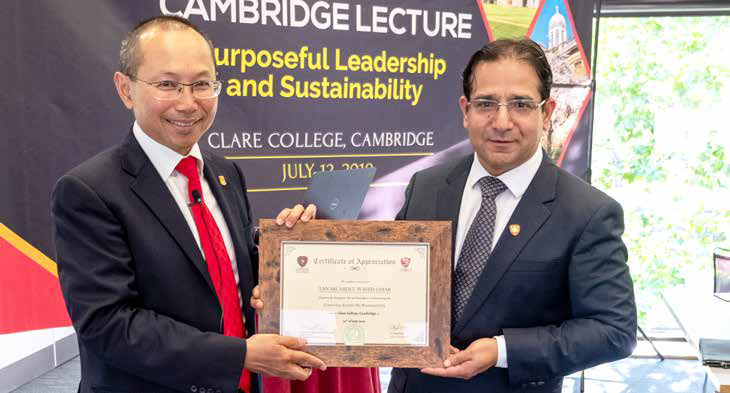

The Cambridge Institute of Islamic Finance (Cambridge-IIF) recently held its inaugural Cambridge Lecture on Sustainability on July 12, 2019 at Clare College, University of Cambridge. The lecture on ‘Purposeful Leadership and Sustainability’ was delivered by Tan Sri Abdul Wahid Omar, Chairman of the Board of Directors, Universiti Kebangsaan Malaysia (UKM). Well-known as a versatile corporate leader in Malaysia, Tan Sri Abdul Wahid Omar have led the helms of four main organisations in the areas of infrastructure development, telecommunications, financial services and investment management. He had held the post of president and chief executive officer of Maybank, chief executive officer of Kumpulan Telekom Malaysia Berhad, managing director/chief executive officer of UEM Group Bhd, vice executive chairman of PLUS Expressways Bhd and chairman of the Association of Banks in Malaysia. From June 2013 to August 2016, he was appointed Senator and Minister in the Prime Minister’s Department for economic planning before being appointed chairman of Kumpulan Permodalan Nasional Bhd (PNB), the largest fund management company in Malaysia; a post he held until June this year. Tan Sri Abdul Wahid is also a Trustee of the World Wide Fund for Nature (WWF) Malaysia since March 2019.

Cambridge-IIF is an independent research centre, specialising in the financial sectors of the countries wherein Islamic banking and finance is a significant activity. Leveraging upon the academic resources the city of Cambridge offers, Cambridge-IIF is well-positioned to undertake research projects to study the global phenomenon of Islamic banking and finance. Cambridge-IIF aims at conducting policy-oriented research to further spur growth in Islamic banking and finance, with a special focus on the Sustainable Development Goals (SDGs). As part of its activities, Cambridge-IIF plans to host a series of lectures each year with specific themes.

The below is the excerpt of the lecture given by Tan Sri Abdul Wahid Omar.

Let me begin by thanking the Cambridge Institute of Islamic Finance for giving me the honour to deliver the inaugural lecture on sustainability at this prestigious University of Cambridge. I must say I was initially undecided on how best to deliver this lecture. However, after consultation with the hosts, I thought that perhaps the best way to talk about Purposeful Leadership is by sharing with you my personal journey and the lessons learnt, eight thoughts on organisational sustainability and, Islamic finance and sustainability.

I was born as the ninth of eleven children in the southern state of Johor, Malaysia. Life was tough then. Imagine a family of eleven in a small living space. But we were blessed to have determined parents and support from extended family members; uncles and aunties who supported us financially. We were given good education as the means to get the family out of poverty.

When I was young, I was told accountants make a lot of money. That was when I decided to choose accountancy as my profession; arguably the most versatile profession in the world. As an accountant, my ambition was to be a Chief Financial Officer (CFO) of a large public listed company (PLC). That ambition was realised when I was appointed as the CFO of Telekom Malaysia Berhad (TM); one of the top four PLCs in Malaysia in 2001. But I got more than what I bargained for. I was fortunate to have been given the opportunity to lead three major organisations as CEO, i.e. the UEM Group involved in infrastructure development, TM in telecommunications, and Malayan Banking Berhad (Maybank) in banking. This was followed by a term of three years serving as a Senator and Minister, before returning to the corporate sector as Group Chairman of Permodalan Nasional Berhad (PNB) in funds management. For the purpose of this lecture, please allow me to focus on my tenure at UEM Group, TM and Maybank.

