ADAM EBRAHIM, NAZEEM EBRAHIM & MOHAMED SHAHEEN EBRAHIM

OASIS GROUP

The Oasis Group is a financial services company that is focused on the provision of investment management services within all asset classes; including listed equity and real estate. It has been at the forefront of product development within the global Islamic Finance sector and has been responsible for the promotion of ethical investment products and practices. Established in 1997, its history coincides with the advent of modern Islamic banking and finance, and its success has been commended through the receipt of a number of prestigious global investment awards. In this exclusive interview with ISFIRE, Adam Ebrahim, CEO of Oasis; Mohamed Shaheen Ebrahim, Chairman of Oasis; and Nazeem Ebrahim, Deputy Chairman of Oasis; share their personal views on the remarkable success of this organisation.

PLEASE TELL US THE STORY OF THE EBRAHIM FAMILY, AS IT WILL BE INTRIGUING FOR OUR GLOBAL READERSHIP TO LEARN ABOUT THE ORIGINS OF A SOUTH AFRICAN MUSLIM FAMILY THAT HAS BEEN IMMENSELY SUCCESSFUL IN BUSINESS IN GENERAL AND IN ISLAMIC ASSET MANAGEMENT IN PARTICULAR.

Adam Ebrahim:

“In the 1890’s, our maternal and paternal grandparents arrived on the shores of South Africa from India. They settled in the city of Cape Town, and the North West province, where they set up successful trading companies. During that period of time, the general business environment was not very easy and some of the persecution that they would have encountered, would have been unforgivable. However, they were able to establish thriving businesses, due to their enterprising outlook, and their sheer determination to ensure that their families and extended communities were taken care of.

Our grandparents were hardworking men and women of impeccable integrity. They were compassionate people who were of the firm belief that one remains forever bound by your word, as it is a reflection of your honour. This is something they were taught at an early age, and it is the very same lesson that my family and I have parted to our children and grand-children today.

We also learned from their successes, largely attributed to their sheer hard work and determination, which ensured that at the end of the day, you have earned your keep.

My late father, Ismail Ebrahim, was born in 1929 during the time of the Great Depression. His formative years were shaped by the experience of many in South Africa at the time, as the subsequent onset of war led to several limitations that were imposed on our people, as the country was responsible for contributing towards the food requirements of the allied forces during that period. This experience definitely shaped my father’s future business mindset, and as a young man he learnt how to identify opportunities. As a result, he realised that by establishing himself in the farmed fruit distribution sector, he was able to create a lucrative and sustainable business. My father was also very curious about the world he found himself in, and was encouraged from an early age by my grandfather, to always seek knowledge.

As Muslims, our noble Qu’ran teaches us from the very first revelation to “read in the name of thy Lord” or Iqraa (Surah Al-Alaq 1) – and this has always been one of the principles of our family. My father was a voracious reader, and loved reading about history and the path of many civilizations and cultures. He was also fascinated about how economies functioned and how people and wars shaped the world we live in. He taught us from an early age to read widely, and would sit with us daily to read the newspaper. Through that process, we learned how to dissect the information we engaged with and understand the underlying media narrative and its influence on society and the political mindset of the day. This experience empowered us in our understanding of the world and gave us a firm grounding that allowed us to choose the direction in life which we took.

My father also imparted on us the value of owning good quality property. He understood why land ownership was so important and besides knowing how to cultivate the land and see it as a means to production, he could identify valuable real estate, and how it could be fashioned for the future where further value could be derived over time. These were key lessons which we learned from an early age that shaped the direction of our lives.

Our parents grew to become respected members of our community, and they were well-prepared for the businesses that they would eventually go on to manage. My father passed away very early on in our lives, and our mother, Miriam Ebrahim, did not shy away from taking over the role as head of our household. My mother possessed a keen “entrepreneurial mindset”, and saw to it that we were educated up to tertiary level and pushed us forward to make a mark for ourselves. I am deeply indebted to her for where we are today as a family; as she remained a pillar of strength for my 4 other siblings and I. Our successes were realised because she ensured we operated firmly as a family unit, taking care of each other, and above all, remaining grounded in our faith and our deep respect for each other as a family.

During our formative years, which was at the height of apartheid South Africa, we had to keep forging ahead, despite the racially motivated restrictions that were placed on our people. My mother was very bold in her outlook and she sought to provide us with every opportunity to become successful. This did not imply that we had everything handed to us on a silver platter. We certainly did not. Whilst we lived comfortably, we were no strangers to hardship and toil, which really spurred us to push the boundaries that were meant to restrict the activities of people of colour during that period of time. While at school and university we worked part-time in the family business, which was managed by my eldest brother, Mohamed Shaheen.

