Founded in 2011, Global Islamic Finance Awards (GIFA) have emerged as the most respectable market-led awards in IBF. No other awards in the Islamic financial services industry have so far attracted larger number of heads of government/ state. GIFA top award – Global Islamic Finance Leadership Award – is presented each year to a head of state/government, former or serving, or someone of equivalent stature, for their leading role in promoting IBF in their respective jurisdictions.

The winners of this prestigious award are known as GIFA Laureates (see the Box on GIFA Laureates).

To date, GIFA has issued 37 award categories (18 in 2011, 23 in 2012, 24 in 2013, and 26 in 2014).

Accompanying table presents all the categories and the award winners in the last four years. The awards are divided into four categories: [1] Top Awards;

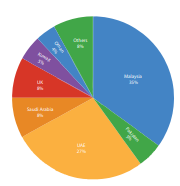

[2] Prestigious Awards; [3] General Awards; and [4] Occasional Awards. The winners have been drawn from a number of countries but for obvious reasons, Malaysia and UAE have dominated the winners (see Figure below). Malaysian institutions have to date received 35% of the awards, understandably because of the leadership role the government has played and the level of sophistication the IBF industry in the country has achieved as a result of a number of regulatory and advocacy initiatives. It is not surprising that two out of four GIFA Laureates hail from Malaysia – Tun Abdullah Badawi, first GIFA Laureate (2011) and Sultan Nazrin Shah, the second GIFA Laureate (2012).

The UAE-based institutions have performed well in GIFA league table because of the central position the country holds in the global Islamic financial services industry and the dynamism of Islamic financial institutions based in the country.

Each year, GIFA top award – Global Islamic Finance Leadership Award – is presented to a head of government or state, former or serving, for their leading role in promoting Islamic banking and finance in their respective jurisdiction. This year, the top award was split into two categories — a Personality Award and a Country Award. The Personality Award was presented to His Excellency Nursultan Nazarbayev, President of Kazakhstan, for his outstanding support to IBF in his country and its effect on the development of IBF in the central Asian region. The Country Award was presented to Malaysia and was received by Dato’ Sri Najib Razak,

Prime Minister of Malaysia, on behalf of his country that have played an instrumental role in promoting the global Islamic financial services industry.

There were four nominations for the top GIFA this year, including Rt. Hon. David Cameron (the UK Prime Minister), His Excellency Recep Tayyip Erdogan (President of Turkey), His Excellency Najib Razak (Prime Minister of Malaysia), and His

Excellency Nursultan Nazarbayev (President of Kazakhstan). All of these leaders have played instrumental roles in the development of IBF in their respective countries. UK’s sovereign sukuk this year spurred the growth of sovereign sukuk, which was followed by the sovereign sukuk by Hong Kong, South Africa and Luxembourg. Turkey has emerged as a major player in IBF under the dynamic leadership of Mr Erdogan who served as Prime Minister of Turkey before getting elected President of his country earlier this year. The Malaysian Prime Minister has been in the centre of all the developments in Malaysia and in other parts of the world. It was a tough job for the GIFA Awards Committee to pick up a winner but at the end, after a lot of deliberations, His Excellency Nursultan Nazarbayev was chosen to be the fourth GIFA Laureate. Malaysia’s leadership role was acknowledged in the form of a Country Award that was received by the Malaysian Prime Minister.

List of all GIFA Award Winners:

| Award Categories | 2011 | 2012 | 2013 | 2014 |

| Top Award | ||||

| Global Islamic Finance Leadership Award (Individual Category) | Tun Abdullah bin Haji Ahmad Badawi, Former Prime Minister of Malaysia | Sultan Nazrin Shah ibni Sultan Azlan Muhibbuddin Shah, Sultan of Perak | Mr Shaukat Aziz, Former Prime Minister of Pakistan | Mr Nursultan Nazarbayev, President of Kazakhstan |

| Global Islamic Finance Leadership Award (Country Category) | — | — | — | Malaysia |

| Prestigious Awards | ||||

| Islamic Finance Personality of the Year Award | — | Sohail Jaffer Deputy CEO of FWU Group | Hasan Al Jabri, CEO of SEDCO Capital | Dr Jamil Jaroudi, CEO of Bank Nizwa |

| Islamic Banker of the Year Award | Badlisyah Abdul Ghani, CEO of CIMB Islamic | Yuslam Fauzi, CEO of Bank Syariah Mandiri | Datuk Sri Zukri Samat, CEO of Bank Islam | Dr Adnan Chilwan, CEO of Dubai Islamic Bank |

| Best Islamic Bank | National Commercial Bank | CIMB Islamic | Dubai Islamic Bank | Bank Rakyat |