I was born as the ninth of eleven children in the southern state of Johor, Malaysia. Life was tough then. Imagine a family of eleven in a small living space. But we were blessed to have determined parents and support from extended family members; uncles and aunties who supported us financially. We were given good education as the means to get the family out of poverty.

When I was young, I was told accountants make a lot of money. That was when I decided to choose accountancy as my profession; arguably the most versatile profession in the world. As an accountant, my ambition was to be a Chief Financial Officer (CFO) of a large public listed company (PLC). That ambition was realised when I was appointed as the CFO of Telekom Malaysia Berhad (TM); one of the top four PLCs in Malaysia in 2001. But I got more than what I bargained for. I was fortunate to have been given the opportunity to lead three major organisations as CEO, i.e. the UEM Group involved in infrastructure development, TM in telecommunications, and Malayan Banking Berhad (Maybank) in banking. This was followed by a term of three years serving as a Senator and Minister, before returning to the corporate sector as Group Chairman of Permodalan Nasional Berhad (PNB) in funds management. For the purpose of this lecture, please allow me to focus on my tenure at UEM Group, TM and Maybank.

Being my first CEO job, I still remember the nervousness and awkward feeling of having to chair the first UEM Group management meeting. UEM/ Renong Group was a large conglomerate with some eleven public listed companies under its wings, and a thirty-seven-year-old “freshie” being the boss to many senior CEOs of subsidiaries and associated companies, was indeed a big feat. But my fellow management colleagues were professional and respected the chair, and they were also hoping that I would be able to steer the Group out of troubled waters after two prior failed attempts of takeover by Khazanah.

The first step towards addressing the predicaments of the UEM Group was to unlock the value of its highway concessions led by PLUS. So, with the support of the management team, the shareholder Khazanah, the Government, the bankers and the investing community; we reviewed the toll concession to a more reasonable level (from 5% pa to 3.3% pa) but made the increase automatic every 3 years, restructured the debts of PLUS and thereafter undertook the initial public offering (IPO) and listing of PLUS Expressways shares on Bursa Malaysia in July 2002. This was followed by disposal of non-core assets in order to reduce the Group’s debt to a more manageable level. While I focused my efforts on corporate matters, my fellow management colleagues continued their efforts to improve operational efficiency and profitability. After two and a half years, we managed to halve the Group’s debts to a more sustainable level of RM16 billion with the bulk of them in the form of project financing. The UEM Group was back on profitable track with an annual profit of RM500 million and revalued net assets of RM10 billion. Khazanah not only achieved its main objectives but also doubled the value of its investments within three years.

Purposeful Leadership 2: Creating a Regional Telecommunications Company

Having completed my task at UEM Group I returned to TM as CEO on July 1, 2004, as part of the larger transformation of Government Linked Companies (GLCs). The mandate given to me was to transform TM into a regional telecommunications company with particular emphasis on mobile communications. The experience of turning around UEM Group and having been the CFO of TM before made me feel relatively comfortable to take on the CEO task. The mandate was clear; the people and the business were familiar to me. TM had its origin as a government department that was corporatised and subsequently listed on the then Kuala Lumpur Stock Exchange (KLSE) in 1990.

Although by then TM had been listed for more than 14 years, its corporate culture was still not as competitive as one would expect of a large public listed telecommunications company. An all-round transformation was needed. The purpose was to turn TM into a competitive regional telecommunications company; the Malaysian flag bearer across Asia. Organisationally, we streamlined management structure, brought in new talents to complement the existing technical staff and strengthened the performance management system balanced scorecard. Culturally, we removed the traditional morning and afternoon tea breaks, normally associated with the public sector and implemented a five-day week with extended working hours, normally associated with the private sector. Many people thought removing tea breaks was an impossible task back then but the staff and Union officials were very receptive as they appreciated the need for cultural change and the benefits it will bring to TM and its people. This proved the point that when there is a clear purpose, you can expect to get an all-around support. We improved customer service and revamped our outlets, Kedai Telekom, into a more customer-centric network of outlets called TM Points backed by better-trained staff, more efficient processes, upgraded IT systems, competitive products and a more pleasant environment. Business-wise, we expanded our mobile operations into Singapore and Indonesia and strengthened our presence in Cambodia and Sri Lanka.