Our friends could enjoy themselves on the weekends and during the vacation periods, but we had to work and while we wanted to join in the fun, we had to discharge our responsibilities first. In addition, we recognised that we simply had to continue on the path that our hardworking parents and grandparents had set out for us; which involved the progression of our family and society at large. In retrospect, the hard work has delivered the benefits we are enjoying now, and has left us in a position to leave a legacy behind. That is immeasurable and also inspires us to continually set the bar higher and ensure that the generations that follow are as inspired and motivated to do even better.

Oasis is really a family business, and at its core carries out the values of my parents and my grandparents. It has a rich heritage in South Africa and we are very proud of our beginnings. What is also worth noting is that Oasis was established to operate in the global context. It has been immensely fulfilling to see how this brand has grown and become such a core part of so many people’s lives, be it directly in the countries we operate (South Africa, Ireland, and the United Kingdom) or through our distribution partners located throughout the regions of Europe, the Middle East and South East Asia. The success of our business has rested firmly on our faith in the Almighty, our accumulated knowledge as a family, our experience in the investment arena and our unwavering dedication and commitment towards the work that we do and the clients who trust us to manage their wealth”.

AS MUSLIMS, OUR NOBLE QU’RAN TEACHES US FROM THE VERY FIRST REVELATION TO “READ IN THE NAME OF THY LORD” OR IQRAA (SURAH AL-ALAQ 1)- AND THIS HAS ALWAYS BEEN ONE OF THE PRINCIPLES OF OUR FAMILY

LEADING AN ICONIC INSTITUTION IN THE HISTORY OF MODERN ISLAMIC FINANCE FIRST IN SOUTH AFRICA AND THEN EXPANDING GLOBALLY HAS ITS OWN CHALLENGES, AS THE POSITION BRINGS HUGE RESPONSIBILITY ALONG WITH THE PRESTIGE IT CARRIES. CAN YOU TELL US ABOUT YOUR EXPERIENCE OF LEADING ONE OF THE MOST PRESTIGIOUS BRANDS IN ISLAMIC ASSET MANAGEMENT GLOBALLY?

Adam Ebrahim:

“It has been an extremely rewarding and enjoyable experience. My career within the investment industry has provided me with immense intellectual stimulation, and many interesting challenges. Working in such a dynamic industry has also developed my character and much of the knowledge that I’ve acquired has been passed on to others within our organisation. When one is entrusted to manage other people’s wealth, you are tasked with an immense responsibility; as this wealth is the source of their security and the reward for their labour. This is a prerogative that requires the quintessence of dedication and commitment, where one is rewarded for the ability to foresee opportunities.

In many respects, my father prepared me for this responsibility and the lessons that I have learnt have been carried with me throughout my career, and of course furthered as I continued to gain experience. In 1997, together with my brothers, Mohamed Shaheen and Nazeem, I decided to establish Oasis. From the very onset we sought to create a global financial services company that specialised in offering Islamic and ethical investment products.

Prior to Oasis, there were absolutely no investment products that was available to cater for the needs of South African Muslim investors, and many individuals had to contend with some really mediocre offerings by some of the product providers. Of course, as I had been managing my family’s portfolio in a Shari’ah-compliant manner long before this offering was made available to South Africans, I was able to gain a significant amount of experience. I also spent a great deal of my time researching Islamic finance, and kept abreast of what was happening in this area globally. This ensured that I had a firm command of developments in Islamic finance and went to great lengths to improve my understanding of the various components that should be included in a modern Islamic investment portfolio, and the institutions that govern and support this industry. This meant that when we decided to forge ahead with Oasis, I had already developed a detailed understanding of Shari’ah-compliant investments globally, and I was very clear about ensuring the business was built with the aim of expanding into the global investment arena where the Oasis brand would participate on the world stage. I also travelled to all corners of the world to identify scholars who were leading experts in the field of Shari’ah-compliant finance and jurisprudence.

These scholars were then appointed to our independent advisory board, and have been with us for over twenty-one years. They include Dr Yousuf De Lorenzo from the United States, Sheikh Nizam Yaqubi from Bahrain and Dr Mohd Daud Bakar from Malaysia. This does not imply that we do not have any competent Shari’ah Scholars in South Africa, but the domestic sector was relatively under-developed and as we wanted to comply with the highest international standards, we identified the need to work with international scholars.

In many respects, it has been an honour to have been at the helm of Oasis when we introduced the brand to South Africans and it has been a privilege to have witnessed the phenomenal growth of our organisation. With complete partner operations that work across 2 continents, servicing 3 markets directly, and over 30 countries indirectly through our widespread distribution network; the brand has set itself apart in the asset management industry. We are blessed and very grateful to have come this far, and we remain humbled by the trust our clients place in us. It is immensely rewarding to be in a position where one is able to change the quality of people’s lives for the better, and we will continue to ensure that in doing so, we will be a part of our client’s lives for generations to come, Inshallah”.

