Since 2016, we have been investigating women participation in the workforce in Islamic banking and finance (IBF). The previous studies have been based on two global surveys we conducted in 2016 and 2017. Cambridge IFA has repeated the exercise this year again to see if there have been any movements in the state of affairs of women participation in the economic activity related with IBF. Although the results are not significantly different from the previous two surveys, it is still instructive to report a summary of results in this inaugural WOMANi Report 2019.

A loud and clear message that comes out of the 2019 survey is that there is some kind of systematic evidence of discrimination against women when it comes to employment opportunities in IBF. There are some cultural and social issues that may hinder entry of women into IBF. However, it is encouraging to note that the industry offers ample opportunities to smart and intelligent women. In fact, it may be easier for women to excel in IBF, as compared to conventional banking and finance, which is a lot more competitive (and where there is some evidence of discrimination against women). It is due to this friendly approach of IBF towards women in general and Muslim women in particular that the employment of women (both Muslims and non-Muslims) is on a rise in the industry. The industry has in many cases endogenized cultural sensitivities of non-Muslim female personnel to ensure that they are provided with a level-playing field. The readers are encouraged to refer to an interview of Angelia Chin-Sharpe included in this report. She shares her own experience of working in IBF in this respect.

THE 2019 SURVEY ON FEMALE EMPLOYMENT IN IBF

This year’s survey was conducted by Cambridge IFA, and the results will be combined with the previous two surveys undertaken by Edbiz Consulting and Cambridge IF Analytica in 2016 and 2017, respectively. A primary objective of these exercises have been to explore and analyse female employment and gender inequality in IBF. We asked just one question through an online survey on social media. There were 10,471 responses in total, from 33 countries of the world. The question was: Why has there been observed low female employment in IBF?

WHY HAS THERE BEEN OBSERVED LOW FEMALE EMPLOYMENT IN IBF?

- Female participation in labour force is low

- Banking and finance is not a popular profession among women

- Banking and finance is male-dominated (and hence intimidatory for women)

- In Islamic banks, dress code and other social requirements are more stringent for women

- Islamic qualifications are not readily available

- Any other (please specify)

The above close-ended question was designed in light of an open-ended question Edbiz Consulting asked in the 2016 survey in which 500 respondents took part. Based on their responses, five most cited responses were selected, for low participation of women in an IBF-related profession. In the next step, the above close-ended question was asked. This was repeated in the 2017 and 2019 surveys.

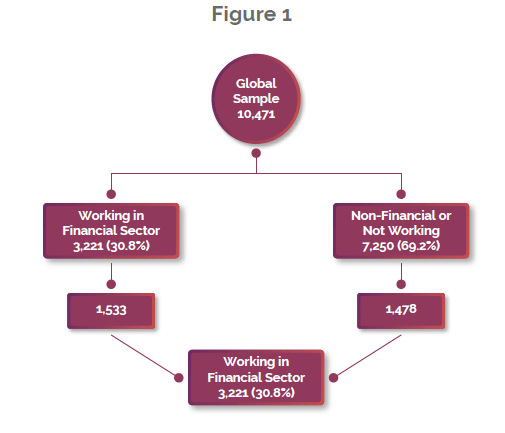

Out of 10,471 respondents, 3,221 were in some kind of employment in financial sector. The remaining (7,250) were not working in financial sector or were not working at the time they participated in the survey. Thus, the survey is heavily based in favour of those not working in the financial sector or those who are not working for any other reasons. Total number of female participating in the survey was 3,011 (see Figure 1).

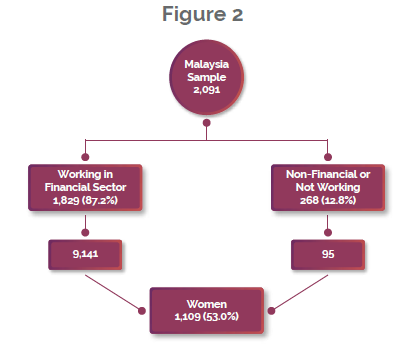

Malaysian sub-samples have in all of our three samples had unique properties. This year, 53% of the respondents in the Malaysian sub-sample were female. Most of them were in some kind of employment (914 out of 1,109 or 82.4% of the sub-sample). Figure 2 presents the Malaysian sub-sample.