After eighteen months, we realised that while we have made significant progress overall with improved financial performance and higher contribution from our international operations, our domestic operations were not doing that great. The traditional fixed-line business was growing much slower than anticipated due to migration to mobile communications. At the same time, Celcom the domestic mobile communications subsidiary of TM, despite registering higher revenue and profit, was losing market share to rivals Maxis and DiGi. We understood that one cannot succeed as a regional champion if one’s home base is weak. Realising this worrying trend, the TM Board and management formulated and executed a holistic performance improvement programme that enabled TM to grow its data business and Celcom to regain market share. The fundamental improvements in customer service, distribution channels, network quality, business expansion and financial performance were reinforced by a global rebranding of TM into a competitive, private sector-driven regional communications company.

Having addressed the fundamentals of the business and as part of the efforts to enhance shareholder value, it was decided that the TM Group would be better off being demerged into two separate listed entities. TM International (now known as Axiata Group) with Celcom and other regional mobile communications business under its wings were successfully demerged and listed on Bursa Malaysia in April 2008. That leaves TM being repositioned as the National High-Speed Broadband (HSBB) champion spearheading the national HSBB deployment in Public Private Partnership with the Government of Malaysia. The demerger “unleashed” Axiata Group to grow further across Asia.

Purposeful Leadership 3: Humanising Financial Services

I was in the midst of planning for the TM demerger exercise in May 2007 when I received a proposition from the then Chairman of TM’s competitor Maxis Communications, Tan Sri Megat Zaharuddin, who was also a board member of Maybank. The initial plan was for me to join Maybank on June 1, 2008 with a one-month break and one-month handover from the then retiring CEO. As it turned out later, Tan Sri Amirsham was appointed as a Minister in the Prime Minister’s Department in charge of the Economic Planning Unit (EPU) in March 2008. That necessitated me to join Maybank one month earlier than scheduled on May 1, 2008. In the three months prior to my arrival, Maybank had finalised three major acquisitions; An Binh Bank in Vietnam, Bank International Indonesia (BII) and MCB Bank in Pakistan. However, many investors did not appreciate the valuation and decided to sell their Maybank shares.

I had to face three major challenges in the first few months at Maybank. First was to follow through on the three major acquisitions costing some RM11 billion and to raise the necessary equity and debt capital required to fund the acquisitions. Second was to deal with the global financial crisis that was unfolding with the collapse of Lehman Brothers, among others, in September 2008. And third was to improve the financial performance of Maybank. Although Maybank was the largest bank in Malaysia, it was growing by only 5% pa between 2003 and 2008 while its competitors such as Public Bank, CIMB and RHB were growing by some 20% pa in terms of assets and profits. If nothing was done and if the trend was to continue, Maybank could have been overtaken by both CIMB and Public Bank in terms of profit within a matter of two years (i.e. by 2010). In fact, the investment and media community had already anticipated that happening when Maybank’s market capitalisation dropped below that of Public Bank’s and CIMB’s in March 2009.

The acquisition of BII was particularly complex with many twists and turns. I recall that Maybank Board met twenty-four times in my first year in office, mostly to deal with the BII acquisition issues. After vigorous renegotiation, Maybank managed to complete the BII acquisition at RM1 billion lower than the original price. BII is now an integral part of Maybank’s regional presence and strategy. While the corporate finance team was busy completing the three acquisitions, the rest of the management and staff members were busy implementing the performance improvement programme called LEAP30 – a series of 30 initiatives identified to improve Maybank’s performance and restore its market leadership. After being put on a “burning platform”, Maybankers collectively resolved not to allow Maybank to be relegated to number three in the market. The team worked very hard and after about eighteen months, their efforts paid off. Assets and deposits grew faster, customer service enhanced, asset quality improved and profit after tax bounced back to a record RM3.8 billion for the financial year 2010. Maybank was back as the number one bank in Malaysia and the most valuable company listed on Bursa Malaysia.

Whilst the team, the board and shareholders were happy with the outcome; we were concerned about its sustainability. Maybankers were working very long hours due to the need to work around the existing processes and organisational structure; some were already experiencing professional fatigue. Personally, more than half of the time, I would still be in the office beyond midnight. We knew this was not sustainable without addressing the organisational structure and revisiting the mission. We then gathered the top 1,000 managers and leaders of Maybank at a “Tiger Summit” in Putrajaya and agreed to adopt a new mission or purpose for Maybank of Humanising Financial Services.