Nazeem Ebrahim:

“The experience has been fantastic, Alhamdulillah. We had our challenges, and there were many that we needed to overcome, but every challenge is a learning opportunity and a stepping stone to success. When we started, South Africa had no real Islamic savings or brand that offered Islamic products to Muslims and ethically conscious investors. We set about cultivating the required laws that would allow for such products and liaised with the domestic central bank, various industry bodies, as well as the respective fiscal and financial services authorities to lobby for the introduction of Islamic investment products.

We were very proactive to ensure that the required legislation was passed in order for the first Islamic investment product to be launched. It must be noted that the South African industry was very open to Islamic finance and there were many individuals within our National Treasury and Financial Services Board that welcomed our participation in the South African financial landscape, and supported and facilitated our entry of this product to the market.

The industry has subsequently grown since we appeared on the scene and when other investment houses, banks and insurers realised the value within the Muslim market in South Africa; they also rolled out a number of Islamic investment products. So we have seen many competitors enter the market, but none of them have kept pace with the innovation and product expansion that has been provided by Oasis.

In the first 10 years, we set the foundations for an all-encompassing product line and had already taken our brand to the global market, where we continued to push the boundaries in terms of innovative product development. Although we were not part of the final launch, we are proud to say that we gave rise to the first South African Sukuk.

This came about as a result of an invitation which we extended to our good legal friend Michael McMillan and our esteemed Shari’ah Advisor, Prof. Yousuf De Lorenzo who made founding recommendations to our fiscal authority. It was years after we made the initial proposals, but the seeds were planted and South Africa saw the benefit of launching its Sukuk. We have a very robust financial system in the country, and the fact that it remains inclusive and diverse at the same time, makes it one of the most attractive investment destinations to this day.

The kind of growth we went through in South Africa was also equalled, when Oasis entered the global investment space, which occurred in our initial years. Oasis entered the global market by partnering with a newly established company within the regulatory framework of Guernsey in 2000. The onset of the millennium, fired up the operating environment for financial services and with this increased momentum, there was a shift to Ireland. In 2002, we obtained our licence and established a complete administration and client servicing facility called Oasis Global Management Company (Ireland) Ltd., which is situated in Dublin, Ireland.

This company is the administrator to the listed Oasis Crescent Global Investment Fund (Ireland) Ltd. At the time that we established our global company, it was owned by our South African entity. However with expansion, we sold this firm to our global partner, Oasis Crescent Global Group Holdings in 2008 and its license holder, the Mylie Group, which is based in Mauritius.

With Mylie, the Oasis brand really gained traction and in addition to the Oasis Funds being registered in Ireland and South Africa, it also received its registration and distribution licence in Switzerland, Singapore, the United Kingdom and the United Arab Emirates.

With a licence in hand we entered the UK retail and institutional investment market in 2012, and we found the environment to be very accommodating. The UK is a progressive, first-world economic hub, and with their government and treasury seeing Islamic finance as a major growth area for its financial services industry as a whole, along with our established track record, we were granted our licences. This really opened up the global market for us and we partnered with a number of wealth managers and platforms to ensure a wide and deep distribution of our global products”.

GLOBALLY, WE HAVE DELIVERED ISLAMIC PRODUCTS THAT CATER FOR THE VARIOUS ASSET CLASSES.

ISFIRE HAS A GLOBAL DISTRIBUTION AND OUR READERS COME FROM ALL OVER THE WORLD; PLEASE TELL US ABOUT YOUR PERSONAL APPROACH TO ISLAMIC FINANCE. AS CEO OF OASIS AND PRIOR TO THAT IN YOUR ILLUSTRIOUS CAREER, HOW HAVE YOU CONTRIBUTED TO THE DEVELOPMENT OF ISLAMIC FINANCE IN GENERAL AND ISLAMIC ASSET MANAGEMENT IN PARTICULAR?

Adam Ebrahim:

“As Nazeem has already mentioned, we put in a great deal of effort to lobby for the introduction of investment products that cater for the needs of Muslims. As such, we have been heavily involved in the development of the financial regulatory framework that facilitated the launch of Islamic finance in South Africa. In addition, these regulations allowed us to establish the first Islamic General Equity Fund in South Africa during 1998. Thereafter, we were also able to introduce the first Islamic Balanced Fund in 2001.

Our commitment to Muslim investors was not limited to the provision of collective investment schemes, as we also launched the first range of Islam- ic retirement funds to the South Afri- can market during 2001. Furthermore, we also started to provide services to international clients through our global partner offices that are located in Dublin and London. The Oasis Crescent Property Fund was then listed on the Johannesburg Stock Exchange in 2005, which made it the first listed Islamic Real Estate Investment Trust (REIT) in the world.

