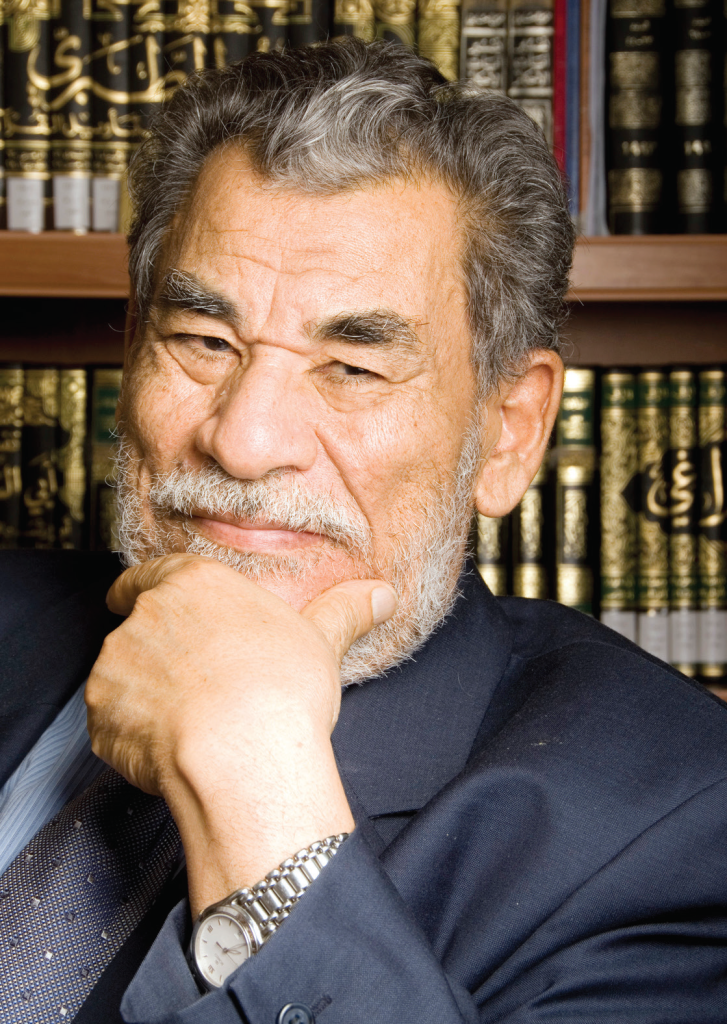

SHEIKH HUSSEIN HAMID HASSAN WORLD RENOWNED SHARI’A SCHOLAR AND ECONOMIST

SHEIKH, YOU ARE A TOWERING PERSONALITY IN ISLAMIC BANKING AND FINANCE AND YOU NEED NO INTRODUCTION IN THE INDUSTRY AND BEYOND, BUT IT WILL BE INTERESTING FOR OUR READERS TO KNOW ABOUT YOUR CHILDHOOD AND EARLY AGE. WOULD YOU CARE TO SHARE WITH US SOME MEMORIES OF THE PAST?

My father was a poor farmer and camel herder. He died when I was 6 years old and I was raised by my mother. In our village, there were no schools, and none of my peers went to school. I used to herd camels as a child. When a Sheikh gave a Jumma sermon in my village he was invited to have dinner with the family. I was serving him, and when he knew that I did not go to school he advised me to memorize the Holy Quran. When I was 12 years old, I memorized the Quran in 4 months only and perfected it in another 2 months. Egypt had a dual educational system; Al-Azhar religious system, and a secular educational system. The students could join both in parallel if they were able to. When I attended school at around 12 years old, I studied in both systems. I went to an Al-Azhar school from 8:00 am to 2:00 pm then to a Ministry of Education school from 4:00 pm to 8:00 pm and got both certificates.

MA SHAA ALLAH, SHEIKH. THIS IS TRULY INSPIRATIONAL.

PLEASE TELL US THE STORY OF ISLAMIC BANKING IN YOUR NATIVE EGYPT, AS IT WILL BE INTRIGUING FOR OUR GLOBAL READERSHIP TO LEARN ABOUT THE ADVENT OF ISLAMIC BANKING IN A COUNTRY THAT IS CONSIDERED AS PIONEER OF MODERN ISLAMIC BANKING.

The principles of Islamic economic and financial system are stated in the Quran and other sources of Shari’a. These were well understood in Egypt since Islam reached the country. It was also known that profit sharing should replace interest in financial matters. However, the idea of establishing Islamic banks was not been realized until the early 1960’s when a bright young scholar, Dr. Ahmed Al-Najjar (later the Secretary General of the International Union of Islamic Banks) was studying in Germany and came across cooperative banks and found out that it was similar to the Islamic system, which is based on cooperation and not interest. He then established the first Islamic bank in Al- Mahala Al-Kobra in the Northern Delta region of Egypt. However, the bank faced several challenges due to incompatibility with the laws and regulations of the Egyptian interest-based banking system at that time. It was not until the idea spread with success in several Arab Gulf countries and other Islamic countries that Islamic banks started flourishing in Egypt in the late 1970’s.

