan. Just the principal of the loan is to be returned. Again this act is highly rewarded and encouraged by Allah.

“Who is he that will loan to Allah a beautiful loan, which Allah will double unto his credit and multiply many times? It is Allah that giveth (you) want or plenty and to Him shall be your return”. (Surah 2Al-Baqara)

The whole religion of Islam is infused with the mercy of giving charity. In a saying of the Prophet (PBUH) “When a man dies, all his acts come to an end, but three; recurring charity (sadaqah jariya) or knowledge (by which people benefit), or a pious offspring, who prays for him” (Sahih Muslim)

This has led to another noble and long-standing Islamic tradition of establishing Awqaf. The singular of Awqaf is Waqf which is a charitable endowment/trust. Monzer Kahf an Islamic Economic Expert has defined Waqf as “holding a property and preserving it so that its fruits, revenues or usufruct is used exclusively for the benefit of an objective of righteousness while prohibiting any use or disposition of it outside its specific objective”

It is very similar to an English Trust except that its purpose is charitable. There is a long legacy of wealthy Muslims donating property, land, buildings and money to awqaf which have played a very important role in supporting the socio-economic needs of society. Awqaf have taken care of a myriad of needs:

- provision of mosques, schools, and supporting scholars

- building of roads, bridges, and hospitals

- helping the elderly, the traveller, the sick, the orphan, the poor and those in debt

- animal welfare

An Islamic financial system cannot be separated from Islam. Every aspect of the financial system should be in harmony with achieving the maqasid al-Shari’a. There are 3 key aspects; Firstly the philosophical aspect or our beliefs which provide the foundations of an Islamic financial system. Allah is the owner of all wealth and we are the trustees of this wealth. Our wealth is a means to achieve the pleasure of Allah. The second key aspect, are the practical rules and principles that we should follow i.e. Staying away from Riba, Gambling and Speculation. Designing a financial and monetary system, which is honest, fair and

just for all of mankind. Not a system which is leveraged so wealth can unfairly accumulate in the hands of the few. The third key aspect is the huge focus and emphasis on charity. This helps to redistribute income and wealth from the rich to the poor and create social harmony. Money is the key ingredient in a financial system. Today money and debt are almost synonymous – 97% of our money is debt. Money should be used as a tool to serve mankind, not mankind enslaved to money.

In both parts, I have painted a very bleak picture of our current financial landscape which continues on a downward trajectory towards its inevitable collapse. However, there are reasons we should be optimistic. Firstly, is the realisation that Allah (SWT) is the creator and owner of the Universe and nothing happens anywhere in his creation unless by his will. “With Him are the keys of the unseen, the treasures that none knows but He. He knows whatever there is on the earth and in the sea. Not a leaf falls but with His knowledge: there is not a grain in the darkness (or depths) of the earth, nor anything fresh or dry (green or withered), but is (inscribed) in a record clear (to those who can read).” (Surah 6 Al An‘am). Secondly, though vast amounts of wealth have unfairly accumulated in the hands of the global elite – the wealth has not disappeared – it is still here on planet earth! It just needs to be redistributed. Lastly, Allah (SWT) says he will destroy Riba. Though the problems of our Riba financial system seem huge and insurmountable, Allah (SWT) has provided us with the solutions. Finally, remember Allah (SWT) said “… How often a small group overcame a mighty hostby Allah’s Leave?” And Allah is with As-Sabirun (the patient).” (Surah 2Al–Baqarah)