Following the success of these products, we launched the first Islamic endowment and Hajj savings products in South Africa during 2010, which has ensured that we now offer the most comprehensive range of Islamic investment products in this region. This range includes a number of savings products, tax-free investments, retirement products, post-retirement products, and endowments. In addition, we also provide a completely tailored solution for institutional clients and wealth management platforms.

Globally, we have delivered Islamic products that cater for the various asset classes. The hallmark of all our global fund offering is our balanced fund range which combines the equity, property, and income assets and depending on risk appetite of investors, also provides excellent portfolio diversification in a single fund.”

WE ALSO STARTED TO PROVIDE SERVICES TO INTERNATIONAL CLIENTS THROUGH OUR GLOBAL PARTNER OFFICES THAT ARE LOCATED IN DUBLIN AND LONDON. THE OASIS CRESCENT PROPERTY FUND WAS THEN LISTED ON THE JOHANNESBURG STOCK EXCHANGE IN 2005, WHICH MADE IT THE FIRST LISTED ISLAMIC REAL ESTATE INVESTMENT TRUST (REIT) IN THE WORLD.

WAY BACK IN 1998, OASIS LAUNCHED ITS FIRST SHARI’A-COMPLIANT FUND, NAMELY, THE OASIS CRESCENT EQUITY FUND. HAS THIS INITIATIVE TO GIVE INTERNATIONAL INVESTORS ACCESS TO OASIS’S INVESTMENT INSTRUMENTS BORNE FRUIT?

WHAT CHALLENGES HAVE YOU FACED AND WHAT WERE THE FACTORS THAT CONTRIBUTED TO YOUR SUCCESS?

Mohamed Shaheen Ebrahim:

“The Oasis Crescent Equity Fund currently holds assets of about $400 million, which attests to the success of this fund. This growth is largely attributed to a number of key factors, which include the superior long-term investment performance that is provided at a significantly reduced level of risk, relative to the market. Since the inception of the fund, we have provided investors with a cumulative return of 2,767% (or 18.1% per annum) when measured in domestic currency returns. This performance is solid when compared to the average South African Shari’ah Equity General Portfolio, which has provided a cumulative return of 987% or 12.6% per annum.

Additionally, while the total cumulative return of the Oasis Crescent Equity Fund is more than twice that of the benchmark, the amount of return per unit of risk is also of particular interest. In this case the Sharpe and Sortino ratios of the fund are 0.6 and 1.1, respectively; while the benchmark is responsible for ratios of 0.2 and 0.3. Hence, not only has the Oasis Crescent Equity Fund provided a high total return, it has also provided these returns at a lower level of risk.

The long-term performance of this fund has been exceptional and those investors that have been prepared to stay invested in the fund, over long periods of time, have been able to realise a considerable increase in wealth. Much of this performance is due to Adam’s prowess when it comes to in-vestment management and the application of his investment philosophy that is focused on long-term wealth creation.

We took this offering globally, applied the same investment philosophy to each fund and the results speak for themselves.

Our Global Funds were launched well over eighteen years ago, and have a solid track record that mirrors much of the value; which our flagship Oasis Crescent Equity Fund has delivered. In the UK, the Oasis Crescent Global Equity Fund has delivered 338% cumulatively since its inception to the period ending September 2018. Relative to the average Shari’ah Global Equity peer group which delivered 56.6% cumulatively over the same period; the Oasis fund offers intrinsic value to investors.

At Oasis we do not take chances with our investments, nor do we chase the latest trends out there or succumb to any pressure when other managers are outperforming us when markets are doing very well. Everyone does well when markets are up but you understand the skill and appreciate it more when your fund manager is still performing when you have punitive falling markets and people start running in all directions. We maintain our focus. Our job is not to time the market; we are stock pickers, and we are very selective about the companies that are included into our portfolios.