“I memorized the Quran in 4 months only and perfected it in another 2 months. Egypt had a dual educational system; Al-Azhar religious system, and a secular educational system.”

YOU HAVE ADVISED ON HUNDREDS OF TRANSACTIONS FROM RETAIL BANKING TO SOME OF THE MOST SOPHISTICATED INVESTMENT BANKING AND CAPITAL MARKET PRODUCTS. WHICH ONE OF THESE YOU WILL CONSIDER AS THE MOST INNOVATIVE AND WHY?

Fortunately, I have been part of all micro and macro initiatives in Islamic banking and finance industry. For us everything was first ever. Applying the principles of Shari’a to contemporary commercial transactions was not less than a challenge for me and my peers. Our challenge was to ensure the integration of principles of Shari’a and Islamic law of contract in the economic ecosystem of a particular jurisdiction mainly focusing on commercial viability, Shari’a compliance and alignment with the applicable legal system. In this context, everything we did for Islamic banking and finance industry was innovative and first of its kind in the industry – right from a simple retail product and service to most complex corporate finance and investment transactions. Our responsibility was to set a benchmark for innovation within the purview of principles of Shari’a and Islamic law of contract. By grace of Allah, me and my peers were successful in satiating the ever-growing requirement of new products, services and structures right from the inception of the Islamic banking till where industry stands today. Let me acknowledge that all this would not have been possible without the assistance of some dynamic institutions which volunteered to try and test these innovative solutions. Thanks to collaborative effort of all stakeholders, Islamic financial institutions are capable of successfully competing with the conventional peers in terms of availability of the products and services.

AMONGST ALL OF YOUR PIONEERING INITIATIVES WHAT WOULD YOU RANK AS YOUR MOST PROMINENT?

Empowering Islamic finance industry through innovative solutions is something I am very passionate about and consider to be one of my lifetime accomplishments. I have advised on conversion of dozens of conventional institutions into Islamic – a challenging assignment that involves not only coordination with competing stakeholders but innovative solutions in the foresight in all aspects. Besides, I have advised a lot of institutions on setting up Islamic windows, new Islamic banks, Takaful companies and other Islamic financial institutions in some of the most challenging legal environments. To empower the industry, I also successfully persuaded Dubai Islamic Bank to setup an Islamic finance advisory firm, Dar Al Sharia, which is a leading Islamic finance advisory firm in the industry.

For me, every assignment is ground-breaking as I would do it differently in a manner to ensure that the project is impactful for the industry. By nature, I do not have a quick-fix approach in my life.

Apart from Islamic finance, my earlier engagements in setting up some of the most prominent institutions such as International Islamic University Islamabad in Pakistan – first of its kind which offers a combined Islamic and contemporary education in almost every basic discipline of education and the Islamic Culture University Nur-Mubarak in Kazakhstan.

Apart from the above, I had humble contributions in many other landmark initiatives in the field of Islamic jurisprudence, Islamic finance and education across four continents. Even in my written contribution in Islamic jurisprudence, I have endeavoured to employ a contemporary style to attract readers’ attention and interest in the subject. My earlier contributions such as Usool Al Fiqh Al Islami (an all-inclusive work on sources and principals of Islamic jurisprudence), Al Madkhal Le Dirasat Al Fiqh Al Islami (a book on history of Islamic jurisprudence and theories of Islamic Law of Contract) and Nazriatul Al Maslaha fi Al Fiqh Al Islami – theories of public interest in Islamic Jurisprudence – and my writings in the near past are a good example of my passion to present and highlight the practical aspects of Islamic jurisprudence and its efficacy as the most relevant code of life for human being in all spheres.

YOU ARE, MA SHAA ALLAH, NOW IN YOUR EARLY 90S BUT STILL VERY ACTIVE PROFESSIONALLY. WHERE DO YOU GET THIS ENORMOUS ENERGY? WHAT KEEPS YOU TICKING?

I would attribute this to four core reasons. Firstly, my passion for Shari’a sciences. I like comparing secular legal and financial systems against the backdrop of the juristic and financial systems advocated under Shari’a principles. This is why I studied three legal and financial systems in three schools simultaneously; The Latin system, the common law system, and the Islamic Shari’a system.

Secondly, because I consider researching in these disciplines as an act of worship and obedience to God and a religious duty.

Thirdly, because I find satisfaction and comfort when I realize from the results of these studies that Shari’a is the most capable of all systems to achieve the welfare of people and elimination of corruption, discrimination and social injustice.

Finally, the validity of my belief has been proven by the tremendous growth of the Islamic finance services industry. Indeed, the solution to all world problems can be found in Shari’a.

