The technology sector has fared well when it comes to Shari’a compliance of stocks listed on exchanges around the world. On 7 November 2013, Twitter went public with a well-publicised IPO, sparking interest from investors from around the world.

Earlier this year Facebook went for a rather controversial IPO on 18 May 2012. Edbiz Consulting, a London-based Islamic finance advisory firm that has partnered with Nasdaq to develop a Shari’a-compliant version of Nasdaq100, reported that Twitter stock was Shari’a-compliant when the company went public. What does this mean?

There are a number of Shari’a screening methodologies employed by index providers around the world to construct, maintain and market what is known as Islamic indices. The most widely used methodology is that of Dow Jones (now S&P Dow Jones Indices) but other methodologies, i.e. that of FTSE, MSCI and Nasdaq do not differ significantly.

There are two screens employed by Shari’a screening companies: (1) business screen; and (2) financial screen, where the results of both must pass the indicated benchmark set by the index providers. The former ensures that the overall business of a firm is not outright in contradiction with Islamic teachings on business and commerce. The business screen, therefore, excludes all the stocks that lie in the impermissible sectors like financials (except Islamic banks and other financial institutions that explicitly commit to Shari’a guidelines in their business conducts), gambling and gaming, entertainment (including but not limited to pornography), weapons and defence manufacturing, alcohol, pork and pork-related products, and tobacco etc.

After being filtered through the business activity screening, companies are then further screened on a financial basis. The financial screen is based on a number of financial ratios which must be met for companies to be considered Shair’a-compliant. The most frequently used financial ratios are the followings:

- Gearing Ratio: Total interest-bearing debt divided by trailing 24-month average market capitalisation of the company

- Liquidity Ratio: Cash plus interest-bearing securities divided by trailing 24-month average market capitalisation

- Cash flow Ratio: Accounts Receivables divided by trailing 24-month average market capitalisation

- Income Ratio: Impermissible income divided by total income

Dow Jones Shari’a screening methodology employs the above-mentioned gearing ratio, liquidity ratio and cash flow ratio but excludes all those stocks that exceed a threshold level of 33%. Investors are recommended to employ a 5% threshold for the income ratio, although Dow Jones do not incorporate income ratio in the process of constructing and maintaining their Islamic Market Index family.

FTSE, on the other hand, uses total assets in the denominator as opposed to market capitalisation when computing the above ratios. They also include cash in addition to receivables in the numerator when calculating the cash flow ratio. A 33.33% threshold for gearing and liquidity ratios is adopted while a higher threshold level (50%) is used for the cash flow ratio. In many ways FTSE may seem a bit liberal in their financial screening methodology. But it all depends on market conditions before one can infer whether FTSE is more conservative or liberal as compared to Dow Jones. For instance, in bullish market conditions,

Dow Jones may prove to be more liberal than FTSE and vice-versa in bearish times.

MSCI has a similar screening process as FTSE in terms of denomination of ratios but their thresholds are more consistent with Dow Jones. All three ratios have a threshold of 33.33%.

Russell-Jadwa Islamic indices use financial ratios similar to that of Dow Jones but threshold of their cash flow ratio (with cash included in the numerator) is far higher than the Dow Jones – 70% as opposed to 33% for Dow Jones.

Securities Commission (SC) of Malaysia uses a more detailed Shari’a screening methodology. Unlike other methodologies (which use 5% threshold for the income ratio), SC uses two thresholds for this ratio to determine whether a business is Shari’a compliant or otherwise.

The first threshold involves a 5% benchmark where stocks are excluded from Shari’a universe if the business of the companies issuing such stocks generates more than 5% revenue from the following sectors:

- Conventional banking including insurance,

- Gambling,

- Liquor and liquor-related

- activities, non-Halal food and beverages,

- Shari’a repugnant entertainment,

- Interest income from conventional accounts and instruments,

- Tobacco and tobacco-related activities, and

- Other activities deemed Shari’a repugnant In the second threshold, stocks will be excluded

from Shari’a universe only if the issuing companies generate more than 20% of their income from the following business activities:

- Hotel and resort operations

- Share trading and stock broking business

- Rent received from tenants engaged in Shari’a repugnant businesses

- Other activities that are deemed Shari’a repugnant

In its second tier screening, SC uses financial ratios (i.e., gearing ratio and liquidity ratio) similar to that of FTSE. Each of the financial ratios must be lower than 33% for a stock to pass as Shari’a-compliant.

In the context of Pakistan, Meezan Bank’s Shari’a screening methodology is adopted by a number of Islamic equity fund managers. It is perhaps the most detailed approach to Shari’a screening. Business screening is consistent with other international Shari’a screening methodologies. However, for financial screening it employs the following five financial ratios with the stated thresholds:

- Gearing ratio, as defined by total interest-bearing debt divided by total assets, should be less than 37%.