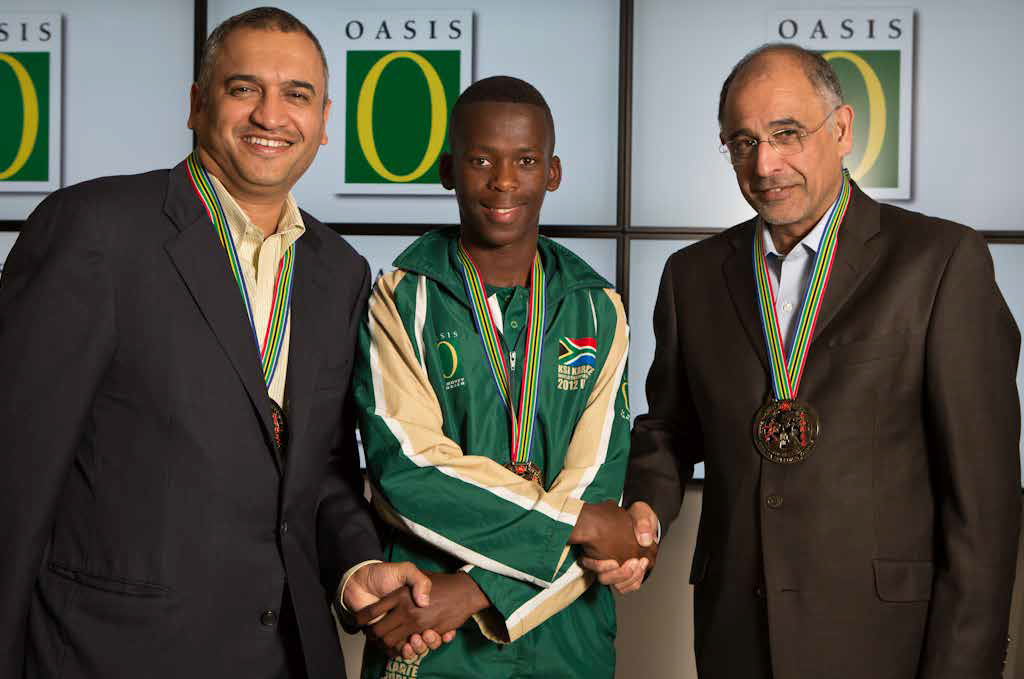

It is also worth noting that none of this success would have been possible without the support of our clients, who also believe in the application of our investment philosophy. This has ensured that we continue to manage a reasonably stable of funds that have not been subject to massive withdrawals at critical points in time. Furthermore, the close relationship we have with many of our clients has been an intricate part of our business model, and it has been important for us to give back to the community that entrusted us with the fruits of their labour”.

IT IS ALSO WORTH NOTING THAT NONE OF THIS SUCCESS WOULD HAVE BEEN POSSIBLE WITHOUT THE SUPPORT OF OUR CLIENTS, WHO ALSO BELIEVE IN THE APPLICATION OF OUR INVESTMENT PHILOSOPHY.

WITH A GROWING NUMBER OF ISLAMIC FINANCIAL INSTITUTIONS OUT THERE, HOW DO YOU POSITION OASIS IN THE OVERALL LANDSCAPE OF IBF IN THE COUNTRIES YOU OPERATE AND GLOBALLY?

Nazeem Ebrahim:

“We set out to become the leading global wealth management company through the provision of ethically focused Islamic investment products. Within the global investment market space as a whole, we have more than held our own. Evidence of this is provided by the awards that we have received and ratings that have been earned by our funds.

For example, we are currently rated as the best Islamic fund management company globally, and we have scooped awards over the years for our skill as investment managers, and the performance of our funds across all markets in which they operate. That provides a clear understanding of the fact that we set out to deliver excellence from the very onset to all our investors, irrespective of who they may be or where they have come from.

At Oasis we respect everyone and work incredibly hard to deliver on our investment philosophy, which has remained consistent since our doors first opened. The fundamental core values upon which the business is founded have never changed, and that is particularly important when one looks to position the organisation within the global investment universe. In many respects, we are still pushing the boundaries that we have set for ourselves, and this has allowed us to stay ahead of the curve, in all jurisdictions in which we currently operate. Globally we are regarded as a leading wealth manager, and that is based on the fundamental values that we have highlighted.

Moreover, we believe that our innovative investment products are of superior quality, which is what our investors have come to expect from all our investment funds.

Over the last twenty years we have sought to develop our operational capability to operate within a worldwide context. Ultimately, we would like to provide our products to many more global investors as we believe that they would also identify with the fundamental values upon which our products were created. Therefore, our aim is to continue contributing to the global investment sector, and our job is to continue working diligently in order to achieve this objective”.

LET US ASK A DIFFICULT QUESTION TO WHICH YOU MUST HAVE AN EASY ANSWER. MANY CRITICS OPINE THAT ISLAMIC ASSET MANAGEMENT HAS FAILED TO REALISE ITS TRUE POTENTIAL WITH GLOBAL AUM OF LESS THAN $100 BILLION. WHAT FACTORS HAVE CONTRIBUTED TO RELATIVELY LESS GROWTH IN ISLAMIC ASSET MANAGEMENT IN THE WORLD?

Adam Ebrahim:

“While I would agree that the sector as a whole has not reached its true potential, I don’t think it has failed its investors. There are a number of investment managers that have certainly not delivered on what they set out to achieve, but the same is true for the traditional investment sector as well. However, when comparing the Islamic investment sector to the traditional investment sector, one would need to acknowledge that managing a Shari’ah-compliant portfolio is slightly more involved, and as such investors need to be cautious when selecting an investment manager in this space.

Through the course of time, you will find that the good Shari’ah investment managers will continue to prosper and those that are not delivering will eventually leave the market. This would ultimately facilitate the continued growth of this sector to the extent that it will be able to reach its potential as the sector matures. We believe that an Islamic finance business that is focused on good business practices, and a sound investment philosophy will certainly prosper, as this sector is inherently prudent by nature, and will promote success”.