“The success of Dar Al Sharia can be attributed to the holistic approach to Shari’a advisory services, the client centric values and the sincere efforts of the team.”

LET US ASK AN EASY QUESTION TO MAKE THE INTERVIEW LIGHTER IN TONE AND CONTENTS. WHICH SPORTS HAVE YOU PLAYED AND ENJOYED THE MOST? AND WHY?

Football (soccer). In this sport, one uses all his body and thus is very useful for the body health. I had a football field near my residence, and I had the chance to practice it as a young boy. My wife and children are all football fans.

SHEIKH, YOU HAVE BEEN A STAUNCH CRITIC OF THE USE OF TAWARRUQIN ISLAMIC BANKING AND FINANCE, BUT DESPITE ALL THE CRITICISM THE ORGANIZED TAWARRUQ HAS ATTRACTED, ITS USE IS RAMPANT IN THE INDUSTRY. HOW DO YOU FEEL ABOUT IT?

Organized Tawarruq is something that should have been a solution that one would have recourse to in an extreme necessity situation – when no other Shari’a nominate contract can be used to do a transaction in a Shari’a compliant manner. Organized Tawarruq has really undermined the very objective of Islamic finance. It undercuts the fundamental values of participation, profit and loss sharing, contribution to mainstream economy and elevation of social and economic conditions of the community as the product operates in a similar fashion as conventional financing which results in indebtedness in addition to, in my opinion, have certain inherent anomalies from Shari’a compliance perspective.

ONE OF YOUR INITIATIVES HAS BEEN DAR AL SHARIA. IT IS AN AWARD-WINNING ADVISORY FIRM. HOW WOULD YOU EXPLAIN ITS SUCCESS AND RECOGNITION?

Dar Al Sharia was established by Dubai Islamic Bank as a pioneering Shari’a advisory and consultancy firm. It has been at the forefront of providing innovative and qualitative solutions. By the grace of the Almighty, the success of Dar Al Sharia can be attributed to the holistic approach to Shari’a advisory services, the client-centric values and the sincere efforts of the team.

ANOTHER LIGHT QUESTION. WHO IS YOUR MOST FAVORITE SHARI’A SCHOLAR COLLEAGUE, AND WHY?

I am very fortunate to live among the most accomplished jurists of our time. They are very thorough in their approaches and enjoy juristic acumen of high level. They are the founding pillars of the Islamic jurisprudence in general and Islamic finance in particular. Islamic finance industry, where it stands tall today, is because of unwavering contributions of all my peers, notably, without assigning any ranking and limiting the list, Dr. Abdul Sattar Abu Ghuddah, Abdallah bin Manee’a, and Sheikh Taqi Usmani, etc. For me, all senior scholars who have been working hard, in any capacity and anywhere in the world, to support the Islamic finance industry deserve all appreciation and, honestly, all of us owe them for their sincere efforts. I am also very satisfied with the work of the current squad of Shari’a scholars who I am sure will follow the footsteps of the senior scholars.

THE WORLD IS FAST BECOMING ORIENTATED TOWARDS THE USE OF SOCIAL MEDIA.

WHAT ROLE CAN SOCIAL MEDIA PLAY IN CREATING AWARENESS AROUND ISLAMIC FINANCE?

I believe that social media can play a vital role in spreading knowledge about Islamic finance, more than any other communication means.

WHAT IS A TYPICAL DAY OF SHEIKH HUSSEIN HAMID HASSAN? HOW DOES IT START AND HOW IT ENDS?

All through my life, my daily routine has always been packed with schedules and commitments. I attended two different schools one in the morning and the other in the afternoon. The same was during my university education, where I obtained degrees from two different universities at the same time (Al- Azhar University, faculty of Shari’a and Cairo University, Faculty of Law). My typical day is still the same, I start my day after Fajr prayer and end my day at around 10 pm. A typical day would involve conducting research, official work, and commercial work.

ON A PERSONAL NOTE WHO HAS INSPIRED YOU THE MOST AND WHY? HOW HAS THIS INSPIRATION SHAPED YOUR APPROACH TO ISLAMIC JURISPRUDENCE?

I have been inspired by a large number of scholars from Cairo University (Dr. Mohsen Shafiq, Dr. Mahmoud Mostafa, Sheikh Abu Zahra, Sheikh Ali Al-Khafeef) and Al-Azhar University (Dr. Othman Muraiziq, Dr. Taha Al-Deenary). I attended their lectures, I carefully read their books and writings, I had friendship with them and many personal meetings. I learned a lot from them that shaped my approach to Islamic jurisprudence.

WHAT WOULD BE YOUR MESSAGE TO THE GLOBAL ISLAMIC FINANCIAL SERVICES COMMUNITY, PARTICULARLY THE YOUNG SHARI’A SCHOLARS?

I encourage them to love their work, act with responsibility on the basis of thorough research, and consider their efforts as a form of worship and obedience to God.