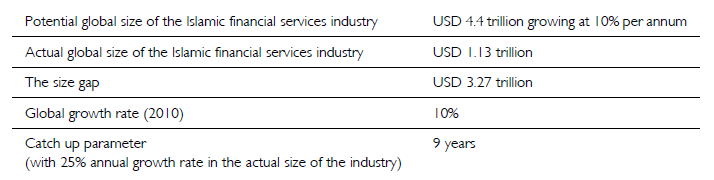

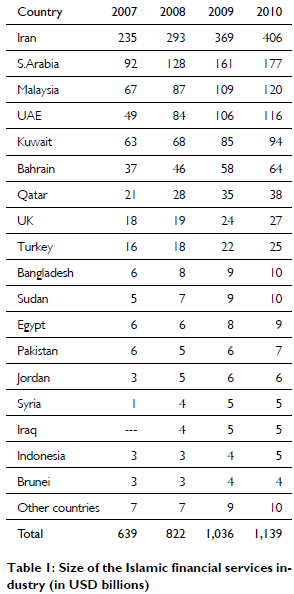

It is true that the current global financial crisis did not directly affect Islamic banking and finance but it certainly did slow its pace and progress. One possible reason for the relative lack of activity in Islamic finance is the decrease in enthusiasm shown by many western financial institutions. The likes of Credit Suisse, Deutsche, UBS and many of the iconic American banks now seem less interested in getting their share of the USD 1.1 trillion pie. The Qatar Central Bank issued an instruction to banks operating in Qatar which effectively requires conventional banks to cease providing Islamic financial services in Qatar by 31 December 2011. This type of move by a central authority in an influential Muslim country makes conventional banks even more nervous to start activities in the Islamic space. This proves the point made by some industry analysts that western institutions offering Islamic financial services cannot offer sustainability nor stability to Islamic finance, as their involvement in this sector is purely opportunistic. Islamic windows of conventional institutions are like prayer mats which can be rolled up at any time, if for any reason these institutions have to close down their Islamic operations. Full-fledged Islamic banks, on the other hand side, are like mosques, which cannot be undone easily once they have set up, except in circumstances of bankruptcy or financial distress.

However it is important to acknowledge that western banks have played a tremendously important role in the development of Islamic finance globally, as well as in local markets. ABSA, a subsidiary of Barclays Bank, for example, has been instrumental in opening up Islamic financial services to the Muslim masses in South Africa. HSBC Amanah and Standard Chartered Saadiq offer Islamic financial services in a number of Muslim countries, and indeed compete with full-fledged Islamic banks.

As the table above suggests, UK-based banks have shown more interest in Islamic finance than US banks. An increasing number of European banks are however showing interest in this new field, with the likes of Commerzbank and Deutsche Bank getting involved. Other important new players include Bank Sarasin and Dexia Bank, which offer a number of products for wealth and risk management.

Despite the claims of many of its enthusiastic proponents, the practice of Islamic finance has so far failed to provide a superior alternative to conventional finance. Critics would argue, how could Islamic finance be superior to conventional banking, if the former merely attempts to mimic the latter? Advocates, however, base their arguments on the theoretical constructs of an Islamic financial system, which emphasises on the economics of profit & loss sharing.

It must be noted that there is clear distinction between the theory and practice of Islamic finance. Most of those who constructed theoretical models of Islamic banks were not practicing bankers and hence what they envisaged was a system of social organisation, which heavily emphasised upon cooperation and sharing of the benefits combined business activity. However the practice of Islamic banking is very much a business activity that attempts to maximise the value of shareholders. Is Islamic finance all about profit or is there something more to it? Whilst the profit motive is important, most advocates and supporters of Islamic finance insist that it should be for the wider benefit of the communities it attempts to serve. In the wake of the current financial crisis, the conventional financial services industry and its wider influence has come under greater scrutiny than ever before. Its very morality or perceived lack of it, in pursuit of profit at all costs is being questioned by financial analysts, governments and regulators. Now is the right time to highlight the Islamic stance; that banking practices should benefit all stakeholders not just shareholders alone, and made relevant to policymaking in countries where Islamic finance represents a significant chunk of financial activity.

Islamic banking and finance in the wake of the financial crisis

There is not a single Islamic bank anywhere in the world that needed to be bailed out by tax payer’s cash, during the recent financial crisis. This of course was not the case for their conventional counterparts. However, it must be noted that some IFIs were in actual fact caught up in the crisis, for a variety of reasons that were both related to the crisis and unrelated. Dubai Islamic Bank was one such institution which went through a management overhaul, after evidence emerged of unusual patterns in its financials. This report does not attempt to analyse what went wrong or what were the causes and consequence of the irregularities, but it must highlight the need for a robust corporate governance system for the functioning of Islamic financial institutions.