WHEN COMPARING THE ISLAMIC INVESTMENT SECTOR WITH THE TRADITIONAL INVESTMENT SECTOR, ONE WOULD NEED TO ACKNOWLEDGE THAT MANAGING A SHARI’AH-COMPLIANT PORTFOLIO IS SLIGHTLY MORE INVOLVED AND AS SUCH INVESTORS NEED TO BE LITTLE MORE CAREFUL WHEN SELECTING AN INVESTMENT MANAGER.

WITH THE BEGINNING OF OASIS AND THE LAUNCH OF YOUR FUNDS YOU ALSO CREATED A TRUST FUND WHICH IS SOCIALLY FOCUSED AND HAS A BIG GIVING PORTFOLIO. TELL US ABOUT THIS AND SOME OF YOUR PROJECTS?

Mohamed Shaheen Ebrahim:

“There are two main streams of contributions towards society that come from Oasis. The first stream is from within the Group itself, while the seconds from the Trusts, which disburses funds on behalf of Oasis investors.

All our Shari’ah-compliant investment funds accrue a portion of non-permissible income, which is also extracted a on a daily basis. These extracted portions are placed into one of two Trust funds, known as the Oasis Crescent Fund Trust and the Oasis Crescent Global Fund Trust, which in turn distributes these monies to identified projects that benefit the society.

As Muslims, we are taught from an early age to give and help those in need. So when structuring the business, we ensured that we set up a vehicle that would channel our investor’s unusable funds towards projects that would make a difference to the lives of those most in need. Oasis is an ethical business, and one of the founding pillars focuses on the well-being of the communities in which our company operates. So with our two streams of funding, we have been able to engage with projects within the areas of education, healthcare, social development and disaster alleviation.

We live in a time where it is necessary, and important to strengthen and empower our society, and make it healthy so that everyone can participate and grow collectively. Collaborative efforts are all about partnerships and rather than just contributing funds, we are actively involved in our projects, we share our values and ensure that the individuals, communities and societies that benefit from our participation are also left in a sustainable and economically improved position.

Some of the projects we manage include the Oasis Bursary Programme, skills training and development of teachers and students within the Early Childhood Development educational programme; installation of life-saving and income-generating medical equipment in hospitals and assisting countries and communities facing periods of natural disaster, war and conflict. Through our focus in education Oasis has also adopted four Children’s homes and an old age home with a view to expose them to rewarding experiences and at the same time integrate them into the lives of the people who live around them”.

SOME OF THE PROJECTS WE MANAGE INCLUDE THE OASIS BURSARY PROGRAMME, SKILLS TRAINING AND DEVELOPMENT OF TEACHERS AND STUDENTS WITHIN THE EARLY CHILDHOOD DEVELOPMENT EDUCATIONAL PROGRAMME; INSTALLATION OF LIFE-SAVING AND INCOME-GENERATING MEDICAL EQUIPMENT IN HOSPITALS AND ASSISTANCE TO COUNTRIES AND COMMUNITIES FACING PERIODS OF NATURAL DISASTER, WAR AND CONFLICT.

OASIS IS AN AWARD-WINNING COMPANY, WITH ITS MOST RECENT SUCCESS AT GLOBAL ISLAMIC FINANCE AWARDS 2018 HELD AT SARAJEVO ON SEPTEMBER 29. HOW WOULD YOU EXPLAIN YOUR SUCCESS AND RECOGNITION?

Adam Ebrahim:

“We will always strive to do the best on behalf of our clients, and it is this determination that largely explains the success that we have been able to achieve. Oasis has developed into a fantastic brand that is based on a successful investment philosophy, and a prudent strategy. Over the last twenty-one years we have developed into an organisation that is founded on excellence. We are supported by 230 equally dedicated and committed individuals that are located across six cities in three countries, to ensure we are able to deliver value to our clients globally. Our team forms the backbone to our entire business operation. It is gratifying to work with all our staff, and the fact that they want to see this brand go further makes it possible for us to really change the quality of our investor’s lives, and that of the communities in which we operate for the better. I am proud of my team, and humbled that they have adopted the vision I had, which is why we have been successful as an organisation”.

Nazeem Ebrahim:

“Throughout the entire organisation we have great determination to succeed on behalf of our clients, and as such we look forward to building and protecting their wealth. Moreover, we also look forward to being a part of the future success of the Islamic finance sector, which contributes to the broader community as well, through various forms of charitable contributions that are made by Shari’ah-compliant investment funds. Given the strength of these fundamental values, we have realised success for which due recognition was given”.