This mission of Humanising Financial Services means: to provide people with convenient access to financing; on fair terms and pricing; advising customers based on their needs and; being at the heart of the community. This was not just a rallying call but a clear purpose or reason for being for the 40,000 Maybankers in Malaysia and across Asia. Organisationally, we created a new “House of Maybank” with three business pillars – Community Financial Services, Global Wholesale Banking, and Insurance & Takaful; with Islamic Financial Services and International Operations straddling across the three business pillars. With the new mission and new “house”, Maybank continued to extend its leadership not only as the number one bank in Malaysia but also as one of the top regional banking groups with presence across all ten ASEAN countries.

Building a Global Leader in Islamic Finance

One of the dilemmas facing me and the other Muslim Maybankers was how to mitigate riba or usury element in our personal income. One suggestion that surfaced was to work on a strategy that will result in the majority of Maybank’s financing business being Shari’a-compliant. This became the purpose for me and my colleagues; to turn Maybank in a global leader in Islamic finance. We then came up with the “Islamic First” strategy where Maybank customers will automatically be offered Shari’a-compliant products whenever they wish to open an account, or seek financing to purchase a house, a car, or to fund their business. Should they wish to opt for a conventional product, then Maybank will offer that too.

The analogy adopted was that of a supermarket. If one were to go to the Tesco supermarket at Brompton Road, London, one will find a small halal meat section and the rest of the supermarket is not necessarily halal. However, if one were to go to the Tesco supermarket in Malaysia, one will find a small pork and liquor section and the rest of the supermarket is halal. This strategy enabled Maybank Islamic to grow faster such that with total assets of RM225 billion as on December 31, 2018. Maybank Islamic is now the largest Islamic bank in Malaysia (three times larger than the pioneer Bank Islam Malaysia Berhad) and the fifth-largest Islamic bank in the world.

Lessons learnt

So, what are the lessons learnt? Please allow me to focus on three areas:

First is corporate leadership and management. Be clear on your mandate. Perform a full diagnosis of the company. Establish the strengths, weaknesses, opportunities and threats. Match the tasks required with the management talent internally before bringing in reinforcements to fill the gap. Revisit the vision and mission to ensure relevance. Articulate a clear purpose or reason for being. Formulate strategies and action plans together with the management team and syndicate them with all stakeholders including the board, shareholders, employees, regulators and business partners, where relevant. Communicate your plans with all levels of employees, and update them regularly. Set clear and measurable short-term and long-term targets with clear timelines and accountability. Implement a balanced scorecard/performance management system. Align the interest of the management with that of shareholders. Share the rewards not just with the management colleagues but with all performing employees.

Second is the management principles; always focus on the fundamentals. Address the core issues of customer service, product innovation, competitive/optimal pricing, effective delivery channels and profitable market shares. Be clear on the costs and benefits of every venture, product, initiative or plan. Beyond the four quadrants of Corporate Responsibility and Sustaiity (i.e Workplace, Marketplace, Community and the Environment), for public listed companies, the bottom line is about shareholder value creation (i.e. more profit, higher dividends and better share price in the medium to long term). Don’t worry about short term market fluctuation. Don’t over-spin. Once you have achieved the fundamental improvements, then you can complement it with branding or rebranding as the case may be. Form without substance will not get you anywhere. But when you combine substance with form, you will go a long way. This applies to personal branding too.

Third is the personal leadership skills and attributes. A good leader must have a clear purpose in life; be articulate, authentic, engaging, a visionary, and have unquestionable integrity. You don’t have to be the typical “loud” corporate leader to be effective. In fact, it can be counterproductive. Gone are the days when the CEO just needs to tell people what to do. In large organisations, CEOs are now expected to be more hands-on and provide appropriate guidance on how things can be done. Be professional, honest, sincere and truthful to your board, management colleagues and employees. Do not hesitate to admit your mistakes and apologize, and learn from them. We are human beings after all. Focus on the job at hand and do not worry about your next career move. Your reputation will precede you.

Eight Thoughts on Organisational Sustainability

I have shared with you how, based on my personal experience, purposeful leadership has enabled the three organisations I have led as CEO to be successful. In the Global Leadership Forecast 2018; DDI, The Conference Board and EY found that purposeful organisations (where leaders bring the stated purpose to life through behaviours) perform 42% better than the market. The challenge, however, is how to ensure such performance is sustainable for the organisation beyond the tenure of a particular leader. This brings me to the second part of my lecture on some of my thoughts on organisational sustainability. There are many aspects of leadership and succession that I can touch on.