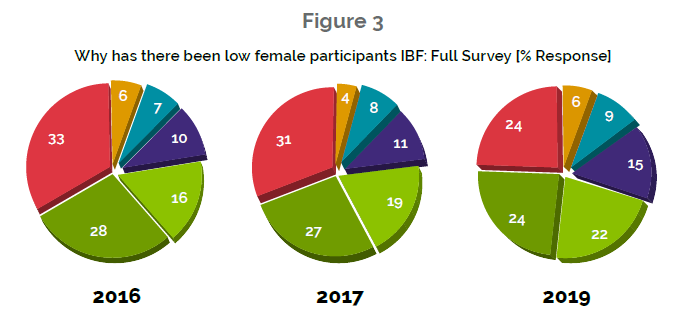

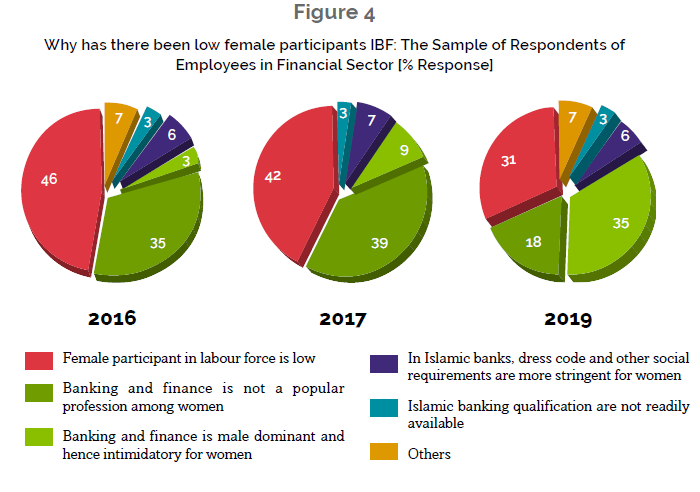

This year’s survey is interesting, as for the first time we have some indication of discrimination against women in banking and finance, in general, and possibly also in IBF. Contrary to the previous two surveys, nearly one-quarter of the respondents gave male dominance in banking and finance as one of the two main reasons for the observed low female participation in IBF. In the 2016 and 2017 surveys, the main reason for this observation was low female participation in the labour force in general (see Figure 3).

To further investigate, we looked into the responses of those who were working for financial institutions. Surprisingly, this year’s sub-sample of the financial sector workers exhibits that the main reason for women not working in Islamic financial institutions is the male dominance in the financial sector of which Islamic financial sector is no exception. Consistent with the previous two surveys, the respondents also attribute the low female participation in Islamic banking and finance to the low female participation in labour force.

This year’s survey attributes three, as opposed to two as exhibited by the previous two surveys in 2016 and 2017, major reasons for the lack of or low female employment in IBF, namely:

- Male dominance in the industry (35%);

- Female participation in labour force (31%); and

- Lack of popularity of a banking and finance-related profession among women (18%).

It appears as if banking and finance is becoming preferred choice among women as for as a profession is concerned. However, the new aspirants to enter the industry somehow find the culture of male dominance intimidating. This point must be further explored in future surveys.

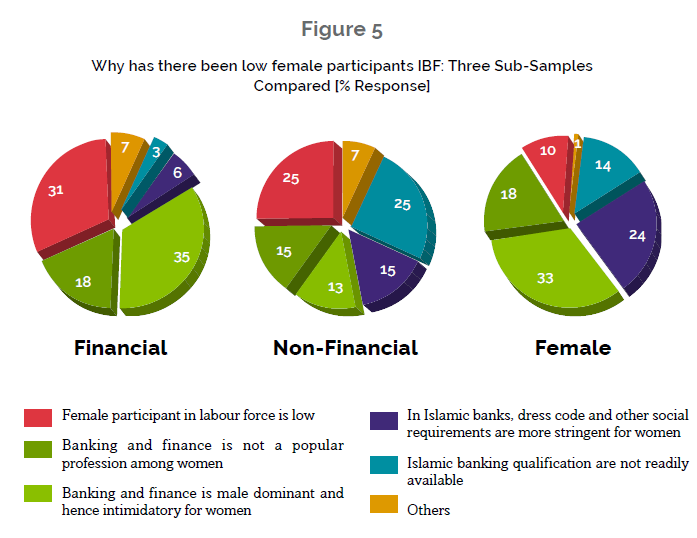

When the above results are compared with the sub-samples comprising only those who work for non-financial institutions or are not working at all, there are some variations. Also, variation in response in case of the female-only sub-sample are given in Figure 5.

Apparently, there is huge variation in response in the three sub-samples, suggesting that all three sets of respondents perceive the problem at hand differently.

From the above results, one may conclude that there are barriers to entry into IBF, although different groups of respondents attribute different causes to these.

“57% women strongly believe that they face real barriers to enter the Islamic finance market because of male intimidation and the stringent dress code requirements.”

Out of the five responses, only 3 and 4 imply real barriers to entry into IBF for women. Only 39% respondents globally accept the hypothesis that there are real and credible barriers to entry into IBF for women; 61% either do not recognise such barriers or attribute the low female participation in employment in IBF to the factors other than discrimination. Slightly more (41%) of those who are employed in financial sector believe that women are restricted to enter IBF-related professions; and even a smaller number of respondents from outside the financial sector believe in the existence of barriers. However, women themselves strongly believe that they face real barriers to enter the Islamic finance market because of male intimidation and the stringent dress code requirements (57%).

Given the above variations in response, there seems to be two biases evident from the responses:

- Arrogance Effect; and [2] Grudge Effect. Those who are already in employment with a financial institution tend to attribute the outsiders’ own circumstances (i.e., inadequate qualifications, personal attributes, and not fit-for-the-job kind of factors) for not being able to get a job with a bank or financial institution. They tend to ignore some factors (other than qualifications and ability) that may adversely affect prospects of employment for those who are seeking jobs in financial institutions, including Islamic banks. We call it Arrogance Effect. The Grudge Effect, on the other hand, is exhibited by the responses of those who considered themselves to be in an unprivileged or disadvantaged situation, i.e., those not working for Islamic financial institutions, the unemployed and the female in our sample.

There are a number of other issues that must be looked into before one may conclusively infer that there is any systematic evidence of discrimination against women in IBF. Whatever be the results of a future research in this area, a clear message that one gets from reading the responses to the simple question posed to the respondents is that women clearly tend to believe that their entry into in IBF is restricted. If true, there is a definite need to encourage more representation of women in IBF.