WE WILL ALWAYS STRIVE TO DO THE BEST THAT WE CAN ON BEHALF OF OUR CLIENTS AND IT IS THIS DETERMINATION THAT LARGELY EXPLAINS THE SUCCESS THAT WE HAVE BEEN ABLE TO ACHIEVE. OASIS HAS DEVELOPED INTO A FANTASTIC BRAND THAT IS BASED ON A SUCCESSFUL INVESTMENT PHILOSOPHY AND A PRUDENT STRATEGY.

MEETING YOU FOR THE FIRST TIME GIVES AN IMPRESSION OF A SOFT AND FRIENDLY PERSONALITY. HOW DO YOU CATEGORISE YOURSELF AS AN ASSET MANAGER: AN AGGRESSIVE MANAGER OR SOMEONE WHO WOULD BE DICTATED BY THE PREFERENCES OF HIS SHAREHOLDERS AND INVESTORS?

Adam Ebrahim:

“Neither. As an investment manager, I have never followed the herd or been part of that mentality. I am hardly swayed by trends or the latest hype put out into the marketplace. This has allowed me to never become aggressive in my stance and for that matter, I have never been influenced by greed or fear. As a fund manager; I listen to my investors. Their concerns are important, and need to be addressed with transparency and integrity. Listening to my investors does not mean I get told what I need to do. My role and position as Chief Investment Officer is very clear and I actively lead my team through a well-defined and cultivated investment philosophy. My approach is to be forward-thinking, to dissect the noise, be decisive, and uncover real value through overlooked opportunities. I use tact and skill to analyse the potential of undervalued companies, and seek opportunities when markets are down and underperforming. Investors want you to deliver value; it really is that simple. They want you to always act in their best interests and ensure that, through your actions, you take care of them. It is a responsibility for which I remain completely committed to”.

MY APPROACH IS TO BE FORWARD-THINKING, TO DISSECT THE NOISE, BE DECISIVE AND UNCOVER REAL VALUE THROUGH OVERLOOKED OPPORTUNITIES.

THE WORLD IS FAST BECOMING ORIENTATED TOWARDS THE USE OF SOCIAL MEDIA. WHAT ROLE CAN SOCIAL MEDIA PLAY IN CREATING AWARENESS AROUND ISLAMIC ASSET MANAGEMENT AND CREATING A VIBRANT RETAIL MARKET FOR INVESTMENTS?

Nazeem Ebrahim:

“If you remember what an important role Social Media had during the time of the Arab Springs, you will know and appreciate the importance of social media in general. Of course social media will create awareness and when employed correctly and respectfully, it can be a powerful tool to bring about greater awareness for Islamic Finance; in much the same way it has driven the agenda for ethical products. People are becoming much more astute in their decision-making, as well as the kind of values they want to live with and be associated to. Ethical products have reached levels of popularity because of the changing mindset, and many people becoming a lot more aware of where their products originate, how it is used And what its impact will be on the environment.

For Islamic investment products, it is no different. Investors want to know where you are investing, how you are investing, and, if through the process of investing on their behalf, you ensure that their money goes into companies and products which they are willing to be associated with. As an asset manager dealing with Islamic funds, you have a limited universe of companies to invest into. The key is to ensure you invest wisely and that you know which companies will deliver sustainable value over the long term, and that requires real analysis and a comprehensive understanding of the markets.

Often, it used to be the norm for investors to receive their information via their statements, key communication which a company would send out, or they could research the website, speak to their financial advisor, and more broadly, receive information via traditional media channels. Social media has dispelled this process and as more people connect with you, they get to interact with you on a deeper level, and in some ways, personally through these platforms. Everywhere you look these days, people are active in the social media space and it’s not just the younger audiences you are reaching but an entire spectrum of engaged individuals who, want to connect, engage and understand the world they live in, and social media has definitely played an important role to ensure that this has happened which is positive for organisations like ourselves. Our messages, through social media really reaches interested audiences and this level of engagement bodes well for Islamic finance as a whole”.

SOUTH AFRICA HAS A SMALL MUSLIM POPULATION. RISING FROM CAPE TOWN TO BECOME A GLOBAL PLAYER IN ISLAMIC ASSET MANAGEMENT IS A HUGE ACHIEVEMENT. WHAT MADE YOU CHOOSE ISLAMIC ASSET MANAGEMENT AS A PROFESSION?

Adam Ebrahim:

“It was inevitable that as an investment manager I would set my company to operate within an Islamic framework. Islam as a beautiful religion and way of life. Our business practices are ethical and being a Muslim I was cognisant of the fact that Islamic Finance was not available to our market. While I received training in the asset management industry, my practises were always according to my beliefs as a Muslim. I invested ethically, and opening Oasis was really an organic extension of what I was inherently doing.

It’s on a much larger scale now, but there was more than a need in the market space for Islamic investments to be offered.

Islamic business is prudent; good and virtuous and its system has attracted more than just a Muslim investor. Oasis doors have welcomed investors from just about every walk of life”.