| Islamic Finance Advocacy Award | — | — | Linar Yakupov, CEO of Tatarstan Investment Deevelopment Agency, the Russian Federation | — |

| GIFA Special Award | Mr Yasin Anwar, Governor of State Bank of Pakistan | — | Mr Sanusi Lamido Sanusi, Governor of Central Bank of Nigeria | Dr Zambry Abdul Kadir, Chief Minister of Perak, Malaysia |

| Award Categories | 2011 | 2012 | 2013 | 2014 |

| General Categories | ||||

| Best Takaful Solutions Provider | FWU Global Takaful Solutions | Etiqa Takaful | FWU Global Takaful Solutions | FWU Global Takaful Solutions |

| Best Islamic Fund | — | CIMB Principal Islamic Asset Management (Ireland) plc | F & C Shari’a Sustainable Opportunities Fund | NBAD Islamic MENA Growth Fund |

| Best Islamic Fund Manager | CIMB Principal Islamic Asset Management Sdn. Bhd. | SEDCO Capital | AmInvest | AmInvest |

| Best Islamic Banking Window | — | ADCB Islamic | ADCB Islamic | Bank Alfalah |

| Best Islamic Finance Qualification | Certified Islamic Finance Executive (CIEF) by ETHICA | Certified Qualification in Islamic Finance (CQIF) by IBFIM | Bachelor of Islamic Finance and Banking by UUM | — |

| Best Islamic Finance Education Provider | INCEIF | Durham University | CIMA | ARI, UiTM |

| Best Islamic Finance Training Provider | — | — | — | IBFIM |

| Best Islamic Structured Products Platform | Societe Generale | CIMB Islamic | Societe Generale | — |

| Best Islamic Finance Technology Provider | Path Solutions | International Turnkey Systems (ITS) | International Turnkey Systems (ITS) | Path Solutions |

| Best Islamic Finance Technology Product | ETHIX by ITS | ETHIX by ITS | — | — |

| Best Islamic Finance Law Firm | Agha & Shamsi/Agha & Co | Zaid Ibrahim & Co (ZICO) | ARSA Lawyers | — |

| Best Islamic Finance Consultancy | KPMG | KPMG | — | Al Maali Consulting Group |

| Best Supporting Institution of the Year | DDCAP | DDCAP | Finance Accreditattion Agency (FAA) | DMCC Tradeflow |

| Upcoming Personality in Islamic Finance | Dr Asyraf Wajdi Dusuki | Dr Wan Nursofiza Wan Azmi | Moinuddin Malim | — |

| Upcoming Personality in Islamic Finance (Leadership Role) | — | — | — | Amr Al Menhali |

| Upcoming Personality in Islamic Finance (Pioneering Role) | — | — | — | Sulaiman Al Harthy |

| Best Sukuk Deal of the Year | — | AJIL Cayman Sukuk – Gulf International Bank | Axiata Group Berhad – CIMB Islamic | Al Bayan Sukuk, Hong Leong Islamic Bank |

| Islamic Social Responsibility Award | — | Islamic Relief Worldwide | SEDCO Capital | SEDCO Capital |

| Best Research and Development in Islamic Finance | — | Asian Institute of Finance | Meezan Bank | IRTI |

| Most Innovative Product | — | Qibla Card – Al Hilal Bank | Emirati Savings Millionaire Account – ADCB Islamic | — |

| Best Islamic Rating Agency | — | RAM Rating Services | — | MARC |

| Best Islamic Micro-finance Institution | — | — | Amanah Ikhtiar Malaysia | Amanah Ikhtiar Malaysia |

| Occasional Categories | ||||

| Pioneer of Islamic Banking | Bank Muscat (Oman) | — | — | PT Bank Muamalat |

| The Most Improved Islamic Bank | ADCB Islamic Banking | — | — | — |

| Upcoming Shari’a Scholar | Mufti Talha Azami | — | — | — |

| Shari’a Authenticity Award | — | — | — | — |

| Best Islamic Savings Product | — | — | National Bonds | National Bonds |

| Upcoming Islamic Bank | — | — | Bank Nizwa | — |

| Best Islamic Finance Case | — | — | — | Bank Islam and Asian Institute of Finance |

| Best Shari’a Compliant Commodity Facilitation Platform | — | — | — | DDCAP Group |

GIFA LAUREATE 2011

His Excellency Tun Abdullah Bin Haji Ahmad Badawi Prime Minister of Malaysia (2003-2009)

Yang Amat Berbahagia Tun Abdullah Bin Haji Ahmad Badawi was honoured with the inaugural Global Leadership in Islamic Finance Award at a prestigious ceremony held on the occasion of Oman Islamic Economic Forum at Muscat on December 17, 2011.