But perhaps I can confine them to eight.

First is the need to select the right leaders for our respective organisations. Many people have been asking, what does it take to be a good and sustainable leader? According to me, beyond working hard and working smart, there are three prerequisites to becoming a good and sustainable leader: unquestionable integrity; competency; and humility. Integrity is about “doing the right thing even when no one is watching”. A competent leader with unquestionable integrity and who works very hard will enjoy a reputation that will precede him. Competency is about having the necessary knowledge and skills to do the job well. Whilst humility is about treating people with mutual respect, about staying grounded to our roots and about being cognisant that we all serve a greater purpose in life rather than our self-interest. Humility is also about knowing that you don’t know everything and that you need a team in order to succeed.

Second is the need to put into place a proper succession planning and talent review process to cover key positions. Not just for the CEO and CEO- 1 positions but also for CEO-2 and even CEO-3 positions for large organisations. For each position, identify 3 potential candidates, their state of readiness (whether they are ready now or within 2, 3 or 5 years) and what is the intervention required to prepare them to succeed the incumbent. For such succession planning efforts to be successful, it needs to be driven from the top i.e. by the board and the management alike. The best practice is for the management to conduct a talent review session twice a year.

Third is the need to strike a right balance between internal talent and external hires. I personally believe in the importance of nurturing our internal talent or ‘grow your own timber’. This is important to provide the employees with good career progression opportunities. However, it is also important to bring in external talent from time to time to refresh the organisation and bring in external perspectives. My hypothesis is that all things being equal, one in every four or five senior positions should be filled externally. That means 75%-80% of the positions should be filled by internal promotions.

Fourth is the need for rejuvenation. Whilst long-serving CEOs provide stability to the organisation, there is also the risk of the leader and his organisation slipping into complacency. I believe there is enough empirical evidence to suggest the performance of many companies whose CEOs have been at the helm for more than 10 years would not be as good as the CEO’s performance in the first 10 years. Therefore, I subscribe to the belief that as a rule of thumb, no one should be in the same role for more than ten years, whether as a head of department or a CEO. If he or she is good, then give him or her a bigger role or give him/her the opportunity to lead a bigger organisation. I am therefore in favour of imposing time limits on the tenure of CEOs and board members. This will instill greater discipline on the CEOs to identify and prepare his successor. Of course, there are exceptions to the rule but they need to be appropriately justified.

Fifth is the need for diversity. I always believe in diversity as a source of strength for any organisation. Diversity in terms of skills, gender, ethnicity, age and even nationality for multinational organisations. Organisations that embrace diversity tend to perform better and more sustainably. I am encouraged that most public listed companies have heeded the call for greater gender diversity at board level. In the Malaysian context, we now have women as the chairperson of important institutions such as Bank Negara Malaysia, PNB and Bursa Malaysia; proving that there is no glass ceiling for women in Malaysia. For public listed companies, the time has come for such diversity to be broadened further to cover ethnic and age diversity not just at the board level but also at the management level.

Speaking of diversity, some organisations get very defensive when we highlight the lack of diversity in their organisations. They would immediately claim everything is based on merit. This brings me to the sixth point, the need for us to be conscious about the “Affinity- Favouritism-Cronyism-Prejudice Continuum”. Well, we are all human beings and it is only natural for us to have affinity towards people from the same school, same university, same profession, same State, same clan, same ethnicity, same religion, and same nationality. But if we do not contain our affinity, it can easily become favouritism. And if you don’t control it further, it will become cronyism. Eventually, it may even result in being prejudice. I have worked in an organisation where a large number of CEOs in the Group were from the same school. I also came across a Kuala Lumpur-based company where a significantly large proportion of the senior management members were from the same state. In such a situation, you may be depriving your organisation of quality talent to propel your organisation forward. At the same time, you may also be depriving the deserving candidates the opportunity to excel in their career. So, it is useful for us to be conscious of the diversity in our organisation (or department) and ensure we do not practice favouritism or cronyism.