AMONGST A VARIETY OF PRODUCTS OFFERED BY OASIS, WHICH ONE WOULD YOU PERSONALLY PICK UP FOR INVESTMENT AND WHY?

Adam Ebrahim:

“I believe that any one of our balanced investment funds present fabulous investment opportunities. These funds epitomise the essence of our investment management philosophy, and they provide investors with relatively high levels of diversification. Therefore, each of these portfolios is made up of a well-blended asset mix that incorporates diversification across geographies, currencies, sectors, asset classes and instruments. The various balanced funds within our range cater for the requirements of most investor profiles, which may constitute varying age groups and risk appetites. Each of the balanced funds is also focused on the creation of long-term growth and sustainability, which underpin our core investment values”.

ISLAMIC BUSINESS IS PRUDENT; GOOD AND VIRTUOUS AND ITS SYSTEM HAS ATTRACTED MORE THAN JUST A MUSLIM INVESTOR. OASIS DOORS HAVE WELCOMED INVESTORS FROM JUST ABOUT EVERY WALK OF LIFE.

ON A PERSONAL NOTE WHO HAS INSPIRED YOU THE MOST AND WHY? HOW HAS THIS INSPIRATION SHAPED YOUR APPROACH TO ASSET MANAGEMENT?

Adam Ebrahim:

“The most influential person in my life has been my father. Through hard work, he was able to acquire significant knowledge and this insight allowed him to identify opportunities long before others started to think about it. In addition, he was also an extremely brave man who had the conviction to follow through on the various strategies that he developed, despite many of the adversities that he encountered. He was very well-read, challenged us to think broadly and deeply, and always led by example. Much of what we have accomplished at Oasis today is grounded in his teachings. My approach to property and Oasis property investment strategies are definitely influenced by my father’s experiences and I remain grateful to him for nurturing my understanding in this area from such a tender age. In addition, my father was also a compassionate man who genuinely cared about others, and as such he tried wherever possible to ensure that those around him would also benefit from his success. I do not believe that anyone could be presented with a better role model.

With my fascination with history I have really admired Khalid ibn Al-Waleed, who I found not only to be an inspirational leader, but also a key strategist and analyst. He was meticulous in his approach to unite the Ummah and in many respects he was able to successfully plan ahead of time to ensure that he was able to outsmart his respective adversaries. I have drawn many lessons from his approach and always made every effort to plan my path ahead as much as I could, Inshallah. Planning is important and every honourable leader, like Khalid ibn Al- Waleed knows that when you have others depending on you; you have to be wise about your choices and always seek out the best plans you can so those that rely on you are well taken care of”.

ANY NEW PRODUCT ON THE HORIZON?

Adam Ebrahim:

“Oasis product offering is comprehensive in itself but there is always room for products to be offered in markets where there is a demand. We have our eye on the retirement industry in the UK, and see this as an exciting opportunity in the near term. Like all our approaches, we are careful to research and plan what our entry into the retirement space would translate into. It is not a straightforward process and you need to make sure this offering is more than just supported, but that it really delivers long-term value and it is sustainable”.

PLANNING IS IMPORTANT AND EVERY HONOURABLE LEADER, LIKE KHALID IBN AL- WALEED KNOWS THAT WHEN YOU HAVE OTHERS DEPENDING ON YOU; YOU HAVE TO BE WISE ABOUT YOUR CHOICES AND ALWAYS SEEK OUT THE BEST PLANS YOU CAN SO THOSE THAT RELY ON YOU ARE WELL TAKEN CARE OF.

WHAT WOULD BE YOUR MESSAGE TO THE GLOBAL ISLAMIC FINANCIAL SERVICES COMMUNITY, PARTICULARLY THE YOUTH?

Adam Ebrahim:

“The beauty of youth is that you have your life ahead of you, and dreams that need to be nurtured and fulfilled. I am very encouraged when I see what young people are doing, and how they explore the world around them in order to make a mark for themselves. They certainly are competitive in all sectors, and my message to them is to never stop growing, learning and challenging yourself. The Almighty has created you for a purpose, and you must realise and fulfil that purpose with honour and integrity. In doing so, you need to plan for the time ahead, and that is true for your finances as well. Nothing worthwhile is achieved without hard work and patience, and this is the same for your investments. It is never too early to start saving and nurturing the kind of life you want for yourself. There is a myriad of Islamic investment products out there, allowing you to interact in this world; stay true to your roots and continue doing the things you need to in order to sustain yourself well into the future, Inshallah”.

NOTHING WORTHWHILE IS ACHIEVED WITHOUT HARD WORK AND PATIENCE, AND THIS IS THE SAME FOR YOUR INVESTMENTS. IT IS NEVER TOO EARLY TO START SAVING AND NURTURING THE KIND OF LIFE YOU WANT FOR YOURSELF.