HE Tun Abdullah Badawi’s nomination for the prestigious award followed his relentless efforts to set up supporting institutions for the development of Islamic banking and finance not only in Malaysia but also in the rest of the world. During his six year tenure as Prime Minister of Malaysia, the country witnessed setting up of Islamic Financial Services Board (founded in 2002, and started operations in 2003) as a global player in Islamic banking and finance. He also founded International Centre for Education in Islamic Finance (INCEIF) in 2005, which has since then emerged as a premier seat of learning in Islamic banking and finance. In 2006, His Excellency’s government embarked upon another global initiative – Malaysia International Islamic Financial Centre – set up by Bank Negara Malaysia to develop Malaysia as an international hub for Islamic banking and finance. In 2008, his government set up International Shari’a Research Academy for Islamic Finance (ISRA), which is now spearheading a number of path-breaking research projects on different aspects of Islamic banking and finance.

GIFA LAUREATE 2012

His Royal Highness Sultan Dr Nazrin Shah Sultan of Perak (2014 – current)

Sultan Nazrin Shah was honoured with the second Global Islamic Finance Leadership Award at a prestigious ceremony held on November 19, 2012, at Royal Chulan Hotel Kuala Lumpur, Malaysia, on the occasion of Asian Finance Forum, for his dedicated services to internationalise Islamic banking and finance.

HRH Dr Nazrin Shah, Sultan of State of Perak, Malaysia, was honoured with the Global Leadership in Islamic Finance Award for his ambassadorial role and engagement on the highest level to promote Islamic banking and finance in Malaysia and other countries of the Organisation of Islamic Cooperation (OIC).

As Financial Ambassador of MIFC, he travelled extensively to promote initiatives related with Islamic banking and finance. He has played an instrumental role in promoting projects related with Islamic banking and finance in a number of fields. He continues to inspire millions of young practitioners of Islamic banking and finance, and has engaged himself in different educational, cultural, research and financial projects to support and promote Islamic banking and finance.

His dedication, integrity and ambassadorial role in Islamic banking and finance put him ahead of any royal in the Muslim world, and he was honoured with Global Leadership in Islamic Finance Award in 2012.

The second GIFA Special Ceremony held on October 28, 2014, at Medinat Jumeirah before the opening session of the 10th World Islamic Economic Forum (WIEF) was attended by a number of dignitaries, including His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Ruler of Dubai and Prime Minister & Vice President of the UAE, along with Sheikh Hamdan Bin Mohammed, Crown Prince of Dubai, and a number of members of the Dubai cabinet. They witnessed the presentation of Global Islamic Finance Leadership Award 2014 to HE Nursultan Nazarbayev, President of Kazakhstan. This Special Ceremony was also attended by the members of international media community, following which a huge media campaign was launched by the government of Kazakhstan to celebrate Mr Nazarbayev’s inauguration as the fourth GIFA Laureate. The mood was buoyant in40 the country on this prestigious award. “Kazakhstan has long been waiting for such recognition. We at the Islamic Finance Development Association have always pointed out the role President Nazarbayev plays in Islamic banking and finance,” said Yerlan Baidaulet, Chairman of the Islamic Finance Development Association.

The third GIFA Special Ceremony was held on the same day at the end of the global media brief of Dato’ Sri Najib Razak after the launch of the 10th WIEF. In the presence of a large number of distinguished guests, including Tun Musa Hitam (a former Deputy Prime Minister of Malaysia and Chairman of the WIEF Foundation), the Prime Minister of Malaysia was presented with the Global Islamic Finance Leadership Award 2014 (Country Category). The moment was captured by an excellent photograph (see the picture) that was subsequently published by a number of newspapers in Malaysia.

This year, there were 26 categories of awards, with a Special GIFA Award presented to Dr Zambry Abdul Kadir, Chief Minister of Perak. Dr Zambry Abdul Kadir was chosen based on his contribution to the socio-economic model in assisting the poor and eradicating poverty in the state through Yayasan Bina Upaya Darul Ridzuan (YBU). YBU, the brainchild of the Chief Minister, was registered in 2009 as the government’s arm in tackling poverty issues in the state. Besides reducing poverty, YBU aims to empower the target group, which includes the poor, the handicapped and single mothers.

Through its programmes like the micro-credit scheme, repairing and building new houses, food assistance and special housing scheme dubbed Rumah Ihsan Aman Jaya, where interest-free housing loans are provided for qualified applicants, YBU has succeeded in reducing poverty from 0.5 per cent to 0.2 per cent since 2012.

GIFA LAUREATE 2013

His Excellency Shaukat Aziz Prime Minister of Pakistan (2004 – 2007)

Mr Shaukat Aziz became the third GIFA Laureate on November 26, 2013, at a colourful GIFA ceremony held in Dubai, and attended by a large number of Islamic bankers and practitioners of Islamic finance from around the world. This was a special occasion for Mr Shaukat Aziz who received Global Leadership in Islamic Finance Award 2013 from the 2012 GIFA Laureate, HRH Sultan Nazrin Shah.