- Investment ratio, as defined by Shari’a repugnant investments divided by total assets, should be less than 33%.

- Income ratio, as defined by impermissible income divided by total revenue, should be less than 5%. Illiquidity ratio, as defined by illiquid assets divided by total assets, should not be less than 25%.

- Market Price per share should be at least equal to or greater than net liquid assets per share.

All the above Shari’a screening methodologies are summarised in the table below:

Based on the above-described screening methodologies and thresholds, Twitter stocks do fulfil the requirements set by all the internationally known Shari’a screening methodologies. Similarly, stocks issued by Facebook and Google are also included in the Edbiz-Nasdaq100 Shari’a index. An interesting observation would be how Apple’s stock which initially passed the Shari’a screening before was deemed as Shari’a non-compliant when its iTunes businesses started generating more revenue, and consequently breached the 5% threshold on the income ratio.

The entertainment sector is a prohibited sector that global index providers (the likes of S & P Dow Jones, Edbiz-Nasdaq, FTSE and MSCI) exclude when constructing their universes for Islamic indices and Shari’a compliant investing in equity stocks listed on the stock exchanges around the world. The entertainment sector includes film industry (including radio, television and theatre), the phonographic industry, gaming, pornography, and media, to name a few. In fact, the media and entertainment industry captures a wide variety of companies. There are a number of segments within the industry, each of which provides a different form of entertainment. These segments include traditional print media, television, radio broadcasting, film entertainment, video games, advertising and perhaps most importantly, the manufacturers of the technology that the above segments rely on.

| Ratio | S&P-Dow Jones | MSCI | FTSE | Russell Jadwa | Meezan | SC Malaysia |

| Income Ratio | 5% | 5% | 5% | 5% | 5% | 5% – 20% |

| Gearing Ratio | Interest-bearing debt/Market cap (33%) | Interest-bearing debt/Total assets (33.33%) | Interest-bearing debt/Total assets (33%) | Interest-bearing debt/Market cap (33%) | Interest-bearing debt/Total assets (37%) | Interest-bearing debt/Total assets (33%) |

| Liquidity Ratio | Cash plus interest- bearing securities/ Market cap (33%) | Cash plus interest- bearing securities/ Total assets (33.33%) | Cash plus interest- bearing securities/ Total assets (33.33%) | Cash plus interest- bearing securities/ Market cap (33%) | – | Total cash/Total assets (33%) |

| Cash Flow Ratio | Accounts receivables/ Market cap (33%) | Accounts receivables plus cash/Total assets (33.33%) | Accounts receivables plus cash/Total assets (50%) | Accounts receivables plus cash/Market cap (70%) | – | – |

| Investment Ratio | – | – | – | – | Impermissible investment/Total assets (33%) | – |

| Illiquidity Ratio | – | – | – | – | Illiquid assets/Total assets (25%)* | – |

| Share Price | – | – | – | – | Share price ≥ Liquid assets per share | – |

Due to a lack of detailed information on the activities of companies in the entertainment industry, most Shari’a screening methodologies recommend to exclude the whole sector from a universe from which equity stocks are to be picked up for investing by Islamic investors. A simplistic approach is also adopted for dividend cleansing of Shari’a-compliant companies that have partial and insignificant (i.e., less than 5%) involvement in impermissible activities. For example, the UK-based supermarket J Sainsbury’s stock (SBRY.L) is a Shari’a compliant stock but the company is involved in trading of some impermissible items like pork, alcoholic beverages and the sale of UK lottery etc, in addition to having some of its investments in interest-based products. The company also owns Sainsbury’s Bank, which is obviously not a Shari’a-compliant business. Despite all these, Sainsbury’s has remained a Shari’a-compliant stock because its reported income from impermissible activities is less than 5% of its total income (the threshold for a stock to be Shari’a-compliant). It must be noted that Sainsbury’s does not report financial information on its all impermissible activities and hence most of the Shari’a screening methodologies take into account only interest income. This is obviously a simplification, which could only be considered as a second-best option in the wake of the lack of detailed information on other activities.

Apple stock (AAPL) provides an even more interesting example. Before the phenomenal success of its iTunes business, Apple was included in most of the Shari’a universes used by players in the Islamic fund management industry. However, Apple has been excluded from such universes since 2013 as iTunes now contributes more than 5% to Apple’s revenue.

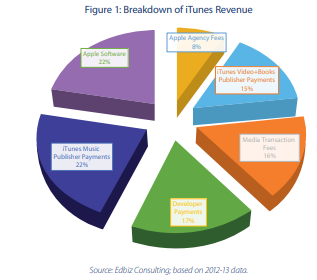

Since there are no public disclosures regarding revenue breakdown within iTunes, precise numbers are not possible. However, a number of industry experts have attempted to come up with some realistic assumptions to further break down iTunes revenue, albeit imprecise. London-based Edbiz Consulting estimates that direct music sales comprise not more than 45.5% of iTunes’s revenue. In fact, iTunes music publisher payments are merely 22% of its revenue; while other constituents of this category are media transaction fees and half of the iTunes video + plus book publisher payments (as is shown in Figure 1).

