Meezan Bank has grown to become the largest Islamic bank in Pakistan. In achieving this impressive feat it has not compromised on Shari’a principles, creating the framework and the internal infrastructure to ensure that the products and services it offers are, and remain, Shari’a compliant. Meezan Bank’s Ahmed Siddiqui, Executive Vice President and Head of the Product Development & Shari’a Compliance unit, and Obaid Usmani, Assistant Manager, discuss the Shari’a function at Meezan and explain the infrastructure in place and its importance for the Islamic finance industry in Pakistan

The role of the Shari’a function for Islamic banks

The Shari’a compliance function is the core differentiating factor between an Islamic bank and a conventional bank. Over the years, the global Islamic banking industry has witnessed rapid growth with a particular focus on the improvement of Shari’a compliance mechanisms in place. With focus on building awareness of Islamic finance, the industry is rigorously working to provide more authentic and reliable mechanisms of Shari’a compliance, so that the system is preferred by its customers to fulfil their banking needs.

Islamic banks are playing an active role in this aspect by putting comprehensive Shari’a controls and mechanisms in place. In particular, Meezan Bank has made notable efforts and progress in this area. With the support of the central bank of the country, today Meezan Bank is the largest Islamic bank in the country and is acknowledged as a benchmark for Shari’a compliance.

A brief overview of Islamic Banking in Pakistan

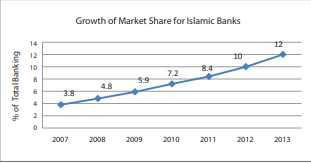

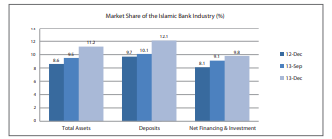

Pakistan, in recent years, has shown a strong inclination towards Islamic banking. The first Islamic commercial bank in the country was established in 2002, and within 12 years Islamic banking share is now more than 12% of the entire banking industry in the country. Over the last decade, Islamic banks have been successful in providing end-to-end Shari’a-compliant alternatives to all conventional banking products. The robust regulatory framework of Islamic banks in the country is one of the major success factors which have supported this rapid growth. With more than 1300+ Islamic banking branches and more than 30% annual growth in deposits, assets, financing and investments, Pakistan is set to become the hub of Islamic banking in the region.

Shari’a scholars

The presence and guidance of Shari’a scholars is the backbone of any Islamic bank, and Pakistan remains one of the most resourceful. The presence of eminent scholars, like Sheikh Muhammad Taqi Usmani, the world’s leading and most respected scholar in Islamic banking, gives a major boost to the cause of Islamic banking and its global acceptability. There are many other Pakistani Shari’a scholars who are part of Shari’a boards across the globe. Thus, the Pakistani Islamic banking industry has been under the supervision of some of the world’s most renowned scholars making Islamic banking in the country sound and reliable from a Shari’a point of view.

Training

Human resources (HR) are a key component of a successful venture. When it comes to Islamic banking, HR is of no less importance; in fact the nature of the industry demands highly skilled and technically sound employees to carry the prestigious label of Islamic banking. Over the years, practitioners in the Pakistani Islamic banking industry have developed technical expertise granting them the ability to train neophyte employees. There are many distinguished speakers who regularly participate in national and international conferences, seminars, workshops and other platforms. Eminent scholars conduct Islamic banking courses at various academic institutes and provide services for course structuring, curriculum development and testing services.

Development of regulatory framework and initiatives from the central bank

Pakistan is one of those few countries where the central bank has devised a robust regulatory framework with the support of Islamic banks. The State Bank of Pakistan (SBP) has also setup a separate department to support and monitor Islamic banking in the country. The regulatory framework is quite comprehensive covering almost all aspects of Islamic banking. Specific regulations for Shari’a compliance are one of the major highlights of SBP along with a separate comprehensive Shari’a governance framework for Islamic banks.