Mr Aziz was honoured for his services as Finance Minister and later Prime Minister of Pakistan when his government changed its policy towards Islamic banking and finance and adopted a dual banking system allowing conventional and Islamic banks to operate side by side. Due to this successful policy, the share of Islamic banking in the total banking sector increased from almost zero to over 6% when he left the office. This provided a solid foundation to the development of Islamic banking and finance in Pakistan. In 2014, Islamic banking’s share in the banking sector is well above 10%.

Mr Aziz was honoured with the Global Leadership in Islamic Finance for putting Pakistan back on the track as a leader in the global Islamic financial services industry.

GIFA LAUREATE 2014

His Excellency Nursultan Nazarbayev President of Kazakhstan (1991 – current)

Mr Nursultan Nazarbayev became the fourth GIFA Laureate on October 28, 2014, when he received Global Islamic Finance Leadership Award at a special ceremony held at the 10th World Islamic Economic Forum at Dubai. The ceremony was witnessed by Sheikh Mohammed Bin Rashid Al Maktoum, Ruler of Dubai and Prime Minister and Vice President of UAE.

Professor Humayon Dar, Founder of GIFA, presented the award to the President for his support to IBF in Kazakhstan and in the wider CIS region. It was primarily due to Mr Nazarbayev’s personal interest and the initiatives taken by his government that Abu Dhabi’s Al Hilal Bank started its operations in Kazakhstan, and became the first Islamic bank in the country. Since then, Kazakhstan has taken a number of measures to ensure that IBF stands on firm grounds in the country. Mr Nazarbayev’s vision and strategic thinking has been behind all these efforts, and it is expected that Kazakhstan will emerge as a centre of excellence for Islamic finance in the CIS region. The Regional Financial Centre of Almaty, established in 2006 by the President, has a major focus on developing Almaty as a centre of excellence for Islamic finance for the Central Asian region.

Speaking on the occasion, Dr Zambry Abdul Kadir said, “This award recognises the model of social responsibility we have developed in Perak. Islamic banking and finance features significantly in our vision.”

Other prominent winners were Dr Jamil El Jaroudi, CEO of Bank Nizwa, who was chosen as Islamic Finance Personality of the Year. Under Dr Jaroudi’s leadership, Bank Nizwa emerged as the first fully-fledged Islamic bank in the Sultanate of Oman. Before that, he was involved in a number of industry-building initiatives in a number of countries. “It is because of the individuals like Dr Jaroudi that Islamic financial services industry is enjoying the kind of status it has attained in the last 40 years,” remarked Professor Dar. Under Dr El Jaroudi’s guidance, Bank Nizwa is a pioneer in the Islamic banking sector offering customers a suite of Shari’a-based products and services that compete with conventional banking. Dr. El Jaroudi went on to thank the Bank’s customers for their trust and support, promising to continue delivering competitive propositions that meet community needs. In addition to his responsibilities at Bank Nizwa, Dr El Jaroudi is a member of the Governing Council of the International Centre for Education in Islamic Finance (INCEIF), the leading university in the world dedicated to offering academic and professional qualifications in Islamic finance. He is also a Board Member of the Beirut Islamic University and a member of the Board of Trustees of the Lebanese American University Institute of Family Businesses. Recognised for his key role in raising awareness on Islamic Banking regionally and internationally, Dr. El Jaroudi was recently invited to join the Global Islamic Financial Investment Group (GIFIG) and contribute to making the London market to become one of the world’s leading Islamic finance centres.

Speaking on the occasion, Dr El Jaroudi said, “It is a great honour to be recognised by one of the most prestigious awards in Islamic banking. This award reflects the dedication and commitment of each and every individual in our team and their unparalleled efforts to make Bank Nizwa, one of the most trusted and innovative banks in the Sultanate of Oman,” said Dr El Jaroudi.

Dr Adnan Chilwan, CEO of Dubai Islamic Bank, was presented with the Islamic Banker of they Year award for his leadership role in reviving his bank in a short span of two years as CEO. On receiving the award, Dr Adnan Chilwan said, “I am an Islamic banker at heart and having been chosen for this award knowing that there were many qualified applicants is a truly humbling and gratifying experience. While this award is recognition for my personal and professional contribution to the field of Islamic banking and finance, this is not the end- game for me.”