However, to simply exclude Apple stock from the Shari’a universe on the basis of the share of iTunes revenue to Apple’s total income seems more of an oversimplification. In fact, iTunes revenue is now a general catchall, as it includes revenue from sales on the iTunes Store, the App Store, the iBooks, Store, and revenue from sales of AppleCare, Apple Software, licensing, and other services. Including it under the general category of entertainment is inadequate. Given that iTunes’ share in Apple’s total revenue is expected to reach 20% by 2020 (Macquarie Equities Research USA), a breakdown of iTunes revenue into permissible and impermissible has far-reaching implications. If iTunes revenue is not scrutinised in detail, it is very likely that the world’s most valuable company will never re-enter the Shari’a universe.

If one actually logs into iTunes (which is only one part of iTunes revenue), the following categories are reported:

- Music / iTunes Radio

- Movies / TV Shows

- Podcasts

- iTunes University

- Books / Audiobooks

- Apps

Each of the above categories are broken into two groups: Paid and Free, and the most popular are disclosed in each category and group. iPhone Apple has over 1.1 million Apps, which is grouped into 24 categories, from Business to Weather – one of which is Entertainment. While Entertainment appears as a popular category, it only constitutes 4% of the available categories in the Apps catalogue. Table 1 gives a flavour of the category of Entertainment by focusing on the top four paid Apps. The information is divided into name of the App, its price, nature of its content, and the age limit of the buyer.

Table 1 is consistent with Edbiz Consulting’s research findings – only a fraction of iTunes revenue comes from impermissible activities such as sale of music and videos. In fact, less than 3% of the total revenue (or 29.5% of iTunes revenue) is drawn from the sale of music as evident in Figure 2. Even if we consider the most liberal figures on Media (4.55% of the total revenue), and not the revenue share originating from music (2.99%), the Apple stock must be considered as Shari’a compliant, and hence should have remained in an Islamically investible universe.

What should be the acceptable form of Entertainment?

The concept of Entertainment is fast changing. Shari’a views on this have evolved on a number of issues, including on television and radio. In the past, television and radio were considered as main forms of electronic entertainment and hence were frowned upon by Shari’a scholars. However, the contemporary Shari’a opinion allows investing in the stocks of companies that produce electronic products including, televisions, radios, iPods etc.

| Name of the App | Price | Nature of the Content | Age Limit |

| Akinator the Ginie | $1.99 | Think of a real or fictional character; I shall try to guess who it is. | 12+ |

| My Talking Pet | $0.99 | Bring photos of your pet to life. | 4+ |

| Apple Icons | $1.99 | Personalise your iPhone, iPod and iPad with custom shortcuts. | 4+ |

| Dynamojis | $2.99 | Animated Emojis and stickers for iMessages | 4+ |

Top 4 Paid Apps on Apple Devices

Similarly, social media companies like Google, Facebook and Twitter are considered as Shari’a compliant, although a lot of activities on such platforms may in fact be Shari’a repugnant. The underlying principle is that an instrument in itself shall not be deemed Shari’a repugnant if it can be put into multiple uses, some of which may in fact not be in compliance with Shari’a.

The fact that iTunes derives its revenue from a number of activities (some of which happen to be Shari’a repugnant) should mean that the platform in itself is not Shari’a repugnant. To make the life of an analyst easy, iTunes incorporates a highly developed filtering system that marks movies, music, apps, etc. with warnings like “Explicit Material” and “Maybe Objectionable.” Although these warnings are primarily aimed at parents but an analyst investigating Shari’a compliance may also find them helpful. In the case of iTunes, it may not be very helpful to consider iTunes segments of Apple’s business as Shari’a repugnant. There is a need to take a view on it as a platform that offers Shari’a compliant and Shari’a repugnant trading opportunities as iTunes is not pure entertainment but rather has some elements that are objectionable. A solution to this problem can be to have some form of an engagement process between the investible companies and index providers, where the latter works with companies in identifying the exact impermissible income. But it goes without saying that such processes can be tedious. It’s an obvious fact that some Muslims are more conservative than others when labelling entertainment as they opined this should be classified as haram without further examination. But common modern activities such as chatting with friends, posting family photos online, or tweeting could be seen as a form of entertainment. The question then arises: are these activities haram? Certainly not! If one takes the view of the analysis above, the decomposition of iTunes revenue suggests that Apple remains a Shari’a-compliant stock despite the fact that iTunes contributes 10% to Apple’s revenue.