Besides working on the Shari’a compliance framework, a major initiative of the SBP has been to bring stakeholders onto a single platform, collaborating in a mass-media campaign to promote the Islamic banking industry in the country.

The Shari’a compliance framework at Meezan Bank

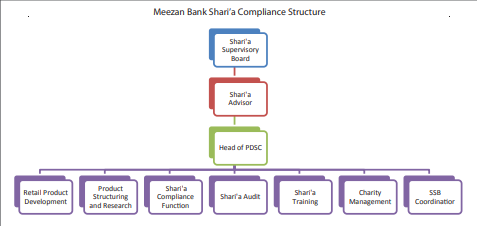

Meezan Bank has a separate department for Shari’a compliance known as the Product Development and Shari’a Compliance (PDSC) department, with the mandate to ensure Shari’a compliance, conduct Shari’a audit of the bank, research for new product development through innovative ideas, charity management, and Shari’a training. The PDSC department has more than 35 professionals making it one of the largest teams in the world dedicated to Shari’a compliance.

- Product structuring & research (PSR)

Product structuring and research is required to develop new products and innovate according to Shari’a guidelines. Various financial products and services have been developed to fulfill previously addressed financial needs of the customers. Besides developing new products, research is undertaken in order to refine, modify, and redefine existing financial products. Providing customized Shari’a-compliant financial solutions to corporate, commercial, SME clients and developing of liquidity management and treasury-related products are hallmarks of the PSR function.

Customized Shari’a-compliant financial needs for all segments of business are done by analyzing the following:

- Customer’s business cycle

- Existing alternatives present in the market

- Payment flexibility (possibility of early repayment)

- Accounting treatment

- Risk mitigation measures

- Basic Shari’a Principles

- Tenure (short-term or long-term)

- Rate of financing (fixed or variable)

- Tax concerns

- Regulatory aspects

- Mode and nature of the assets

Once the structure of a new product is finalized, it is presented before the Shari’a advisor who may either approve, decline or suggest modifications in the product. In cases where the Shari’a advisor does not approve or decline the product, he will report the case in the next Shari’a supervisory board (SSB) meeting. The SSB will then take the final decision on the product.

- Shari’a compliance function (SCF)

The Shari’a compliance function is broad as it relates to all departments in the bank. The basic purpose of SCF is to monitor Shari’a compliance in regards to:

Corporate, commercial and SME financing (assets of Meezan Bank Ltd). For each customer a separate process flow is devised. Hence the murabaha process flow for a textile concern will be different from that designed for a sugar mill, leather tannery, fiber producer, power station, etc.

- Investment banking transactions related to sukuk and syndicated financings.

- Funding, financing, investment, foreign exchange related as well as other activities conducted by the department of the bank.

- Pool management and profit distribution of deposit products.

- Development of bank-wide policies, procedures and guidelines for ensuring Shari’a compliance and vetting policies of other departmental functions such as HR, marketing, admin, etc.

The importance of SCF can be judged from the fact that the bank’s management has designated it the authority to approve or disapprove any financing proposal so that nothing is compromised on Shari’a principles.

For example, upon review if SCF holds the opinion that the facilities proposed in the financing proposal are not practical as per Shari’a, then SCF will not approve the limit and will propose a different solution/product to the business unit. In 2012 alone, the SCF function reviewed more than 1300 financing proposals.

Besides reviewing all financing transactions and bank policies, the SCF also serves as the coordination unit with the SSB which includes planning the meetings of the Shari’a board, preparing agenda items to be presented in the meeting, rolling out the decisions taken in the Shari’a board meeting across the bank as well as ensuring proper implementation of the rulings.