Best Islamic Bank 2014 award was given to Bank Rakyat of Malaysia, which is the largest cooperative Islamic bank in the country. Under the able leadership of Datuk Mustafha Abd Razak, Managing Director, the bank has emerged as a major player in the Islamic banking industry in Malaysia. “Recognition of Bank Rakyat as Best Islamic Bank of the year is in line with our three-pronged

objective of commitment to IBF, social responsibility and Shari’a authenticity,” commented Professor Humayon Dar after the awards ceremony. Co-operative banking has by and large been ignored in Islamic banking, and it is hoped that this year’s GIFA will highlight the potential role of this form of banking in the context of IBF. Datuk Mustafha

Abd Razak commented after receiving the award, “I want to express my utmost appreciation and thanks to Global Islamic Finance Awards (GIFA) Committee for recognising Bank Rakyat as the Best Islamic Bank 2014. We are truly honoured to receive it on behalf of the Malaysian Islamic financial services fraternity and the country”.

Mr Kairat Kelimbetov, Governor of National Bank of Kazakhstan, while representing the President of Kazakhstan at the gala dinner, re-affirmed his country’s resolve to make Kazakhstan as a regional centre of excellence for Islamic finance.

The welcome address was given by Professor Humayon Dar, Founding Chairman of GIFA. Addressing over 300 people seated in the grandeur of Al Masa Ballroom at The H Dubai, Professor

Dar termed the occasion an acknowledgement, appreciation and celebration of the success of the global Islamic financial services industry. He shared Edbiz Consulting’s estimate for the size of the global Islamic financial services industry. “The historic mark of two trillion US dollars was indeed not possible without contributions from a number of governments, institutions and individuals involved in Islamic banking and finance; these contributions deserve formal recognition that must be respected and held in high esteem,” the applauding audience heard him saying. He continued:

“Four years back when we founded Global Islamic Finance Awards and presented our first batch of awards to the industry leaders, we knew that we were actually starting not only a tradition but a global movement. Our three-pronged objective of promoting commitment to Islamic banking and finance, social responsibility and Shari’a authenticity has resulted in identifying a group of institutions and individuals who are indeed more committed to Islamic banking and finance, are more socially responsible and are more sensitive to the requirements of Shari’a authenticity in their products and institutions than those who have yet to win a Global Islamic Finance Award.”

GIFA Methodology is the most scientific, data-oriented and objective methodology to quantify contribution of a government, business and individual to Islamic banking and finance (see the Box delineating GIFA Methodology). In just four years, GIFA have emerged as the most authentic awards in the Islamic financial services industry.

Inspired by the success of the GIFA 2014, Professor Humayon Dar, announced GIFA Million Dollar Campaign, which aims at promoting Islamic financial education. “We shall endeavour to raise US$1 million by the next GIFA Ceremony to be held in 2015, and would request our GIFA Laureate 2015 to launch a GIFA Islamic Finance Scholarship Programme, which will offer scholarships to the most talented students studying Islamic banking and finance at top universities in the world,” said Professor Dar in a buoyant mood.

Awards in General Category

Notable award winners in general category included Bank Alfalah Pakistan, FWU Global Takaful Solutions, and Al Maali Consulting Group. Bank Alfalah received the prestigious award of Best Islamic Window, as it has the largest Islamic banking operations within a conventional banking group in Pakistan. Rizwan Ata, Head of Islamic Banking at Bank Alfalah picked up the award on behalf of his bank. GIFA Awards Committee decided in favour of Bank Alfalah to highlight an otherwise underestimated role of Pakistani Islamic banking in the global Islamic financial services industry.

“While Meezan Bank is the largest Islamic bank in the country and is recognised in the international markets for its pioneering role in the country, it is the banks like Alfalah which give the required depth to Islamic banking in Pakistan,” said Rizwan Malik, Head of Business Development at Edbiz Consulting.

FWU Global Takaful Solutions won the Best Takaful Company 2014 award for the second consecutive year. FWU was preferred over other retail takaful operators because most of them re focused on a national market, unless the winner that have operations in multiple jurisdictions and have played a pivotal role in the development of takaful industry in a number of countries. Also, Mr Sohail Jaffer, Deputy CEO of the company, is a well-known figure in IBF, who has written extensively on takaful and other related topics in IBF. FWU Group has shown its commitment to IBF and its promotion by supporting a number of industry-building initiatives.

Al Maali Consulting Group received the Best Islamic Finance Consultancy Award 2014. Al Maali Consulting Group is a small boutique Shari’a advisory company based in Dubai, which has advised a number of institutions in structuring Shari’a-compliant products and transactions.

Unlike mainstream consultancy companies with teams specialising in IBF, Al Maali is a stand-alone full-fledged Islamic advisory company, and this was due to this that the GIFA Awards Committee took a decision in favour of it.