Real estate developers such as Nakheel and property finance companies such as Amlak and Tamweel were badly caught up in the problems faced by the real estate sector in Dubai. This also points out the need for diversification in the Islamic financial services industry.

Whilst it is true that Islamic finance emerged from the crisis stronger and more resilient, there is a need being felt that it should be reformed to make it more socially responsible, committed to community development and poverty alleviation, in addition to the continued emphasis on compliance with Shari’a.

“The recent global financial crisis seems to be a bless- ing in disguise for Islamic finance,” opines, Dato’ Dr Nik Norzul Thani, Chairman of the Malaysian law firm, Zaid Ibrahim & Co. According to him, one of the impacts of the crisis has been an increasingly enormous interest around the world with regards to the soundness and resilience of the Islamic financial model.

What helped Islamic banking & finance in the current financial crisis?

The small size of the Islamic banking and finance industry prevented its exposure to so-called toxic assets in the west, which ruined the balance sheet of most of conventional banks. Islamic banking and finance has yet to attain a certain degree of sophistication and in many cases remains primitive and conservative in its product offerings and investments. For example, despite the huge emphasis put forward by the likes of John Sand- wick on the need for setting up a comprehensive Islamic mutual funds business, the emphasis has so far been on other areas such as private equity and real estate because they offer quick and lucrative returns.

What else has helped Islamic finance in the current financial crisis?

Malaysia. Yes, Malaysia has helped Islamic finance to come out of the financial crisis. This is the country that has fully committed itself to developing Islamic banking and finance in its own country, the Asian region and the world at large. The government of Malaysia plans to use Islamic banking and finance as a tool to create a financial link between Malaysia and the rest of the countries in the Organization of Islamic Conference (OIC).

There are also a number of Middle Eastern-backed banks operating in the country. These include Al Rajhi Bank, Kuwait Finance House, Asian Finance Bank and Unicorn International Islamic Bank. Furthermore, Dubai Islamic Investment Group has a 40 percent stake in Bank Islam Malaysia.

Islamic finance as a genuinely ethical business

Whatever the case is in terms of success or otherwise of Islamic finance during the crisis, it is about time that the global practices of the industry are brought in line with the development agenda of multilateral institutions such as the World Bank, IMF, United Nations and other similar organizations. While imitating conventional financial products has certainly helped Islamic banking in terms of acquisition of financial technology, it has nevertheless taken it further away from its objectives of achieving social justice and fairness for all the stakeholders in the financial business.

This is also the time for financial regulators to set up ‘objectives of Shari’a boards’, to ensure that Islamic financial practices are not only in compliance with Islamic legal requirements, but are also in line with the objectives of Shari’a in terms of social responsibility, community development and poverty alleviation.

Changing leadership in Islamic banking & finance

There is no doubt that Prince Mohamed Al Faisal, a son of the late Saudi King Faisal Bin Abdulaziz Al Saud, played a pioneering role in the development of Islamic banking and finance. Faisal Banks, set up by Dar Al Mal Al Islami Trust – the financial conglomerate created by Prince Mohamed Al Faisal – are now only small players in the fast-growing Islamic financial services industry. Although Sheikh Saleh Kamel (and his Dallah Al Baraka Group) is still an important global Islamic financial player, other new players are assuming even greater importance on a global scale. Al Rajhi Bank of Saudi Arabia – the largest Islamic bank in the world outside Iran – is emerging as an important global player.

Similarly, intellectual leadership of the industry has over the last four decades seen a dilution of the influence of Islamic economists in favor of a very powerful role played by Shari’a scholars. During the recent financial crisis, the role of Shari’a scholars has come under greater scrutiny and it seems as if strong institutions and regulatory bodies will dominate the future intellectual leadership of the industry.