Seventh is giving young people the opportunity to lead. I was fortunate to be given the opportunity to be the CEO of UEM Group when I was 37 years old. Dato’ Abdul Rahman Ahmad, the current CEO of PNB, was 32 when he was appointed as CEO of MRCB. Likewise, Tan Sri Mohd Bakke Mohd Salleh, the newly appointed Chairman of Felda, was 35 when he was appointed as CEO of a property company. Dato’ Shahril Ridza Ridzuan, the current CEO of Khazanah Nasional, was 32 when he was appointed as CEO of MRCB. Renowned corporate leader Tan Sri AzmanYahya, was 30 when he was made CEO of an investment bank Amanah Merchant Bank. Yet many of us now regard executives in their 30s and 40s as being too young to be CEOs. I have even come across some board members opposing the appointment of someone as CEO for being too young. That CEO was 50 years old! The time has come for us to renew our commitment to nurture future leaders and have the courage to give some talented young managers, with the prerequisites of being a good leader of course, the opportunity to lead an organisation as CEO.

The eighth point is the need to develop quality leaders in sufficient quantity. Many organisations complain about how their managers and executives are being poached by competitors and other organisations. I tend to take a more liberal view on this. Surely when your organisation is the market leader, you can expect other organisations to regard the people you have trained as being good and talented and will provide them with a ready pool of talent to poach from. So, instead of complaining, what if you were to hire and train more people so that you will still have enough talent even after half of the people you have trained left you after say ten years? These people whom you have trained will be your ambassadors and reference points in the future.

Islamic Finance and Sustainability

Over the past thirty years, I have been fortunate to have been exposed to Islamic finance. From being involved in arranging the first Islamic bonds or sukuk issued by Shell MDS in 1990, to the introduction of Islamic factoring by Amanah Factors and development of the ‘Islamic first’ strategy at Maybank. I hope to broaden and deepen my knowledge in Islamic finance during my upcoming tenure as a Visiting Fellow at the Oxford Centre for Islamic Studies.

As a prelude to my fellowship, I did a quick poll among some renowned Islamic finance practitioners on what are the first things that come to their minds when I mentioned the word “Sustainability”. The answers were varied but some common themes that emerged include justice, benevolence, wellbeing, ESG, Maqasid al Shari’a, the role of human beings in protecting the world and environment we live in, a balanced ecosystem, sustaining a productive and healthy ecosystem for the earth’s plants and creatures to support the well-being of humans sustainably, doing economic and social activities that do good and are not harmful in the long term, using resources responsibly taking into account the needs of future generations.

For me personally, Islamic finance in its truest form is indeed sustainable finance. It is supported by a legitimate transaction, formalised via a legitimate contract or ‘akad’, not speculative, and is not harmful to mankind, society nor the environment. I am heartened that such thinking is being embraced globally with central banks playing their role in promoting Islamic finance as sustainable finance. For example, Malaysia’s central bank, Bank Negara Malaysia, and the Islamic financial institutions have been working on Value Based Intermediation (VBI) since 2018 with the issuance of three guidance documents namely;

THE IMPLEMENTATION GUIDE FOR VBI, WHICH PROVIDES GUIDANCE ON PRACTICAL VALUE–BASED BANKING PRACTICES. IT ALSO OUTLINES THE PHASES OF IMPLEMENTATION, KEY IMPLEMENTATION CHALLENGES AND SOME PRAGMATIC SOLUTIONS;

THE VBI FINANCING AND INVESTMENT IMPACT ASSESSMENT FRAMEWORK, WHICH FACILITATES THE IMPLEMENTATION OF AN IMPACT-BASED RISK MANAGEMENT SYSTEM FOR ASSESSING THE FINANCING AND INVESTMENT ACTIVITIES OF ISLAMIC FINANCIAL INSTITUTIONS IN LINE WITH THEIR RESPECTIVE VBI COMMITMENTS; AND

THE VBI SCORECARD, WHICH PROVIDES AN OVERVIEW THAT COVERS PURPOSES, KEY COMPONENTS OF ASSESSMENT AND MEASUREMENT METHODOLOGY.

The application of VBI practices will contribute towards better facilitation for entrepreneurs, community well-being, sustainable environment and inclusive economic growth without compromising on shareholder returns. These outcomes are similar to the objectives of Environmental, Social and Corporate Governance (ESG) framework, Sustainable, Responsible Impact Investing (SRI) and ethical finance frameworks.