GIFA continues to highlight emerging talent in the Islamic financial services industry. This year’s Most Upcoming Personality Award was split into Pioneering Role and Leadership Role, and the winners were Sulaiman Al Harthy, General Manager and Head of Islamic Banking Division – Meethaq – at Bank Muscat, and Amr Al Minhali, Head of Islamic Banking at Abu Dhabi Commercial Bank (ADCB), respectively. Sulaiman Al Harthi has been a member of the team that pioneered Islamic banking in Oman. Amr Al Minhali, on the other hand, has played an exemplary leadership role in developing ADCB’s Islamic franchise – ADCB Islamic. Both these individuals were awarded Most Upcoming Personality in Islamic Banking and Finance. GIFA Awards Committee took a view that these two individuals would assume even higher leadership roles in their future engagements in IBF.

Path Solutions, the largest Islamic core banking systems provider, was named the Best Islamic Finance Technology Provider 2014. The selection was made after extensive debate and discussion among the Awards Committee, as this category is the most fiercely fought for by the players in Islamic financial technology sector. According to Professor Humayon Dar, “Path Solutions deserves this honour. They have been working tirelessly to deliver cutting-edge software solutions to support their clients’ unique business objectives”.

Path Solutions continues to play a vital role in the development of the Islamic finance industry worldwide, and winning the GIFA award reiterates their constant endeavour in bringing about technology innovations to suit their clients’ ever-changing needs and requirements.

The award was presented to Abd El Aziz Lotayef, EVP – Pre-sales & Business Consulting, Path Solutions.

Each year, GIFA picks up one institution to acknowledge its importance in serving the Islamic financial services industry in a supporting role.

This year’s winner was DMCC Tradeflow. The award was received by Ahmed Bin Sulayem, Executive Chairman of DMCC, who commented, “DMCC has a deep heritage in Islamic finance and a longstanding track record in supporting the Islamic economy.” The award was decided in favour of DMCC Tradeflow because it offers players in the UAE Islamic financial market a home-grown trading platform with the locally available commodities as an alternative to existing Commodity Murabaha solutions in other parts of the world. A number of Shari’a scholars in the Middle East have shown their preference for local commodities for Commodity Murabaha transactions, and DMCC Tradeflow does exactly the same.

“Receiving the Global Islamic Finance Award for Best Supporting Institution 2014 is further testament to our commitment to the industry and our consistent drive to further support His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice President, Prime Minister of the UAE and Ruler of Dubai’s vision to transform Dubai into the capital of Islamic economy globally,” said Ahmed Bin Sulayem.

Best Islamic Fund 2014 award was won by NBAD Islamic MENA Growth Fund. The fund was chosen for the award for its investment strategy that favours local and the Middle Eastern stock markets.

Many advocates of IBF prefer to invest Islamic capital locally or in other Islamic economies. This is exactly what NBAD Islamic MENA Growth Fund attempts to achieve by investing in identified opportunities in the MENA region.

Malaysia-based AmInvest won the Best Islamic Fund Manager Award second time in a row, following their success in GIFA last year.

Malaysian Rating Corporation Berhad (MARC) was named the Best Islamic Rating Agency 2014, and its Chief Executive Officer, Mohd Razlan Mohamed, received the award. Datuk Azizan Abd Rahman, Chairman of Board of Directors of MARC, was also present on the occasion. The award was decided in favour of MARC because of its active role in the development and growth of Islamic finance and promoting governance at Shari’a-compliant institutions.

“It is a tremendous honour for MARC to receive this prestigious award in the category of Best Islamic Rating Agency from GIFA. We are privileged to have participated in the development of the global sukuk market and its stellar growth over the years through our role as a trusted arbiter of risk,” said Razlan Mohamed. “This award will further spur the team at MARC to push the boundaries of excellence in ratings of Islamic instruments and Islamic finance research,” he added.

Since commencing operations in June 1996, MARC has provided ratings on a wide range of Shari’a-compliant issuances by both domestic and foreign companies in the Ringgit-denominated sukuk market. MARC’s rating coverage extends to corporate and structured finance sukuk, project finance sukuk and Shari’a-compliant banking and insurance institutions. MARC has completed 715 ratings, accounting for about USD140.6 billion (RM450 billion) in issuance value as at 31 August 2014.

Among MARC’s key initiatives to support the growth and development of Islamic finance are introducing the first set of Shari’a-based rating scales and rating the world’s first global sukuk, Kumpulan Guthrie Bhd’s USD150 million sukuk ijara in 2002. The world’s first sukuk using the musharaka structure valued at USD694 million (RM2.5 billion) by musharaka One Capital Bhd in 2005 was also rated by MARC. Since then, MARC has provided insights on sukuk rating through our publication entitled Rating Approach to Sukuk: A MARC Perspective, which has become a key reference for sukuk investors and issuers.