Report layout

This report is divided into four parts. The specific focus of this year’s report is regulation of the Islamic financial services industry, with a thorough analysis of the global regulatory infrastructure and a de- tailed review of the regulation of Shari’a advisory, covered in PART 3, after a broad study of all the different market segments and asset classes covered in PART 2. PART 1 gives an exposition of the global Islamic financial services industry. Part 4 presents country sketches, a coveted section of the GIFR brand which reports and analyses Islamic financial activity in over 50 countries. This study forms the basis for the creaing to their activity and development in the Islamic financial services industrytion of the Islamic Finance Country Index, which ranks countries according to their activity and development in the Islamic financial services industry

“People often forget that the godfather of modern capitalism, and often called the first economist—Adam Smith—was not an economist, but rather a professor of moral philosophy. Smith had a profound understanding of the ethical foundations of markets and was deeply suspicious of the “merchant class” and their tendency to arrange affairs to suit their private interests at public expense…. In short, Smith emphasized the ethical content of economics, something that got eroded over the centuries as economics tried to move from being a value-based social science to a value-free exact science.” Subbarao, D. “Ethics and the World of Finance” Keynote address at the Conference on “Ethics and the World of Finance,” organized by Sri Sathya Sai University, Prasanthi Nilayam, Andhra Pradesh, 28 August 2009.

Part 2

Chapter 2 starts the substantive side of the report by discussing Islamic retail market operations specifically referring to the consumer and SME markets. Besides giving description of certain retail products, it spells out the distinctive features of Islamic retail banking and its intermediation roles. It also focuses on wealth management and bancatakaful products in Islamic retail banking. Chapters 3 and 4 discuss the structuring of Islamic finance products. Chapter 3 highlights innovations in creating banking products to serve the array of customer needs in retail banking. Chapter 4 builds on this by focusing on legal issues in the USA that arise when structuring Islamic finance products and services. The chapter’s focus is on the financing of equity investments, the offering of Shari’a-compliant financing and finally investment products. Chapter 5 provides market insights and perspectives on bancatakaful, a fast growing segment of the Islamic finance industry. The reader will have the opportunity to review the best practices of corporate governance as well as the evolving landscape for tact- ful players and the competitive distribution edge of the bancatakaful channel. Chapter 6 looks into the Islamic capital markets paying close attention to the growth of the equity and sukuk market in the GCC and Malaysia over the last few years.

Chapter’s 7 and 8 take a closer look into Islamic asset management. Chapter 7 looks at the modern portfolio theory and how this fundamental approach to asset management has never been applied in the world of Islamic finance. While many banks offer Islamic asset management services, the reality is they most often randomly sell Sharia-compliant products. Little or no effort is made to link the professional tools of asset management with the needs of the Muslim investor. This chapter presents a thoroughly researched and tested approach to solve this problem. Globally accepted investment standards were followed to achieve a precise outcome, but with strict Shari’a compliance. The results show that Shari’a-com- pliant asset management may be equal or possibly even superior to conventional asset management. Following on from this, Chapter 8 tackles the distribution puzzle. Hitherto, distribution has primarily found success via di- rect retail banking networks. However, for the evolution and growth of the industry, Shari’a asset managers have to move from the in-house retail network-based model and adopt the distribution model of successful conventional asset management firms.

The mechanisms and systems of conventional finance offer much for Islamic finance to learn from. Collaboration has undoubtedly strengthened Islamic finance services provision. But with competition, IFI’s are evolving and gradually becoming viable competitors for market share. Chapter 9 analyses the comparative performance of Shari’a equity indices visavis conventional equity indices. Results show that both are capable of achieving similar investment performances, thereby strengthening the proposition that the Shari’a investment approach provides a real, profitable alternative. Chapter 10 pro- vides an overview of key features and developments in the Shari’a-compliant derivatives market. Market size and standardization remain the prominent challenges. Market practice constitutes an important driver for standardization along with industry initiatives on standard documentation. Yet, the markets have to gain more experience with the use of these instruments and structures and their documentation.

Chapter 11 studies the efficiency and profitability performance of banks. A common concern has been the lack of rigorous empirical studies undertaken on Islamic finance. This chapter seeks to address these shortcomings. The growing size of Islamic banks and the entrance of foreign players will have an effect on institutional efficiency, the number of players in the market, product offerings and socioeconomic conditions. The chapter progresses into an empirical study on the profitability of Islamic banks. Results from the research conducted suggest profitability and fee-based income generation do not depend on the type of banking system used.

Chapter 12 looks at the role of Shari’a boards in Islamic finance. The term Shari’a-compliance is defined and its importance highlighted. Furthermore, the challenges and issues with regards to Shari’a compliance are discussed in some detail. The chapter also shows that an IFI cannot be fully Shari’a-compliant unless it is supervised and guided by a qualified and fully empowered Shari’a board, comprised of Shari’a scholars who are well-versed in both Shari’a knowledge and banking practices. Chapter 13 highlights the increasing demand for highly qualified and skilled finance professionals who combine knowledge of Shari’a and technical financial skills. It looks at the importance of developing the necessary human talent pool together with the best methods for achieving this so that the barriers currently causing a shortage can be removed in order for the industry to progress. Chapter 14 looks at the market for Islamic banking IT systems. The emergence of Shari’a-compliant banking has created a need to have software systems which are capable of accommodating the nuances of Shari’a. The solutions together with the main vendors are discussed in detail.