Shari’a training also falls in the ambit of SCF which conducts all Shari’a-related trainings within the bank as well as amongst the customers, covering Islamic finance concepts, product training in light of Shari’a rulings and refresher courses to reinforce the concepts of Islamic finance along with any further updates regarding developments in the Islamic finance industry. Different modules for training are designed in order to cater to different kinds of audiences. The period of training may vary from one day to as long as 4 months based on the complexity of the course. Trainings may be focused on a single product or may cover the entire ambit of Islamic finance.

| Year | Number of training sessions | No-of Employees Trained |

| 2010 76 1750 | ||

| 2011 | 100 | 2786 |

| 2012 | 109 | 3314 |

| Year | Number of Seminars | Attendance |

| 2009 | 24 | 1955 |

| 2010 | 38 | 4370 |

| 2011 | 39 | 4540 |

- Shari’a audit

The objective of Shari’a audit is to ensure proper execution of transactions as per the guidelines laid out by the product development and Shari’a compliance team. The Shari’a audit team reports directly to the SSB, and works under the supervision of the in-house Shari’a advisor. The Shari’a audit of a branch/department is conducted by a particular team, from which the Shari’a audit report is prepared and assigned a rating. In 2012 more than 250 branches were audited and reports issued.

From the audit, if a concern is raised on the Shari’a complicity of transactions of a particular customer then charity may be imposed. Based on the seriousness of the concern, the case would be referred to the Shari’a compliance team in order to revise the process flow.

Until the process flow is revised no future disbursement may be made.

The Shari’a audit team works closely with the Shari’a advisor in preparing the Shari’a advisor report each year. Meezan Bank’s Shari’a advisor report is considered the most informative and comprehensive Shari’a advisor report in the global Islamic banking industry, and is acknowledged as a benchmark. The report encompasses all activities of the bank and provides information on Shari’a activities and new product development.

- Advisory services

Meezan Bank has developed alternatives for all types of asset and liability products that a conventional bank offers. Having a well-established product catalogue, Meezan bank offers its counterparts assistance in developing products. Meezan bank has provided consultancy services to international banks advising on Shari’a compliance not only at startup, but also making certain that there are no loopholes which may make the ban non-Shari’a compliant in the future. Another important function is providing advice on Shari’a audit and Shari’a compliance as well as strengthening and streamlining the internal operations of its client organizations from a Shari’a compliance perspective.

- Retail product development

Retail product development is another vibrant function of the product development and Shari’a compliance department. The unit develops innovative deposit products, consumer financing products and is also involved in the profit distribution and pool management system of the bank. This unit plays a vital role in re-vamping existing products to retain existing customers and attract new customers to the bank. Recently, Meezan Kafalah, a saving plan with takaful benefits, was developed by this unit which received an overwhelmingly positive response from the market.

- Charity management

At Meezan Bank, charity management is conducted through Ihsan Trust which was founded in January 2010. Ihsan Trust Fund is a waqf, made through a separate waqf deed. There are two sources through which Ihsan Trust raises funds: donations from customers, and donations from other Islamic banks and Islamic asset management companies.

Ihsan trust has been focusing particularly on the areas of health and education by providing medical equipment to hospitals, and interest-free loans (qard hasan) to students who lack financial resources to continue higher education. Till now, Ihsan Trust has helped more than 1000 students to pursue higher education in leading universities like IBA, LUMS, NUST, GIKI and others.

- Shari’a supervisory board coordinator

The product development and Shari’a compliance department plays another important role in the bank by acting as a coordinator with the SSB. Coordination includes arranging meetings, following up, and implementing of directives from the SSB.

Conclusion

The Shari’a compliance function has become a critical driving factor for not only performance but in sustaining the principles of the Islamic finance industry. Meezan Bank in this regard has emerged as a role model for other peers, both locally and globally, which can be proven by its unmatched success leading Meezan Bank to win awards for the best Islamic bank in the country on a regular basis by different forums. Recently, Meezan Bank was named as the ‘Best Research & Development Institution in Islamic Finance 2013’ by the Global Islamic Finance Awards (GIFA).

The entire banking industry of Pakistan is currently facing challenging times due to declining discount rates which has squeezed the banks’ profit margin, and in this situation, Islamic banks face further challenges of not only maintaining their performance in terms of profitability but also maintaining it without any compromise on Shari’a compliance.