Additionally, MARC ‘s rating offering introduced in 2010 called “Islamic Financial Institution Governance Ratings,” provides a structured assessment of the quality of institutional governance, acknowledging the significant role played by governance in an Islamic financial institution. In support of Islamic Development Bank’s (IDB) initiative to create a sustainable and dedicated Islamic credit rating institution, MARC has remained, since 2011, a committed technical partner to IDB-initiated Bahrain-based Islamic International Rating Agency.

Over the years, MARC has rated many innovative Sukuk instruments and structures. Among the notable Sukuk that are rated by MARC include:

- Projek Lebuhraya Usahasama Berhad’s (PLUS) USD7.3 billion (RM23.35 billion) Sukuk Musharaka Programme, issued in 2012 and remains to date the largest rated sukuk issuance by a single entity in the world.

- Jimah East Power Sdn Bhd’s USD2.6 billion (RM8.4 billion) Sukuk Murabaha Programme, the largest rated Sukuk to be issued by a single entity in Malaysia for the year 2014.

- Aman Sukuk Berhad’s USD3.1 billion (RM10.0 billion) Islamic Medium Term Notes Programme

- Malakoff Power Berhad’s USD1.7 billion (RM5.4 billion) Sukuk Murabaha Programme

- CIMB Islamic Bank Berhad’s USD1.6 billion (RM5.0 billion) Basel III-compliant Tier 2 Junior Sukuk Programme

- Sime Darby Berhad’s USD1.4 billion (RM4.5 billion) Islamic Medium Term Notes Programme

- TNB Western Energy Berhad’s USD1.3 billion (RM4.0 billion) Sukuk

Social responsibility is central to the GIFA methodology. Islamic Social Responsibility Award is given to an organisation or individual for their explicit commitment to social responsibility and good causes. In 2013 this award was presented to Saudi Arabia-based SEDCO Capital for its ESG (environmental, social and governance) approach to Islamic investing. GIFA 2014 once again decided to honour SEDCO Capital for it being the only Islamic asset manager signed up for the United Nations Principles for Responsible Investment (UNPRI) in the world.

At this occasion CEO of SEDCO Capital Mr Hasan AlJabri stated that, “It is great to see entities like Edbiz Consulting making efforts to enhance the Islamic Finance industry through the quality and well thought through research, papers, publications and reports. It is these initiatives that build and create long-term benefits to the Shari’a-compliant finance sector. We are honoured to have been recognised for the work our team has done in responsible and ethical investment at this Global Islamic Finance Awards 2014 by winning the Islamic Social Responsibility Award for the second year in a row; a proof that we will always continue to play our part in supporting the industry and sharing the knowledge.”

Islamic financial education and quality training in IBF are crucial to support growth in the sector. Two Malaysian organisations that have played pivotal roles in this respect are IBFIM, and Accounting Research Institute (ARI) at Universiti Teknologi MARA (UiTM). IBFIM was recognised as the Best Islamic Finance Training Provider, while ARI was recognised as the Best Islamic Finance Education Provider for the year 2014. The awards were received by Dato’ Adnan Alias (CEO of IBFIM) and Tan Sri Sahol Hamid (Vice Chancellor of UiTM). IBFIM previously received Best Islamic Finance Qualification Award in 2012 for its Certified Qualification in Islamic Finance (CQIF).

Best Research & Development in Islamic Finance award for the year was presented to Islamic Research & Training Institute (IRTI), a member of the Islamic Development Bank Group. The award was received by Dato’ Azmi Omar, Director General of IRTI. A number of senior officials of his team were also present on the occasion.

The Best Sukuk Deal of the Year award was conferred upon Hong Leong Islamic Bank for its role of an arranger in Al Bayan Sukuk.

Awards in Occasional Category

Through several award categories, GIFA has honoured the best of the best — institutions and individuals for their contribution to the growth of the Islamic banking and finance industry in the education sphere. This year, the GIFA Awards Committee decided to introduce a new category – Best Islamic Finance Case Award for the best Shari’a-based organisational case studies narrated. The decision was based on the growing number of case studies in Islamic finance developed in recent years as well as the need to promote cross-company knowledge sharing by showcasing successful organisational case studies and their key learning to the wider business community.

The Best Islamic Finance Case 2014 Award was conferred to Bank Islam Malaysia Berhad and the Asian Institute of Finance (AIF) for their case study titled “Dare to Lead: Transformation of Bank Islam Malaysia”. The case highlights the leadership role that Datuk Zukri Samat, Managing Director of Bank Islam Malaysia, played in bringing Bank Islam out of a deep crisis to one of the best managed and profitable Islamic banks in the region. Datuk Zukri Samat was also recipient of the GIFA Islamic Banker of the Year award last year.