Part 3

Part 3 looks at the regulatory framework of the global Islamic finance industry and is divided into three distinct parts. The first part comprises of Chapters 15 – 18 which deal with the Islamic finance infrastructure. Chapter 15 looks at the regulatory stance adopted by countries and industry bodies with respect to Islamic finance. Chapter 16 provides a more incisive look into the challenges of regulating Islamic financial services. Chapter 17 focuses on two topical aspects of the Islamic finance industry which has garnered much debate: risk management and Shari’a governance. Many banks still struggle with the implementation of Basel II rules regarding risk management, transparency and market discipline. With regards to Shari’a governance, high concentration and clustering has not resulted in consistency or legal certainty. Chapter 18 assesses the repercussions of the financial crisis on the regulatory framework. The regulatory and supervisory environment going forward will be very different and will pose serious challenges to both the conventional and Islamic finance industry. Changes in the areas of capital adequacy, liquidity, quality of information will pose challenges for the Islamic financial industry. At the same time, these changes offer an opportunity for the Islamic financial industry to take bold steps in enhancing the regulatory and supervisory framework and make serious efforts to implement the framework with the help of all stakeholders.

Chapter 19 – 27 embarks on a review of the regulatory models adopted by specific countries. One can see similarities and variance in their respective approaches. Chapters 19 and 20 assess two of the most dynamic regulatory models in accommodating and promulgating Islamic finance: Malaysia and Bahrain respectively. Chapter 21 looks at the stance taken by the DFSA to Islamic financial institutions in the DIFC, an onshore financial free zone that bridges the east and the west. The re-port then moves onto regulatory approaches adopted by the UK in Chapter 22. The UK has a more mature regulatory system having been a supporter of Islamic finance for over 15 years. Chapter 23 highlights Pakistan’s regulatory infrastructure and the important role played by the State Bank of Pakistan and the Securities and Exchange Commission of Pakistan. Chapter 24 moves onto the thorny issue of regulating Islamic finance in the USA. The USA has had to adopt a more subtle approach predicating the economic substance of an Islam- ic finance product and reconciling it with conventional counterparts. Chapters 25 and 26 take an alternative slant to regulation, focusing on taxation regimes of Ireland and Luxembourg respectively. Both countries have ambitions of becoming domiciles for Islamic funds and a flexible and unencumbered taxation regime will be important in achieving this.

The remaining three chapters encapsulate the problems arising from governance. Chapter 27 commences with a holistic look at Shari’a governance, the issues that arise, the approaches which have been undertaken and the improvements that need to be made to create an efficient system. However, even with (or without) a robust governance system, there will be occasions where courts will get involved. Chapter 28 explores this in greater depth. Through the discussion and analysis of various disputes arising within the Islamic finance industry, one can conclude that the leading cause of disputes involving Islamic finance transactions are rooted in failure of the market structures to accord with genuine Shari’a-compliance. These problems are exacerbated by governing law clauses and the choice of court in hearing disputes. These are incongruous with the subject matter of the dispute and therefore may well lead to serious enforceability issues in spite and at times because of the election of foreign laws. Chapter 29 narrows the focus by delving into a topical issue at present: the restructuring of sukuks in the event of a default. The chapter looks at the legal issues that arise and the rights of investors and creditors under such circumstances. Chapter 30 then attempts to reconcile the governing law and choice of court conundrum by suggesting the creation of an international Shari’a court which encompasses the manifold viewpoints in Islamic law.

Part 4 Part 4 contains a detailed analysis of the state of the Islamic finance industry in 55 countries. Each country sketch carefully analyses the current state of the industry in that particular country, looking at history, regulatory frameworks, capacity, institutional presence as well as future challenges. The sketches complement the unique and pioneering Islamic Finance Country Index (IFCI) included in the report. The IFCI is a unique path-breaking one of its kind study that has ranked countries according to how receptive they are to Islamic finance. Rigorous statistical analysis has been applied to create a composite set of statistics, which provide an immediate and unbiased assessment of the state of the Islamic finance industry across the globe.