Speaking of Islamic finance and sustainability within the context of people’s well-being and inclusivity, one organisation that comes to mind is PNB. Established in 1978, PNB’s purpose was to address the socio-economic imbalance facing the majority Bumiputera community who in 1970 collectively own only 2.3% of equity in the corporate sector. The idea was to mobilise funds from the community via a mutual fund to be invested professionally into the equities market. The concept was subsequently broadened to include all Malaysians. PNB now manages some RM300 billion mobilised from 14 million unit holders.

I had the privilege of being appointed as the third Chairman of PNB on August 1, 2016 with the mandate to enhance the corporate performance of PNB. By November 2016, PNB’s President and CEO Dato’ Abdul Rahman Ahmad and I unveiled PNB Strategic Plan 2017-2022 named Strive-15 aimed at building PNB to be a distinctive world-class investment house. Fifteen initiatives were rolled out under three strategic pillars of enhancing sustainable returns, effective funds management and driving operational excellence. With rigorous execution of the various initiatives by the PNB team, we were able to achieve significant outcomes within the first year of implementation in 2017. These include, inter alia, improved financial performance with 16.8% increase in 2017 net income to RM17.7 billion; Transformation of strategic companies resulting in a RM39.5 billion increase in market capitalisation. This represents total shareholder returns of 26.0%, double the total KLCI returns of 13.2% for 2017; successful migration to a new IT system which enabled PNB / ASNB to launch its online portal; and recognition of investment in PNB managed mutual funds as “Harus” or permissible by the Selangor and Penang State Fatwa Committees in 2017, in line with the national edict issued in 2008.

Contributing towards the Education sector

It has been eight months since I assumed the Chairmanship of the National University of Malaysia (UKM). I must say it has been very enlightening to be involved in the education sector. On my part, I hope to be able to add value, among others, in the following three ways:

TO BRING PRIVATE SECTOR’S PERSPECTIVE INTO THE UNIVERSITY IN ENHANCING ITS PERFORMANCE AND GOVERNANCE AS WELL AS STRENGTHENING THE ORGANISATION STRUCTURE AND HUMAN CAPITAL DEVELOPMENT;

- TO ASSIST IN EFFORTS TO ENHANCE THE UNIVERSITY’S FINANCIAL SUSTAINABILITY VIA INCREASING PRIVATE AND INTERNATIONAL STUDENTS’ ENROLMENT, EXPANSION OF

THE UNIVERSITY’S CORE COMPETENCY (SUCH AS HEALTHCARE SERVICES) AND COMMERCIALISATION OF REAL ESTATE AND OTHER ASSETS;

- TO ENHANCE INDUSTRY–ACADEMIA COLLABORATION, AMONG OTHERS:

- THROUGH STRENGTHENING OUR VARIOUS FACULTIES WITH THE APPOINTMENT OF INDUSTRY PRACTITIONERS AND CORPORATE LEADERS AS LECTURERS, FELLOWS AND ADJUNCT PROFESSORS;

- INCREASED CONTRIBUTIONS FROM THE PRIVATE SECTOR IN THE FORM OF ENDOWMENT, RESEARCH GRANTS AND COMMERCIALISATION OF RESEARCH FINDINGS;

ENHANCING GRADUATE EMPLOYABILITY THROUGH CURRICULUM DEVELOPMENT, INDUSTRIAL ATTACHMENTS AND LEADERSHIP DEVELOPMENT.

Back to the theme of Purposeful Leadership and Sustainability, I believe it is important for us to instill sustainability, purpose, and leadership values in our people from a young age. This means starting from parenting at home to early education in schools and later at the institutes of higher learning. When such universal values are ingrained in our people and society, the outcome will be more pronounced and sustainable.

Conclusion

Let me close by expressing my gratitude to Dr. Humayon Dar, Dr. Sofiza Azmi and the Cambridge Institute of Islamic Finance for inviting me to deliver this lecture. Coming from a poor household, I was fortunate to have been given a good education at a boarding school MRSM Seremban and awarded a scholarship by the Bumiputera empowerment agency MARA to pursue professional accountancy qualification (ACCA) in the United Kingdom. My ambition was to be the CFO of a large organisation, but I ended up with more than what I asked for. I am grateful to God Almighty for His blessings, and to my parents for raising me and instilling the universal values in me. I am grateful to my country Malaysia for the opportunity made possible by the then New Economic Policy; a policy with twin objectives of eradicating poverty irrespective of race and eliminating the identification of race with any particular economic activity. A policy with the purpose of providing equitable growth and opportunity for the people. This is what sustainability is all about; not only caring for the environment, but being responsible for the people too.