The award also acknowledges the pivotal role that research plays in advancing knowledge in Islamic finance. Dr Wan Nursofiza Wan Azmi (Director of Strategy, Policy Development & Research at AIF), who jointly received the award along with Datuk Zukri Samat, has emerged as one of the best case writers in Islamic banking and finance. In 2012, AIF received Best Research & Development in Islamic Finance Award when Dr Wan Azmi was also named Most Upcoming Personality in Islamic Finance in the year 2012.

The time has proven the integrity and the highest standard of judgment that GIFA Awards Committee posses. It is the people like Dato’ Dr Asyraf Wajdi Dusuki (recipient of the Most Upcoming Personality Award 2011; and now one of the youngest members of Senate in Malaysia) and Dr Wan Nursofiza Wan Azmi who have proven the authenticity of GIFA. Our chosen upcoming personalities have advanced in their respective careers to become established leaders in their areas of specialisation.

There is no doubt that DDCAP Group and its Managing Director Stella Cox have helped the Islamic financial services industry by developing a Shari’a-compliant commodity facilitation programme that allows Islamic financial institutions around the world to execute Commodity Murabaha transactions on London Metal Exchange. Therefore, DDCAP Group was chosen as the Best Shari’a Compliant Commodity Facilitation Programme 2014. Although now there a number of commodity facilitations platforms in different countries where IBF is significant but it remains the fact that DDCAP Group is still the pioneering institution that is benefitting the industry on a global level.

This year’s occasional award for a pioneering institution in IBF was given to Bank Muamalat of Indonesia, which became the first Islamic bank in the country and paved way for further prestigious award that articulates our aim of fostering financial stability for the UAE as a whole and the wider region by encouraging individuals and families to take the crucial step towards developing a regular savings habit. We are glad that our efforts are receiving industry accolades. Such recognitions incentivise us to continue delivering innovative solutions for raising the financial literacy of the communities we engage with.”

The award particularly highlights National Bonds as the first scheme of its kind in the Muslim world to offer a mudaraba sukuk on a retail basis and at an affordable price starting from Dhs100 to citizens, residents as well as non-residents in the UAE.

The award additionally recognises National Bonds’ rewards programme — the largest and richest of its kind in the region. The savings programmes offered secure competitive annual returns in addition to daily and weekly prizes distributed of more than Dhs49 million.

In the award citation, National Bonds was also commended for its commitment to educate and promote a culture of savings among all segments of the society in the UAE and beyond through offering a range of products including the monthly savings programme via the Direct Debit platform with banks or the popular monthly salary deduction programme for employees from the private and public sectors. development of Islamic banking sector therein. It is institutions like Dubai Islamic Bank, Bank Islamic Malaysia Berhad and Meezan Bank Pakistan, which have played instrumental and pioneering roles in developing vibrant Islamic banking sectors in their respective countries. However, the award was adjudged this year in favour of Bank Muamalat to highlight its leading and pioneering role in introducing Islamic banking in an Islamic country with the largest Muslim population in the world.

There are very few stand-alone sustainable savings programmes in IBF. National Bonds of Dubai presents a case of innovation that allows Shari’a sensitive investors to save through an instrument that offers economic profile of a premium bond with additional benefits in the form of annual dividends — a feature that makes National Bonds a better alternative to premium bonds.

Mohammed Qasim Al Ali, CEO of National Bonds Corporation, said: “We are delighted to win this prestigious award that articulates our aim of fostering financial stability for the UAE as a whole and the wider region by encouraging individuals and families to take the crucial step towards developing a regular savings habit. We are glad that our efforts are receiving industry accolades. Such recognitions incentivise us to continue delivering innovative solutions for raising the financial literacy of the communities we engage with.”

The award particularly highlights National Bonds as the first scheme of its kind in the Muslim world to offer a mudaraba sukuk on a retail basis and at an affordable price starting from Dhs100 to citizens, residents as well as non-residents in the UAE.

The award additionally recognises National Bonds’ rewards programme — the largest and richest of its kind in the region. The savings programmes offered secure competitive annual returns in addition to daily and weekly prizes distributed of more than Dhs49 million.

In the award citation, National Bonds was also commended for its commitment to educate and promote a culture of savings among all segments of the society in the UAE and beyond through offering a range of products including the monthly savings programme via the Direct Debit platform with banks or the popular monthly salary deduction programme for employees from the private and public sectors.

Mohammed Qasim Al Ali added: “The innovative initiatives offered through our strategic partnerships with financial institutions and local takaful companies enable us to offer a richer savings experience and support the efforts to ensure a sustainable financial future for our bondholders. This award is another significant validation of our role in supporting Dubai to becoming the global capital of Islamic economy.”

Next year’s GIFA Ceremony is expected to take place in Kazakhstan. The nominations will start in March 2015 and will be announced through a global press release.